NOTICE: This post references card features that have changed, expired, or are not currently available

Update: The Curve card has been discontinued in the United States. Any purchases attempted after July 8, 2024 will be declined.

The Curve credit card may become the hottest thing to happen to wallets in this game in a long time, offering the ability to “Go Back In Time” and choose the best card for a purchase after the fact — but most readers will probably want to wait on it at least a bit as it currently only supports Mastercard, Discover, and Diners Club credit cards to back it. It is also only available to beta users who were in the top 100 on the waitlist last fall, but the fact that it is available to beta users makes me confident that it will become publicly available unlike a number of similar concepts that never came to fruition.

Let me back up: I started writing a post the other day about “what’s next”. After my big 600K+ haul with the Amex Platinum card, hitting those +4 Amex referral offers with gusto from the fall into the winter, and completing the spending requirement on my wife’s Venture X card, I wondered which card would capture most of our household spend next. Enter the Curve card, which effectively answers that question with “any card I want”….as long as it’s not a Visa or American Express, that is. Curve is here (for a few of us) and it works as it was advertised so far. This post is only going to be my earliest impressions in getting the card and initial use, but so far I am about as giddy as can be considering its current limitations.

What is the Curve credit card?

We wrote about the Curve card some time ago and Greg had long ago written about the UK version. The short story is that Curve is a credit card with no annual fee that works similarly to PayPal Key in that you back it with another credit card. That is to say that you provide the Curve card number or use the physical Curve card in the store and your purchase is actually charged to another card of your choice on the back end. It’s worth noting that Curve is indeed a credit card, not a debit card. More on that in a bit.

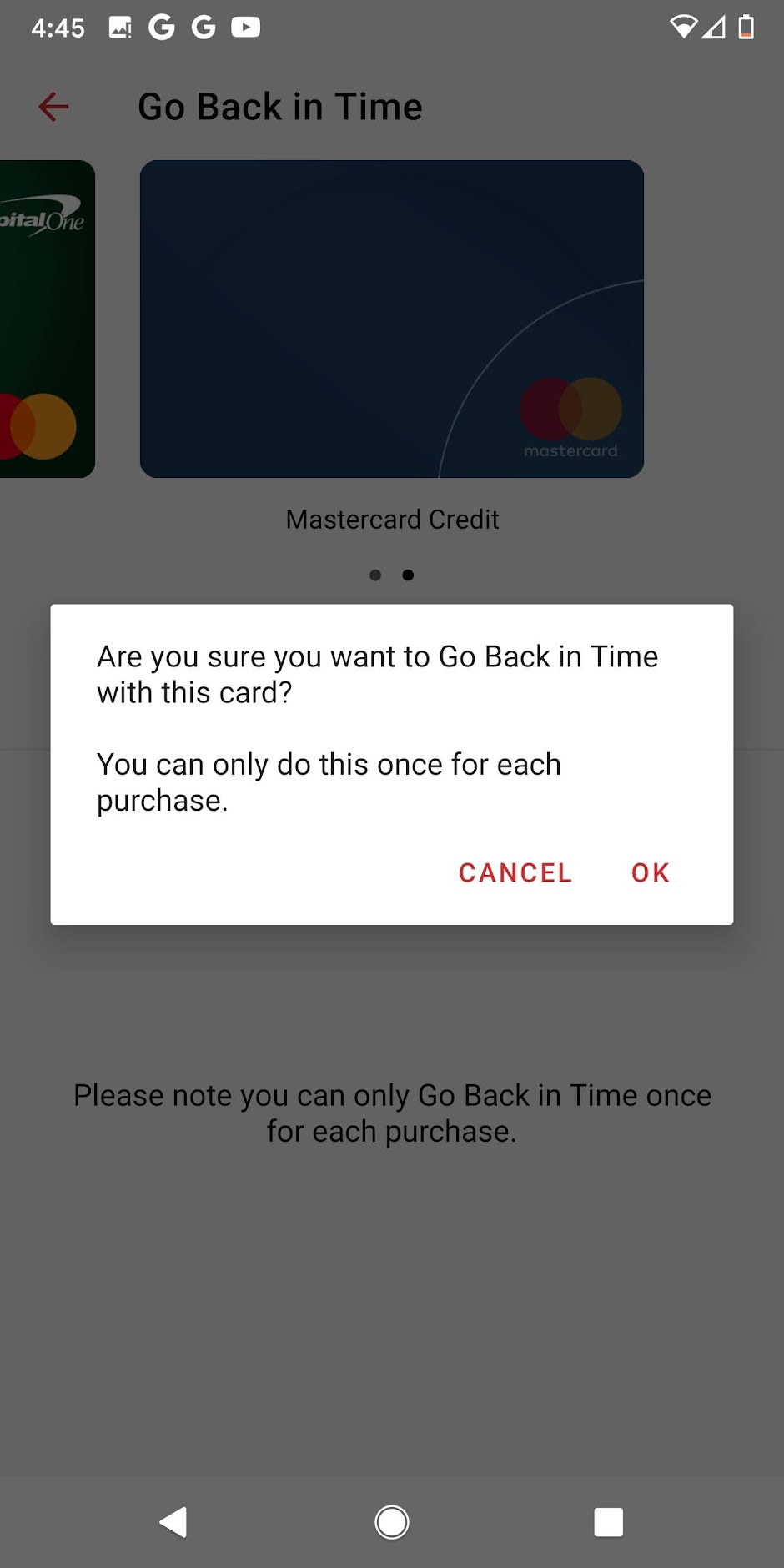

What makes Curve awesome and far more exciting to me than PayPal Key is that you can change the card used after the fact. Curve calls this feature “Go Back in Time” and it makes it possible to make a purchase and then later “go back in time” to switch the backing card to which the purchase is charged. You can do this one time on any individual purchase.

To me, that is a standout feature. This makes Curve the ultimate “Player 2” card. Have a spouse / partner who often forgets which card to use for grocery or gas or dining? This would make it possible for them to simply use the Curve card all the time and then you could always go back and switch the backing card to the best option later on.

Ever make a big purchase and then open a new credit card a week or two later and wish you could have charged that big purchase to the new card to meet the welcome bonus? Curve would make that possible.

The Go Back in Time feature is what made the Curve card so interesting to me. It has the potential to be the ultimate rewards card unifier. And it works as easy as it sounds. I’ll share my experience with that in a minute.

To add icing on the cake, the Curve card adds an extra 1% on all purchases for the first 6 months. That’s an extra 1% from Curve on top of the rewards earned on the backing credit card. So let’s say you use the Citi Double Cash as your backing card — you’ll end up getting 2% back from Citi and 1% back from Curve for a total of 3% back during that initial six-month window. Refer friends and get an extra month of 1% back for each friend you refer (they only allow referring up to three friends at this time though).

Note though that the Curve card is not yet publicly-available. Most readers probably won’t be able to apply yet, but the fact that the card is officially available for beta users is a key step in making me confident that it will be available to the public rather than dying in the “interest list” phase (as has been the fate for many other all-in-one credit card ideas).

Speaking of that interest list phase, Curve offered a waitlist promotion last fall (we wrote about it it here). Those in the top 100 on the waitlist last September earn a special bonus of 10% back for the first 6 months on top of credit card rewards (up to $1,000 back) – that’s 1% initially and an additional 9% at some future time. Since we ended up in the top 100, I expect to earn 10% back on top of credit card rewards, which makes this an absolutely phenomenal option for my household for the next six months. Unfortunately, I don’t have a DeLorean to actually go back in time and get anyone else in that top 100 list, so that’s a promotion that won’t be applicable to readers at this point — but the extra 1% on top of credit card rewards for six months is something that should be part of the public offering.

Probably not an option for manufactured spending

I’m sure that some readers will see the extra 1% and have ideas about options for increasing spend. Unfortunately, I don’t think any of those options are likely to work.

Curve is very specific in listing things that will not qualify for additional Curve cash back, including gift cards, prepaid cards, reloadable cards, and anything that may be seen as rewards abuse by Curve or the credit card issuer. They additionally note that you won’t earn cash back on tax payments, insurance premiums, or adult entertainment. I find it kind of odd that they even exclude some categories that don’t have obvious manufactured spending angles. Clearly they are looking to avoid someone using Curve just for the rewards.

While we know that the way terms are written doesn’t always match the way that terms are enforced, Curve seems specific enough here and I value the Go Back in Time feature highly enough not to want to mess with it. I don’t think that this is going to be a viable MS vehicle.

Our experience applying for the Curve credit card

The application process was an absolute breeze. We downloaded the app, filled in personal information, and were off to the races in just a couple of minutes.

As mentioned above, the Curve card is really the ultimate Player 2 card. While I generally won’t make a mistake like using a 1x card for a purchase that could have been 4x or 5x on another card, my wife will sometimes forget which card to use (which is fair since we have a lot of cards). I therefore realized that it made a lot more sense for her to have the Curve card (and it would likely provide me with a lot more real-life opportunities to test and report on the card’s Go Back In Time feature). Being able to manage those small “whoopsies” from an app on her phone without harassing her over which card she used is the ultimate in assuring “Happy Wife, Happy Life”. Therefore, we opened the Curve card in her name.

The application process was super simple. She had to provide the usual identity and income details and the app said it would first perform a soft credit check before displaying card terms. If she then accepted the terms, the app said it would perform a hard pull to open the account. The application process was incredibly smooth and only took a few minutes.

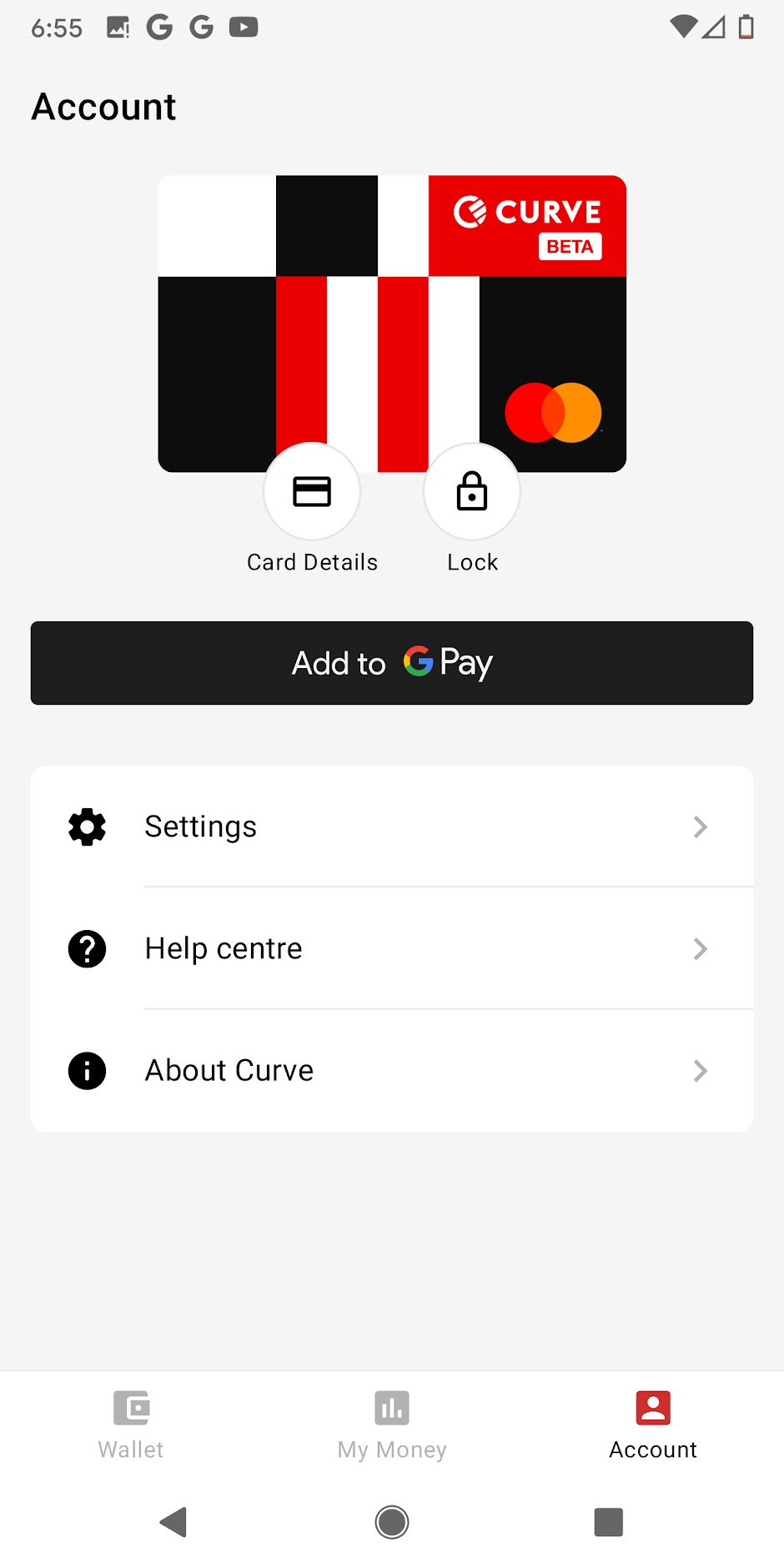

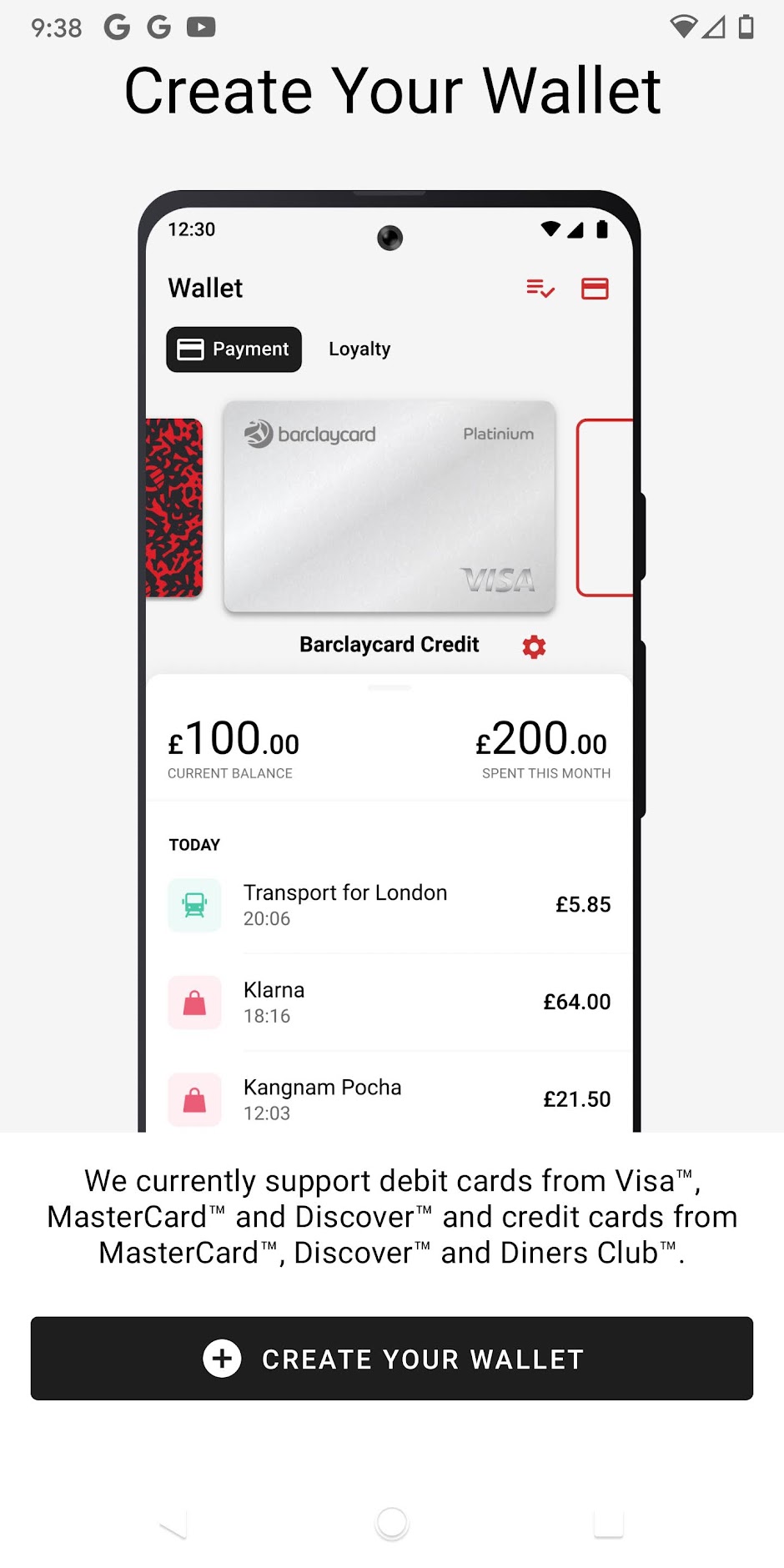

Once approved, she was prompted to create her wallet by adding credit cards.

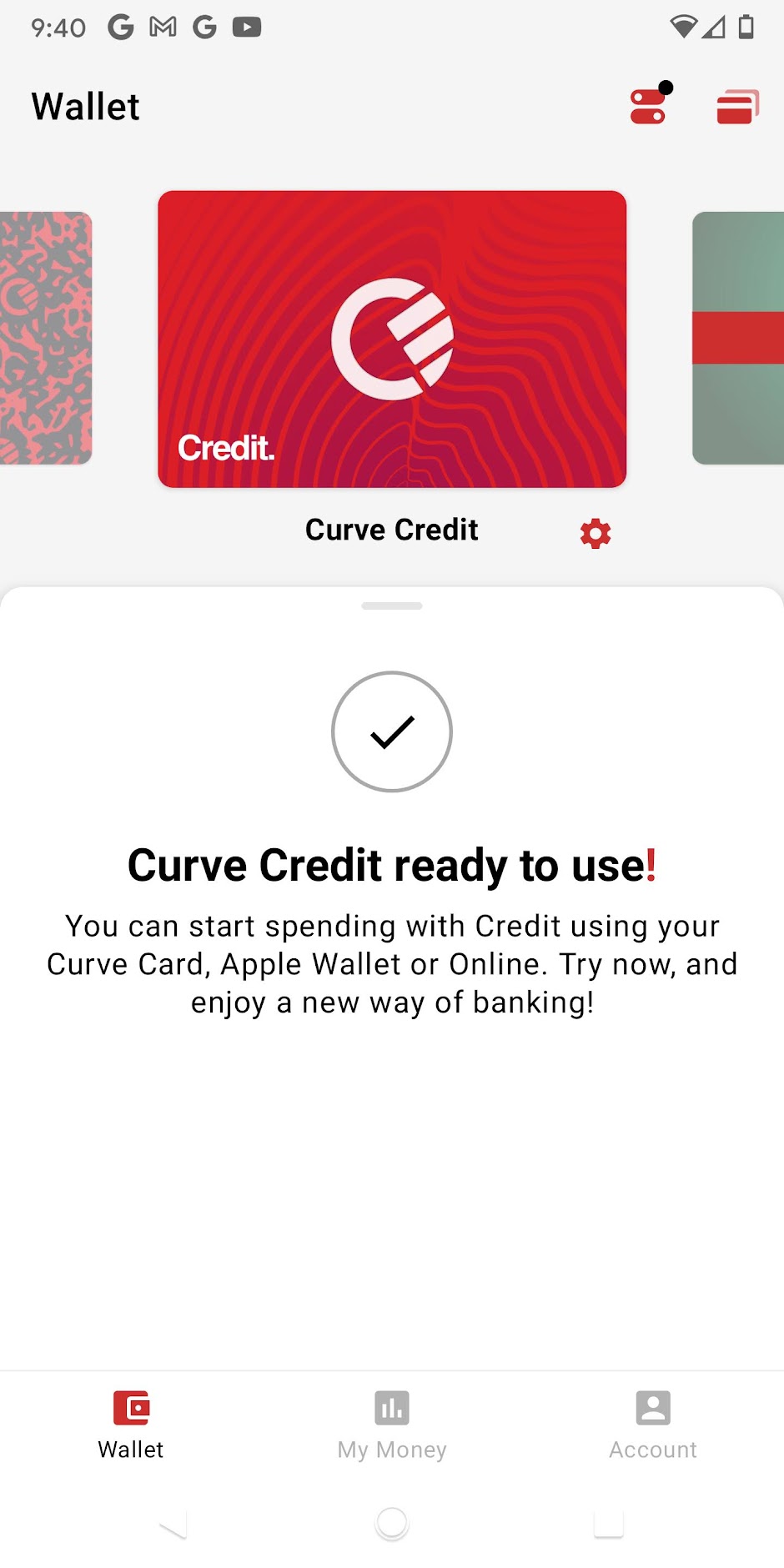

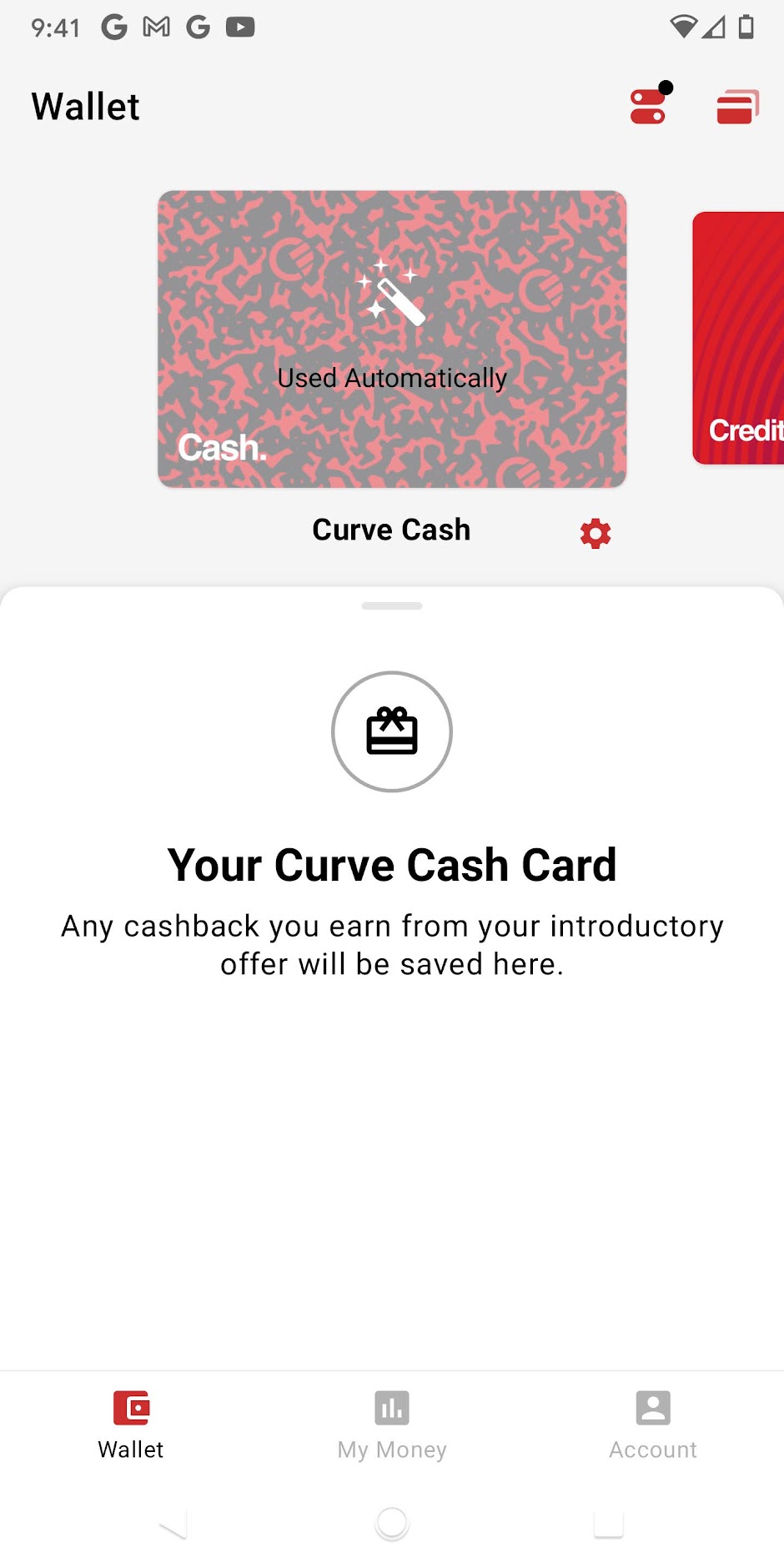

Her wallet initially consisted of “Curve Credit” and “Curve Cash” until she added a card.

Curve Credit is like a back-up: Curve provides you with a credit card in case your backing card gets declined. Your Curve Credit can then kick in and cover the purchase and then you’ll need to pay Curve back at the end of the month. I don’t yet know whether you can “go back in time” on a purchase made with Curve Credit, but I suspect you can. My wife’s credit limit for Curve Credit was far lower than any of her other credit cards. I don’t know whether that’s by design (perhaps they only want to kick in and cover average purchases like a trip to the grocery store rather than a new washer & dryer set) or if it is temporarily low pending activation of her physical card. Since this is a backup payment method in the event that her backing card gets declined, I’m not too worried about it.

Curve Cash is where your cash back from the introductory offer resides. The app says that this is used automatically. I don’t yet know exactly how that works — does Curve automatically use your cash back toward the next purchase you make every time, reducing the amount charged to your credit card? I’m actually not a big fan of that if that’s the case since some credit card purchase protections require paying for the entire purchase on your credit card. I’d hate to lose extended warranty or theft/damage protection because Curve used $0.23 of cash back toward a big purchase. I’ll have to report back on how this works out in day to day use.

Adding cards is very simple, though unfortunately it is a limiting factor at the moment given that you can only add Mastercard, Discover, or Diners Club credit cards (you can also add Visa, Mastercard, or Discover debit cards).

To add a card, you just enter the card info initially. Then you must “verify” the card. Curve places a small charge on the backing card that shows up in your online statement with an alphanumeric code in the description. My wife added two cards to her Curve wallet and both of them showed that pending charge immediately, so she was able to verify both cards right away.

Going back in time is easy

Going back in time to switch the backing card used is very simple. Just click on a transaction and choose the option to “Go Back In Time” and switch the backing card to another in your wallet.

The app will then ask which card you’d like to use and it will remind you that you can only go back in time once.

The charge was immediately reversed on the original card used (and charged to the new backing card).

This literally took two or three clicks. I was really impressed with how easy and quick it was.

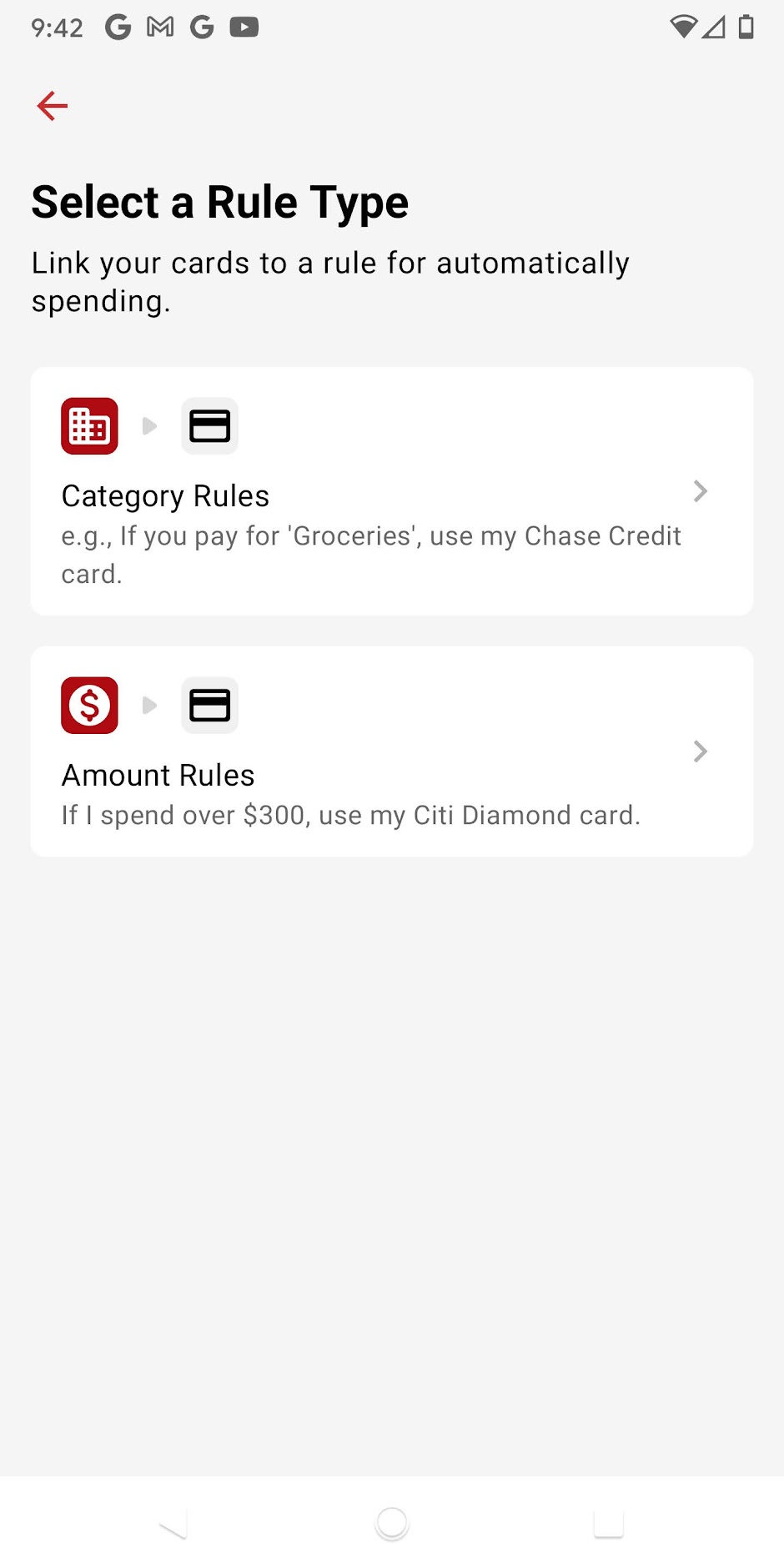

You can additionally create rules about which card to use for specific types of purchases, though I have not yet tested this.

The major limitation of the Curve card: It only supports Mastercard, Discover, and Diners Club for now

Unfortunately, Curve only allows you to add Mastercard, Discover, and Diners Club credit cards right now (note that they do support Visa debit cards in addition to debit cards with a Mastercard or Discover card logo).

They noted in their initial email that they are working on a solution to support Visa credit cards. Hopefully that is coming because there are far more Visa rewards cards in my household than the options Curve currently supports.

Unfortunately, we don’t expect Curve to support American Express cards. Curve has existed in the UK for years and they briefly allowed for adding American Express cards, but Amex quickly shut that down and stopped allowing their cards to work with Curve. To my knowledge, Amex cards never returned tot he UK version of Curve, and Amex prevented their cards from working with PayPal Key, so I don’t expect to see Amex come to the US Curve card either. That’s a big time bummer because many of our best cards for bonus categories like grocery and dining are Amex cards.

Still, I could concede the extra point per dollar on the Amex Gold card if I could make sure that my wife always got 3x for every dining or grocery charge or at least always avoids the dreaded 1x by “Going Back in Time” (or she could probably handle carrying the Gold card just for groceries and the Curve card for everything else).

That said, I’d probably recommend that others hold off until a solution for adding Visa cards is implemented. Of course, the card is still in Beta right now and isn’t yet available for the general public to apply. Maybe they will have a Visa solution implemented by the time it is publicly-available.

Which cards make the most sense when paired with Curve?

I’ve been asking myself the above question since last night. We don’t have many cards in my household that run on the qualifying networks (who still has a Diners Club card??), so I’ve been looking to what we should add to our wallets to ensure maximum return on spend with Curve. Ideally, we want to have eligible cards with the best return in popular bonus categories and also a good “everywhere else” option.

The best “everywhere else” Mastercard in our household for the time being will be the Nearside debit card since that card is offering 2.2% cash back for the rest of 2022. Getting an extra 1% back via Curve makes for a total of 3.2% cash back everywhere for the next six months, which is excellent. Since our link was in the top 100, I expect to earn a total of 12.2% cash back for the next six months (on up to $10K in purchases), which is outrageous.

However, the Nearside card may not be the “everywhere else” card in my wife’s Curve wallet for long.

She’s never had a Discover card and the Discover IT Miles card offers an effective 3% back for the first year since it doubles up first year rewards earnings at the end of year 1. Backing the Curve card with a new Discover card will yield even better value (4% for six months for most people when the Curve card is publicly available).

But probably better yet would be opening a new Mastercard and working on a welcome bonus while also adding 1% on top via Curve (or 10% on top in our case). Luckily, we maintain a page with the best Mastercard offers. There are a number of good options that could be worthwhile when paired with the extra rewards offered by Curve. The card that has my eye right now is the U.S. Bank Business Triple Cash Rewards. That’s a card that I’ve never really considered, but it has a nice $500 welcome bonus after $4500 in purchases in the first 150 days and it offers 3% back on gas, office supply store, cell phone providers, and restaurants (and it has no annual fee). That pairs nicely with the additional rewards from Curve. The cash back from that card can be deposited to a US Bank business checking account and they have a checking account bonus going right now that could add some more icing on this cake.

I’d probably have my wife use her Brex card for dining purchases since that card offers 4x transferable points (which can alternatively be redeemed for cash, making 4% the baseline return on dining). The nice thing is that we can always adjust this on the back end after making a purchase.

If she weren’t going to also carry the Gold card in her wallet, the Aeroplan card would be tempting for its grocery bonus category and ability to spend toward status. The Citi Premier would be another good choice for grocery.

For now, I think a good welcome bonus to pair with the extra 1% makes the most sense. I don’t expect the Curve card to continue offering rewards on top of credit card rewards over the long-haul, so I’m not sure the “best” card matters for the first six months if you’re willing to hit an intro bonus or two with the Curve card. Moving forward, we’ll seek out welcome bonuses on cards that pair well with the ability to “Go Back in Time”.

Bottom line

Could the Curve credit card be the “one card to rule them all”? Not as long as it only supports Mastercard, Discover, and Diners Club cards, but I think this is as close as we’ve come to that single card to rule them all thanks to the Go Back In Time feature. Even without the ability to add Visa or American Express cards, I think the Curve card will easily be the best “Player 2” card for those who have a partner who is less obsessed with using the right card (since you’ll be able to help them adjust the card used on the back end later). If and when they add Visa support, we will only rock the Curve card harder. I look forward to the day when they do support Visa and we can simply carry the Curve card and an Amex or two to get the best of every credit card bonus category available. Sprinkle in the ability to retroactively charge purchases to a new card to meet spending requirements and I am like a kid in a candy store. Getting the email that it was time to apply for the beta was the best curveball to be thrown at our wallets in a long time.

According to this FAQ (https://help.curve.com/how-do-i-move-a-transaction-HkxHBOnUd), they don’t keep the original MCC when going back in time: “Keep in mind, you can only Go Back in Time once per transaction and the original Merchant Category Code (MCC) of the transaction won’t be preserved, so choose wisely!“

Anyone having any luck getting through the wait list?

My guess is that maybe they’ve only opened it to the people who were in the first 100 (except for maybe a few more who squeezed in when the application first went live).

Anyway, after having used it for a but longer, I’d say that you shouldn’t be that disappointed to be on the sidelines while the wrinkles get smoothed out. There have been some bumps in the road and I think they need the time to be able to work out the kinks.

Looks like the floodgates might have opened. I was just sent an email stating I was now eligible to apply which I did and was approved.

You mentioned purchase protection benefits of underlying credit cards (theft, damage, extended warranty, price protection if that’s still a thing on any cards, lost luggage, trip delay, car rental, etc.). I wonder if the claims process for any of those benefits will be complicated or even denied if Curve is used as an intermediary. The purchase receipt will show the (partial) Curve card number, which will not match the card offering the benefit. In my experience, as part of the documentation required, the claims processor requires both a receipt/invoice showing which account was used, as well as the monthly card statement on which the transaction posted. Having one but not the other seems like it might be problematic. I guess there’d be a Curve transaction record that provides the missing link, but will it be accepted? (How has this situation historically been handled for purchases made through PayPal, Google Pay, or any of the other third-party payment services?)

Since this is a credit card, does it count against 5/24? I really enjoyed using curve when I lived in Europe, but as I’m currently just under 5/24 I wouldn’t want to use a slot on it.

Do the transactions to the backing card post as card present or card not present?

Have you tried adding VGC or MGCs?

Didn’t work for the few BINs of reach I tried

Whoa! Umm this is the PERFECT companion card to another very similar platform. The charge back feature is gold. In fact it’s the key to many many points. Can’t wait for it!

Which similar platform?

Nick, how did you get to the “Select A Rule Type” page? Not seeing any option for rules in the Android app.

Based on my experience with a Curve card obtained in Europe, I would avoid manufactured spend or anything funny with their cards. They seem to watch for anything out of the ordinary, and if your account becomes restricted, dealing with their support can only be done by email (maybe it’ll be different for the US market), meaning it can take days to get anything resolved. They’re also borderline paranoid about fraud.

What’s the monetization on this? 1 stop shop to sell your transaction data?

Don’t see why card issuers would agree to reduced interchange fees on the pass through. Unless there is some debit to credit arbitrage…doesn’t sound like that’s the case though.

No idea, but I assume data collection with just about everything these days. Or continued venture capital. Either way, I don’t personally get too wrapped up in how any of these FinTech companies will make money since many of them never will.

Would the system allow you to connect your card to your wife’s Curve?

Yup!

Wow. I definitely need to get my P2 on this card!

Just wanted to say thanks, Nick, for this extremely detailed, helpful post. I really appreciate it!

The merchant code on any purchase is then determined by the underlying card, correct?

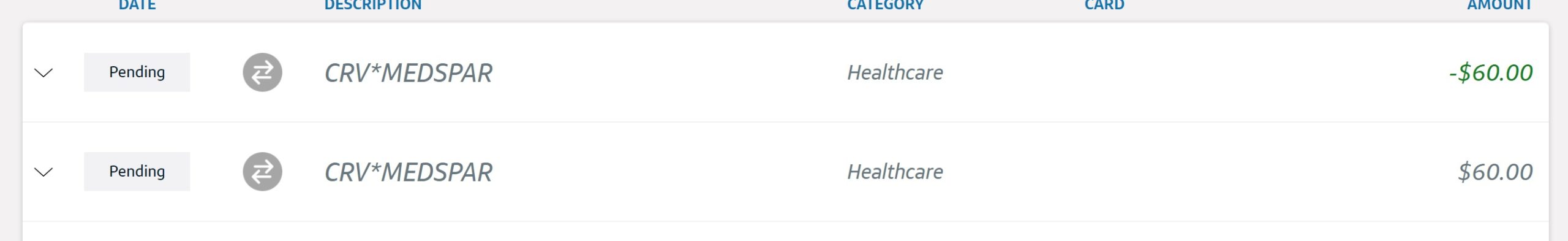

Yes, it should be. We paid a medical bill and I can confirm that Capital One had the charge classified as Healthcare and Citi classified it as “Medical Services-not Else Where Classed”, so they clearly both got that it was a healthcare charge even when going back in time to switch.

According to their FAQ that’s not the case. They say the original MCC isn’t preserved when going back in time.

I’ve done Go Back in Time a couple of times and the MCC was preserved. Maybe they can’t guarantee it but it seems to happen at least some of the time if not always.

Great DP, thanks!

As for the Go Back in Time feature, Curve will allow you to go back and change each purchase once, and that’s great. However, each time a purchase is made does the charge immediately flow through to the underlying card? It most likely does. If a customer uses the Go Back feature too often, I can’t imagine any credit card issuer being too happy with multiple, repeated charges followed by chargebacks.

Yes, it does immediately flow through. You’re right that multiple charge/refunds in close succession on the same card might cause an issuer to at least temporarily lock up your card. I think the rule-setting feature will be useful for this because, at least theoretically, we can set dining charges to go on her Brex card and grocery on some other card, etc. That way, hopefully there won’t be too many charges that need to be changed at once.

Did Curve say how many cards can be added?

I haven’t seen it noted anywhere yet. We don’t have that many Mastercards in our household, so I’m probably not in danger of reaching the cap for a bit (haven’t yet tried to add all of them), but I’ll let you know if I find whatever the limit is.