NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

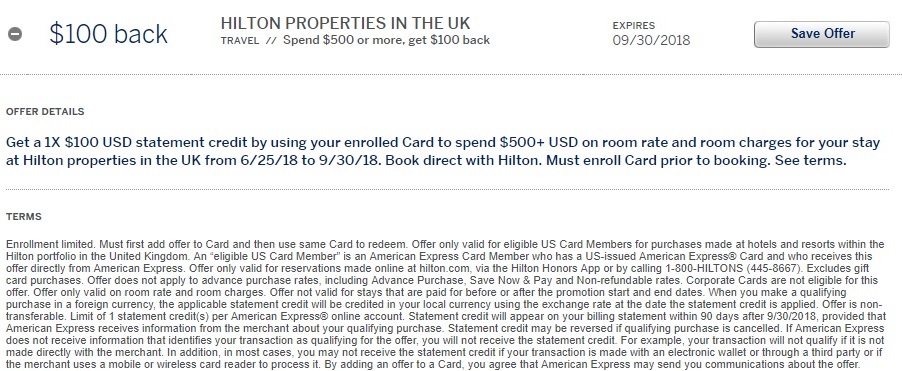

This morning, Stephen posted a quick deal for a new Hilton offer on Hilton / Canopy / Curio Collection (See: Hilton, Curio Collection & Canopy Amex Offer: Spend $250, Get $50 / 5K Back (Targeted)). There is an additional offer aimed at Hilton Hotels in the UK. This one is also targeted, but it’s good for $100 back for those with $500+ in paid stays in the UK.

The Deal

- Targeted Amex Offer: Spend $500+ at Hilton properties in the UK, get $100 back

Key Terms

- Only valid at Hilton properties in the UK from 6/25/18 to 9/30/18

- Excludes prepaid rates

- Excludes gift card purchases

- See offer for full terms

Quick Thoughts

This is a nice offer if you have travel plans in the UK over the next couple of months. If your stay is coming up in July and you are a holder of a Hilton Honors card from American Express, you can earn triple points (See: Hilton Q2 Double Points Promo; Triple Points In July With Hilton Amex) if you have any of the following cards.

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: This card is loaded with valuable perks that are more than worth the card's annual fee if you stay in Hilton resorts at least twice per year. $550 Annual Fee Earning rate: ✦ 14X Hilton spend ✦ 7X US restaurants, flights booked directly with airlines or amextravel.com, select car rental companies ✦ 3X on all other eligible purchases ✦ Terms & Limitations Apply. Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Additional free night awards after $30K and $60K in eligible purchases in calendar year Noteworthy perks: ✦Annual Free Night Reward every year upon renewal ✦ Free Diamond Status ✦ Up to $400 Hilton Resort Credit per calendar year ($200 semi-annually) ✦ $200 Flight Credit (Up to $50 per quarter for purchases directly with airlines or via Amex Travel) ✦ Up to $209 CLEAR (R) Plus fee credit per calendar year ✦ Up to $100 on-property credit w/ Aspire Card package ✦ Terms Apply. See Rates & Fees See also: Amex Hilton Aspire In-Depth Review |

FM Mini Review: Easy way to secure Hilton Gold status (which offers free breakfast among other perks). Those who want Diamond status may be better off with the Aspire card. $150 Annual Fee Earning rate: ✦ 12X Hilton spend ✦ 6X U.S. restaurants, U.S. supermarkets, and U.S. gas stations ✦ 4X U.S. Online Retail Purchases ✦ 3X on all other eligible purchases Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: ✦ Free night award after $15K in eligible purchases in calendar year ✦ Hilton Honors™ Diamond status with $40K in eligible purchases in a calendar year ✦ Terms apply Noteworthy perks: Automatic Hilton Honors™ Gold status. Hilton Honors™ Diamond status w/ $40K in eligible purchases in a calendar year. ✦ Up to $200 in Hilton credits ($50 per quarter) ✦ Terms Apply. |

FM Mini Review: Easy way to secure Hilton Honors™ Gold status (which offers free breakfast among other perks). Amex business cards do not count towards 5/24 status so will not hurt chances of applying for Chase cards. $195 Annual Fee Earning rate: ✦ 12X Hilton spend ✦ 5X on other eligible purchases (on the first $100K in purchases per calendar year, 3X Points thereafter). Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Hilton Honors™ Diamond elite status with $40K in eligible purchases in a calendar year Noteworthy perks: ✦ Automatic Hilton Honors™ Gold status. Diamond status w/ $40K in eligible purchases in a calendar year. ✦ Up to $240 in annual credits for eligible Hilton purchases (Up to $60 per quarter) ✦ Complimentary National Car Rental(R) Emerald Club Executive(R) status (enroll through the link on your American Express online account) ✦ Terms Apply. (Rates & Fees) |

FM Mini Review: This card isn't particularly rewarding, but it's good to keep primarily for targeted Amex upgrade offers to the Surpass card. No Annual Fee Earning rate: ✦ 7X Hilton eligible Hilton purchases ✦ 5X US restaurants, US Supermarkets, and US gas stations ✦ 3X on all other eligible purchases Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Gold elite status with $20K in eligible purchases in calendar year Noteworthy perks: ✦ Free Silver status; Gold status with $20K in eligible purchases. ✦ Terms Apply. |

As Stephen notes in that post, Aspire cardholders can earn 54 points per dollar on Hilton stays in the month of July, so you can bank a bunch of points on top of the offer.

It’s worth noting that a reader recently reached out about the results of a similar offer for Hilton hotels in Hawaii. Whereas in most cases, Amex Offers post as an Amex statement credit (and therefore do not affect the points earned from your stay), in her case the Amex Offer posted as a credit from the hotel in Hawaii. This reduced her spend at the hotel and therefore the points she earned from the stay.

To illustrate that more clearly, a Diamond member paying for a $500 stay with the Aspire card in July 2018 can earn 27,000 Hilton points, broken down as follows:

- 10 base points per dollar (5,000 points)

- 20 bonus points per dollar (10,000 points)

- 10 points per dollar for Diamond members (5,000 points)

- 14 points per dollar for paying with the Aspire (7,000 points)

The first three bullet points are from Hilton Honors based on the $500 you paid at the time of your stay. The last 14x comes from Amex for Hilton spend on the Aspire. In the past, an Amex Offer would not have influenced the 40 points per dollar from Hilton. As far as Hilton was concerned, you’d have spent $500 — the Amex credit was from Amex and therefore didn’t affect your spend at the hotel level.

However, the reader who reached out indicated that the Amex Offer instead came as a credit directly from the hotel and therefore the points for that spend were removed from her Hilton account.

Applied to this Hilton UK offer, that would drop that qualified spend down to $400, therefore earning 21,600 points.

I don’t know for sure that the same will apply, but thought it was worth noting that you may end up earning a few less points than you expect with this offer. Still, a hundred bucks back is enough to make it worth looking to see if rates are competitive at any Hilton properties for your upcoming UK stays.

As always, we have added these offers to our Current Amex offers database, where you can always check to find the lastest offers we’ve discovered on our accounts.

Do you have to spend $500 in a single stay, or can you have multiple stays during the promo period that add up to $500 in room rates?

So I used the similar offer in Hawaii. Seems like the terms and conditions are the same. Stayed at the Hilton Garden Inn and they ended up splitting our room charges (Valet parking) with the actual room charges on my card. My understanding is I should still get credit for the offer but haven’t gotten any indication from Amex that I’ve met the requirements. Does it usually take longer for these things to post? It’s been a month now.

No, it doesn’t usually take longer. The terms of this one state that it could take 90 days, but in my experience Amex Offers rarely take more than a few days to post.

I don’t understand why the valey parking wasn’t charged with your room. Was the valet parking not actually charged by the Hilton? (like did it show up as “Aloha Valet Services” or something like that on your statement?). Was it on your folio? Did you earn Hilton points for the parking charges (from Hilton on your room bill, not from Amex)? If the parking wasn’t charged to your folio, that could be the problem….I’m not sure you’ll have much recourse, but it might be worth a call to Amex anyway.

Thanks for the reply Nick. They actually forgot to charge us so I asked them to add it to our room charge during checkout. I think that resulted in them being split into two separate charges. The stay didn’t reach $1000 so I was relying on the valet charges to push us over. Both charges show that it was by the hotel though.