NOTICE: This post references card features that have changed, expired, or are not currently available

On this week’s Frequent Miler on the air, listen in as Greg and Nick discuss what you need to consider for your CNB exit plan, which card is a no-brainer for most (and why it’s not for Greg), 5,000-mile award tickets to New Zealand and more. We kick off this week’s broadcast discussing feedback from one reader who thought that we talked too much about the SoFi Money deal last week (which, amazingly, is still going on). I’ll add to what I said below that I think it would be hypocritical for us to talk about how to eke an extra quarter of a percent back on your dining spend when paying with credit card ABC or how great the welcome bonus is on card XYZ and then intentionally hide a deal like the SoFi Money deal that puts easy money in almost anyone’s pockets with almost no effort. Sure, there are referral links on that deal — and that’s precisely what makes it such a potentially profitable deal for you. Don’t miss it or let your friends and family miss it while it lasts. Check out the video below or download the podcast to hear our take on this week and read on for the summary of this week’s posts.

FM on the Air Podcast

For those who would rather listen during the morning commute or while you’re working, the audio of our weekly Facebook Live broadcast is also available for download as a podcast on all of your favorite services:

Note: If you’re not seeing the latest episode available for podcast download just yet, check back shortly for the update.

On to our weekend recap of the week’s top stories:

In devaluations

CNB Crystal Visa Infinite loses valuable perks as of Jan 1 2020

It was a fun ride while it lasted for those who were able to lock down the CNB Crystal Visa. I don’t think you can even get mad at this devaluation; it’s never been a matter of if the card would be devalued, it was a matter of when. Is it sad that the end is near? Of course it is. But this deal goes to show that you have to strike while the iron is hot. Those who got in on this card when they first found out about its great perks have likely benefited handsomely and can likely toast the good ole days without too much bitterness. Even if you just got the card last week, you have plenty of time to come out well ahead, if not as far ahead as you’d hoped.

Uber card “refreshed” (big devaluation)

The Uber Visa card was actually a great no-fee cash back card in the sense that it had good payouts on popular bonus categories. The key word in that sentence is was. Cue up the funeral march: this one’s dead.

In ways to leverage value

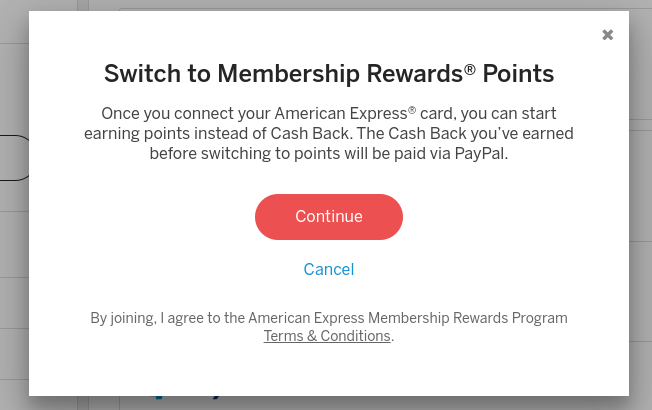

Rakuten (formerly Ebates): now change from cash back to Membership Rewards points

This is big. Those whose accounts were stuck on Ebates cash back can now convert to earning Membership Rewards points. While Rakuten doesn’t always have the best payouts, this can certainly be worthwhile as Membership Rewards points can be used to great value with transfer partners and/or when stacked with point transfer bonuses.

Awesome credit card combos

Greg is wrong. At least, sort of. In this post, he outlines the best credit card combos, and I have no qualms with the combos he recommends. However, he notes that Chase has a big leg up because of the ability to redeem points for 1.5c in value towards any travel. I think that benefit is overvalued. Next week, I’ll argue why — but for now, I’d say that if your main goal is to earn rewards toward paid travel, you should be focusing on cash back. You can get a lot more value out of transfer partners, so I do recommend earning transferable currencies and learning to use them — but if you do, I think it’s hard to argue for the Chase combo over the Amex and Citi combos. I know that is heresy and might smell of hypocrisy since I earn a lot of Ultimate Rewards points, but I think that Amex and Citi have better transfer partners. Citi’s lack of travel protection is a problem; I hope they address that sooner rather than later.

Which Ultra Premium Cards are Keepers? Version 3.0

I don’t even need to look at the spreadsheet to know that I should probably dump by Citi Prestige card when the annual fee posts next year, but the truth is that I just can’t get enough ThankYou points, my restaurant spend is high(er than it should be), and family members without cards that offer travel protections keep giving me opportunities to buy their airfare. I actually need to go through and do the sheet still, but I think the CSR might be the card on the chopping block this year for me.

Is it worth MSing Marriott Platinum status?

Nah. It really isn’t. I say that as someone who has had Platinum status this year (and who is writing this from the lobby of a Residence Inn as I inch closer to Titanium status tonight). Free breakfast is the only benefit you can actually count on — and even then, Greg had to make an entire resource page so you can figure out whether or not you’ll get it! The opportunity cost of doing $75K spend on a Marriott card is just too high. Furthermore, the threshold to earn Platinum status is pretty low: after a single meeting and the nights from holding a credit card, you only have to stay 25 nights to earn Platinum status. If you’re staying far less than that, I’d wonder if you’re using the benefits of your status enough to justify having it and if you’re staying somewhat close to 25 nights it is easy enough to fill the gap. I can’t see $75K spend to get it.

A student credit card plan: 825,000 points by graduation

If you have a college student in your life and you’ve wondered how to get them “in the game”, Greg’s got a plan. Whether you follow the game plan with the type of precision that reaches 825,000 points or you modify to fit your situation, the potential outcomes are impressive. Imagine you had that many points at age 22 as a recent college grad: where would you go? What would you do? To know then what we know now, right? The possibilities abound.

In award travel

Getting a squad home from New Zealand in business class

Similar to Greg’s post about piecing together an impossible award, I recently had to figure out how to get 4 people home from New Zealand in premium cabins. Here’s how we did it with a couple of extra stops on the way home for a reasonable amount of miles and cash per passenger.

In resource page updates

See these resource pages for updates published this week:

Rakuten (formerly Ebates) Visa with Membership Rewards. Everything you need to know.

Amex Membership Rewards Complete Guide

That’s it for this week at Frequent Miler. Check back soon for FM’s week in review around the web and this week’s last chance deals.

![A coupon book with a credit card, a credit card program with an airline, and more [Week in Review] a person reading a magazine on a couch](https://frequentmiler.com/wp-content/uploads/2017/05/kick-back.jpg)

[…] last week’s Frequent Miler on the Air broadcast/podcast, Greg and I discussed the recent major devaluation to the CNB Crystal Visa Infinite that changed it […]

Happy you guys liked my Apple Podcast review (so Nick’s mom is still available to write one!). You may have thought it was over the top, but I really think Frequent Miler is tremendous. Thank you for all your work. My wife and I are going to Hawaii for 2 weeks in May for free thanks to your advice (Turkish airlines, proper credit card sign ups for newbies, no fee hilton aspire, etc), and we’ll still have tons of points leftover. Maybe we’ll use our SoFi debit cards to take out some free bonus cash with no ATM fees while we’re there? 😉

Thanks again. THE BEST!

Thanks Captain Greg!

It seems Nick’s voice volume is lower than Greg’s in this video.

Greg and Nick, I enjoy the content of the podcasts. Great “background music” when on a treadmill.

Do you think I’m missing anything by not watching the podcast? If the answer is “not really” (which I suspect) then please alert your audience in case this changes for a particular episode. E.g., you are showing examples of your spreadsheet or a powerpoint or something.

Again, much appreciated.

You’re not missing anything. Great suggestion: we will be sure to alert readers when there’s something worth watching rather than just listening

Is it just me or is Greg’s audio good, but Nick’s is quiet? Two weeks in a row.

I also found this to be the case when watching/listening to the podcast. For me–and I can’t explain it–I listened to the “web version” and the sound levels were more normalize.

Yes that’s true on the video. I think I know how to fix it next time. The audio-only podcast should sound fine though.

What’s the airbnb article? The only one i can find in the news is about the “airbnb mansion party” shooting from Halloween in the SF Bay Area.

Nick said that he would publish a link to the article this evening

In the video I mentioned that Activities could be a good deal for redeeming CNB points. Scratch that. Sadly, I just spent some time on the website and found that they charge about $10 more per activity than the cost of buying directly.