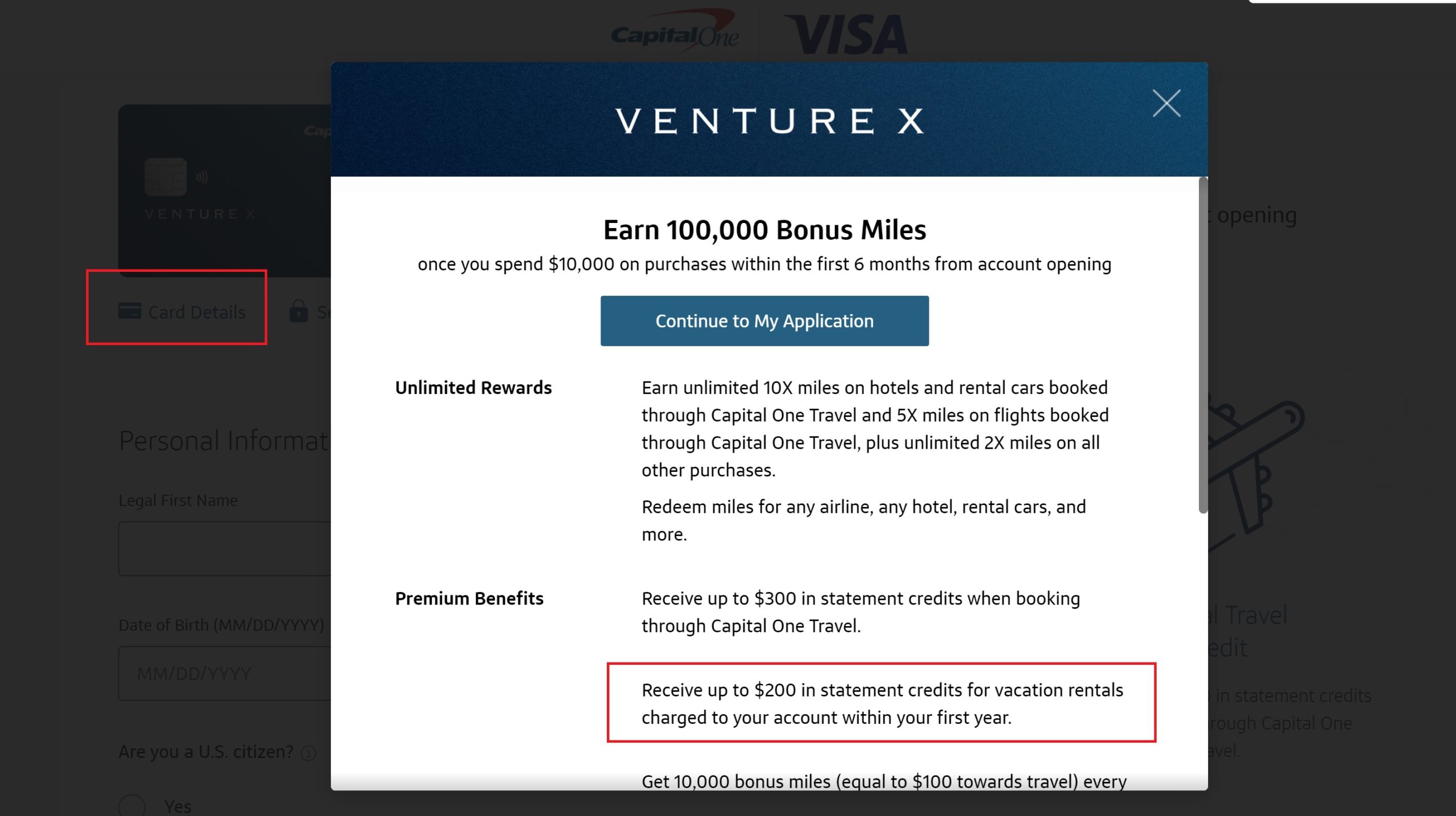

Update: A couple of eagle-eyed readers in the comments have noticed that I was incorrect and the referral offer does include the $200 vacation rental portion of the welcome bonus. While the $200 credit isn’t reflected on the referral landing page or the Rates & Fees section, nor in the “Important Disclosures” section on the application page, there is a link for “Card Details” on the actual application page (as shown in the screen shot below) that does indeed list the $200 vacation rental credit. That’s great news. The original post follows below the screen shot.

A reader noticed something today that I hadn’t about the Capital One Venture X refer-a-friend offer: the friend referral offer doesn’t appear to include the $200 vacation rental credit(Update: the vacation rental credit is included as shown above). That may not matter if you are referring a second player in your household as the referral bonus you’ll get is worth more, but if you’re referring friends outside of your household they would not be getting the best possible deal.

The Capital One Venture X public offer that we have written about include the following:

| Card Offer and Details |

|---|

75K Miles ⓘ Affiliate 75k miles after $4k spend within first 3 months. (Rates & Fees)$395 Annual Fee Recent better offer: Expired 3/14/22: 100K after $10K spend in 6 months + $200 credit for vacation rental spend in first year FM Mini Review: This card offers annual rebates that easily mitigate the fee for those who travel often. Authorized users are free and also get access to perks like Priority Pass, Capital One Lounges, Plaza Premium lounges, and more. The card earns 2 "miles" per dollar on most purchases just like the Capital One Venture Rewards card, which are worth exactly 1 cent each toward travel. This makes the return on most spend similar to a 2% cash back card (though in this case you must redeem your miles to offset travel in order to get 1 cent per mile). One huge advantage over cash back: Capital One allows transfering their "miles" to airline miles & hotel points. Click here for our complete card review Earning rate: 10X miles on hotels and rental cars booked via Capital One Travel ✦ 5x miles on flights booked via Capital One travel. ✦ 2X miles everywhere else. Card Info: Visa Infinite issued by CapOne. This card has no foreign currency conversion fees. Noteworthy perks: $300 annual credit for bookings made through Capital One Travel ✦ 10,000 bonus miles each year starting at first anniversary ✦ Up to $100 application fee credit for Global Entry or TSA PreCheck® ✦ Capital One Lounge access ✦ Priority Pass membership w/ unlimited guests (lounges only) ✦ Plaza Premium lounge access ✦ Cell phone insurance ✦ Trip insurance ✦ Primary CDW coverage ✦ Redeem miles for travel at value of 1 cent per mile ✦ Convert "miles" to airline miles & hotel points |

Venture X cardholders can refer friends for a similar offer, but the $200 statement credit for vacation rentals is not mentioned in the referral offer.

While I wouldn’t have expected the referral offer to be different, it highlights something interesting about the current offer Capital One has on their site and we have on our Best Offers page: a number of people have noticed that the way Capital One has worded the current (non-referral) offer makes it sound like only the $200 statement credit for vacation rentals is a limited-time part of the bonus. On the positive side, the fact that the referral offer omits that credit seems like a sign that the 100K offer may be around to stay (since the referral offer is only missing the “limited-time” part of the welcome bonus). We don’t know that for sure, and 100K seems incredibly generous for a “normal” offer, but it gives me hope.

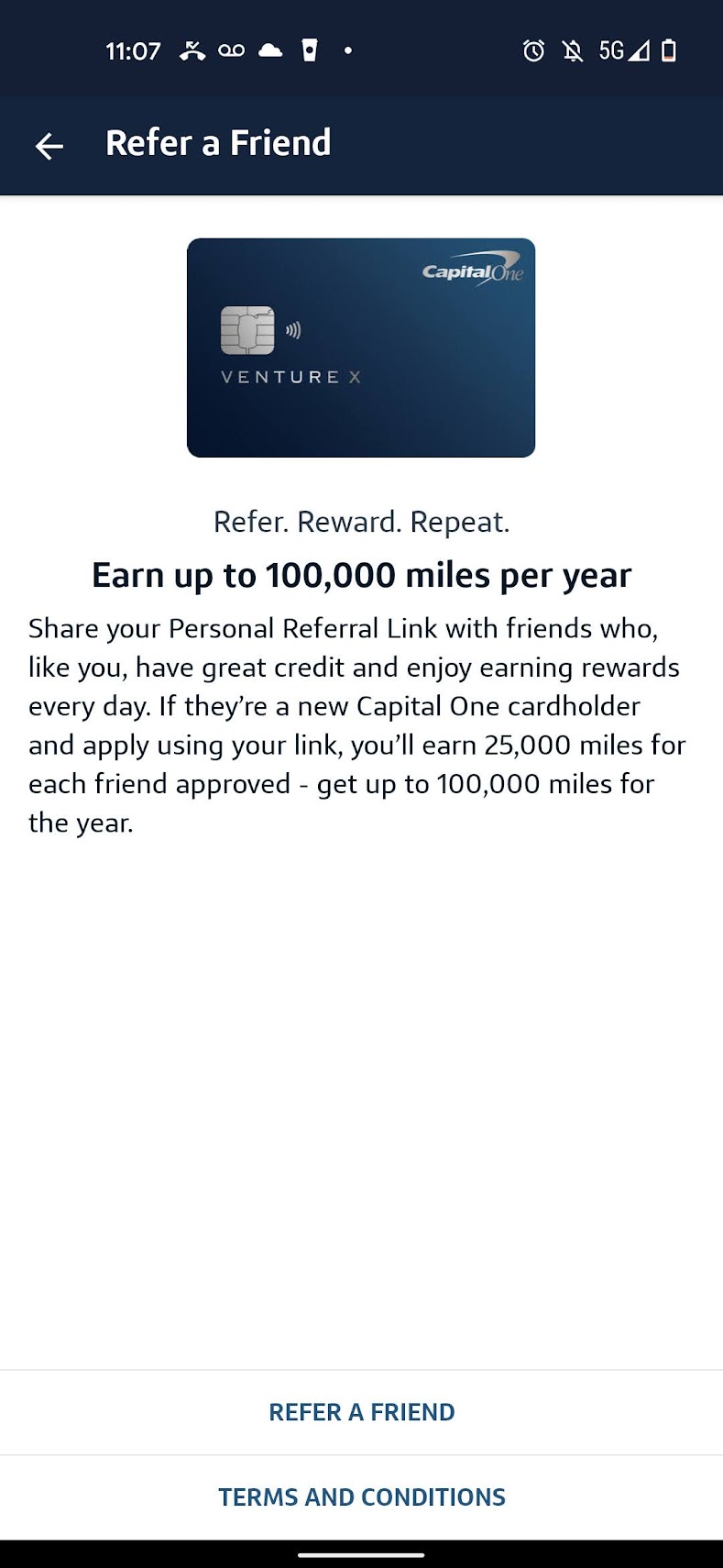

If you are referring an immediate family member, you probably won’t mind that the statement credit is missing from the refer-a-friend offer. That’s because Capital One gives Venture X cardholders 25,000 miles for each person they refer to the Venture X card up to 100K miles per year.

This makes referring a second household player a great deal since it means a net gain of 25,000 miles. Those 25,000 miles could be used to reimburse $250 worth of travel (perhaps a vacation rental?) for Player 1 or could be transferred to partners for far more value. If my wife were referring me, I’d definitely have her take the referral offer. If we really wanted to book a vacation rental out of my account for some reason, she could always transfer the miles over to me since Capital One allows you to move miles to other miles cardholders.

However, a friend reached out to me just a little while ago and asked if I had a referral link. I told him that I do but that it’s a better deal for him if he applies directly through Capital One, whether through our link or someone else’s so that he gets his $200 vacation rental credit.

Do note that if the person you refer has any other Capital One credit cards, you will not receive the referral bonus. You only get the referral bonus if the customer you refer is not a Capital One cardholder.

Even for those who will be happy to trade the $200 vacation rental credit for 25K miles, I figured it was worth posting this as I know there are many newly-minted Venture X cardholders out there who are probably eyeing the chance to pick up a bunch of miles but may have missed what’s missing.

I am an AU on P2’s old Capital One card, but I’ve never had a Cap One card personally. If a different person refers me to the Venture X, would they get the referral bonus? Or does Cap One view me as an existing cardholder?

I am also wondering!

Ideas on what else triggers the vacation rental credit besides an actual vacation rental?

Do u get referall bonus if friend has a CapitalOne DEBIT card?

If I have a Capital One Venture, can I use a referral from that card to get my husband a Capital X?

I noticed on the referral page that it says you earn 25k points per friend referred up to 100k per year but when I click on the t&c, it says maximum 50k per year. Hmm.

Has anyone tried to use the $200 credit? How does it work? I can’t find any info on CapOne site. do you just use the card and hope it credits?

I used it by booking a stay with AirBnb and 3 days later I received my credit. It says on the small print the following:

Eligible Venture X accountholders will receive a statement credit for up to $200 for qualifying vacation rental purchases. Purchases must be charged to your account and appear in your account statement within your first year as a cardholder to qualify. The $200 statement credit will be provided as a single credit if the purchase is greater than or equal to $200, or in multiple statement credits until the total vacation rental purchases are greater than or equal to $200. If the credited vacation rental purchase is canceled, the statement credit may be removed from your account, though it can be reissued on any past or future vacation rental purchases up to $200. The credit should appear in your account within 1-7 business days, but it may take up to 2 billing cycles after purchase. Your Venture X card account must be open and in good standing at the time of statement credit fulfillment. Capital One uses merchant category codes to determine if a purchase is a qualifying vacation rental. This means that sometimes a purchase may not earn this statement credit. For example, some vacation rental agencies may use a “hotel” code rather than a “rental” code. Capital One is not responsible for merchant category codes used by merchants. Eligible vacation rental merchants include Airbnb, Turnkey, Vacasa, and VRBO.

weird question: i applied without lifting my credit freeze (i somehow do this all the time) so they declined. i lifted the freeze and they declined again but no credit pull so that might duplicate application issue. does anyone know how soon can i reapply?

I have an old Neiman Marcus store card that got acquired by cap one. It shows up in my cap one account. Will that prevent the person referring me from getting the 25k referral bonus?

I’m not positive. I would think it shoudn’t, but I don’t know of many data points on that type of situation.

Usually Capital One referrals post very quickly, just like points from purchases (2-3 days after approval), so if you try it you should know within a week whether or not the person referring you got the bonus (maybe I’d give it up to a week before declaring failure). If you do try, please let us know whether or not your friend got the bonus.

@Nick Reyes The way this referral system works is ridiculous. I mean you don’t get the 25k points if the refered person already has ANY Cap1 card??? Wtf? No other issuer works like that. Maybe institute a warning in the referral section on your review of the VX?

I had that info in yesterday’s post titled “Everything you want to know about Capital One and the Venture X card”.

Because it’s such a rare / quirky thing, I forgot all about it until I went to generate a referral link the other day. Then I remembered that my wife had referred someone for the Spark Cash earlier this year and never got referral credit because of that (the person she referred already had a Spark Miles card).

Nothing like AMEX saying can’t can’t have a certain Marriott card because you had a Chase Marriott card.

It’s their bank and they can say what they like. At least we know now, not a few months later when you don’t get the bonus because the bank didn’t like what you bought.

I think that’s a Marriott thing my guy. It’s my understanding that the cobrand may pay for a portion of the SUB in exchange for a potentially larger share of the revenue split from the interchange.

its not in terms but there is an image on 2nd page (on the employment page). i took a screenshot.

Correct, it appears when you go to the application page where it lists the sign-up bonus.

Thank you both! Updated and corrected.

I can’t tell you how glad I am that the creepy “Presented By Capital One” and the accompanying wallpaper isn’t present on your site. Please tell me that you’re maintaining your journalistic impartiality by not doing that. I like respecting you guys and never having to second guess what you post.

I didn’t even know what you were talking about until just now. I had a good laugh when I saw it in a couple of other places. I have no idea what’s up with that. I don’t deal with affiliate stuff like that, so if that was offered I wouldn’t know.

Glad to hear it. Many thanks.

Classy move and just reinforces why FM is always a cut above the rest of the travel blogs out there!