NOTICE: This post references card features that have changed, expired, or are not currently available

I signed up for the Citi Prestige card in September, 2014. Back then, it was much easier to get Citigold status and so I locked in a $350 annual fee. Until this month, the fee never increased despite my having let my Citigold status lapse. Today, you need $200,000 invested with Citi in order to be granted Citigold. If you do so, you too can get the Prestige card for only $350. For everyone else, the annual fee is now $495. And Citi has stopped grandfathering me into the Citigold pricing. Late last week the new $495 annual fee appeared on my credit card statement.

I signed up for the Citi Prestige card in September, 2014. Back then, it was much easier to get Citigold status and so I locked in a $350 annual fee. Until this month, the fee never increased despite my having let my Citigold status lapse. Today, you need $200,000 invested with Citi in order to be granted Citigold. If you do so, you too can get the Prestige card for only $350. For everyone else, the annual fee is now $495. And Citi has stopped grandfathering me into the Citigold pricing. Late last week the new $495 annual fee appeared on my credit card statement.

Citi has radically changed the Prestige card multiple times since I signed up five years ago. Earlier this year, they implemented a number of changes, some good, some bad. On the good side, they added 5X earnings for flights, travel agencies, and restaurants; and they made the $250 travel credit much easier to earn; and they made points easier to cash out at 1 cent each. On the bad side, they ruined the 4th Night Free hotel benefit, took away increased point value for flights booked with points, and increased the standard annual fee from $450 to $495. You can read about those changes here.

To me, the card changes were a mixed bag. I hated losing the 4th Night Free benefit in its previous form, but I loved the ability to earn 5X worldwide for dining and airfare. Then, in one fell swoop, Citi dropped all of their valuable travel and purchase protections. Car rental insurance: gone. Trip Cancellation & Interruption Protection: gone. Travel Accident Insurance: gone. Trip Delay Protection: gone. Price Rewind: gone. 90 Day Return Protection: gone. Missed Event Ticket Protection: gone. You get the picture.

With the end of travel and purchase protections, my subjective value of the Prestige card plummeted. It had been my go-to card for all flight purchases, but now I’ve reverted to booking travel with my Sapphire Reserve card. Yes, it means earning 3X Ultimate Rewards instead of 5X ThankYou points, but it’s a trade-off I’m willing to make in order to insure my travel purchases. The Sapphire Reserve already had better travel protections than the Prestige card, but now of course it’s no contest (see our coverage of Ultra-Premium Travel Insurance here). A reader pointed out to me that I could have my cake and it it too by buying airline gift cards with the Prestige card to earn 5X and then when booking travel use gift cards plus put a small portion on my Sapphire Reserve. That would work since the Sapphire Reserve covers you even if you only pay part of your travel with the card, but honestly I’m not likely to go to that much trouble.

Other readers have asked why I care so much about travel protections. Surely I pay for travel insurance separately anyway, right? Um, no. I’ve never paid for travel insurance, or any kind of insurance or extended warranty that wasn’t required by law. I think of such things as a gamble: the only way to win is for something terrible to happen. I’d rather not bet on disaster. Still, I find that I’m willing to “pay” a little bit for travel insurance peace of mind by giving up the Prestige card’s extra 2X points. If you regularly pay for travel insurance, then of course it makes sense to continue to use the Prestige card to purchase airfare.

Time to break up?

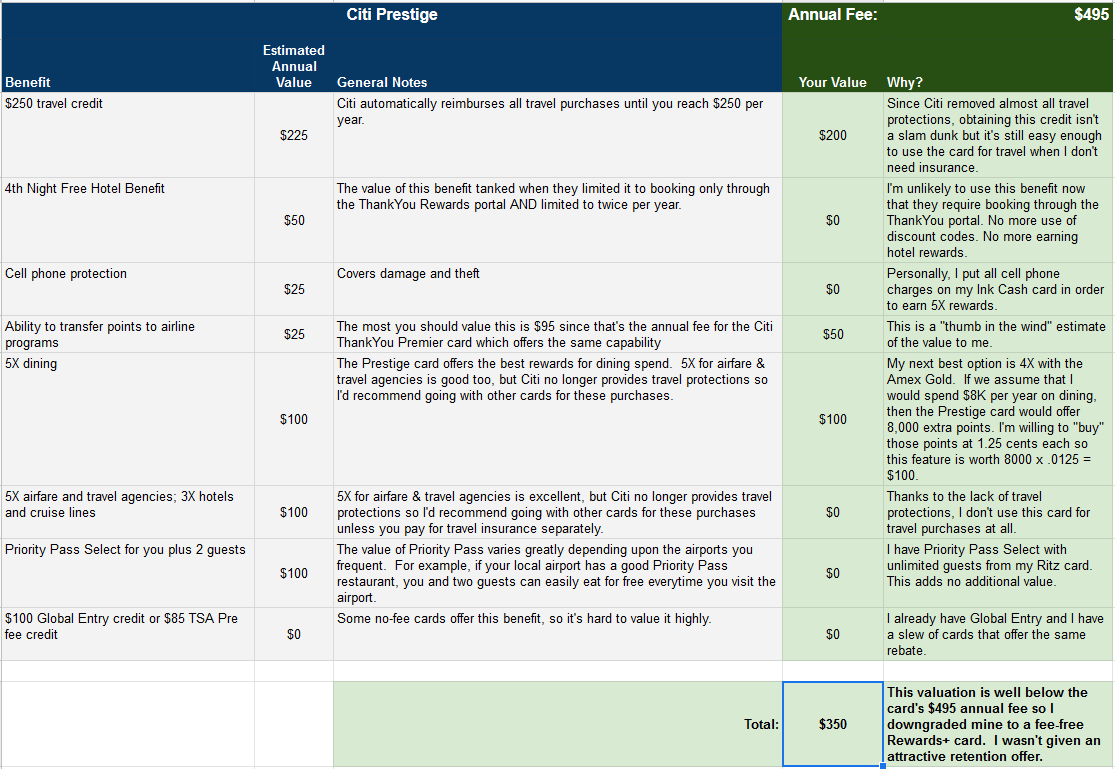

Now that I no longer use the Prestige card for flights and now that I know that I’m no longer grandfathered into the old $350 annual fee, it was time to reassess my 5 year relationship with the card. I turned to my Ultra Premium Credit Card Value worksheet (see: Which Ultra Premium Cards are Keepers?) to figure it out.

Using the spreadsheet, I estimated that the card was worth paying $350 per year (note: everyone should come up with their own valuations!). Clearly it’s no longer a keeper for me. Time to call and cancel…

Retention Offer?

I didn’t really think that I was going to give up my Prestige card. I figured that I’d get a nice retention offer to made it worth keeping for at least another year. So, I called Citi, waited until I got a human on the phone, and then said that I wanted to cancel the card (if you tell the computer, there’s the risk that the computer will abruptly cancel the card with no recourse). As expected, I was transferred to a retention specialist.

I explained that I didn’t want to pay the annual fee due to the loss of travel & purchase protections. Unfortunately, all the specialist could do was read off the retention offers loaded to my account. And, sadly, they were awful:

- $50 statement credit with $9,000 spend: Spend $3,000 per month for three months in order to get $50 back.

- 10K points with $9,000 spend: Spend $3,000 per month for three months in order to get 10,000 bonus points.

Both were awful offers, but 10K points is the less awful of the two since worst case is that 10K points can be cashed out for $100. Still, that’s a huge amount of spend for such a paltry bonus. Note that there was some confusion about whether I’d get $50 or 10K points every month for three months or just once. The agent put me on hold for quite a while and returned to say “just once”. Was she right? I don’t know, but I don’t think I would have made a different decision either way.

I said no thank you to both offers and asked to downgrade to a no-fee ThankYou card instead. That’s the best way to keep points alive when ditching the Prestige or Premier card. Citi offers two no-fee ThankYou cards: ThankYou Preferred and Rewards+. The Rewards+ is the much better option if you don’t already have it (see this post for details). I already have both no-fee cards, so I didn’t have a preference. The agent suggested the Rewards+ card, so I said OK.

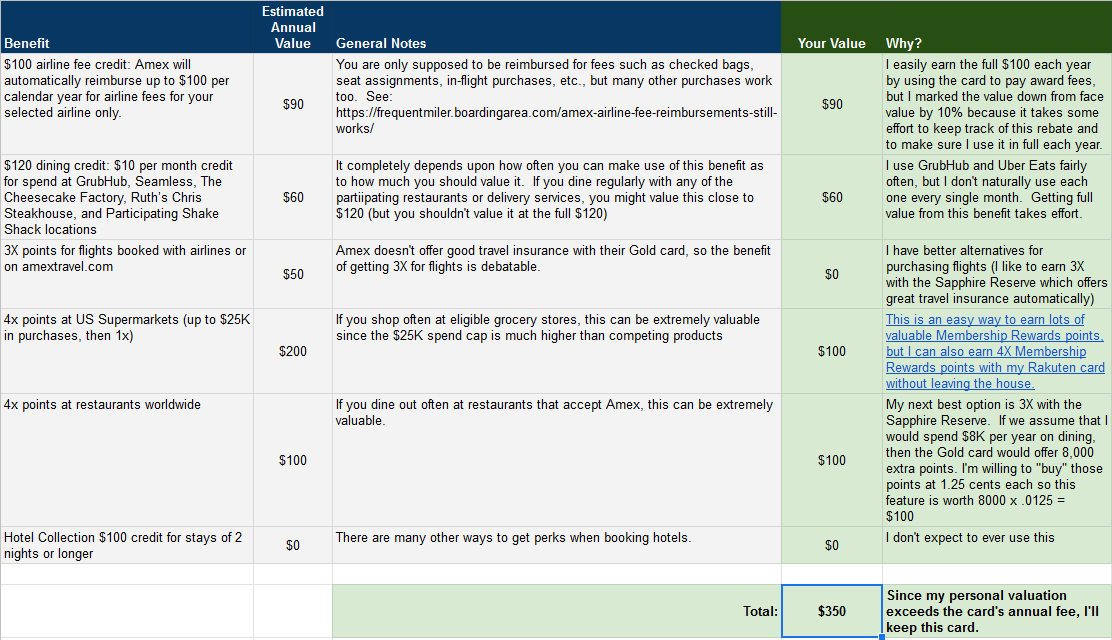

Reassessing other cards

I then went through the spreadsheet to update my valuations of other cards. This was necessary because some of my valuations were low due to the assumption that I would get 5X for flights and dining from the Prestige card. The biggest change for me was my valuation of the Amex Gold card. Previously, I valued the card at $250 per year which happens to be the same as the annual fee. At that point I was leaning towards cancelling the Gold card since it didn’t offer more benefit than cost. Now, however, my dining purchases will go on the Gold card and so I assigned value to the card’s 4X dining benefit. Given that I ditched the Prestige, Amex Gold is now a keeper.

Using my ThankYou points

Citi ThankYou points can be incredibly valuable when transferred to airline programs for high value awards. For examples, see: Citi ThankYou points sweet spots. In order to transfer points to airline programs, you need either the $495 Citi Prestige card or $95 Citi Premier card. Currently I have neither.

I’m currently sitting on over 800,000 points with no direct way to use the points effectively. But I do have two indirect options:

- My wife has a Citi Premier card. When I’m ready to transfer points to an airline program, I can share my points with her for free and she can transfer those points to airline miles. The only real downside to this approach is that the miles then end up in her airline loyalty program rather than mine. And that only matters in cases where I already have miles or where I have elite status and so there may be benefits to booking from my account (such as lower change fees). In most cases, this option would be fine. Note though that there is a 100K per year cap on moving points to another person, so this option has that additional limitation (H/T Ray)

- I can upgrade one of my no-fee ThankYou cards to the Premier card. In the past, I’ve often received offers to upgrade my Preferred card to the Premier card. These offers included the first year free. Next time I see this offer, I’m inclined to accept it. Or, if I have immediate need to transfer points to miles in my own account, I should be able to upgrade at any time.

Wrap up

I’m a bit sad to end my five year relationship with the Prestige card. Is it weird that I get emotionally attached to credit cards? Wait, don’t answer that. I know. Yes, it’s weird. So, it’s weirdly sad, but at the same time I’m confident that it was the right decision. Will Citi enhance the Prestige card to make up for the loss of travel and purchase protections? Perhaps, but then I can always upgrade back to that card if it makes sense.

Coincidentally, dropping the Prestige card came closely on the heels of my decision to cancel my CNB Crystal Visa Infinite card. In quick succession, two ultra-premium cards are out the window. I think it’s time for me to do a new “what’s in my wallet?” type of post. Look for that soon.

[…] was of course writing about dumping his Citi Prestige card. In the months since, I’ve been searching for ways to justify keeping mine. Part of me has […]

Bummer, no retention offer for me on the Premier for the first year. Downgraded to the Rewards+. Guess I’ll just upgrade when it’s time to use my points balance as I don’t have an immediate need to book travel yet.

I don’t disagree with your analysis. Citi has destroyed the Prestige and made it into a joke. I will cancel next year when my renewal is due.

A counter to the GC workaround is that primarily only US-based airlines have GCs. International itineraries seemingly are more likely to trigger the insurance conditions and travel I’d value the protection more. So unless sufficient amount of travel is domestic / you can accept the booking avenue limitations internationally the workaround produces less incremental value.

I know I will hear about it, but I downgraded my Chase Sapphire Reserve to a no annual fee card two months ago and cancelled my Amex Platinum card today. I was approved for the Citibank Prestige card a month ago. Waiting exactly 25 months after I closed it last time. Paying $550 and $350 just stopped making sense even after the credits that I did use. Too many redundancies with the premium cards. The points to airlines transfer bonuses on Virgin Atlantic, Avianca Lifemiles and others are way more valuable to me than travel or purchase protection and insurance that CSR or Amex Plat offered. PS. I am going away next week to two European cities, first class on Lufthansa going out and business class on Swiss Air coming back thanks to the Avianca Lifemiles 25% transfer bonus from Citi and Avianca Lifemiles 15% transfer bonus from American Express.

Ravi

No well done I’m going the other way will drop Prestige then get some other card for the sign up . I just added up my AF $1000 per year not cheap . Perks are nice both doubles so I think I’ll come back to Citi 25 months from the day too . I think I have the right idea.

CHEERs

I really think you’d keep the same card number – it’s a Prestige > Rewards+ downgrade, same family. These frontline CSRs can’t be trusted as we all know. Please update when you actually get the new card

I just downgraded Prestige to R+ in September. Agent said it would be a new number and she was correct. So, likely reset of 24 for me.

I’m CitiGold and will be keeping my Prestige. I will put at least one low risk flight on this card to get the $250 credit. I put my T-Mobile bill on this card for the insurance on 4 phones (also have CIC so -4x is painful but I value insurance more than the URs). I’ve used new version of 4th night free benefit once in 2019 already and I’m guessing I’ll use this once per year going forward at a value of around $250. 5x at restaurants is the icing on the cake for me, I put about $2-3k/yr of personal dining on this card which I value at $200-$300 (balance on Amex Gold).

As CG, I’m easily recouping the $350 fee so I see no reason to cancel and I don’t understand other CG that “don’t see the value”. There’s no more outsized value, but we all knew that wasn’t sustainable. At $495, I might even still keep it, because I have the opportunity to put large restaurant bills on the card for an associated business, which generates 80-100K miles/yr with very little work. I understand this is an uncommon situation though.

I also have the Amex Gold but I find that card to be a complete PITA. I don’t always get 4x for restaurants due to merchant coding, and the airline reimbursement is difficult to use since I generally fly United (Gold) or JetBlue (Mosaic) where I don’t have need to pick seats or pay for bags. Having to choose a single airline is too restrictive in this free agent era. I have to force myself to use the $10/mo restaurant credit before end of month. I’ll probably cancel this if I don’t get a good retention offer.

Darn timely! AF payment due today, Does the 10% rebate for rewards+ redemption only on points redeemed that were earned on that card, or not?

Just told it did not, but they said the account number would remain the same…..from Prestige to Rewads Plus…wish I had taped that convo.

Maybe more of a theoretical question. If you have the Rewards+ and you want to use your points but didn’t want to upgrade to a Premier or Prestige, what’s the ‘best’ way? Booking travel with a 1.00 cpp through the portal?

Do you have access to the options under “More Ways To Redeem” > “Cash & Charity”?

I’ve never used those options because I have the Premier, but the description says you should be able to get a check, mortgage payment, or student loan payment at 1.00cpp. I would do that, or even a gift card cash out, over their travel portal which I dislike.

cashback / statement credit is only .5 cents per point for everything but the prestige (1cpp). You could do a 1cpp to a loan though yes. And most gift cards appear to be 1cpp also

You are right about the Cash Rewards option! Citi was logging me out (they like to do that randomly as I navigate) and showing me the Prestige rate of 1cpp for Cash Rewards. When I log back in and it sticks I see 0.5cpp.

Anyway, yeah, AFAIK the GCs are no better than 1cpp. I just find the travel portal to be on the glitchy, time-consuming side to use, and you usually lose loyalty benefits, so to cash out quickly at equal value of 1cpp I’d rather have the GC. Just my personal perference these days. If you’re willing to spend time and comparison shop you might get lucky and find a deal with the travel portal; usually their prices are the same or slightly worse than elsewhere, but a couple of times I’ve gotten lucky with an inexplicably better price, like on a last-minute car rental the day before.

just to clarify as I have been confused by other people’s posts. If I downgrade the Citi Premier to the Rewards+, do I still keep the points? I don’t have to use them all up for the PC?

EDIT: looks you answered this question several times in this thread, so nvm :). THANKS! To anyone else reading, if you downgrade to a true TY point card like the Rewards+, you keep your points. If you downgrade to a DoubleCash card, you have 60 days to use your points. In either case, if you are given a new account number, your 24 month bonus time resets.

The key reason to downgrade is to not reset your TYP 24 month clock.

Not for me. The reason to downgrade was to prevent my points from expiring. Since they gave me a new card number (according to the agent), my clock was reset.

That’s because you downgraded to Rewards+. If you would have downgraded to Premier or Preferred then your card number would have stayed the same. I asked specifically about this before downgrading, and that’s what CSR told me, which is why I chose to downgrade to Premier…that and I already have a Rewards+.

The CSR may have been right in your case, but I downgraded a Premier to a Rewards+ about a month ago and the card number stayed the same. So whether you get a new card number doesn’t seem to depend (or at least not entirely) on the card you are downgrading to.

Is there a way to know if my card number will stay the same?

The Citi CSR will tell you whether or not the card number will change as part of the disclosures at time of product change.

I tried to downgrade my Prestige to a Preferred and was told the card number WOULD change.

Earlier this year, I downgraded a Premier to a Rewards+ and the card number did NOT change.

Perhaps in order to go from Prestige to Rewards+ or Preferred without resetting clock, you would have to downgrade first to a Premier and then downgrade again to either Rewards+ or Preferred.

There’s no set rule that I can figure out. I’ve done the exact same product change and once it resulted in a new number and once it did not. My guess is that if you had a second Premier card and tried to downgrade it to a second Rewards+ your number would change.

I tried to downgrade my Prestige to a Premier and it was the same result as trying to downgrade to a Preferred or Rewards+: the card number would change.

Along with my Prestige, I only have a Rewards+ and Access More.

I wonder if Citi is saying the card number would change when in actuality it wouldn’t change if I went from Prestige to a Premier or Preferred since I don’t have those?

I don’t think so. If they say the card number will change it probably will.

It doesn’t make sense. You compared the additional marginal value of Citi Prestige vs. best of all other cards, while you compared that value to the FULL annual fee of Citi Prestige. Sure, 5X dining is only a little better than Amex Gold’s 4X, but you didn’t get that 4X for Amex Gold for nothing, right?

I think you’re right, but there’s an interesting chicken and egg situation going on…

The way I fill out the spreadsheet (and the way that I recommend others fill out the spreadsheet) is to start with the cards you are sure you’ll keep. Then, when you move to the next cards, put in how much you value just the extra benefits they offer. A simple example is with Priority Pass. If you have a card that offers a good version of it and you plan to keep that card, then assign full value of Priority Pass only to that card. All other cards should be assigned zero value for that feature. The purpose is to see if these cards offer enough extra value over whatever else you have to be worth paying the annual fees.

With the Amex Gold 4X dining bonus, for example, I compared to 3X with the Sapphire Reserve (which I know I’m going to keep) and decided that it offers $100 per year extra value for that feature. As I think you’re arguing, I should have done the same withe the Prestige and compared 5X to 3X in order to get a $200 valuation. Instead, I updated my Prestige valuation a final time AFTER updating the Gold valuation. So, I saw that I was going to keep the Gold card and so I compared 5X to 4X and determined that the Prestige only offered $100 extra benefit (instead of $200 if I had compared it to the Sapphire Reserve).

Fortunately, for me, even with a $200 valuation for 5X dining, I wouldn’t have kept the Prestige, but it’s an interesting problem to consider:

If you’re trying to decide between two cards that offer similar benefits, then I think you’re right that it makes sense to compare to whatever your base level is (in my case, Sapphire Reserve). But once you decide to keep one of those two cards, doesn’t it make sense to base other assessments on the idea that you already have that one card?

I see what you mean. The comparison was based on the fact that, for various reasons, one has already decided to keep card A/B/C, then thinking the marginal benefits that Citi Prestige provide. My point was more about if we are just trying to fairly compare two cards, one should compare the marginal benefits to the DIFFERENCE of the annual fees of the two cards, rather than just (the Prestige’s annual fee – $0). The table presented was especially unfair against the Prestige IMO, as you are pitching Prestige against almost the best of many other cards, while assuming $0 fee for other cards.

I definitely echo your frustration about the benefits though; I have a feeling (or maybe just silly hope) that this is a gap now that they are transitioning to something new and better? It really doesn’t make sense to have such slim benefits for a premium card. I remember it used to be Visa/MasterCard providing a lot of those benefits; I wonder if there were broader changes at the Visa/MasterCard level.

I don’t understand your point about the annual fees. In every case I compare the value of a card to its own annual fee. My thought is that the card is worth keeping if its value is higher than the annual fee.

Greg – I am in a similar situation when my $495 fee hits in Dec. I plan to cancel for many of the same reasons you outlined. My question is regarding closing the Prestige and retaining flexibility with my earned TY points. I have a TY Premier and my TY points from both the Prestige and Premier accumulate in one combined account. Can I cancel outright as I will still retain the TY Premier or will the points earned from the Prestige be on an accelerated expiration? Or do I need to downgrade to Rewards+ to keep my TY points earned from the Prestige with extended expiration?. Thanks for the clarity on this issue

You need to downgrade to another ThankYou card (Rewards+ or Preferred) in order to prevent the points earned on your Prestige card from expiring. I recommend the Rewards+ if you don’t already have it.

Greg, you downgraded to another instance of a card that you already had. Why? To keep the credit line? To get a partial refund?

Also, do you know if you can switch to a no annual fee card in another family (i.e., non TY)?

Double Cash seems to be an option. Not sure about other cards. (like AA)

I downgraded to another ThankYou card for one reason only: to keep my ThankYou points alive. You can product change to another family but that won’t preserve your points. Even changing to Double Cash doesn’t preserve your points since it’s not really a ThankYou card.

Greg, but you wrote this “Citi offers two no-fee ThankYou cards: ThankYou Preferred and Rewards+. The Rewards+ is the much better option if you don’t already have it (see this post for details). I already have both no-fee cards, so I didn’t have a preference. The agent suggested the Rewards+ card, so I said OK”.

I read that to understand that you already were keeping your TY points alive. (And that the new Rewards+ card was a redundancy.)

So my question is better asked as this “what is the value of having yet another no-fee TY card?”

(Also, there are cases like mine—I actually have a negative TY points balance–where I want to keep the credit line but NOT the points balance. That’s why I asked about switch OUT of the family.

No, this is different from Amex. With Amex you just need ANY membership rewards card in order to keep all your points alive. With Citi, you need to keep the original account open to keep your points alive. The only way to do that and to avoid annual fees is to downgrade to a no-fee ThankYou card.

There is no value to having another no-fee TY card other than keeping my points alive (and I guess having additional opportunities for upgrade or retention offers)

Yep, thought it worked like Amex MRs. It’s clear now. Thanks!

I’m almost in the same boat as you (canceled CNB, have been paying $350 AF for the Prestige), except my last hurrah with the 4th night free benefit was to book a 4-night stay at the Fogo Island Inn for next year, so I have a very large reimbursement coming in the future. So if I do get charged $495 this time around, looks like I am going to have to pay it this one time.

Anyone considering canceling their card with an outstanding 4th night free reservation will need to factor that into the equation.

Can u Cancel and book online like I did and Get it Now ?

CHEERs