NOTICE: This post references card features that have changed, expired, or are not currently available

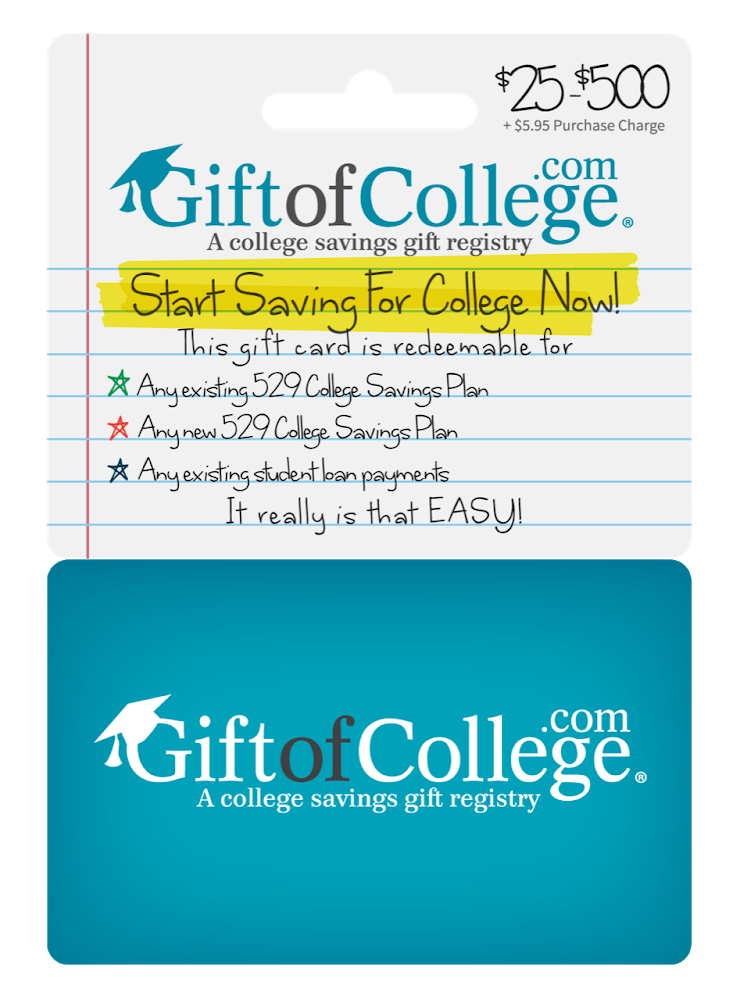

This post covers the most rewarding options for buying Gift of College gift cards…

Gift of College Gift Cards Availability

Gift of College now offers a BUY IN-STORE LOCATOR. Note that this locator only shows stores that may sell the cards. Whether or not the cards are in-stock cannot be found online.

Many stores accept credit cards for the purchase of 3rd party gift cards, but the decision is usually left to the store manager. As a result, some of the stores that carry Gift of College gift cards won’t be useful for earning rewards if they don’t accept credit cards for the purchase.

Gift of College gift cards are currently available through the following stores and websites…

In-Store (up to $500)

- Brookshire Brothers Grocery. Located in Texas, Louisiana, and Arkansas.

- Cumberland Farms. Located in Connecticut, Florida, Massachusetts, Maine, New Hampshire, New York, Rhode Island, and Vermont.

- Foodmaxx. Discount supermarket. Located in California and Nevada.

- H-E-B Texas Grocery

- Lucky Supermarkets. Located in California.

- Save Mart Supermarkets. Located in California and Nevada.

- Stop & Shop Supermarkets. Located in Connecticut, Massachusetts, New York, New Jersey and Rhode Island.

When buying these gift cards in-store, it is always best to load $500 to each card purchased. In this way, you’ll minimize the $5.95 or $6.95 gift card fee as a percentage of the total amount spent. A $6.95 fee with a $500 load results in a 1.2% fee. As long as you pay with a rewards credit card that offers better than 1.2% value in rewards, you’ll come out ahead.

In-Store (up to $200)

- CVS: $25 – $200

- Fleet Farm: $25 – $200

- Stripes Stores: $25 – $200

Note that while the above stores are now selling Gift of College gift cards, the low maximum values mean that each card’s $5.95 or $6.95 fee is a large percentage of the overall transaction. As a result, these offer poor value unless you happen to have a credit card that offers a very large bonus at these stores.

Online

- GiftOfCollege.com max $200

- GiftCards.com: $25-$75

- Also available through a few 529 Plan websites. Check your plan’s website to see if they sell these gift cards and to compare fees.

Among the online options, Fluz is clearly the best since it has no purchase fees and offers cash back. The others all have significant purchase fees.

Credit Card Bonus Categories

Grocery Stores

Gift of College Gift Cards are currently available for purchase at multiple grocery store chains:

- Brookshire’s Grocery. Located in Texas, Louisiana, and Arkansas.

- Foodmaxx. Discount supermarket. Located in California and Nevada.

- H-E-B Texas Grocery

- Lucky Supermarkets. Located in California.

- Save Mart Supermarkets. Located in California and Nevada.

- Stop & Shop Supermarkets. Located in Connecticut, Massachusetts, New York, New Jersey and Rhode Island.

Many credit cards offer bonus points at grocery stores. Here are some of the best options:

- Amex Gold Card: Offers 4 points per dollar at US grocery stores (up to $25,000 annually).

- Blue Cash Preferred: Offers 6% cash back at US grocery stores, up to $6,000 annually.

- Citi Strata Premier: Earn 3X ThankYou points per dollar at grocery stores.

- More great options can be found here

Gas Stations

Gift of College Gift Cards are currently available for purchase at the following stores that are known to code as gas stations:

- Cumberland Farms. Located in Connecticut, Florida, Massachusetts, Maine, New Hampshire, New York, Rhode Island, and Vermont.

Many credit cards offer bonus points at gas stations, but you won’t earn a bonus for those that limit bonuses to “pay at the pump”. Here are some of the best options:

- Wyndham Rewards Earner Business Card: Earn 8X Wyndham points at gas stations!

- Amex Business Gold: Earn 4X Membership Rewards on the two categories where your business spends the most each billing cycle from the following categories: ⚬ US purchases at restaurants ⚬ Airfare purchased directly from airlines ⚬ U.S. purchases for advertising in select media ⚬ U.S. purchases at gas stations ⚬ U.S. purchases for shipping ⚬ U.S. computer hardware, software, and cloud computing purchases made directly from select providers. 4X applies to first $150,000 in combined purchases in your two categories each calendar year, 1X point per dollar thereafter and on other purchases. Terms apply.

- Citi Strata Premier: Earn 3X ThankYou points per dollar at gas stations.

- Bank of America Business Advantage Cash Rewards Mastercard: Earn 2% on dining plus 3% on 1 choice from: gas stations (default), office supply stores, travel, TV/telecom & wireless, computer services or business consulting services (for the first $50,000 in combined choice/dining purchases each calendar year, 1% thereafter). With Business Advantage Relationship Rewards Platinum Honors status (which requires $100K in savings and investments across Bank of America and Merrill Edge), you’ll get a 75% bonus on rewards. This translates to 5.25% cash back within your chosen category of spend.

- Bank of America Cash Rewards with Platinum Honors: You can get up to a 75% bonus through your banking relationship with Bank of America and/or Merrill Edge. This makes it possible to earn up to: 3.5% at grocery stores and 5.25% on gas up to the first $2,500 in combined purchases each quarter; and 1.75% cash back everywhere else.

- More great options can be found here

More info

To learn more about how to earn miles when saving for college (or paying student loans), please see: Frequent Miler’s Miles for College.

FYI, the link for Cumberland Farms locations is changed to:

https://cumberlandfarms.com/find-us/

The current link does not work.

Does anyone know how long Gift of College gift cards have been gone from Kroger . com? I last bought them in April of 2024 so is this a new development?

Any updates to this? Appears Fluz has been dead for awhile. I don’t know of any even relatively reasonable options these days for GoC.

Fluz no longer has gift of college 🙁

It will be be added back soon.

Source?

Fluz used to have them no-fee with a discount. Then they switched to $500 + $15 fee with no discount. Now they’re gone completely.

It’s been a year … so … define “soon” 🙂

I finally found these Gift of College gift cards at my local CVS. The fee is now $6.95, which make it this option less attractive.

Is it possible to buy a Gift of College gift card using VGC?

I don’t know

The article mentioned “Also available through a few 529 Plan websites” … which 529 plan websites are those?

Sorry, I don’t know

Could anyone who has used these to pay off student loans answer a question for me?

My monthly payment amount is small ~$100. I would like to purchase a $500 card and use it towards multiple months of payments. When you add it to your account, does it automatically use the entire amount, or can I tell it to only deduct the amount of my monthly payment? I can’t afford to pay $500 each month but instead planned to get a $500 card and use it for 4-5 months before getting the next one.

Thanks!

whole GC is applied to a single transaction, no splitting, according to CSR and did not see any option for splitting on website

Open a 529 plan, and pay the loan from the plan.

Hey guys! Thanks for the info. I’m looking to get a sizable amount of these for college 529 gifts, and wanted to ask: is there a reason the Wyndham Earner Business card with 8X on gas isn’t included in the list of good options for Cumberland Farms gas stations? I know you guys are big fans of that card so I was surprised not to see it – and curious if that’s because maybe it’s known not to work (e.g. does it code as the wrong category or not considered “eligible” gas purchase)? Would love to know if anyone’s has proven success or failure at Cumberland Farms with the 8X gas as if it works, I’m probably going to do a lot of these and get myself a bunch of Vacasa nights

Thanks for this. The only reason it isn’t there is that this post was written before that card existed. I’ll update it right now! It WILL work to earn 8x.

Awesome, thanks!!

Looks like the option to purchase from Kroger.com and the gift card websites is gone, sadly. I could have earned 4x with the Kroger.com option or 2.5x on the gift card sites.

seems crazy but I think the numbers work. I don’t live near any of these but am looking to pick up around $50k of cards to load for the kids college funds and do a fly to a city and pick up a bunch a few times. Question: Amex has the best supermarket rates for me (gold and everyday cards) – even if I’m not on a new card bonus offer will Amex mind if I’m buying gift cards at one of these groceries especially figuring so not to hit the crazy fraud thresholds I would likely need to call Amex in advance. If so – any better card it would work on?

This may have already been asked…. but in CT 529 contributions qualify for a tax deduction. If you buy these Gift of College cards from a “gas station” and add them to your beneficiary 529 account, can you still get a tax deduction on your contributions even though you bought it as “gift cards” and did not “directly” contribute to the 529?

Yes, absolutely. It doesn’t matter how you fund the account in order to get the tax deduction.

I noticed GOC, offers email versions online. Is there a fee?

Without using Gift of College, is there any place that charges less than Plastiq to pay tuition if the school doesn’t accept credit cards?

Is there anything else in the marketplace other than repeated sign-up bonuses to make my exorbitant tuition pay for itself? 🙂 Thanks!

Yes, there’s a fee. I don’t remember exactly how much, but I remember that it’s too much to be practical as a way to earn credit card rewards. Probably something like $5.95 per $200 gift card (e.g. 3% fee)

After I contacted the company, I learned it’s $5.95/200, and the $200 is only available at a few select sites. I am still trying to figure out how to optimize paying for school? So far, Melio and a debit card with perks may be the best option. Any other thoughts?

I guess you don’t live anywhere near the stores that sell GoC gift cards? Buying those in-store would be the best bet.

Sadly, I don’t but they are supposedly near my grad school. 🙂

[…] college savings. See the post Miles for College for a full rundown. The short story is that you can buy Gift of College Gift Cards at select stores and use those gift cards to fund a 529 plan. The purpose of buying gift cards rather than funding […]

I reached out to Gift of College about Barnes & Noble and they responded today that their gift cards are no longer sold at Barnes & Noble.