As we reported separately, Marriott once again is out with a huge welcome offer for the Bonvoy Boundless card: five 50K free night certificates after $5K spend in 3 months. While there are plenty of downsides to Marriott’s certificates, I think it would be hard not to get great value from this bonus. Plus, this pick positions you for a future upgrade to the single best Marriott card (out of a very big selection).

Overview

At the time of this writing, the Bonvoy Boundless card has the following welcome offer: Five 50K free night certificates after $5K spend in 3 months. The card is issued by Chase and has a $95 annual fee. The card earns 6X at Marriott properties; 3X at gas stations, grocery stores, and dining on up to $6K in combined purchases each year; and 2X everywhere else. Those multipliers sound great, but when you consider that our current Reasonable Redemption Value for Marriott is only 0.8 cents per point, those earning rates aren’t too rewarding. That said, the card does give you a 35K free night certificate each year upon renewal, and that alone is easily worth much more than the $95 annual fee (we currently conservatively value the certificate at $224, but much more value is easily obtainable).

Overall, in my opinion, the Boundless card is a good one to have and to hold (but not to spend on) for it’s annual free night certificate. More importantly, the card currently has a great welcome offer, and it’s a good stepping stone towards the Ritz card. More on that later.

Are you eligible?

Before I get your hopes up in explaining why I think the welcome bonus is so good, I’ll start by dashing your hopes. I’m guessing that many readers are not currently eligible. First, you have to slip by Chase’s 5/24 rule. Second, you need to consider Marriott’s byzantine rules for obtaining a new Marriott card…

Chase 5/24

To determine your 5/24 status, see: Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely.

Marriott Eligibility Rules

Marriott cards are issued by both Chase and Amex. And Marriott has worked hard with both issuers to make sure that the card sign-up rules are as complicated and ridiculous as possible. For full details, you’ll want to see this post: Are you eligible for a new Marriott card?

For the Boundless card, specifically, here are the rules (note: if you’ve never had a Marriott card, none of these rules apply to you)…

You can’t get the card at all if you currently have any of the following cards or you received a new cardmember bonus for any of the following Chase cards within the last 24 months:

- Marriott Bonvoy Boundless® credit card

- Marriott Bonvoy Bold® credit card

Additionally, you can’t get the welcome bonus for this card if you’ve had the Marriott Bonvoy® American Express® Card in the past 30 days. This is the old SPG card. This clause means that you can cancel the Bonvoy Amex card, wait 31 days and then apply.

Additionally, you can’t get the welcome bonus for this card if you applied and were approved for any of the following cards within the last 90 days or received a new cardmember bonus or upgrade bonus for any of the following cards within the last 24 months:

- Marriott Bonvoy Business® American Express® Card

- Marriott Bonvoy Brilliant® American Express® Card

- Marriott Bonvoy Bevy™ American Express® Card.

The Downsides of Free Night Certs

Before I get into why the 5 night welcome bonus is so great, let’s go over the downsides to Marriott free night certificates…

No fifth night free

When booking a Marriott stay entirely with points, Marriott discounts the stay by the cost of the cheapest night so that you end up paying for only four nights out of five. When you use certificates, the “Stay 5, Pay 4” benefit doesn’t apply. This decreases the value of free night certificates when used on 5-night stays.

Top-off limited to 15K points

Marriott lets you supplement certificates with points to book a higher priced hotel. For example, you could use a 50K free night certificate plus 14,000 Marriott points to book a night that costs 64,000 points. The ability to top-off with points, though, is limited to 15,000 points max. That means that you cannot use a 50K certificate to book a night that costs 66,000 points or more.

What this really means for you is that you are probably not going to be using these certificates for top-luxury hotel stays or even for reasonably nice hotel stays in popular destinations where Marriott prices awards unreasonably high. For example, you probably won’t be able to use the certs at beachside resorts in Hawaii, California, or Florida.

Dynamic award pricing makes planning difficult

Marriott no longer has award charts. Instead, award prices are dynamically priced. This makes planning really tough. Suppose, for example, that you currently see a resort available to book with 50K free night certificates during dates that you are free to travel. You then sign up for the Boundless card, wait for the card to arrive, meet minimum spend requirements, and then wait for the free nights to be deposited to your account. By the time all that happens, it’s anyone’s guess as to the current pricing of the resort you were eyeing. If you’re unlucky, it may now be priced 66,000 points per night, or higher.

Poor value for low-end hotels

Suppose the hotel you want to book costs only 25,000 points per night. It would be great if you could use your 50K certificate to book two nights, but you can’t. Each certificate is good for only one night and it has no residual value no matter how cheap that one night was.

Resort and destination fees are extra

While you won’t pay most hotel taxes when using points or free night certs, you will pay resort fees. Unlike Hilton, Hyatt, and Wyndham, Marriott does not waive resort fees on free night stays. This is an issue whether you book with points or free night certificates. The one exception: at hotels that base their resort fees on a percentage of the room rate, you won’t pay the resort fee at all if the room was free due to points or free night certificates. The flip side is true too: some municipalities have extra hotel taxes that are fixed amounts rather than a percentage of the base rate. In those cases you will pay taxes on award stays.

One year expiration (maybe two)

The free night certificates will have a hard expiration date one year from the date that they are issued. And you must travel by that date, not just book the nights by then.

One saving grace here is that it is usually possible to extend free night certificates for another year by calling Marriott. Unfortunately, it’s a process. Many people have reported having to call many, many times before a call center rep would extend their certificates. See this post for more (and check out the many success examples in the comments): Marriott Rules for extending free nights.

Huge value possible (now for the good stuff…)

Unless you plan to use your free nights in cheap destinations, I think you would have to go out of your way to use them at hotels that cost less than $300 or more after taxes. That means that it should be a piece of cake to get more than $1,500 value from this welcome bonus. In fact, we currently conservatively value Marriott 50K certificates at $320 each. That means that it should be easy to get 5 x $320 = $1,600 value, or more, from this bonus.

Let’s look at some real world examples…

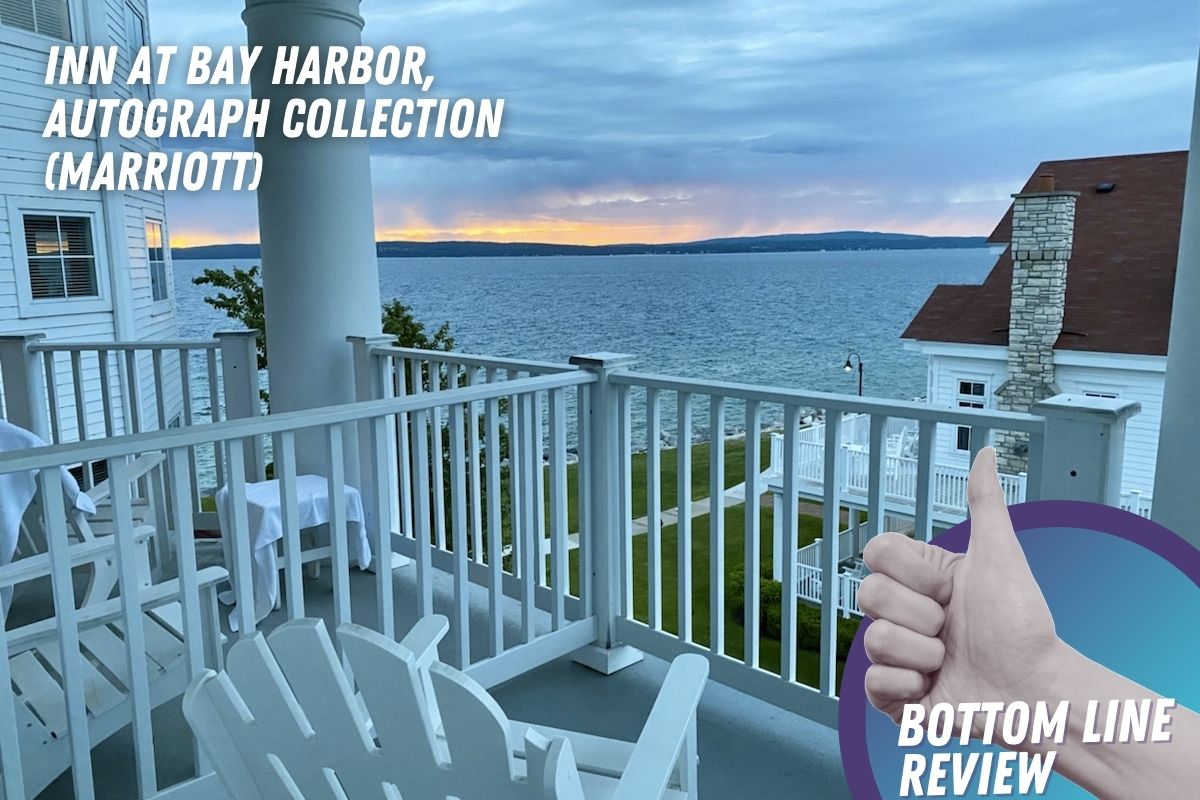

Inn at Bay Harbor, Michigan ($1,620 to $3,250 value)

My wife and I have been visiting the Inn at Bay Harbor almost every summer for many years now. It’s a nice resort with beautiful views of Lake Michigan. Unfortunately, finding award availability in the summer can be really tough. This year, I used StayWithPoints to alert me when the hotel opened for a 3 night stay in the summer. And, finally, the alerts came in and I successfully booked one stay in late June and another in the beginning of July. (Once we decide which stay to keep, I’ll cancel the other stay, and I’ll let people know via our Frequent Miler’s Insiders Facebook Group that a 3 night stay just opened up).

Cash prices for the nights I booked came to around $650 after taxes, but the award rate was 45,000 points per night. I paid with a mix of soon expiring 50K free night certs and 35K free night certs topped off with 10K points each. One awesome thing about using points or certs at this resort is that the resort fee is 10% of the room rate. When the room rate is zero (as with points or certs stays), the resort fee is also zero.

If you were to use the five 50K free night certs at this hotel under similar circumstances to what I booked, you would be getting ~$650 x 5 = $3,250 in value!

Compared to a booking with points, the value is lower. If the five nights were all in one stay, a points booking would include one night free, and so would cost 45,000 x 4 = 180,000 points. If you bought Marriott points when on sale for around 0.9 cents each (as happens fairly often), the stay would cost you only 180,000 x $0.009 = $1,620. Keep in mind that this is worst-case value for the certs since it assumes that the alternative is the best case value of using points (i.e. a five night stay with one night free).

Ritz-Carlton Dove Mountain, Tucson ($1,665 to $2,730 value)

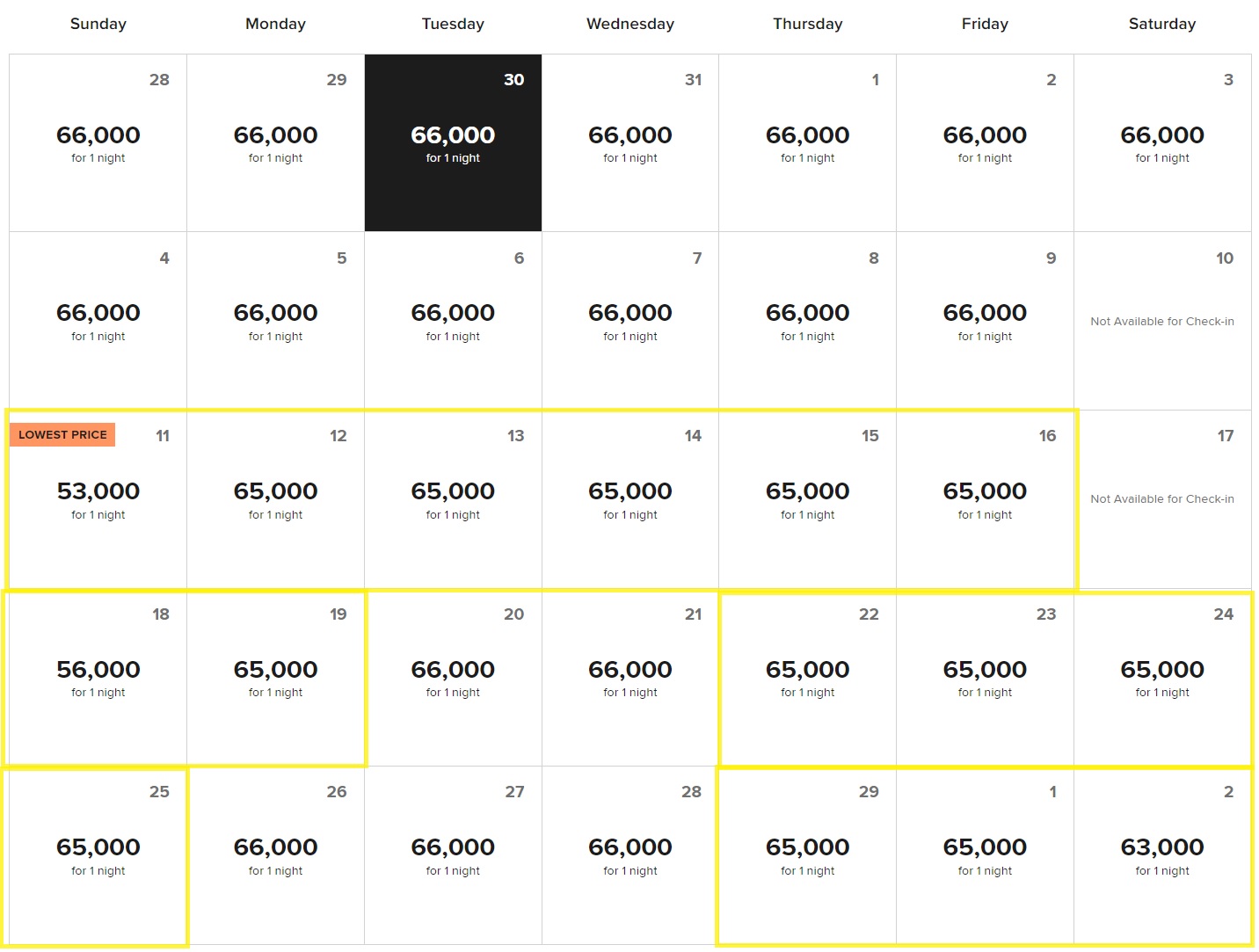

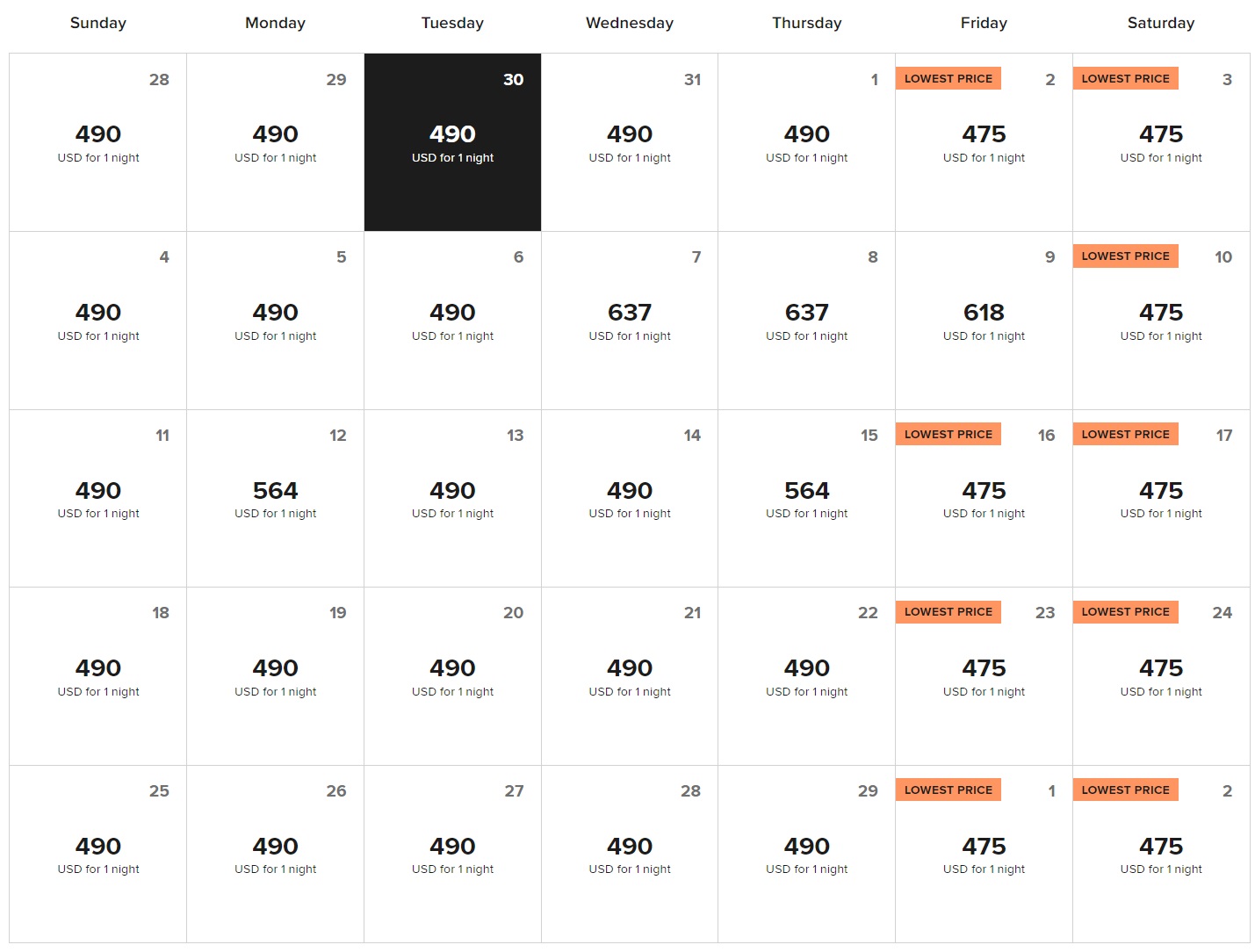

My wife and I recently discussed planning another stay at the Ritz-Carlton Dove Mountain resort in Tucson, Arizona. We had a great time on our last stay and would like to go again. Last week, I took a look at award prices in February of 2024 and found that the Ritz was available almost every night of the month for 65,000 points or less. In fact, there were three nights at the beginning of the month that were available for exactly 50,000 points per night. Perfect! Unfortunately, between then and now, the prices changed. Now, it’s like they purposely priced many dates at 66K which is just outside of the range of the 50K certs. Here’s what I see at the time of writing:

Above, I highlighted the dates that can be booked with 50K certs plus points. It’s not quite half the month, but it’s close. And here are the cash rates with the same dates highlighted:

As you can see above, all of the dates that are bookable with 50K certs plus points cost $743 or 744 per night. Now let’s look at a five night stay Feb 12 to 17. Here are the all-in prices when booked various ways:

- 50K cert booking: Redeem five 50K certs plus 15K points per night (75K total). Also pay $344 in resort fees ($60 per night plus tax).

- Points booking: Redeem 65K x 4 (thanks to fifth night free) = 260K points. Also pay $344 in resort fees ($60 per night plus tax).

- Cash booking: Pay $3,749 all-in (including resort fees).

We can’t say that the five 50K certs are worth the all-in $3,749 cash rate because with certs you would still have to pay 75K points plus $344 in resort fees. If we assume that you could buy the 75K points when on sale for around 0.9 cents each (as happens fairly often), then we can value those points at 75K x $0.009 = $675. After subtracting the cost of points and the resort fee from the all-in cash rate, we get a total value of $2,730 ($3,749 – $675 – $344).

Another way to look at the value of using the certs for this stay is to compare the cert stay to an all-points stay. We can ignore the resort fee since it is charged with either option. So, we’re comparing 5 certs plus 75K points to the all points option of 260K points. The cert option, therefore, saves us 185,000 points. If we use the same 0.9 cents per point cost as discussed above, we get a 5 cert value of 185K x $0.009 = $1,665. Keep in mind that this is worst-case value for the certs since it assumes that the alternative is the best case value of using points (i.e. a five night stay with one night free).

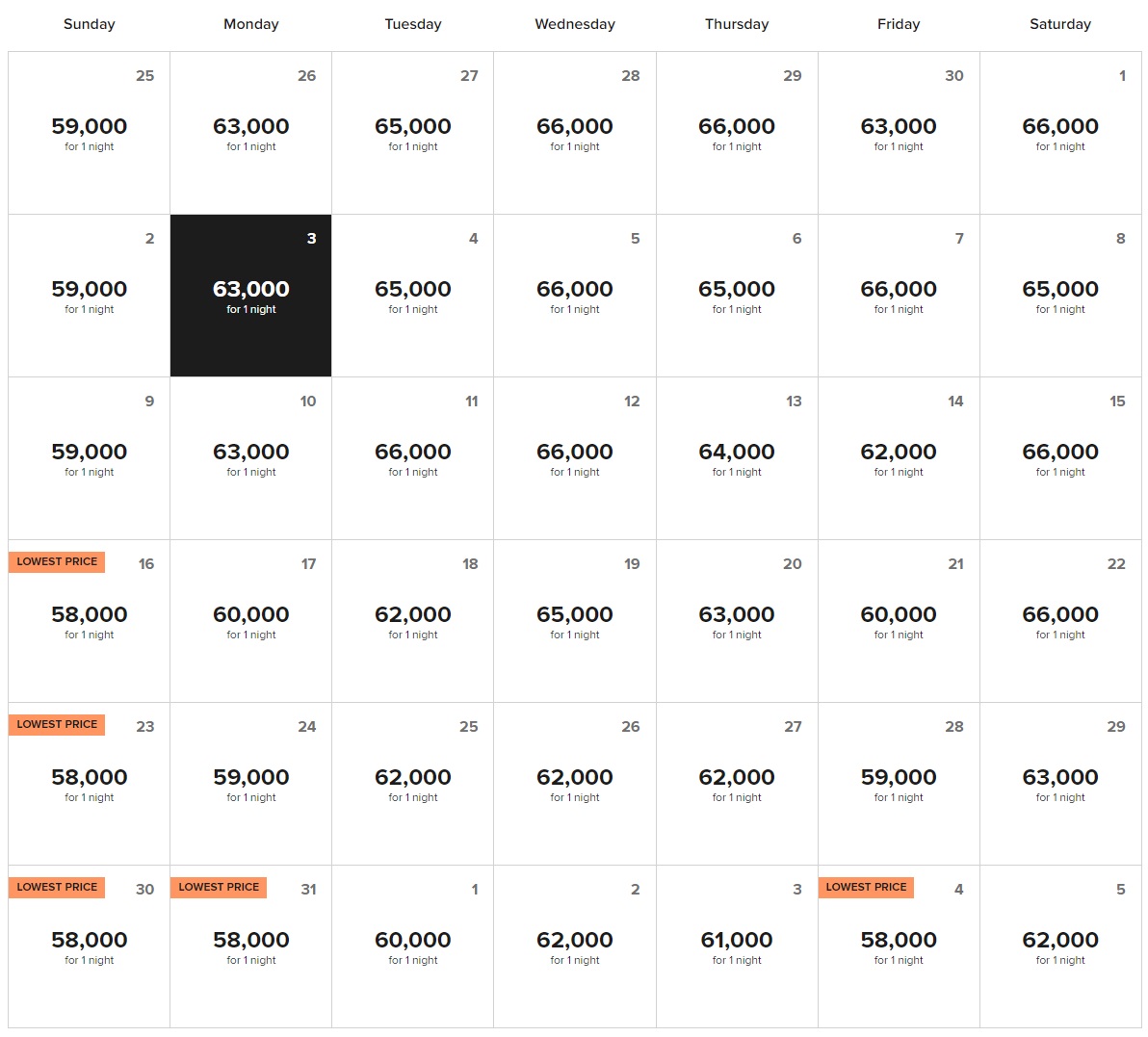

Le Meridien Maldives ($1,737 to $2,812 value)

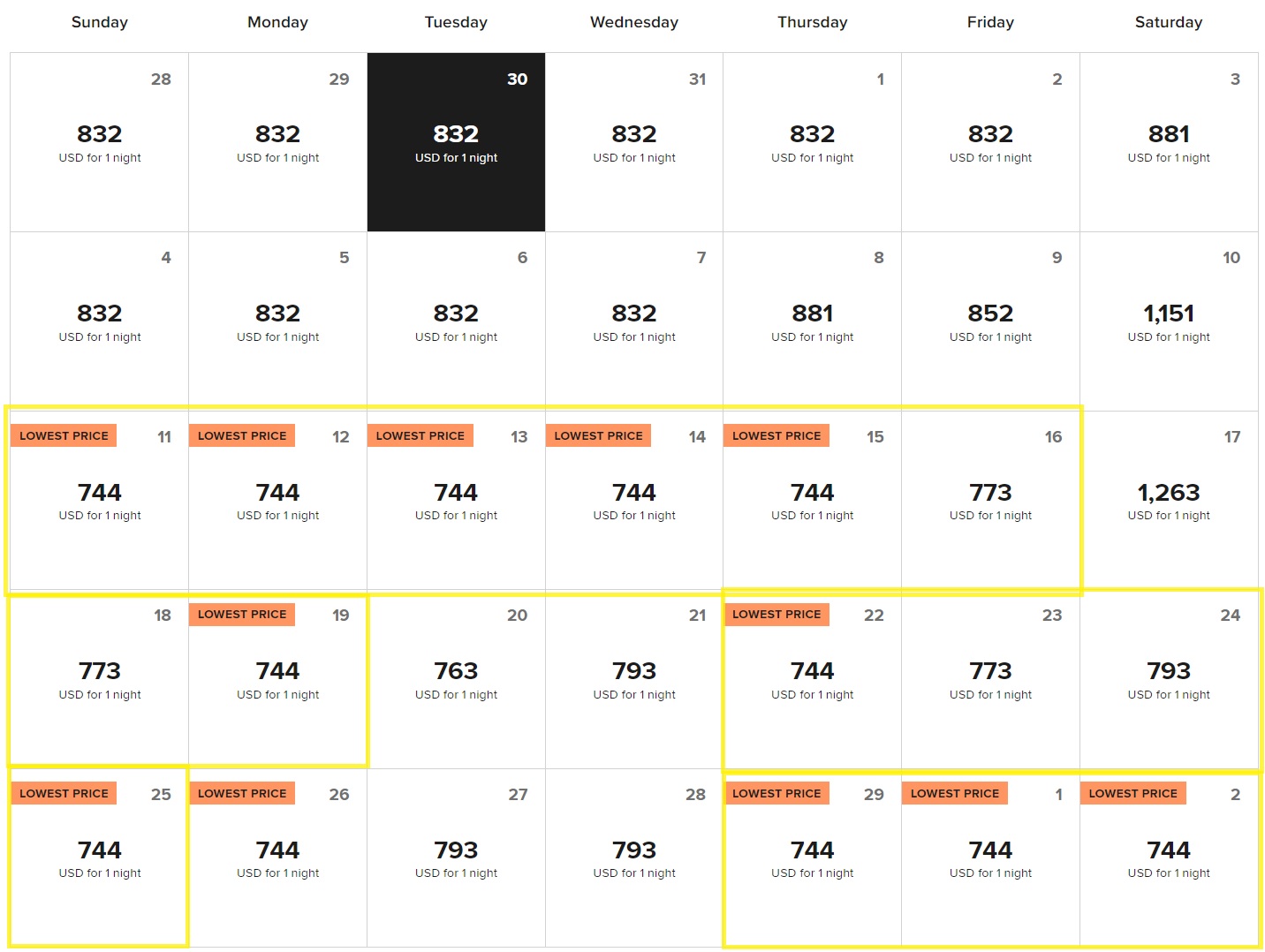

Nick and I visited this resort when it first opened and we were blown away. The resort was great, and the service was truly awesome. The award price has gone up since our visit, but it is still usually bookable with 50K certificates. Here are the award prices for February 2024:

As you can see above, every night of the month is available to book with a 50K free night certificate plus some points. And here are the cash rates:

I find it interesting that the weekend nights are almost always the cheapest with cash. I suppose that people usually travel over the weekend to get there and then spend the week days there.

Now let’s look at a five night stay Feb 12 to 17. Here are the all-in prices when booked various ways:

- 50K cert booking: Redeem five 50K certs plus 7K or 8K points per night (37K total). Also pay $30 in taxes.

- Points booking: Redeem 230K points (thanks to the fifth night free). Also pay $30 in taxes.

- Cash booking: Pay $3,175 (including taxes and fees).

In all of the options above, you would have to pay $515 per adult for seaplane transfers. Since that’s the same regardless of how you pay, we can safely ignore that part in our analysis.

We can’t say that the five 50K certs are worth the all-in $3,175 cash rate because with certs you would still have to pay 37K points plus $30 in taxes. If we assume that you could buy the 37K points when on sale for around 0.9 cents each (as happens fairly often), then we can value those points at 37K x $0.009 = $333. After subtracting the cost of points and the $30 tax from the all-in cash rate, we get a total value of $2,812 ($3,175 – $333 – $30).

Another way to look at the value of using the certs for this stay is to compare the cert stay to an all-points stay. We can ignore the $30 tax since it is charged with either option. So, we’re comparing 5 certs plus 37K points to the all points option of 230K points. The cert option, therefore, saves us 193,000 points. If we use the same 0.9 cents per point cost as discussed above, we get a 5 cert value of 193K x $0.009 = $1,737. Keep in mind that this is worst-case value for the certs since it assumes that the alternative is the best case value of using points (i.e. a five night stay with one night free).

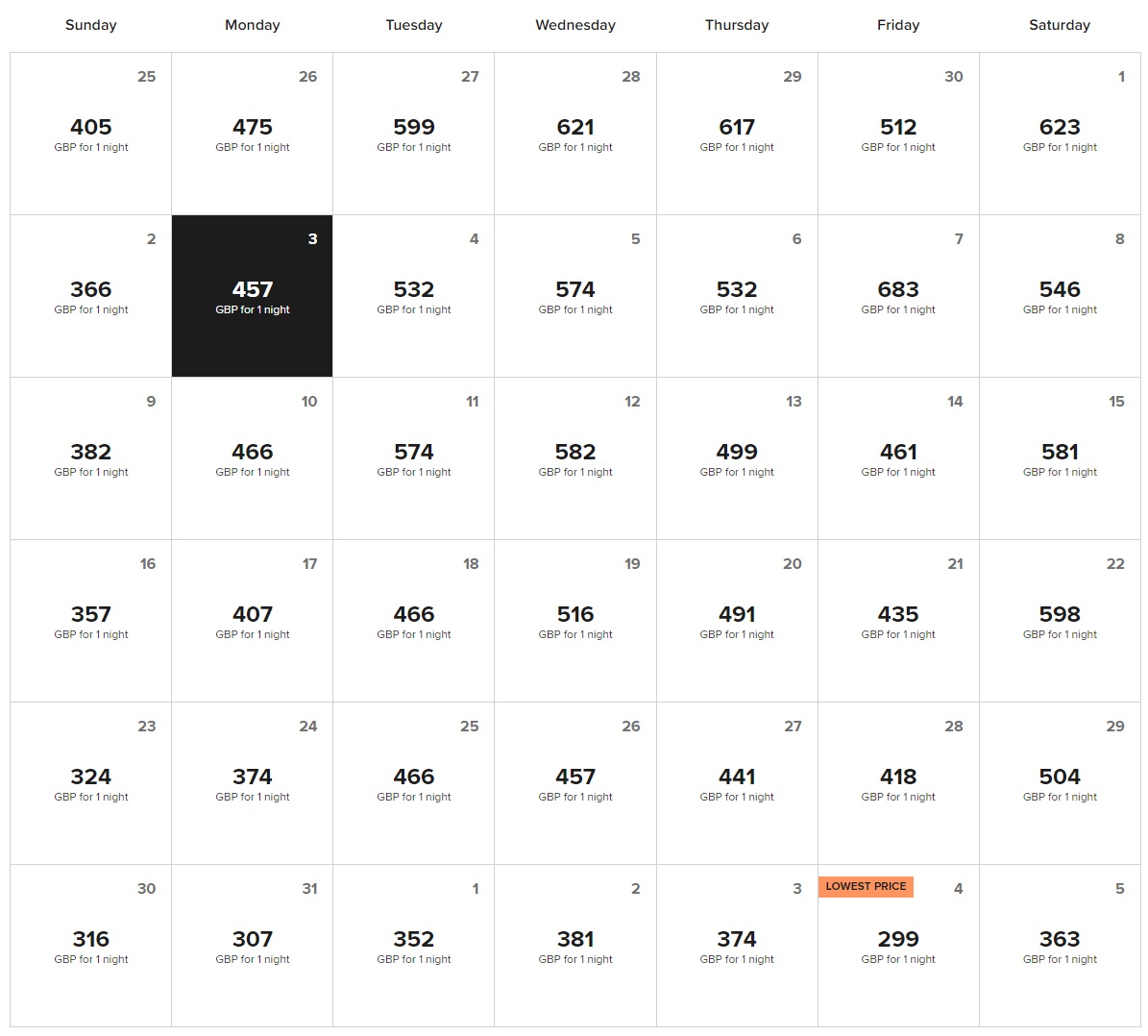

St. Pancras Renaissance Hotel London ($1,710 to $2,638)

Pre-pandemic, my wife and I visited London often, and while there we often stayed at the St. Pancras Renaissance hotel. I’ve written before about our stay in a junior suite (St. Pancras Renaissance Junior Suite. Wow!), and about the delightful Chambers Club. More recently, Nick stayed at St. Pancras Renaissance and enjoyed an upgrade to the Grand Staircase Suite. The hotel isn’t necessarily great for those visiting London for the first time since it’s a bit out of the way of popular tourist attractions, but it’s very convenient for taking the train to explore away from London (the St. Pancras train station is in the same building and includes the Eurostar among other train options), and for the next-door tube station (King’s Cross) for exploring all of London.

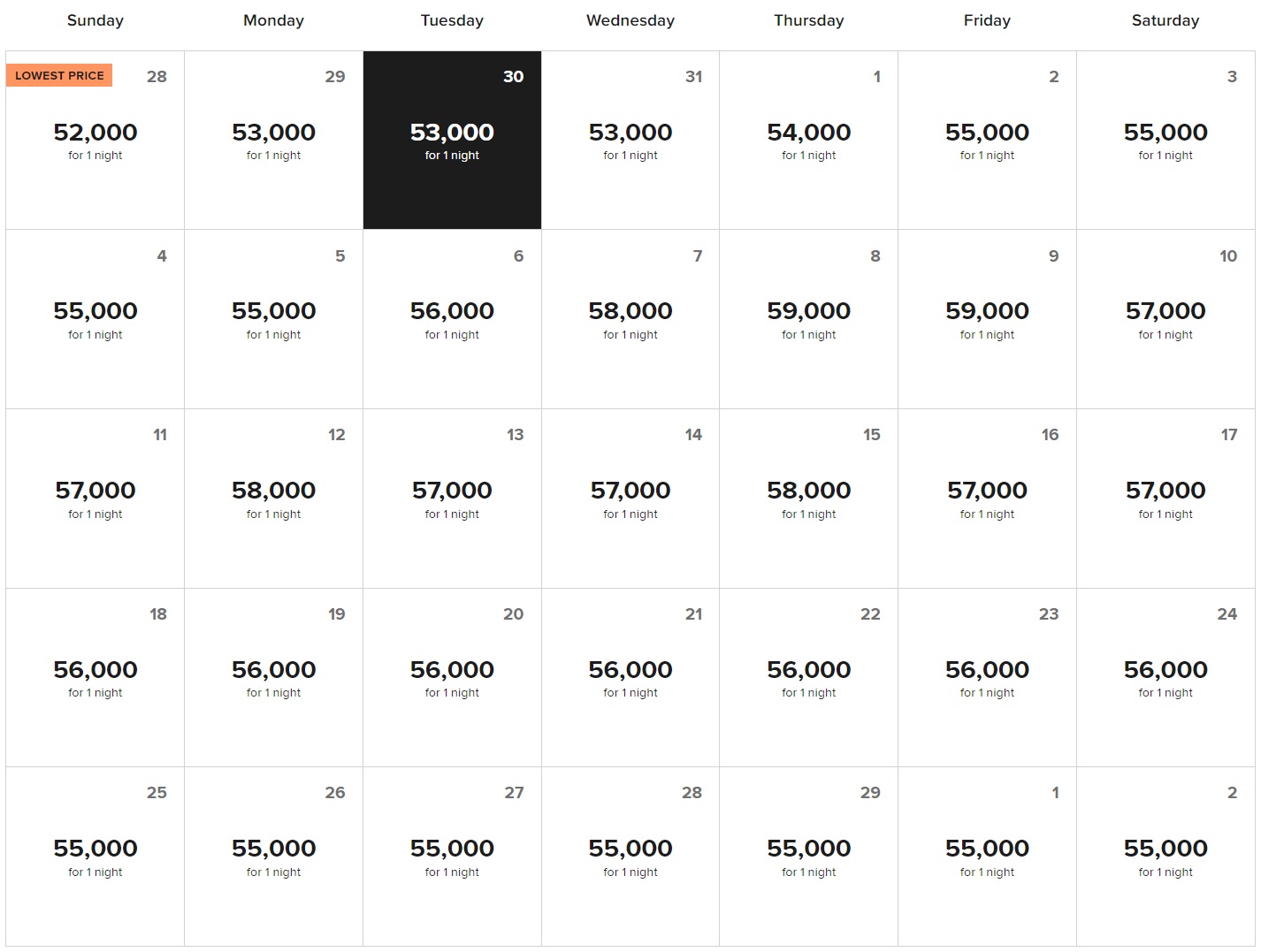

While I don’t have immediate plans to return, I thought it would be interesting to look at the value of 50K certs there in the summer of 2023. Here are the nightly award prices for late June through early August:

As you can see above, most nights are available for 65,000 points or less and so can be booked with 50K certs plus points. And here are the cash rates (in pounds):

Now let’s look at a five night stay July 17 to 22. Here are the all-in prices when booked various ways:

- 50K cert booking: Redeem five 50K certs plus 10K to 15K points per night (60K total).

- Points booking: Redeem 250K points (thanks to the fifth night free).

- Cash booking: Pay 2,572 GBP (including taxes and fees). Google tells me this is currently equivalent to $3,178 USD

We can’t say that the five 50K certs are worth the all-in $3,178 cash rate because with certs you would still have to pay 60K points as well. If we assume that you could buy the 60K points when on sale for around 0.9 cents each (as happens fairly often), then we can value those points at 60K x $0.009 = $540. After subtracting the cost of points from the all-in cash rate, we get a total value of $2,638 ($3,178 – $540).

Another way to look at the value of using the certs for this stay is to compare the cert stay to an all-points stay. So, we’re comparing 5 certs plus 60K points to the all points option of 250K points. The cert option, therefore, saves us 190,000 points. If we use the same 0.9 cents per point cost as discussed above, we get a value of 190K x $0.009 = $1,710. Keep in mind that this is worst-case value for the certs since it assumes that the alternative is the best case value of using points (i.e. a five night stay with one night free).

The Path to the Ritz

Chase’s Ritz-Carlton card is arguably the single best Marriott card available. But, it’s not directly available. You can’t sign up for this card new. However, if you have a consumer Marriott card issued by Chase you can call to upgrade to the Ritz card after you’ve held the other card for at least a year. That’s why I like the Boundless card as a step towards the Ritz card. Get a great welcome bonus now with the Boundless card and later upgrade to a better card.

In exchange for its $450 annual fee, the Ritz card gives you Priority Pass with unlimited guests, free authorized users each of whom can also get a Priority Pass card, $300 annual credit for airline incidentals, and an 85K free night certificate each year upon renewal.

My Thoughts

As you can see above, it’s easy to get outstanding value from 50K certificates. I didn’t even try to cherry-pick great options. Instead, I considered a few Marriott properties that I’d like to return to and looked at real world cash and award rates. That said, caution is required here. If you don’t have flexible travel plans, I think it can be very easy to miss out on the value of this welcome bonus altogether. For example, if you vacation twice a year in popular destinations like to beach locations in Florida, California, or Hawaii, or popular and expensive cities like Miami or New York, you’re probably going to find that the resorts you want to stay out are priced too high for your 50K certs.

Independent of the 50K certs, another interesting finding above is how easy it is to get great value for your Marriott points. In every example above, you would easily get more than 1 cent per point value. That’s pretty good when considering that the average value of Marriott points is closer to 0.8 cents each. On the other hand, that also shows that I may have just gotten lucky with my selection of hotels for this post. Keep that in mind when you do your own award searches. You might very well find much lower value awards elsewhere.

Just booked the Ritz Carlton Melbourne, Australia (a brand new hotel) for July for a little over $1,700 in value. Had to top up with a few points, but very happy! The Ritz Perth is actually even more expensive in cash and fewer points, but not as desirable a location for many, I’m sure (but quite a popular getaway from where we are in Singapore). Either would be a good redemption with the free nights.

I am ashamed for not knowing this… When a hotel prices at $350+45K points would a cert work in that situation?

I am eyeing a couple of properties in Asia (i.e. Ritz Langkawi) where I can get a suite for some added cash. Could a cert be used in a situation like that?

Sadly you cannot use certs here

I wish, but no. That won’t work sadly. But if you can book a base room with certs, you can probably then contact the hotel directly and pay the $350 or whatever to upgrade.

I was definitely at 6/24 and still got approved. Not sure why. My first card was a secured Cap One card, but still figure that would count. Anyways, I am happy. Also there are some Ritz Carlton Hotels around the world you can get at under 65K, so look out!

Greg and company what are your thoughts on how to earn Marriott points for high end property stays since more of their best card bonuses seem to be going the FNC route?

This first popped into my mind when last month had the previous Boundless card offers of 100K points or 75K + $300 e-gift card as an alternative to the 3 50K FNC standard offer. I have a Boundless card and can refer P2 for a 40K referral bonus but the point offers weren’t available by referral (sparse data points out there on whether you could refer and then have Chase match the 100K/75K + $300 offer). If a match was possible it made me wonder which was more valuable – 100K or 3 FNC? In my case I will have Platinum, possibly Titanium, status through 2024 but P2 has no chance of reaching Platinum, so the points have potentially more value there in transferring to my account which you can’t do with the FNC.

The 5 FNC offer is clearly a better overall offer, especially if it becomes available by referral, but its repeated appearance on the Boundless card makes me wonder what the strategy is for potential stays at 70k+ point Marriott properties? Or is the answer “those properties aren’t a great value anymore”?

You’ve hit on a broad issue: there aren’t any great ways to earn Marriott points these days. Or, more specifically, there are almost always better ways to earn other more valuable points and so it seems a waste to earn Marriott points. For example, why put a lot of spend on a Marriott card that earns 2x when you can instead earns 2x transferable points with Amex, Citi, or Capital One? Same problem with category bonuses. Unfortunately, I don’t have a good answer!

I agree with you that for your wife a 100K offer may be better than a 5 night offer since she can move the points to you.

If I’m a authorized user under my wife with this card, do I still qualify for the bonus? Also I have a regular Amex Marriott and a business Amex Marriott. Thanks.

Yes being an authorized user doesn’t affect your ability to sign up yourself. As to whether your Amex cards are a problem: yes. See details in this post where I detailed the rules for getting this card.

Amazing blog thanks for sharing.

Good offer. Unfortunately less valuable after the devaluation compared to the last time they offered five 50k certs but still a good option for some locations

Thanks for the great detail, Greg – applied & approved by Chase via email several hours later.

The 5 FNCs will be fantastic for one of my fav properties but especially happy to now have to top-off nights needed for status at year end (you posted this strategy late last year). Nice to have another solid status tool + an addtl anniversary FNC. So happy this offer come around again!

Awesome that you were instantly approved. Curious where you plan to use the certs? You always have so much great info about hotels!

Thank you! Took several hours for Chase to reply “Approved” via email but sure a LOT faster than their Ink cards generally take me.

I’ve posted before about the Hotel Drover in Cowtown (Ft Worth) – see “Best uses for Marriott free night certificates” (I won’t add link cos then this post goes into “review!”) but is a noteworthy property. Being smack dab in the revamped Stockyards (with nightly entertainment, frequent festivals/concerts) & world-class dining), rooms are insanely priced now since its extraordinarily successful opening. Last time I stayed in Oct (have been 5x), the cash rate was $1,800 for a regular room, but I cashed in a 35k FNC & topped it off.

It’s a fun few days, great to coordinate with a concert at (new-ish) Dickies Arena or Tannahill’s Music Hall just down from the property (play all music genres). History is as rich as the food!

how quickly do you get the certs after meeting MS? I worry good redemptions would be gone by the time I get the certs

Same question, but due to specific upcoming travel timeline. Any DPs on this?

My hope is within a few days following statement close after meeting spend, but I have no idea.

Does anyone here have recent experience with this?

Last year I got them almost immediately after meeting the minimum spend. I was pleasantly surprised. I didn’t even have to wait for the statement to close.

I remember them posting fairly quickly as well – within less than a month of hitting MSR. I never received an email notifying me of the certs posting which makes it hard to track down the exact date.

I’ve had a Boundless card for 3+ years. Dont have any Amex Marriott cards. If I cancel my current Boundless can I immediately apply for a new one and be eligible for this bonus? Thanks!

Yes that should work. I’d wait a few days after cancelling just to make sure

Is this a public offer ? I googled Marriott boundless and it is still showing the 3 FN offer. Was approved for this card last week, asked for a match in Chase secured message a couple of days ago and was declined.

J C, I am in the same boat. I sent a message via Chase secured message but declined. I called but the representative couldn’t help because Chase’s website only showed her 3 FNs. I will give a few more tries and see how it goes.

It’s not the standard public offer so it can’t be used for a match. Hopefully that will change soon but I don’t have any info one way or the other.

Are there any tours of the St. Pancreas Hotel that you’d recommend? I took one a few years ago that was disappointing.

I believe that the tour you’re talking about shut down permanently after an ungrateful Julian didn’t even leave a tip.

Or maybe I tipped an amount that was commensurate with the quality of the experience? (Though to be fair, I did leave a tip for the lounge folks — they were great. 😉 )

And of course my wife signed up for the three 50K certificates after $3,000 spend last month.

If the standard public offer changes to 5 50K certs sometime soon it will be worth calling Chase to see if they’ll match her to that offer. As things stand right now, though, this offer isn’t the standard one.

Thanks, Greg!

I took a retention offer in early March to keep my Boundless personal card open. I got a $50 statement credit as a compensation for paying the $95 annual fee again. Does receiving a retention bonus on the Boundless card in the past 24 months make me not eligible for a new 5x 50k bonus. I don’t want to cancel my current Boundless and wait 31 days to apply and find I’m not eligible. Bonvoy eligibility rules are like reading the tax code. I wouldn’t even try again except this offer is too much better than the normal ones.

It’s my understanding no for SUB eligibility, but upgrade offers will effect sub eligibility. However, you may have some problems as the terms of the retention may require you to keep the card open. Chase is a bit lighter on this IIRC, opposed to amex who will block you from new offers and shutdown/blacklist you.

I currently have this card and Under the Marriott Eligibility I would not be able to get the bonus. I was reading an older post under the credit card offer and there is a section talking about Application Tips to Get Same Card Again: What would be a suggest waiting period after canceling and then reapplying for the card for the bonus? Also, do you think it will be possible to down grade to the Bold and get the boundless again (Just to keep the Credit History)? (I’m under 5/24, I don’t have any of the other Marriott cards and I haven’t a bonus in years) Are there any data points on this?

Thanks

It’s a big No on the down grade to the Bold!!!! So,what would be a suggest waiting period after canceling and then reapplying for the card for the bonus? Any Data Points?

Thanks

For getting a new chase marriott, you can’t have the bold or boundless. Check greg/Nick’s chart for marriott’s byzantine rules. But you can upgrade to the ritz(check 30 day wait period, idk on that) for a year then downgrade to a second boundless. Since you have it for only 1 year you’d get 2 $300 credits(please check what counts, not like csr) since theyre based on calendar year, an 85k cert after month 12, priority pass, marriott gold, etc.