Capital One has introduced two new transfer partners today: Wyndham Rewards and Accor Live Limitless at the following transfer ratios:

- 2 Capital One miles = 1 Accor Live Limitless point (i.e. 1,000 Capital One miles = 500 ALL points)

- 2 Capital One miles = 1.5 Wyndham Rewards points (i.e. 1,000 Capital One miles = 750 Wyndham points)

It’s great to see Capital One continue to expand its list of transfer partners. Neither Wyndham nor Accor are among the most popular hotel loyalty programs in the points and miles community, but there should nonetheless be some opportunities to get solid value for points with these additions. It is not immediately clear to me when transfers will become available as I do not see either program when I log in to Capital One right now, but both should soon launch for transfers.

Capital One ventures into hotel programs

Unfortunately, Capital One continues to offer differing transfer ratios that make the program more confusing than its competitors. On the one hand, these ratios mean that Capital One® Venture® Rewards Credit Card and Capital One® Spark® Miles for Business cardholders will earn decent value for points in both programs. On the other hand, I find that even as someone who writes about loyalty programs all day long I still need to reference a chart to remember Capital One’s various ratios. I suppose if that is what it takes to maintain the better values, I shouldn’t complain.

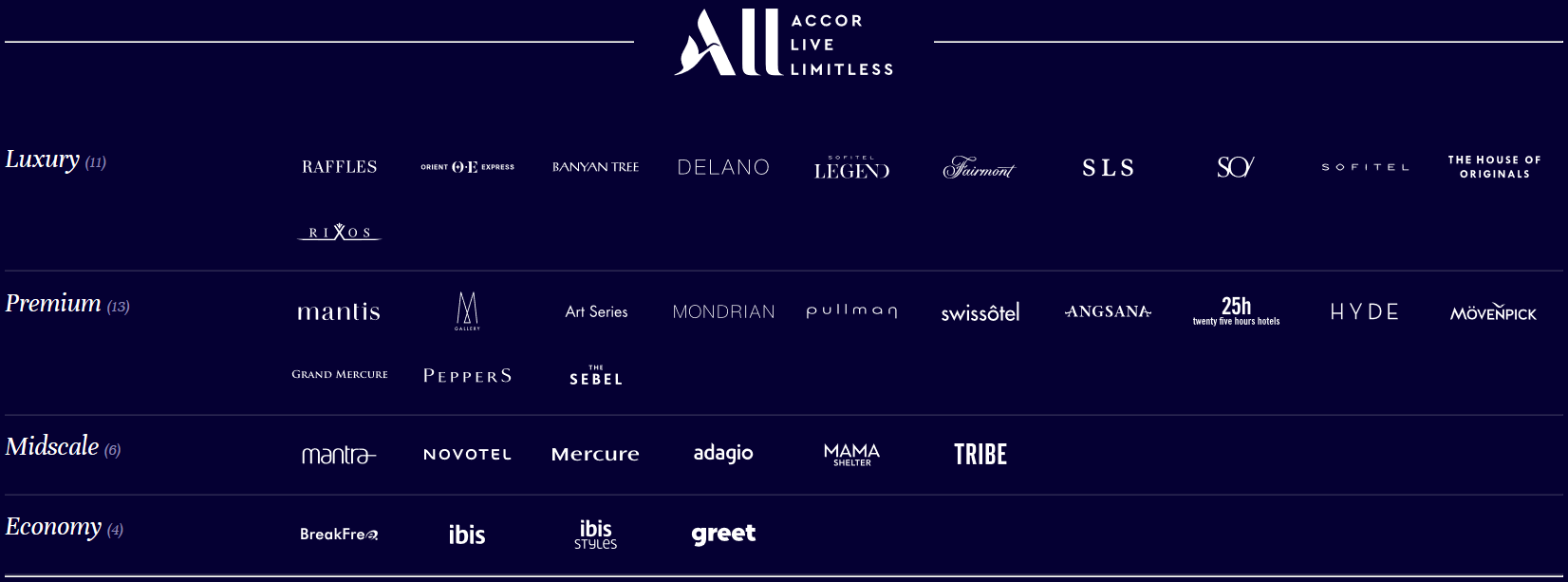

And in this case, the addition of Wyndham and Accor do add some opportunities to get decent value. Greg covered Accor Live Limitless in detail on Friday (See: Accor Live Limitless (ALL) Complete Guide). In short, ALL points are worth about 2.2c each based on the exchange rate at the time of writing. With Capital One miles transferring at 2:1, it means Venture and Spark Miles cardholders are earning an effective 2.2% back towards ALL stays. With ALL including brands like Fairmont and Raffles, that certainly may appeal to some.

I also like that although Capital One has a minimum transfer of 1,000 Capital One miles, you can transfer in increments of 100. That enables you to get closer to exactly what you want/need and leave fewer points orphaned in any particular program.

Sweet spots possible

While Accor has a revenue-based program where you’ll trade points for money off the bill, they also have some unique airline partners. None of them would be a good deal to transfer Capital One –> ALL –> airline on an average day, but if we see a transfer bonus from Capital one in the future and then perhaps a transfer bonus from ALL to an airline program, there could be some opportunities. We’ll have to see how things progress to find any of those opportunities.

We recently reported that a number of Wyndham properties are changing category soon. It certainly is sometimes possible to get good value from Wyndham Rewards. I recently stayed at the Wyndham Magic Village in Orlando, where the rooms are all 3 and 4-bedroom condos.

At the time when I booked, it was 15,000 points per night for either room size, so I was able to score a 4-bedroom unit for what would be the equivalent of 20,000 Capital One “miles”. That’s not an amazing trade, but it would be better than redeeming miles for travel at a value of $0.01 each.

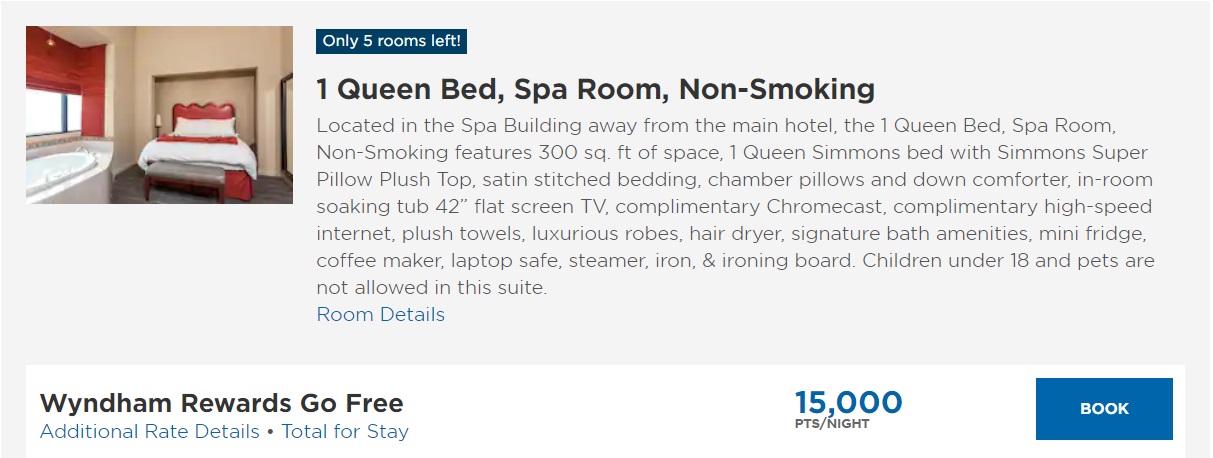

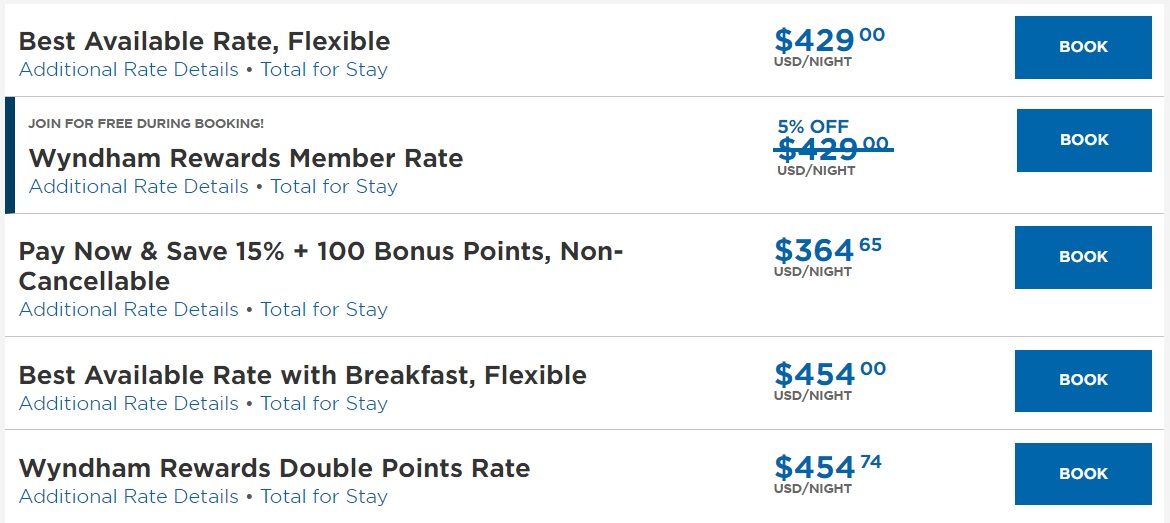

Unfortunately, that property has since gone up in price to 30,000 points per night. Still, Stephen recently pointed out another similarly interesting opportunity at the Sedona Rouge Hotel & Spa, Trademark Collection by Wyndham, demonstrating that if you keep your eye out for opportunities you may find values with Wyndham.

Which beats paying the cash rate:

Which beats paying the cash rate:

Don’t forget Wyndham’s partnership with Caesars

One thing that interests me about this new partnership is Wyndham’s partnership with Caesars Rewards.

Last year, I covered how you could match from a program like Hilton to Wydnham and then from Wyndham to Caesars. Because of differing elite status years, we were then able to match back from Caesars to Wyndham in January and once again match to Caesars Diamond for 2020. See: [Time to hop on board]: From zero to hero on the status-match-go-round. That means I should get another Caesars Diamond celebration dinner (and so will my wife, so we could enjoy a $200 meal) and two free show tickets each month.

Two things excite me about this partnership:

- You could use Wyndham points to stay at Caesars properties

- As a Caesars Diamond member, you can access the Caesars Diamond lounges in Las Vegas for food and drinks, but you need to have 1,000 Caesars points to do so

That second point is why I did not visit a Caesars lounge on my stay last year, but I will definitely look to do so this time around. The minimum number of points to transfer from Wyndham to Caesars is 10,000, so you’ll need to transfer 13,400 Capital One “miles” to have enough Caesars points to visit a lounge 10 times, though anecdotally I think that the lounge attendant may not always deduct the points on a visit. YMMV. I look forward to a chance to check this out.

Transfer ratio to JetBlue improved

Additionally, Capital One is improving the transfer ratio to JetBlue to 2:1.5 starting Tuesday, February 4, 2020. That should also present better-than-floor-redemption value (i.e. better than 1c per Capital One mile) when redeeming for JetBlue award flights. For those who live near an airport served by JetBlue, earning the equivalent of 1.5 JetBlue points per dollar spent could be a solid deal.

Bottom line

Again, I’m glad to see Capital One expanding partnerships. Since they debuted their transfer partners, they have continued to offer good transfer bonuses and add new programs. While neither ALL nor Wyndham Rewards are incredibly exciting to me generally, I certainly am glad to have additional opportunities to get good value out of my Capital One miles. Especially with the recent devaluations on the Alliant Cashback Visa, the Capital One Venture card has been moving to become my regular “everywhere else” credit card. Two new hotel partners make for welcome additions.

Nick, this is a nice option to have to top up Wyndham Rewards balances. However, this program has lost some value since Wyndham Vacation Rental condos are no longer bookable with Wyndham rewards points as of Jan 1 due to the acquisition of WVR by Vacasa. Wyndham Vacation Club condos are still bookable, but availability is more difficult. As always, YMMV.

Nick, status with Accor can be earned with enough points. Can transferred points from Cap1 be used towards acquiring ALL status? Thanks

Isn’t it 10k min. to be able to transfer points from Wyndham to Caesars?

Apparently you are correct. I thought the min was 5K. Turns out it is 5K from Caesars to Wyndham or 10K from Wyndham to Caesars. Updated, thanks.

“In short, points are worth about 2.2c each” I think should instead say 1.1c. It is a dollar of spend, not a point, worth 2.2c.

Edit: Oh, sorry, you meant ALL points! Carry on ….

Thanks for commenting though — I did edit it to make that clearer.