NOTICE: This post references card features that have changed, expired, or are not currently available

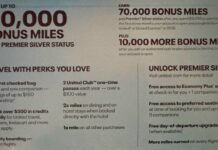

In a normal week, we’d have almost surely posted a new offer on the United Mileage Plus Explorer card that’s good for 70,000 total bonus miles. This week was anything but normal. As compared to other offers currently available, this new bonus on the United card doesn’t feel especially compelling. However, if you’ve specifically been looking to add the United card to your collection (perhaps to eventually downgrade to the no-fee card), getting it during an increased offer like this would obviously make sense.

The Offer & Key Card Details

For full card details and to find a link to apply, click the card name below to go to our dedicated card page.

| Card Offer and Details |

|---|

ⓘ $856 1st Yr Value EstimateClick to learn about first year value estimates 70k miles ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 70K miles after $3K spend in the first 3 months. Plus, earn an extra 10,000 miles after you add an authorized user to your account in the first 3 months your account is open. (Offer Expires 5/20/2026)$0 introductory annual fee for the first year, then $150 Alternate Offer: There is currently an in-flight offer for up to 75K. This card is subject to Chase's 5/24 rule (click here for details). Recent better offer: 80K Miles after $3K spend in the first 3 months (expired 5/8/25) FM Mini Review: Decent perks such as free 1st checked bag and 2 annual club visits makes this a keeper for some. Earning rate: 2X United ✦ 2X restaurants ✦ 2X on hotel stays Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: $100 Travel Credit after spending $10,000 in a calendar year ✦ 10,000-mile award flight discount after spending $20K ✦ Earn up to 1,000 PQPs per calendar year: 1 PQP per $20 spend Noteworthy perks: Two United Club passes per year on your anniversary ✦ Improved economy saver award availability ✦ Free first checked bag for primary cardholder and one travel companion when you pay with the card ✦ Up to $100 in credits for United Hotels ($50 each on your first two bookings per cardmember year) ✦ Up to $60 per year in rideshare credits (up to $5 per month) when using your card to pay for rideshare services.(requires annual enrollment) ✦ Up to $50 in Travel Credit for Avis or Budget car rentals per cardmember year ✦ One $10 Instacart credit per month when you have Instacart+ membership ✦ Priority boarding ✦ One year of complimentary Dash Pass (Must activate by 12/31/27) ✦ Primary auto rental collision damage waiver ✦ Up to $120 Global Entry, TSA Pre-check or Nexus credit ✦ 25% back as a statement credit on purchases of food, beverages and Wi-Fi on board United-operated flights and on Club premium drinks when you pay with your Explorer Card ✦ Up to $100 as a statement credit each anniversary year for JSX flights booked directly |

ⓘ $788 1st Yr Value Estimate$200 TravelBank cash valued at $170 Click to learn about first year value estimates 80K Miles + 3,000 PQP ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 80K miles and 3,000 PQPs after $4K spend in the first 3 months. Plus, earn an extra 10,000 miles after you add an authorized user to your account in the first 3 months your account is open. (Offer Expires 5/20/2026)$350 Annual Fee This card is subject to Chase's 5/24 rule (click here for details). Recent better offer: 100K miles and 3,000 PQPs after $4k spend in the first 3 months (Expired 8/21/25) Earning rate: 5X Renowned Hotels & Resorts for United Cardmembers ✦ 3X United ✦ 2X restaurants including eligible delivery services ✦ 2X on all other travel ✦ 2X select streaming Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: Earn up to 18,000 PQPs per calendar year: 1 PQP per $20 spend ✦ Earn an additional 10,000-mile award flight discount after $20K in purchases in a calendar year ✦ Earn 2 global Economy Plus seat upgrades after $40K in purchases in a calendar year ✦ 1,000 bonus PQPs each year Noteworthy perks: $200 in United® TravelBank cash each membership year - terms apply ✦ Up to $150 in statement credits per cardmember for Renowned Hotels and Resorts ✦ 10K award flight discount per cardmember year ✦ First and second checked bag free for cardholder and one companion when you purchase your tickets with the card and include your MileagePlus number ✦ Up to $120 Global Entry, TSA PreCheck or Nexus reimbursement ✦ Up to $100 in rideshare credits per year (up $8 per month January to November and up to $12 in December, re-enrollment is required annually) ✦ Up to $80 in Travel Credit for Avis or Budget car rentals per cardmember year ✦ One $10 and one $5 Instacart credit per month when you have Instacart+ membership ✦ 25% back on United inflight or Club Premium drink purchases ✦ Get a jump start on earning Premier status with 1,000 Card Bonus PQP each year, awarded within 6 to 8 weeks after February 1 each year ✦ Up to $150 as a statement credit each anniversary year for JSX flights booked directly |

Quick Thoughts

The ordinary offer on this card is 40K-50K miles after minimum spend. We’ve also seen it hit 60K a number of times. The current 70K offer is an excellent offer for this card, especially considering the fact that the annual fee is waived for the first year, giving you a chance to try before you buy.

Personally, I’m not big on United miles given that there are typically better options for booking Star Alliance awards. That said, if you earn a lot of United miles from your flight activity each year for work, you may appreciate the ability to juice your balance with a nice chunk of miles.

In my opinion, the key card benefit on this card is expanded access to United saver awards. As we have noted many times in the past, that benefit also exists on the no-fee Mileage Plus credit card. The no-fee card isn’t available to new applicants (and the card stinks for spend, earning 1 mile per two dollars spent). The only way to get that card is to downgrade from another United card like this one. So if you want long-term no-fee access to expanded United saver availability, it can certainly make sense to apply when the bonus is high and annual fee is waived in the first year as is the case right now.

That said, 70K United miles don’t feel like a particularly generous bonus right now given that the Chase Ink Cash and Chase Ink Business Unlimited are both offering 75K Ultimate Rewards points right now after spending $7500 in the first 3 months. Given that you could move those points to a premium or ultra-premium Chase card like the Chase Sapphire Preferred, Sapphire Reserve, or Chase Ink Business Preferred and then transfer them 1:1 to United (while also have the flexibility to transfer to many other partners 1:1 as the situation may suit your needs), this bonus seems ho-hum by comparison. Then consider that Amex has some partners that are much better for booking Star Alliance awards and the monster Platinum card offer stands out farther yet.

However, if you can’t qualify for an Ink card and you’ve been waiting for a United card, maybe this is the right spot for it. I’d still hesitate to recommend collecting an individual airline’s miles in the current environment, but I could see that there are some situations where this card might make sense right now.

[…] 70K United Airlines miles available […]

Curious – when you say better partner award for Star Alliance – I know that one is Avianca Lifemiles. I have liquidated all my United miles for a family trip to Hawaii. Now I have to add 2 tickets. I want to keep them all as awards in case someone tests positive for COVID – I want the miles back in my account. I’m now facing having to buy miles – at a bonus – for these extra tickets. If I use Lifemiles and LIFE happens, is it just as easy to cancel flight and have Lifemiles redeposited?

DP: I was approved for the 60k miles for $3k spend offer in September. I completed minimum spend on that offer earlier this month.

On Nov. 10 I secure messaged Chase and requested a courtesy match to the current offer. Less than 12 hours later they messaged me back and confirmed I was matched and told me to send another secure message when I had met the $6k spend to receive 10k bonus miles. Easy win.