Recently, several readers have asked us about doing a post on which credit cards are in our wallets here at Frequent Miler. Part of my own hesitation in taking up such a post is that the cards in my day-to-day wallet aren’t necessarily a reflection of A) what should be in my wallet, B) what should be in your wallet, or C) my full portfolio of credit cards, which includes many cards that get used in specific ways such that I don’t need to carry them each day. Still, I understand the curiosity, so if you have wondered, ponder no longer: here are the cards in my actual factual carry-around-every-day wallet.

Citi Prestige Card for dining

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: The Prestige card's best in class 5X rewards for dining, airfare, and travel agencies is hard to beat. Sadly, this travel card doesn't provide any travel protections. $495 Annual Fee Earning rate: 5X airfare, dining, and travel agencies ✦ 3X hotels and cruise line ✦ 1X everywhere else Card Info: Mastercard World Elite issued by Citi. This card has no foreign currency conversion fees. Noteworthy perks: $250 travel rebate per calendar year ✦ Free lounge access: Citi Properietary Lounges; and Priority Pass Select with free guests ✦ $100 Global Entry application fee credit ✦ 4th night free hotel benefit See also: Citi ThankYou Rewards Complete Guide |

This one is an easy carry for me: at 5x on dining, this card is always in my wallet to pay for food when I’m out. I love group meals where I can pay and others can Venmo me. While I certainly don’t dine out daily (a “perk” of rural life), dining works out to be my biggest totally organic bonus category spend of the year, so this card always stays in my wallet.

Note that while this card offers 5x on airfare, I do not use it to book airfare ever since Citi removed all the travel protections last September. It’s not worth the small bump in rewards to give up things like trip delay / cancellation insurance, baggage delay insurance, etc. On the other hand, I do sometimes use this at hotels, particularly when I’m staying at a Hyatt, IHG, or anything other than Marriott/Hilton (where I’d rather use the hotel chain credit card for more points).

Chase Ink Plus for gas stations

| Card Name w Details & Review (no offer) |

|---|

$0 introductory annual fee for the first year, then $95 Earning rate: ✦ 5X office supplies, 5X cellular/landline/cable ✦ 2X gas and hotels ✦ 5X Lyft through September 2027 Card Info: Visa Signature Business issued by Chase. This card has no foreign currency conversion fees. Noteworthy perks: ✦ Points worth 25% more when redeemed for travel ✦ Transfer points to airline & hotel partners See also: Chase Ultimate Rewards Complete Guide |

This card is no longer available for new applicants, but its little-brother card, the Chase Ink Cash, offers the same structure with a lower $25K annual cap on 5x categories).

This pick is likely to surprise many readers as it offers a relatively low category bonus of just 2 Ultimate Rewards points per dollar spent at gas stations. That’s nowhere near the best category bonus on gas. I wouldn’t recommend this card as a go-to gas card for most readers. So why don’t I have something better in my wallet? The main reason is that I don’t actually spend that much on gas. My wife and I both work from home. Sure, we live in the middle of nowhere and often drive somewhere on the weekends, but I’d guess that we spend far less on gas than the average American who owns a car.

No matter how much I spend at gas stations you can make the (correct) argument that I’m giving up a greater return by choosing not to earn at least 4% back on this category. But in the overall scheme of things, the actual amount lost in potential rewards has been relatively small. Until recently, I didn’t have a convenient gas station for MS purposes and I’ve been replenishing a supply of Ultimate Rewards points that I depleted pretty heavily in 2018/2019. That said, I do now have a gas station at which I would like to increase credit card spend and as such I need to step my game up here. I’m very tempted to go with the Citi Premier card for gas for as long as the Turkish Miles & Smiles sweet spot exists, but it would likely make more sense to go after the Ducks card.

As a bonus, the Chase Ink Plus stays in my wallet in part because I always want to have it handy should there be an unadvertised Visa or Mastercard gift card deal at an office supply store.

Capital One® Venture® Rewards Credit Card: My “Everywhere else” card

If you told me three or four years ago that the Capital One Venture card would become my go-to “everywhere else” card, I’d have gotten a good laugh out of that joke. I’m as shocked as anyone that Capital One became aggressive in making this card a compelling option. At essentially 1.5 airline miles per dollar spent (with most transfer partners) or a floor-level equivalent of 2% back if you use the rewards to cover travel expenses, this card offers a nice mix of both worlds.

However, if that were the beginning and end of the story, I’d say that the Citi Double Cash might make a lot more sense as an everywhere else card: at what is essentially 2x ThankYou points everywhere (if you move the points to a Premier or Prestige card), the Citi Double Cash offers great earning potential with no annual fee.

The reason Capital One currently gets the spot in my wallet is because I apparently opened an old Venture One card during some limited window of time where the card offered a special gift card redemption that I’ve written about before (See: The best hotel credit card ever): while most gift card redemptions through Capital One offer 1c per Capital One “mile” in value or less, I have the ability to redeem Capital One “miles” at a value of 1.4c each towards $900 gift cards for Marriott/Ritz, Fairmont, or Raffles. I had a moment of panic yesterday when I thought that this function was actually disabled in my account, but it turned out they had just moved it. At any rate, I can move Capital One “miles” from my wife’s Venture card (on which I am an AU) to my Venture One and then redeem 64,250 Capital One “miles” for a $900 Marriott gift card (a value of 1.4c per Capital One “mile”). That means I am essentially earning 2.8% back towards Marriott stays when I use the Venture card as my “everywhere else” card with the intent to make this redemption. That’s solid enough for me to use it that way, especially because there isn’t otherwise a very reasonable way to earn hotel rewards through credit card spend (since the Marriott cards offer relatively poor value for spend) — save for Hyatt of course (via Chase Ultimate Rewards). Hyatt isn’t everywhere I need to be, so the Marriott gift card redemption is very useful for me.

As a backup, I can live with the 1.5x airline miles per dollar spent that I’d get through transfers to most of Capital One’s transfer partners and could hope to take advantage of a transfer bonus that makes the ratio closer to 2 miles per dollar spent.

SoFi Money debit card

I don’t often use cash, but I carry the SoFi Money debit card in case I need it. Since SoFi reimburses ATM fees at the vast majority of ATMs and charges no foreign transaction fees, this is an easy go-to card for withdrawing money worldwide. I used this card recently to withdraw cash at a gas station and had the notification that SoFi had rebated the ATM fee before I walked out the door.

Ironically, even though this account offers a decent APY of 1.6%, I don’t keep much money in it just in case my debit card gets stolen.

With 20% back on Lyft rides until February 19th and the coming benefits when this converts to a Mastercard debit card, I continue to be impressed with SoFi Money and it’ll keep a place in my wallet as long as they maintain the status quo. For more on SoFi Money, see this post: Easy money: SoFi Money & SoFi Investing new account / referral bonuses.

A Simon Visa Gift Card

While not quite always in my wallet, these days I often have a Simon Visa Gift Card in my wallet (and did when I went to write this post, so I included it). That’s because, since Simon is so welcoming of those wishing to increase credit card spend, I’ve been making a couple of trips per month on average to a Simon Mall. I then need to use those gift cards. In my case, I’m often using them to buy money orders. However, living in a small town means I don’t have liquidation options nearby (every couple of weeks I spend a night in a nearby city on a liquidation run). When I’m out and about, I’m always keeping an eye out for new places to try, so I generally keep a Simon card in my wallet “just in case” until I’ve liquidated my current supply.

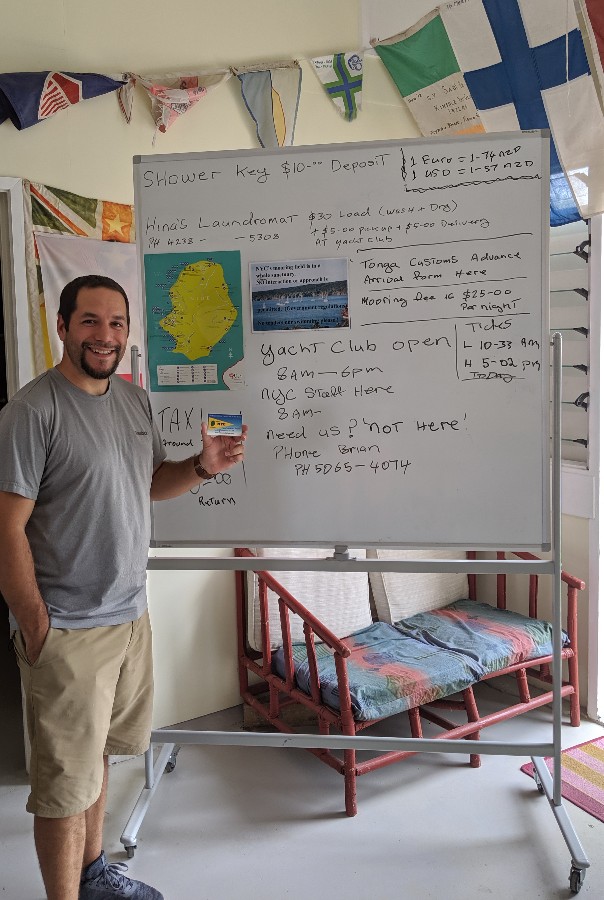

My Niue Yacht Club Membership Card

During the 40K to Far Away challenge last year, I joined the Niue Yacht Club for about twelve bucks. Yeah, I carry the card. It’s kind of fun.

What’s not in my wallet?

There are a lot of cards that aren’t in my wallet but are in my stable. I’m not going to list every card I have here, but there are a couple of key cards missing from the story above that are worth noting:

Amex Gold Card

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: This card offers an awesome return on US supermarket and worldwide dining spend, putting it at or near the top-of-class in both categories. Dining credits and Uber / Uber Eats credits go a long way towards reducing the sting of this card's annual fee. $325 Annual Fee Earning rate: 3X points for flights booked with airlines or on amextravel.com ✦ 4x points at US Supermarkets (up to $25K in purchases, then 1x) ✦ 4x at restaurants worldwide (up to $50k in purchases, then 1x) ✦ 1X points on other purchases. Terms apply. Card Info: Amex Pay Over Time Card issued by Amex. This card has no foreign currency conversion fees. Noteworthy perks: Up to $10 in statement credits monthly with participating dining partners (Goldbelly, Wine.com, Five Guys, Seamless/Grubhub, The Cheesecake Factory) ✦ $10 monthly Uber or Uber Eats credit (use it or lose it each month - must select Amex card as payment method to redeem) ✦ $7 monthly Dunkin' credit - enrollment required ✦ $50 twice-annual Resy credit ✦ $100 hotel credit on qualifying charges on stays of 2 nights or longer, plus a room upgrade upon arrival, if available with The Hotel Collection at americanexpress.com/hc ✦ Enrollment required for select benefits. |

This is my wife’s card and I had kept it on my Samsung watch for US Supermarket spend when I am without her, but I wiped my watch recently and haven’t added this back yet. I need to get this back on my watch as I’ve missed out on some easy points recently. Still, we’ll max out the category bonus spend this year easily.

One of the positive points of living in the middle of nowhere is that we actually spend far less day-to-day than many people: there’s no Starbucks, no drive-through, no tasty little Thai noodle shack for lunch, etc. For years, I thought that made life boring (hence why I became a traveler!). As I get older, I realize that makes life cheap (or cheaper). One way in which life isn’t so cheap: when I don’t plan out a weekend trip to the supermarkets in a larger area, I get stuck running up to the store in my small town a couple of times during the week, where prices could be described as being as competitive as you’d set them if you had no competition within 30 miles. Between all of those trips and the other ways to increase spend at grocery stores, we’ll keep this card for that bonus category alone.

Alliant Cashback Visa

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: Good cash back card for everyday spend as long as you do not spend more than $20K per billing cycle (at which point a 2% card would be better). Lack of foreign transaction fees is a positive. No Annual Fee Earning rate: Tier One Rewards (which now requires $1,000 in an Alliant high-yield checking account and 2 electronic transactions per month) offers 2.5% cash back everywhere on up to $10K per billing cycle, then unlimited 1.5% cash back beyond $10K in purchases in a billing cycle. (Note that some purchases, like those from GiftCards.com, are not eligible for cash back) Base: 2.5% Card Info: Visa Signature issued by Alliant. This card has no foreign currency conversion fees. |

Truthfully, this alternates as an “everywhere else” card, though as I wrote recently, I think this one will be on its way out when renewal comes up at the end of this year thanks to the coming monthly cap on cash back earning and last year’s increase in annual fee.

Citi AT&T Access More

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: Excellent choice for those who shop often online (thanks to 3X earnings) $95 Annual Fee Earning rate: ✦ 3 points per $1 on products and services that are purchased directly from AT&T ✦ 3 points per $1 on all purchases at online retail and travel sites ✦ 1 point per $1 on all other purchases Card Info: Mastercard World Elite issued by Citi. This card has no foreign currency conversion fees. Big spend bonus: 10,000 anniversary bonus points after $10,000 in annual spending See also: Citi ThankYou Rewards Complete Guide |

This card is no longer available for new applicants, but it offers 3x at many online retail & travel merchants. This one is never in my wallet, but it gets monthly use. Each year in which I spend $10K, I also earn 10K bonus points, making this an easy keeper despite its $95 annual fee.

Bottom line

I do not profess that my wallet should be your wallet nor that my wallet is even quite ideal for my spend and redemption style. In fact, I’m always looking to improve upon the mix and I know that my gas station spend needs a better solution sooner rather than later. In part, I’m sharing this post to keep myself accountable: I know that a couple of readers are likely to take me to task about why not this card or that one and there are excellent arguments that I can make for why some other cards may deserve a spot. My choice of the Venture card for an “everywhere else” card is an option that just won’t apply to many readers since most won’t have my unicorn Marriott gift card redemption (though note that if you find someone in your family who does have it, remember that Capital One allows you to transfer points to any other cardholder who has a miles-earning card with no annual caps or stated limitations). Most would be better off with a Double Cash or Blue Business Plus as an “everywhere else” — or better yet the Bank of America Premium Rewards card with Platinum Honors if one can qualify. That last card is likely to push its way into my wallet by this time next year and at that point I’ll have to consider where the Venture card stands.

[…] current wallet to note the fact that every credit card I’m carrying today is different than the cards I had in my wallet six months ago. I caught flack from one reader who suggested that, for most people, the small bump in rewards […]

[…] What’s in Nick’s wallet? […]

Hey Nick, I asked Greg the same, is there any chance you can do a post on what’s in your wifes wallet? I’d love to know your strategies and such for your travels

Those are the only cards that you have accounts with? Not listing any sock drawer or faintly used cards?

Of course not. As I mentioned in the section “What’s not in my wallet?” and in several responses above, I noted that I have a lot of cards that aren’t in my day-to-day wallet. I have a lot more cards than most people will ever need because I blog about them. The purpose of this post was to answer the question, “What cards do you carry in your wallet day to day?”.

[…] write about this topic for a while, but my final motivation was reading 2 Frequent Miler articles: What’s in Nick’s wallet? and What’s in Greg’s wallet? The first thing you should know about me (if you already […]

Great article but more importantly I like the wallet!

Thanks!

[…] in response to reader inquiries, Nick revealed the credit and debit cards he carries in his wallet. Now it’s my turn. But please note that these are not recommendations for what you should […]

I love your wallet. That really is a great gift idea. I am a girl I notice details.

Thank you :-). It was a very meaningful gift.

I have the same granite in my kitchen!

I know some people MS on their cards but just as an example with your “dining” card, Citi Prestige even with a 7.25% rate of return, you have to spend $6,828. to overcome the annual fee on that card. That is a lot and maybe a family with a good income might get there but that is to just break even on the card.

If you spent that amount on something like the Gold card with its $250 AF, and even if I value the points less, at 4X and assume only a 6% return you’d be ahead by $150 or the Green card ($250AF) and its 3X you’d be ahead by $157 due to its lower $150 AF. (I’m only using 1.5 cents per Amex point, maybe a bit low).

You probably MS on it but I think too many people out there obsess over how many points per dollar without calculating the total spend, return on the spend, and the annual fee. Often getting less points with a much lower AF is a better deal for the average person.

On a separate topic, do you do anything special to keep track of all of the Chase and Amex offers for their credit cards? I’m referring to the offers you have to go to their web page and click on and add to your card. There are so many, that I can’t keep them straight so I rarely use them.

Surprised there is no Amex BB+ for 2xMR everywhere and no AF, no Chase Freedom, and no Citi Rewards+ for small purchases and 10% rebate on points redemptions.

Amex Blue Business Plus definitely work great, even better if there is an Amex offer. But I just don’t feel 2 MR pt is comparable to 2.625 cent cashback from BOA travel rewards. If you don’t have preferred reward status, it would be another story.

Chase Freedom never a frequent resident in my wallet. Only when there is a great quarterly bonus, it will stay for one or two days and I spend all $1.5k all at once. Then it goes back to drawer.

Can’t comment Citi Rewards+ as don’t have it. But it sounds like the “tiny wool” that my old Freedom used to offer. Overall, it doesn’t add up that much.

I actually don’t have a Freedom or Citi Rewards+, but if I did neither would be in my day-to-day wallet. It’s not worth adding to my wallet for the tens of points I could earn with the Rewards+. At least in an era where I can stop at a Simon Mall and pick up thousands of points in a few minutes, I’m not concerned with paying for my bananas one at a time right now. It’s just not going to make a significant impact in my rewards balance. On the other hand, it would very much be worth it for the 10% rebate on redemptions if I had a card I wanted to PC to a Rewards+ right now. Unfortunately, I don’t. But it still wouldn’t be in my wallet. Maybe it would be on my watch for very small purchases I guess — though realistically, how often am I spending less than $5 at a place that does not ordinarily earn a category bonus of better than 2x on another card? I suspect not often.

If I had a Freedom, I’d likely max out the 5x category in a day or two and not carry that every day.

In terms of the BBP, I think that’s a definite carry-daily card for most people. In my case, Membership Rewards are not an immediate need. As long as I am able to generate Marriott GCs at what is ~2.8% back, the Venture card stays for me. That would not be the case if I were in need of MR points though as I do value those greater in general. In my case, I’m good on the airline miles I need for the next year or two, but my Marriott point balance has dwindled and the gift card route is appealing.

For this post purpose, I glanced at my own wallet:

1. Amex Cash Preferred (grocery, 6% up to $6k)

2. Costco visa (costco identification card. I rarely charge on it though, maybe gas occasionally, but use GC for gas most of time and GC stays in the glovebox)

3. Chase Ink cash (staples, 5x UR)

4. BOA Travel rewards with Preferred rewards status ( everything else including Costco)

Anything else? DL, some cash bill, some sale receipts that I forgot to throw away.

That’s all. I have a slim leather wallet. Forgot the brand name. But really hate a bumpy wallet.

Good grief. If you keep that many cards in your wallet, I certainly hope it’s a front pocket wallet. Keeping a wallet with that many cards in your hip most certainly will create back problems!

Thanks for the article, though. Very interesting. Can’t wait to see what Greg and Stephen carry!

Is six cards a lot to carry in your wallet?

I haven’t carried my wallet in my back pocket for more than 20 years. I was never comfortable driving with it in my back pocket.

RFID I hope ?

6 plus…. Driver’s license, membership cards, loyalty cards, and all the other “junk” that can’t be loaded onto a mobile wallet….

I just carry 3 daily. Have others I carry if for a specific purpose, but never more than 4 total at any one time. Even when traveling and I may need others I don’t carry them in my wallet.

Slim front pocket wallets are the only way to go for me.

Driver’s license, a health insurance card, a card my wife gave me that has something meaningful on it, and one folded bill (maybe a $20 or maybe a $100) in case of emergency. So you’re right that there’s a bit more in there.

Re: Sofi card – just freeze the card with the app (its what I did while in South Africa). Just unfreeze it to pull cash then refreeze.

If you have Samsung pay you can add your insurance card manual to the membership cards and take picture of front and back and if it has a bar code it can generate that or a QR code.

I keep pic of DL, Car insurance KP and dental insurance and other gift cards that I can’t load to Swych or S-pay the regular way

( I just take a pic of the back with pin and digits. As well as Airline and Hotel loyalty cards/ numbers. Even keep a pic of Passport /passport card (can always import to another Samsung phone – if phone is stolen lost when out of country).

When we travel Intl – I also carry a mugging wallet with dead MCGC/VGC and a few odd loyalty cards and old Costco card and maybe a Malibu racing DL lol.

Also an Moto G5 with Google Fi data sim (wifi hot spot) as my mugging phone (hopefully never need ito give up either- but makes it a no brainier to part with if face with a someone who pulls a weapon).

Added $30 worth of Sam’s Clubs e-GC to Samsung Pay membership ( mainly as way to store and so the e-GC can be scanned in store then just entering pin.

I took advantage of the Sam’s club deal at the end of January – turned around got a referral link – then refereed DW (she had the Amex offer as well – mine has posted still waiting on DWs – Dosh never posted – but did add the card on 1.31.2020 no biggie – so far the referral e-GCs are the only ones to arrive so far -everything else is showing as shipped.

I didn’t even think of freezing and unfreezing. Great idea!

FWIW you can add your SOFI card to Samsung pay. (Might only be valuable for getting cash back at POS in the US).

Wow, that is just short of $1k in annual fees. I realize you may be able to deduct those costs as biz deductions, but still wow! Care to do an accounting of how much you’ve paid in average on annual fees since you started or is that too intrusive?

Good question. It would be a lot in annual fees since I started.

A couple of points relevant here:

1) My most recent Prestige annual fee still charged at the grandfathered $350 rate from opening a checking account back in the day (the rate should have increased, but hasn’t yet). Citi has said that the next AF for those of us in that boat will be the full $495. I’ll re-evaluate if and when I get charged that fee. In the meantime, I book flights for family members who have no cards that offer travel protections and I pay for group meals often enough that the 5x restaurants is valuable enough to me to want to keep the Prestige at this point. I definitely want to be able to transfer to partners, so in my boat it’s either the Prestige or the Premier — up until now, the difference for me has been $255 ($350 – $95). If that goes up another $145, I’ll reconsider because I could alternatively use the Amex Gold for restaurants and the Premier for gas. We’ll see in a few months.

2) The AT&T card offers 10K bonus points when I spend $10K in a calendar year. I’m already using the card for $10K in purchases per year, so the 10K points (more than enough for a domestic one-way ticket within the US, including Alaska and Hawaii, on United using Turkish Miles & Smiles) are worth far more to me than the $95 fee.

3) Alliant card will go at next AF.

4) Venture card: Capital One has been good about waiving the AF at least every other year when we call in to ask. Just like with retention offers, it pays to call and ask.

5) Your point that I pay a lot in annual fees is absolutely accurate and a great point: paying as much in annual fees won’t make sense for everyone. A big piece of the reason that I keep some cards is certainly because know how the cards and benefits work matters for my job here. I am lucky to have a job doing something I enjoy and keeping a number of these credit cards so that I can experiment with them and answer questions about them surely is part of the cost of doing business to to speak. That’s another good reason why I’m not saying that my wallet is the right wallet for everyone. In my case, I also feel that I get more value out of the cards than the money I put into them, but your point is an important reminder that the travel isn’t “free”. I don’t think my card lineup would make the most sense for most people. For most people, I’d recommend this lineup instead I think to achieve similarish results for a lot less:

1) Amex Gold for dining & US Supermarkets ($250 fee at the time of writing)

2) Chase Ink Cash (no AF) for 5x categories and 2x gas and restaurants

3) CSP or Ink Business Preferred ($95) so you can transfer those Ink Cash points to partners

4) Citi Double Cash or Amex Blue Business Plus (no AF) for everywhere else

5) If you choose Doule Cash, you’ll need the Premier to transfer to partners ($95)

To be clear, I’m not saying that is the ideal credit card lineup and I am not at all including welcome bonuses in the equation or using up 5/24 slots — I’m just saying that it provides similar end results in terms of flat number of points earned and gives the the opportunity to diversify your points pool for much less in annual fees.

Going a bit off topic to ask about your experience with Alliant in getting your cash back. I’ve had the card for several months now and just requested the cash via statement credit. I paid my most recent bill in full, less the amount of the rebate. They tell me that’s a no-no but I don’t know what the problem is. I find them to be shady, even with their website which I find a bit challenging for finding answers. Needless to say I won’t be keeping the card long enough to pay an annual fee.

I’ve had no issue redeeming several thousand in cash back. I always redeem cash back for a check rather than statement credit lest the statement credit negate rewards earned on spend (it does with some issuers and not others so I just don’t bother redeeming that way to avoid the issue rather than have to look up who handles it which way).

I’ve seen the note from issuers before saying that redeeming for a statement credit won’t count towards your minimum payment due, so that’s not a uniquely Alliant thing.

Why do you find them “shady”? They have a pretty crummy website, but I find that to be a common issue with any smaller financial institution. I’m not happy with their changes to the card, but folks I know you have used Alliant as their primary bank for years have had good things to say. My main complaint is that payments are slow to post (which, again, tends to be an issue with smaller financial institutions). While the website isn’t intuitive, I didn’t find it too tough to request checks for the cash back and they’ve been issued promptly. Like I said, I’m not very enthusiastic about the card anymore, but I’ve had no issues with Alliant.

Thanks very much for the detailed response. It must be the “quirky” website that makes it seem like they want you kept in the dark, so I appreciate your comments about it.

Hey Nick, thanks for the article. I wonder when Greg will post what’s in his wallet? Please give him a nudge for me…

It’s interesting that you rather use your Citi Prestige to pay for your Hyatt stays. Aren’t you better off getting the Chase WoH card for Hyatt spend? I think that might be a better idea.

Am I reading this correctly? You rather use a Marriott card for your Marriott spend? It seems like the consensus else where is to use a card like CSR or Citi Prestige/Premier for Marriott spend given the low value of Marriott points. I would love to hear you explain in details why you rather use a Marriott card for Marriott spend.

Yes, if I had the WoH card I’d use it to pay for Hyatt stays since I’d be putting at least $15K per year on it (and likely more since I’d probably spend toward Hyatt status).

In a world where I wouldn’t otherwise spend on the Hyatt credit card, I’d honestly be split in terms of whether to use the Hyatt card for 4x Hyatt or the Prestige for 3x TY. I really like the Turkish sweet spot. $2500 in Hyatt spend could give me enough for a one-way domestic ticket with Turkish (if I use the Prestige card) vs 10K Hyatt points by using the WoH CC. That’s a tight race. I certainly wouldn’t fault anyone for taking the Hyatt points in that situation. On the other hand, I can earn Hyatt points at a good clip at office supply stores, so I’m less concerned with picking them up on the few paid stays I make each year.

In terms of using the Marriott card for Marriott spend vs the CSR or Prestige/Premier: it depends on how you value Marriott points. I consistently get 1c per point in value or more. The past two weekends, I’ve spent nights at a Cat 1 off-peak Marriott where the cash rate was just over $100/nt, but I paid 5K Marriott points. I’d personally collect 6x Marriott over 3x UR or TY in part because I’m lighter on Marriott points than I’d like to be and partly because I keep finding good uses for them. That said, I wouldn’t disagree with someone choosing to take 3x URs or 3x TY points instead. Those points can certainly be more valuable than 2c each toward many redemptions.

It’s funny that in less than 24 hours after you post this, Marriott devalues their program again. Would you agree that their points have even less value now? I’m so disappointed in Marriott’s constant devaluations. I’m sort of glad that I no longer put my Marriott spend on their cards. I think I’m better off with UR/TY/MR going forward.