Given that the best ever 90K offers for the fee-free Ink Cash and Ink Unlimited cards are ending soon, I decided that it was time for my household to jump in. The results were surprising and awesome. Despite my being over 5/24 and despite having an open Ink Cash card, I applied for another one under the same business and I was instantly approved. Despite my son having opened an Ink Cash card in November, he applied for another Ink Cash with the same business and was instantly approved. And, despite my wife having had another Ink Cash card for years, she applied for another one under the same business and she was instantly approved.

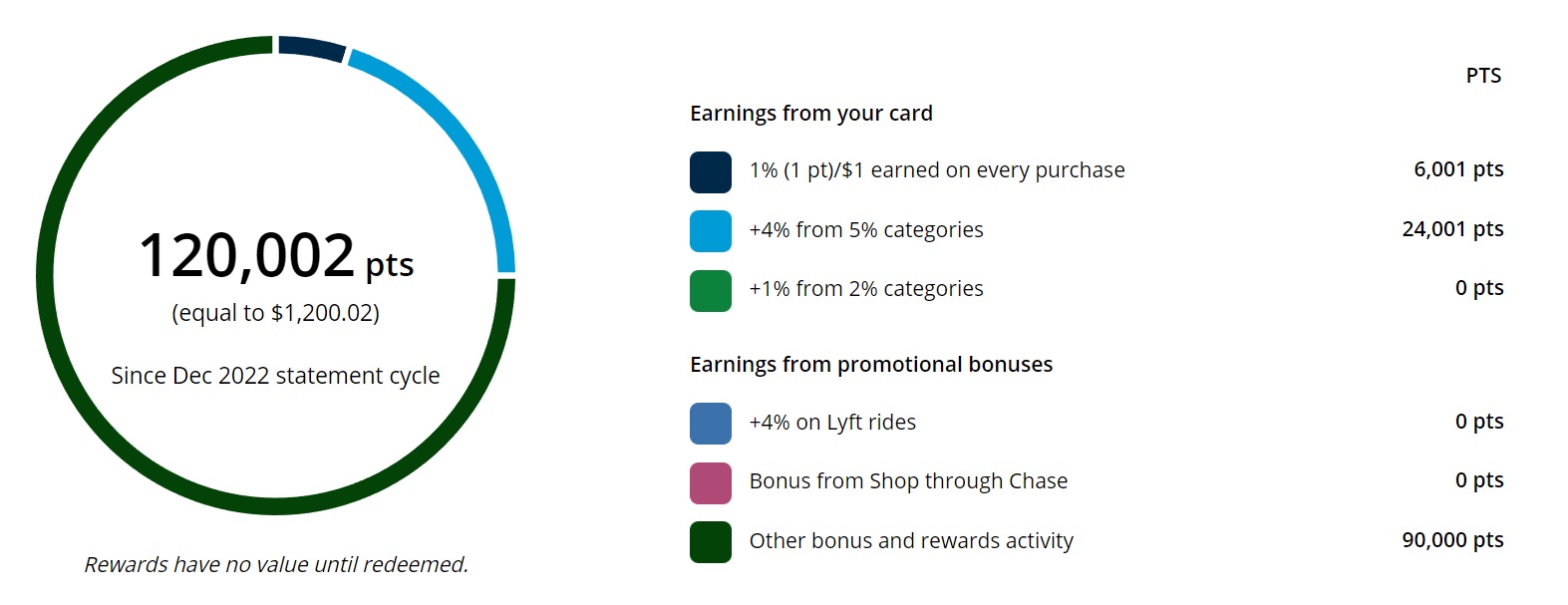

Once we meet the minimum spend on all three cards, the welcome bonuses will add up to 270,000 super-valuable Chase Ultimate Rewards points. And if we complete all of that spend entirely through 5x categories, we’ll earn another 90,000 points for a grand total of 360,000 points!

More than cash back

Chase advertises the Ink Cash card as a cash back card, but it actually earns Ultimate Rewards points. For example, the card’s welcome offer (at the time of writing) is advertised as “$900,” but it is actually delivered as 90,000 Ultimate Rewards points. If this card is the only Ultimate Rewards card in your household, then the best use of points is to cash them out. If you have a Sapphire Preferred, Sapphire Reserve, or Ink Business Preferred card in the household, however, you can then move your Chase Ink points to that card so that you can then transfer points to airline and hotel partners (like Hyatt!) or use points to pay for travel through Chase Travel℠ for better than 1 cent per point value.

My plan for 3 Ink Cash cards

My plan is to (hopefully) spend all of the required $6,000 at office supply stores in order to earn a total of 30,000 points for the required $6K spend. After earning the 90,000 point bonus, this would mean earning a total of 120,000 points with each of the three cards. This approach worked out great with my son’s Ink Cash card that he picked up in November:

Why were our applications approved?

First lets talk about 5/24…

To determine your 5/24 status, see: Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely.

I’m currently over 5/24, but my application was instantly approved. It happens. In the past this has been common with cobranded cards such as Southwest or IHG, but for the moment, Chase seems to be allowing at least some people to bypass 5/24 when signing up for the Ink Cash card (and probably the Ink Business Unlimited as well). I’ve seen similar reports in our Frequent Miler Insiders Facebook Group, so I know that this isn’t unique to me. That said, I’m confident that this situation is temporary given that they also apparently suspended 5/24 for these cards, at least for some people, in December.

About getting a second Ink Cash card…

All three of us successfully opened a new Ink Cash card despite already having one open. And my son was approved despite having earned a welcome bonus a couple of months ago. With most Chase cards, there are rules against both of these things. Usually you can’t get a card that you currently have open, and you usually can’t qualify if you’ve earned a welcome bonus in the last 24 months. Fortunately, these rules don’t apply to Chase Ink cards!

See also: How to sign up for Chase Ink cards.

I tried to get the Ink Business Card and they denied my because of 5/24. The agent on the reconsideration line said that was the only reason it was denied. So we went after the Wyndham cards. Got those now and I am wondering where we should go next. Both me and wife are at 5/24. We are sitting on 313,000 CUR points and about 200,000 Wyndham points. Looking toward going to Europe next year, probably Ireland or Scotland. Any advice as to which way we should go?

I had my P2 do this they were also approved with the same business however, the bonus tracker isn’t showing did you eventually get these bonuses did the tracker show for these cards?

I don’t think I ever looked at the bonus tracker. Yes we earned all of the bonuses.

Just another datapoint- applied P2 for her 2nd Chase Ink Cash card (last one opened on 12/01/22) from my referral and she was instantly approved. Same business on the application. Wow that’s crazy a simple 115K points + 30K from office supply SUB spend. Thanks for the heads up!!

how long do we need to wait to apply for another business card?

I received my Ink business unlimited in January, when can I apply for ink cash without being automatically rejection?

You don’t have to wait. Chase will typically approve up to 2 cards in a month (and sometimes more)

Wanted to add another data point.

I currently am 5/24 with one card dropping off in April and one in June. My credit score fluctuates between 790-810.

In the Chase ecosystem, I have the Freedom Unlimited, Sapphire, Amazon Prime, and the Business Cash.

I applied for the Business Unlimited card on 3/4 with my business’ EIN. I got the “under review message.” That week I got a letter requesting I call to give them more information. I called on 3/11 and gave them my SSN and was transferred to another department so they could review my application. The gentleman I spoke with said that he couldn’t approve it and would need to send it on for further review because the credit limit I already had with my current cards was on the upper limit. He told me the process usually takes 48 hours so if I wanted to, I could call back after that amount of time. I didn’t end up calling because I was out of town.

Yesterday I got an email notification welcoming me to the Chase Ink Business Unlimited. They gave me my credit limit and congratulating me on choosing their card.

I was disappointed when I read that the bonus for these cards would end before I was under 5/24, but decided to take a chance since other people in similar situations were being approved and I’m so glad I did. Thanks for all you do and all the information you share!

My sole proprietor earning is less than my home property tax, which is more than CIC’s SUB limit. Would paying my property tax with CIC flag Chase to look into my accounts or (gasp!) shut down my Chase accounts? I’d like the CIC anyway but wonder if charging so much would displease the Chase overlords.

I don’t think that would raise any red flags at all

Shockingly, I was approved for CIC this morning. (!!!) I question Chase’s standards, hah. Certainly different than Cap1 which recently rejected me, putting a damper on the whole thing – my first rejection ever.

My meager business earning and stated expenses are less than my property tax or the spending to get the SUB. We’ll see if my credit limit is high enough… Thanks for your input.

Data point:

Earlier this month I had an older Ink Unlimited and a very recent Ink Cash. P2 had exactly the same. Both under 5/24.

So “we” went ahead and applied for P2’s second Ink Cash – approved immediately.

Then P2 referred me and I applied for my second Unlimited – not approved – “wait for letter explanation of why not”. Hit to TransUnion only – which was odd as these have always been Equifax.

Then the next day, for some odd inexplicable reason I decided to go for the Ink Cash and see what would happen – same thing as the application for my second Unlimited – same message about wait for letter, but this time no hard pull at all.

I badly wanted to call recon and see what was going on but I fought the impulse … and 10 days later I get an email saying Unlimited #2 was approved. And then yesterday another email saying Ink Cash #2 was approved.

I could hardly believe my luck – and on top of all this I got an alert today from Credit Karma about a change to my score – which showed that my Equifax score actually went UP a notch rather than down and still no hard pull.

This was like winning the lottery !!! Thanks Frequent MIler for the heads-up on these offers not going to last long.

It seems as though Chase with their Business Inks is trying to outdo Amex with their Business Platinums.

Data point–I was declined for a Chase Ink Unlimited today. I’m currently 6/24. I have both a Chase Ink Unlimited and Chase Ink Cash, both of which had been opened for a few years. I have the IHG biz card, which as been opened around a year or so. Applied under my same business EIN as the others. Strange, as Chase had sent me a preapproval mailer on the SW Business Card, but I don’t really want to pay the $199 annual fee.

Data point. My husband was instantly approved for his second ink business cash. He got the chase ink business cash in October and ink unlimited in late November and the ihg business card 2/1. He is 2/24. I did not refer him per Greg’s post/advice.

So, I signed up and got approved, but @greg, why do you think you would get the bonus again? Doesn’t the language say something like “if you have not gotten this in the last 24 months” or something to that effect?

It has to do past history and with where that language is. With most other Chase cards, the splash page for the offer has a link that says “Offer Details” and if you click that, (with non-Ink cards), you’ll see something like “This new Cardmember bonus offer is not available to either (i) current Cardmembers of this business credit card, or (ii) previous Cardmembers of this business credit card who received a new Cardmember bonus for this business credit card within the last 24 months.”

With the Ink cards, you won’t see that language under Offer Details. The only place with Ink cards that shows that type of language is in the fine print on the application screen itself under Certifications:

I think that the language in the fine print is boilerplate but shouldn’t really be there for Ink cards. In the past, that language has been there, but plenty of people (including me) have received the bonus despite still having the card and/or having received a “new Cardmember bonus for this card in the past 24 months.”

Instantly approved for my first CIC. Got my CSR in december and I am at 4/24 currently. I wish I could apply 2nd one before offer ends.

Greg

THANKs I was going to pass so no shut down but saw ur post. I applied 10 mins ago and got the 10 day-thing.But 5 mins later got the approval email .Free $$$$$

Greg, congrats on getting the card. I just applied and got approved (8/24). On another note, are you comfortable making the minimum spend by buying gift cards. I know that Amex clamps down on this, not sure about Chase. Thoughts?

Yes, personally I’m totally comfortable with that. Chase doesn’t specifically target gift card purchases the way Amex does.

My business doesn’t require any spending whatsoever, apart from $50 a month. How could I make this work???

LIE

Many people (including me) use business cards like these for personal spend as well as business spend. If you’re uncomfortable with doing so (which I totally respect), the only option I could think of is to use the card to buy $6K of Visa or Mastercard gift cards which you will then use for your business expenses over time. Of course with only $50 per month spend, you’ll be using those gift cards for a very very long time….

One of your comment seems confusing me – you mentioned ending up with 18K worth of gift cards to liquidate – but mentioned using those to pay for services where credit cards are accepted? isn’t that mixing apples with oranges? …don’t you mean services that are accept gift cards for payment – and which ones are those? Thanks

The gift cards are Visa and Mastercard gift cards which can be used almost anywhere that credit cards are accepted. For example, my insurance company accepts credit cards for bill payments so I could spend those gift cards by paying insurance bills.

And if you use them at Trader Joe’s you can just swipe the card and tell the terminal it’s a credit card and it doesn’t require a PIN. Also TJ’s will drain the card automatically so you don’t have to guess the balance and can use multiple cards.

Same at Costco as long as it’s a VISA – and if it’s a Mastercard you can always use it to buy a Costco gift card online.