A couple of days ago, a member of our Facebook group had a bad experience with a hotel booking they made through the Capital One Travel portal. They had booked through Capital One Travel to use the Capital One Venture X Rewards credit card’s annual $300 travel credit, but when they arrived at the hotel the only room available had one bed instead of the 2 beds they had booked and wanted. That stinks. In response, another group member said “This is why the Capital One travel credit is worthless”. Having seen this type of situation and response before with many other credit card perks, I couldn’t help but think to myself “stop trying to cut your steak with a butter knife”.

Here’s what I mean by that: Imagine someone trying to use a butter knife to cut a steak and then exclaiming that “this knife is trash” or “this is a worthless knife!” because it wouldn’t cut through the steak. Would you throw the butter knife away? Of course not. You’d recommend that they get a sharper knife for the steak and use the butter knife on butter. It’s not that the butter knife is worthless, it’s that it isn’t a good fit for cutting steak. It’s a matter of understanding the ideal use(s) of the tool in question and then applying it to those situations rather than getting upset about the fact that it won’t work for the wrong situation.

The Capital One Travel Credit is an example, though far from the only one. The person who posted about her experience led by recognizing that she knows they “shouldn’t have” booked through the Capital One portal, but she was looking for help with a remedy. To be clear, if you’ll allow me to continue my analogy, the person who posted the initial story recognized that they were using a butter knife and just hoped that the steak would be tender enough. When it wasn’t, they looked for a remedy. I don’t criticize that decision — sometimes you take a swing and miss. That’s fine if you recognize when you’re taking a chance, but it’s good to consider benefits and drawbacks of using a perk in one way or another.

For instance, in this case, the reader was booking a trip during spring break and needed the extra bed since they were traveling with a teen that was going to be uncomfortable on a couch all week long. If we play Monday morning quarterback, we can say that if you value the sleeping arrangements and you’re booking during a peak travel period, you should book directly with the hotel in that case to maximize the chance of getting what you’ve paid for paid for. The hotel is likely more inclined to accommodate those who booked directly and less inclined to care about customers who booked through a comparison portal since “those customers aren’t “loyal” anyway”.

It’s unfortunate that we have to play Monday morning quarterback on that. It’s frustrating when credit card benefits aren’t as easy or seamless to use as we’d like. But reading the story and another group member’s response about the credit being worthless made me think about how to use things like the Capital One Travel credit to as much benefit as possible with the least potential for frustration, so with this post I wanted to put together some common frustrations and how to alleviate them.

Tips for using the Capital One annual $300 travel credit

My preferred uses of this credit from most preferred to least preferred would be:

- One-night airport or road trip hotel stays. I think this credit is best used when you don’t care about your room or benefits. I usually find myself in this situation a few times a year either traveling by myself for work (like going to a conference) or even with the family when we just need a place to sleep with an airport shuttle. Two or three of those nights per year, which I may ordinarily book with points but could just as easily book with this credit, wraps this one up.

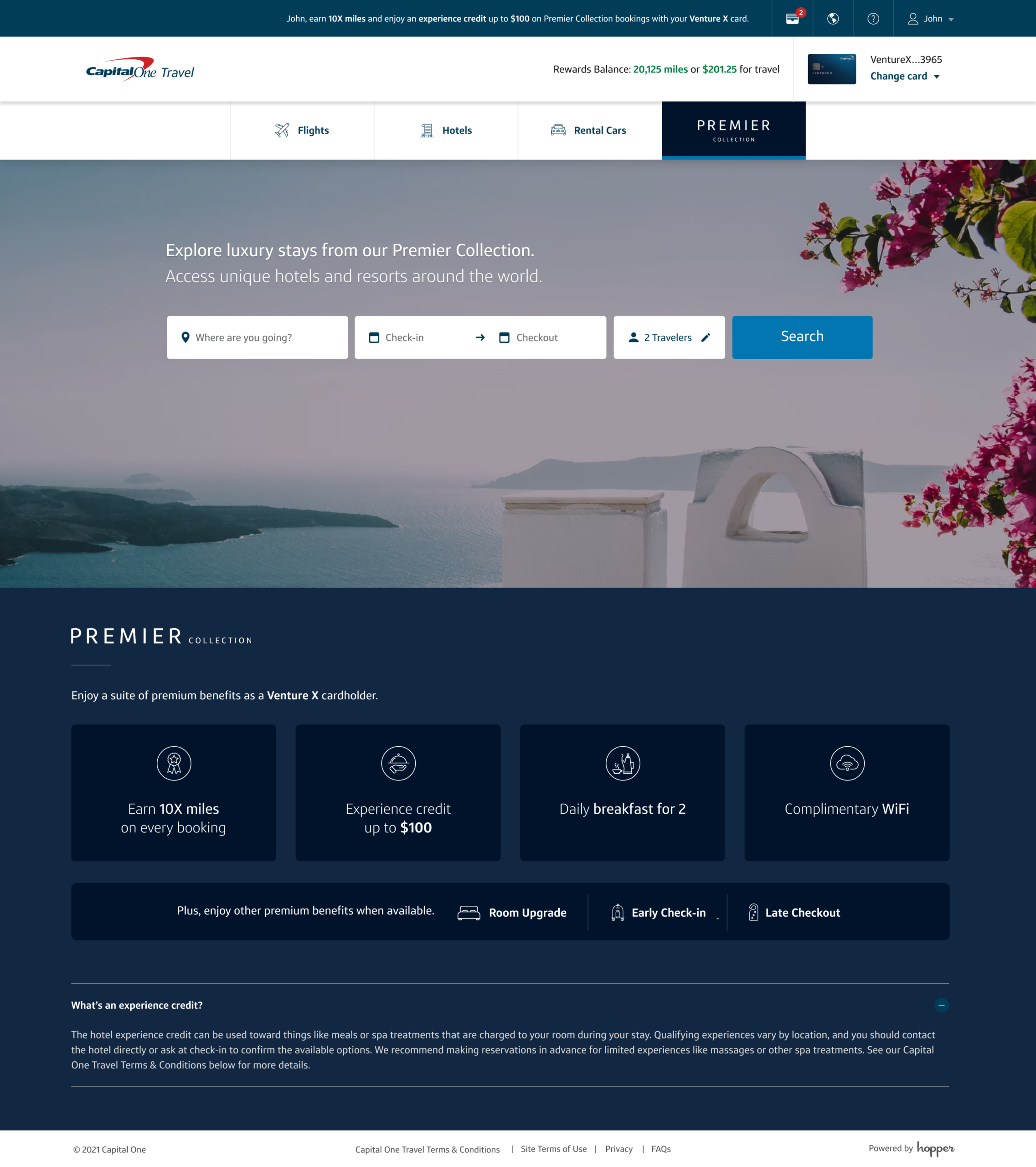

- Capital One Premier Collection booking. This is Capital One’s version of Amex Fine Hotels & Resorts, so bookings come with free breakfast for two and a $100 property credit type of amenity. At these types of properties, you’re very likely to get what you reserved or better and the win can be compounded with free breakfast and a credit that may be used for a free lunch or dinner, too.

- A simple domestic flight booking during non-winter months. Ever since pandemic cancellations, people have been very hesitant to use travel credits for flights. Given the overall low odds of irregular operations (that’s why they are called irregular), I feel comfortable using a credit to book a domestic flight, especially a simple nonstop during a month without frequent weather issues, etc.

I would be hesitant to use this credit on a multi-night stay (where getting the wrong room type or perhaps a sub-par room would matter more). I would equally be hesitant to use it on a car rental booking since I rarely find a credit card portal to have the best pricing.

Similarly, I wouldn’t use this credit if things like elite credit and elite benefits mattered since you typically get neither when booking through a third-party online travel agency. I would be much more likely to use this credit on a hotel where everyone gets free breakfast and there aren’t many upgrades available (like a Hampton Inn, Fairfield Inn, TownePlace Suites, etc).

It’s still possible to run into the same type of problem with a hotel that is unable to honor your chosen room / bed type, but I’d rather only have to deal with that for a night rather than having that be the arrangements for a week-long vacation.

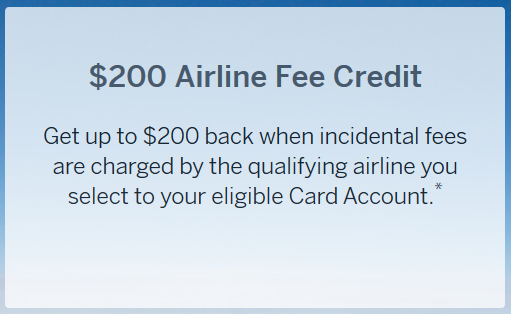

Tips for using airline incidental fee credits

Years ago, it was possible to use some types of airline incidental credits to buy gift cards with some airlines. Ever since that stopped working, some have bemoaned the need to “jump through hoops” to use various airline incidental credits.

However, rather than focusing on an item you can’t buy, it makes more sense to focus on things you can buy. If you don’t have a need to travel immediately, we know that some cheap airfares (less than $100) have been known to trigger airline fee credits. Now that some airlines give you a credit that never expires when you cancel a ticket and given that in some cases you can transfer that credit to anyone, it should be very easy for many people to use those airline fee credits. See the post: Amex airline fee reimbursements: What still works? That post focuses on using Amex airline fee credits because those tend to be the most restrictive. If you have a Bank of America Premium Rewards card or Ritz-Carlton Visa Infinite, almost anything may trigger the credits on those cards (almost any airline charge seems to work on the Bank of America Premium Rewards card and depending on the agent nearly any travel-related purchase might work on the Ritz card).

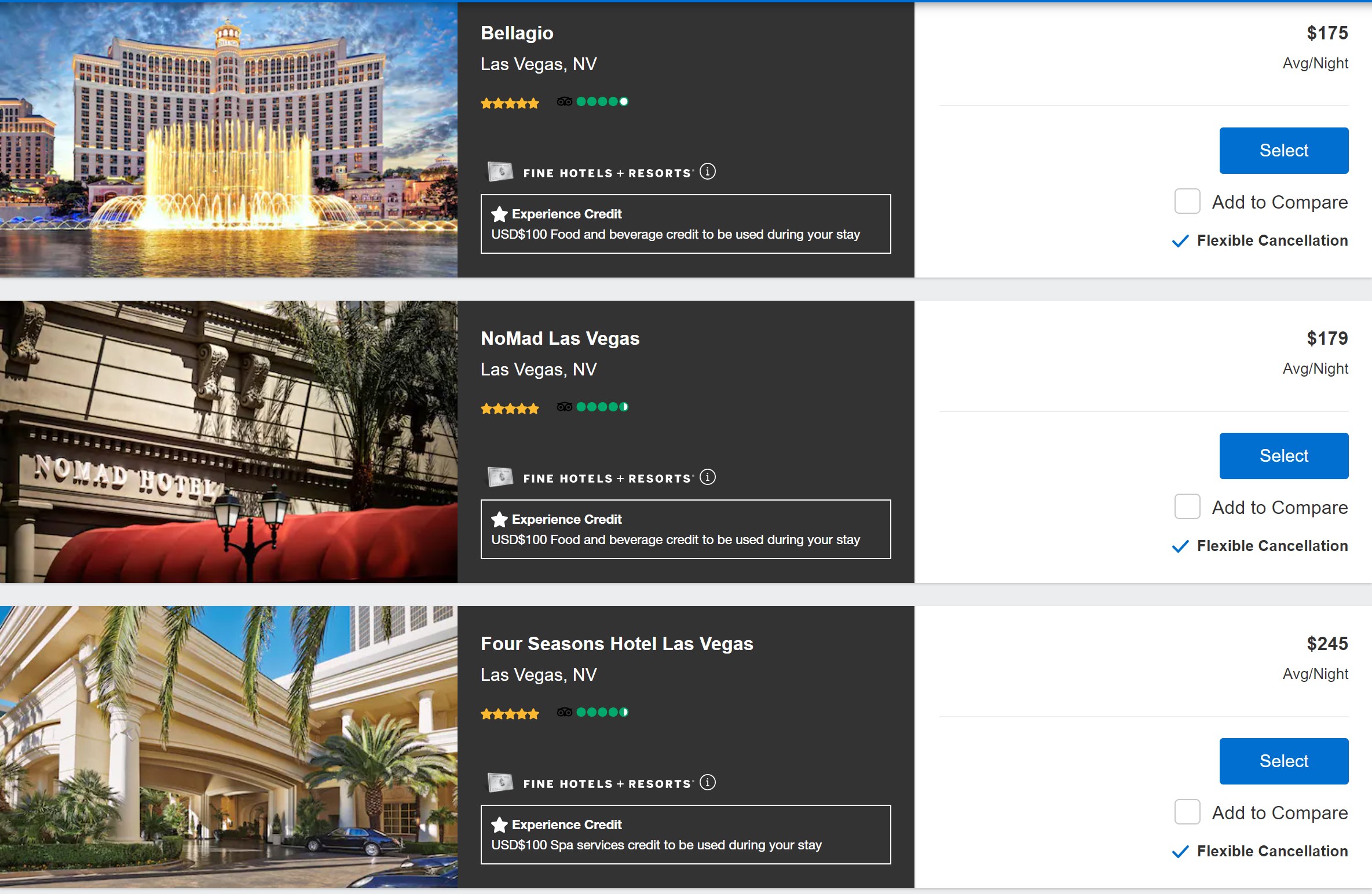

Tips for Amex Fine Hotels & Resorts credits

If you’re focusing on cities like New York and London for Fine Hotels & Resorts credits, or you’re looking to travel to other luxury hotels during peak travel seasons, you’re not likely to find anything that can be covered entirely by the American Express Platinum Card’s® annual prepaid booking credit. Instead, try these things:

- Avoid the biggest US cities (for the most part). Places like New York City and San Francisco tend to offer high prices year round and probably won’t be great places to try to use your FHR credits if your goal is to stay for as close to free as possible.

- Consider off-peak travel periods. Chicago can sometimes have reasonable FHR pricing in late fall and winter months. Shoulder seasons can often be a good time to travel in terms of pricing and availability in general and that certainly applies to finding FHR bargains.

- Consider markets known for offering luxury on a budget. Places that come to mind are Las Vegas, Dubai/Abu Dhabi, and Bangkok. Cities like those tend to have a lot of competition for reduced-price luxury, which opens the door to value pricing on FHR properties. Keep in mind still peak periods: Las Vegas can be very cheap from Sunday to Thursday and very expensive on Friday and Saturday.

- Find your own Fine Hotels & Resorts deals. <-Use the techniques in that post

Tips for getting good elite member treatment

All of us have been a “Diamond Guest” and been disappointed with the outcome on at least a few occasions. Not all hotels deliver equally on elite benefits like upgrades. To increase your odds of getting great elite recognition:

- Don’t book where everyone else is booking. Or at least, don’t expect to book the top 5 Hyatt properties in the world according to blogs X, Y, and Z and expect to be the only elite member checking in. I recently checked in to a popular Hyatt and the front desk person told me they had sixty six Globalist members checking in that day. If you’re the 30th or 40th or 50th Globalist member to check in, don’t be surprised if there isn’t a suite upgrade available at check-in.

- Consider traveling at off-peak times and/or to out-of-the-way places. This is probably obvious, but elite recognition is likely to be better when you aren’t competing with sixty-five other Globalists.

- Look up reviews written by elite members. When I scan Google reviews or TripAdvisor reviews, I’m often looking for terms like “Diamond”, “Platinum”, or “Globalist” as many elite members will specifically note their experiences with elite benefits, which gives me an idea of what to expect. I also figure that those with elite status have a wider range of comparison points when it comes to reviewing other features of the hotel.

- Email the hotel in advance. When a stay is important to me, I’ll sometimes look up the name of the general manager in advance and email with a couple of requests and/or a specific room type I’m hoping to be able to get. Most chains follow a standard email address format (like firstname.lastname at hotelbrand dot com), so it can be easy to deduce someone’s email address. I try the general manager assuming that he or she will not be the person to handle the request but rather than when the person who actually does handle the request gets a message from the general manager saying “handle this”, the odds of a good outcome generally increase. Similar tip: try Marriott chat.

- Be nice. The old saying “you catch more flies with honey than vinegar” is true. Approaching requests for upgrades in a friendly way leads to more success than being combative about what one is entitled to receive.

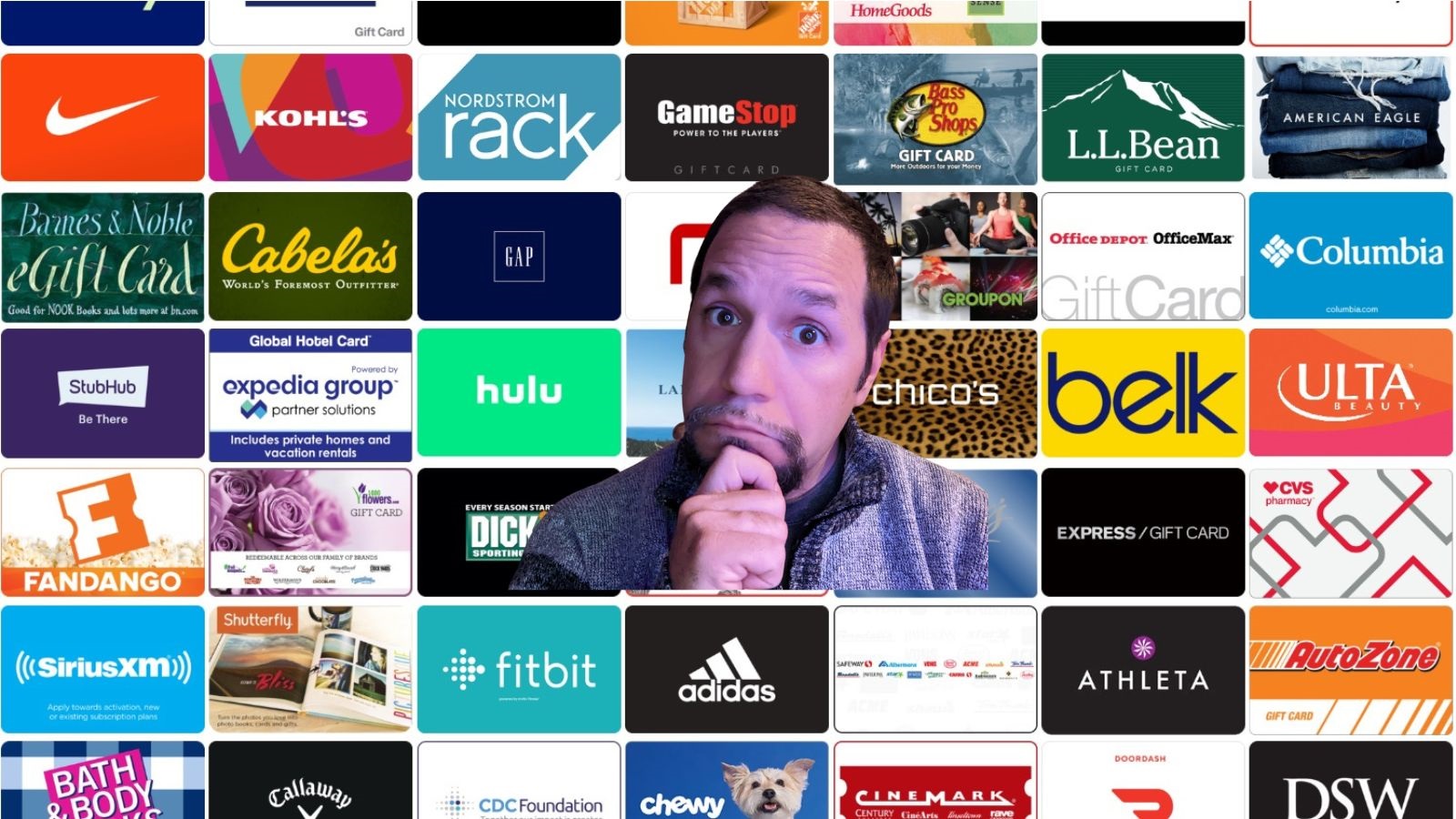

Tips for getting good value out of Capital One Shopping rewards

Capital One Shopping is a public shopping portal (no Capital One card required) that has been offering some amazing portal payouts. The frustrating thing is that you can only redeem your portal rewards in the form of gift cards. Here are some tips:

- Shop outside your comfort zone (buy stuff from included retailers). This tip seems silly, but given the wide range of included merchants, it should be possible for many people to find things they need at included stores even if they aren’t the normal go-to sources. For instance, I usually buy paper products at my local grocery store, but Lowe’s carries things like paper towels, paper plates, and that sort of thing. Similarly, eBay carries plenty of household essentials that I could buy there. You may discount the value of the rewards a bit for the inconvenience (or increased cost) of “shopping outside your comfort zone”, but I think there are enough cases where you could adjust habits, discount the value, and still come out pretty far ahead.

- Buy travel. I don’t typically like to book through a third party website like Hotels.com, but as long as I’m earning 18% back at GiftCards.com (a targeted offer that’s been available on my account for a while), I’ll accept that the margin for gravy rewards is high enough that there will probably be some Hotels.com and paying for breakfast in my future. I’ll also redeem for DoorDash and GrubHub and probably take care of some of that breakfast food that way.

- Sell gift cards. I urge some caution here, but if you really don’t want to buy anything form any of the included retailers, you can probably redeem rewards for gift cards to some of the included brands and sell them for 85-90% of face value to gift card resale sites. I urge caution because I could imagine you running into problems if you go at that unrestrained.

Bottom line

Things don’t always work out the way we hope when leveraging credit card perks and elite benefits. Sometimes, that’s out of our control and other times we may accept the risk of an ideal use of a credit or benefit since it’s our only chance to use it — you may not be able to travel during an off-peak period or may not have many opportunities to use a travel credit. In those cases, it is sometimes tempting to think one benefit or another isn’t worth much. While I think it is important to recognize when a benefit isn’t a fit for your needs, I think in many cases it’s a matter of finding the way to increase odds while recognizing the confines of the benefit. No, you’re not going to get a luxury hotel in New York City on a weekend during a school holiday for $200 a night, but I enjoy looking for the loopholes where I can squeeze value out of things like that. Sometimes that means adjusting my plans for a benefit, but one of the things I think I’ve come to enjoy the most about this game is the chance to pivot and find what works rather than focusing on what doesn’t (it’s more fun!). When that doesn’t work, I’ll know that a benefit just isn’t for me — but in a lot of cases, I’ve been happy to find an alternative that does work when my first choice doesn’t.

I almost always agree with Nick, but not this time.

I think either cap one or the hotel is on the hook for this screw up. You can’t blame this on OP and most of the time, they would make it right for him.

I also think using this for car reservations is a good use of the credit… I found it was better than any comparable option for a Hawaii weekly rental, but the bigger point is: it’s hard to get many free auto rental days. I don’t see why it makes sense to use it for something you could get free, rather than something you’d otherwise have to pay for.

In other words, don’t bring a butter knife to a steak fight.

At what point do we question why the OTA can sell me a steak knife and buried in the T&Cs is the caveat that they can actually deliver me a spork? This is one that I would definitely go back to CapOne travel and ask them what they are going to do to make it right. They want this portal to roll with the big boys (direct booking), they need to stand behind their word like the big boys.

I am 0 for 2 on CapOne Travel hotel bookings going off without a hitch, but their customer service was top notch in resolving my issues when I called.

With all these caveats and limitations for using the credit, are you guys going to revise your prior implications that this travel credit is worth face value?

From your prior write-up:

“Venture X pays for itself: The card has a $395 annual fee, but it includes $300 in statement credits annually for bookings made through Capital One Travel, and 10,000 bonus miles each year upon renewal. That combination means that we can easily get $400 in value per year to justify the card’s $395 annual fee even if we don’t use the card in any other way.”

For the purpose of calculating First Year Value on our credit card pages, we estimate the travel credit at 90% of face value. I think there are enough easy tricks to get full value that 10% off is enough of a fudge.

I’ll also add to this that the 10,000 anniversary miles are transferable points, so they are clearly worth more than 1c each. Our current RRV is 1.45c, which makes the 10K anniversary miles worth $145 — so if you get at least $250 worth of value out of the $300 travel credit (or substantially more value out of the anniversary miles, like using 7500 points transferred to Turkish for a ticket to Hawaii or Alaska) then the card does indeed pay for itself.

In general, what do you think of diverting domestic flight cash bookings to the C1 portal? I recently booked flights (nonstop one-way) via the portal to use my $300 travel credit and was pleasantly surprised to receive an email telling me I also had $100 travel credit in my account (separate to the $300 credit) because the price of the flights had gone down and C1 offers price drop protection. It got me thinking whether it would be a worth booking more flights this way in general even though I’ve used up my annual $300 Venture X credit to take advantage of the price drop protection.

On road trips and flights, C1 is going to be my plan D or E. I’d much rather book a 5k hyatt or earn crazy points and cashback at a wyndham or ihg. And again, for me personally, FHR style bookings are even lower. Don’t get me wrong, these are some of the best ways to burn that credit, but it never feels optimal.

Where I personally think it could become plan A is in remote locations without chain hotels, like national parks. There’s almost never any benefit to booking direct which often has a worse experience, they aren’t on shopping portals, they’re not in FHR/THC, and they don’t give you 14%+ back in points. I see they’ve got the Death Valley Inn available and the lodge in Big Bend is at least listed. These might be new as I don’t remember seeing Death Valley when I visited in January.

Overall, I’m tempted to value the $300 at $150. I’m likely to use it sub optimally (<90% value) just to liquidate it and there’s the time/value of money to consider. But the rest of the ding comes from how annoying it is, to figure out when to use it, to understand their refundable fare gimmick, to search on yet another site, to deal with fallout if something needs changed, and so on. It’s a lot of effort for something you’ll hopefully only use once per year.

If you can identify situations where C1 is not merely passable, but predictably preferred, that changes the economics drastically and it becomes full value.

More than 3 years ago, Capital One announced a new lounge at IAD airport. 3 years later, its a construction site. 3+ years !

Capital One is an untrusted travel partner.

The announcement for this lounge was in February of 2020. I think you can probably guess why this lounge hasn’t opened on the schedule originally expected.

This strikes me as a bad take. This would be fair if they booked the one bed room and were hoping for an upgrade. Instead, it sounds like they booked the room they wanted and the hotel didn’t honor it. They ordered the steak knife and were given a butter knife instead.

Would the hotel be more likely to honor a direct booking? Maybe, but I don’t think it’s unreasonable to expect that you get what you booked via an OTA. And if it is in fact true that you can’t trust a Capital One travel booking to be at least as good as what you booked, that does diminish the value of the credit.

I agree it comes down to details here. If they wanted an upgrade, were trying to vie for a better room, etc., sure, a non-direct booking is the wrong tool for the job and won’t maximize those odds.

But if they specifically booked the exact double bedroom they wanted and were merely asking for the thing that was printed on the reservation, a card’s ability to goose out extra benefits is a separate discussion.

I’m sure somewhere deep in the T’s and C’s, room type is not truly guaranteed, but as a matter of consumer practice, it’s pretty reasonable if you booked a double room to show up thinking you’ll get it even if you “paid incorrectly.” Its like the Seinfeld episode.

As a matter of practice though, I fully agree that I only use portal bookings for either FHR type stuff, or low-stakes, low-needs situations, like a nonstop 1-hour flight or an overnight on a road trip.

I’m definitely not excusing them not getting the bed type they’ve reserved nor blaming them for not getting what they paid for — that definitely falls on the OTA (Capital One Travel in this case) and the hotel. But I think it is very common that bookings made through Expedia / Priceline / et al get the lowest priority in terms of room type / upgrade / etc. When I book through any third party like that, I obviously do expect to get the bed type I reserved, but I also expect to get the view of a brick wall / the room on a low floor / with an awkward layout / etc. And on more than one occasion when I’ve booked through an online travel agency, they’ve not had my bed type available at check-in. It’s not that you can’t trust Capital One Travel, it’s that most hotels do not prioritize those bookings in terms of guaranteeing anything.

I agree 100%. Any defense is simply an excuse… the lady that booked the hotel should have gotten what she paid for, or been offered something better than she had booked (as long as that was acceptable to her).

This constant excuse making is what has allowed hotels, resorts and even airlines to get by with so much crap…. lack of open lounges, lack of simple housekeeping, resort fees continually added and increased, destination and other junk fees.

I agree with this. The technology exists to sell “bed type not guaranteed” rooms and, if that’s what’s on offer, that’s how they should be sold.

If C1 sold a particular bed type and didn’t reserve that with the hotel, it seems they owe the guest something for not having delivered what they sold. If they did reserve the correct bed type and the hotel didn’t come through, it seems like they hotel is on the hook for something.

All that said, if a place is full and you get there late you may need to be flexible. Still, someone’s at fault here and it doesn’t sound like it’s the guest.

I like USB Altitude because direct travel works to trigger travel credit, no need to go through a portal.

If only they had X-fer partners!!!

except…Capital One told you they would give you a knife for your dinner, but didn’t tell you what kind of knife they would give you

Good comparison!

Hey Nick, I think the last sentence under the section, “Tips for using airline incidental fee credits” got cut off.

You’re right. I fixed that — sorry!

Interesting take! I’m about to use a Card travel portal to book a 5 night stay in a city without any other good points options. We’re a couple who doesn’t really care what the room looks like – and booking this way will allow us to get closer to the city center than we would have otherwise, and gives us much more flexibility with budget. I do plan to call the hotel after making the booking to confirm it went through. While it’s definiitely not the highest use of points, I honestly don’t mind – I will have more money for fondue and pasta. I think Nicks’ recommendations are good here though, and a good analogy

I would also add rental car as a good option for the Capital One Venture X travel credit

I would tend to disagree for several reasons:

1) You can’t use any discount codes at all. No AAA, no Costco membership, no corporate code or affiliation, no airline partnership.

2) Because of #1, you are almost guaranteed to be paying more for a rental car booked through a credit card portal over other options. You’re very very likely better off using Autoslash.

3) The ridiculous portal payouts from Capital One Shopping amplify how much you can save by clicking through a portal and then booking directly. I’ve recently had offers for 30% back at Hertz or Dollar and I got an offer two days ago for 15% back at Avis.

More about this topic in this post, where you’ll notice situations where Capital One is charging hundreds of dollars more for the same few-days-rental over what you’d pay elsewhere. https://frequentmiler.com/shopping-for-car-rentals-comparison-results/

Obviously if you find a situation where prices are close, then going through Capital One to use your credit might make sense. But I expect those scenarios to be few and far between.

I also use for car rentals, primarily because I find it is the one travel expense I almost always pay with cash. To Nick’s point, you aren’t getting 100 cents on the dollar, but I like doing this versus not getting elite credit at Hyatt (for instance).

Yes, that makes sense. I can imagine where that trade off could make sense. Unfortunately, in many cases, I found that the Capital One Travel portal cost hundreds of dollars more than my best alternatives for car rentals just for trips I’m planning this year (though I think I have one example scenario where it’s something like $240 vs $220, which is a time when what you’re saying makes sense).

It’s sort of like the Citi Premier travel credit. Sure, it’s $100. But, you’d never capture it because you’d never use Citi’s portal to book. It’s simply too expensive.