NOTICE: This post references card features that have changed, expired, or are not currently available

Starting today, August 1st 2018, your SPG credit card will earn 2 rewards points per dollar for base spend. Previously, the same card earned 1 Starpoint per dollar. If you haven’t been following the details of the Marriott & SPG transition to one rewards program, it might sound like the card has gotten better. It hasn’t.

Each Starpoint is worth 3 rewards points. So, the transition from earning 1 Starpoint per dollar to 2 rewards points per dollar is a 33.3% depreciation. For those most interested in airline miles, SPG cards previously offered 1.25 miles per dollar when Starpoints were converted to airline miles at the ratio of 20K points to 25K miles. The new program has preserved the points to miles transfer ratio (20K Starpoints = 60K rewards points = 25K miles), but with 2X point earnings, it will take $30K spend to get the same 25K miles that required $20K spend before. In other words, the SPG card now offers only 0.833 airline miles per dollar. Boo. For more on the topic of spending for airline miles, see: Spending for miles. Best SPG alternatives.

What if you’re not interested in airline miles, but prefer to earn hotel rewards? Our current Reasonable Redemption Value for Marriott Rewards points is 0.72 cents per point. With that valuation, the new base earning rate for your SPG card is only 2 x 0.72 = 1.44 cents per point. Compared to a 2% cash back card, or even a 1.5% cash back, that’s not very good. For hotel rewards, you can get better returns for spend if you focus on Hyatt or Hilton instead. See: Manufacturing free nights (Hyatt, Hilton, Marriott).

Picking a new Everywhere Else card

Ever since the loyalty program merger was announced, I’ve been using my SPG card as my “everywhere else card”. This is the card I turn to when I can’t earn a valuable category bonus using other cards.

With a few exceptions, these are the cards I use for various categories of spend:

- Travel & Dining: Chase Sapphire Reserve earns 3X Ultimate Rewards.

- Gas & Grocery: CNB Crystal Visa Infinite earns 3X rewards.

- Pay bills online via Plastiq, Shipping, and online advertising: Chase Ink Business Preferred earns 3X Ultimate Rewards

- Phone, Internet, Cable, and Office Supply Purchases: Chase Ink Cash earns 5X Ultimate Rewards

- Apple Pay: US Bank Altitude Reserve earns 3X rewards

- Rotating categories: Chase Freedom earns 5X Ultimate Rewards in categories that change each quarter

And then there’s my “everywhere else” card. This is the card that I use at local merchants, department stores that don’t accept Apple Pay, discount stores, etc. With my SPG card turning into a pumpkin, my favorite everywhere else options are:

- The Blue Business Plus Credit Card: Earn 2X Membership Rewards points for all spend, up to $50K per calendar year.

- Chase Freedom Unlimited or Chase Ink Business Unlimited: Earn 1.5X Ultimate Rewards points for all spend. Move points to a premium Chase Ultimate Rewards card to make the points more valuable.

- Bank of America Premium Rewards with Platinum Honors Preferred Rewards: Earn 2.63% cash back on all spend when you have $100K or more invested in BOA and Merrill Edge / Merrill Lynch.

You can find a complete list of great “everywhere else” cards, here: Best rewards for everyday spend.

In my case, my new everywhere else card is the Blue Business Plus Credit Card. 2X everywhere Membership Rewards points is hard to beat!

Is the SPG card still useful for bonus categories?

The consumer and business SPG cards now earn 6 rewards points per dollar at SPG, Marriott, and Ritz properties. That’s pretty good, but I value 3X Ultimate Rewards points about the same as 6X Marriott/SPG points. So, personally, I’ll keep using my Sapphire Reserve card for hotel spend.

The business SPG card adds the following bonus categories: 4X at US restaurants, US gas stations, wireless telephone services purchased directly from US service providers, and US purchases for shipping. If you don’t have a card that offers valuable category bonuses for those categories, it may be worth using your SPG Business card for these purposes, but many cards offer far more valuable rewards within these categories. See our Best Category Bonuses page for in-depth category bonus coverage.

Personally, I already have cards that offer equal or better category bonuses, so I won’t use my SPG card for any of the above purchases.

Consider keeping the SPG card even if you don’t use it regularly

Even if you don’t use the SPG card regularly, it might still be worth keeping despite the $95 annual fee thanks to these perks:

- 1 Free Night Award (redemption at or under 35,000 points) every year upon renewal.

- 15 nights towards elite status (starting 2019). This does NOT stack with elite nights offered by other cards.

- Free unlimited Boingo Wi-Fi

- Amex Offers

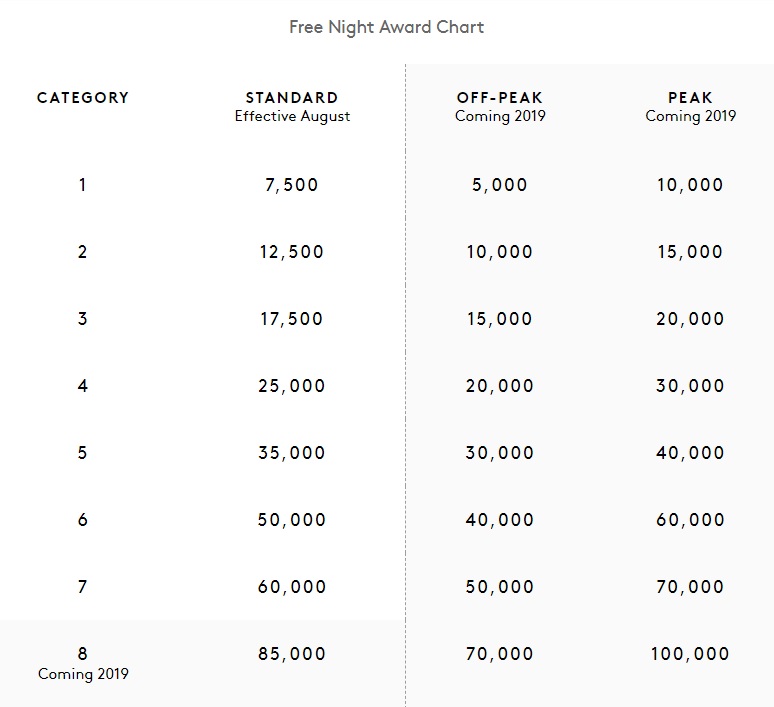

The most valuable of the above perks, as far as I’m concerned, is the annual free night award. Based on the award pricing that becomes effective on August 18th, these certificates can be used to book hotels up to category 5. And there are many very nice hotels at category 5 or below (you can find the announced pricing per hotel here).

The annual free night certificates will hit a snag once peak pricing becomes a thing in early 2019. At that time, some or many of the category 5 hotels you may want to stay at will have peak pricing at 40K. You won’t be able to use the 35K free night certificates to book 40K nights. Instead, you’ll have to use the certificates during non peak times or with lower category hotels.

Personally, I was initially excited to see that a favorite Michigan hotel of mine would be priced at 35K in the new program: Inn at Bay Harbor, Autograph Collection. It would be great if I could use my free night certificates there each summer. But then I realized that they’ll almost certainly set the entire summer to peak award pricing. So, that won’t work.

Despite the peak pricing issue, I’m confident that I can get significantly more than $95 value from the free night certificates each year. Until that changes, I’ll keep my SPG cards open, and continue to pay the $95 annual fee. Yes, they’ll be stuffed into my sock drawer, but they’ll still be alive.

What is the best thing to do with all of my SPG rewards? Transfer to the airline of my choice? I have 25K points.

Keep them until you need them. They will be converted from 25K Starpoints to 75K rewards points on August 18th. If you need airline miles at some point, you’ll can still then convert them at the same rate. e.g. today you would be able to convert 20K Starpoints to 25K miles. After August 18th 60K rewards points (20K starpoints) will get you 25K miles (slightly more with United). By keeping them as points, you can pick an airline once you know which airline miles you need, or you could use points to book a hotel stay.

Will the Business SPG card still grant access to Sheraton Club lounges?

Nope

That benefit is already gone.

*tear

My card anniversary is Aug 28th. Will I receive the annual free night in a few weeks or will I have to pay the AF now and then wait another 12 months after paying another AF till I receive the first free night?

I think you’ll receive the first one this year

Anytime you are forced to find a reason to visit a shitty mid-range hotel just to use a supposed “benefit”, you know you’re screwed. Can’t see any reason to tie up a slot with the SPG card anymore. Hasta la vista to ~100 AUs once 11/30 comes, or whenever I’m done with Lowes/Staples.

Amex is sure going downhill fast. I was hoping they’d do something with MRs to replace the versatility of Starpoints, but they’ve totally failed – beyond mystifying. What are those clowns thinking? Must be hundreds of millions of spend that are going to competitors as of Aug 1 (most of it to Chase, no doubt). Chase is eating Amex’s lunch and they don’t seem to have an answer – although it’s staring them in the face.

I enjoyed SPG stays. Too bad Marriott took it over. I may just concentrate on

Capital One cc.

Ill use the spg Business card for Gas stations (4X) with the 10% discount on Mobil (Amex offer). I think is a great deal.

Not as great as 2x MR on Amex BBP

or 3X MR (Amex Everyday Preffered)

But no 10% discount.

I will never genuinely use the SPG personal/biz card again, but will be keeping both for the free nights. Marriott did a smart thing by keeping the free nights as cat 5 and below. It used to be that cat 5 hotels would only be in garbage locations and spots well outside of desirable metro areas. Now, those same free night certs can get you hotels in some great places. Found hotels in NYC, Boston, Chicago, and bunch of others that weren’t previously available for those free night certs. Because of that, its an easy choice to keep both open. And since I also have a Marriott Premier Plus card, thats three cat 5 certs I can stack together for a fun long weekend each year. That easily offsets the AF.

I mostly agree, but keep in mind that the certs won’t be usable at cat 5s during peak award pricing.

Thats certainly the big caveat. If they are overzealous with that “peak” designation, the certs lose much of their value. And if thats what they do, I would just close the cards. Hopefully they make it reasonable.

For now. Between Peak pricing and inevitable devals I expect the current crop of Cat 5 NYC hotels, for example, to be outside the certs within 2 years.

Which is why I am going to NYC in June.

Would it still make sense to apply for a business version of SPG card, solely because of bonus points?

If you can qualify for the bonus. Sure. See: https://frequentmiler.com/2018/07/30/navigating-marriotts-byzantine-credit-card-rules/

Thanks!

I’m about $3K shy of $30K spend on the card for the year. Still worth spending to get Gold status or not worth it?

Personally I wouldn’t bother, but it really depends on how much value you think you’ll get with Gold status and whether you have other options (such as having/getting an Amex Platinum card)

Amex offer nixed. Points-earning devalued. I think I’ll cancel mine if there’s no retention just to free up a card slot for another applicaiton.

You left out the fact that you can’t stack stay credits from two SPG cards anymore.

True but I don’t chase status so it’s not a big deal for me.

How are you using the chase freedom categories this quarter,

Haven’t yet, but will probably make some visits to 7-11

And do what? I was told 7-11 only sells GCs for cash. How much slurpee can one drink?

That’s true in some places, but not all

Try another 7-11 then. Don’t trust what store employees tell you.

Does the Amex blue business plus card still only soft pull credit?

I’m not sure. Probably.

I’m curious IF/WHEN Amex discontinues the personal SPG card entirely. I hate Chase I’d rather have a SD card from Amex than a Chase one.

Greg? I know this site isn’t what it once was but the fact that there’s no post about the death of Amex Offers multi tab is kind of shocking actually.

Working on it.

I transfer my Starpoints to Alaska to redeem for premium cabins on international flights with a free stopover (e.g. Cathay Pacific, JAL). I do appreciate the 5000 bonus on a 20K transfer. I will probably keep this card for another year to let changes settle.