NOTICE: This post references card features that have changed, expired, or are not currently available

Yesterday, Greg published the latest edition of his brilliant spreadsheet for determining which expensive credit cards to keep: Which Ultra Premium Cards are Keepers? Version 3.0. Someone in the comments brought up a question that we receive from time to time: is it worth MSing Platinum status on the Ritz-Carlton Credit Card (no longer available to new applicants but possibly available via product change) or the Marriott Bonvoy Brilliant card? The initial answer in my mind is an unequivocal “NO!”, but that was entirely subjective; I hadn’t actually run the numbers on it. After running the numbers, my answer is still a pretty firm “NO!”, but here is my rationale from both subjective and (relatively) objective viewpoints.

My subjective take

In yesterday’s post, Greg made the point that when determining the relative value of an individual card benefit, you should consider how much you would be willing to pay for a subscription to that benefit. Forget how much you’ll “save” and consider instead the price at which you’d subscribe. For example, if an airline credit card comes with free checked bags, how much would you be willing to pay for a subscription to get free checked bags on that one airline’s flights? Let’s say you think you’ll probably spend $300 over the course of the year on checked bags. How much would you pay up front to probably save $300? You’d need to be saving a substantial amount to consider subscribing and pre-paying (because you don’t know for sure that you’ll save $300 since you may fly another airline or travel less often than intended or find a cheap first class fare that includes free bags, etc). Maybe you’d pay $150 for that subscription; I doubt you’d pay $250. In that case, it makes sense to value the checked baggage benefit at about $150 (the price at which you’d pay to subscribe to it).

We should therefore pose the question: How much would you pay for a subscription to breakfast at Marriott hotels? (Side note: I’m surprised that IHG hasn’t offered this!).

If you’re going to value free breakfast, it makes sense to consider how many nights you are likely to stay and how much you would otherwise pay for breakfast. Then figure how much you would pay for a subscription to that benefit.

For argument’s sake, let’s say you intend to actually spend 10 nights on vacation in swanky Marriotts where you would otherwise have to pay $120 per day on breakfast for two. Faced with that option, I think most of us would probably find a more reasonably-priced option for breakfast off-property, but now that I am a family traveler I do understand that it is much more convenient to have breakfast on-property. Let’s therefore suppose that you think you’ll likely spend about $1200 on breakfast over the course of the year. How much would you pay for a subscription that locks you in to only having those swanky breakfasts at Marriott hotels? A subscription would have to cost substantially less to interest me; I don’t know for sure that I’ll spend those 10 nights at swanky Marriott hotels (maybe I’ll get sick and miss a trip or maybe there will be a hotel price mistake at a Hilton or maybe this or that) and I further don’t make a habit of spending $120 on breakfast. As a guy who is totally happy with a Texas Sausage Melt at Waffle House for like $5, I’d be kidding myself if I said I’d lock myself in on ten breakfasts at an average price of even $60 for two people. Maybe I’d pay $500, which works out to spending $25 per person for breakfast over those 10 expected nights. Maybe. That’s about as far as I can realistically imagine stretching it.

Whatever you decide you’d pay for a Marriott breakfast subscription is your valuation of Marriott Platinum status. OK, Platinum status comes with a slightly better chance of an upgrade and 4pm late checkout, so you may assign some value to those things, but I wouldn’t recommend valuing them very highly. You only get Suite Night Awards if you actually collect 50 elite nights, so don’t count those in your valuation if you’re considering MSing Platinum status. You also earn a few more points per dollar on paid stays, but if you’re not staying enough to reach status naturally, then I can’t imagine that the few extra points you’ll earn are a benefit to which you’d pay to subscribe. Also note that if you earn Platinum status via $75K spend, it does not get you closer to Titanium status. You still need 75 nights of elite credit to get to Titanium (spending $75K doesn’t get you 50 nights, it just gets you Platinum status).

In the end, I think you’re fooling yourself to value Platinum status at more than about $500 or maybe $600 if you’re going to spend those 10 nights in swanky hotels where you’ll have an expensive on-property breakfast. If you had to spend more than $60 cash each morning on breakfast for two people, you’d probably accept the inconvenience of getting breakfast off-property for $10 per person or buying a box of cereal to enjoy in your room. But feel free to adjust your valuation as you see fit.

But what if you’ll stay more than 10 nights?

If you’ll stay more than 10 nights at those swanky Marriotts, I think you’re crazy to even contemplate spending $75,000 on a credit card to earn Platinum status. Here’s why:

- You get 15 elite night credits from having one of the Bonvoy credit cards

- You can get 10 elite night credits for hosting a meeting once a year at a Marriott

- You’ll get 10 elite night credits for the 10 nights you intend to spend at hotels with swanky breakfast

That’s a total of 35 nights of elite credit, which puts you just 15 nights shy of Marriott Platinum status. The cost of hosting a meeting where you get elite night credits will vary and it will take a little effort to be sure you get it set up correctly to get the elite night credit (see our shortcuts to Marriott Platinum status post), but let’s say you pay $150 to host a meeting (anecdotally, I’ve certainly heard of people finding hotels willing to host a meeting for less). Still, you’d be within striking distance of Platinum once you get that sorted out. If you intend to stay more nights at a Marriott hotel, you’re even fewer than 15 nights away from qualifying for Platinum status naturally (which will come with your choice benefit where you could choose suite night awards for example).

Let’s assume for a moment that you’ll only have the 35 nights of elite credit outlined above. I’ve previously written about the fact that Category 1 properties now cost 5,000 points per night off-peak. Since the 5th night is free on award stays, it costs 20,000 points to book a 5-night stay at a Category 1 property off-peak. Therefore, if you can find a Category 1 property with off-peak pricing, 60,000 points would be enough to cover three separate 5-night reservations — giving you the 15 nights you’d need for Platinum status.

Since the various Marriott Bonvoy credit cards earn 2 Marriott points per dollar, your worst case scenario (and I do think this is a worst case since I wouldn’t actually do this) is that you could spend $30,000 on any of the Marriott Bonvoy credit cards to generate 60,000 Marriott points and then use those points to book your three 5-night reservations at locations / times that are convenient for you to be able to check in (whether or not you actually intend to stay). Admittedly, there might be some complexity here: if housekeeping sees the room unoccupied day after day, there is a chance that the hotel could check you out early. If you actually followed this approach (and I do not recommend you do), you’d probably want to be up front with the front desk and make sure that the manager knows you are planning to come and go and may not be there every day but you don’t want to be checked out early since you may need the room again at some point over the next few days. This plan, which I think is your worst case scenario, requires $45,000 less spend on Marriott credit cards than the option to spend $75K (and may therefore be worth a little inconvenience to you to pursue).

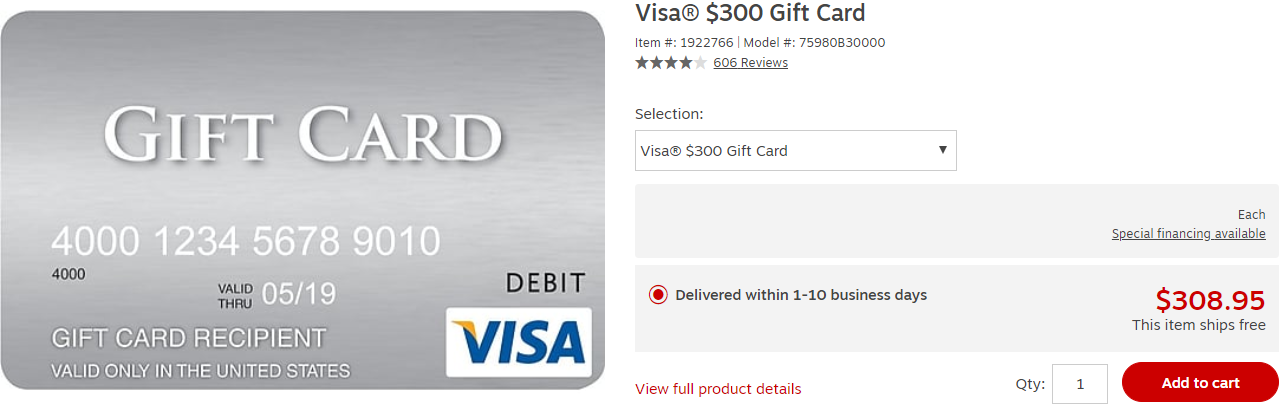

Of course, if you wanted to follow the above plan to book three 5-night reservations at Category 1 properties, you could manufacture the 60,000 points required pretty cheaply via Chase Ultimate Rewards. Greg recently wrote about the best cards for buying Visa and Mastercard gift cards and showed that you could easily generate Ultimate Rewards points at a cost of 6 tenths of a cent per point ($0.006). That’s a worst-case scenario that doesn’t take into consideration promotions like next week’s fee-free Visa Gift Cards at Staples. Since Marriott is a Chase transfer partner, you could therefore generate 60,000 points at a cost of $360 (likely less because you will likely take advantage of fee-free promotions by keeping an eye on our current Visa and Mastercard gift card deals page). Add your $150 cost for hosting a meeting and you’re at about the $500 I previously said I might consider spending to subscribe to free breakfast (or less cost with fee-free promos). This is not a great deal and I generally wouldn’t consider transferring Ultimate Rewards to Marriott, but the fact of the matter is that at 5x, you could generate the 60,000 points necessary to pursue the off-peak Marriott Category 1 strategy with just $12,000 spend on a Chase Ink Cash card. To be clear, this would not be my strategy for attaining Marriott Platinum status, but my point is that it could be yours and would require sixty-three thousand dollars less in spend.

If you’ll stay even more than 10 nights at a Marriott hotel over the course of the year, the strategy to manufacture Category 1 nights becomes even cheaper since you’ll need fewer nights to fill the gap. For example, if you’ll spend 15 nights per year at Marriott hotels naturally, then combined with 15 elite nights for having a Marriott credit card and 10 elite nights for hosting a meeting, you’d only need to manufacture the points for 10 nights at Marriott Category 1 properties (40K points if booked off-peak in 5-night increments). Adjust the options above down accordingly.

What if you’ll stay fewer than 10 nights at Marriott hotels?

If you’ll stay fewer than 10 nights at Marriott properties with swanky breakfasts, I recommend a visit to your psychiatrist to explore why you would consider spending $75,000 on a single credit card to earn elite status that you’re not actually going to use.

A (slightly) more objective viewpoint

The above is heavily influenced by opinion, including how much I think free breakfast is worth and how averse I would be to spending so much on a single Marriott credit card. However, I think there are more objective arguments as to why it doesn’t make much sense to spend $75K on a Marriott credit card for Platinum status.

Spending for Marriott elite status comes at a very high opportunity cost. If you complete $75K spend on a a Ritz-Carlton credit card (as an example) at 2x, you’ll have 150,000 Marriott points and Platinum status. According to our Reasonable Redemption Values, the points are worth around $1080 (at a value of 0.72 cents per point) when used towards Marriott stays. If we continue to value Marriott Platinum at around $500, that’s a little less than $1600 in total value from spending $75K. Let’s look at the alternatives:

- Spend $75K on a credit card that earns 2% cash back, get $1,500 in cash back

- Spend $75K on a credit card that earns 2.5% back or better, like the Alliant card or BOA Premium Rewards with Platinum honors, get at least $1,875 cash back

- Spend $75K on a credit card that earns 3% back in the first year (like the Alliant card or the Discover IT Miles card effectively), get $2,250 cash back

- Spend $75K over several new credit cards to earn welcome bonuses and earn a lot more

It’s worth noting for #4 that if you have the capability to spend $50,000 within 6 months, you could earn $3,000 total with a single new cardmember bonus and the return on everyday spend at the time of writing. If you split your spend over multiple new credit card welcome bonuses, you could easily eclipse that total.

My point here is this: even at just 2% cash back, you’re earning almost a wash with the value of the Marriott points plus Platinum status and you would be earning cash instead of funny money and a breakfast subscription. To me, that’s more valuable than Marriott points and a wishy-washy valuation of Marriott Platinum status. If you know you’ll get those 10 nights with swanky morning breakfasts, maybe you could convince yourself to trade the opportunity to earn $1500 in cash back for 150K Marriott points and Platinum status, but if you have the chance to earn any more than $1500 in cash back for that spend (as outlined above), I think your choice to spend on a card to earn Marriott Platinum status becomes more and more questionable. If you could earn close to $2,000 in cash back, I think it makes more sense to go for cash back and just buy yourself breakfast if and when you stay at the swanky Marriott (or mix things up and perhaps choose to buy breakfast for 5 nights, sleep in and miss breakfast for 3 nights, and go find a local place for breakfast for $20 two other nights — if you’re earning cash back, the choice is yours). Furthermore, if you earn cash back, you won’t be locked in to spending those nights at Marriott properties: feel free to stay at a Hilton or Hyatt or vacation rental and buy yourself breakfast with your cash back since you won’t feel like you’re locked in to Marriott based on having spent $75K on the card to earn status.

Let’s also consider that if you spend more than 10 nights per year at Marriott hotels (and therefore have more than 35 nights of elite credit as outlined in the section above), you could concentrate your spend on cash back and use some of the cash back to book cheap Marriott hotels for the nights needed to fill the gap.

Bottom line

Of course, those who MS heavily may make the argument that they can have their cake and eat it too by earning cash back while also MSing Platinum status. I still think the value of MSing Marriott Platinum status is tenuous at best. In order to value Platinum status, you obviously need to be able to leverage that status by staying at Marriott hotels. While I’m basing the analysis above on plans to stay 10 nights at Marriott properties, I think that’s a low threshold: I personally wouldn’t value status very highly if I only intended to use its benefits ten nights per year. As you increase the number of nights per year that you’ll stay at Marriott properties, the gap between your elite credits and Platinum status becomes smaller and the value proposition of spending $75,000 on a single credit card becomes more and more questionable. I think most people who stay enough nights per year to value status but not quite enough to get to 50 would be better off with a strategy to combine hosting a meeting with booking a few throwaway Category 1 nights to fill the gap to get to 50 nights and earn Suite Night Awards or to instead earn cash back and buy themselves breakfast, forgoing status entirely or if very close to 50 nights to earn cash back and use some of that cash to book cheap paid nights to fill the gap. I just couldn’t justify $75K spend on one of the Marriott cards.

With the 10 night elite credit from meetings getting nerfed, would that change your opinion now Nick?

Is there a way to sort the comments in a chronological order like before? You fixed it last time when you updated the website.

I think your analysis is sound. However, for people who stay less than 10 nights a year at Marriott, I believe there is still tremendous value to MS Marriott Platinum IF you are young (<30 yo).

If you would not have gotten Marriott Platinum with stays this year and decide to MS Platinum, you would be 1 more year closer (10%) to the 10 year requirement for lifetime Platinum. This is much more valuable to me as an opportunity cost to make sure I get to 10 years as fast as possible. The night requirement can be much easier to fulfill depending on job situation (e.g. you may not be traveling much now but could be in 2 years) or just cram in with cat 1 stays. So imagine an MS'er who got in the game at 22. He theoretically will have 10 years of Plat when he is 32 and assuming he gets all his nights, he will be lifetime Platinum. At that point, he has roughly 40-50 years to enjoy lifetime Platinum status with no MS costs. This should be heavily considered in your analysis. Of course I can only speak for myself and not for people who are older. This is why making sure you optimize for years, which cannot be crammed in like cat 1 nights/stays, is important to enjoy as many years of lifetime Marriott Plat as possible on the backend. This is the only reason why I would suggest to MS Marriott Plat and not MS Hyatt Globalist because Globalist, while a much better elite status, does not have years requirement so no opportunity cost in terms of time. I don't stay at Hiltons but the same justification can be made to pay for Aspire for 10 years as soon as possible but Hilton night requirement is higher than Marriott. I also prefer Marriott over Hilton footprint.

This makes a lot of sense especially for people who are leaving the work force for a couple years and their normal travel goes way down (e.g. McKinsey consultant headed off to an MBA for 2 years). Instead of being slowed down by a couple years on your way to lifetime, one can lock that opportunity cost down each year with MS. You cannot get back time!

I like how TD thinks, but I would not be in such a hurry. If young and can spend $75k early in the year, do it every other year. For example, if you earned Plat in 2018, that should expire 2/29/20; once you spend $75k in 2020, that should run through 2/28/22; skip spend in 2021; repeat in 2022. Maybe you drop to gold for a few months every other year, but the opportunity cost will be less.

My point in responding to TD here is that a young person will then have 20 years to earn lifetime, enjoying Plat 90% of the time along the way (Gold the other 10%). Less 15 nts/yr and the certs from the card, one only needs to average 13 nts/yr to reach lifetime Plat ((600-21×15-20)/20). And maybe some years will have heavy travel and topping off Nick’s way will be better. Very doable if a young person with cash flow gets in this game early.

When closing in on nights in the future or to the other posters with nights but just short on years, sure lock it in. Over 10+ years, Marriott will move the goalposts again. I signed up for both Amex and Chase, personal and business, around the time of the merger, hoping the bonuses would help with the point requirement Marriott lifetime had at the time. Oh well, at least the night credits stacked for one year getting me Platinum, and the points paid for a week in Grand Cayman.

Then this year I spent $75k at 3pts/$ instead of 2 with an offer on the old SPG card, then took 50k points to upgrade to Brilliant and was given Plat based on the spend on the old card. I don’t know if I’ll spend that again at 2pts/$, but it’s every other year if I do. Not being quite as young as TD, I have just enough time to get lifetime before retirement, but then I’ll loose the discounted rate through work that Marriott gives me even on leisure.

I decided to MS the 75K bc I was headed to the St Regis Maldives where breakfast is $140 per couple per day and that brunch was off the charts great and got us through to dinner. So that was a unique situation. My question is how long does the platinum status last? And I think Greg mentioned at a seminar that once you have it it doesnt’ take 75K the following year. Did I get that right or wrong?

“If, in any calendar year of Card Membership your total eligible purchases on your Marriott Bonvoy Brilliant™ American Express® Card account reach $75,000, you (the Basic Card Member) will be enrolled in Marriott Bonvoy Platinum Elite status…Your upgrade to Platinum Elite status is valid for the remainder of the calendar year in which it was earned and the subsequent calendar year.”

The Ritz and Brilliant cards work differently for this. The Amex Brilliant’s $75K spend requirement is based on calendar year spend but the Ritz card’s is based on membership year. So with the Ritz card it is possible to earn Platinum status that straddles Marriott’s elite year. In the past, this has led to multiple years of Platinum status. I don’t think that’s the case anymore, but I’m not sure.

This seems partially in response to my question above. We put 75k on the Amex Brilliant. Terms and conditions caution to allow 8 – 12 weeks after 75k spend for status change. We hit 75k recently, and status was changed from Gold to Platinum within days after hitting the threshold. She’s now Platinum for the rest of next year, and through the end of 2020. I guess I’ll find out eventually, but I would like to know if her lifetime counter will increase by 2 years from this or only one, as that will affect whether I maintain the card and for how long. I would prefer to put the 75k spend on another card once this is accomplished.

I don’t know the answer to that one. I’m sure it’s meant to count as just one year but who knows if they coded it correctly. I also think that the Ritz card has a better shot of counting as two years

You are probably right. I’m just hoping. The terms and conditions from the benefits section of the Amex Brilliant site state in part “A calendar year is from January 1 to December 31 regardless of when you open your Card Account. Allow 12–16 weeks from the time your total eligible purchases reach $75,000 for your enrollment in Platinum Elite status to become effective. Your upgrade to Platinum Elite status is valid for the remainder of the calendar year in which it was earned and the subsequent calendar year.”

That seems to open the window for 2 years. Hope springs eternal.

Is it worth charging the $75k to earn Platinum for life? I’m two years away & not planning on staying at many Marriott’s in those 2 years.

First, I think I’ve answered my own question and we will only earn 1 Platinum year for 2019, and will have to requalify in 2020 & 2021 for lifetime. This is from the current Bonvoy terms and conditions:

“4.2.e. Earning Lifetime Elite Status

i. In order to obtain Lifetime Elite Status, a Member must meet the below Lifetime Elite Status Criteria (4.2.f.) during the Member’s participation in the Loyalty Program. An “Eligible Status Year” is a calendar year during which a Member obtained Elite membership status (Silver Elite, Gold Elite, Platinum Elite, Titanium Elite, or Ambassador Elite) by achieving the Silver Elite, Gold Elite, Platinum Elite, Titanium Elite, or Ambassador Elite Minimum Requirement during such Eligible Status Year. Only a calendar year in which a Member achieves Silver Elite, Gold Elite, Platinum Elite, Titanium Elite, or Ambassador Elite Status, as described in the prior sentence, will count as an Eligible Status Year, regardless of the length of time that such Member will retain the benefits of Elite membership Status. For example, if a Member meets the Gold Elite Minimum Requirement during the 2019 Eligible Status Year by earning twenty-five (25) Eligible Nights and becomes a Gold Elite Member for the remainder of 2019 and for all of 2020, 2019 will count as a single Eligible Status Year, but 2020 will not count as an Eligible Status Year unless the Member meets the Gold Elite Minimum Requirement during the 2020 Eligible Status Year.”

As for value, it is worth it for us, as my wife could easily have 30 years of status, and given our past success with overseas upgrades. She also books at least 25 domestic nights in Marriott properties each year, and the perks have some value. On the other side, the spend is real and not a stretch, and I don’t feel we give up much earning these points versus most others. However, YMMV

Hey Nick, I think it was me that asked about MSing in Greg’s article and thanks for this article.

I’m going off-topic here, but I think you mentioned that the Hyatt card being the only hotel card worth spending money on. Just wondering if you have status with Hyatt it any other hotel chains? Are you planning to write any articles about Hyatt or Hilton?

Have you thought about writing an article about the cards that you have and why you have them?

Thanks!

Nick,

My wife is the traveler, and on our annual (or more) vacations we use miles and points to fly business or first, which we would not otherwise pay for. Over many years we have had tremendous hotel upgrades in Europe or Asia when one or the other of us was Platinum although upgrades have been less impressive in the US.

She is lifetime Gold on Bonvoy, and has enough nights for lifetime Platinum – but has only 7 years as Platinum or above. Three more years of Platinum gives her lifetime Platinum, which has value for us. Accordingly, I arranged for her to earn Platinum status by putting 75k organic spend on a Brilliant card. (because of reimbursed business expense we can easily put that much on this card).

Would this change your analysis about the value of this strategy simply to earn lifetime status? Additionally, her status just changed to Platinum as we passed the 75k threshold, which will last until the end of 2020. Does anyone know if this will result in 1 additional Platinum year on her counter, or 2 years (2019 & 2020)?

Nick, even though we have Plat status through spend (thru Ritz), I’m kind of kicking myself for not getting a Marriott cc where you can get Plat status through nights AND spend (in case you need both) to qualify. Any news as to whether they might bring this option back?

Speak for yourself!!! I have 14 children, we stay at 300 nights a year at Marriotts, MS costs me nothing and we normally1 pay $60 pp for breakfast anyway so we’re saving millions!

And travel IS free ’cause I have all these cards.

Sigh.

For me, my recent experience with high end hotels in Milan not offering breakfast really soured me on Marriott platinum. It’s exhausting to try to figure out whether your platinum status is going to actually get you that fancy breakfast! And then some place like a Moxy, provides a credit that doesn’t even cover the breakfast.

That’s also a great point: after MSing $75K, you still have to be vigilant when researching and booking to make sure you choose a brand that actually offers free breakfast and whether the property you want offers a set menu, a buffet, or a croissant and cup of juice. That’s another calculation altogether, but there is definitely a time investment there as well.

Citi Prestige Card holders (lots of holders here) I just got this email .

IF u Book not stay from 11/1/19 to 12/31/19 on any hotel stay of $750 or more and 4 nites or more u get the 4th nite free as usual + $75 off ur stay . The $75 is off @ the booking time on thankyou.com or calling only.

USE code TY75HOTEL when booking..

CHEERs

When it comes to hotels I’m primarily looking for a clean, safe, convenient hotel. While it is nice to get an upgrade, it is probably the least important thing for my travel. I value having a nice airplane seat at the top.

Breakfast at hotels is horribly overpriced. I stayed (on points, of course) at the Park Hyatt in Milan (I think it was that one or the one in France) and they comped our breakfast despite not having status. I guess it ran at least $40+ per person. We weren’t impressed and were just as happy walking down the street getting a pastry and a drink.

While not anything great, simply getting a free breakfast at Hiltons work fine for us since it only involves Gold status which is easy and cheap to acquire. And probably comes in handy for families with children.

I could never imagine MS to gain hotel status. Too many ways to get lower status easily (or in Hilton’s case, just get the Aspire card). Obviously others seem to value it, maybe for practical reasons, or maybe for their ego.

I do think Greg’s spreadsheet is a good idea. Too many people who don’t travel much chase after status but they would be better off just paying for it when needed. Obviously not true for business travelers or hard core travelers.

excellent analysis.

Could we do an analysis for those with larger families? My family stays ~10 nights or so a year at Marriott properties, and MS’ing platinum status would seem to be worth it. I’ve got a family of 5 (children ages 6, 4, and 1), and we usually prefer Hilton because it’s easier for us to generate Hilton points. But there are more Marriott properties out there, so sometimes we have to stay at Marriott.

In my case, I’ll consider the benefit of breakfast doubled since there are at least that many more mouths to feed. $1000 benefit let’s say. And on top of that, room upgrades go further with us since there are more of us.

Last but not least, in terms of other shortcuts, we live in Hawaii, so there aren’t any 5k properties around, and mattress runs to the mainland would be difficult. Moreso, I can’t host any (mainland) meetings with my family and schedule.

Just for kicks, I looked up the local prices for hosting a meeting, and the cheapest was $600 at a local courtyard property. For me, that route doesn’t seem to be worth it.

Anyways with points included I’m already at over $2000 in value I’d get from MS’ing platinum, but please feel free to correct me.

Aloha

Good idea all kinds of travel out there. I was clueless about free BK 20 years ago but my buddy travels with his Hockey club . No free BK’s no stay’s all young kids that saved the parents a lot he said .

CHEERs

Nick, I agree with your analysis as far as it goes. It’s silly for almost anyone to try to MS Platinum off of $75k spend on the Brilliant or Ritz cards. The opportunity cost alone would suggest otherwise. As a data point for your analysis, I offer the following information.

My wife and I both have the Bonvoy Brilliant card and have just renewed them both (with each of us getting a retention offer of 20k points after $2k spend in 3 months). We value the card not for the MS to Platinum (I’m currently Titanium and she’s Gold), but for the $300 yearly credit ($600 total) at Marriott properties and the 50k point free night cert (x2). This year (as you mention in the article as a better approach), I manufactured 2020 Platinum status through our stays (22 actual nights plus one 4-night mattress run at a Cat 1 hotel), 15 elite nights from one of my cards, and 10 elite nites from a “meeting.” Next year we plan to stay at Marriott properties at least as many nights as this year and manufacture Platinum status the same way.

I see non-premium Marriott cards the same way Greg does – valuable for the free nights alone. I also have the Ritz card, making our yearly “take” on free night certs (with 6 Bonvoy/Ritz cards between us) at six per year (3-ea 35k certs and 3-ea 50k certs). The premium cards are worthwhile when you add the $300 Marriott credits for the Brilliant card and the $300 airline fee reimbursement of the Ritz. While hotel award redemption inflation is cutting into some of the math of last year, our pattern of travel continues to justify keeping our 6 Bonvoy/Ritz cards.

I also would add that valuing Platinum Bonvoy status goes beyond free breakfast – oftentimes we find ourselves also enjoying a “dinner” in a Marriott lounge that is serving heavy hors d’oeuvres and drinks (especially at Marriotts in Asia). So Platinum status is probably worth a little more than you attribute in your article. That said, it most likely does not effect your conclusions.

Hi Bob, you don’t mention how long you have been Titanium, but can you tell me if your experiences differ much from Platinum? I read posts that downplay Platinum status but my own experiences are a dramatic positive shift from Gold. Am wondering if Titanium is equally different from Platinum? Not necessarily the benefits as posted on paper but real value received once on-property? Thanks so much

Pam: I’ve been Titanium for only a year, capitalizing last year on getting 15 elite nights per card (rather than only once starting this year), as well as being able to get 10-elite night credits (x2 for 20 elite nights) for hosting a meeting (cost = $200 each) twice last year (this year you’re only allowed to do it once for a total of 10 elite night credits). The key benefits of Titanium for me has been: 1) getting an extra free night (40k point) cert and 2) complimentary United Silver elite status (I don’t pursue airline elite status like I do hotel status, but do enjoy the perks such as boarding priority, etc.). I also chose 5 Suite Night Awards (also available for Platinum), so don’t include this as differential to Titanium. On balance, I think making Titanium for me is now beyond reach with the new rules – I just don’t stay at Marriott properties enough to manufacture the extra elite nights needed (but can do so for Platinum status, which I value for free breakfast and lounge access).

Thank you for your summary – your info is esp valuable for me since you moved up just this year during all the Marriott changes.

Do you mind telling me under what brand you booked your meeting; how you selected it; & how much you spent? Thanks again

Meetings last year and this year (all 2-3 hours long) has been at a local Fairfield Inn. Cost was $217 (including taxes) per meeting. That’s just under $21 per manufactured elite night. Based on what Greg’s said in the past, this rate is about as low as it goes.

That’s actually quite a bit higher than the numbers I’ve heard from many people. I used the number $150 in the post and noted that many people have reported finding places for less. It’ll likely come down to how many calls you want to make.

It’s true that Marriott Platinum offers more than free breakfast, especially in hotels in Asia.

We have Platinum as sign-on bonus with the Ritz-Carlton along with 2 free nights, $300 credit back on airline fees, Priority Pass and $100 credit for airlines tickets if purchased thru Visa Infinite.

We took advantage of all those benefits during the first year to make it an excellent choice for getting that card. By reading those blogs, we also learn how to follow new updates and to get all benefits to the maximum.

For the 2 free nights, we were able to book the Prince de Galles in Paris (Cat 7 or 8) normally costing extremely high in points or cash during last May. We got upgraded to Suite due to Platinum status. It was fantastic, a real suite with another toilet restroom which fits very well for a small party. The normal cost for that kind of suite is over 1,000 Euros, not including taxes.

We also got free breakfast for 2 nights. It was fabulous, like a buffet with very good food, normal cost around 50 Euros per person.

Unfortunately, the Prince de Galles is not a big hotel (like Marriott on Champs-Elysees nearby) so it doesn’t have a lounge. Otherwise, we would like to enjoy good benefits with it.

We did stay at Marriott Marquis in Atlanta who offers food like dinner (no free drinks). There was a long line of guests who know about this extra benefit.

But the crème of the crème for free benefits of Platinum is with stays in Marriott hotels in Saigon, Vietnam last July. We stayed a whole week at Sheraton with the Travel Package (by exchange Marriott points to get United miles) free of charge. Its normal rate is about $200 or 25K points for a Cat 4 Marriott.

With Platinum, we got free breakfast (a huge buffet with regular price of $22 pp), free tea time with pastries and free happy hour from 5-8 pm which actually looks like dinner time, along with free drinks and cocktails.

We did return to Saigon again in September. This time, we use only 70K Marriott points to book 5 free nights at Le Meridien (Cat 3 costing 17,500 points or $175-$200). We got the same excellent benefits like at the Sheraton.

All of our friends and relatives could not believe that we could get all of those almost completely free, especially when we invited them to join us at those upgrade rooms to suites.

So yes, you need to do some research in order to get valuable benefits; otherwise you may get only $10 credit pp for breakfast if staying at Courtyard. Or you will get free breakfast anyway at the other Marriott brands like Townplace, Fairfield Inn, Residence Inn etc.

It did happen to us. When we book hotels in Rome last November, the Marriott in Rome has a lounge but offers only soft drinks and chips! And at Venice, the AC hotel does not have a lounge and also offers 11 Euros as credit for breakfast.

Yes, you’re absolutely right about this! I’m going to say some cuz I haven’t stayed in all of the Marriott’s in China, but they also essentially give you dinner for free at the lounge in addition to breakfast.

As an aside (sort of), I would personally find a step-by-step on booking meetings helpful from people who have actually recently done it. 10 nights is a lot & gets an elite 20% of the way to Platinum. I have read all the links but info is still cryptic on the A-Zs. Maybe that’s by design? Much of the info is outdated, regardless, & I would like to know if it currently works & where before diving in, if that at least is possible.

Also, I used my AMEX/RC $1k airline “incidental” credits early this year so was covered before the shut down. Greg sometimes mentions his ease of use still in receiving back credit. Those updated tips, too, would be helpful going into the next calendar year. Thanks!

Your best bet is to reach out to properties directly — you’ll have to do a little legwork / make a few phone calls. The list of places, prices, etc would change too often to make any published list useful.

Of course, Nick, was just looking for a realistic $ range and whether one brand was more amenable than others for booking sham meetings. I submitted a meeting request form earlier this year (with the intent of already holding one this year). I live in a large city, and the list sent back included almost every Marriott brand available encompassing about 25 properties. It was a little daunting never having done it before, especially as each property had different restrictions and terms, particularly if you weren’t staying at the property as well. Will probably pick the idea back up in 2020, looks like I’ll hit Plat this year without it.

Any thoughts on a new airline incidental credit post?

Pam,

I recently booked a “meeting” at a Courtyard property through a phone call. Originally I sent the RFP off to Marriott, but the Courtyard property called me directly and at first offered a meeting room for $350 for my 2 hour meeting. I said that we wouldn’t be able to pay that much, and she offered the room for $200. I mentioned that I was waiting for another property to return my call and she offered the room for $150 if I would confirm the contract then and there. I agreed at $150. She sent over a contract with the terms, and I signed it and returned it via email.

Our meeting is tomorrow (Saturday), but I will report back and let you know how it went. One thing I did not do prior to signing the agreement was inquire about the 10 elite night credits being added. I currently have an email request in to the meeting coordinator asking about those particular terms, but I doubt it will be a problem to add them if requested.

In any event, I’ll try to report back after the weekend.

Thank you so much, Bryan, I really appreciate the info & look forward to knowing how it all turned out.