Greg and I have been loving American Airlines miles more than ever before. On last week’s show, we both admitted how much we’ve been using them lately, but we didn’t discuss ways to gather them en masse. On this week’s Frequent Miler on the Air, we discuss all of the best ways to create a stockpile of AA miles.

Greg and I have been loving American Airlines miles more than ever before. On last week’s show, we both admitted how much we’ve been using them lately, but we didn’t discuss ways to gather them en masse. On this week’s Frequent Miler on the Air, we discuss all of the best ways to create a stockpile of AA miles.

Elsewhere on the blog this week, we covered why the way high hotel prices fortify Marriott’s new offer, Bilt’s latest new build, the coming construction of a new Hyatt brand, and a lot more. Watch, listen, or read on for more from this week at Frequent Miler.

00:00 Intro

01:03 Award Talk

01:04 Booking The Signature at MGM Grand via Airbnb

07:10 Roame.Travel adds JetBlue

08:07 Seats.Aero helps Greg find Qsuites availability

09:28 Giant Mailbag: Laddering flights

12:40 Giant Mailbag: Can I transfer Ultimate Rewards to American Airlines miles at a rate of 2:1 right now?

16:10 Card Talk: American Airlines cards

16:55 Citi AAdvantage MileUp card

19:17 Citi AAdvantage Platinum Select

22:50 Citibusiness AAdvantage Platinum Select card

23:31 Citi AAdvantage Executive card

28:14 Barclays AAdvantage Aviator Red

30:24 Barclays AAdvantage Aviator Silver

36:16 Barclays Aviator Business

38:36 Main Event: Amassing American Airlines miles

38:40 Credit card strategies

49:47 AAdvantage Shopping Portal

53:06 SimplyMiles

56:48 Rewards Network AAdvantage Dining

57:38 Hotels: Rocketmiles / BookAAHotels

1:00:36 Hotel partnership with Hyatt

1:02:46 Car Rentals

1:04:10 Shell partnership

1:04:40 Banking: Bask Bank & Citi Checking bonus

1:10:36 Question of the Week: How can you value Hyatt points more highly than Chase Ultimate Rewards points?

Subscribe to our podcast

We publish Frequent Miler on the Air each week in both video form (above) and as an audio podcast. People love listening to the podcast while driving, working-out, etc. Please check it out and subscribe. Our podcast is available on all popular podcast platforms, including Apple Podcasts, Spotify, and many more.

Alternatively, you can listen to the podcast online here.

This week on the Frequent Miler blog…

The best American Airlines credit card

Had you asked me before we recorded this weekend’s podcast which is the best American Airlines credit card, I probably wouldn’t have had a strong opinion. If pressed, I probably would have said the one with the best welcome bonus or the Executive card if you want Admirals Club access for you and your 10 best friends / family members. But as you’ll hear in the discussion and as Greg concludes in this post, the Aviator Silver is the overall winner in my book (though as Greg concludes this depends a bit on what matters most to you). That’s a card I had nearly forgotten all about — but this post shows why you might not want to forget it if you like collecting AA miles.

Awesome bonus: Five 50K free Marriott nights [On My Mind]

The new Marriott Bonvoy Boundless offer is pretty intriguing considering some of the best uses of Marriott 50K free night certificates. With hotel cash prices climbing in so many markets, these certificates can be really valuable when leveraged in the right circumstances. My hesitation in recommending this card to Marriott newcomers is that you would probably want elite status when staying at the fancier Marriott properties where you would use these certificates and getting this card will make you ineligible for the Amex cards for a couple of years. That means you’d need to stay 35 nights per year (combined with this card’s 15 elite night credits) to get “breakfast status” (Marriott Platinum). If you travel enough to meet that requirement, then great — go after this bonus and get some awesome free nights.

Two very different experiences applying for the Wyndham Earner Business card

Speaking of applying for new cards, two family members recently applied for the Wyndham Earner Business credit card and their experiences were very different in getting approved. Barclays really seems to require a lot of documentation from some customers — and it doesn’t always make sense as to who and why. Still, most reports indicate success after jumping through their hoops, and the $200 Caesars Celebration Dinner that my wife and I enjoyed this week by combining our $100 each (courtesy of Wyndham Diamond status matched to Caesars Diamond) was proof enough that this card is worth the hassle even before you consider all of the cruises it can currently get you through casino status matching.

Bilt Rewards now offers dining program: Earn 5x points when paying with linked card

In non-credit-card loyalty news, Bilt Rewards (the rewards program, not the credit card) is now offering 5x points at select restaurants in major cities when paying with a linked card (which is to say that you could, for instance, link your Amex Gold card to earn 4x on that card and also 5x Bilt points at participating restaurants). Considering Bilt’s slate of transfer partners, that’s a great return. Unfortunately, this is only available in select major cities. Fortunately, friends in a couple of those cities report some of their favorite restaurants being included in the program. This isn’t Rewards Network Dining, but I imagine there will be some sweet stackage in instances where the programs converge.

Hacking Las Vegas

An unexpectedly extended trip to Las Vegas has had me honing my skills for utilizing points and miles effectively in the city of Lost Wages. For instance, I am typing this post from a Radisson property on the Las Vegas Strip that I booked with Radisson Americas points at a value of around 1cpp (see the post to find out which casino resort that is). In total, there are more than 20 properties on the strip that are bookable through at least 7 different hotel loyalty programs, which means that there are plenty of ways to slice and dice the price. That said, MGM Rewards can often be the cheapest game in town, but even that couldn’t beat booking an MGM property via Airbnb last weekend. See the post for more detail.

Hyatt Studios: An almost exciting new Hyatt brand (on Stephen’s mind)

I actually share Stephen’s guarded optimism for Hyatt Studios. I agree with Stephen that Ben at One Mile at a Time is off in his assessment that a full-size fridge isn’t useful — as a parent who travels with two kids who never completely finish anything, I hate not having a fridge big enough for the leftovers when I know they would otherwise eat them the next day. That said, I don’t like the fact that there won’t be one-bedroom suites and they look a bit tight. I’m not sure I’d actually want a 30 or 60-night stay at this brand, but if they come out in Category 1 or 2, I’d certainly be happy to have some new options here and there.

Westin Hapuna Beach: Bottom Line Review

I’ve only been to the Big Island a couple of times, but until Tim’s review, I didn’t know that this property existed. This certainly might make for a good use of those 50K certificates from the new Marriott card offer on nights when you can top off those certs to book. The pictures certainly made me miss Hawaii a little bit more — one of these days I’ll get back to my happy place.

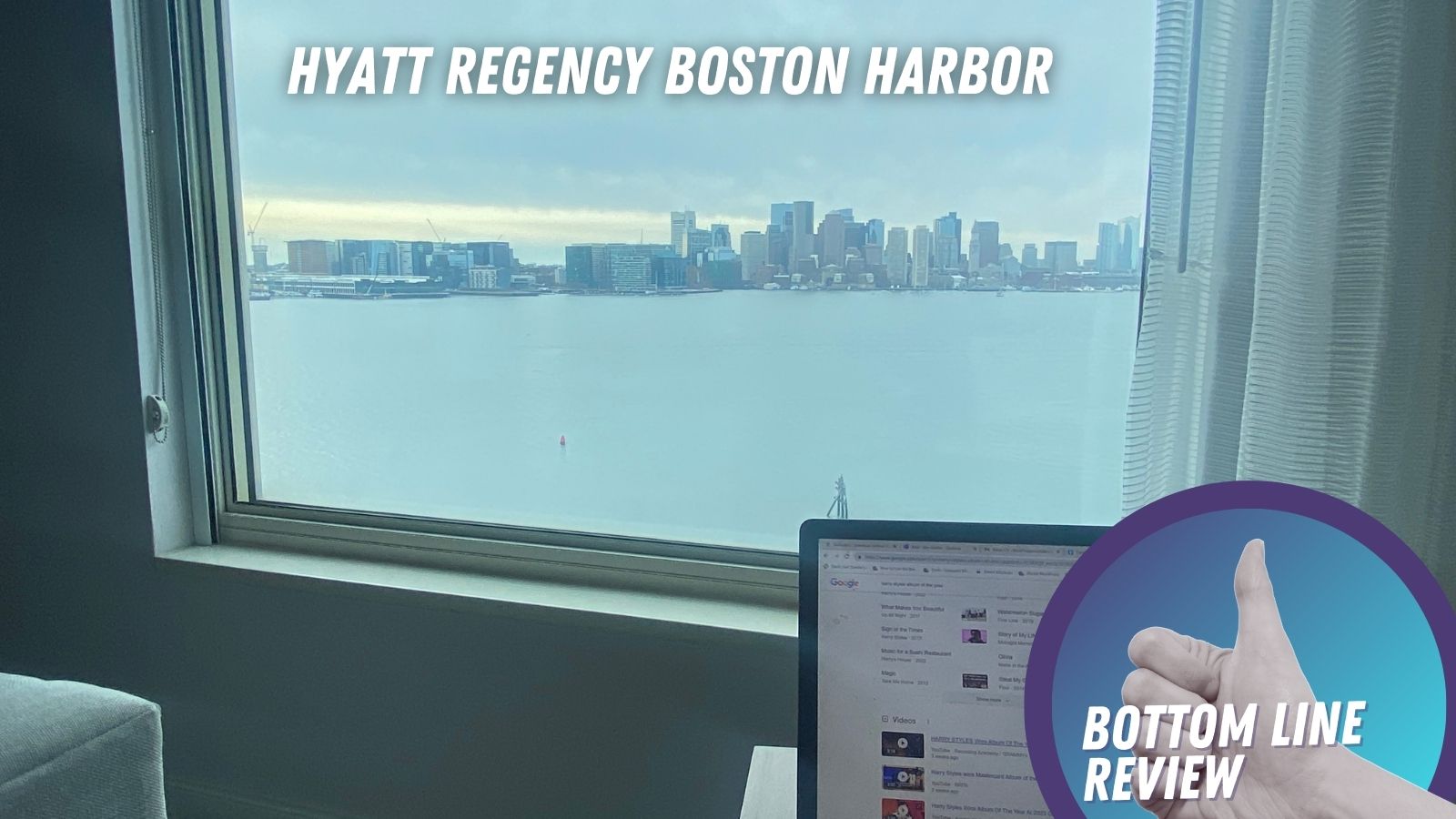

Hyatt Regency Boston Harbor: Bottom Line Review

Tim reviews a Hyatt Regency that I’ve wished I could book a couple of times before when I wanted to fly from (or back into) Boston, though I haven’t had the fortune of finding either award availability or a good cash rate at the times I’ve wanted to book it. Given the location, I’d probably only consider this when I need access to the airport, but if you would find the ferry fun, I could see this being appealing to some Beantown visitors.

That’s it for this week at Frequent Miler. Keep your eye out for this week’s month-ending last chance deals to make sure you grab all of those scheduled to expire at the end of the month.

![Mileage running 2026-style, playing the AA transition, a coming points conference and more [Week in Review] a group of toy airplanes on a game board](https://frequentmiler.com/wp-content/uploads/2022/01/American-Airlines-Game-218x150.png)

If trying to amass miles/loyalty points, wouldn’t it make more sense to book hotels through BookAAHotels rather than tens of thousands of dollars in credit card spend to hit a 10k LP reward? By selecting to pay more under the booking options you can get 16,000 miles/LPs per hotel night. Even with the surcharge you pay through this 3rd party booking, it seems far more appetizing than the opportunity cost of all that credit card spend on a co-branded AA card. And as someone else mentioned, once at 60k/100k you get 20%/30% additional miles/LPs. Plus you get a hotel stay out of it.

Regarding the Stand Up To Cancer donation, Greg mentioned that he got a receipt that indicated part of his donation went to acquiring miles. My gut is that’s not what happened. The receipt was probably just indicating the value of the miles and what is tax deductible for the person who made the donation. By law, any time you make a donation and receive any kind of “in kind” benefit, you cannot claim the donation as a tax deduction for the portion where you received that benefit. In this case, American is likely allowing the full donation to go to the charity, but they must indicate to you what the value of the miles is, and in turn, what you’re allowed to write off as a donation.

just like AA is best airline card to collect outside of those with transferable partners, what’s the best hotel card/ points to collect ?

Hyatt, but you want to collect those via Ultimate Rewards and transfer them. There is no hotel program I’d consider that isn’t a transfer partner with a major currency.

thats what i was doing. just wondering if there was a hotel chain that i should be collecting on its own that couldn’t be transferred easily from Chase/Amex.

No.

A minor thing, but you forgot to mute Nick’s coughing towards the end.

Yes, I noticed when I listened for the timestamps, but at that point the video and podcast was already loaded and I was in a hotel room trying not to wake up my kids, so I didn’t have enough time to go back and re-produce and re-upload. I hoped it would be forgiven. Sorry about that! I usually listen before uploading and mute things like that out, but didn’t get a chance to do it that way this week.

Wow, what does it say that a whole show about earning AA miles did not mention …

… earning them by flying!?

When you consider the history of frequent flyer programs, it is rather extraordinary that we have come to this pass.

I mean, as you know, you’re not going to earn that many from flying unless you’re spending a lot of money. More importantly, the tag line of this site is “earn miles without flying”, so we obviously focus on other ways to amass miles.

Totally with you. Just amazed how much has changed in such a short period of time. When airline rewards (miles plus status) were tied to miles flown, the whole game was looking for low fares and promotions that amplified rewards. Now … not at all.

There are some interesting plays earning AA miles on partners, where is still distance based with -ups for class of service and elite status. Depends on finding cheap J or premium economy long distance flights.

@36:29 the 5% bonus is based on all miles earned the previous year, including the SUB (Barclay’s aviator biz).

Great tip, thanks.

Do they post when the fee posts or do you have to wait an extra month or two?

I’m quite new to this and I just applied for the Marriott Boundless card, I was wondering why getting this card prevent you from getting Amex cards for a couple of years? Thanks!

There are rules that Amex and Chase have. They are in the terms. Greg made a helpful chart that is in this post.

https://frequentmiler.com/marriott-card-eligible/

Exactly what FL Mom said.

This would be only for the Marriott Amex cards then, not all Amex cards. Thanks for the link and clarification on this!

When booking a stay via AA Hotels or RocketMiles, if the pricing and points are the same on the two platforms, use AA Hotels. AA Hotels will receive Loyalty Points bonuses if you’re above 60k or 100k Loyalty Points, whereas RocketMiles will not. Hope this helps.

Thanks! Good info, I am getting near the 60k bonus and often use Rocketmiles for work.

Barclays also has the Aviator Blue Card. Like the Silver, one cannot get it directly. Like the Silver, after a year holding the Aviator Red Card, you might be able to product change to the Blue. The Blue is a bare bones card (essentially no bonus categories other than AA purchases) with a $49 annual fee and no foreign transaction fees. This might be appealing to some.

Citi also has the AAdvantage Gold and the business AAdvantage Select cards. Not available directly but via product change. These are bare bones cards but DO have foreign transaction fees.

A year ago, it was “we avoid flying on AA if we can help it.” My how things have changed. Ha.

Ha ha. I had the same thought. I think a lot depends where you live. I rarely fly DL even though many think they’re the best for example.

Thanks Nick & Greg for covering so many routes to earning. I didn’t realize the potential LP with Citi Exec plus Barclays Silver (if you can get it). Regarding earning AA with surveys, there was someone on FT who furiously took surveys to cap off his EXP faster, because they count as LP. (As you said I wouldn’t recommend though without getting crossed eyes).

One small correction- I think you forgot that AA Gold requires 40k LP this year not 30k. https://www.aa.com/pubcontent/en_US/aadvantage-program/loyalty-points/index.html

Yes, that was my mistake!

Also, to your points Lee (about avoiding flying AA) and Nun (“a lot depends on where you live”), in my case it has nothing at all to do with flying on American Airlines and 100% to do with their award chart and flexible award cancellations. I still haven’t flown AA since they debuted loyalty points apart from a couple of intentional award tickets – I haven’t flown them domestically. But their miles are very useful to me because of their partners and flexible cancellations.

Fair enough. Would you still turn down a gift of EP status?