NOTICE: This post references card features that have changed, expired, or are not currently available

This week we posted analyses of the newest huge credit card offers and predicted what will come next. Also, because of intense interest in Hyatt mattress runs, we posted a mattress running Q&A. And I tackled the too-good-to-be-true X1 card: is there a way they can fulfill their promises?

On our show, in addition to our usual segments (Giant Mailbag, What Crazy Thing Did Citi Do This Week?), we discussed mattress running Marriott and the brightening credit card space: lots of good news and our best guesses of what changes we’ll see soon… Watch Frequent Miler on the Air, here:

Subscribe to our podcast

We publish Frequent Miler on the Air each week in both video form (above) and as an audio podcast. People love listening to the podcast while driving, working-out, etc. Please check it out and subscribe (if we get enough people to subscribe, we might be able to earn some income from this someday. So far, the podcast is just a labor of love).

Our podcast is available on all popular podcast platforms, including:

Apple |

Spotify |

You can also listen here in the browser:

This week at Frequent Miler

Credit Card Bonuses

Chase has resumed approving business card applications. That’s great news! Chase business cards consistently rank near the top of our Best of the Best Credit Card Offers list. Plus, I’ve often argued that the fee-free Chase Ink Business Cash is one of the few cards that all point collectors should have. It’s awesome that it’s now possible to get it again!

Capital One is out with a new 100K offer for their Venture Rewards card. That sounds exciting, but when I compared it to the Sapphire Preferred 80K offer I found that the Sapphire Preferred comes out on top… for most people. See: Venture 100K vs Sapphire 80K. Which is better?

I also attempted to address the question of whether or not its worth waiting for an even better offer for the Sapphire Reserve card. See: Chase Sapphire Reserve 100K Offer – Will it return?

And finally, I realized that it was time to refresh my credit card planning posts. If you’re new to credit card bonus hunting, but you’re ready to go big, where should you start? My recommendations are here: Beginner credit card plan: over 500K points in 12 to 15 months

Hyatt Mattress Running

Following last week’s posts regarding mattress running Hyatt to earn top tier status, there was a lot of interest and many questions. I did my best to answer the questions here: Hyatt Mattress Run Q&A

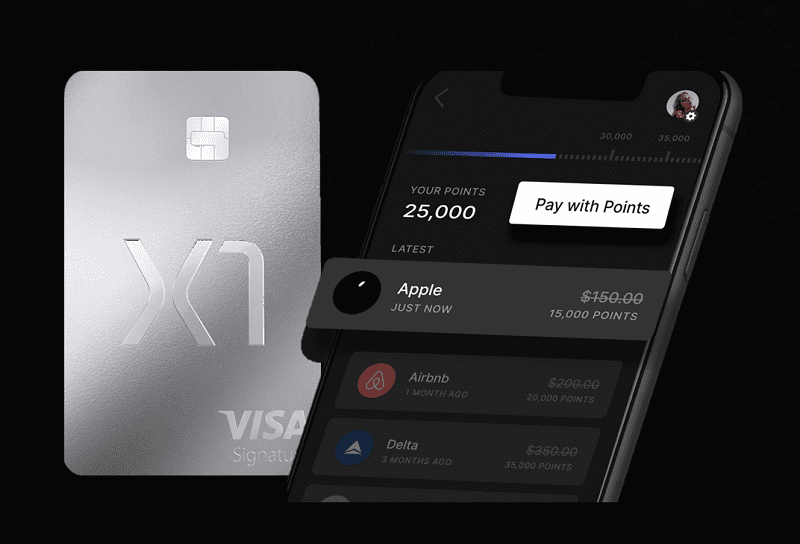

X1 Card: Too Good To Be True

I almost wrote a post about why I was confident that the X1 card was doomed to fail. Instead, I got creative. Here’s how they might just pull it off: X1 Card: Too good to be true. Here’s how they’ll do it.

Updated resources

The deal of the week

I was bummed that I didn’t find this offer on any of my Amex cards. It’s worth up to 40% off! Amazing Delta Amex Offer: Spend $300+ & Get $120 Back (Highly Targeted)

More noteworthy deals

-

Visa SavingsEdge: Get $2,500 In Plastiq Fee-Free Dollars For New Accounts

-

New MGM Resorts Amex Offers: Stack With Hyatt Promos For Extra-Rewarding Stays

-

New Amex Offers Available For Most Hilton Brands – Potential Savings Of 24%+

![A coupon book with a credit card, a credit card program with an airline, and more [Week in Review] a person reading a magazine on a couch](https://frequentmiler.com/wp-content/uploads/2017/05/kick-back.jpg)

Don’t forget bonus points when discussing hotel running the numbers. With Marriott’s 2500 pts per stay and 5k bonus after 3, you can earn 25k bonus points. Add that to your 12.5k as a gold (and arrival pts potential) and you have enough for a 35k night. That’s close to the $350 out of pocket…

Good point, thanks!

That was an EPIC post roast Nick! Gregg you missed an opportunity for a podcast title worthy of such greatness. All hail Reyes University. I am eagerly awaiting Gregg’s rebuttal for next week’s instalment. Great job guys

I was kind of surprised the one hotel card wasn’t a Hilton card, Surpass or Aspire, is the gap between brands that big? Agree that Marriott is a better choice than Hyatt due to footprint and that it really comes down to personal brand preference but if a someone really had to start off with getting a hotel CC, I don’t think the Marriott or Hyatt card would be the first one.

WoH card’s free Cat4 is good but beyond that, the card isn’t compelling for spend other than Hyatt stays and the best perk on that card is accelerated elite night accrual. Having that card, I don’t see it as good value or a priority to get unless you are already committed to Hyatt hotels. Marriott CCs are neither compelling for spend nor offer compelling status. The free night is situationally useful. Hilton has similarly large footprint as Marriott, their $95 card gets you free breakfast and there’s often good Amex offers for Hilton stays.

If I had to recommend a hotel card to someone starting off, I think it’d be a Hilton card 99% of the time.

The reason a Hilton card isn’t in there is because it isn’t subject to 5/24. You can always get that any time later on. You have to plan a strategy where you get the Chase cards you want before you go over 5/24. I wouldn’t burn a 5/24 slot for an Amex Hilton card (except in that instance where the Aspire card’s fee was waived for the first year, but I think that only lasted a few hours).

You’re right that the Surpass and Aspire are potentially great options, it’s just that they will still be options when you’re over 5/24.

Completely agree on getting the Hyatt before it’s too late. I started out 4 years ago picking up CSR, CSP, and Southwest along with a couple other cards (non-chase, rookie mistake), not knowing how important it was to just have certain cards. Being over 5/24 I picked up a few more cards since I couldn’t get chase anyways. Finally, I was tired of reading about the Hyatt card and decided I needed to bite the billet and get under 5/24 for it. Even as a casual traveler I love having it.

More Greg and Nick = better life. If it’s better for y’all though to make them shorter NBD. Know you are making the big bucks from it 😉 Don’t know if it was intentional or not but it has dropped in Google podcast feed Friday afternoon the last couple weeks. Cheers!

No need to rush in my view. I like 1 hour.