Yesterday, Simon Mall opened registration for a new manufactured spending opportunity that enables the volume for which their malls have become known with the convenience of shopping from home. See: Simon Gift Card online bulk ordering. Everything you need to know. Readers had two key questions: Which credit card(s) should you use to purchase and how the heck are you liquidating these Simon gift cards in a time when most of the United States is under stay-at-home orders? Greg recently wrote about 7 ways to increase spend from home. The truth is that apart from paying taxes, your options are limited today. Don’t buy these cards if it means you will need to make extra trips to the store today. However, we’ll eventually get past COVID-19 and return to a world in which liquidation is easier, so today’s post will focus on which card(s) to use to buy Simon Visa Gift Cards when it makes sense for you to do so again.

A word of caution

First up: if you are new to manufactured spending, you should read our Manufactured Spending Complete Guide before you jump into buying any type of prepaid gift cards. Know that there are risks and complications. You have to be organized (losing one thousand-dollar-card will wipe out the value gleaned from a lot of points). Banks may not like your spending patterns and may shut down your accounts. Liquidating cards can be complicated, difficult, or impossible in some areas. There are a lot of variables.

To that end, I recommend reading a post I wrote last year when Simon debuted the $1K Visa Gift Cards at their malls: Mistakes to avoid on $1K Simon Visa Gift Cards.

A couple of key points from that post (I recommend reading the whole thing if you haven’t):

- Avoid a sudden sharp increase in spend on any one issuer’s card(s) as this is a common trigger for account shut downs. Also see Why Chase shutdowns have increased and how to avoid them. This may become even more relevant in a recession.

- Diversify your earnings. Amex awards no points for Simon purchases (so don’t use an Amex to buy these). You never know when another issuer may become the next Amex, so don’t put all your eggs in one basket.

- Have a backup to your backup plan in terms of liquidation. I wrote last year that you never know when your preferred liquidation option might disappear. I never could have anticipated that this would be because we are all sheltered at home trying to get a pandemic under control, but the current situation with COVID-19 is a good example as to why you don’t want to buy more cards than you can afford to float since you don’t know when things can suddenly change.

- If you are purchasing money orders, be sure to deposit in a bank that you don’t care much about. Some banks will shut down your accounts for money order deposits, so you don’t want to deposit them in a bank that issues credit cards that you want to have. Furthermore, avoid structuring your deposits, which is a crime.

You can read more on mistakes to avoid in the post linked above in this section.

Costs of Simon Gift Cards

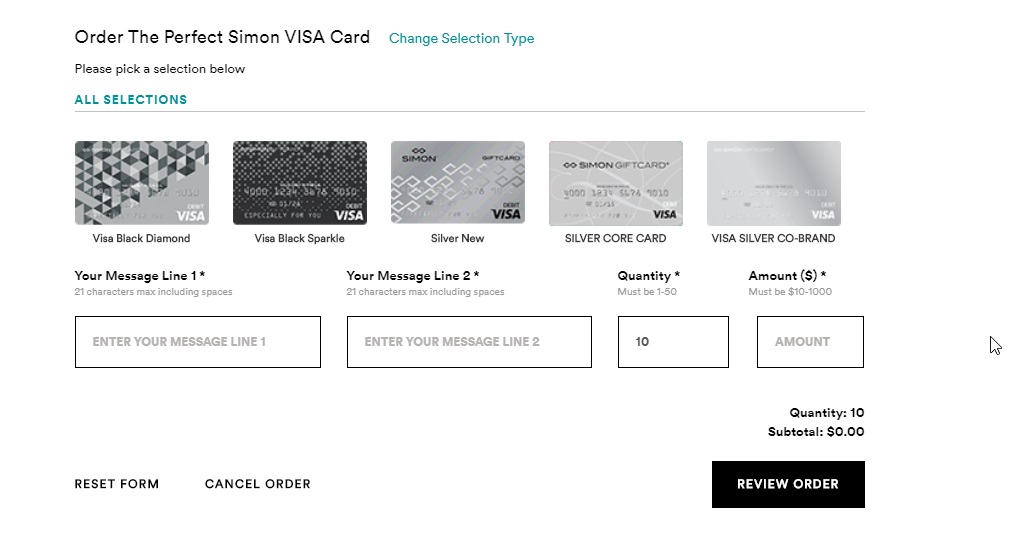

Simon Gift Cards can be purchased online in denominations of $10-$1,000 with an activation fee of $3.95 per card.

When ordering online, there is an additional $10 processing fee per order regardless of order size. You will also pay for shipping, which varies depending upon your location. The fee to my home address is $10 per order, others have reported $11 or $12. For the purposes of this post, I’ll suppose a $12 shipping fee.

Simon’s velocity limit is $25,000 per day. That number is total spend including fees. Customers can place multiple smaller orders as long as they stay under $25K per day, but note that the processing and shipping fees will be charged separately for each order.

For the purposes of comparison below, it is useful to figure the cost per point if you’re buying Simon Gift Cards online. However, the cost per point varies depending on your order size since the processing and shipping fees make up a larger percentage of a smaller order.

The Simon bulk ordering program is really designed for those who can and want to buy larger volume, but to create comparison points, I have figured costs below based on 3 hypothetical order sizes: $5K in gift cards, $10K in gift cards, and $24K in gift cards (I’m using $24K in case you don’t want to end up with a single card with an odd amount on it). I’m using $12 as my estimated shipping figure to do the math.

I am further going to assume a cost of $1 per $1K to liquidate. Your true cost may be more or less depending upon how you liquidate.

That means those orders will cost:

- $5K in Visa Gift Cards + $19.75 activation fees (5 x $3.95) + $10 processing + $12 shipping + $5 liquidation = $5,046.75.

- $10K in Visa Gift Cards + $39.50 activation fees (10 x $3.95) + $10 processing + $12 shipping + $10 liquidation = $10,071.50

- $24K in Visa Gift Cards + $94.80 activation fees (24 x $3.95) + $10 processing + $12 shipping + $24 liquidation = $24,126.80

Below you’ll find the cost per point for each of those order sizes depending upon whether you’re using a credit card that earns 1x, 1.5x, or 2x points as well as your cost per thousand dollars spend for those focusing on cash back.

To give an example that explains the methodology for the numbers:

- Buy $5K in gift cards for $5,041.75, earn 5,041.75 points at 1x.

- Cost to earn those points with $5 in liquidation fees added = $46.75

- $46.75 / 5,041.75 points = $0.00927 (rounded to 0.93 cents per point)

As you can see, at 1x you’re paying just under 1 penny per point all-in. That’s the methodology used for the numbers below.

Cost per point at 1x

- $5K order = 0.93c per point

- $10K order = 0.71c per point

- $24K order = 0.53c per point

Cost per point at 1.5x

- $5K order = 0.62c per point

- $10K order = 0.47c per point

- $24K order = 0.35c per point

Cost per point at 2x

- $5K order = 0.46c per point

- $10K order = 0.36c per point

- $24K order = 0.26c per point

Cost per $1K card including shipping and processing before liquidation:

- $5K order = $8.35 per card

- $10K order = $6.15 per card

- $24K order = $4.87 per card

Why buy Simon Gift Cards online?

To someone relatively inexperienced in manufactured spending, the numbers above likely look pretty good: after all, those costs are well below the Reasonable Redemption Values of many different types of points.

However, it isn’t the cheapest game in town. As Greg previously noted in his post about 7 ways to increase credit card spend from home, Gift Card Mall and GiftCards.com both offer cheaper options considering portal rewards. Given the fact that Simon is more expensive, it probably wouldn’t make sense to sign up for the program if your aim is only to buy a few thousand in cards at a time. You can do better if you’re only looking to order a couple thousand now and then. However, Simon does have some advantages that make it attractive for some.

For starters, Simon welcomes MSers with open arms. They know we’re buying cards to earn points and they are happy to have us — they obviously launched this special bulk ordering program specifically for folks looking to earn points. While I have no doubt that GCM and the like know why people are ordering, they can sometimes be a real pain. After just one or two orders of $1K or $1500, my account was banned from ordering on Gift Card Mall for years for no explicable reason. We couldn’t even place orders under my wife’s maiden name before we were married (same shipping address). Eventually, after several years, I was able to get an order through — but my wife still hasn’t gotten one through successfully. Many readers regularly place orders with those sites without issue, but at the same time we aren’t the only ones who have had difficulty. That’s not an issue with Simon.

A second benefit of Simon cards is that they offer the highest denomination available online since each card can be loaded with $1K. Those higher denomination cards are much more convenient for me in terms of liquidation. Larger cards means splitting tender fewer times which in turn tends to mean less scrutiny / skepticism from cashiers. I have a much easier time splitting tender two ways for $2K in MOs than four or more ways over smaller cards. The fact that the cards can now be personalized with my name should make this even easier.

Finally, volume makes Simon appealing. The ability to spend up to $25K per day is unmatched. I imagine that most readers don’t need anywhere near that capacity, but it far exceeds the limits you’ll hit elsewhere so for those who are looking to do heavy volume, this provides an option.

Which are the best credit cards to use for Simon gift cards online? The Best Everywhere else cards

First of all, do not use Amex cards to buy Simon gift cards. Since 2019, Amex cards have not earned points on Simon gift card purchases.

[Update] Second, do not use the Alliant Visa Signature card. Alliant stopped paying cash back on obvious online gift card purchases in February 2018.

In terms of risk, no other issuers stand out as particularly risky nor particularly safe. Any issuer may shut down your accounts for large gift card purchases. My advice is always to go slow: avoid spending way beyond your stated income with any one bank, avoid a sudden sharp increase in spend, do not cycle your credit limits (this means using your entire credit limit, paying off the amount owed, and then charging on the card again in a single billing cycle). Even if you follow those pieces of advice, a bank could shut you down at any time. If you will lose sleep over being shut down, you should re-think buying gift cards.

All that said, the best cards for Simon purchases will be those that earn the best rewards for everyday spend since Simon purchases likely will not trigger category bonuses on most credit cards. Of course, if you’re working on a new welcome bonus, Simon makes for a relatively cheap way to earn a big initial bonus. There are also the Best Big Spend Bonuses to consider. For example, I earned 3 Radisson free night certificates this past year mostly by buying Simon gift cards.

In the next section, I’ll summarize the best card from each bank, but the following table comes from our Best Everywhere Else Cards page. See that page for a full explanation and keep in mind that you need to ignore the Amex cards.

Best card from each bank

Based on the table above (again, see our Best Everywhere Else cards page for a full explanation of the methodology), here are the best options to consider from each bank:

-Amex: BBPRemember: do not use Amex.- Capital One: Venture or Spark Miles. At 2x “Miles” everywhere, these cards earn the equivalent of 1.5x airline miles per dollar spent with most of their transfer partners. Alternatively, redeem miles for a statement credit against travel purchases at a value of $0.01 per mile.

- Chase: Freedom Unlimited or Ink Business Unlimited. At 1.5x Ultimate Rewards points per dollar, the cost per point is very reasonable no matter which of Chase’s airline partners to which you transfer (Hyatt is also a great value). If you also have the Sapphire Reserve and redeem points for travel through Ultimate Rewards, getting 2.25c would also be attractive.

- Citi: Double Cash. At 2% back, this card will earn $20 per $1K spent. That’s an easy win. However, keep in mind that if you have a Citi Premier or Citi Prestige, you can also turn rewards into Thank You points and transfer to partners. At the costs per point shown above, a sweet spot like using Turkish miles to book United becomes really sweet.

- Bank of America: Cash Rewards (limited) or Premium Rewards with Platinum Honors. The Cash Rewards card offers a 3% bonus category that you can choose and online shopping is an option. I don’t know for sure that Simon’s bulk ordering will trigger this bonus, but Simon has long offered their $500 cards online and according to Doctor of Credit’s payments workshop those orders triggered the online shopping bonus. Note that the 3% bonus is limited in use as it is capped at $2500 in spend per quarter. For those with $100K on deposit with Bank of America (in cash & investments), the Premium Rewards card with Platinum Honors is your best bet. At 2.625% back everywhere, it earns $26.25 per $1K spent.

- Barclays: Unless you have the no-longer-available Arrival Plus or Arrival Premier or you really value a particular co-branded program’s points, give Barclays a miss. Some may consider using an Aviator card since it is the most practical option for earning AA miles, but it’s not very cheap to do so. Perhaps it could be worth it for the big spend bonus.

- US Bank: The Altitude Reserve maybe? To my knowledge, Simon won’t trigger any current US Bank category bonuses, nor does US Bank have a particularly good “everywhere else” card. I’d likely give them a miss as well unless you’re going after the aforementioned Radisson free night certificates, which are earned for each $10K spend up to $30K per cardmember year.

- Others: A Discover IT Miles card could be a terrific option given the fact that you’ll earn double the rewards at the end of the first year, making for an effective 3% back. Of course, if your account gets shut down before the year is done, you may not see those rewards. Still, it is a worthy contender. The BBVA Compass Select may offer a niche play according to one reader. Finally, any 2%-back card (like the Fidelity Visa) offers enough earnings to more than offset costs.

Bottom line

The bulk ordering program for Simon Visa Gift Cards isn’t for everyone. For starters, it isn’t the cheapest option online. By the same token, many readers won’t need the kind of volume that Simon offers. On the other hand, for those who can handle more volume and stomach the potential risk, they do offer a very interesting option to earn rewards that outweigh the costs. At the present moment, liquidation is a huge obstacle. As I noted yesterday, I will once again be clear here: I am not encouraging anyone to risk your health and the health of others to engage in MS. Please don’t order cards with a plan to make extra trips to the store for the purposes of liquidation right now. However, we will hopefully eventually get past the current pandemic — between now and then is a good time to make your plan of attack in terms of which card(s) make the most sense for you. Be sure to know your liquidation options before you get in for a large order and If you’re intending to order in bulk, it probably makes sense to spread the love around over several cards and issuers. There’s still some risk, but the rewards are worth it for some.

any recent data points from Simon purchases counting or not counting towards Cap1 minimum spend?

I guess I’ve just been really lucky. I deposit money orders into my regular Wells Fargo checking account. The most that I have deposited in a day is just under $9K. I typically deposit just under $3K per day. For Simon Mall purchases, I use the Discover It, Citi Double Cash, and Fidelity Rewards Visa. Discover gives you the highest cash back, but my credit limit is kind of low. I buy just under $3K worth of money orders at a time and make a profit of about $47 per trip. I have been doing this for almost a year.

My wife and my citi double cash card “declines” above $2000 @ Simon Mall.

I just got my Alliant CU statement and DID NOT earn the 2.5% rebate on my Simon VGC bulk purchase. I was just below their $10k monthly spend limit for rebate and got nothing on the Simon portion.

Shoot. I didn’t even think to include a note about Alliant in this. They stopped paying out for obvious online gift card purchases 2 years ago:

https://frequentmiler.com/alliant-paying-0-cash-back-giftcards-com/

So I’m not surprised that it didn’t pay out but I’m sorry that I didn’t include a note about not using Alliant in this post. I’ll update to include that.

Thanks, lesson learned, guess I’ll just have to wait till my Simon mall opens back up and use it there. That has consistently paid the 2.5% on my VGC purchases.

Yes, they’ve paid out fine for all of my on-mall purchases as late as the end of February. No issue there.

is “non MR” earning AMEX card still a no-go? For example, Hilton, Bonvoy, etc from AMEX still won’t earn anything?

To my knowledge, none of them will earn anything. Of course, this specific bulk ordering system for non-business customers is new, so I guess there is some minuscule chance that this will somehow code differently and slip through, but I put that chance at near-zero.

Might make sense to also include the big spend bonuses on your credit cards, e.g., Radisson free nights.

Seems like any discussion ought to include some rating as to shutdown risk for various cards. I’ve heard the Altitude Reserve doesn’t like MS. Does that include Simon? I’ve seen a couple data points recently about US Bank shutting down Radisson/Club Carlson cards for obvious MS.

Links to data points on the US Bank/Radisson shutdowns?

While useful, I think the Simon 1K VGCs are slightly overrated because of the lack of category bonuses. The earning rates for the listed cards don’t seem overly exciting, with the possible exception of the BofA cash rewards card due to the online category, though I don’t have this card. For me, the single best card card to use for Simon 1K VGCs is the Hyatt card. Even though there isn’t a category bonus, Hyatt points are quite valuable, there are milestone rewards (free nights, etc.) with each tier of nights stayed, and it’s the most convenient and cost effective way to gin up Globalist status. I can’t get anywhere close to staying 60 nights, but I can stay 35 nights, and then just MS 50-60K with Simon VGCs relatively easily to earn the remaining nights, in terms of the lower cost and (most important) easier liquidation at Walmart. It may not be a bad option, either, to use the Southwest card to obtain the remaining points needed for the companion pass, after a sign up bonus has posted.

Here’s my question: How much do you guys know about the economics of this for Simon? Someone’s got to be coming out behind in this and I can’t figure out who.

Simon is charging 0.4% (less than 1%). It seems unlikely to me that they’ve negotiated a super-low rate with the credit card companies, so presumably they’re paying between 1% and 3% percent on that same transaction. In that case, Simon is losing between $6 and $26 per $1K card sold. That can’t be right?

The only way I can see that it would be economical for them is if they’re paying a discount on the $1k on the card. That might be possible if the underwriter of the card is expecting some “breakage” (that is, some small proportion of cards are paid for but never use — or only partially used). If that’s the case then either the card backer is correct (in which case it’s individual consumers — the ones who don’t fully realize the value of the card — who come out behind) or the card backer is wrong and they themselves are coming out behind. While the assumption about breakage may be valid for smaller scale transactions I’m guessing that anyone who buys $1K cards like this is pretty likely to realize the full value.

I have to assume that both Simon and the gift card underwriters keep a pretty close eye on this, in which case it has to be breakage that keeps the music playing on the merry-go-round. You guys have any idea?

DOC had an article on Oct 13, 2019 about the economics of gift card sales. Basically the article claimed that there is 9% breakage on gift cards. The article claimed that the retailer earns 5% on the sale minus 2-3% for swipe fee. Blackhawk Network keeps 4%.

I assume that these numbers are fairly accurate. It also explains why supermarkets and office supply stores can occasionally sell the cards at a loss.

These programs are specifically targeting customers that will have near zero breakage (lost or stolen cards, not leaving balances on them), so I’ve wondered if there is some financial engineering reason to want to boost revenue numbers.

“If you are purchasing money orders, be sure to deposit in a bank that you don’t care much about. Some banks will shut down your accounts for money order deposits.”

This is a must.

Just got all my accounts closed by Santander (after depositing about ~5k in MO’s per week for the past 18 months). Made the mistake of using that checking account to pay all mortgages, all utilities, student loans, etc. Real PITA brought on my laziness, plus the angst of waiting for a big check from them via snail mail.

Somewhat humbling to receive a letter from them with the opening lines, “Santander has decided to end its relationship with you. This decision is final.”

I’ll be back to Santander in a year for a bank bonus (if they’ll have me), but lesson learned.

Thanks for sharing your experience. It’s useful info. However, making an effort to keep each deposit under $10K (and/or to spread them around multiple banks to avoid this limit) is bad advice.

The $10K threshold Sam mentions here is because banks need to report cash deposits above this amount. Intentionally depositing less to stay under the reporting threshold is structuring. That is a crime. Manufactured spending is legal; structuring your deposits to avoid reporting thresholds is not. Personally, I never deposit less than $10K at a time in order to specifically not appear to be trying to avoid that limit.

Some banks are more accepting of MO deposits than others. It’s worth doing some research (the forums at Flyertalk are good for this) to determine which banks might be easier than others (though of course note that you could still be shut down at any time). With a couple of exceptions, your best bet will be to find smaller local banks/credit unions where you won’t be too upset if and when they close your account.

Sorry, Nick. Edited to clean it up. Didn’t mean to create more work for you.

Of course let’s get the Feds looking into our accounts and asking questions too . Is this stuff really worth it ? Stay away from the banks u do bus. with or they will contact the Feds . Their just like ur CPA if they don’t turn u in they LOSE it all .

Have fun let’s hope they don’t hold up ur Tax refund while looking @ ur pocket change profits.

CHEERs

What a great perspective Nick! This is the part of ms I’m most concerned about. To clarify…u don’t make mo deposits under 10k and keep it to 1 bank, correct?

Also, if u do make deposits >10k, who does the bank report u to and how does that impact u?

the other sam, thanks for the heads-up. I had a Bank of West checking account closed a couple years back for depositing about $12k in MOs inside 2 weeks. It was a not a main account, but a bank bonus producing account that one can churn every 2 years.

Another heads-up: Do not deposit MOs in bank bonus accounts, even on a small scale.

Thanks for all the detailed info!