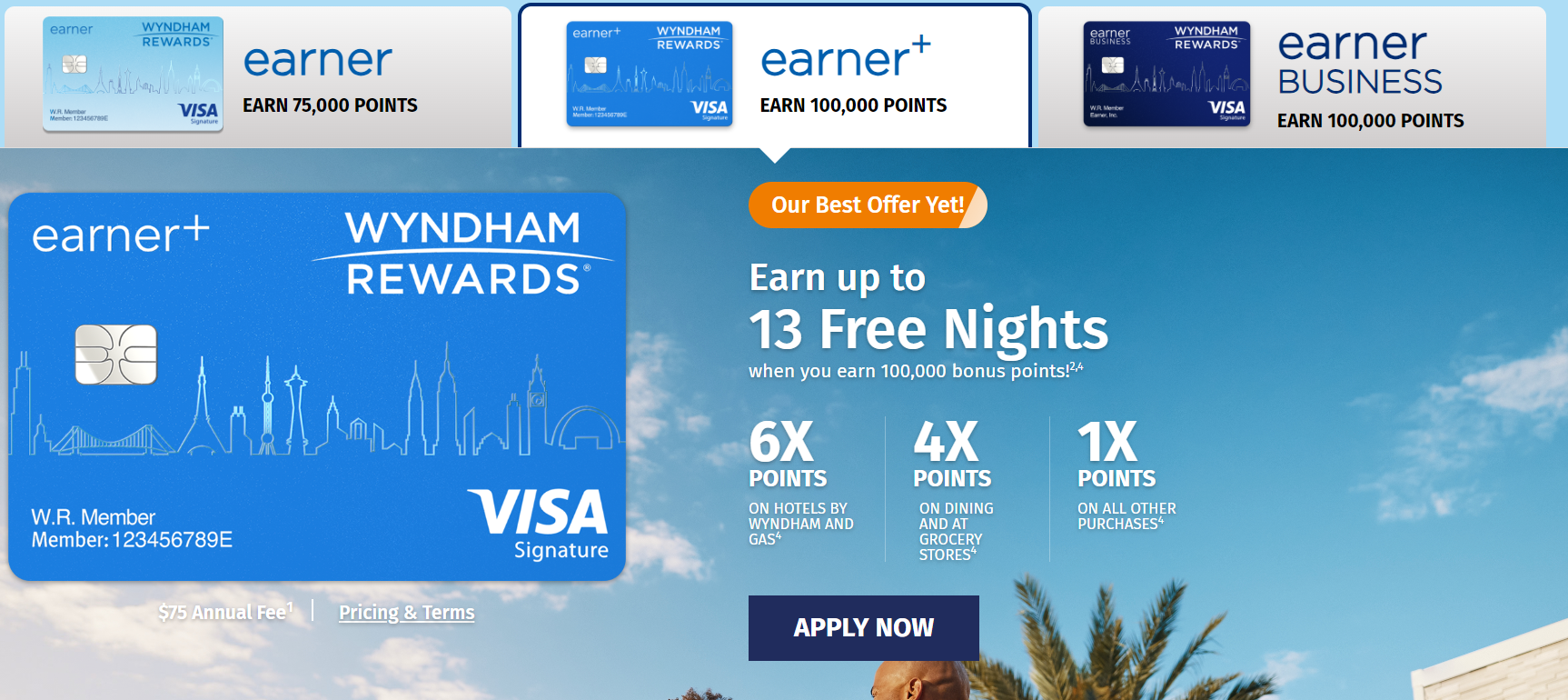

Barclays has launched some massive offers on the Wyndham Earner and Earner Plus cards that are the best that we’ve ever seen for each product. The offer for the Earner Plus gives a whopping 100,000 Wyndham Rewards points after only $2,000 in spend, while the regular Earner card is offering 75,000 points on the same $2K in spend. Each one beats the previous best offer by 30% or more. Wowza.

The Wyndham Business Earner card, our favorite of the Wyndham offerings because of its 8x earnings on gas, also has a best-ever offer of 100K…but with a required $15K in minimum spend. We’ll do a separate writeup on that as it’s such a different value proposition.

The Offers & Key Card Details

Click the name of the card below to go to our dedicated card page for more information and a link to apply.

| Card Offer and Details |

|---|

ⓘ $186 1st Yr Value EstimateClick to learn about first year value estimates 30K Points Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler 30K points after $1K spend in first 90 daysNo Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: Expired 7/11/24: 75K after $2K in spend FM Mini Review: Sign up for the bonus. Keep for the 10% award discount. Earning rate: ✦ 5X Wyndham & gas ✦ 2X restaurants & grocery ✦ 1X everywhere else Card Info: Visa Signature or Platinum issued by Barclays. This card has no foreign currency conversion fees. Big spend bonus: 7,500 points each anniversary year after $15K spend Noteworthy perks: Gold status ✦ 10% discount on free night awards ✦ Cardmember discount on paid stays ✦ No foreign transaction fees |

| Card Offer and Details |

|---|

ⓘ $216 1st Yr Value EstimateClick to learn about first year value estimates 45K Points Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler 45K points after $1K spend in first 90 days$75 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: Expired 7/11/24: 100K after $2K in spend FM Mini Review: Not bad, but the business version is better. Earning rate: 6X Wyndham & gas ✦ 4X restaurants & grocery ✦ 1X everywhere else Card Info: Visa Signature or Platinum issued by Barclays. This card has no foreign currency conversion fees. Noteworthy perks: 7,500 points each anniversary year ✦ Platinum status ✦ 10% discount on free night awards ✦ Cardmember discount on paid stays ✦ No foreign transaction fees |

Barclays Applications Tips

- 6/24 Rule: Similar to Chase, Barclays has a rule that you may not be approved for a new card if you have opened 6 or more cards (with any bank) within the past 24 months. However, this rule is inconsistently applied and there are data points of people being approved despite being over 6/24.

- 24 Month Rule: Barclays also has a rule that you can only get a welcome offer on a card for a second time if it's been more than 24 months since you last received a welcome offer on the same card. Like the 6/24 rule, this seems to be inconsistently applied and some cards display the following language: “You may not be eligible for this offer if you currently have or previously had an account with us in this Program.”

- No Duplicate Cards: Barclays won't let you have two of the same card. In order to reapply, you'll need to cancel the card first. It's generally thought that you need to wait at least six months after cancelling before attempting to reapply.

- Velocity Limits: It's generally thought that Barclays will usually only approve you for a new personal card every 6 months. However, there are examples of people being able to move faster.

- Card Limits: Barclays doesn't have a strict limit on the amount of cards that you can have, but it does place limits on the total amount of credit that they will issue you across all cards. It's also thought that the bank will use your spending on other Barclays cards as one of its approval considerations.

- Application Status: Call (888) 232-0780 to check your application status or use this link for personal cards and this link for business cards.

- Reconsideration: If denied, call (866) 408-4064 and ask for your application to be reconsidered.

Quick Thoughts

We love Wyndham points around here, primarily because of the value that can be had in using those points towards Vacasa vacation rentals, Wyndham Vacation Club and Cottages.com. Wyndham recently announced that it would be devaluing Vacasa redemptions, effectively putting a ceiling on redemptions of ~ 1.67s cent per point (or 1.85 cents per point factoring in the 10% reward discount for Wyndham cardholders). Even at that reduced rate, each of these offers atill represents a potential of well over $1,000 in value when redeemed through Vacasa…for only $2k in spend.

My wife and I both have the Wyndham business card and I haven’t felt any need to pursue the consumer versions. That changes as of today and we’ll each be firing off an application as soon as I’m done writing this.

Currently, none of these elevated offers appear to be available via referral. That will most likely change at some point, so if someone notices that these are showing up on their referral link, let us know ASAP and we’ll set up a reader referral post.

Was approved for the consumer earner plus about 3 weeks ago, have made a few gas station purchases and all fine. Just noticed my Wyndham loyalty number is not attached to the credit card.

An total train wreck of phone calls. Both Wyndham and Barclays say they can’t associate the credit card and the Wyndham account. They sent me back and forth until I refused to hang up. Finally they said they are associating it but that it takes 30 days!!!!!!!!!!! They kept saying that this is the normal course of business for them. The internet seems to indicate that Barclays is by far the worst bank on the planet to deal with but holy crap,

Anyone go for the Earner and the Earner+ consumer?

Already had the Earner+ Business and was approved for Earner+ consumer and completed the spend. Considering the Earner also to since it has the high offer.

I got Earner plus card two weeks when the SUB was 75,000 (the highest I’ve seen to this point) for $1K spend in 90 days. Now it is 100,000 SUB for $2K spend, which I can easily do. I wonder if I can call and “switch”/request that or am I toast?

I have diamond status via the business card, if I apply for the earner+ card, will I be downgraded to platinum?

terrible offer. the pathetic 100K points will give you couple of nights at. dirty stinky bed beg ridden Super 8 motels where the owner receptionist stinks with marijuana and dozing off on the desk. only decent offer would be 400K points. avoid

Sounds like you speak from personal experience. Plus, how rude of the receptionist not to share their weed with you! I hope that reading this blog will provide you with some valuable knowledge on how to better spend those 100K points 🙂

i believe it should be a death penalty to consume, sell any drugs in the USA like rest f the world.

Been to Amsterdam lately? I’ll take that as a no. And a 400k point offer on a free card? Keep dreaming buddy…

Great write up. I never thought of getting the consumer card. Now it’s the time. I just wonder if I got earner plus, can I downgrade to earner card one year later?

The earner card has a 2k spend, not 1k

Is that the card display you’re seeing that in? I refreshed the cache, so hopefully it’s displaying correctly now.

Yes, correct now. Was hoping it was only 1k, but now I’ll do the earner plus.

Does Wyndham have a referral program if I want to refer a family member?

FYI, I’m seeing on the Wyndham credit card site that you actually have 6 months to meet the SUB spending requirement on the Earner and Earner+, not 90 days. Even better!

AFAIK Wyndham will not let you transfer points to other family members. Will they let you make bookings in the other person’s name? (P1 travels more often for work without P2, but P2 is better positioned to apply for the card currently).

BTW with the new offer it makes more sense to save $13K of spending to use towards another blockbuster Amex SUB so unless you MS at the rate where it doesn’t matter, the personal card offer is way better than the business one.

Thanks, Tim! If you already have these cards, is it know if you can get approved for an identical card and earn the SUB on it? (I opened these cards back in 2022.) Thanks in advance for any insights you might have.

Re-reading the article might yield the insights you are looking for.

Oh, man, I’ve never been *that guy* (who asks a question covered in the post) before. My bad! Thanks for going easy on my, Vincent!

I just figured out what happened. My iPhone had read the “Best Ever 100K offer on Wyndham Earner Business card (but with big spend)” post to me, in which my question was not answered. I then jumped on my computer to pose the question but, not realizing Tim had done a separate post on the personal cards, I accidentally clicked on this post and posed my question here.

In atonement for my faux pas, I will offer this nuance to the “No Duplicate Cards” rule. I have—and received the SUB—on two Wyndham Earner Business cards: one for my LLC and one for my sole proprietorship. I was never sure if I was able to get that card and its SUB twice because of the different businesses or whether with Barclays you could more widely get the bonus on multiples of the same card. Sounds like the former.

What an awesome bonus! I love the Vacasa redemptions, even though they were severely devalued from the beginning of it.

P1 had Wyndham Earner Plus 19 months ago, applied again, app pending.

P2 never had any Wyndham cards, app pending for business card.

Hope they’re approved!!!

Over 5/24. Instant approval.

Biz or Consumer?

Consumer

If I currently already have the Earner Plus, would I be approved for the Earner and get the bonus? I got the Earner Plus last June.

I have the same question on the SUB for the Earner, though I’ve had the Earner+ for 5+ years.

In the 6/24 rule, do business cards count toward the six?