NOTICE: This post references card features that have changed, expired, or are not currently available

UPDATED 11/30/16

Note: On January 8, 2016 American Express sent out a notice to a large number of Bluebird & Serve cardholders informing them that loading capabilities on their accounts had been terminated. For more information, see: Amex kills Bluebird and Serve for manufactured spend

Among the trio of similar Amex prepaid reloadable cards, Serve has an advantage over Bluebird and REDbird in that it can be reloaded online with a credit card, up to $1,000 per month. Unfortunately, as of April 15 2015, Serve added a new restriction: Only Amex credit cards can now be used to reload Serve online. And, as before, Amex credit cards do not earn rewards when loading Serve.

Serve with Softcard (no longer available to new applicants), does not currently appear to have the Amex only restriction (see the comments in this post). For everyone with regular Serve, though, their remains at least one way to earn rewards through online credit card loads. The key is to find rewards based American Express cards that are issued by banks other than American Express…

The best Amex card options issued by other banks…

U.S. Bank FlexPerks® Travel Rewards American Express® card: You’ll only earn 1 point per dollar when using this card to load Serve, but points are worth up to 2 cents each when used to purchase flights (see: Maximizing value from the U.S. Bank FlexPerks Travel Rewards Card). Plus, cardholders get 3,500 bonus points when they spend $24,000 in a year on the card. Serve can be used to get you half way there. For reference, this card also earns 2 points per dollar for gas, groceries, or airline purchases (whichever is most each billing cycle); 2 points per dollar at restaurants; and 3 points per dollar for charities (I especially like to use this card for Kiva loans).

BBVA NBA TripleDouble Rewards American Express: This card earns 2X at gas stations and supermarkets and 3X for NBA purchases. So, most of the time, this card will only earn 1% cash back when loading Serve. However, the card earns 5X on all purchases during the NBA All-Star Weekend and two weeks of the NBA finals. So, twice a year its possible to earn 5% cash back when loading Serve.

Personally, I’m not a big fan of this option. I like to setup my Serve accounts to load automatically, so I wouldn’t want to worry about changing the timing of the loads to match up with NBA events.

Fidelity Investment Rewards American Express Card: The Fidelity Investment Amex card offers 2% cash back and no annual fee. By loading $1,000 per month to Serve with this card, you can earn $240 cash back per year. UPDATE: Unfortunately, the Amex version of this card is no longer available, and existing cardholders will be switched to the new Visa card by June 2016.

Other options (as found in this Doctor of Credit post):

- PenFed Defender American Express Card: Earn 1.5% cash back. Must be in military service, the National Guard, the Reserves, or an honorably discharged Veteran of the United States Military to apply.

- BOA Accelerated Rewards American Express Card: 1.25%.

- FNBO TravElite Credit Card: 1.5% ($99 annual fee)

Reasons to consider Amex issued Amex cards

UPDATE 11/30/2016: Serve loads with Amex issued cards no longer count towards minimum spend requirements or big spend bonuses.

If you don’t have any of the above mentioned cards, you might still find a use for loading Serve with Amex issued cards even though they won’t earn points for these loads:

Meet minimum spend requirements: When you signup for a new Amex card, there is usually a requirement to spend a certain amount with the card within 3 (sometimes 6) months in order to receive the signup bonus. According to many reader reports, you can meet that spend requirement with Serve online credit card loads even though you won’t earn points.

Meet big spend bonus requirements: A number of Amex credit cards offer bonuses for big spend. For example, the Delta Platinum card offers 10,000 bonus miles (plus 10,000 medallion qualifying miles) when you reach $25,000 spend within a calendar year. According to reader reports and my own experience, you can use Serve online credit card loads to help meet that big spend requirement.- Waive $1 monthly fee: Serve charges $1 per month (except in New York, Texas, and Vermont), but waives the charge if you load at least $500. Amex issued credit card loads can be used to waive that fee.

Important: Serve loads do not help to meet billing cycle spend requirement for EveryDay cards: I’m a fan of the Amex EveryDay and EveryDay Preferred cards (see why here). The EveryDay card offers a 20% bonus on all points earned when you make at least 20 purchases in a billing cycle. Similarly, the EveryDay Preferred card offers a 50% bonus on all points earned when you make at least 30 purchases in a billing cycle. Unfortunately, according to multiple reader reports, Serve online loads do not count towards the required 20 or 30 billing cycle purchases.

How to use the money that’s been loaded

Once money has been loaded to Serve, it’s very easy (and free) to make good use of it:

- Pay bills that can’t normally be paid by credit card: Log into your Serve account and pay anyone. If the recipient isn’t found, you can enter their name and address and they’ll be sent a check in the mail.

- Withdraw from MoneyPass ATMs for free

- Withdraw to your bank account: You can find the option under: Settings… Withdraw Funds.

- Use as credit card: Your Serve card can be used as a credit card anywhere that American Express is accepted, but I don’t recommend it. You will not earn extra rewards this way. It’s better to use a rewards credit card if at all possible.

Questions?

If you have general questions about Serve (or Bluebird and REDbird), please see: The complete guide to Bluebird, REDcard, and Serve.

| Chase's 5/24 Rule: With most Chase credit cards, Chase will not approve your application if you have opened 5 or more cards with any bank in the past 24 months. To determine your 5/24 status, see: 3 Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely. |

| Chase 5/24 semantics ("Subject to" vs. "Count towards"): Most Chase cards are subject to the 5/24 rule. That means the rule is enforced in making approval decisions. In other words, you probably won't get approved if your credit report shows that you opened 5 or more cards in the past 24 months. Meanwhile, most business cards (such as those from Chase, Amex, Barclaycard, BOA, Citi, US Bank, and Wells Fargo) are not reported on your personal credit report. These cards do not count towards 5/24. Example: Chase Ink Business Preferred is subject to 5/24, so you likely won't get approved if over 5/24. If you do get approved, it won't count towards 5/24 since it won't appear as an account on your credit report. |

| Amex credit and charge card limits: If you apply for a new Amex credit card, you may get turned down if you already have 5 or more Amex credit cards; or 10 or more Pay Over Time (AKA charge) cards. Both personal and business cards are counted together towards these limits. Authorized user cards are not counted. See also: Which Amex Cards are Charge Cards vs. Credit Cards? |

| Applying for Business Credit Cards Yes, you have a business: In order to sign up for a business credit card, you must have a business. That said, it's common for people to have businesses without realizing it. If you sell items at a yard sale, or on eBay, for example, then you have a business. Similar examples include: consulting, writing (e.g. blog authorship, planning your first novel, etc.), handyman services, owning rental property, renting on airbnb, driving for Uber or Lyft, etc. In any of these cases, your business is considered a Sole Proprietorship unless you form a corporation of some sort. When you apply for a business credit card as a sole proprietor, you can use your own name as your business name, use your own address and phone as the business' address and phone, and your social security number as the business' Tax ID / EIN. Alternatively, you can get a proper Tax ID / EIN from the IRS for free, in about a minute, through this website. Is it OK to use business cards for personal expenses? Anecdotally, almost everyone I know uses business cards for personal expenses. That said, the terms in most business card applications state that you should use the card only for business use. Also, some consumer credit card protections do not apply to business cards. My advice: don't use the card for personal expenses if you're not comfortable doing so. |

| Manufacturing Spend Caution: Many, many things can go wrong when manufacturing spend. If you suddenly increase credit card spend, your accounts may get shut down. If you cycle your balance often (e.g. spend to your limit, pay the bill, repeat) within a billing cycle, your accounts may get shut down. If you repeatedly pay your credit card bill from an anonymous bill payment source, your accounts may get shut down. If you buy lots of gift cards you may lose money due to gift card fraud, theft, loss, or simply mishandling those gift cards (e.g. maybe you thought you already used a gift card and tossed it into your “used” bin). If you rely on only one method to liquidate gift cards, you may be stuck unable to pay your credit card bill when that method gets shut down. In other words, don’t try this at home unless you know what you’re doing, and you understand and accept the risks.. |

| Chase Ultimate Rewards points are super valuable and super flexible. At the most basic level, points can be redeemed for cash or merchandise, but you'll only get one cent per point value that way. A better option is to use points for travel. When points are used to book travel through the Ultimate Rewards portal, points are worth 1.25 cents each with premium cards (Sapphire Preferred or Ink Business Preferred, for example) or 1.5 cents each with the ultra-premium Sapphire Reserve card. Another great option is to transfer points from a premium or ultra-premium card to an airline or hotel program when high value awards are available (see this post for details). If your points are tied to a no-fee "cash back" Ultimate Rewards card, then first move those points to a premium or ultra-premium card before redeeming them in order to get better value. |

| Amex Membership Rewards points can be incredibly valuable if you know how to use them. In general, if you use Membership Rewards points to pay for merchandise or travel, you won't get good value from your points. One exception is with the Business Platinum card where you'll get a 35% point rebate when using points to book certain flights. This gives you approximately 1.5 cents per point value, which is pretty good. Another exception is with the Business Gold Card where you'll get a 25% point rebate when using points to book certain flights. This gives you approximately 1.33 cents per point value. If you don't have either card, then your best bet is to transfer points to airline miles in order to book high value awards. More details can be found here: Amex Membership Rewards Complete Guide. |

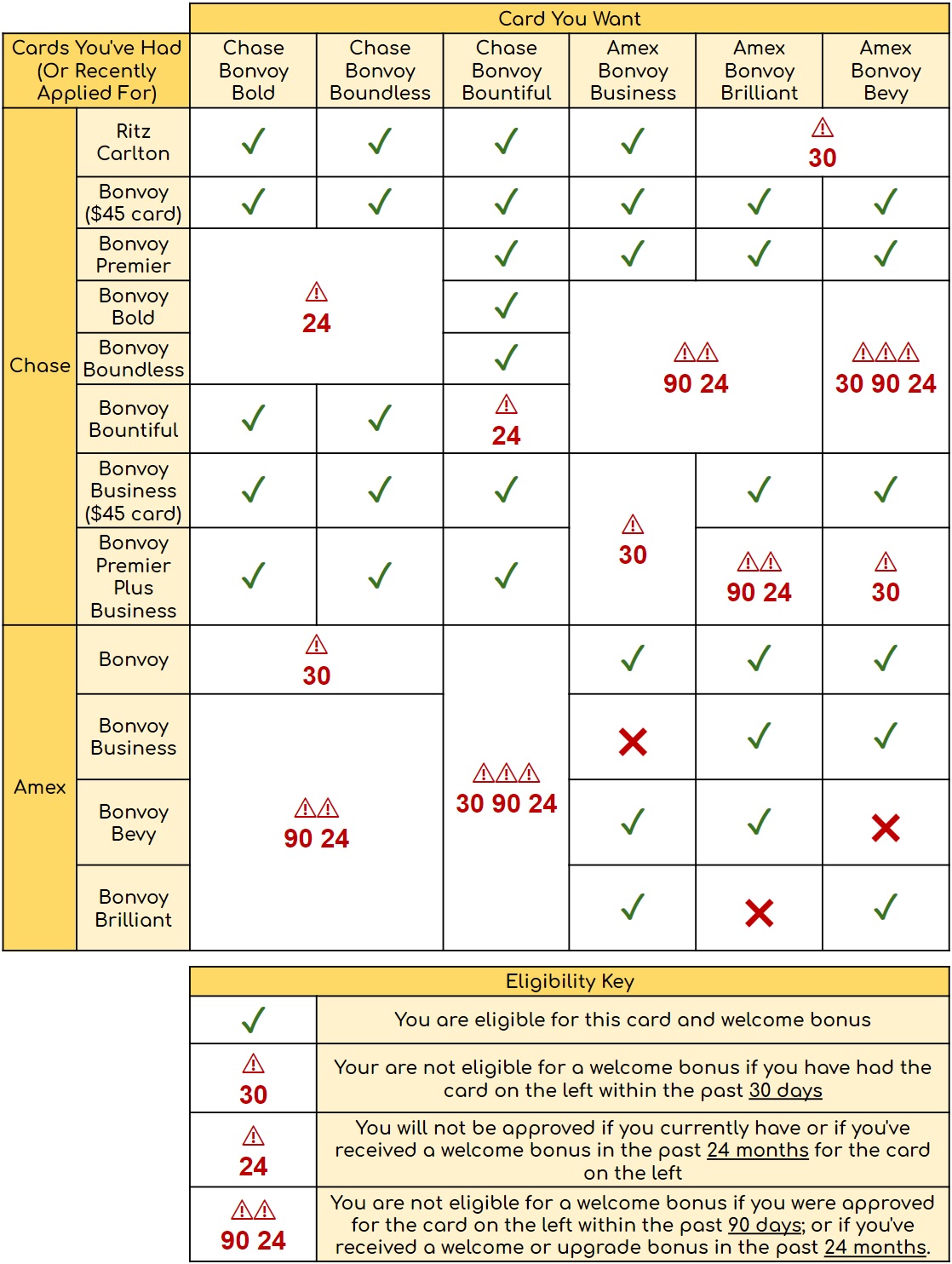

| Marriott points can be redeemed for free night awards, travel packages, airline miles, or experiences. 5th Night Free Awards: When redeeming points for free nights, the 5th night within a single reservation is free. Airline miles: Points can be converted to airline miles at a rate of 3 points to 1 mile. With many programs, a bonus is added on when you transfer 60,000 points at a time, such that 60,000 points transfers to 25,000 miles. Also, you'll get a 10% bonus when transferring points to United Airlines. Everything you need to know about Marriott's rewards program, Bonvoy, can be found here: Marriott Bonvoy Complete Guide |

| Editor’s Note: This guest post was written by the same guy who showed you how to fly round trip to Africa (DC to Senegal) for 50,000 points, how to book business class to Europe for 80,000 miles roundtrip, and more. You can find John’s website and award booking service here: theflyingmustache.com/awardbooking. -Greg The Frequent Miler |

Amex Application Tips

Check application status here. |

Chase Application Tips

Call (888) 338-2586 to check your application status |

Citi Application Tips

Check application status here. |

Bank of America Application Tips

Click here to check your application status |

Barclays Application Tips

Consumer: Click here to check your application status |

Capital One Application Tips

Call (800) 903-9177 to check your application status |

Discover Application Tips

Click here to check your application status |

TD Bank Application Tips

Call (888) 561-8861 to check your application status |

US Bank Application Tips

Call (800) 947-1444 to check your application status. |

Wells Fargo Application Tips

Check application status here. |

Under certain circumstances consumer Visa cards don't work with Plastiq. The following payments are fine:

|

In order to meet minimum spend requirements, people often look for options to increase spend in ways that result in getting their money back. These techniques are referred to as "manufacturing spend". American Express has terms in their welcome offers that exclude some manufactured spend techniques from counting towards the minimum spend requirements for the welcome offer. For example, most new cardmember offers have terms like this:

Eligible purchases to meet the Threshold Amount do NOT include fees or interest charges, purchases of travelers checks, purchases or reloading of prepaid cards, purchases of gift cards, person-to-person payments, or purchases of other cash equivalents.That said, many techniques for meeting minimum spend are perfectly fine. Here are some techniques that are safe for meeting Amex minimum spend requirements (click each link for more information): |

|

| We have added this to our running list of Black Friday deals, which will be constantly updated through Cyber Monday with a mix of gift card deals, merchandise deals, and travel deals. Check back often. |

![[EXPIRED] Serve One VIP to be discontinued Switch REDbird to Serve](https://frequentmiler.com/wp-content/uploads/2015/09/SwithRedbirdToServe.png)

Will the AAdvantage Citi Amex credit card award miles when you use it load the Serve card online?

I think so. Has anyone tried a non-Amex issued Amex recently?

Hi Greg,

do you know if loading Serve with the Old blue cash Amex will count towards the first $6500 you need to spend in a reward year to activate the 5% cashback? I currently have 4 Serve accounts and, if these loads count, I plan to load $6500 across those 4 counts (max $1k per account per month) so that in 2 months I’ll be done with it. Do you see any problems using the same CC to load those 4 accounts? Both the 4 Serve accounts and the CC are in my name. Thanks

I don’t think it will work. Loading Serve no longer counts towards meeting minimum spend for signup offers, so I doubt it will work here. I could be wrong though!

Oh, and yes, you can’t use the same card to load multiple accounts: you need the name on the credit card to match the name on the Serve card. You could get AU cards that match though

My questions is whether one can use a kiosk (if available) rather than the money center to reload with the GC. BB has been shut down was my understanding…am i to understand that this is still possible for MS?

BB was frozen for many people, but not everyone. Plus anyone new is fine… at first. Eventually your account is likely to be frozen, but you might as well take advantage of the card until then.

If you can find a still-working kiosk, then yes it can be used to reload with a gift card. Such kiosks are extremely rare today though.

My heads spinning with all these info. Let me get this straight. I go to Wal-Mart and open up an account called BB. I buy gift cards from my CC to meet minimum spend and deposit it into BB. So my CC thinks I went and paid my bills from wherever but in fact I just bought say 3,000 worth of gift cards. Now I wait for the bill and pay them with my check that I have from my account at BB or does BB cut a check to them on my behalf? Right now I’m thinking of paying my rent [1040.00] using CC to cover minimum through Plastiq which charge me 2.5 percent [26.00] Help me,my head is spinning. Nate

Yes, mostly.

You can signup for Bluebird online for free.

When you use their bill pay service, Bluebird either cuts a check and mails it or sends funds electronically. When paying most credit cards, it will be the latter.

The real problem with all of this is that not all Walmart stores will let you load Bluebird with gift cards. Plastiq is an easier way to go, with less risk. Bluebird is potentially better for much lower fees (the only fees are to buy Visa/MC gift cards)

Thanks for your quick response. Okay, AMEX just emailed me saying my card is coming.When it arrives, I activate it. Is my account active at this point? Now I purchased Loew’s GC [200×5] When it arrives, I go to Walmart and deposit those GC into my BB account? Any specific place at Walmart. I hear mention of a kiosk. I haven’t seen one but maybe it’s because I wasn’t looking for one. Now these cards are in my account with a value of $1,000.00. My rent is 1040.00 so I add 40.00 more and tell them to cut a check to my landlord?

Right now, I pay my rent using Plastiq an/or Radpad to cover for my minimum sign up bonus but I wouldn’t pay my rent for the fee [26.00] You mentioned risk in using BB? What risk? I don’t get it. Please explain. Nate

You can’t use Lowes gift cards, you have to use Visa or Mastercard gift cards. Don’t buy Vanilla brand gift cards though because they do not work as debit cards at Walmart.

Visa and MasterCard gift cards are debit cards. Depending on the type you get, the PIN is either the last 4 digits of the card number, or found in the packaging.

You go to the Walmart money center and tell them that you want to reload Bluebird with debit cards.

The risk is that many Walmart employees have been taught to not allow gift cards to be used as debit cards. So, you might find that you can’t actually load it as expected.

So do you have any suggestions on how to liquidate my Loew’s cards short of actually using them [wasn’t planning to] or go to Loews and hope someone will help me unload through their purchasing. But the cards you mention that may or may not work, is that the ones I saw at Office Max with some black strip on the back? Is that the pin numbers. Is that the one that turns this card into a debit card?? I also read to make sure that the GC is from US BANK or some other bank. Another problem I’m having is the cost of this cards. By the time I pay for those cards and all, Plastiq may be easier to pay my rent and fulfill my minimum requirement. If I need more to pay for, say 4,000.00 minimum, I’ll just pay my sons rent for 2 month [2,100.00×2] which cost about $110.00 through Plastiq, I thought there was a less expensive way to do it.

No, sorry, I don’t know of any good way to liquidate Loew’s gift cards. Loew’s won’t let you buy gift cards with gift cards. You can sell them to a gift card reseller but you’ll only get about 81 cents to the dollar: tcardwiki.com/giftcards/Lowe’s

tcardwiki.com/giftcards/Lowe’s

Hi!

I have a $4000 expense to make with my new chase ink, and I was thinking to use it to buy a lot of visa gift cards at staples (so i earn 5x dollar) and load them into a serve or bb and then make the purchase.

Which card (serve, bb…) will let me swipe $4000 in one time?

Thanks!

I think that either one will work as long as you have $4K in your account. I’d recommend double checking by reading the member agreement though. Alternatively, do this in order to earn even more rewards:

1. Load $4K to your BB or Serve card as you described

2. Use a rewards credit card to pay the $4K expense

3. Use BB or Serve’s online billpay to pay your credit card bill

[…] Best options for Serve online loads – … – You can’t load Serve online with MasterCard or Visa credit cards but excellent options remain. I’ll show you how to make the most of Serve online loads […]

[…] Best options for Serve online loads […]

[…] Best options for Serve online loads […]

I confirm, SPG does not earn any rewards or points when loading serve

What about the Minimum spend? Does it work for that?

Yes

What about the BBVA NBA Amex card? I am guessing that would work too, right?

Don’t see why not. It should also earn you 1% back in points (with the exception of the All-Star weekend coming in February and the NBA Finals which is months away). I signed up for this card about 2 weeks ago. Tried calling to expedite and it was pointless as others have mentioned. Still waiting to see if the card comes in the mail.

[…] Many people currently use the Fidelity Amex to load their prepaid Serve card online, for free, up to $1000 per month (or $1500 per month for those who signed up with Softcard Serve when it was available). If you do not have the Softcard version of Serve, then you are limited to Amex-only loads. So, this switch to Visa may be a problem for you. I think that the next best option for Serve online loads is the U.S. Bank FlexPerks Travel Rewards American Express card. For more details, see: Best options for Serve online loads. […]

Can confirm SPG card earned min spend towards sign up bonus but no miles.

So, has there been a definitive signal that this strategy will or won’t meet minimum spend requirements on “mainline” AMEX cards? (there are conflicting comments on this)

I used my Old Blue AMEX for this late in 2015 to meet the minimum $6.5k on my Old Blue AMEX card (my anniversary for this card’s new year was October), but know of no way to see if it counted until I start seeing 6% back for grocery/drugstore spend (and I am waiting for their one-month lag to see if I am now getting this rate).

In 2016, I was going to switch to using my Delta Plat AMEX to meet the min. spend for bonus MQMs (and it should be easy to see whether this works on statements when I start), but wondered if anyone has been having success with that?

Thanks!!

I can confirm that it works for earning MQMs with the Delta Platinum card.

I can confirm as of last month that it does meet the minimum spending requirements for the AMEX EveryDay card. Just doesn’t earn any of the 20/30 purchases bonus points benefit nor any points from reloads.

[…] Serve prepaid product. In April, they began restricting these loads to Amex cards only (but… there are still good uses for this feature!). And, Target used to allow in-store credit card loads to REDbird (the Target Prepaid REDcard). […]

I have an AmEx card from First National Bank of Omaha. Wonder if that would at least earn the 1% from loads?

It should. The only risk is if they treat the transaction as a cash advance. To protect yourself, see if they’ll reduce your cash advance limit to less than $200.

Right. I did a test transaction of $10 for the test. So far my cash advance limit hasn’t decreased, so I’ll see what happens. Next dumb question: What if I load $200 on the card and withdraw the money to a bank account a few days later to pay student loans. Wonder if that would throw up a flag? Even 1% back on paying my student loans is better than nothing.

I doubt it would raise a flag, but I couldn’t say for sure. I think it is a bit safer to use Serve’s bill pay feature, if possible, to pay your student loan

Indeed. That is my PREFERRED way, but I don’t know if the idiots at Navient are intelligent enough to apply it correctly. 🙁