Amex Platinum cards often have huge welcome bonus offers of 150,000 points or more. Plus, they come with many valuable perks and rebates. The downside is that they also come with $695 annual fees. One approach for maximizing rewards is to triple dip rebates by signing up for a Platinum card in early December. That way, it’s possible to earn the welcome bonus plus many of the card’s rebates three times: December of the current year, anytime the next year, and in January of the year after that. Then, if you don’t think the card is worth keeping, you can cancel within 30 days of when the second year annual fee posts and you’ll get that annual fee back. For example, it’s possible to earn the $200 airline fee credit three times: once immediately upon opening the card in December, once the following calendar year, and once in January after that.

I had planned the triple dip for two of my Platinum cards (one consumer and one business), but I messed up the business triple dip. Below, I’ll explain how I messed up and how I (mostly) fixed it. I really didn’t want to pay the full $695 for another year.

Personal Platinum Card

With my Schwab Platinum card’s annual fee due on December 27th of 2022, I figured that it was a good time to dump the card after eking out whatever value I could in January. So, in January, I made sure to collect on each of these rebates:

- $200 airline fee rebate (I bought a Delta ticket that cost exactly $200 more than a flight credit I had on my Delta account)

- $50 Saks rebate (I bought some Bombas socks)

- $15 Uber credit (Uber Eats delivery)

- $9.99 Peacock streaming service (I don’t really care about this but I have it charging automatically to my card and it automatically rebates)

I didn’t try to use the $200 Fine Hotels & Resorts credit for 2023 because I wasn’t ready with a specific hotel to book.

By the time the airline fee credits showed up on my account in January, I still had a few days left to cancel and get the annual fee back. In this case, though, they offered me 20,000 bonus points after $3K spend to keep the card. It was a close call since that’s not a very big bonus, but I decided to keep the card for another year. Between the $100 Schwab relationship bonus that I qualify for, and the card’s perks & rebates, and the 20,000 points, I decided that it was just barely worth keeping. I value too staying on Amex’s good side as a customer and so will usually keep a card when the math is close like that.

Business Platinum (Failed Triple Dip)

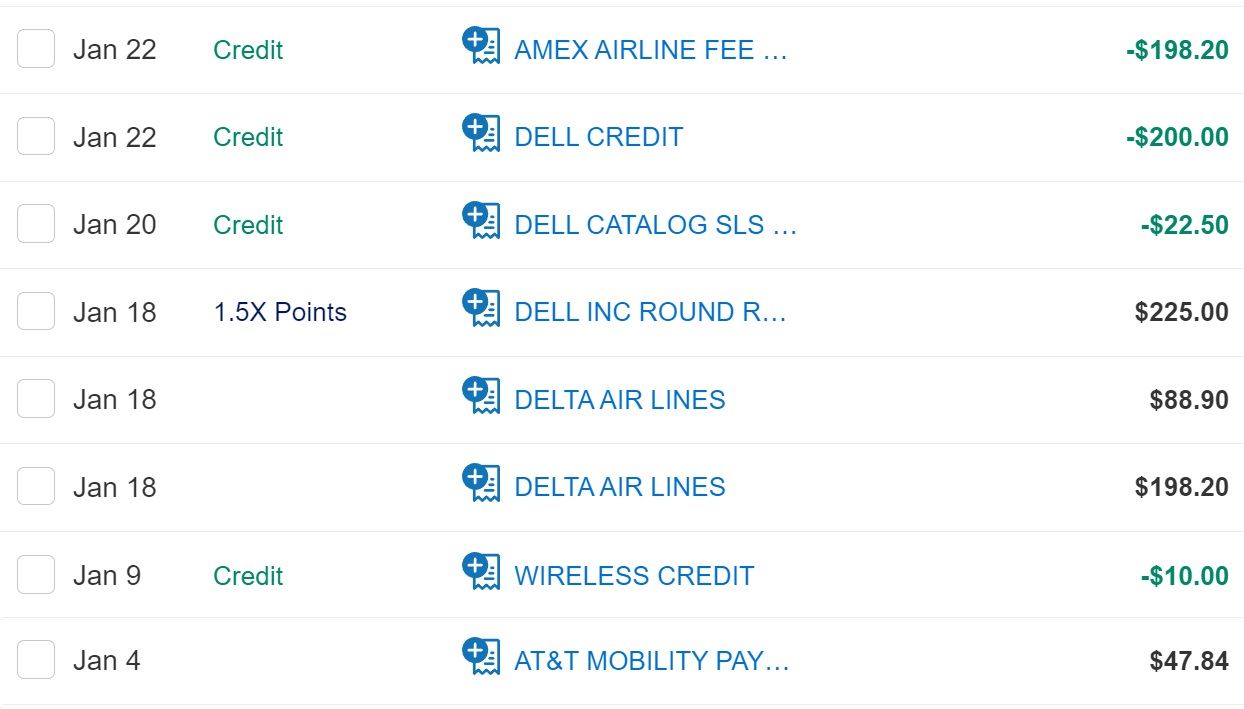

My Business Platinum card’s $695 fee hit on December 22. Since it’s necessary to cancel within 30 days to get the money back, I needed to cancel by January 21. So, I should have started working on earning rebates as early in the month as possible, but following my awesome trip to New Zealand, I didn’t get started in earnest until January 18th. Yes, earlier in the month I had earned the card’s $10 wireless credit, but It wasn’t until January 20th that I started working on my airline fee credits and Dell credits. By the time the credits posted, it was too late for me to cancel and get my annual fee back:

Saving the Triple Dip

Even though I knew I was too late, I called Amex to ask about cancelling the card. I had hoped that I’d be offered a nice retention bonus to keep the card. That didn’t happen (I’m pretty sure I got one for the same card last year). So then I double checked about the 30 day thing. I asked how much of the annual fee I’d get back if I cancelled. As expected, the answer was that I’d get nothing back at all. I was out $695.

At this point, there was no reason to cancel, but I did have an option to get most of my money back. The Business Platinum card is a “pay over time” charge card. As such, it can be product changed to any other business charge card that earns Membership Rewards. And when you product change an Amex card, they give you a prorated refund for the previous card and charge you a prorated annual fee for the new card. So, I picked the cheapest option: The Business Green Card costs only $95 per year.

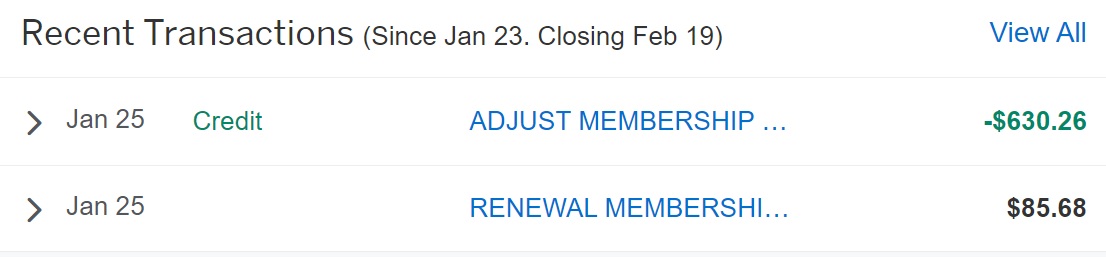

By product changing to the Business Green card, Amex issued a $630.26 refund for the Business Platinum card and charged $85.68 for the Business Green. These numbers come from the fact that I was already about a month into my membership year and so I was refunded about 11/12th of the $695 Business Platinum fee and charged about 11/12th of the Business Green $95 fee.

As a result of messing up the triple dip, I didn’t get back the full $695 that I had paid in December. Instead, I paid an additional $85.68 and got back $630.26. This means that the mistake cost me a total of $150.42. That’s much better than losing the full $695! Plus, there’s a decent chance I’ll receive valuable targeted offers to upgrade either to the Business Gold or back to the Business Platinum card. If that happens, this triple-dip error will turn out to have been a great thing.

Downgrade Paths

If you need to downgrade a Platinum card to a cheaper card, below are the available options (as far as I know). One downside of downgrading is that you won’t then be eligible for a new cardmember bonus for the lesser card. If you’ve had the card you want to downgrade to before, then that shouldn’t matter. Also, the Green cards don’t usually have great bonuses so there’s less danger of losing out with those (especially true with the Business Green card).

Consumer Platinum $695

Downgrade options from the vanilla (not co-branded) Platinum card:

As far as I know, neither the Morgan Stanley Platinum card nor the Schwab Platinum card have any downgrade path. Even though a fee-free Schwab Investor card exists, I believe it is a credit card rather than a Pay over Time charge card and you cannot product change from one to the other. And I don’t think you can product change from a branded to a non-branded card (but it can’t hurt to ask Amex if you want to).

Business Platinum $695

Downgrade options:

![175,000 Membership Rewards points consumer Platinum card offer for some [Targeted] a hand holding a credit card](https://frequentmiler.com/wp-content/uploads/2019/01/Amex-Platinum-Card-in-Hand-218x150.jpg)

Hi! Thank you for the information here! It’s excellent, and also a bit overwhelming. I could use some suggestions about what direction is best for me. I have a Platinum card (since 1985). The card renewed on January 25th, and I’m told I have til Feb. 25th to make any changes.

A retention rep told me yesterday that if I renew, I can get 30,000 miles after a $3000 spend in 3 months. The rep also mentioned a 50,000/$6000 offer but said it doesn’t apply to me. The 30k/$3k offer seems pretty low. I obviously don’t qualify for any of the Welcome offers.

I’m retired, so no business expenses. I use the CLEAR credit and some of the digital services rebates, and some of the $200 airline credit (though I also have a Delta Plat card I put most spending on, though I fly perhaps two or three times a year, I like the miles).

I have several hundred thousand Membership Miles on the Plat card.

I don’t use the Fine Dining or the Travel Service features (I’m old-school and prefer to make my own reservations).

I’ve been using the Uber credit sporadically (in my area, Los Angeles, Lyft usually comes in cheaper even with the credit).

I’m trying to decide between biting the bullet and keeping the Plat card, or downgrading to a Green or Gold card. I like being able to transfer MMs to Frequent Flyer programs, and the occasional offer on the “laundry list” of 100+ offers I have to scroll through.

I like [what used to be] the exclusivity of the Plat card, but that’s more nostalgia than anything. The last few times I used the Centurion or Delta lounges, the wait was over 30 minutes to get in, and the food and atmosphere were less than “special.” I do miss the days when a call to customer service at 800-525-3355 was answered by a US-based human instead of a recording (I did say I’m old-school!), and due to some hearing issues I often have trouble understanding offshore reps, but those are minor issues.

The advice here is usually solid, so I would really appreciate any thoughts on what my options are (given that I have a week to decide). Thanks in advance (and sorry for the length of this)!!!

I didn’t know there was a green business card never seen it in the line up of cards

Interesting experience. Similar to mine in triple dipping then product switch to Green with hopes of NLL offers to upgrade with bonuses. It’s how I got here this cycle 🙂

been a member since 1983 and fun to have the Green Card again;-)

“Don’t let your Ice Cream Bonuses Melt, while you’re counting Amex’s triple-dippy sprinkles”

Re the Saks benefit, you can get a refund to a gift card so buy a $50 item and return it for a gc. They never expire and can be used online at Saks and Saks Off 5th. Multiple can be used on a purchase. They never expire. And we should all have free ShopRunner so it can be done from the comfort of your own home.

Be careful, ShopRunner rotates stores. I haven’t seen Saks Fifth Avenue listed in awhile. I believe Saks Off 5th was there during the holiday season, but currently is not.

In December 2022 I was specifically told at the store that they are not allowed to give the refund to a gift card anymore (it had worked previously).

Not in-store – online purchase/return. This worked for me a month ago.

Just go to a Saks store and buy the $50 gift card. I accumulate mine for Tumi luggage.

Nick, you are correct about no product changes for the CS and MS Platinum Cards.

Good to hear your thought process. As a fundamental strategy, I think a person is likely better off downgrading a “regular” Platinum or Business Platinum in the hope of an upgrade offer than outright canceling the card. Consider the interim annual fee an investment expense.

hi how are you quick quistion

if you downgrade then do you get all the benfits of the green card

for example do you get a new clear benfit when you downgrade from the plat card to the green card??

Yes

oh wow thats fire info

thanks greg love fm

Actually, I should be more clear: you do get all of the benefits of the new card, but what happens if there is an overlapping benefit like CLEAR rebates? I’m not sure.

You make it sound like the $200 airline credit it’s as easy as just booking a ticket for $200 which is not true. That credit has so many strings attached and for tickets it just doesn’t work.

Can vary by airlines. Also my experience you can’t book a ticket outright, but upgrade, add to whatever (e-cert), but not start a new booking and expect to get $200 rebate. The rules clearly state that won’t work.

Check out the “What Still Works…” article from a few months back. That, together with Flyertalk forums, give you a pretty good idea of how to make it work.

While not 100% straightforward, it does allow for good data about how to get value from the credit. I personally value the $200 credit at around $175 since there are always other means to get that airfare cheaper with gift cards, other transfer partners, credit card bonuses etc.

Orlando, on any airline that you might have selected as your designated airline, let’s say that you want a premium cabin class seat from A to B. That might be domestic first class or international premium economy, business, etc. First, book and pay for a standard economy seat. Wait 24 hours. Then, go into your booking and upgrade to the cabin class you actually want. The amount you pay for the upgrade should code as a change/incidental fee and should trigger the airline incidental statement credit.

Next, if you have selected American Airlines as your designated airline, book whatever ticket you want . . . paid or award. Wait 24 hours. Then, go into your booking. If it is an award flight or a paid flight that you’re crediting towards your AA account, you will be given an opportunity to earn more miles. For $X, you will earn Y AAdvantage points. Doing so will trigger the statement credit.

Next, if you have selected Delta as your designated airline AND you have a Delta e-credit, book whatever paid ticket you want using your e-credit. Any amount of airfare not covered by the e-credit would be paid with a credit card – your Platinum / Business Platinum. The amount paid with your Platinum / Business Platinum should code as an incidental fee and should trigger the statement credit.

Next, if you have more than one card, buy an Admirals Club membership . . . in person (or over the phone). In person, you can split your payment among the different cards and take care of all statement credits in one shot. Easy-peasy.

These ought to get you started. Experiment on your own.

Excellent ideas for future years. This year all 3 Platinum cards when to United Flight Bank so $600 off a United ticker! 🙂

I did one starting on December 26 and got all the rebates in. I would say mid-December would be best.

Started December 21 on biz plat and worked on $200 airlines & Dell rebates. Then repeated after January 1 and worked again with no issues.

Lesson learnt. Even if another country, you gonna get on those credits Jan 1 or 2. Use a vpn if needed. And the credits don’t always post in 4 days. One could to the dell purchase Jan 2 and still find themselves waiting 2 weeks for the credit to post.

Excellent and informative post. About ready for another platinum card but sad I missed the December sign up window.

Great post and good insights for future plans. Question on your CS Plat retention offer. I did the exact same thing back in September. Only a day or two left to get refund credited back and then accepted retention offer. So…the next time our annual fees hit is there not an unwritten rule to not cancel the card within 12 months of a retention offer or be ready for clawbacks and dislike from AMEX? Does this strategy then only give us basically a VERY short window of a couple of days to cancel? Or does this strategy basically lock one in for really an additional 3 years of we want to be in AMEX’s good graces?

Thanks!

That’s a great question, but I don’t have a good answer. I was thinking that we’d be fine as long as we wait until the next annual fee posts, but you’re right that the rule of thumb is to wait a full 12 months, so there may be some risk in my approach.

The 12-month claw back date is from the account approval date. Exactly one year to the day. Technically, you can cancel on this date (or best to do it the next day) and not experience a claw back. You do not have to wait until the annual fee posts.

On the other hand, your annual fee will post at the end of Month 13. So, you actually have a wider window than you think to weigh your options.

Here’s a fun factoid: if you cancel your card AFTER the exact one-year date of account approval but prior to the exact one-year date of the posting of your first annual fee (at the end of Month 1), you will actually receive a pro rata refund of your first annual fee.

Alternatively, if you product change AFTER the exact one-year date of account approval but prior to the exact one-year date of the posting of your first annual fee, you will actually receive a pro rata credit of your first annual fee posted against the annual fee on your new card.

How about them apples?

Not sure if this is a relevant data point but I canceled a consumer platinum before my saks credit posted and months later I received a check for the credit.

That’s very relevant! Thanks for this. That means that I could have cancelled in time after all and still received the credits. Wow.

FYI once you downgrade an amex card, that restarts the 30 day annual fee refund clock as well. So you have 30 days from the downgrade date, in your case Jan 25th, to now call a second time and cancel the card after the downgrade. That means you can get the $85.68 refunded any time before Feb 24th with a second call.

Great to know, thanks!

Greg, did you ever get an upgrade offer from your product change to business green?

Nope. Thanks for the reminder to cancel!

Just got a decent retention offer for the card: 35K points after $5K spend. I took it.

BTW, Amex was adamant that if I cancelled my biz plat before the credits posted, I would never get the credits. I suspected they were wrong but was too a coward to risk it.

I had the same with my Dell credit on the Business Platinum, I got the credit after I canceled the card.

A bit more details, I closed the account on Oct 14, I had a Dell charge post on the 17th and got credits on the 18th.

I got 2 credits, the 10% credit and also the “Dell.com – Member Week Offer

Spend $100 or more, get $50 back”.

Thanks for this! I read this comment and am now hoping for the same result. Last day to cancel was March 4, did a Dell purchase March 3. I already see the amex offer credit, hopefully we get the $200 credit shortly.

This is one of the biggest turnoffs for me with the plat/gold card. No 0-AF downgrade options and unsure I will spend down the sub in a year. Not one of those repeat AF persons

No downgrade options, but there are so many alternatives with Amex. When was the last time there wasn’t a lucrative sub for an alternate card? Basically no limit to the number of NLL business card offers. And worst case scenario, you could always just get a no fee Amex Everyday to keep the points alive. One time HP and 5/24 hit if that’s meaningful to you, but you can keep this open long term and play the lucrative Amex sub game whenever you like.