NOTICE: This post references card features that have changed, expired, or are not currently available

UPDATE 9/23/19: I’ve confirmed that points from Double Cash are transferable to airlines when paired with Premier or Prestige!

UPDATE 9/22/19: 1 to 1 transfers are real! At the time of this writing, the Citi website shows the ability to convert to points at a rate of 100 pennies ($1) to 100 ThankYou points. This seems to have gone live a day earlier than intended and so, clicking on “Convert to Points” returns an error, but it’s good proof that this is real! Anyway, until it works we still won’t know for sure whether these points are transferable to airline programs when points are pooled or moved to an account with a Citi Premier or Prestige card. I’m confident that they will be transferable, but time will (very soon) tell. Hat tip to Doctor of Credit for showing that this was live.

This has been a whirlwind year for Citi credit cards. In January, the Citi Prestige card became the card in my wallet for all restaurant and airfare spend when they introduced new 5X awards in those categories (see: Prestige rocks my wallet for 2019). The main downsides were that Citi increased the card’s annual fee and nerfed the Prestige card’s 4th Night Free benefit. But, for me, 5X for dining (which I do a lot of!) was a net win.

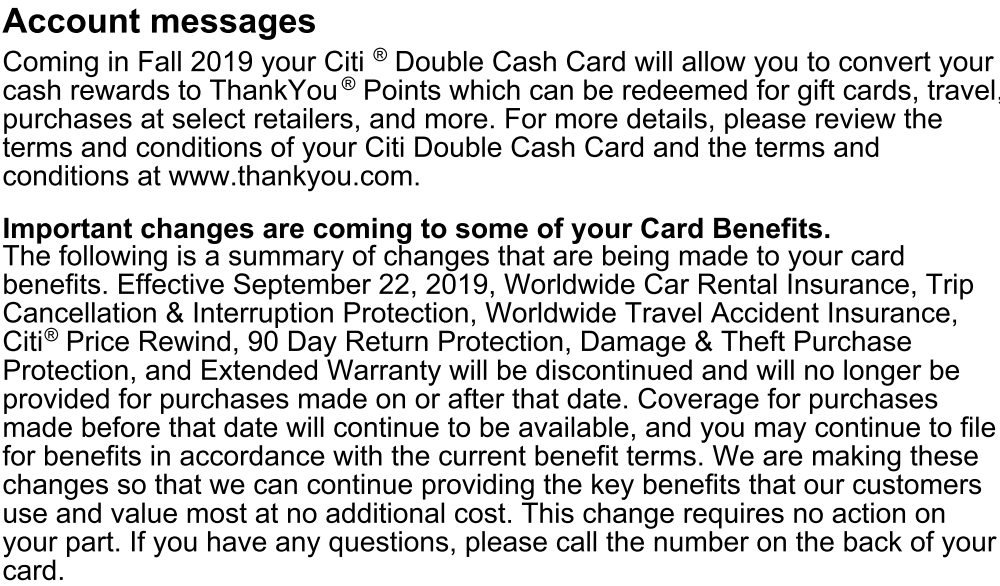

Then, Citi took away any good will we had by announcing the elimination of almost all purchase protections and travel protections as of September 22 2019 (Don’t worry if you’re a Costco Anywhere Visa fan, they didn’t cut benefits to that card).

I was stunned by this news. Previously, the Citi Prestige card had one of the best sets of travel protections among all ultra-premium rewards cards (see: Ultra-Premium Credit Card Travel Insurance). Now, unless something changes by September 22, it will be hard to recommend either the Prestige or the Premier card for travel purchases.

And now we’ve learned that Citi Double Cash rewards will soon be convertible to ThankYou Points. The announcements regarding both the ability to convert points and the loss of card benefits were in cardholders’ July Double Cash statements (hat tip to Doctor of Credit for pointing out the point conversion announcement). For example, here’s an image clipped from my July statement:

A few days ago, a Reddit user was reportedly told by a Citi rep that the ability to convert points would begin Sep 21 and that the conversion ratio would be 1 to 1. If true, this is huge news!

If this plays out as expected, the Citi Double Cash card will be the only card on the market that earns uncapped 2X rewards which are convertible 1 to 1 to airline miles. Here are the closest competitors:

- Amex Blue Business Plus: Earn 2X Membership Rewards for all spend, up to $50K per year. Points are transferable 1 to 1 to many airline programs. This is definitely the closest competitor the the Double Cash.

- Capital One® Venture® Rewards Credit Card: Earn 2X “miles” for all spend, uncapped. Unfortunately, Capital One “miles” transfer to airline miles at less than a one to one ratio (usually 2 to 1.5).

- Chase Freedom Unlimited or Ink Business Unlimited: Earn 1.5X Ultimate Rewards points for all spend, uncapped. Move points to a premium or ultra-premium card so that points may transfer 1 to 1 to a number of airline and hotel programs.

Filling a hole in the ThankYou ecosystem

All of the other transferable points programs offer a way to earn better than 1 mile per dollar for all spend. For example, with Chase, you can earn 1.5X on all spend with the Freedom Unlimited card and then move those points to the Sapphire Preferred (for example) in order to transfer to airline miles. With Amex, you can earn 2X everywhere, up to $50K per year with the Blue Business Plus. With Capital One, the Venture card earns 2X “miles” everywhere which translates (usually) to 1.5 airline miles for all spend.

Up until now, Citi has been missing a good “everywhere else” ThankYou Rewards card. In fact, in the post “Super credit card combos,” I suggested supplementing earning ThankYou rewards with cash back via the Double Cash card. If things turn out as expected, that was even better advice than I had thought at the time since the Double Cash rewards won’t be limited just to cash back but will be transferable to ThankYou points and then to airline miles as well.

Purchasing Travel: 2.5% back everywhere (with a big caveat)

The ThankYou Premier card lets you redeem points for 1.25 cents each towards travel booked through the Citi ThankYou portal. Assuming we can pool Double Cash rewards converted to ThankYou points with our Premier card points, we can then get that same 1.25 cents value on points earned at that 2X everywhere rate. In other words, you can get 2.5% value on all spend. That slightly beats out the Chase Freedom / Chase Sapphire Reserve combo which results in 2.25% value on all spend.

One big caveat: prices for hotels, cars, etc. are often more expensive when booked through the ThankYou portal than when booked through other means. This can completely wipe out the advantage of getting 1.25 cents per point value. Airfare is usually (but not always) priced competitively, but hotel prices are usually awful. See: How bad are Citi ThankYou hotel prices?

Keeping Chase in the mix

If Citi doesn’t replace their travel and purchase protections, then it would be very hard to recommend using a Citibank card to purchase travel or important items. I’d recommend continuing to use the Prestige card to earn 5X for dining, but not for airfare. And I’d recommend continuing to use the Premier card to earn 3X at gas stations, but not for travel. And I’d recommend using the Double Cash for most spend outside of bonus categories, but not when buying electronics or other items that may benefit from purchase protections such as an extended warranty or damage/loss protection.

Here’s where things would get really silly: Let’s say you want to transfer Citi ThankYou points to airline miles to book a trip. In that case, I would recommend paying the award taxes with a Chase travel card such as the Sapphire Reserve. Chase offers travel protections even when you pay only part of the airfare with your Chase card. As a result, paying the award fees with your Chase card should protect you. It’s absurd to imagine that Citi would want Citi ThankYou Rewards fans to use Chase cards to book travel, but that’s what I’m going to recommend if they don’t replace their travel protection benefits.

And now we wait

September 21 is the date when the Citi Double Cash card will supposedly get the ability to transfer cash rewards one to one to ThankYou Rewards. And September 22 is the date when all Citi cards except the Costco card lose their travel and purchase protections (see this post for details).

Will Citi replace the travel and purchase protections with new equivalents? Will the Double Cash card really offer 1 to 1 conversions to ThankYou points? If both happen, then Citi will suddenly have a rewards program that in some ways will be second to none. If neither happens, then ThankYou rewards will likely fade into a niche program who’s only real benefit is the ability to transfer points to Turkish Miles & Smiles (see why that matters here). If the Double Cash thing happens, but travel & purchase protections don’t return, then we’ll be in an interesting middle ground where ThankYou points will be super easy to earn through spend, but we’ll want to keep around other cards for certain types of purchases.

I’m excited to see how this plays out. The ability to convert points from the Double Cash card to ThankYou points might be just one of many new benefits that Citi is getting ready to roll out. That’s what the optimist in me thinks is going to happen. If I’m right, this will be a fun ride!

For good or bad, Citi will rock our wallets. In which direction will it go? What do you think?

[…] Shortly after dropping purchase protections in September 2019, Citi added the ability to transfer cash back to ThankYou points. Combined with certain other Citi cards, this made the Double Cash’s rewards more flexible […]

I currently have both the Prestige and the Premier. I have had the Prestige for several years and the Premier for about a year. I got the Premier with intentions of downgrading the Prestige, due to last years devaluations, then they increased the bonus categories, and my plan shifted to downgrading the Premier once it was a year old. Now with the latest devaluations, I am going to downgrade the Prestige to the Double Cash assuming they will let me. I have the my Premier and Prestige points pooled, is that going to be an issue when I call to downgrade? Will I still have to use the points earned with the Prestige within 60 days?

Do you need a premier in order to utilize the points? I want to PC my premier to this card if so.

Yes you need either the Premier or Prestige card for it to make sense to convert the cash back to ThankYou points

[…] that the Citi Double Cash card doubles as a 2X everywhere ThankYou Rewards card (see what I did there?) and the Rewards+ card rebates award redemptions, I realized that it was […]

Wow. I may shift some spend to DC simply to get my TYP balance up to about 500K from the 200K it is now.

[…] Citi is poised to rock our wallets again […]

I wonder if they will ever try to match Freedom by making the dividend card’s cash back transferable to miles. That would really be nice, especially because you can earn the whole $300 in cash back in any quarter you want.

Do you have to have TYP earning card to use this?

Yes.

Thanks I figured!

So Costco keeps ALL protections the other cards lost? Should we use this card then for other purchase and travel taxes/fees?

I have the same question regarding their protections benefits as well because if that’s the case, that’s the card I will be putting a significant amount of purchases on moving forward.

Hasn’t almost everyone been given bad information by a customer rep at some point? They want to answer your questions and will just choose a logical one if they’re not sure.

Of course 1:1 would be great, but it could even be 0.8 points. At that rate 2 “cents” of double cash would become 1.6 TYP which redeems at 2% off the travel portal.

A new citi quadrafecta vs quintafecta if you are keeping the prestige.

1. Citi double cash 2xty points anywhere

2. Citi thankyou rewards plus for 10% rebate of points and using on charges under say $4 for the rounding up to 10 points minimum.

3. Citi att access and more for 3x ty points online (if you have a grandfathered card) $95 annual fee but 10,000 ty points per year if over $10,000 spend. Also seemingly annual widespread extremely generous retention offers that allow 2 additional bonus ty points on up to $17,500 more spend over 6 months.

4. Citi premier to unlock transfers and 3x ty points for gas stations, broad definition travel/parking $95 fee…

This seems like the sweet spot for most people to me, but some may benefit from the citi prestige, especially if you are citigold for the $350 annual fee reduced rate.

5. Citi prestige, nerfed but still potentially useful 4th night free 2x per year, and 5x dining and airfare.

You forgot Rewards+ for 10% points back, and Sears card. That would be septifecta.

Rewards+ was listed as 2

I’ve been wondering for a while why Amex hasn’t offered a personal 2x everywhere card similar to the BB+. The loss of SPG has surely seen large drop for everyday spend for Amex. Hopefully Citi does offer 1:1 conversions and it will pressure everyone else to follow.

Greg,

Y isn’t the Capital One Business Travel Rewards x 2 per $ spend mentioned for comparison

I suppose because it’s the same comparison as the Venture card. You’re right that it’s another equal option to consider. Off the top of my head, I can’t think of any reason to choose one over the other except for the fact that the Venture’s welcome offer currently requires less spend.

I don’t get how they could offer 2X (convert at $0.01/TYP) on everything with the Double Cash while still expecting people to use the Rewards+ for any purchase that is profitable to them (i.e. where roundup doesn’t cost them more than the interchange fee).

The 10% rebate, ability to book at 1cpp* on the portal, and ability to transfer to jetBlue at 0.8cpp* apply whether or not you use the card. So a perfectly good addition to the sock drawer.

*assuming no Premier/Prestige. Having either eliminates these benefits, but the 10% rebate with no annual fee is still a good reason to have – and not use – the Rewards+.

Aren’t there different types of ThankYou points? For example, I have a checking account that earns ThankYou points but I cannot transfer to airlines (and I don’t have any Citi credit cards at all). I can only buy gift cards with it to redeem the points. I want to know if this Citi Double cash card would require other premium cards to convert into airline miles. And will the thank you points from my checking account can then also be transferred to airlines.

Yes, you need either premier or prestige credit card to transfer citi thank you points into airline miles. I do not think the points you get from your checking account can be transferred into airline miles. Even though they are thank you points, only the points earned from a credit card can be transferred into airline miles.

For more information, please check the post “Citi ThankYou Rewards. Deep Dive.” on this site.

You’re correct that there are different “types” of ThankYou points and the ones earned from your checking account can not be transferred to airlines.

I think it’s safe to assume that points earned from the Citi Double Cash card will be similar to those earned from other credit cards in that it will be possible to transfer them to airline miles. That said, I expect you will need to pool the points with those earned on a Citi Prestige or Premier in order to be able to transfer (similar to how you must combine points from a Freedom / Freedom Unlimited with those from a Sapphire Preferred / Reserve / etc in order to transfer to partners). So yes, I think it will require you to have a Prestige or Premier (or perhaps to transfer the points to someone else who does). We obviously don’t know for sure how this will work yet, but that’s my best guess.

I don’t expect that this would have any effect on the Thank You points earned from your checking account. I expect those points will continue to have the same limitations.