NOTICE: This post references card features that have changed, expired, or are not currently available

Air Canada Aeroplan’s new U.S. based credit card fascinates me. From 3x earnings at grocery stores to big spend incentives (all the way up to a million dollars), it seems to be custom designed for “gamers” (people who push the points & miles hobby to the extreme). Whether or not the card is right for me (probably not), I love what they’ve done with it. My mind twirls with ideas.

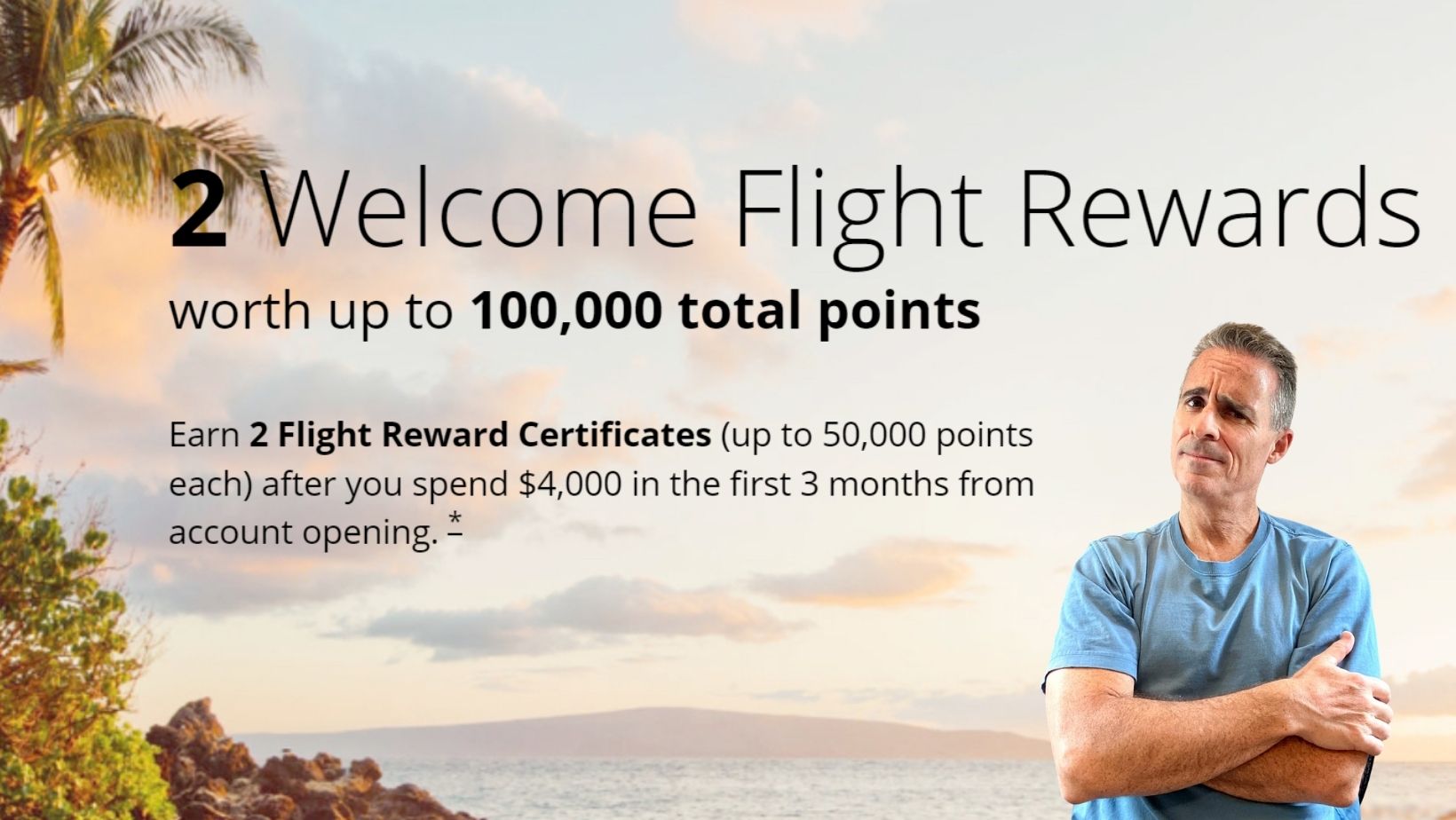

One thing I don’t like about the new card is the welcome bonus. Instead of offering points that can be used any which way we’d like, the Aeroplan card offers two 50K Flight Reward Certificates after $4K spend in 3 months. My first reaction when I learned this was “ugh!” I had assumed that these things would be like hotel free night certificates with limitations and expiration dates. Fortunately, I was wrong.

Here’s what we know now about the certificates:

- Reward Certificates never expire as long as you keep your Aeroplan card account open.

- Reward Certificates can be combined with points to book award flights. For example, if your award flight costs 70,000 points, you can book the award with a combination of a 50K Reward Certificate and 20K Aeroplan points.

- Reward Certificates cannot be combined on a single award. Suppose you want to book a 100K round-trip award flight, for example. You wouldn’t be able to pay for that award with both certificates. However, you could book the award as two separate one-way awards for 50K each in order to use both certificates.

- If you use a certificate to pay for an award that costs less than the certificates face value, no residual value will be left. For example, if you use a 50K cert to pay for a 30K award flight, the certificate will be done, empty, valueless, kaput. You don’t get to keep the 20K difference.

Clearly Aeroplan’s Reward Certificates aren’t as bad as hotel free night certificates. Hotel free night certificates typically expire one year after they’re issued, and they usually can’t be combined with points for a higher level award night (Marriott will soon offer an exception to this).

OK, so Aeroplan’s certs aren’t as bad as I expected, but that doesn’t mean that I like them. If your main use for Aeroplan Flight Rewards is for cheap economy flights, you might not get the opportunity to use the certificates at full value at all. Plus, if you don’t use your certificates in the first year of card membership, you’ll basically be forced to renew the card in year 2 unless you’re willing to forfeit the certificates altogether. And, of course, that same dynamic could spread into years 3, 4, and beyond… If they just gave us 100,000 points as a welcome bonus instead, neither of those issues would occur. Points can be used any which way you like and they’ll stay in your Aeroplan account even if you close your Aeroplan credit card.

I get why Chase and Aeroplan decided to offer a welcome bonus of certs instead of points. They can still advertise that their welcome bonus offers “up to 100K point value,” but it costs them less to deliver on that promise. Some cardholders will redeem certs for rewards that cost less than 50K points. Others will close their card accounts and lose the certs altogether.

My concern with this development is that Chase may start to offer similar certificates with other co-brand cards. With most airlines that would be extremely annoying. With Southwest, it would be a disaster since flight reward certificates wouldn’t count towards the Southwest Companion Pass the way that points do. On the plus side, Chase can’t impose a change like this without the airline’s rewards program being all-in. With any program, it would take a lot of work to add the ability to redeem certificates for flight rewards. My bet is that no other program will be willing to put in that work. So, fear not.

OK, enough rambling. The short story is this: Aeroplan’s Flight Reward Certificates aren’t as bad as I feared, but they’re nowhere near as good as points. And, while I’d hate it if this type of welcome bonus spread to other airlines, I’m pretty confident that it won’t. It would take a lot of IT work to pull it off, and most programs have plenty of higher priority IT work to get done.

How do these certs play in the Family Plan? Can I apply one of mine to my son’s fare, or is the usage limited to the cardholder?

Where do you actually see the reward certificates in your Aeroplan account? Waiting for mine still.

Same question here. Completed the spend, see the points in account plus the 10,000 from ealy register ..Where would I find these 50K certs? Also, how does one use the 30 eUpgrades?

OK, Now I see them, a bit hidden.

Click on My Aeroplan and then Benefits and you will see in the middle Flight Reward Certificate with the number 2 above it. Then you can click on Redeem. It lets you see only 1 but I presume that’s to make sure you don’t expect to use 2 on a trip.

thank you for this info, that’s really well hidden!

Can P1 and P2 use both the certificates on the same itinerary?

Do you mean that P1 and P2 both have their own certificates? If so, no, I don’t think you could combine them into one itinerary, but you could use P1 certs to fly both of you outbound, and P2’s certs to fly the return

is this card 5/24?

Yes

I believe one big reason for the certs is because Chase won’t want to give 100k points that you could turn around and just use the pay yourself back feature instead of engaging with Aeroplan.

I was prepared to get the Chase/Aeroplan card but now I won’t apply for it. These certificates aren’t nearly as valuable as comparable number of miles/points, especially compared to transferrable points. For Chase, I’d continue focusing on earning UR points. Transferrable points are more valuable because of their optionality (to be able to redeem in multiple programs). Similarly, these certificates are less valuable because of their lack of optionality (to even realize their full point value in a single program).

Twirls, whirls? Ah, potato, tomato….

I’m also guessing that Aeroplan’s more profitable awards are those in the higher redemption area over 50k. The incremental cost per point likely decreases as we get over 50k. I do think you’re right that it is going to push people to redeem sooner rather than later. I hate having hotel certs hanging over me, so these tied to an annual fee would annoy me too. Those that procrastinate would likely engage with the card more to get their ‘moneys worth’ out of the annual fee. Thus likely increasing spend and making it a win win for Chase and Aeroplan. The sock drawer is an issue they’ve always struggled with and I think we will likely see more complicated things in the future to help customer engagement.

Greg, do you know if we can use the 50k cert. to book a partner airline (say Turkish one way in business is 85K), and I’ll use 35k miles along with the cert. or is the cert./points only when flying Air Canada? Thanks!

Yes it can be used to book partner awards

Recently when redeeming Aeroplan miles for a flight, I was given options at checkout to Redeem for less points with (~reasonable) additional cash. This was for Air Canada metal. US to Canada.

Wondering if this is also the case for partner awards and when using these (Chase) 50k certificates.

Out of curiosity I did check out AC Int’l footprint – with our home Hub being PDX we have do have a handful of non-stop flights to Asia/EU/UK.

But a 45-90 mi. Flight to SEA or SFO opens a plethora of non-stop Int’l options while remaining in the US without transiting YVR (Vancouver) approximately 75 min flight.

This is probably similar situation for for those readers living between MSP to BOS over flying to to Eastern Canda int’l Airports from the US.

Pre-COVID AC flew NS from YVR to Australia. ( We booked AC to MEB-YVR via UA award).

This is probably one sweet spot for J awards to/from Australia for Western States.

While AC does fly to HKG from YVR – I would fly Cathy over AC as they have historically had a superior hard/soft product.

Was looking if anything made sense for me with to time this card a 5/24 spot.

I think I’m still ahead of the game sticking with flexible Hybrid options with Citi TYP/Cap1/ MR/UR and USB AR for mobile wallet at 4.5cpp (RtR) at Costco, Dentist, Vet, and other category-less spend.

This sign up bonus seems more like a lock in mechanic to keep you paying the annual fee, especially with covid restrictions. It’s ridiculous you can’t combine them on the same one way award across multiple partners. Also, why can’t we spend $100k for areoplan 50k status? Because that would provide tangible value and we can’t have that. *S gold would be great, areoplan 25 and 35k suck.

I was concerned maybe the certs would only be valid on AC metal, but I haven’t seen any such restriction…have you?

What kind of valuation would you put on certs vs points? If they offered a choice between certs and straight points, I’d probably take 70k points over the two certs, but I’d take certs over 60k, so around a 30-40% discount.

You answered your own question! Valuations are personal. Depends on how you value the program, not others. Valuations are dependent on a lot of factors including routes you take, distance to one of their hubs, how often you fly with them or their partners, likelihood of using certs before card renewal, likelihood of renewing card, do you fly in premium cabins, and a host of other factors. No one can answer this but the person getting the card.

What other ways can one earn Aeroplan points? Per your Google sheet It looks like the main transfer capabilities are MR and C1 at 1 to 1 rate. Surely Chase would allow UR transfers as well?

Chase added the ability to transfer to Aeroplan last summer.

Well that’s something for Greg to fix in the Google Docs spreadsheet.

Thanks.

Thanks. Fixed.