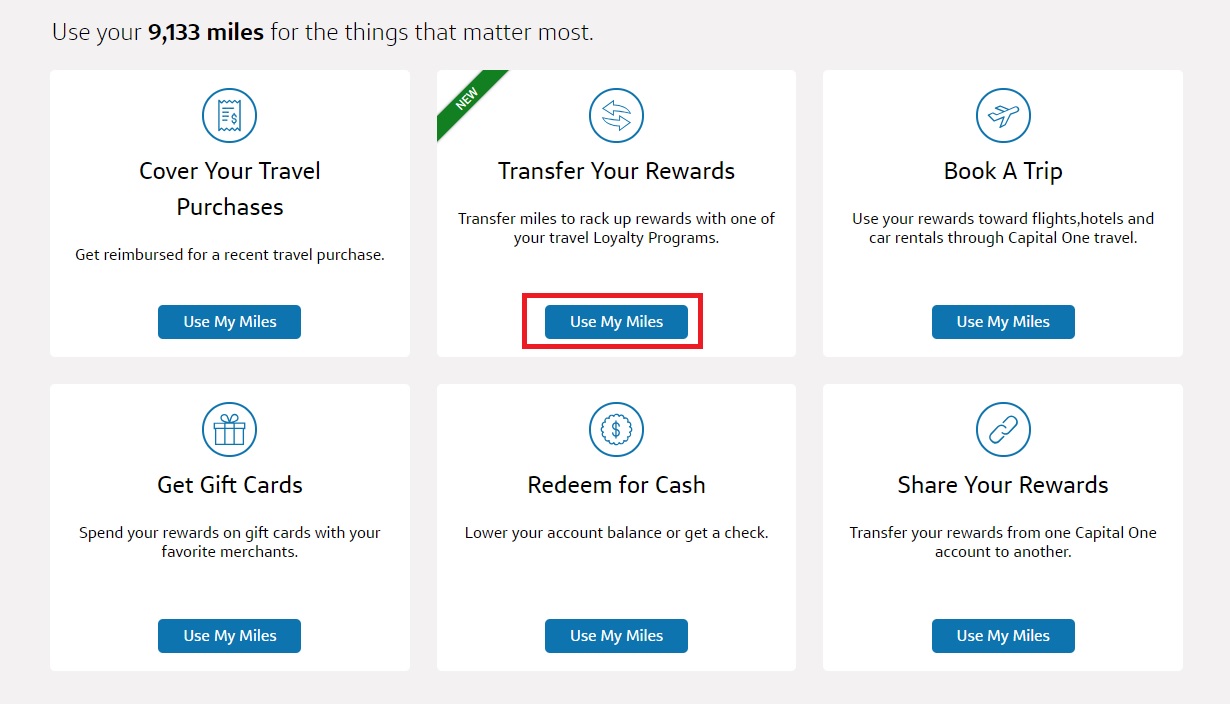

This week, Capital One introduced the capability to move your miles. Whether transferring to airlines or friends and neighbors, that added significant value…and it only got better with the secret hotel special offers we found. Read about product changing to a card that earns a great return, when to use Capital One miles the old way or new, and more.

iPhone withdrawal symptoms when switching to Android Pixel

![]()

Greg bought a Pixel 3 XL in the recent Google Fi deal – and so did I. He and I are coming into this from totally opposite directions: Greg was already using Fi as his primary cell service, but he’s (at least temporarily) switching from iPhone to Android to use the Pixel. I’m not seriously considering Fi for cell service and I’m a lifetime Android guy. He’s not sure what makes Android so special. I’m not sure what makes Apple (generally) so expensive. All of his friends and family use iPhones. I had to think about it for several minutes to come up with 5 people I know who use an iPhone. In this post, Greg talks about what he’s missing about his iPhone while using the Pixel. I’d be happy to tell you how awesome the Pixel is. Instead of telling you about it, I’ll just let the above pic of my son taken with my Pixel 3 speak for itself. The phone is awesome. Or maybe it isn’t. See this post for Greg’s thoughts.

The best hotel credit card ever

Which is the best hotel credit card there has ever been? I’m going to tell you it’s the Capital One Venture card and you’re going to spit out your morning coffee laughing at me and accuse me of really working to flog a credit card. Except…it is the best. At least, if you have the secret special hotel offers redemption in your account it is. We haven’t figured out exactly who gets this option or why, but several other readers also found this in their accounts, and it makes the return on the Venture card better than the old SPG card. When you catch your breath and clean up that coffee, see this post and tell me why I’m wrong.

Capital One “Rewards miles” Complete Guide

We have complete guides on the books for Chase Ultimate Rewards, Amex Membership Rewards, and Citi ThankYou points. Now that Capital One Rewards miles are transferable to airline partners and combinable with other Capital One cards and customers, it was time to add a complete guide to Rewards Miles. If you read that hotel credit card post above and suddenly find yourself more interested in Rewards miles than you ever thought you might be, see this for the low down.

Booking Delta flights with Capital One miles

Does it make more sense to transfer to partners and book or to use your Capital One Rewards miles at $0.01 against the cost of your ticket? The answer obviously isn’t constant, but Greg takes one specific example and shows that the answer can vary for different seats on the same flight — and not just by a little bit.

A product change that’s better than expected

Earlier this year, I got rid of my Alaska Airlines Visa signature card, but instead of canceling I product changed to a card I haven’t used since. That’s about to change. Product changing to the Cash Rewards card is going to turn out to have been a terrific decision as that card is about to start earning as much as 5.25% back on up to $2500 in spend per quarter….and you get to pick the category. And you can change it monthly. If you have no status with BoA, it’s only going to be 3% — but when you get to choose the category, that’s still not bad for a no-fee card. This is going to turn into a profitable product change after all. One small update on this one: it seems that BoA issues this card in both Visa and Mastercard varieties. I realized mine is actually a Visa, which I assume is due to the fact that I product changed from a Visa? Not sure, but that means it won’t be a good choice for Plastiq payments after all.

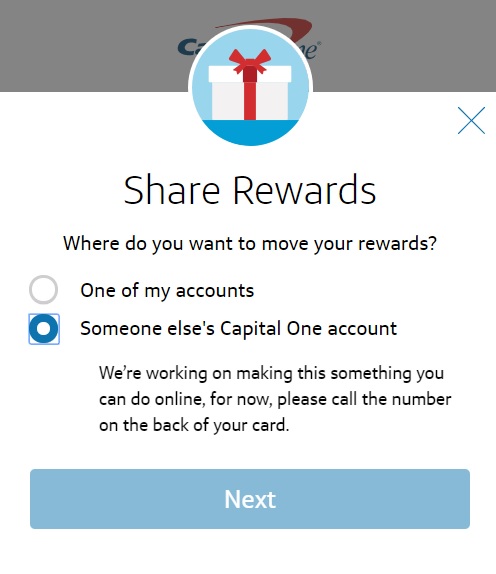

Now share Capital One miles with others

Apart from my discovery on the hotel special offers noted above in the post on the best hotel credit card, the ability to transfer Capital One Rewards miles to anyone with a miles-earning Capital One card was the biggest piece of news to come on the Capital One front this week. In my opinion, this is huge and I’m surprised it didn’t get more airtime around the blogosphere. Sure, these cards haven’t been the most popular — but in my mind, that’s all the more reason why combining is useful. My wife and I had three accounts between the two of us with Rewards miles balances and each balance was small enough that it didn’t really seem useful. However, when we put them all together, we can now make decent use from a single redemption. Furthermore, being able to transfer to anyone with a miles-earning card, and without any annual cap, means it would be easy for a few family members to toss together a heck of a rewards balance for a family trip. See this post for more on how it works.

Now transfer Capital One miles (and 2 more partners added…at a poor ratio)

Good news: you can now transfer Capital One miles to airlines. Bad news: most of them aren’t amazingly useful. Good news: they said they would work to add more partners and they already have added 2 more than originally announced. Bad news: those 2 partners come at a poor transfer ratio. While that might feel like a mixed bag, and in some ways it is, I’d say that the flexibility to choose between $0.01 per mile or transferring for awards adds value for cardholders, so this is a net win. Glad to see it come together.

On my mind, unplugged (Business Platinum Edition)

I love a good acoustic show, and Greg certainly jammed out here. On a long flight with no Wi-Fi, Greg gives us a look at his free-flowing thought in pondering the Business Platinum card and which member of his family will open and triple dip it next.

That’s it for this week at Frequent Miler. Check back soon for our week in review around-the-web and this week’s last chanced deals.

![Maximizing free night certificates, award booking for beginners, and more [Week in Review]](https://frequentmiler.com/wp-content/uploads/2024/07/Sailrock-Resort-SLH-218x150.jpg)

![Why you might want to stop spending on Delta cards (and start spending on Hilton cards?), misAAdventures, and more [Week in Review] a room with a bed and a television](https://frequentmiler.com/wp-content/uploads/2023/01/img_1508-218x150.jpg)

![The British are coming (for your favorite award sweet spots), maximizing Platinum, dumping Gold, and more [Week in Review]](https://frequentmiler.com/wp-content/uploads/2024/07/British-Are-Coming-for-DL-AA-AS-218x150.jpg)

OFF Thread but so What !! Is April too late to book a Deal on HOTELS in Greece ,Crete, Israel for Sept. Travel ?? I want to get the Capital One card first but if it’s not worth waiting will book in Jan if u think that’s better . I could then use those card points for EZE travel in 1/2020 .

THANKs

CHEERs