NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

Update 6/24/21: Doctor of Credit reports a new round of people being targeted for this bonus from 7/1/21 to 12/31/21. If you opened your account a few months ago and haven’t closed it, be on the lookout for an email about this promo as it is quite easy to take advantage (though note that I think transfers to the Cash stopped working for this. Not sure about the Point debit card).

HSBC is out with a targeted new promo that might make that HSBC Premier account more appealing for those who have opened it for the current $600 bonus, so I wanted to take a few minutes out of my current paternity leave to report this. Both my wife and I received emails advertising this promo, but YMMV. The short of it is that you can get $15/month for six months for making 10 transactions per month with an HSBC Mastercard (including the debit card!) and $15/month for six months for paying 3 bills with HSBC bill pay. That adds up to $180 over six months if you complete both — and I’m happy to keep the account around for a while for more easy money from HSBC.

The Deal

The Deal

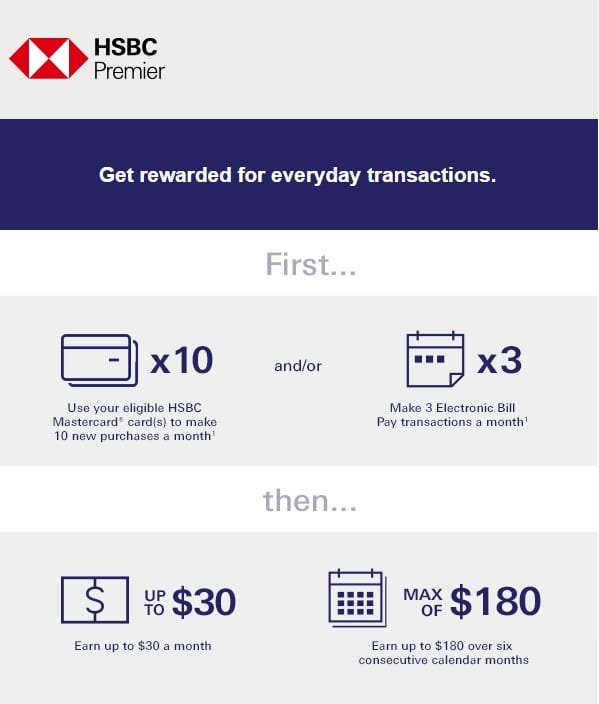

- HSBC is out with a targeted promotion to get up to $180 in bonuses for those with an HSBC Premier checking account as follows:

- Get $15 per month for using an eligible HSBC Mastercard(s) (which includes the debit card) to make 10 new purchases per month (up to six months)

- Get $15 per month for making 3 Electronic Bill Pay transactions a month (up to six months)

- Promotion is targeted with an email subject line, “Earn up to $180 for making everyday transactions”. Note: My email indicates that the promo is valid from

10/1/20 to 3/31/217/1/21 to 12/31/21, though YMMV depending on if and when you are targeted. - Direct link to promo landing page

Key Terms

- This Promotion is non-transferrable and is only available to the recipient of this invitation.

- This Promotion includes two Offers, each requiring qualifying activities and is available from the first full calendar month after the date you receive this invitation and is valid for 6 consecutive calendar months (“Promotional Period”).

- Promotional Period for these offers is 10/01/2020 through and including 03/31/2021.

- To qualify for the Card Transaction Offer (“Card Offer”), up to $90 ($15 max per month), you must have an Eligible HSBC Mastercard® Card (“Eligible Card(s)”) issued to you by HSBC Bank USA, N.A. and complete at least 10 eligible new purchases per calendar month using your Eligible Card(s) during the Promotional Period. Eligible Card(s) includes HSBC Debit Mastercard® card(s) linked to your HSBC Premier checking account and/or HSBC Mastercard® credit card(s).

- Debit card transactions excluded from eligible purchases include, but not limited to, ATM cash withdrawals.

- Credit card transactions excluded from eligible purchases include balance transfers, credit card checks, cash advances or overdrafts.

- Transactions must post to your Eligible HSBC Mastercard® Card within the calendar month to qualify.

- To qualify for the Bill Pay Offer (“Bill Pay Offer”), up to $90 ($15 max per month), you must be registered for Online Banking and complete at least 3 Electronic Bill Pay transactions to third party payees per calendar month during the Promotional Period.

- Electronic Bill Pay is defined as paying bills from your HSBC Premier checking account using HSBC’s Bill Pay service available on HSBC’s Personal Internet Banking or the HSBC Mobile Banking App. (Data rate charges from your service provider may apply. HSBC Bank USA, N.A. is not responsible for these charges.) Transfers between internal or external accounts do not qualify as an HSBC Bill Payment.

- You will automatically receive the Card Offer and/or Bill Pay Offer into your HSBC Premier checking account approximately eight weeks after completing that month’s qualifying activities.

- Limit one “Card Offer” and one “Bill Pay Offer” per customer, including all individual and joint accounts – the first line name on the joint account is considered the customer for gift purposes.

- The Promotion to your HSBC Premier checking account will be reported on the applicable IRS form.

Quick Thoughts

Both the email and promotion landing page indicate that this is a targeted offer and as such I’m guessing that eligibility dates could vary (it seems that they likely send the email a few days before the date when the promo would take effect).

Both my wife and I opened our accounts in April under an offer that required direct deposit for six months starting with May. That means October would be the final month for us to make a direct deposit under our offer; it doesn’t seem like a coincidence that this new offer comes at the tail end of that to incentivize us to continue using HSBC. In my case, this will sure work. Both my wife and I received the offer and it will be pretty simple for us to meet the requirements, banking $360 total between the two of us. I find this promotion to be really smart on HSBC’s part as it certainly gives us reason to treat HSBC more like a primary account.

I’m not sure whether and how soon new account holders who have opened under the Share The Experience offer may see a similar promotion, but it’s good to know that they do offer incentives like this. In our case, we had neither used the Bill Pay feature nor had we used the debit card. We’ll certainly begin making it a point to start doing both from 10/1. I obviously won’t turn the debit card into my primary use card and forgo credit card rewards on major purchases, but I’m sure I can find ten uses per month for each of us.

I have made some updates to the original post about the HSBC Premier account (including my wife’s information). For those who missed that deal, HSBC is currently offering a $600 bonus to those who open an HSBC account via a referral offer. This Share The Experience offer has no requirements in the terms to trigger the offer (it only notes that your account must remain open for a minimum of 15 business days and that you need to maintain a Premier relationship), though some people are being told by phone reps that direct deposit of $5K/mo for several months is required. YMMV: the single data point we’d previously reported received the bonus less than a month after opening, but it’s possible that the terms were changed. See more detail in the updated post about that deal.

![(EXPIRED) [Extended to 1/31/21] HSBC: $600 bank account bonus available with easier requirements a hand holding a fan of money](https://frequentmiler.com/wp-content/uploads/2020/08/hand-full-of-money-refund-cash-218x150.jpg)

[…] (EXPIRED) (Back) Up to $180 in easy bonuses for HSBC … […]

Targeted for this offer. Anyone actually get paid out by HSBC though?

Yes, I did. I think my $15 bonuses posted about a month behind activity.

did any of the $15 bonuses post for you ?

and if yes, how long did it take?

Two questions:

1) what’s your thoughts on downgrading the account (so as not to be charged a monthly fee) after receiving this promo? I don’t see why it shouldn’t work but was wondering if you had any thoughts or my have triad it.

2) do you have any tips for the bill pay bonus? Would something like paying my credit card work (maybe just split up my bill into the) ?

1) I have no idea. A lot of people have asked about downgrading, but I haven’t seen any DPs from anyone who has done it. I’ve still got the Premier account and I just continue to shuffle money around each month.

2) Just pay your bills? Of course paying your credit card would work – that’s the main use of bill pay. I guess maybe paying the same bill three times would work. I just pay 3 different cards since I’m pushing $5K into this account anyway. I think one month I only paid $10 or $15 on a couple of cards, so I would think splitting it up and doing 3 payments to the same card must work. But you must have more than 3 different cards you can pay towards, no? Why bother wondering if it’s going to work when you could just make 3 small payments toward different cards and make yourself an easy $15?

1)ty i still have the premier and they still have not charged me ( ihave not been moving in 5k a month) but i think that stops after six months

2) i always pay my credit card from the card end ( not from my checking account interface) so i never thought of that as a bill.

I’m assuming you have to pay it from HSBC’s end (push) and not adding your HSBC account number into your credit card online account. is that correct?

at least for 1) its right there in the FAQs

“What happens if I change my Premier checking account to a different type of HSBC checking product, OR close it? To be eligible for the Promotion, your current HSBC Premier checking account must be open without being changed to a product with lower requirements, and in good standing at the time of fulfillment.”

signed up for the HSBC premier back in SEP and received this offer on 01/29

just a heads up

p.s. i wish there was a email i could send to with such tips

Great to know! You could always hit “contact” in the top menu bar to email us, but comments like this also come to our email, so either way. Thanks for letting us know.

[…] The Cash App is basically like a prepaid debit card (this is owned / run by Square) that you fund with a debit card (to my knowledge, you’ll need a real debit card for this, not a gift card). They send you a physical card in the mail (like mine pictured above) and then you load money via the app and activate “boosts” that save you money on specific types of purchases. I’ve been using my HSBC debit card since I have an offer right now to earn $15 per month by using my debit card 10 times per month. […]

[…] up the easy bonus, so I wanted to use a real debit card. It didn’t hurt that my HSBC account was targeted with another easy money offer that requires 10 debit card transactions per month, so this was an easy debit card transaction […]