Since the demise of the (greatly missed) Prestige card, Citibank has remained curiously absent from the bougie world of ultra-premium travel cards. Once it leaked that the bank had trademarked the name “Strata Elite,” years of false starts, rumors, and speculation followed, while points and miles collectors not-so-patiently waited for the moment that the new ThankYou Points superhero would finally be unmasked.

Last month, it finally happened. But was it worth the wait?

Citi Strata Elite Current Welcome Offer

| Card Offer |

|---|

ⓘ $1274 1st Yr Value Estimate$200 Blacklane credit valued at $80, $200 "Splurge" credit valued at $160, $300 hotel credit via Citi Travel valued at $180 Click to learn about first year value estimates 100K Points 100,000 points after $6,000 spend in the first 3 months.$595 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: Excellent portfolio of transfer partners, but mediocre bonus categories and a so-so group of credits. Recommend pairing this with Citi Premier and/or Double Cash. Click here for our complete card review |

Citi Strata Elite Review

First off, with $500-700 of calendar-based credits that can be double-dipped during the first cardmember year and an excellent welcome offer, the Strata Elite is just short of a first-year no-brainer. But after that?

With the addition of American AAdvantage, ThankYou Points now rivals both Amex Membership Rewards and Chase Ultimate Rewards in terms of its transfer partner portfolio. The $595 Strata Elite card offers a fairly easy-to-use $300 hotel credit and $200 “Splurge” credit that can be used at places like Best Buy, Live Nation, and American Airlines. It has the requisite Priority Pass membership, Global Entry credit, and earns 1.5x everywhere with no foreign transaction fees, something that neither Chase nor Amex can replicate.

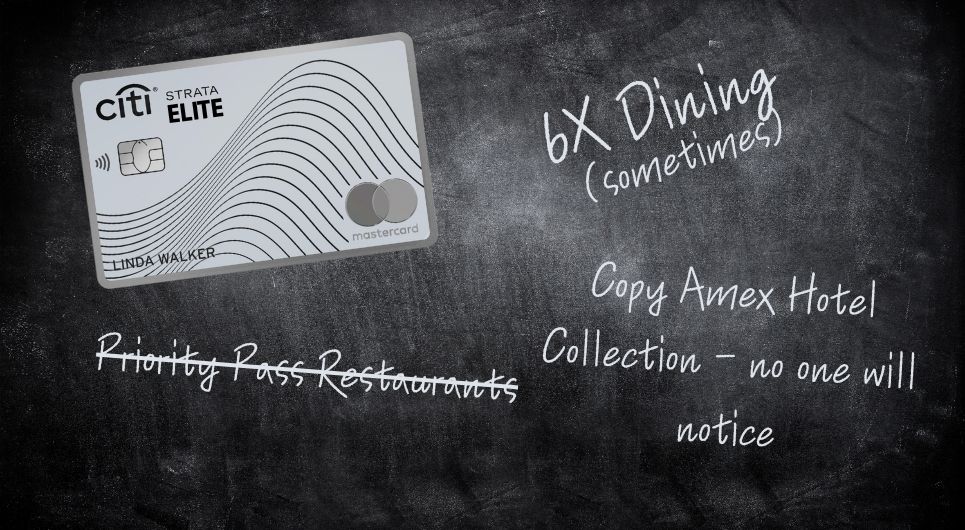

However, the bonus categories are few and far between. It’s a “travel card,” but if you don’t book through Citi’s portal, you’re earning 1.5x and your travel protections lag behind what’s offered through other ultra-premium products. The 6x dining category is just short of absurd, as it only works on Friday and Saturday nights from 6 pm-6 am EST…and doesn’t everyone worldwide want to keep track of Eastern time when they’re going out for dinner?

If you combine this card with the Citi Strata, Double Cash, and Custom Cash, you’ll have an excellent quartet of bonus categories and everywhere rewards, even when outside the US. But outside of that 1.5x earning when traveling abroad, it’s hard for me to see the rationale for most folks to make this the cornerstone of their Citi wallet instead of the $95 Citi Strata Premier.

- Annual Fee: $595

- Authorized User Annual Fee: $75

- Foreign Transaction Fee: None

- What points are worth: The Citi Strata Elite card earns Citi ThankYou Points. Our current Reasonable Redemption Values peg them at 1.5 cents each.

- Best Use for Points: ThankYou Points (TYP) can be transferred to most travel partners at a 1:1 ratio, and this will usually yield the most value. TYP has one of the better mixes of hotel partners of any of the major transferable currencies: Accor, Wyndham, Leading Hotels of the World, Preferred Hotels, and Choice Privileges. Airline partners also offer excellent options, including American Airlines, Avianca LifeMiles, Air France/KLM Flying Blue, British Airways Avios, and Eva Air. Citi is the only program that transfers 1-1 to Eva Air, and it can be a great choice between the US and Asia. Cardholders can also use points for statement credit at a rate of 1 cent per point.

- Earning Categories:

- 12x Hotels, car rentals, and attractions booked through Citi Travel℠

- 6x Air Travel booked through Citi Travel℠

- 6x Restaurants between 6 pm and 6 am EST Friday and Saturday nights

- 3x Restaurants all other times

- 1.5x Everywhere else

- Travel Perks:

- Priority Pass Select membership with two free guests (no restaurants)

- 4 American Airlines Admirals Club passes per calendar year (each one good for one adult and up to three children)

- Credits:

- $300 Hotel Credit (one per calendar year): Only valid on hotel stays of two nights or more. Must book through Citi Travel℠.

- $200 Splurge Credit (one per calendar year): Up to $200 in statement credits on your choice of up to 2 of: 1stDibs, American Airlines, Best Buy®, Future Personal Training, or Live Nation.

- $200 ($100 Jan-June and $100 July-Dec) in private chauffeur credit with Blacklane.

- $120 Global Entry® or TSA PreCheck® application fee credit (once per four years).

- Travel Protections:

- Trip Delay Protection: Round-trip travel only, must pay full cost of transportation with card, $500 max/trip, 2 claims per account per 12 consecutive months.

- Trip Cancellation and Interruption Protection: Round-trip travel only, must pay full cost of transportation with card, $5K max/trip and $10K/account per 12 consecutive months

- Lost or Damaged Luggage Protection: Must pay in full with card and/or with points associated with card, $5K max/trip ($2K for New York residents)

- Car Rental Insurance: Coverage is secondary within the country of residence and primary outside of that country. Covers rental car only.

- Purchase Protections:

- Damage and Theft Protection: 120 days against damage or theft up to $10,000 per claim/$50,000 per calendar year.

- Extended Warranty: Citi extends coverage by 24 months on items with a manufacturer’s warranty of 24 months or less. $10K/item. This is the best extended warranty coverage of any issuer.

- Who’s this card for? Anyone for the first year, where it’s possible to double-dip the credits. After that, folks who can utilize the excellent rates for booking travel through Citi’s portal and who eat out A LOT on weekend nights.

- Is the Citi Strata Elite a keeper? If you book a lot of travel through online travel agencies like Expedia or Booking.com, the Strata Elite will give you much better earnings. Outside of that, it’s tough to see who this card is a fit for long-term.

Citi Strata Elite Pros and Cons

Pros

- Excellent earnings through Citi’s travel portal

- Credits are relatively easy to take advantage of

- Very good extended purchase protection

- Impressive variety of airline and hotel transfer partners

- Transfers to Choice Privileges at double the rate of Amex or Capital One

- Miles can be shared across cards and cardholders

- Forms a good quartet with the Citi Double Cash, Strata, and Custom Cash

- American AAdvantage is arguably the best domestic airline partner of all of the major transferable currencies

Cons

- Although the card now offers travel protections, they are more restricted than those offered by competitors

- Bonus categories are lackluster for such an expensive card

- Only earns 1.5x on travel if you don’t book through Citi’s portal

- 6x dining is nice…but who wants to track what time it is in New York when you go out to eat?

Citi Transfer Partners

| Rewards Program | Citi Transfer Ratio | Best Uses |

|---|---|---|

| Accor Live Limitless | 1000 to 500 | Use to pay hotel bill with value of 2 Euro cents per point. In some cases (such as hotel to airline transfer bonuses) it may make sense to convert Accor points to the following airline miles at a 1 to 1 ratio: Finnair, Iberia, Qantas, or Virgin Australia |

| Aer Lingus Avios | 1 to 1 via Qatar | Fuel surcharges are sometimes lower when booking with Aer Lingus rather than British Airways, Qatar, or Iberia. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. |

| AeroMexico ClubPremier | 1 to 1 | AeroMexico is a SkyTeam partner. Club Premier points can be used to book flights on AeroMexico, SkyTeam alliance members (such as Delta or Korean Air), or on select partner airlines. Unfortunately many have reported that awards are extremely difficult to book through AeroMexico so we do not recommend transferring points to this program. If you want to fly AeroMexico, look to transfer points to another SkyTeam partner (such as Air France) and then book AeroMexico with that program. |

| Air France KLM Flying Blue | 1 to 1 | Monthly Air France Promo Awards often represent very good value. Air France miles can be used to book Sky Team awards, including Delta awards. Air France often offers very good business class award pricing between the US and Europe & Israel. |

| American AAdvantage | 1 to 1 | Best for AA's web special awards or for partner awards such as Cathay Pacific business class, Qatar business class, Etihad first class, etc. AA no longer charges change or cancellation fees on awards. |

| Avianca LifeMiles | 1 to 1 | Avianca LifeMiles can be decent for Star Alliance awards. They offer reasonable-ish prices and no fuel surcharges on awards. Best of all, their mixed-cabin pricing can lead to fantastic first-class award prices. See this post for details. |

| British Airways Avios | 1 to 1 via Qatar | While flights on British Airways itself often incur outrageously high fuel surcharges, many BA partners charge low or no fuel surcharges. Excellent value can often be had in redeeming BA points for short distance flights outside the US. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. |

| Cathay Pacific Asia Miles | 1 to 1 | Cathay Pacific has a decent distance based award chart, but they don't allow stopovers longer than 24 hours. Cathay Pacific Asia Miles can be a good option for booking American Airlines flights with a distance based award chart, especially if other OneWorld Alliance miles aren't available. For long distance flights, it is possible to reduce the cost of a premium cabin award by adding on a lower cabin segment. See this post for details. |

| Choice | 1 to 2 | Choice Privileges points seem to be randomly valuable within the US, but dependably valuable internationally in expensive locations such as Scandinavia and Japan. Points can sometimes offer great value when used towards participating Preferred Hotels of the World. |

| Emirates Skywards | 1000 to 800 | The best use of Emirates miles has been to fly Emirates itself. Unfortunately fuel surcharges can be extremely steep. One workaround is to book select routes such as JFK to Milan or Newark to Athens. See: How to find and book Emirates first class awards. |

| Etihad Guest | 1 to 1 | Etihad offers a distance based award chart for flying Etihad and another for its partners. Points may offer good value for expensive but short-distance flights. |

| EVA Air Infinity MileageLands | 1 to 1 | If you want to fly one of the best business class products in the sky, the best way to snag EVA flights is with their own miles since they release more award space to their own members. One-way business class flights from the US to Taipei cost 75K to 80K miles. Fuel surcharges are very low on these routes. |

| Finnair Plus+ | 1 to 1 via Qatar | Finnair points are now "Avios" and points can be moved to/from other Avios programs. Finnair uses zone based award charts rather than distance based. As a result, Finnair sometimes has better (and sometimes worse) pricing than other Avios programs. |

| Iberia Avios | 1 to 1 via Qatar | On their own flights, Iberia offers low award prices and a very reasonable 25 Euro cancellation fee. Partner awards can offer good value under some circumstances as well, but these are usually nonrefundable. Fuel surcharges are sometimes lower when booking with Iberia rather than British Airways, Aer Lingus, or Qatar. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. |

| Jet Airways Inter Miles | 1 to 1 | JetAirways JetPrivilege miles are useful only for a few very specific cases such as certain flights to Hawaii for as low as 15K (30K business) one-way, or to the Caribbean or Central America for as low as 10K (20K business) one-way. Details can be found here. |

| JetBlue | 1 to 1 | JetBlue points offer the most value when cheap ticket prices are available and when award taxes are high relative to the overall cost of the ticket (more details can be found here). The JetBlue Plus Card and the JetBlue Business Card offer a 10% rebate on awards, so you can get more value by holding one of these cards. |

| Leading Hotels of the World | 1K to 200 | It is often possible to get 8 cents per point value, or more from LHW points. |

| Malaysia Enrich | 1 to 1 | Given Malaysia's award chart devaluation in June 2017, We're not aware of any good uses for these miles. |

| Preferred Hotels & Resorts I Prefer | 1 to 4 | Redeeming points for hotel stays offers the best value but availability can be hard to find. Next best option is to look for good value points+cash opportunities. Redeeming for certificates is always poor value. |

| Qantas Frequent Flyer | 1 to 1 | Best use is probably for flights on El Al with no fuel surcharges. Also useful for short AA flights. Qantas offers distance based award charts similar to Cathay Pacific. Both are OneWorld Alliance members. I recommend comparing award prices across both programs before transferring to either. Qantas offers round the world business class awards for only 280,000 points (but with many restrictions) |

| Qatar Privilege Club Avios | 1 to 1 | Qatar has reasonable award prices for flying Qatar itself. Points are now transferable 1 to 1 to British Airways (and from there to Aer Lingus or Iberia). It is now also possible to book JetBlue flights with Qatar Avios. |

| Shop Your Way Rewards | 1 to 10 | Don't do it. Shop Your Way points can be redeemed for a variety of gift cards. That said, unless Shop Your Way starts offering discounted gift cards, there's no point in converting transferrable points to Shop Your Way. |

| Singapore Airlines KrisFlyer | 1 to 1 | Use to book Singapore Airlines First Class awards (generally reserved for their own members), Alaska Airlines economy awards, or for Star Alliance awards (including United Airlines). |

| Thai Airways Royal Orchid Plus | 1 to 1 | I'm not aware of any good uses for these miles |

| Turkish Airlines Miles & Smiles | 1 to 1 | Miles & Smiles offers a number of awesome sweet-spot awards including 7.5K one-way anywhere within the US, even to Hawaii. Many awards cannot be booked online but can be booked via phone or email. See: Turkish Miles & Smiles Complete Guide and Turkish business class sweet spots from the US. |

| Virgin Atlantic Flying Club | 1 to 1 | Virgin Atlantic offers a few excellent sweet spot awards. See: Best uses for Virgin Atlantic points (Sweet Spot Spotlight). |

| Wyndham | 1 to 1 | Wyndham often allows booking multi-room suites for the same price as a standard room. It's sometimes possible to get great value from points in that way. Bonus: award nights are not subject to resort fees. Wyndham Earner cards offer automatic 10% discount on award stays. |

Related Cards

| Card Offer and Details |

|---|

ⓘ $1274 1st Yr Value Estimate$200 Blacklane credit valued at $80, $200 "Splurge" credit valued at $160, $300 hotel credit via Citi Travel valued at $180 Click to learn about first year value estimates 100K Points 100,000 points after $6,000 spend in the first 3 months.$595 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: Excellent portfolio of transfer partners, but mediocre bonus categories and a so-so group of credits. Recommend pairing this with Citi Premier and/or Double Cash. Click here for our complete card review Earning rate: 12X hotels, car rentals and attractions booked through Citi Travel ✦ 6X airfare booked through Citi Travel ✦ 6X dining between 6pm and 6am EST Fridays and Saturdays ✦ 3X dining all other times ✦ 1.5X everywhere else Card Info: Mastercard World Legend issued by Citi. This card has no foreign currency conversion fees. Noteworthy perks: Transfer points to airline and hotel partners ✦ $300 annual (calendar year) hotel credit on a stay of 2 nights or more when booked with Citi Travel ✦ $200 in annual (calendar year) statement credits on your choice of up to 2 of: 1stDibs, American Airlines, Best Buy®, Future Personal Training, or Live Nation ✦ $200 in annual private chauffeur credit with Blacklane ($100 Jan-June and July-Dec) ✦ Priority Pass Select membership with two free guests (no restaurants) ✦ 4 American Airlines Admirals Club passes per calendar year (for one adult and up to three children) ✦ $120 Global Entry® or TSA PreCheck® application fee credit ✦ Travel protections ✦ $145 annual fee rebate for CitiGold and Citi Private Client members See also: Citi ThankYou Rewards Complete Guide |

ⓘ $741 1st Yr Value EstimateClick to learn about first year value estimates 60K Points 60,000 points after $4,000 spend in the first 3 months$95 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 75k after $6 spend in the first 3 months (ended 4/8/25) FM Mini Review: Very strong earnings for spend. Excellent bonus categories. Points transferable to select airlines. Recommend pairing this card with Citi Double Cash Click here for our complete card review Earning rate: 10X hotels, car rentals, and attractions booked through Citi Travel℠ ✦ 3X grocery ✦ 3X dining ✦ 3X gas stations & EV charging ✦ 3X flights, hotels, travel agencies Base: 1X (1.5%) Flights: 3X (4.5%) Hotels: 3X (4.5%) Portal Hotels: 10X (15%) Grocery: 3X (4.5%) Dine: 3X (4.5%) Gas: 3X (4.5%) Card Info: Mastercard World Elite issued by Citi. This card has no foreign currency conversion fees. Noteworthy perks: Transfer points to airline and hotel partners ✦ $100 Annual Hotel Savings Benefit ($100 off a $500+ hotel stay, excluding taxes and fees, when booked through Citi Travel) ✦ Travel protections See also: Citi ThankYou Rewards Complete Guide |

ⓘ $434 1st Yr Value EstimateClick to learn about first year value estimates 30K Points 30,000 points after $1,000 spend in the first 3 monthsNo Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: Excellent bonus categories. Points transferable to select airlines. Recommend pairing this card with Citi Strata Premier and/or Citi Double Cash. Earning rate: 5X Hotels, Car Rentals and Attractions booked on cititravel.com ✦ 3X grocery ✦ 3X gas stations & EV charging ✦ 3X select transit includes car rentals, ferries, commuter railways, subways, taxis/limousines/car services, passenger railways, bridge and road tolls, parking lots/garages, bus lines, and motor home and recreational vehicle rentals ✦ 3X self-select category (Fitness Clubs, Select Streaming Services, Live Entertainment, Cosmetic Stores/Barber Shops/Hair Salons, or Pet Supply Stores) ✦ 2X dining Card Info: Mastercard World Elite issued by Citi. This card imposes foreign transaction fees. Noteworthy perks: Transfer points to airline and hotel partners (at reduced ratios and no AA) ✦ Earn $5 Lyft credit after 3 eligible rides See also: Citi ThankYou Rewards Complete Guide |

ⓘ $299 1st Yr Value EstimateClick to learn about first year value estimates 20K points $200 cash back after spending $1.5K in first six months. Note: $200 is awarded as 20,000 ThankYou® Points.No Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: 2X rewards for all spend with no annual fee makes this card a winner. Earn 2X everywhere and redeem for the equivalent of 2% cash back or 2X ThankYou points. Pair with the Premier or Prestige card to make points transferrable to airlines. Click here for our complete card review Earning rate: 2% cash back everywhere (1% cash back for each purchase + 1% when paying your credit card bill for that purchase). ✦ Earn 3% total cash back on hotel, car rentals, and attractions booked on Citi TravelSM Portal. Card Info: Mastercard World Elite issued by Citi. This card imposes foreign transaction fees. Noteworthy perks: 1X when you make a purchase + 1X when you pay for those purchases ✦ Transfer points to airline and hotel partners (at reduced ratios and no AA) ✦ 24 month extended warranty See also: Citi ThankYou Rewards Complete Guide |

ⓘ $284 1st Yr Value EstimateClick to learn about first year value estimates $200 statement credit Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler $200 statement credit after $1K spend in the first 3 MonthsNo Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: This has a good gas station bonus for a no annual fee card, but there's not much else to make it a compelling card Earning rate: ✦ 3 points per $1 at gas stations ✦ 2 points per $1 at grocery stores ✦ 1 point per $1 on all other purchases Card Info: Mastercard issued by Citi. This card imposes foreign transaction fees. Noteworthy perks: $20 statement credit every billing cycle you spend $1,000+ or $10 statement credit when you spend $500 - $999.99 (for AT&T Wireless customers omly) See also: Citi ThankYou Rewards Complete Guide |

ⓘ $276 1st Yr Value EstimateClick to learn about first year value estimates 20K Points Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler 20K points after $1,500 spend in the first 6 monthsNo Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: Expired 9/13/22 - 20,000 points after $750 spend in first 3 months FM Mini Review: This is a great card to have and hold for a single category where you spend no more than $500 per month as it represents an excellent return without rotating categories to track. Earning rate: 5x on purchases in your top eligible spend category each billing cycle, up to the first $500 spent, 1x thereafter. Eligible categories: Restaurants, Gas Stations, Grocery Stores, Select Travel, Select Transit, Select Streaming Services, Drugstores, Home Improvement Stores, Fitness Clubs and Live Entertainment. ✦ 1x on all other purchases Base: 1X (1.5%) Travel: 5X (7.5%) Flights: 5X (7.5%) Hotels: 5X (7.5%) Grocery: 5X (7.5%) Dine: 5X (7.5%) Gas: 5X (7.5%) Card Info: Mastercard issued by Citi. This card imposes foreign transaction fees. Noteworthy perks: Transfer points to airline and hotel partners (at reduced ratios and no AA) ✦ 24 month extended warranty See also: Citi ThankYou Rewards Complete Guide |

ⓘ $0 1st Yr Value EstimateClick to learn about first year value estimates None Non-Affiliate This card is no longer availableNo Annual Fee This card is available in-branch only and is not available online. The bonus may vary by region and can be as high as 40K. Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Earning rate: 3x travel ✦ office supply ✦ professional services Base: 1X (1.5%) Card Info: Mastercard World issued by Citi. This card has no foreign currency conversion fees. Noteworthy perks: Anniversary bonus on base earnings each membership year. (1% in year 1, 2% in year 2 and 3% in year 3 and beyond.) See also: Citi ThankYou Rewards Complete Guide |

ⓘ $0 1st Yr Value EstimateClick to learn about first year value estimates None Non-Affiliate This card is no longer availableNo Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: Downgrade from Prestige or Premier to this card in order to keep points alive Earning rate: 2X dining and entertainment Card Info: Mastercard World issued by Citi. This card imposes foreign transaction fees. See also: Citi ThankYou Rewards Complete Guide |

ⓘ $0 1st Yr Value EstimateClick to learn about first year value estimates None Non-Affiliate This card is currently not accepting applicationsNo Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: Terrific bonus categories for a card with no annual fee, and has regular spending offers that often give 10-15% cash back or Thank You Points. It's a keeper. Earning rate: 5X gas (up to $10k in spending per year) ✦ 3X grocery, dining (up to $10k in spending per year) ✦ 3X deparment stores, drug stores ✦ 1X everywhere else Card Info: Mastercard issued by Citi. This card imposes foreign transaction fees. Noteworthy perks: Known for extremely generous targeted spending offers for statement credits and points. |

ⓘ $-16 1st Yr Value EstimateClick to learn about first year value estimates None Non-Affiliate This card is no longer availableNo Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: This card may be worth it for a welcome offer, but it would be worth considering a product change to the Double Cash down the road..Unforunately, it seems it is no longer possible to product change to the AT&T Access More card. Earning rate: ✦ 2 points per $1 on products and services that are purchased directly from AT&T ✦ 2 points per $1 on all purchases at online retail and travel sites ✦ 1 point per $1 on all other purchases Card Info: Mastercard World issued by Citi. This card imposes foreign transaction fees. See also: Citi ThankYou Rewards Complete Guide |

ⓘ $-95 1st Yr Value EstimateClick to learn about first year value estimates None Non-Affiliate This card is no longer available$95 Annual Fee This card is no longer available to new applicants. Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: Excellent choice for those who shop often online (thanks to 3X earnings) Earning rate: ✦ 3 points per $1 on products and services that are purchased directly from AT&T ✦ 3 points per $1 on all purchases at online retail and travel sites ✦ 1 point per $1 on all other purchases Card Info: Mastercard World Elite issued by Citi. This card has no foreign currency conversion fees. Big spend bonus: 10,000 anniversary bonus points after $10,000 in annual spending See also: Citi ThankYou Rewards Complete Guide |

ⓘ $-495 1st Yr Value EstimateClick to learn about first year value estimates None Non-Affiliate This card is no longer available$495 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: The Prestige card's best in class 5X rewards for dining, airfare, and travel agencies is hard to beat. Sadly, this travel card doesn't provide any travel protections. Earning rate: 5X airfare, dining, and travel agencies ✦ 3X hotels and cruise line ✦ 1X everywhere else Card Info: Mastercard World Elite issued by Citi. This card has no foreign currency conversion fees. Noteworthy perks: $250 travel rebate per calendar year ✦ Free lounge access: Citi Properietary Lounges; and Priority Pass Select with free guests ✦ $100 Global Entry application fee credit ✦ 4th night free hotel benefit See also: Citi ThankYou Rewards Complete Guide |

Citi Application Tips

- 48 Month Rule: With most Citi cards, you can only receive a welcome offer every 48 months. This applies to the same exact card, not families of cards and is counted from the date that you receive the welcome offer, not from when you're approved.

- Velocity Limits: Citi allows a maximum of one card per 8 days and a maximum of two cards per 65 days (includes both business and personal).

- Inquiries: Citi is thought to be more credit inquiry-sensitive than other issuers. We've heard reports that it's difficult to be approved for a new Citi card if you've had more than 6 hard inquiries within the last 6 months. That said, data points abound of people being approved despite being above that, so it's certainly not a hard and fast rule.

- Card Limits: Citi doesn't have a strict limit on the amount of cards that you can have, but it does place limits on the total amount of credit that they will issue you across all cards. Unfortunately, unlike most banks, Citi does not allow you to move credit from one existing card to the another card.

- Application Status: Call (866) 606-2787 or go here to check your application status. For Costco cards, call (877) 343-4118.

- Reconsideration: If denied, call (800) 695-5171 for personal cards or (866) 541-7657 for business cards.

DP: P2 just got instant approval. Credit ~800, 4/24, 1/12, 5 inquiries in the last 6 months all business cards. With all the reported 4506-C issues, this was most stressed I’ve been on an application in a while! Now need to get the card in time to max out the 2025 credits – go triple dip!

If I get the sign on bonus on this card, can I still get the other bonuses offered on the lowered tier Citi cards??

a

Honest question: why do so many folks sh!t on this card? I don’t have it yet but thinking of applying soon. I appreciate that the $300 hotel credit isn’t restricted to high-end properties, and I will easily hit $200 in costs from AA thanks to unaccompanied minor fees. We also fly through Denver on Southwest once or twice per year as a family of four and this will give us lounge access in the right concourse (much needed now that Cap1 won’t let us bring the kids in). 3-6x on dining and 1.5x elsewhere isn’t earth-shattering but it’s acceptable. I’ll be able to transfer to AA or Choice, which I can’t do as effectively with any other card.

Contrasting with the Amex Platinum ecosystem, I haven’t yet found a use for FHR/THC credit (even at $300 twice per year) without a huge cash outlay required and I can’t bring my family into Centurion lounges. Unfortunately Chase won’t approve me for the CSR with a welcome offer so I can’t really evaluate how The Edit would work out for me.

Before I apply for this card, I want to understand if there’s some massive downside that I’m missing. Thanks!

This is a great question. No, there’s no major downside you’re missing (I’m not sure what your plan is for getting lounge access in Denver when flying Southwest, though — you have to be flying AA or an oneworld partner to use the lounge passes).

My biggest disappointment with the card is how poor the earning structure is, with only restaurants giving better than 1.5x for direct purchases. That said, it’s easy to supplement with other no-fee Citi cards: Double Cash for 2x everywhere, Strata for 3x categories, Custom Cash for 5x.

Initially, I was also disappointed by the $300 hotel credit since hotels booked through Citi used to be far overpriced. That has changed drastically, though. Now, Citi often has the best prices. Also with the Strata offering 12x for hotels booked through Citi, the card has become a great option for booking independent hotels.

So, now, I’m warming up to the Strata Elite card. If you value its Priority Pass, AA lounge benefits, and annual credits, it’s a keeper.

Seems I can use the splurge credit at Best Buy to buy third-party gift cards (Amazon, Ebay, Instacart, etc.). Am I wrong? Is there a catch I’m not seeing?

One Data Point. My Citi cards were frozen (but seemed to originate from my Elite) pending my submission of a 4506-C form (requesting transcript of my tax return). Googled it and apparently it is happening to a lot of new CSE cardholders who used the 100k application link.

Citi Strata (plain) does impose foreign transaction fees (3%), unfortunately! Still looking far and wide for a card to take over my 3x in tolls/parking/trains/buses, since the CSR will discontinue that. For domestic expenses, I was looking at the Citi Custom Cash (5x TYP up to $500); for abroad, it seems like I will just have to settle for 2x with CSP/Venture X (I also have US Bank Altitude Reserve, but that seems to cover only trains). Does anyone else have a better idea? TIA!

Amex green does 3x travel with no foreign transaction fee. Had good luck using Amex in public transit abroad

Are you certain that the Strata Elite extends warranty by 24 months like the Strata Premier? Where do you see that in the T&C?

Very disappointing that a “travel” card with a $595 AF can’t offer primary car rental insurance. Also disappointed with trip delay coverage requiring round-trip AND having to pay the entire cost on the card. Capital One Venture X far superior in this area with primary car rental coverage and trip delay on one-way or round-trip with any portion of the fare charged on the card.

This means I won’t be using the Citi Travel portal to book rental cars for 12x. Will stick to Capital One 10x bonus, even though I now value Citi Thank You points much more with the ability to transfer to AA.

Your fee is $200 higher that Venture X — do better Citi!

Since it is marketed to US people, mainly on the East coast as Citi is focused there, the weekend definiton from 6PM Friday makes sense

Can you imagine 24 time zones of complaints?

I’m disappointed the Citi Elite and really everyone offer these $200-$300 hotel discounts in some form, but never include property rentals like Vrbo/AirBnb.

Marriott Brilliant is the same – you can’t apply a Brilliant FNA to Homes & Villas, even though they own that brand. I know it’s not the best use of points, but I’d still use it sometimes.

If they wanted everyone to get full value than they wouldn’t coupon the benefit.

Breakage is heavily built into these “elite” cards couponing, on top of an overall breakage system. Miles are redeemed less than cash back, many benefits are unused, etc. etc. If customers actually use the benefits, as what happened with the original CSR credits and the C1VX lounges, they take stuff away to increase breakage.

There would still be a lot of breakage if you could redeem an FNA for homes and villas. Sorry if you thought I meant getting straight out points, which would have zero breakage

So appreciate your thoughts; they mirror my own. I had planned to join the TYP world but will not through Citi Strata Elite.

I’m still waiting for the Splurge credit to apply to my AA flight ticket. Been almost a week and haven’t seen statement credit.

T’s and c’s say that it may take up to1-2 billing cycles. I bought $200 gift card. Still waiting also.

This is my first Citi card and I don’t plan on keeping it. What are the logical product changes for someone like me?

Without doubt, Strata Premier.

Not a good recommendation since Strata Elite was his first Citi card. If he product changes to Premier, no bonus.

Before it comes time to product change, get a new Custom Cash (so you get the sign-up bonus). Then downgrade the Strata Elite to another Custom Cash. Then be sure to get further Citi cards only as new signups in order to get bonuses.

I second this.

In a couple places you mention 1x earning on travel if not booked through City Travel. That should be the “everywhere else” rate of 1.5x.

Yes, you’re right, that’s a typo. Thanks.