NOTICE: This post references card features that have changed, expired, or are not currently available

This week has been bonkers. Had you told me two years ago that we would see a 15x bonus category good on up to $25,000 spend, I’d have laughed you out of the room. Had you said it would come as a side dish with 125,000 Membership Rewards points on the same plate, I’d have made like E.T. and tried to help you phone home because you clearly would not have been from this planet. Heck, just on Thursday morning I didn’t have it on my mind to find a better offer than the 100K offer we published initially or the 125K referral offer after that. Greg and I talk about how it all went down on this week’s Frequent Miler on the Air below. Watch or listen below or read on for posts this week about how to meet Amex minimum spending requirements, what changed on the Platinum card (note that the changes also apply to existing cardholders immediately, with the new annual fee expected to apply at 2022 renewal), the latest updates to Chase Pay Yourself Back and more.

Subscribe to our podcast

We publish Frequent Miler on the Air each week in both video form (above) and as an audio podcast. People love listening to the podcast while driving, working-out, etc. Please check it out and subscribe (if we get enough people to subscribe, we might be able to earn some income from this someday. So far, the podcast is just a labor of love).

Our podcast is available on all popular podcast platforms, including:

Apple |

Spotify |

You can also listen from your browser:

This week at Frequent Miler

Everything Amex

The Amex Platinum “Coupon Book” Review [On my mind]

Many dissatisfied cardholders have compared the various Amex Platinum monthly credits to a “coupon book”. Is that fair? I understand the temptation to do that given new monthly credits for a small handful of streaming / media services and Equinox. On the other hand, the card still carries a couple of easy-to-use $200 credits and benefits like Hilton Gold, emergency medical evacuation, and a host of other Platinum benefits. Personally, I do not at all value the streaming or Equinox benefits, but I think I’d actually be OK with spending $145 for a $200 FHR credit each year, so I’m probably going to hang in there despite the fact that I one thousand percent agree that I don’t want to see any more twenty dollar credits that I need to stress over remembering to use in order to justify a $695 credit card. I hope Amex has that stuff out of its system.

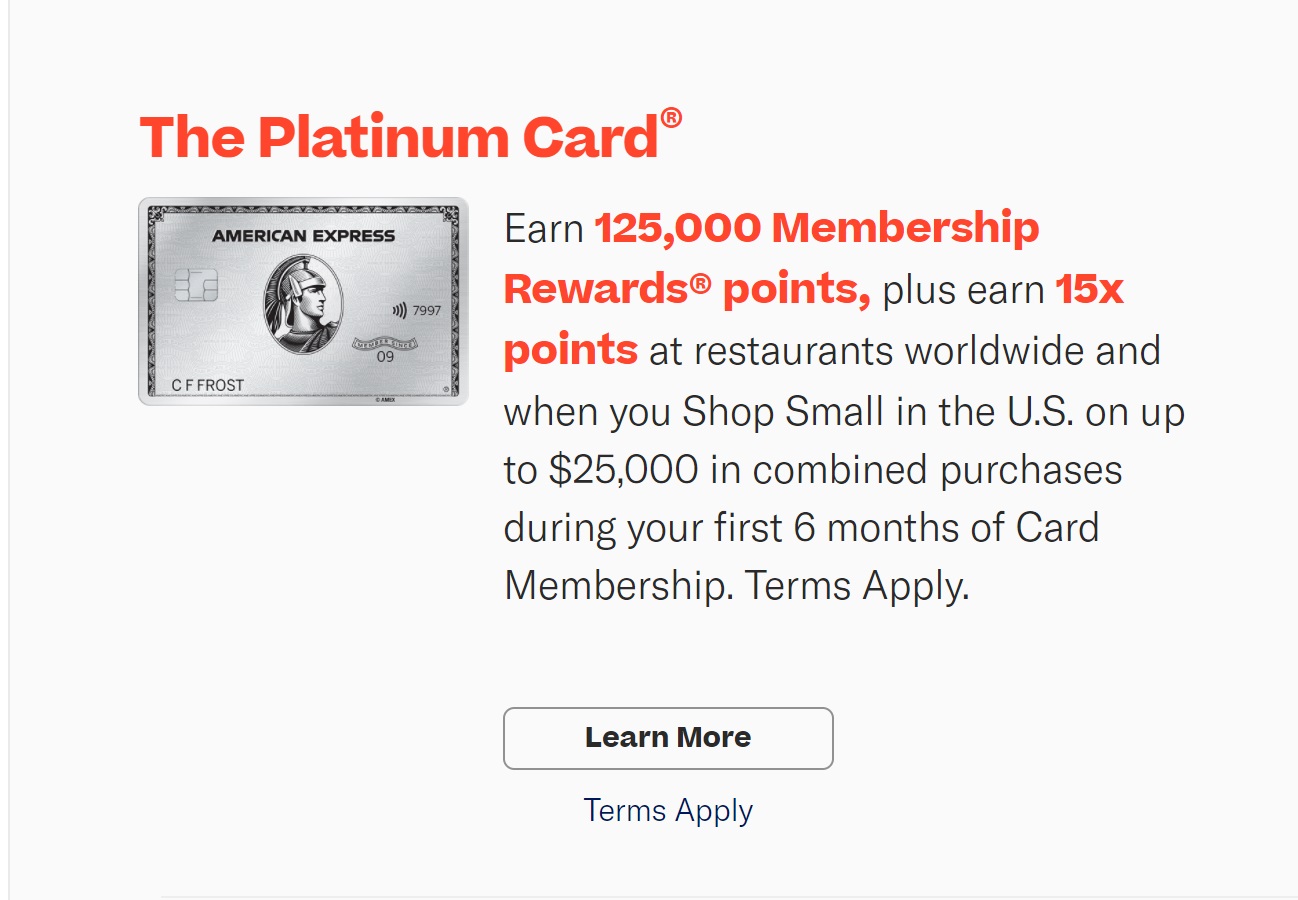

Now 125K + 15x Platinum via Resy!

Wow, wow, wow. Had you told me that a card would offer 15x on up to $25K spend in any category at all, I’d have laughed you out of the room a year or two ago. Getting 125,000 points and 15x — at restaurants and small businesses is utterly amazing. This new Platinum card offer that’s only available at Resy could yield up to 500,000 Membership Rewards points from just one new credit card. That is incredible almost beyond description. When you consider that local contractors, car dealers, restaurants, wedding vendors, salons, retail stores, and maybe even franchise-owned chain locations could possibly qualify as small businesses, the possibilities for 15x start to feel endless. You’ll need to make test purchases to verify how those businesses will code, but this offer is off-the-wall crazy.

New 125K + 15x Platinum live: Disappointing restrictions, monster 10x cap

The Resy offer is so amazing as to make the Platinum card changes entirely irrelevant for new cardholders. That is to say that even if you use zero of the new benefits, that Resy offer more than mitigates the fee by a long-shot. But if you are currently a Platinum cardholder and you’re wondering what changed this week, this post summarizes my thoughts on the changes and new offers. Existing cardholders got access to new benefits like the $200 Fine Hotels & Resorts or The Hotel Collection credit starting on July 1st, so you don’t need to wait or to have opened the card new to get those long-term benefits. Personally, I am incredibly disappointed in the streaming credit as I don’t use any of the included services (there are better apps than Peacock for entertainment, I am already invested in building playlists on Spotify, I like to read the newspaper but reading a long-form New York Times article on my phone would make me want to pull my eyeballs out, and since I don’t commute I don’t listen to audiobooks). That said, I’ll be really happy to use the $200 FHR credit this year and next calendar year before getting hit with the new annual fee.

How to meet minimum spend requirements with Amex cards

Got yourself a shiny new Platinum card or some other new Amex? Wondering how to safely meet minimum spending requirements without getting your points clawed back for spending on things that Amex doesn’t want you to spend your money on? This post gives you a bunch of ideas about ways to safely meet Amex minimum spend and earn your big bonus without risking your points. Personally, I don’t like to play games with an Amex welcome bonus — the points are worth too much to risk getting them clawed back and I don’t want to be logging in every day to make sure that my points are still there — so I appreciate a post like this to keep things simple.

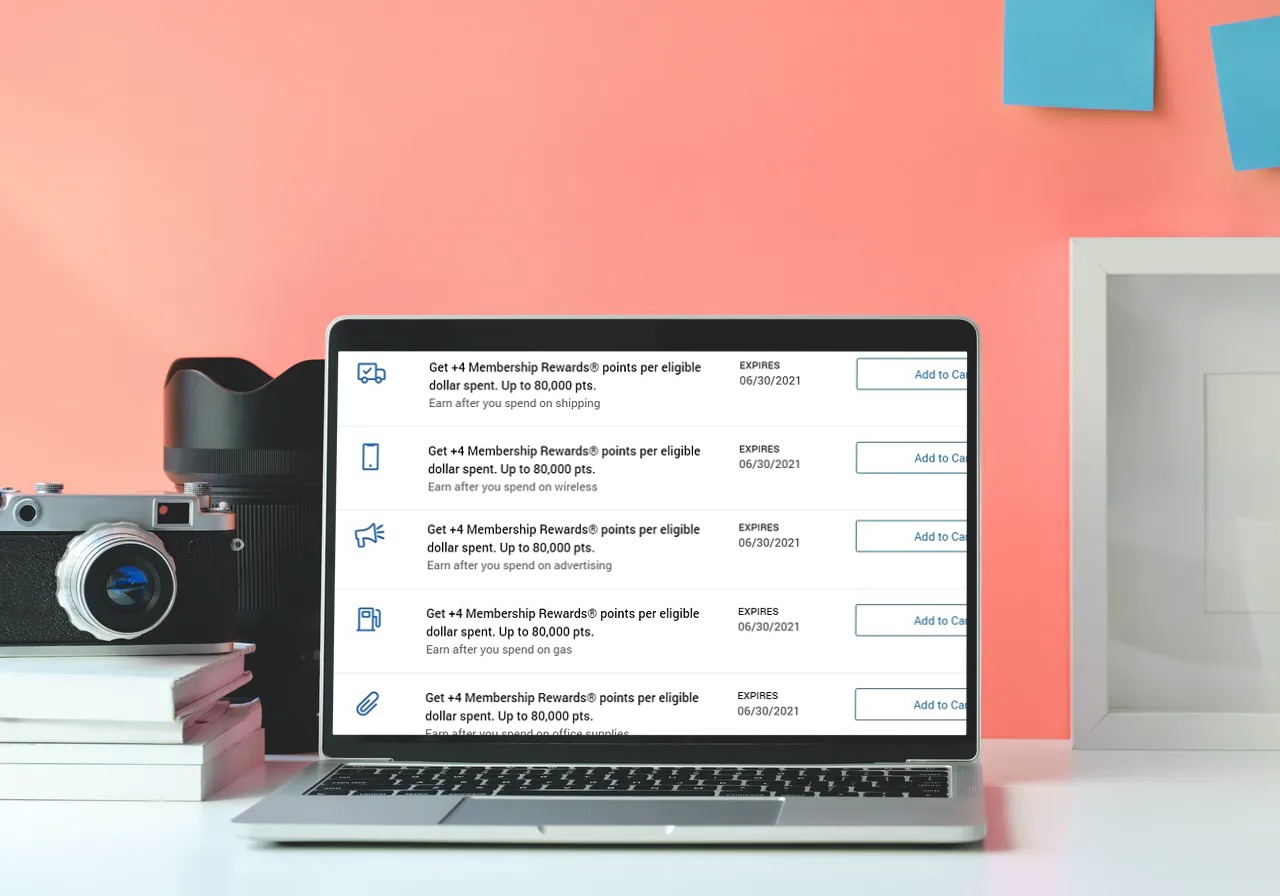

Amex Offer Cheat Sheet

A new month is upon us; have you used your monthly wireless credit? How about your dining credits? When does that Amazon Amex Offer end? Bookmark this resource so you can stay on top of the game.

Goodbye, Membership Rewards

Earlier this week, I talked about saying goodbye to my Membership Rewards points while they can still be redeemed at 1.25c each via the Schwab Platinum card. The reality is that I’ve got too many points sitting and they have a lot more potential in an investment account. If I was concerned about dropping my balance to zero, the new Resy Platinum offer could probably fix that problem in a hurry, so despite Membership Rewards being my favorite transferable currency and my knowledge that I could get far outsized value from the points via transfer partners, I’m pretty sure that I’ll be party with almost all of my points before the conversion ratio changes in September. There is just too much long-term potential to ignore.

Amex Platinum Complete Guide

Which Platinum card has the best deal for authorized users? How can you get the annual fee rebated? What’s the difference between the business and personal versions? Everything you need to know about the Platinum cards can be found in this complete guide, so bookmark it now.

New Simon Spend Card: $250 Visa Gift Card With $6.95 Fee (But Easier Liquidation Options)

There’s a new Simon card in town: it’s got some great features, but sheesh it’s expensive. Simon clearly “gets it”: they’ve designed a card that doesn’t say “gift card” or “Simon” anywhere and made sure it can be used at Walmart and grocery stores. Unfortunately, you probably don’t want to buy it. Why? The fees are too darn high. At 2.78% in fees, this will only make sense for those who need to meet a minimum spend requirement or valuable big spend bonus and who can’t make use of something like Plastiq to save a bunch of time running around to liquidate gift cards. That said, the fact that Simon is trying so hard to give us what we want shows me that Simon isn’t the weak link here. Here’s hoping that this turns into something better eventually.

Chase “Pay Yourself Back”

Chase has updated Pay Yourself Back with an extension for business cards, so this post has been updated and refreshed to be a go-to resource for which categories are available on which cards and at what rates. Given this new round of extensions to match those previously announced on the consumer cards, we continue to be confident that we’ll see more extensions (though possibly category changes) over time.

That’s it for this week at Frequent Miler. Don’t forget to check out this week’s last chance deals.

![Cutting our collections, comparing free night certificates, and expediting new cards [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/07/Nick-Platinum-cancel-218x150.jpg)

![Re-Bilt already, Fixing Marriott, the best Hyatts for Free Night Certificates and more [Week in Review]](https://frequentmiler.com/wp-content/uploads/2026/01/wp-1768653765552601913603261308925-218x150.jpg)

my local grocery store is a small business. They carry visa, target, Amazon etc, gift cards. Is it worth paying the 5.95 fee for the Visa cards? Not sure how I should spend $25,000 here? Thanks!

Have you heard of a Amex titanium card coming?

Have you heard a new AMEX TITANIUM card that is coming out. It’s a card that would fall between 5he Centurion and Platinum??

Nope, haven’t heard anything about that.

Another question: can an existing cardholder get any of the 15X restaurant and small business point offers? Also, I just checked what qualified as “streaming.” What a joke for the reasons you stated. Peacock? Really? How about Fubo, Sling, Hulu, Netflix.

No, 15x is part of the welcome bonus. You only get a welcome bonus when you open a new account. You get the ongoing annual benefits, but nothing that’s only offered in the first few months of being a card holder.

In fairness, I guess they call it a digital entertainment credit. I suppose streaming was my word because they offered the streaming credits last year. But either way, I agree that it’s lame.

Thanks for the quick reply, and the great articles. Really enjoy them.

Question: do you need the Charles Schwab Platinum to redeem points to a Schwab account? If so, can you have the regular Platinum and a Schwab platinum card? Thanks for the great info as always!

Yes, too both questions.

I loved the podcast this week and had totally missed the Resy news among all the rest.

I think you overlooked the obvious with the Chase BA/IB criticism though. Why compare it to Amex Plat when you can have both?! Who says you can’t have 2 new cards? The Chase spending threshold is not enormous either.

Does the Resy offer have NLL?

If only my property taxes counted as a Shop Small.

Our local municipal water bill coded last year as SS.

I’m sure some Unicorns will be found with the offer.

It would be more interesting if CS would have remained .0125/MR. That would be 26.25% CB on $25K spend.

Has anyone else noticed that it seems like Amex has been slow walking the posting of MR/Points.

Noticed it the last 45-60 days. Lagged more than I can remember.

“…could possibly qualify as small businesses”

Has anyone seen a link or blog or anything that has complied a list of merchants that code with Amex as a “small business”?

I’m all about making small test charges, but sometimes it’s just not feasible.

There is a find-a-store searchable site on Amex for Shop Small, searchable by zip. A couple local, but not so small, grocery chains are listed, i.e. vgc.

Thinking ahead:

I don’t especially want to keep the Amex Platinum card at $695, especially in 2023 when they remove guesting privileges at the Centurion lounges. But I did enjoy the Centurion lounges on a recent many-legged trip around the US and was pleasantly surprised by how many airports I used or transited had Centurion lounges). Plus, my home airport’s (LGA) Centurion lounge just reopened.

At the same time, P2 does not have a Platinum card and I have the 150K point Business Platinum offer.

We could do the Resy offer for P2 and / or the Business Platinum offer for me, then let my Amex Platinum go when the fee comes up next spring (I think they’re going to see a lot of cancellations when the card renews at the higher fee).

Make sense?

Does anyone have any idea when the Resy offer and the targeted Business Platinum offers might expire?

IIRC the Biz plat offer ends 12.31.2021 but could be pulled early.

I totally agree they may see a lot of cancellations with the increased annual fee, particularly if it’s true that in 2023 you can’t bring a guest to the lounge for free. That it when I would likely cancel (the streaming credit may make the increased annual fee palatable)

I added an additional authorized user to my platinum account in June, to receive the 20k bonus, does my authorized user also receive 10x on grocery and gasoline for 6 months?

Yes!

Did anyone get one of the ‘new’ Amex cards on 7/1 or later and have the terms in the mailer state $550 annual fee? Mine does. Wonder if that’s a mistake or we’ll actually be charged $550.

pretty sure they will have to only charge you $550 if that’s what the disclosure states.