People often ask whether the Bilt card has a use case if you’re not a renter. A year ago, I’d have said “not really” for most people. But that has changed: last week, we added the card to my household and Greg is spending toward Bilt’s top elite tier. On this week’s Frequent Miler on the Air, we talk about what has changed and who should be giving this card more attention (as well as who shouldn’t).

People often ask whether the Bilt card has a use case if you’re not a renter. A year ago, I’d have said “not really” for most people. But that has changed: last week, we added the card to my household and Greg is spending toward Bilt’s top elite tier. On this week’s Frequent Miler on the Air, we talk about what has changed and who should be giving this card more attention (as well as who shouldn’t).

Elsewhere on the blog this week, we discuss major Delta card changes, divergent viewpoints on Necker Island, whether I should upgrade to the Aviator Silver and an Andaz you might want to visit. Watch, listen, or read on for more from this week at Frequent Miler.

Frequent Miler on the Air Podcast

00:01:12 – Giant Mailbag (Bilt transfer bonuses are bogus)

00:04:18 – Card Talk (Big changes to Delta Credit cards…)

00:13:29 – Crazy Thing: (Dany says “I’ve had a Chase Ink $95 card for 10 years and this year they sent out a 10 year gift of coffee and some treats from a veteran owned company. Today I got the 1099 in the mail for it!”)

00:15:54 – Mattress Running the Numbers (IHG promo: Earn 40k bonus points every 4 nights at Iberostar properties)

00:18:48 – Award Talk (Award Discover Tools)

00:24:34 – Main Event (Game changing transfer bonuses)

00:24:34 – Old advice: the fee free Bilt card is GREAT for renters but with limited ways to earn points, it’s not great for points & miles hobbyists.

00:25:19 – New advice: Bilt is great for points & miles hobbyists too

00:33:04 – Bilt Card Overview 00:35:00 – Bilt elite status / transfer bonuses

00:39:15 – Is there a Bilt welcome bonus?

00:42:01 – Earn points primarily through card spend

00:46:20 – Sample strategy for Silver status

00:48:21 – Sample strategy for Gold status

00:50:46 – Strategy for Platinum status

00:56:23 – Who should consider this?

01:03:34 – Downsides & risks

1:05:47 – Question of the Week

We publish Frequent Miler on the Air each week in both video form (above) and as an audio podcast. People love listening to the podcast while driving, working-out, etc. Please check it out and subscribe. Our podcast is available on all popular podcast platforms, including Apple Podcasts, Spotify, and many more.

Alternatively, you can listen to the podcast online here.

This week on the Frequent Miler blog…

How Nick built his own Bilt bonus

One of the biggest complaints about the Bilt card is the lack of a welcome bonus. When Bilt announced a one-day-only (February 1st only!) Rent Day promotion to get a 75-150% transfer bonus to Air Canada Aeroplan, I couldn’t sit on the sidelines. I referred my wife, she got the widely targeted offer for 5x for the first 5 days after receiving the card, and in the space of just 6 days she turned an $11K tax payment into 110,000 Air Canada Aeroplan points (and I turned the 2,500 points for referring her into 4,375 points when I transferred my Bilt points at a 75% bonus). When I wrote this post, I had totally forgotten about Aeroplan Family Sharing, so the real kicker is that we both took advantage of the transfer bonus and now our Aeroplan points are pooled for easy shared redemption.

Big changes to Delta Gold, Platinum, and Reserve cards

The Delta cards underwent huge changes on the first of the month. While annual fees increase, those changes manage to look largely positive (ya know, apart from the fact that the annual fee on the Reserve card has now increased by almost 50% over the past couple of years). I’m sure that a lot of people will be more excited about the companion certificates on the Platinum and Reserve cards since those will now be able to be used for travel to Hawaii (for newly issued certificates after 2/1). And the couponizing of the cards will probably work out for a lot of people. I still probably won’t get a Delta credit card myself, but I think the trade here is mostly decent for Delta fans.

Should Nick upgrade to the Aviator Silver card?

My wife and I have been American Airlines AAdvantage Aviator Red cardholders for all of about 4 months and both of us have been offered the opportunity to upgrade to the Aviator Silver. Given the Silver card’s big spend benefits and the fact that we’re both about halfway to a 5K Loyalty Point boost and a $99 Companion Certificate that’s good for two companions each, I wondered aloud whether it might be worth upgrading now — especially since it wouldn’t cost anything to upgrade until my anniversary date.

About that Necker Island piss-poor review…

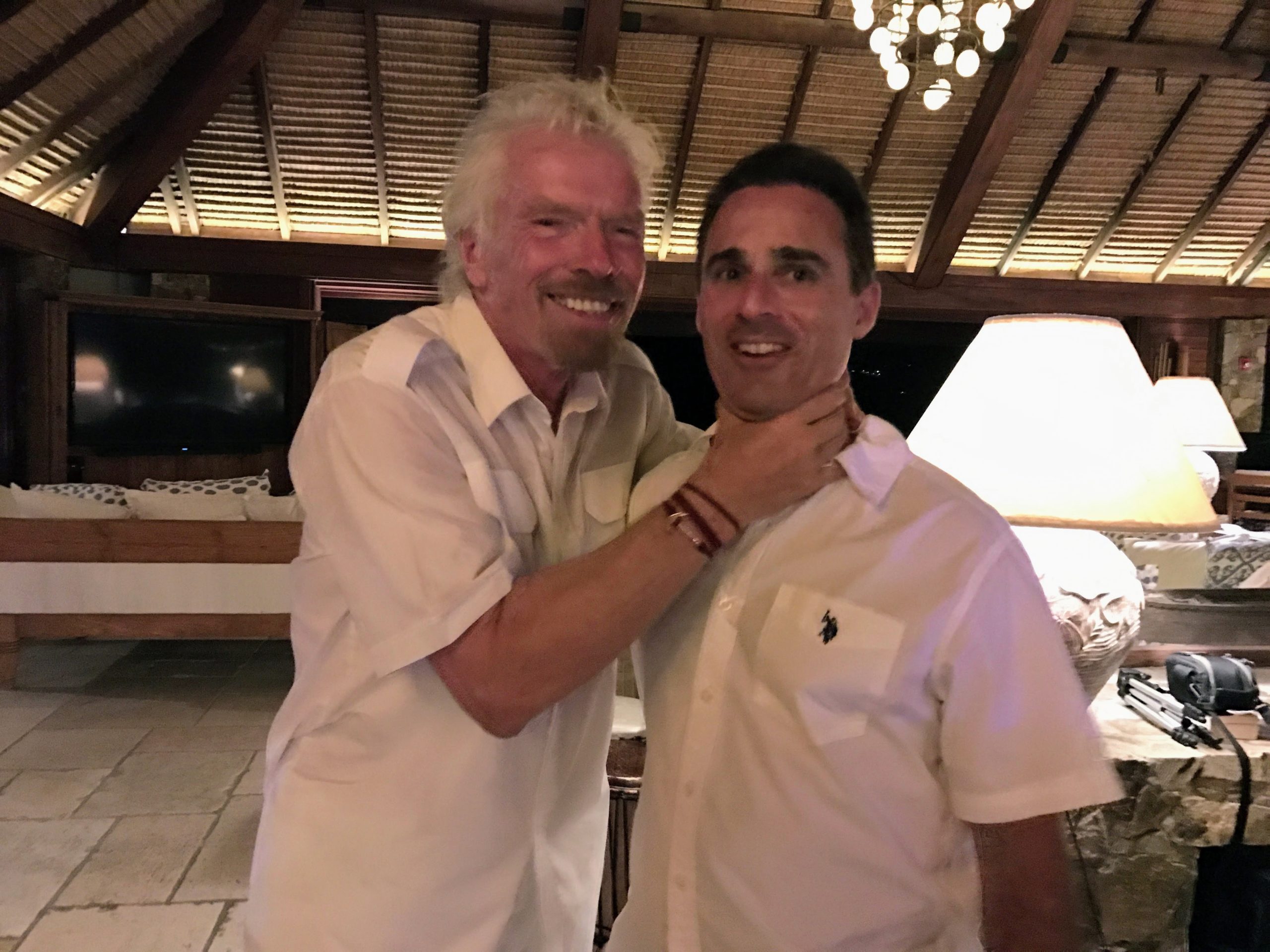

Greg went to Necker Island. Some guy named Tom also went to Necker Island. The experience starts to diverge from there. In this post, Greg tells a tale of two mostly different experiences at Richard Branson’s private island in the Caribbean. As you’ll recall, Greg had a fabulous experience there a few years ago, but a poor review by another guest prompted Greg to compare where they agree, where they disagree, and where a difference of opinion may just be a difference of perspective.

Andaz Scottsdale: Bottom Line Review

Tim recently stayed at the Andaz Scottsdale and reviews his experience in this post. I also traveled to Phoenix last year and considered this property but ultimately stayed at the Tempe Mission Palms. The Tempe Mission Palms was nice enough (especially for the 9K or 12K per night!), but the Andaz does look considerably nicer when you consider the entire property grounds. In my case, I wasn’t there for a relaxing getaway, so the Andaz didn’t seem like the vibe I wanted. I think that was probably the right answer for my situation after reading Tim’s review, but if I had cause to go back I’d probably try out the Andaz based on his experience there.

How to Match Wyndham Status To Caesars Rewards (reminder to match again)

I’m including this post as a timely reminder for those with Wyndham Diamond status to match back to Caesars Diamond as the Caesars membership year ended on January 31st. If you’re a Wyndham Business Earner cardholder, this match should be business as usual. If you earned your Wyndham status by matching from Caesars Diamond last year, things are iffier. Either way, it takes at least a week (sometimes two) for status to update, so you want to match sooner rather than later. If your status doesn’t update, rather than submitting again (which I think just sends you to the back of the processing line), try sending an email to support (see this post for how to do that).

That’s it for this week at Frequent Miler, but don’t forget to keep an eye on this week’s last chance deals.

A tip to the Korea family trip person: ANA has a pretty decent deal on Asiana to Seoul, except the taxes and fees are around $550 or so per person per round trip for economy. Still saves a lot on the trip especially if you’re going during a popular period. Another option is cobble together a trip via Tokyo – we are doing this on Delta of all things because they had a decent economy points rate.

A lot of interesting and thoughtful comments on Bilt here. I’m glad I’m in the camp where it’s a no-brainer: I rent. Until recently, I’ve mostly just gotten points from rent and put my spending on other cards. I’ve been rethinking that lately with the transfer bonuses and have started shifting more (non-SUB) spending to my Bilt card. Including buying gift cards at restaurants that I am going to go to anyway. It’s a super easy way to get 6x when I go out to have a beer.

With respect to the 5 transactions a month hassle: I had one month where I hadn’t done 5 transactions and I received a notification (I can’t remember if it was a text, email, or a notification from the app) reminding me to use the card so I didn’t forfeit the points for the month. I thought that was super convenient. Since then, I’ve just put some small reoccurring monthly charges on that card, so I don’t even think about it (my cell phone bill is an easy one, since Bilt also has cell phone protection).

I don’t know if this has been mentioned but in regards to needing 5 transactions per month to receive Bilt points I have found this helpful. I complete all 5 transactions as early as possible on Rent Day. If I am short transactions I will do $1 Amazon gift loads. On most Rent Days my newly earned points POST to my Bilt account and I am able to use my same day earned points for a great transfer if I so desire.

The fast track to platinum includes the phrase :spend on Bilt Dining, Lyft rdieshare, Bilt Travel Portal AND MORE with any linked credit or debit card.

What is included in AND MORE?

@CAS where do see this? “And more” doesn’t show at the fast track discussion at https://support.biltrewards.com/hc/en-us/articles/5536520671117-What-are-the-Bilt-Elite-Status-tiers .

I don’t get this at all. Sorry, I must be stupid. ??

With Chase or Amex or Cap1, I can earn 90k-200k points SUB + referral in 2 player mode, on $4-15k spend, EOS.

I can transfer those points *at any time* to *dozens of partners* whenever a deal comes up.

Or I can spend tens of thousands of dollars for years on Bilt and then hope there is a transfer bonus, and then only to one partner, and only on one day.

What am I missing? Yeah, *if* you have high status with Bilt (not getting other SUBs) and *if* want to fly Aeroplan in the future and *if* Aeroplan comes up as a Rent Day transfer bonus, then you can get an amazing deal. But that is a lot of “If”s in a game already fraught with “If”s

Love Frequent Miler. Our kid has Bilt. But I don’t get this Main Event at all.

It’s tough to get 5,000 words & SEO out of ‘my wife referred me for a CIP, I spent the $8k on taxes & we netted 148k UR’

LOL!

(Just to be clear, I love FM / Greg & Nick. Tons of great content, very helpful. But this … wow, this one …)

In fairness, Greg and Nick mention at the 1:00 (1 hour) mark that applying your spend toward SUB is a better strategy (or at least that’s “probably true” as Greg says), but if you’ve run out of good SUBs and/or can generate spend beyond what you need for SUBs, these strategies on the Bilt card can be good. Maybe it’d be helpful to have the Who is this For? and Downsides and Risks sections earlier.

I’m with you – I love FM and don’t doubt their motives here. I just think the perception of the Bilt coverage implies “this is the best strategy for most readers” even when they don’t actually say that. Clearly every Podcast Main Event doesn’t have that same tone (MGM-Marriott partnership 2 weeks ago was appropriately uninspired), but for some of us at least the Bilt coverage (“Bilt IS all that” and now “Game changing…”) carries a head-scratching tone.

Matt and LSP do a nice job of summarizing the surprise some of us feel about the degree of enthusiasm for this program.

Moreover, I think it’s clear from their tone that they (a) are not calling out FM’s integrity here, and (b) don’t have an ax to grind against Bilt or its management.

I agree. Only folks who made it to minute 56 of this week’s podcast got to hear what was probably the most balanced, thoughtful take on the product from any influencer thus far.

100%. They have earned the benefit of the doubt over years of coverage. As Nick writes below, they write about what genuinely excites them, rather than “talking their book”, like many competitors in this space clearly do.

Yes. Arguably, another example is naming a one-day Bilt transfer bonus as the “deal of the year”.

Listen to the end of their Bilt segment. The key point is that many people (including Nick and Greg) do BOTH everyday spend AND card signups. It’s not necessarily mutually exclusive. And if you can muster the spend needed to get to Platinum status as Greg can, that’s potentially 250,000 points which is not chump change. Given how huge the transfer bonuses have been, this becomes a situation where with the right partners it DOES make sense to transfer prospectively.

I consider myself a “moderate” points and miles player. I managed to accumulate enough Bilt points that, combined with the transfer bonuses to Flying Blue and Virgin Atlantic we put together a Premium Economy family trip on Air France and KLM to Paris and Italy with a business class flight from Paris to Italy, using an Air France promo fare. And of course I *also* sign up for cards, but I’m doing daily spend as well.

Making 5 charges per month to allow points to be earned was an easy and painless task for me. I make 5 separate monthly charitable donations to the Bilt card.

I still have to monitor the card since the charges must occur within the statement period, not monthly. So maybe I’ll need one more occasionally.

I have read the entire discussion. Thank you everyone for thoughtful comments.

I think when evaluating Bilt, we should only consider what is included in their terms in conditions (actually, a pretty compact document). They talk about 1X on rent (up to 100K a year), 3X on dining and 2X on travel. They also talk about Lyft and making 5 transactions a month. Nowhere in T&C they talk about transfer bonuses or 5X for 5 days at signup. Nor they talk about Rent Day activities. There is some generic statement that “from time to time we may offer promotions, etc.”

Whatever is not in T&C, should not be considered when comparing Bilt to Amex BPP or Citi DC. What we end up with is an OK no fee card – 1X on everything (including rent), 2X on travel and 3X on dining. Yes, definitely valuable points from an innovative fintech startup, but hardly a “game changer”.

I’m not sure this is the right way to evaluate things. Plenty of businesses and programs offer things beyond just the T&Cs; the transfer bonuses and Rent Day broadly are key parts of their marketing, and should be factored in.

hi pls tell more

Let’s make this super simple and super low risk. Move spending to the first of the month and get 2X on whatever it is you earn. Forget about waiting for the 2.5X transfer rate to wherever. Then, on the second of the month, transfer all of the points you earned from the prior day to (for example) AA. You now have a 2X card for AA. No risks, no delays, just points. Where else is someone going to get 2X on unbonused spending? Is there a problem with that?

That is 2X on AA specifically

I’ll admit that I’m a Bilt naysayer. However, FM has been quite compelling on it. Now I’m actually considering it.

My one thought is that the Bilt card might be the best AA non-category spend “business card”. (for Hyatt as well).

I could run some biz spend on the first of the month and have an easy 2x AA earn (although with other transfer bonuses, other programs might be considered better).

I’m not at the “end game” part of my card journey, but I am closely approaching it.

I’ve read Nick’s argument comparing it to a Double Cash or BBP, and I can see the reasoning in it.

I can also see the skepticism with new fintech cards that are often unsustainable. There are plenty that got hyped and fizzled, *cough* X1.

I think you really have to examine your card strategy, where you are in the “game”, 5/24, the currencies and points balances you already carry, etc., not to mention your booking skill level.

The earnings are arguably higher, but… uncertain. So the question is whether or not you have a 5/24 slot… as well as spend… to gamble a bit.

It really is intriguing, yet borderline compelling.

I’m not sure how to read this. Do you mean, you have almost all the pieces in place that you want for a long-term earning strategy, and don’t want to churn? Something else?

I actually agree with all of this. Well stated to boot. +1.

I can’t believe FrequentMiler is giving more exposure to this fake-welcome bonus card.

You’d be doing a service to your readers and listeners if you told Bilt that you would publish no more articles about them until they make the 5x welcome bonus available to everyone who is approved for the card. Otherwise they’re stealing a 5/24 slot from that person with no bonus.

If Bilt doesn’t want to give the 5x bonus to someone, don’t approve them. Period.

Let’s say there’s no SUB. Fine. What about the potential 120k Rent Day bonuses per year? What about the 2.5x transfer rate? Would it be a disservice to the readers to not put that information in front of them? The game is more than SUBs. Just with the two features I mentioned above, I strategized and worked Bilt’s system and it paid off in spades. And, it wasn’t due to a ridiculous 50k SUB. Put on your big boy pants and thinking cap and figure it out. But, don’t leave pissing and moaning comments unless it’s a complaint about Delta’s new cards. 🙂

As of now, this comment scores a -3. But IMO FT’s point is valid. Why not either decline applicants who won’t get the 5x welcome bonus, or at least give them an opt out?

Amex is able to provide a popup telling you in advance that you won’t get their SUB. That empowers the applicant to make the best decision for them.

Why can’t Bilt do the same?

The difference (which, honestly, should be glaringly obvious) is that Amex is advertising the bonus and Bilt has never, anywhere, published a word about their offer. The 5x for 5 days offer was discovered by users and reported by the blogs.

You’re correct, LarryInNYC, that Amex advertised the SUB and Bilt did not. And you’re also correct that the blogs have widely reported this bonus (as Bilt’s marketing team knew they would).

-Bilt wins because they get more applicants then they would without this non-transparent, targeted bonus–and they don’t even have to pay out the bonus consistently.

-The blogs win because Bilt pays them more signup commissions.

-But the applicants who are led to expect they’ll get the bonus and do not, for no discernable reason? They lose.

You are right that because they weren’t promised the bonus, Bilt did not lie to those applicants. But I hope you’ll agree that that’s a low bar.

Bilt isn’t giving its potential cardholders the information they could easily provide to help them make an informed decision. I don’t blame FT and others for objecting to this.

150% transfer bonuses isn’t sustainable. It’s just a good marketing ploy to get a lot of people talking about their card. Of course, they could continue to burn through VC money for another year or two – I have no idea. So maybe enjoy it while you can.

And, Wells Fargo is a partner because . . . ?

Not sure what your point about WF being a partner is. They just raised $200M in VC funding based on a $3.1B valuation. So it’s no surprise that they’ve got money to spend to try to grab more market share. These flashy transfer bonuses aren’t sustainable. Once more people have the card and also have large point balances available to transfer, 150% transfer bonuses will be too costly. But if you want to plan your next two years of credit card spend based around it, be my guest.

Bilt is reported to be already profitable. The 150% transfer bonuses may not be sustainable but most of the cost use probably bring borne but the loyalty programs, not by Bilt.

Regardless of whether or not Bilt is already profitable, getting new $200M funding means they want to rapidly expand which means big, flashy promotions which aren’t going to last. I’d be impressed if they got the loyalty programs to pay substantially for the promos. But either way, as their customer base grows and as card holders build up larger point accounts, the cost to run +150% promos is going to increase exponentially. No company is going to be able to keep that up for long.

I would also be impressed if Bilt got loyalty programs to pay for the promotions. But I would not be shocked.

One of the reasons Mr. Kerr is worth his salary and then some, IMO, is that he’s tirelessly beating the bushes meeting with transfer partners. I’m betting he makes a good case to the second and third-tier foreign carriers that Bilt tends to partner with for transfer bonuses. Something like this:

This bonus I’m proposing you fund [or largely fund] is eye-popping enough in size to get you more attention so you can grow brand awareness in the US. Yet your financial exposure will be limited because the duration is only one day. Then you can evaluate the results for yourself. Once you’ve had time to do that, we can iterate, incorporate those results into our next promotion. Everyone wins.

Would you see this as a compelling pitch, Al C? I think for at least some potential partners, it would be.

I agree that these attention-grabbing bonuses don’t seem sustainable long-term for any given funder. But maybe Bilt can be the company a loyalty partner works with when it wants to use its own marketing dollars to focus on its own growth. That wouldn’t be a bad strategy.

Sure your pitch could work to get them to contribute something to the bonus. But that’s only because the airline’s exposure is currently small (because the total amount of outstanding Bilt points is very small relative to other older programs) and only goes to reinforce the bigger point that these massive transfer bonuses aren’t sustainable. Can you imagine what would happen if Amex had a one day 150% bonus transfer to any decent foreign carrier? Someone would be on the hook for a huge bill.

I agree. This is partly because so many have massive Amex balances (unlike Bilt), and find it relatively easy to generate more.

But Bilt’s smaller size–and their desire for rapid growth, is also a factor. Both Bilt and these foreign carriers are more likely in a “growth/exposure above profit” phase, which makes for a potentially strong alignment of interests until that changes.

Out of curiosity, what do you think makes a card that offers no SUB but does 75-150% transfer bonuses less sustainable than cards that offer 100K+ SUBs and 15-30% transfer bonuses? To me, it just seems like a different marketing/acquisition/retention strategy.

Here’s Tim coming to Bilt’s defense yet again….

I think the Bilt card makes sense if

You’re not working on a welcome bonus

You prefer this over Ink Cash 5x , Amex Gold 4x etc

You’re ok with speculative transfers to airline programs

You’re confident this start up credit card rewards company won’t devalue or shutdown prior to transferring your points

Talking about the Bilt card always gets lots of comments.

I finally broke down on this and got the card. My biggest issue is that it highlights my inefficiency of buying 5x VGC/MGC at staples. Most of what ill put on this BILT card will be stuff i SHOULDNT if im maximizing my CICs. But I am also not doing that….so….I guess its a win.

See my comment below. You’ll do fine.

Thanks Nick.

As one of the many readers who consider the Bilt program overhyped, I wasn’t looking forward to it being the Main Event on your podcast this week.

But having listened, you and Greg deserve credit for including the most balanced discussion of the program in the blogosphere thus far.

Specifically. starting at 56m, you explain that aside from renters, Bilt is really for a subset of readers who (a) get outsized value from foreign airline transfer partners, and (b) who are willing and able to track Bilt’s program carefully, won’t sweat its uncertainties, and can play by its unique rules.

FWIW, future featured discussions of Bilt might start with those sorts of qualfiers. Then–especially to those who aren’t longtime fans and don’t know you better–you don’t risk looking like yet another blog whose staff has seemingly drunk the Bilt Kool-Aid. 🙂

David, my wife and I are both Bilt cardholders since it came out. We’re not bloggers. We don’t market credit cards. We have no profit motivation in touting the card. We learned to maximize Bilt’s strengths and we’ve played the “long game.” And, we have *massively* profited. My support for the Bilt card comes not from Kool-Aid but from my personal experience. And, I scratch my head when I hear so much negativity expressed towards the card from a particular subset of hobbyists. (I’m not saying that you are in that group.) It might not be the card for everyone but it can be a tool in the toolbox for many.

Thanks for replying Lee,

I’d enjoy hearing more about your experience. How have you “*massively* profited”? Are you renters (or do you pay HOA or other fees to build your balance)?

I do think Bilt is a good pick for renters and for folks who are willing to learn to “maximize Bilt’s strengths”, as you aptly put it.

For me thus far, a non-renter, the combination of the chronic uncertainty surrounding the program (e.g. will I get a 5x SUB, how will the rent day bonuses continue, will heavy use get me shut down, et cetera), the opportunity cost of not putting spend elsewhere, and the lack of outsized benefit from foreign miles programs have kept me from spending a 5/24 slot on the card.

But I’m open to changing that opinion. 🙂

As for the negative many express, I can’t speak for others of course. But my sense is less that people think the program is terrible (it clearly is not), but that it commands a disproportionate share of attention from influencers.

Over the course of two+ years, we accumulated a substantial number of Bilt points. Those Bilt points turned into 2.5X Virgin and Air France points.

To get to a *substantial* number of Bilt points, we moved spending to the first of the month to each capture the 10k Rent Day bonus. 10k * two players * 12 months = 240k Bilt points * 2.5X transfer bonus = 600k Virgin or Air France points. As these are gravy points on top of the regular points on spending. Holy smokes!

Bilt Dining started out in New York and (in the beginning) a number of our favorite restaurants were on the list – 5X on top of 3X. On Rent Day, they were 11X. (Then, multiply by the 2.5X transfer bonus.) Holy smokes!

And, if we weren’t dining on the first of the month, we could buy a gift card from the restaurant on the first of the month and it would code correctly. I suppose one could shift other bonus category spending to the first via gift cards. One just needs to ensure that the gift card codes to the bonus category.

Rather than look at airfare, hotels, and rental cars as 2X, we looked at them at 2X * 2.5X transfer bonus = 5X. As compared to the CSR, which would have been 3X * 1.3X transfer bonus = 3.9X to Air France. But, if one timed an airfare purchase on Rent Day . . .

Rather than look at all-other-spending as 1X, we looked at it as 2.5X.

I’m not an MSer but . . . 1X on Rent Day becomes 2X, which becomes 5X upon transfer. Same as the CIC. But, each CIC is limited to $25k per year. Bilt tops out at $120k per year. A person would need 5 CICs to do the MSing that one Bilt card could do.

If one were not MSing, one could buy VGCs for non-bonus everyday spending. Buy them on Rent Day and get 2X . . . which becomes 5X after transfer. Better than the Citi Custom Cash, eh?

It just takes a little imagination.

Opportunity cost? As I noted in a prior comment, if someone’s entire spending is committed to SUBs, that’s the thing to do. Absolutely. But, any spending not committed to SUBs, Bilt has a gloriously profitable scheme . . . if you can use Bilt’s transfer partners . . . if you are patient . . . and if you acknowledge Nick’s thoughts about which transfer partners are likely or not likely to receive the 2.5X transfer rate.

Thanks for your thoughtful reply, Lee. I appreciate seeing a concrete use case.

Well done! You’re obviously optimizing the Bilt game here.

I’d only add that spending exactly $10k x 2 on the exact 12 days a year, while entirely doable, requires a fair bit of timing and coordination. I try to save that kind of mindspace for truly outsized rewards, like SUBs, retention bonuses, AU bonuses, and various outsized promotions. But folks who are better organized or who have more energy than me could probably handle both easily!

Sounds like you get great value from Bilt Dining also. Near me, the eateries on Bilt are more often 2x than 5x, meaning I’d do better with AA dining save on Rent day. No doubt this would be attractive to many.

No doubt, if you can use the miles that happened to be bonused on a rent day, Bilt offers real value.

If the do start to bonus mortgage payments, that might persuade me to join you.

One has to climb the mountain if one wants to enjoy the view.

Let me start by saying that I know you frequently comment with helpful / insightful stuff and aren’t trolling. But the negativity toward Bilt (and this concept of “drinking the Kool Aid”) from a subset of hobbyists really perplexes me.

What I don’t get is that nobody ever asked us for those types of qualifiers about the Citi Double Cash or Amex Blue Business Plus card despite the fact that they typically come with no welcome bonus or a very weak one and the fact that you can’t average any more than 2 miles per dollar spent on those cards except in the case of a transfer bonus and then it’s likely to be not more than 25-30% and despite the fact that those cards have weaker transfer partners comparatively and the fact that the Double Cash can’t even transfer to partners without a $95 card. The community has long accepted that having a 2x card for “everywhere else” spend is sound advice. This card is that, but for things you can pay for on the 1st of the month only and then for travel or dining it’s even better and decent at any time – and then if you get a crazy transfer bonus on top, it’s world’s better. I’m not saying it has to replace your Blue Business Plus card, but if you’ve ever had that card and used it, why wouldn’t it make sense to use this card in cases where you’ll get 2x or better with better transfer partners and the chance at making that return far larger with a transfer bonus that is *far* higher than any that Amex has ever offered?

I legitimately don’t get why it is harder to understand the value prop on the Bilt card as compared to those even before the unprecedented 75-150% transfer bonuses and ignoring renters completely. I further don’t understand the negativity (not saying from you, just from the small group of naysayers in general) because even if you’re not interested in the Bilt card, I can’t imagine why you wouldn’t cheerlead a competitor to the big programs that is offering wildly better transfer bonuses. I want competition in this space. I would think that we all do?

On this week’s ask us anything, we had a reference to the old SPG card, which used to be the darling of hotel credit cards because it effectively offered 1.25 airline miles per dollar spent – but only if you transferred in increments of 20K points. And there were no bonus categories other than spending at Starwood, so you had to spend $20,000 to get 25,000 airline miles. It sounds kind of ridiculous in today’s environment that the SPG card was the gold standard just eight or nine years ago because competition has increased earnings so substantially. I want that same competition for transfer bonuses and transfer partners, so even if I didn’t think Bilt was a fit for me, I’d be hoping for it to succeed.

I don’t see the Bilt card / program as terribly complex, nor do you need to be a master of foreign airline programs to do well with it (1:1 transfers to American Airlines and Hyatt still provide as good or better value spending on this card as compared to options other than an Ink Cash at an office supply store).

I know that there is a tiny subset of readers who are constantly working on a new card welcome bonus and don’t need an “everywhere else” card or a card that earns a dining bonus category. I have no argument at all against that crowd – earn those welcome bonuses first! But I don’t understand how those folks aren’t surrounded by enough people in the real world to understand what kind of an outlier they are, even within the hobby. There are a lot of things that aren’t for me that I can still understand. Delta elite status is a great example – I’ve got absolutely no interest in it and I’ve never had a Delta credit card and probably won’t because Delta just isn’t a fit for me. But I recognize that there is a massive market segment for whom Delta is a good fit and for whom Delta elite status makes sense. And if Delta makes positive changes, great! I don’t particularly care about them, but I hope they’ll pressure the airlines that I do care about to be better.

Nobody has done what Bilt has done. Barclays launched a card with transfer partners years ago and it lasted all of six months. Nobody else has been able to launch a program from scratch, get a best-in-class roster of transfer partner programs, and then offer anything remotely close to the transfer bonus promotions they’ve had. Making Capital One Miles transferable is the closest thing I can think of and even then they don’t have partners or transfer bonuses that beat Bilt. I can’t imagine that nobody has ever wanted to create such a program, but how easy can it be to even get your foot in the door to get a meeting with someone at AA and Hyatt and United to convince them that you’ve got a program worth partnering with? What they’ve done does impress me. If that means I’ve “drunk the Kool aid”, pour me another glass! It’s pretty sweet.

Excellent.

Thanks for the typically thoughtful reply, Nick. A few reactions, first on where we agree:

-I specifically said you don’t look like you’ve “drunk the [Bilt] Kool Aid”, because of the important caveats you offer late in today’s podcast. So I’m not calling you out here.

-I absolutely agree with that innovators in the rewards space are to be cheered on, and that Bilt is a noteworthy innovator. In particular, I actually like that they aren’t signup bonus focused. I’d rather see them spend capital otherwise devoted to SUBs to make the long-term value proposition better. And arguably they are already doing this to some degree, e.g. folks like Lee in this thread.

-You’re right that the game has changed massively since the Starwood days of yore! (I had a Starwood Business Amex since 2001, now a Bonvoy business card).

-I also 100% agree that “There are a lot of things that aren’t for me that I can still understand.” Indeed, I granted that if you’re willing to play by Bilt’s rules and/or can use its outsized foreign airline transfer bonuses, it’s probably a good fit–and more so if you’re renting.

On to where I’d push back:

-Bilt isn’t comparable to a simple 2% card.

You compare Bilt to Citi Double Cash and Amex BBP. But those cards give you a solid (albeit not outsized) return without any thought at all. Thus I can in good conscience recommend them to the friends family who have no interest in tracking anything. By contrast, Bilt requires you to:

Charge 5 transactions a month. Or no soup for you, period.Focus your spend on “Rent Day” if you want outsized points.Cap your spend at $10K if you want a Rent day multiplier.Hope your are targeted for a sign-up multiplier. Maybe, maybe not…but every other issuer I’m aware of doesn’t leave you guessing on this like Bilt does. Hope for 1-day transfer bonuses for outsize transfer value.Redeem strategically. Simple statement credits are .55cpp, unlike Citi doublecash or amex points (redeemed to checking).Hope you aren’t overspending. Amex and Citi have well reasonably established rules for big spenders. They generally won’t shut you down if you don’t cycle your CL or engage in other odd behavior (e.g. paying by debit card or from 3d party checking accounts). From the datapoints I’ve seen, Bilt will.Hope the VC funding doesn’t run out. 🙂 Bilt is a startup, spending big marketing dollars to gain market share. I’m skeptical this will be sustainable. By contrast, big players have different and more mature business models. Of course nothing is certain: Citi and Amex could also devalue or neuter their DC or BBP products. But they’ve been around many years. Short of legislation curbing interchange fees, I’m not worried about that.-Bilt isn’t valueless; just over-hyped.

The blogosphere is very worked up about Bilt. I think this is pretty obvious, but please push back if you disagree.Other (better?) tools generate way less hype. Plenty of potential examples here. My favorite is the Wyndham Business Earner card, which I would argue is clear MVP of the travel hacking space (albeit not a one-card solution). But outside of a few reader-focused areas like FM, it’s barely mentioned. Why is that? I think it’s becauseBilt has better influenced the influencers! First, Bilt pays for referrals, whereas Barclays (the Wyndham Business Earner sponsor) generally does not. But beyond that, Bilt hired longtime miles-and-points influencer Richard Kerr to not only build out the product, but to be its hype man. And, well, Mr. Kerr seems good at that job. 🙂-Bilt’s influence on other issuers seems TBD.

I hope that Bilt’s innovations will spur other banks to innovate and improve their products. Maybe folks more informed than me have evidence that this is happening, or will likely happen if they continue on their present trajectory.

TLDR: Built is an interesting program with clear use cases. But many think its hype outstrips its value.

Going forward, I hope more coverage will offer the disclaimers and use cases you two did starting at 56m into today’s podcast.

There are clear limitations. But like…c’mon. It is a no annual fee card that has similar (but slightly more restrictive) earning structure to the CSP. It has better transfer partners, and so far, better selective transfer bonuses. It has reasonably good travel protections. Bilt also gives away a few points a month with trivia games, and one day a month, you get double points on everything. It is the double points day that allows it to be gamed more than the CSP (and would make it attractive to people messing around with a drawer full of Chase Ink Cash cards). That’s the use case for everyone. Nobody said the CSP is a world beater card, but it is often touted as one of the best starter cards for regular people. In a lot of ways, especially with the no AF, the Bilt card will be better for those people (unless they spend a ton on transit, tolls, online grocery, or streaming services).

For people that are in bigger cities, the ability to collect some dining points and to collect points on rent/HOA/coop maintenance fees makes this much more attractive than the CSP. I know. I have both, and will most likely downgrade my CSP in July. It just doesn’t have much unique use with the Bilt card around. The 60k sub was nice, and I’ll get that again (hopefully) in 2027. Until then, I don’t need it. I’m not interested in pretending to have a business, and the rest of the Chase ecosystem opened up by the CSP is just not that interesting (quarterly categories are a hassle and 1.5x doesn’t cut it) for someone wanting to keep a stable set of cards in the wallet.

It is not the best card. But the loyalty program has created the most valuable transferable points currency (that much, I think, is inarguable). The trade off of the points currency value is that it is harder to collect those points. People are now finding ways to go out of their way to collect as many of these points as they can. Nick did a nice job demonstrating how it can be done. It won’t be for everyone, but I would make the argument that the Bilt card should be a supplemental card (or a dining card) for a lot of people.

But like…what do you want them to say? It has no AF. The only other contenders in that category are the Blue Business Plus (where you have to pretend to own a business), the Amex Everyday (a dud), the Venture One (1.25x) or the Citi Double Cash (with 3 transfer partners). Yeah, I guess the disclaimer should be: “for no AF, you can collect the most valuable transferable points on the market, but you know, it just can’t out earn a Hilton Surpass.” It would be similar to the complaints that Hyatt doesn’t put a 10x multiplier and a 125k sub on its $95 co-branded card. The whole thing is just silly.

IMO the best no AF contender in the past year wasn’t any of these, but rather the Chase Freedom unlimited with the 2x first year bonus, which Tim covered for FM.

That’s what I had my biggest spending family member pick up as their daily driver. 6x dining, 6x drugstore, 10x travel portal, and 3x unbonused spend. And unlike Bilt, that bonus is entirely uncapped, and isn’t burdened with any of the other restrictions or uncertainties listed above.

Sadly, Chase pulled that offer last month. And yes, this 2x bonus only lasts one year.

OTOH, after that promo year ends, you can convert the card to one of many Chase products that might suit you best. Or, you can reallocate your CL to other chase personal products. Bilt can’t do these things. (And I’m far from certain that Bilt’s bonuses will last more than 12 months anyway.)

Brent- You probably shouldn’t mention rent/hoa in your argument since everyone agrees Bilt is a no brainer in that situation.

This week’s discussion is about the rest of us. I really wanted to be convinced by this podcast and still think it’s borderline worth the PITA. I’m not paying estimated taxes every month, or health insurance like Nick, and do better with sign up bonuses. There’s no way I’m timing my travel bookings to the 1st unless it’s something I already have and can cancel and reticket that day. I don’t feel like chasing status on a credit card but will consider that. If I’m not guaranteed the 5-day pseudo sign up bonus I’ll pass.

One big piece glossed over is that people with public exposure can earn mega referral bonuses for Bilt. In that situation I can see why it’s hyped monthly.

Good points @Nun. +1 from me.

-Yes, Bilt is an easy call if you have significant rent or rent-substitute transactions, and you’re willing to make at least a minimal effort (e.g. 5 txns per month.

I agree on all of this. Bilt is interesting, and it might be fun to get on board that train. But the PITA factor holds me back in the absence of something more compelling to me like mortgage points.

I’m glad you said that, and I hope yours and comments like it make its way back to Bilt’s marketing team. This illustrates how empowering customers by giving them reliable information can be good business.

Excellent point. I haven’t tracked that. How mega are these referral bonuses? Are they transparent, or also YMMV like the welcome bonus?

Dave- It seems like the terms changed since I checked but you could earn 1 million points.

https://www.biltrewards.com/editorial/post/share-bilt-get-rewarded

https://www.biltrewards.com/terms/refer-a-friend

Thanks Nun. Interesting. Each referral isn’t high limit (Chase and Amex offer more), but a much higher max per referrer (50 referrals).

Seems consistent with Bilt’s apparent strategy of maximize growth / good press at the lowest possible cost per acquisition.

Seems smart to me.

David, out of a thousand ways to make a light bulb that didn’t work, Edison only needed to find one way that did work. You (a guy who doesn’t even have the Bilt Card) are telling everyone a thousand ways the Bilt Card won’t work. Well, I found my one way that does work. You are entrenched in your position and you’re trying to convince the wrong guy(s). And, if a knucklehead like me can make it work, a smart guy like can too.

No.

On the contrary, I’ve agreed that Bilt is an innovative product, with strong specific use cases (renters, people who use lots of foreign airline currencies, people who don’t need to spend beyond Bilt’s caps, et cetera). And I specifically congratulated you for optimizing it to the degree that you did.

I just think it’s overhyped. Judging by the constant pushback against Bilt in particular. I’m not alone in this thinking.

No I’m not. I’ve considered getting the card, and may still, especially if they extend rent bonuses to mortgages.

In the meantime, I’d welcome pushback on my specific arguments.

Apologies for the badly garbled formatting in the above post, which appears to have happened when I fixed a typo. Now it won’t let me edit.

(If possible, I’d love to see the forum software settings adjusted so that we had a day or two to edit, rather than a few hours tops.)

The reason you can’t edit after a short time is because bots comment and then edit their comment to include links to spam sites. It was happening over and over and we were having to delete tons of comments that were links to various sites you wouldn’t want to be clicking on. Limiting the ability to edit eliminated that problem. I know it’s unideal in situations where someone just needs to edit something, but it’s better than the alternative.

Thanks for explaining Nick! Makes total sense. Hopefully a better solution will prevent itself eventually.

Now THAT is how to shut down the pom pom hypesters!! Can’t blame the hypesters for pumping, tho they do need a reality check to keep it real.

Some thoughts, sort of in reverse order:

1) [Your statement: Bilt hired Richard Kerr to influence the influencers, etc. . .] First, I don’t necessarily know why Bilt hired Richard Kerr as I’ve never asked anybody there, but my assumption has been that they hired him as someone who was an expert in the space, so he could provide valuable insight into the things that would excite rewards enthusiasts (both in terms of which transfer partner relationships to pursue and what features (no doubt like the Rent Day transfer bonuses) would get people talking) and I assume also because they wanted someone on staff who would anticipate what types of behavior would likely occur they may consider to be abuses if they did “this” or “that” (I’m frequently surprised that nobody at most major issuers seems to consult anyone in the rewards enthusiast space about either what features would be exciting / duds or what loopholes they aren’t anticipating; Bilt seems to have had some foresight there).

As to whether they thought he would buy influence with bloggers, I can’t say. I had only met Richard Kerr once at an FTU conference years ago and I spoke to him for six or seven minutes about what he was doing for health insurance at the time. I otherwise didn’t know the guy — that’s literally the only time I had met him or interacted with him before he worked at Bilt. I don’t know how well others knew / know him. I’ve obviously interacted with him more now that he works at Bilt. I don’t know that he’s “hyped” anything to me. He shares the press releases when they come through and I’ll say that he’s very good at answering questions. Surprisingly, not every person who works in communications responds in a timely manner with clear answers, but he does do a very good job at that and I appreciate that. I also long appreciated the fact that someone who used to work as Hyatt’s PR person was amazing in that regard — she always replied quickly and when she didn’t know the answer, she found out and made sure it was the right answer. You wouldn’t know her name because she was never a blogger, but my point in mentioning that is to say that Bilt isn’t the only company that has someone who is good at answering questions — and while I guess that may buy influence in the sense that I like getting clear and accurate answers to my questions, it’s not like our coverage of Hyatt was “overhyped” by getting my questions answered. I don’t feel it is at Bilt either. We’re legit excited about the program. That has nothing to do with Richard Kerr. Again, I’ve had good interactions with him, but I don’t know him on a personal level.

Again, I think Bilt’s influence has been because they are doing something interesting. Sure, there is affiliate commission from their card, but just do the math as to how many cards there are with issuer X, Y, or Z and ask yourself whether you think we would be writing about Bilt at all if affiliate commissions dictated our content. I think Greg once said that it would be akin to tipping the front desk person 1c and thinking that you got the upgrade because of your tip. But if there is one thing I’ll give Bilt massive credit for that I think does gain them influence it is in being candid behind the scenes. They’ve been open in a way that just isn’t common in this space. We’ve had access to their executives and in some cases gotten insight into decisions they’ve made and the opportunity to share feedback about what could make them better. Again, I’m surprised that other rewards programs don’t make similar efforts to connect, though that’s largely because those other programs are so large.

Should we not write about what we’re excited about? That’s what we’ve always done. Back when the Alliant card offered 3% cash back for the first year and 2.5% back in subsequent years, I sung its praises regularly despite the fact that there were no affiliate commissions for that card. We’ve covered the Wyndham Business Earner extensively (and I’ve extensively covered how to leverage it to get free cruises, etc). I don’t know that I’d call it the MVP of the travel hacking space because not everybody likes cruises, not everybody can get to Atlantic City for that portion, and not everybody cares about the relationship with Vacasa (which I love but has a very limited footprint), and certainly not everyone wants to stay at Wyndham properties. See any of the numerous posts I’ve written about why the card is great or any of our “What’s in our wallet” posts to know that I do love the card and we all carry it in our everyday wallets, but calling it the MVP of the space seems a bit of a stretch. And Barclays can be a lot harder to get approved with for a business card than some other issuers, so it’s probably not a fit for everyone’s audience. I’m not saying you’re wrong — it’s probably true that some sites don’t write much about it because it doesn’t earn them any income. But I can’t imagine that Bilt is making enough of a financial impact to be out hitting the heavy hitters anywhere. Again, Greg has been candid in comments on his state of the business post about the minuscule affect it’s had on this site’s finances. If we were primarily excited by money, I can’t imagine you’d have ever heard of the Bilt card from this site. They’ve just made a good product. I should note that there are plenty of cards that pay affiliate commissions that you’ve probably never heard us mention. You remember the last time we mentioned the Quicksilver card? Yeah, I don’t either — because it’s not an exciting card. Bilt is. And I should add here that the point of this particular podcast was to note how our opinion about the card had changed. It’s not that the Bilt people didn’t always try to convince us that everyone should have the Bilt card. Of course they did. And neither Greg nor I had it in our households for a long time. Instead, we said it was almost a no-brainer for people who rent, but probably not a fit for anyone else. I specifically had that conversation with the CEO of Bilt back in the beginning about why I didn’t have the card and I only thought it made sense for renters: I said that it didn’t make sense for me to have it because I had other cards out-earning it and I didn’t pay rent. He tried to convince me that everyone should have it and that it was a better value than my Amex Gold card. He didn’t convince me – I kept the Gold card in my wallet and didn’t have a Bilt card in my household for a couple of years after that conversation. But the big transfer bonuses and the slate of partners they have added did make me feel differently about the card (and that’s why we added it).

2) Your statement: Bilt isn’t comparable to a 2% back card. Ok, fair enough. I’m comparing it to the Citi Double Cash because the Double Cash has no annual fee and has points that can be transferred to partners if you have a Premier. As Brent pointed out here, what do you want to compare it to? A Freedom Unlimited that offers 1.5x everywhere, 3x dining and pharmacy, can only transfer to partners if you have a $95 card also, and hasn’t ever (I think?) offered an airline transfer bonus of more than 25%….and doesn’t have any interesting partners that Bilt doesn’t (and lacks many that Bilt has)? Sure, the 3x everywhere year was a great offer for big spenders (and I also recommended it to a family member for whom I thought it was a great fit during that offer). That said, if I had put my $11,000 tax payment on that card with that offer, I’d have 33,000 UR points, which I’d probably transfer to Hyatt. Instead, I did it with Bilt and I got 55,000 points that I could have transferred to Hyatt (but ended up transferring to Aeroplan for 110,000 miles instead). And even if I didn’t get the 5x for 5 days, I’d have made that payment on the 1st of the month for 22,000 points and waited for the next good transfer bonus and ended up with at least 38,500 airline miles. No, it’s not guaranteed, but neither is it guaranteed that I’ll get great value with Hyatt — I’m just confident enough in both situations not to really be worried about the alternative. Feel free to place your confidences elsewhere.

The BBP offers 0.6cpp for statement credits. If you also have an Amex Business Checking account, you can get 0.8c per point for a statement credit. It’s only if you also have a $695 Business Platinum card that you can get 1c per point — so the BBP isn’t a 2% cash back card, either. And I’d argue that the only way to get outsized value from Amex points is to transfer them to foreign airline programs. Delta and JetBlue are poor redemptions since the points value is more or less capped and you’ll pay a fee to transfer to them. Hilton can offer lukewarm value when there’s a good transfer bonus — but then you don’t like counting on those, so we can’t count that because we don’t know that Amex will offer them. So how are you getting solid return without any thought at all? Don’t tell me with the 35% pay with points rebate as that once again requires a $695 fee, so it’s not comparable. Again, foreign transfer partner programs are where it’s at with Amex. Bilt has all of the best of Amex’s partners except for ANA and also has Chase’s best partner, Citi’s best partner, and all the best Capital One partners, and AA which nobody has. Don’t get me wrong: I love Amex Membership Rewards points. I’ve collected millions of them each year for the past several years (and used millions of them in that time also). I’m not saying that the BBP is a bad card or that the currency itself is bad, just that it has the same caveats regarding use of the points. Your counter-argument is that 2x everywhere all the time is better (though only on $50K per year, then 1x). I’d counter your counter with the fact that once you’ve spent $10K on the Bilt card, you’re getting a 100% transfer bonus during these bonuses (which, as you say, could never happen again — though don’t you agree that would be a really strange play if they want to expand to mortgage? Do you not think they’ve thought a few steps ahead all along?). Anyway, if you’re happy with the transfer partners most likely to offer the big bonuses (Air France, Virgin Atlantic, Hawaiian, Aeroplan, and I’d predict Avianca LifeMiles and Avios – no inside info there, just educated guess), then your return becomes similar to a Blue Business Plus without the $50K annual limit and with the ability to transfer to more programs.

3) You have to jump through hoops to earn rewards. Yeah, the 5 transactions per month thing is kinda annoying — but, again, I haven’t heard much pushback on Amex for years and years requiring 30 transactions per month to get the 50% bonus on the EDP. While I agree that the 5 transaction thing is kinda annoying, I also think it’s not unreasonably onerous and I accept that there need to be breakage points in any program in order for the maximizers to get great value. If that’s one of the things that makes it possible for folks like you and I to get good value out of the program, so be it. I could easily schedule five payments to my car insurance on the first of every month (or a payment to my car insurance and one to health insurance and one a couple of other bills) — many billers make it easy to set up recurring payments, so that’s not really a hurdle I think I’ll struggle to make it over. Same thing for focusing spend for Rent Day — it’s literally a few clicks of the mouse to schedule out recurring payments for things I have to pay monthly to happen on the first of the month. That’s not a major mental bandwidth drain for me — it’s a set it one time and forget it type thing.

I found it interesting that one of the caveats you mentioned is the need to redeem strategically. I’d argue that’s an absolutely base level skill required to succeed in this game no matter what your preferred credit card(s) or program(s) may be. That’s not unique to Bilt and I’m surprised that you’d suggest that a currency that can transfer to AA, Hyatt, and United requires more strategy from a novice user than one that can’t transfer to any of them (Citi? Capital One?). If you’re not redeeming strategically, then just get yourself a 2% cash back card (or one of the Bank of America cards for 2.625% back if you can qualify for Platinum Honors) and call it a day. All points and miles programs require strategic redemptions. Bilt provides the hands-down best mix of transfer partners in the business for being equipped to make great strategic redemptions, don’t they? Unless your preferred redemption is cash — they stink for that, no doubt. If you want to use credit card rewards to pay your rent or redeem for cash back, the Bilt card is not for you, full stop. No argument.

As far as hoping for the initial 5x for 5 days bonus and transfer bonuses, you’re right. Legit question: How many people do you know who have gotten the card and haven’t been targeted for the 5x for 5 days? As I’ve said before, I know they must exist. I’m curious how many you know. I applied because for me, that number was zero (and yes, I do know numerous people who have the card).

4) Your comment: Hope you aren’t overspending. Your point here I think is the risk of shut down. It’s true that I’ve gotten the sense that Bilt will shut down heavy MSers (and as I said at the beginning, I always assumed that was why they hired someone from the points and miles space – in order to anticipate that and cut it off), so I’ll agree that if your primary ideas for using the card are traditional MS methods, you’re taking a risk with Bilt. But then, I know people who have been shut down by each of the major issuers, so that risk is never nonexistent. But personally, I intend to use the Bilt card as intended, though obviously maximizing the big earn opportunities for legitimate stuff. I don’t want to be looking over my shoulder at these points, so I don’t intend to do anything that’s going to put me at risk. For the record, I take the same approach with the Altitude Reserve for the same reason — I know they were a little shut-down happy in the beginning and I value the 3x mobile wallet enough that I don’t want to risk losing it, so I’m not doing any shenanigans there.

5) Hope the VC funding doesn’t run out. I’m not terribly emotional about this. I get the sense that they aren’t relying on the VC money to pay their bills but rather are using it to expand the program — but I obviously don’t know that for sure. More importantly, I don’t think it’s likely that we’ll see a sudden shutting off of the lights and disappearance even if your fear here comes to fruition. The only similar precedent I can think of is Brex. Brex had a much more limited set of transfer partners, but they also went wild with an unsustainable welcome bonus (and were giving that 100K / $1,000 bonus to some people multiple times with multiple businesses, etc). I’d argue that they didn’t do their homework in terms of knowing what the outcome of that was going to look like, but even in that scenario where they exited the small business market, everyone got the chance to transfer out / redeem all of their points — balances didn’t just get zeroed without warning. I guess that crazy end-of-the-world scenario could happen here. And if it does, someone who was a naysayer the whole time will tell me “I told you so!”. I think that between now and then I’ll probably have redeemed a lot of points to very good value already, but maybe I’ll get caught out there and regret having gotten the card. I just don’t see that scenario as being more likely than the one where I get great value for a long time. I have gotten the impression that Bilt has always been playing the long game. Obviously every startup also thinks they are playing the long game….but not many of them get as far as Bilt has in terms of the doors they’ve opened and things they’ve made happen. It’s easy to point to venture capital as the “obvious” way that they’ve made the good things happen, but let’s use the Point Debit Card as a comparison point: they pulled in a bunch of venture capital and offered huge earning in a lot of places and the promise that they’d eventually launch transfer partners — but despite the venture capital, they never convinced any transfer partners to come on board. I imagine — maybe incorrectly, but it’s my educated guess — that for major partners like American, Hyatt, and United to come on board, they probably needed more convincing as to the roadmap and sustainability than an amount of venture capital money. Those companies aren’t playing ball for venture capital dollars. Again, this is all conjecture on my part, and maybe it’s all a house of cards waiting on a strong wind to collapse….but the logical thinker in me will be pretty darn surprised if that happens. Again, not impossible — my wife will be the first to tell you that I’m not always right. But whether I’m right or wrong, I just don’t share this fear.

6) Bilt is over-hyped. Is it? If Citi offered a 75-150% transfer bonus to Asia Miles one month, EVA the next, and Turkish a few months later, would you expect us not to cover it for fear of “over-hyping” it? It would be a disservice to our readership not to talk about such unprecedented opportunities. Out of 240 podcast episodes, I think we’ve done 2 with main events about Bilt (feel free to correct me if I’m wrong – I haven’t checked as I’m in Guadeloupe at the moment and my Internet is slow). In the last 6 months, I count 13 posts with Bilt in the title. Four of those were about the 75-150% Rent Day transfer bonuses (should we not cover those??), two of which were about new transfer partners added (should we not cover those??), one of which was Greg’s first impressions after getting the card (is that not useful content?), one of which was to say that there was no more public welcome bonus (shouldn’t we tell readers about that?), one of which was about how it couldn’t be gamed with Curve anymore……what are we “overhyping”? Should we not be excited about a 75%-150% transfer bonus when it happens? Should we pretend not to be excited about it? If not that, what should we get excited about that we don’t? Again, I just legitimately don’t understand this point of criticism. Someone else said it’s just the overall amount of exposure — sort of the Taylor Swift effect where it doesn’t even matter if it’s something good, too much of it turns people off. I guess — but then I ask again, should we not tell people when they can get an amazing transfer value and how to maximize it?

By the way, none of those posts have claimed that everyone should have the Bilt card on their wallet. None of them have called it the “MVP” or king of this space. Sure, we’ve been excited about the program when they’ve done good things…but I wouldn’t pretend not to be excited just because some people won’t like that I’m excited. Perhaps you could say that we don’t give them enough flak about not having a public welcome bonus. I mean, believe me, we’ve mentioned that to them plenty of times — but at this point it’s clear that they don’t intend to do that…and while I would have said in the beginning that they were nuts and wouldn’t be competitive without one, the bottom line is that they got us to open one without offering a publicly-advertised welcome bonus, so I guess they weren’t wrong that they didn’t need to. As you mentioned, I think it’s been innovative that they’ve decided to forgo that expense in favor of doing other things that make the program more competitive. Would I like to see an easy public welcome bonus? Of course I would. But I think they are more focused on making a card that they’ll get people to want to spend on. They aren’t alone in that desire — the minimum spend creep that we’ve seen from other issuers has clearly been designed to get people to use their card more. I think every rewards program wants that. Bilt is obviously trying to accomplish that in a different way than other issuers have. And, again, if not offering a welcome bonus makes it possible for them to offer these nutso transfer bonuses to those of us willing to work the system, then so be it.

Finally, and this is a point you may find relevant, I think that the nature of the “Life is like a box of chocolates, you never know what you’re gonna get” nature of the Rent Day promotions turns some people off. Fair enough. I said in a comment on FB earlier that I think that for someone who says, “I want to go to Bangkok the first week of December and I don’t care what the points cost is, I just want my trip not to cost me any dollars,” the Bilt program probably isn’t the right fit. If you’re the type of person who says, “Oh, Bilt has a 75-150% transfer bonus to Avianca LifeMiles, which means that I can travel to Europe in business class for as low as 25,200 Bilt points….and look! There’s a bunch of Star Alliance award availability to Albania in September and I have a free week in September and Carrie from Frequent Miler wrote a post about how much she loved Albania. I can go to Bangkok next year, but the chance to get to Albania in business class for 25.2K points is a rare opportunity, so let’s go figure out what Albania has to offer!”, then I think the Bilt program can be exciting. And I think that a lot of people who get into blogging about this stuff love those spontaneous trips to Albania and aren’t going to try to fit a square peg in a round hole (the Bangkok example) but are rather going to take their square peg and look at it as an adventure to find the perfect square for that. So I think that’s why at least some rewards travel enthusiasts get excited about it. And it’s a fair criticism that the card isn’t necessarily a slam dunk for someone who wants a specific trip at a specific time unless they are only looking at it as a supplemental points generator to add to the program that gets them that trip. But, again, I don’t think that the card doesn’t deserve the attention it’s received just because it isn’t a fit for some people.

I’m not trying to convince you that you should have the Bilt card or care about Bilt Rewards. It’s fine if you don’t. But you responded with detail, so I thought you deserved a full answer. I’ve said it a few times, but I’ll say it again: maybe I’m dead wrong about Bilt. I can accept that in the same way that when AA had the crazy SimplyMiles deal I was willing to gamble $6K on the 240x paying out. It did and I felt like a winner, but if it hadn’t I could accept that and move on to the next deal. Despite what you may think based on the length of my responses here, I don’t get terribly emotionally attached to any particular deal. I don’t expect any of them to last forever — I just try to maximize the opportunities I see for low-hanging fruit. Bilt fits in that strategy for me. Someday, it may not (and I guess it probably won’t?). But I think that day probably isn’t soon. We’ll see.

Frankly, there are far more topics that get far more attention than the Bilt Card. The negative comments to articles about the Bilt Card are curious. They are intense. As if they are trying to persuade the world not to get the card. It’s as if these commenters have an ax to grind. While they suggest the coverage of Bilt is suspect, as one who has significantly benefited from the card, I suggest that their intense comments are suspect.

But why, Lee? What possible motivation would I and so many others have for being Debbie Downers on Bilt?

I not only want them to succeed, but I want them to shake up the space.

Thanks Nick! That’s a very thoughtful (and thorough) reply.

A few thoughts in response:

FM’s position vs. the larger points/miles influencers’ position.

You note that you aren’t emotionally invested in these award programs, and I don’t doubt that. I also don’t think you guys do anything but “call them as you see them”, rather than “talking your book”. Indeed, that’s why I’ll spend an hour or more commenting here, rather than any number of other places in this ecosystem. You guys simply combine savvy commentary and integrity better than any other public-facing commenters I’ve seen in this space. Given that, I’m delighted by (and benefit from!) you guys writing about what you feel passionate about!

That said, you do seem to take observations about the larger blogging space personally, even when aren’t meant that way at all.

For example, I argued above that “Bilt is over-hyped”. But you replied as if I’d said, “FM keeps over-hyping Bilt.” The irony here is that my original comment in this thread specifically praised your and Greg’s caveats in your podcast today (starting at minute 56). That’s because you were doing the opposite of hyping. Rather, you offered a more nuanced use case for whom you thought should and shouldn’t be interested in the product. And I found myself nodding throughout that whole sub-segment, thinking, this is best take I’ve heard any bloggers make on this program.

Another example is the Wyndham Earner Business card issue. I wrote, “outside of a few reader-focused areas like FM, it’s barely mentioned.” That’s because your team have indeed covered it repeatedly, and well. But your reply reads like I’m accusing you of not covering it.

Perhaps you’re growing weary of all the pushback on Bilt?

Mr. Kerr

I don’t know him either. I do listen to him pretty regularly on Ed Pizza’s “Miles to Go” podcast. He strikes me as inarguably good at his job. First, as you noted, he has spearheaded the assembly of a list of partners that’s second to none, and in a relatively short period of time. Second, he clearly knows how influencers think–as well he might, because he was a full time influencer before taking the Bilt gig. Third, he’s clearly focused on building an engaging program–what you called “interesting” (I agree)–at at the most sustainable cost possible. (That said, I personally don’t care for how much of a role breakage, non-transparency, and unpredictability play in their game plan. But I do understand why they’re doing it.)

I have no doubt that Mr. Kerr is extremely responsive and straight-up with you guys, and that’s to his credit. It’s also worth noting that he has worked with and been friends with many prominent influencers in this space. And just like the most effective lobbyists in Congress are often former members themselves, I’m sure he’s very effective at generating maximum enthusiasm for what he has on offer.

One last remark on this. Kerr himself was recommending the 2X uncapped Chase FU offering on Miles to Go. He marveled at how Chase was able to make the math work on an offer so generous, and recommended the offer to his own associates. I appreciated his going public with this take, notwithstanding his loyalty to his employer.

Transferability vs. Simplicity

Bilt’s transferability is great. So are its uncertainty and complexity

Nick, I agree with you, Lee, Brent, and others that Bilt’s transfer targets are best in class. And specifically, their transfer bonuses are concentrated on currencies of foreign air carriers, who are looking for a bigger piece of the US market (as you’ve noted multiple times). So if international travel is your jam (it isn’t for me) Bilt probably warrants a look for that reason alone. (OTOH, we agree that if you’re looking mostly for cash it’s terrible).

But Bilt is also significantly more complicated and unpredictable than other cards, for reasons I explained above among others. You focus on the 5 purchases for month requirement in your reply. But for me, that’s the least onerous of Bilt’s hoops. For instance, I’m often most busy with work at the beginning / end of the month…when I would have to do find out what’s coming on rent day, do all my rent day purchases, and make all my redemptions. It’s harder to plan in advance than with other issuers, because who knows whether this month’s or next month’s 1-day promotion will be better. I’d also constantly be running up against that $10k monthly cap. With Chase/Amex and the rest, I don’t have to worry about any similar hoops, restrictions, or 24 hour windows.

I get that for many devoted gamers, these factors aren’t a big deal. And more power to them! For me, and especially for friends and family who aren’t comfortable in this space, they give me pause. If I have to deal with that much tracking, timing, complexity, and uncertainty, there’d better be an outsized payoff.

If they’d add mortgage payments to rent, that might do it for me. Especially if they started to weight reliability and predictability somewhat more, even if that meant they could “surprise and delight” less.

Overhyped vs. Being Excited

Nick, writing about what excites you is a absolutely a feature of FM, not a bug! It’s part of your authenticity. Indeed, I think your team’s enthusiasm is arguably the “secret sauce” in this community. Please don’t take anything I’ve written to suggest otherwise.

A question for you: based on everything you know and have heard so far, why do you think Bilt incites so much pushback? (Has any other program even come close?) Or to put it another way, what would I and so many other posters have to gain by branding Bilt as overhyped if we didn’t genuinely think it so?

Parting thoughts

To answer your question, I don’t have good data on how many people haven’t received a 5x bonus. My recollection is that it’s varied based on when applicants opened their card, but I’m not sure how much. (If that number is low, why not just make it a uniform benefit?)

Please let me know if I’ve missed anything specific you’d like me to comment on. And thanks again for taking the time to respond so thoughtfully. IMO, this kind of answer is one of the reasons you guys are without peer in this space.

Are you the Dave Hanson who hyped the Crypto.com card?

No. (And I’ve no idea who that is.)

Well, his name is Dave Hanson, and he has a YouTube called “Hey there, Dave here”, in which he talks about finance, credit cards, crypto, etc.

So a person with your exact name who’s in the credit card YouTube space exists.

Thanks @Mushu_Pork. Is he any good?

He’s a smart guy who I believe cashed out from a large tech firm.

The production quality on his videos is seriously professional grade. Like, other YouTubers should be taking notes on his lighting setups.

His credit card videos while entertaining, really only show the basic level of credit cards (creating “setups”).

He seems like an intelligent nice guy, but I stopped watching when he was into the crypto credit cards (which ironically got nerfed not long after).

Nick,

I think its because its so different and unique – and people are skeptical that it can continue. And they hate things that appear to be in front of their faces more than they think the should be, irregardless of how good they may be (see also Taylor Swift and Stanley mugs).

This whole game we play is a game of opportunity cost. I’d rather pay my auto insurance with 5X Staples GCs on my CIC and get 5 flexible Chase URs than try to remember to charge it to my BILT card on the first of the month so i can redeem it at 150% transfer bonus to whatever partner BILT decides is worthy that month. I still get 5X, but lose the flexibility. But to do that, I have to actually GO to staples, get someone to dig the cards out of the storage room, run the risk of them being drained, try not to get robbed in the parking lot, and maintain all the cards to ensure im not the one creating the breakage that creates the reason they do this in the first place. And lets be honest, while I do all this…because im twisted and think its fun…im not nearly as efficient as I can be and leave many points on the table.

I did just pick up the card, as i noted above – and i love playing the game – so we’ll see how it goes. I just dropped my dry cleaning off so that i can be sure to pick it up during my 5X days (assuming i get the welcome offer). And ive made a list of over $7,000 of things to spend on once i get that offer. And now im “curating” a first of the month list to tackle every month. Thats hassle too,

So what i’ll probably do is let the BILT card become my everyday dining card. There isnt much better than 3X for dining with a 150% bonus. Worst case – its the same as my CFU card – and transfers to Hyatt at the same rate. And I’ll take my first of the month list – and try to whittle down with 5X on CIC. And what i cant do there (especially bills greater than $200) will be a big win getting at least 2X and maybe as much as 4.5X from my couch. Worst case – thats the same as my Venture X, and just slightly better than my CFU.

I also own rental properties – so ill have to decide if its worth using plastiq to make my mortgage payments (and whatever shutdown risk that may expose me to – i haven’t researched that yet)

But other than dining, it feels like a one day a month everywhere card. Which is (frankly) just odd. Unless your a wierdo (like many of us) who enjoy playing the game almost as much (or perhaps even more than) the rewards – the hassle is perceived as more than its worth. Combined with the attention this card has been getting – i think thats the backlash.

But its also a no-fee card…so the only “risk” is really a 5/24 slot. Its pretty easy to stop using the card if you stop getting value. Thats a lot easier than watching the superbowl and hoping to avoid Taylor Swift.

I hope I love it.

FWIW I think this is well (and succinctly!) stated.