My 23 year old son recently applied for two business credit cards and a business checking account. In all three cases, he was instantly approved. Even better, by the time he is done meeting the spend requirements for the credit cards and balance and transaction requirements for the checking account, I expect that he will be at least 365,000 transferable points richer!

Overview

My son has a side-business as a filmmaker, but revenues are just hopeful projections at this point. Still, regardless of whether a business is profitable, it’s possible to sign up for business credit cards. Actually, even if you don’t think you have a business at all, you probably do. If you’re an aspiring author or influencer, or if you occasionally sell things on eBay or at yard sales, then you have a business. To keep things simple when applying for new accounts, use your real name as your business name and apply with “sole proprietor” as the type of business you own.

Several years ago, my son signed up for his first personal credit card as a university freshman (see: My teen’s first credit card, and his next steps towards rewards) and his first business cards as a sophomore (see: Chase Business Ink as a student starter card). Now that he is a college graduate, he can keep going with more and more applications, but he’s not really into the points & miles game so I manage his applications and cards.

Last week, I realized that two opportunities were just too good to pass up: the Chase Ink Cash 90K offer, and the 230K Amex Business Platinum + Business Checking bundle offer. My son applied for each of these and was (amazingly) instantly approved for all. Now I expect that after meeting the bonus requirements for these offers he will be at least 365,000 points richer. And these are not just any points, but super-valuable Chase Ultimate Rewards points and Amex Membership Rewards points. Sweet!

Chase 120K Ultimate Rewards points with 1 card

Ink Business Cash

At the time that my son applied, the welcome bonus for the Chase Ink Business Cash card was 90,000 points after $6K spend. In the past I’ve found that Chase rarely instantly approved Ink card applications and so I nearly fell off my chair when my son’s application was instantly approved!

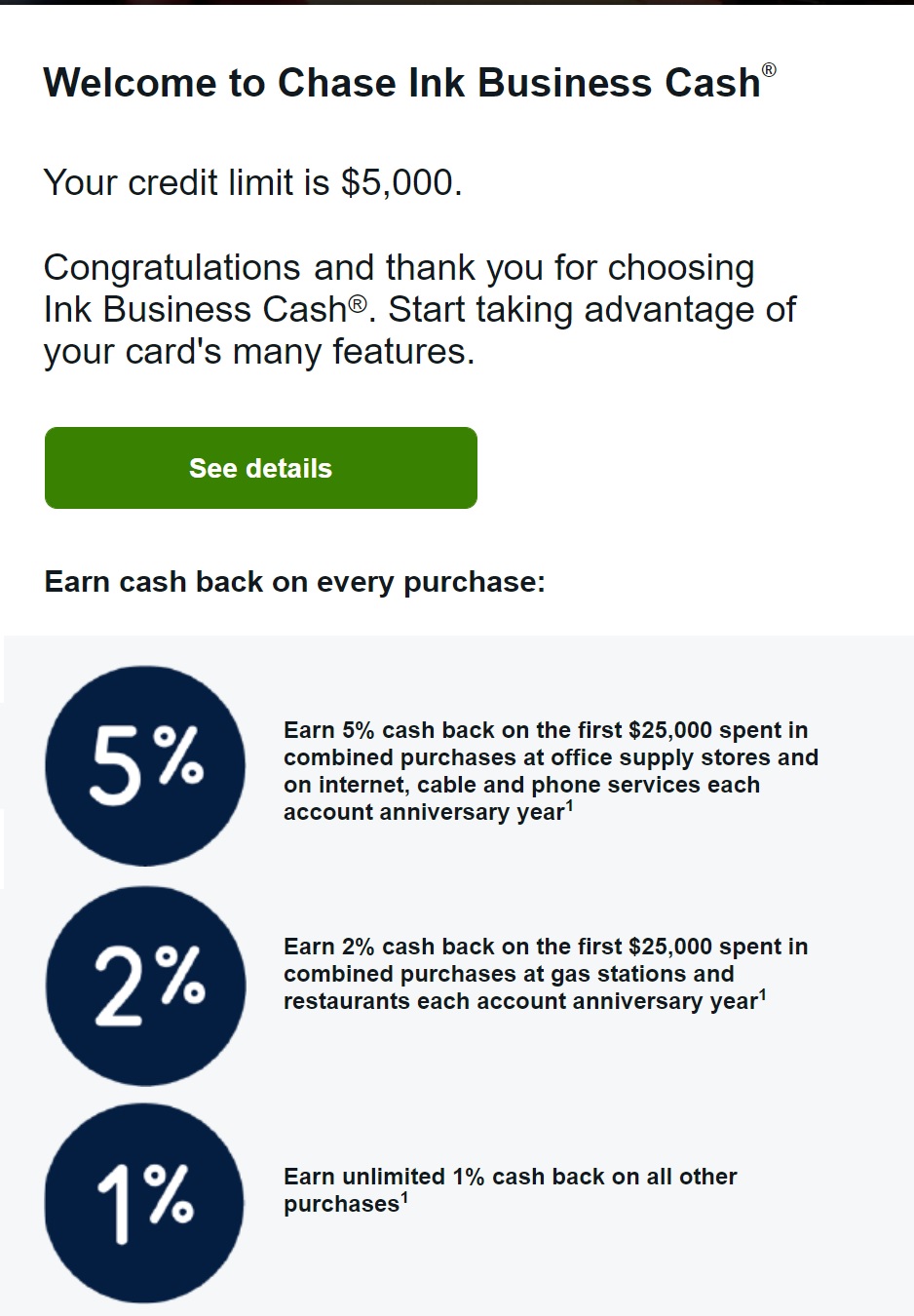

Since offers change regularly, this display will show the current offer for the Chase Ink Cash card:

Card Offer and Details

The great thing about the Ink Business Cash card is that it earns 5 points per dollar at office supply stores and on internet, cable and phone services on up to $25K spend per cardmember year. So, our plan is to spend all of the required $6,000 at office supply stores in order to earn a total of 30,000 points for the required $6K spend. This is made much easier by the fact that Staples and Office Depot keep offering fee-free (or better) Visa and Mastercard deals nearly every week (for details and current deals, see: Best options for buying Visa and MasterCard gift cards).

Once my son earns the 90K welcome bonus, he should be a total of 120,000 Ultimate Rewards points richer. He will most likely use these points by transferring them to me so that I can book Hyatt stays for him. There are two reasons to do it this way: 1) he doesn’t currently have an Ultimate Rewards card that allows transferring points to hotel and airline programs; and 2) Since I have Hyatt Globalist status, I could book stays for him as Guest of Honor reservations. That way he will be treated like a Globalist with free parking, room upgrades, free breakfast, free lounge access, etc. For details about this side-door approach to elite benefits, see: Shortcuts to top tier Hyatt elite status.

Amex 245K Membership Rewards points with 1 card and 1 checking account

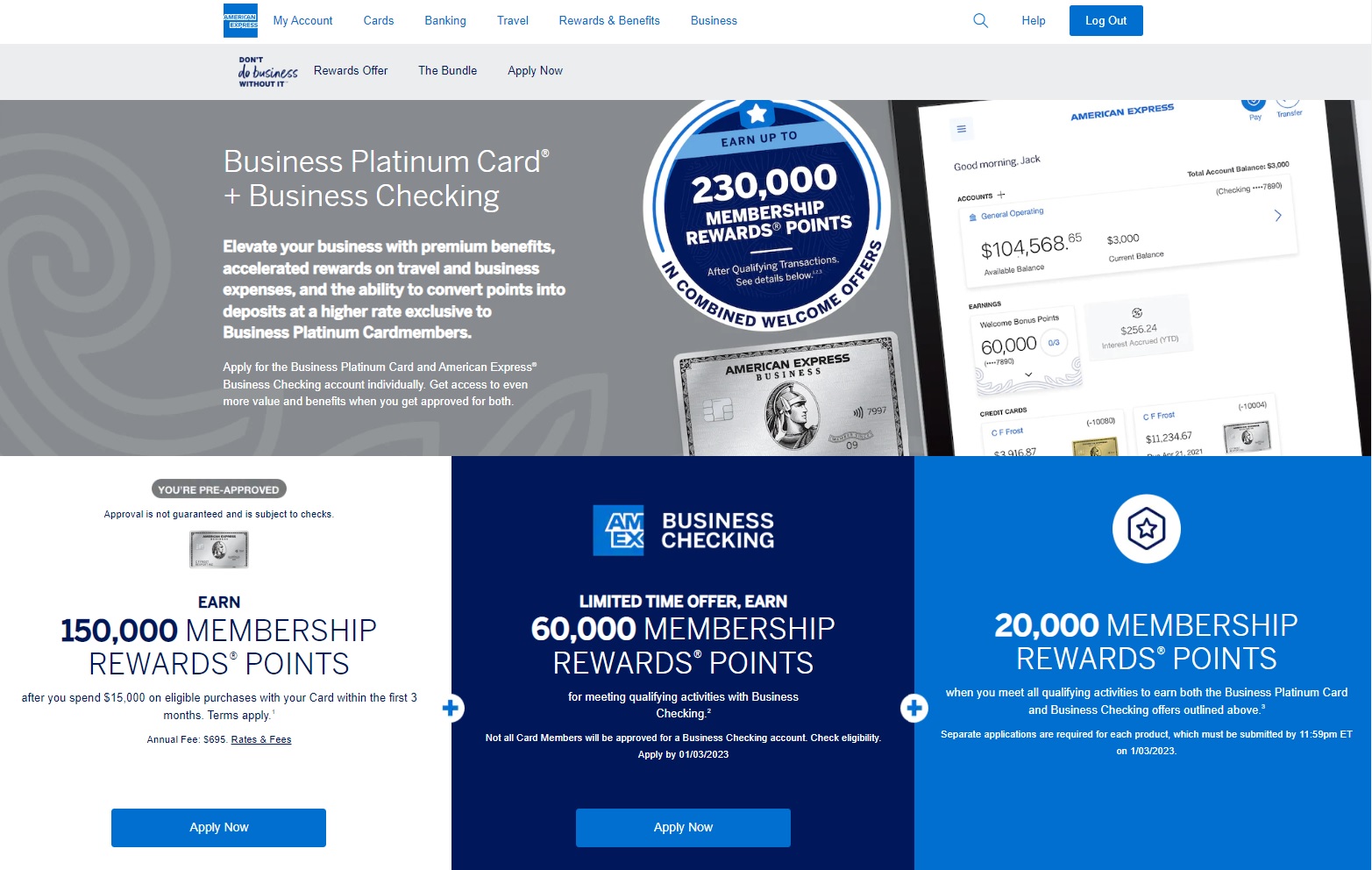

My son keeps getting offers from Amex for 150K points after $15K spend if he signs up for another Business Platinum card for the same business. He’s previously taken advantage of offers like that twice, and until now we’ve resisted adding more because there’s a limit to how many cards I want to deal with (I do the card juggling for him!). The latest targeted bundle offer, though, was enough to get us over this hesitation. Now, by accepting that 150K offer plus the amazing 60K business checking offer, Amex will give him an extra 20K points on top of all of that! See this post for details.

Here’s how we plan to tackle the requirements of each part of the offer…

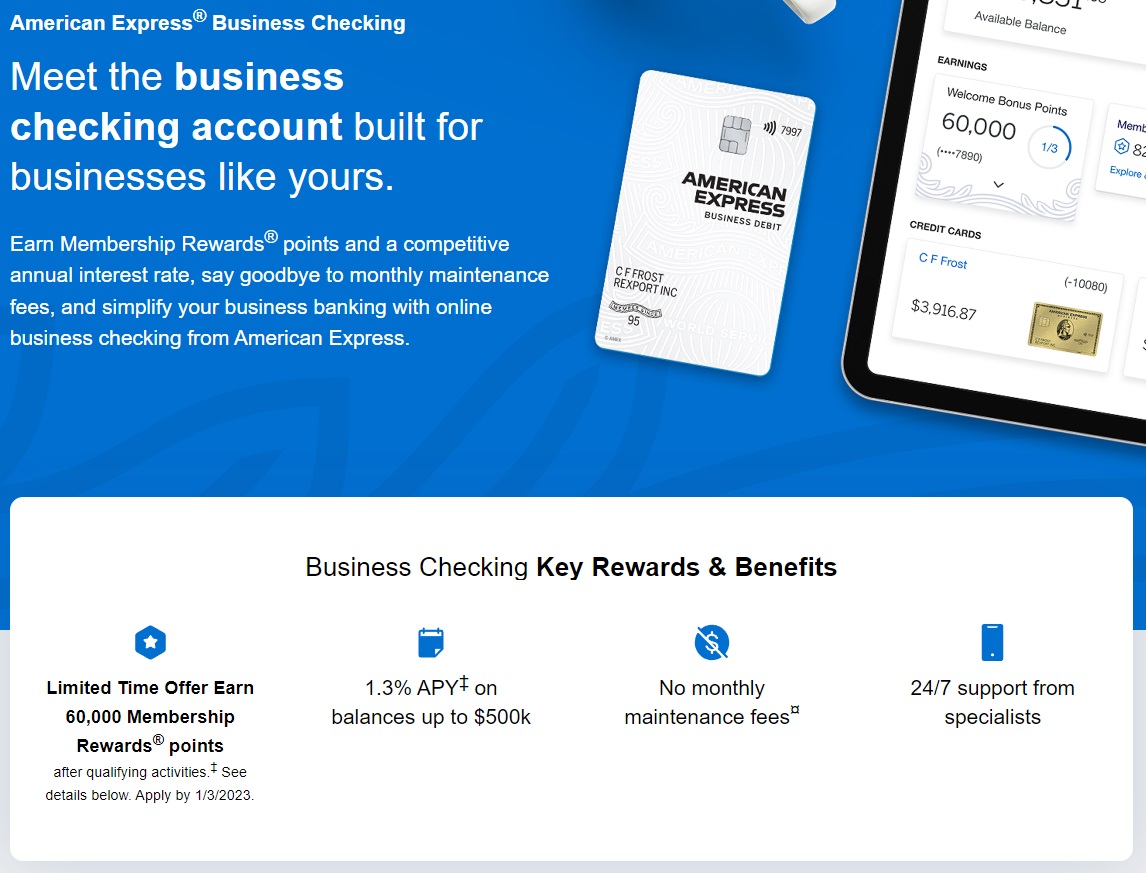

Amex Business Checking 60K

The current 60K offer for opening an Amex business checking account requires the following:

- Open a new American Express Business Checking account (done!)

- Deposit a total of at least $5,000 in the first 20 days

- Maintain an average account balance of $5,000 for 60 days

- Make 10 or more qualifying transactions within 60 days of opening your account.

For that last part, Amex states “Qualifying transactions are mobile deposits, and electronic/online transactions including ACH, Wire, and Bill Payments. Business Debit Card transactions and deposits using our Redeem for Deposits feature are not qualifying transactions.”

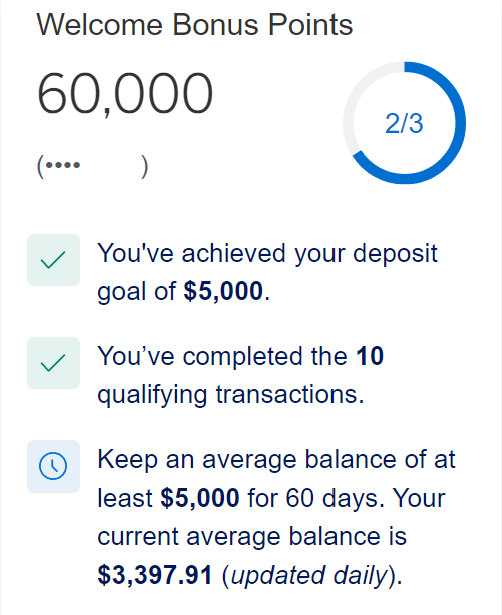

I believed that he could meet requirements 2 and 4 simply by making 10 separate deposits to get to the $5,000 requirement. Then, by keeping the money there for 60 days, he should be good to go. Luckily Amex provides a Welcome Bonus Points tracker on the checking account’s online dashboard and, sure enough, the deposits did indeed count as separate transactions:

Amex Business Platinum 165K

Often, when my son logs into his Amex account, Amex invites him to “expand his membership” by adding another business Platinum account. In return, he is typically offered 150K points after $15K spend on the new card. Frequently there is also an offer for additional points after adding an employee card. This time, though, my son accepted an offer that didn’t have the employee card component. He instead clicked through the targeted offer for the bundle of the Amex Business Platinum + Business Checking.

The part of the bundled offer that is specifically for the Business Platinum card offers 150,000 points after $15K spend. The Business Platinum card offers 1.5 points per dollar for purchases of $5,000 or more, so from $15K spend alone, it’s possible to earn 15,000 x 1.5 = 22,500 points. While I expect that at least some of the spend towards $15K will meet that requirement, for this post lets assume that purchases will be below $5K and will earn only 1 point per dollar. In that case, my son will earn 15,000 points from spend plus 150,000 points from the card bonus for a total of 165,000 points.

I’m willing to bet that he’ll soon get an offer for even more points for adding an employee card. For now, though, we’ll assume that he’ll end with “only” 165K points.

Business Platinum + Business Checking Bundle Bonus 20K

By meeting the welcome bonus requirements for both the Business Platinum card and the Business Checking account, my son will earn an extra 20,000 points!

Total: 365,000 Transferable Points

As shown in the sections above, my son expects to earn at least 365,000 transferable points:

- Chase Ink Business Cash: 120,000 points (90K welcome bonus + 30K from spend)

- Business Checking: 60,000 points

- Business Platinum Card: 165,000 points (150K welcome bonus + 15K from spend)

- Business Platinum + Checking bundle offer: 20,000 points

- Total: 365,000 points

For ideas about how these points can be used, see:

![(EXPIRED) Amazon: Save up to 40% when redeeming at least 1 Membership Rewards point [Targeted] a laptop on a table](https://frequentmiler.com/wp-content/uploads/2022/07/Amazon-Laptop-Featured-Image-218x150.png)

So I cannot believe your son is a college graduate! Seems like just yesterday you published the article as soon as he turned 18. At the time it seemed very far away for me but now I myself have a 17.5 year old – any thoughts on updating the first credit cards strategy post or would you say the original is still what you’d advocate even today? Thanks!

Greg, if you dont mind me asking. How did you do the 10 deposits?

Transfer from external account; mobile deposits; ACH?

I did it from within the Amex site. I linked an external account and pulled in money ten times.

i just received a NLL mailer for another biz plat and was super excited about the timing as this means i could triple dip on the dell/airline credits before the years up.

however i just realized that my last biz plat’s account opening date was only 20 days ago. do i actually have to wait 90 days from that date before applying using the mailer or is 30 day spread sufficient?

No need to wait. The 90 day rule is only for more than two cards and only for credit cards. These charge cards / pay over time cards don’t have that restriction

Should I be worried!? Approved for business checking, started with 6 $500 ACH pulls from my bank. Received call from AMEX to give the a call. On the call, reps couldn’t say exactly reason for the call. Told them my account showed “restricted”. Agent said AMEX is doing a “review” and wait to see what happens in 5 business days?? So now, I’m in the dark as to what’s going on, the clock still counting? for $5K deposits in 20 days (today is day 7, but i’m going to lose 5 more days with this “review”) I haven’t done anything wrong, anybody else been in this boat? Any advice greatly appreciated.

I don’t have any idea what is happening with the review but note that you can do multiple deposits or other transactions in one day so if you get access back soon you should still be able to meet the requirements. Alternatively, load up to $5k in one transaction and handle the remaining transactions separately (after 20 days)

Ok, thanx.

What happened with the review

After a determined set date (5 business days), I called in to check status and whatever the issue was (they never said) “cleared”. Strange, but glad I was able to resume ACH /$5K within the 20 day window.

Thanks , I followed Greg’s advise, did 5K deposit on the 4th aCH transfer. Now will start withdrawals for 6 transactions

Are you at all worried that average daily balance is well under $5k and won’t meet the threshold at day 60, or do you think they’ll start counting 60 days from when you achieve $5k in deposits? I’ve been going slowly with a transfer or two in per day so as not to set off alarm bells with my home bank, but seeing that calculation on your screenshot has me spooked.

It showed a lower than $5K avg daily balance because some of the deposits were still pending. It now shows an avg daily balance of $5,047 (that’s how much I deposited in total). My assumption is that they don’t start averaging until after the first 20 days.

Thanks for responding! I’ll keep an eye on that, but sounds like it should work out just like yours after all the deposits clear.

Will applying for the Amex biz checking result in a credit pull and count against chase 5/24?

No

That’s awesome! What’s your plan on how to use all of the gift cards you get from Staples? Is there a good way to do that? I’m scared I will be thousands of dollars of gift cards and struggle applying them to things lol.

If you close the account after say 6 months, do you forfeit the points? I don’t have an amex card if that matters.

I don’t know what would happen, but there’s no reason to close the account since it is free.

Silly me, I applied for the personal checking account months ago, with no bonus, and now Amex blocks anyone who has or had a personal checking from the 60k business bonus.

Logged onto chase account and first time saw you are pre-approved for Chase ink card . Does it mean that I should be approved if I apply ? The offer had a fixed APR rate

Also works for withdrawals. I deposited $5050 and then did nine $5 withdrawals and it counted.

Over what time period did you do the withdrawals, if you dont mind me asking?

I generally did 2-3 at once every few days or week. I bet you could even do 9 withdrawals at once and it would accomplish it.

Quick question received a mailer for 150k busniess platnium offer my 3rd one this year I see the checking offer isn’t like a bundle thing so they’d be separate applications would you still qualify for the 20k bonus for doing both? And what requirements are needed for busniess checking account , I’ve only been using ein for all my business credit card applications are they going to require more information? Just finishing up spark travel eliete bonus and figured why not amex loves me anyways

No I don’t think you’ll get the bonus for doing both unless you go through the links on the bundle offer (just my assumption). Requirements are similar to applying for a business credit card

Hi Greg, my wife applied for the Amex Platinum personal card and got denied because of too many recent credit card accounts. She has only opened 2 cards in the last year, one in January and one in August. Then I added her recently to my Venture X in September. I called Amex for reconsideration but they told me to call Experian. Do you have any recommendation or have seen similar experiences? I really wanted her to take advantage of the Platinum benefits for an upcoming trip in December (and triple dip)

I haven’t heard of that happening with Amex cards. Is she totally new to having Amex cards? If so, she might have better luck starting with a fee free card or business card and later trying for the Platinum

Yes she is totally new to Amex. We have used the new pre-approval tool and not the actual application. I guess we’ll try with a lower level card first, it’s just annoying as i was waiting for December to come…

wife as AU helped her tremendously, before she even had any AMEX cc

Do you mean AU on a amex card?

We had the Ink Cash for just under 4 years and canceled it to get a new bonus. How long should we wait to re-apply?

1 hour.

It’s still showing in our account (been only a day) but it says “for your information”. Do we need to call and unlink the account before applying again?

No you can qualify either way

Hi Greg, great article and offer. I wonder what you think are the easiest qualifying activities for the business account. Interested to know your sons strategy for ticking those off the list quickly. Thanks

I think that depositing money to the account $500 at a time should get him to the 10 transactions and $5k balance. We will know soon