NOTICE: This post references card features that have changed, expired, or are not currently available

It’s official: today is the deadline for purchasing IHG points in the latest sale and I had to make a decision as to how many I would be purchasing for our #3Cards3Continents challenge. As it turns out, I will be staying at only two IHG properties during my trip and as a result I am purchasing 22,000 points today. Actually, in real life, I’m buying more IHG points than that, but I’m only buying 22K for the purposes of the competition and as such I’m accounting for it as though I only purchased 22K (which makes a difference in the bottom line).

- See which cards they each selected in the live-streamed credit card draft here.

- Review the challenge rules and budgets here.

- Catch up on all ongoing updates here.

I definitely didn’t go into this competition planning to spend any nights at IHG properties. After all, in American Express Membership Rewards, I chose a currency that transfers directly to Marriott (1:1), Choice Privileges (1:1) and Hilton Honors (1:2). I expected it was more likely than not that I would be targeted with a transfer bonus to Hilton at some point that would make the ratio 1:2.3 or 1:2.6, in which case I figured Hilton would become a reasonable option.

Somewhat to my surprise, we haven’t seen a Hilton transfer bonus over the past couple of months. More surprising to me is that I haven’t found a single Hilton property in the places where I will be traveling that would be appealing from an award stay perspective even with a transfer bonus. That’s not to say that there aren’t some nice Hilton properties (nor is it to say that I won’t be staying at any Hilton properties!), but rather that Hilton award stays in my chosen locations wouldn’t have fit the budget.

As a reminder, in addition to the points from the cards that we drafted, we have $1,000 in cash to use to make travel arrangements like booking flights / paying award taxes, booking hotels, paying for airport transfers, etc. That thousand dollars also needs to cover the annual fees of the credit cards we chose in the draft.

Since I chose credit cards with cumulative annual fees of $790, that meant that I had $210 remaining from the initial starting budget. In order to make my trip work, I therefore needed to cash out some of the welcome bonus points I earned. Thankfully, one of the cards I chose was the Schwab Platinum card. One of the key reasons I chose the Schwab card is because points from this card can effectively be cashed out at a value of 1.1c per point. This means that I can cash out points to pay for flights or hotels — or to buy hotel points.

As an aside, one piece of hindsight “wisdom” on this trip is that I’ll end up needing to cash out enough Membership Rewards points that I’d have been better off focusing on a good cash back bonus rather than taking the Schwab card at all. In hindsight, I know exactly what card I should have chosen — but that’s material for another post on another day.

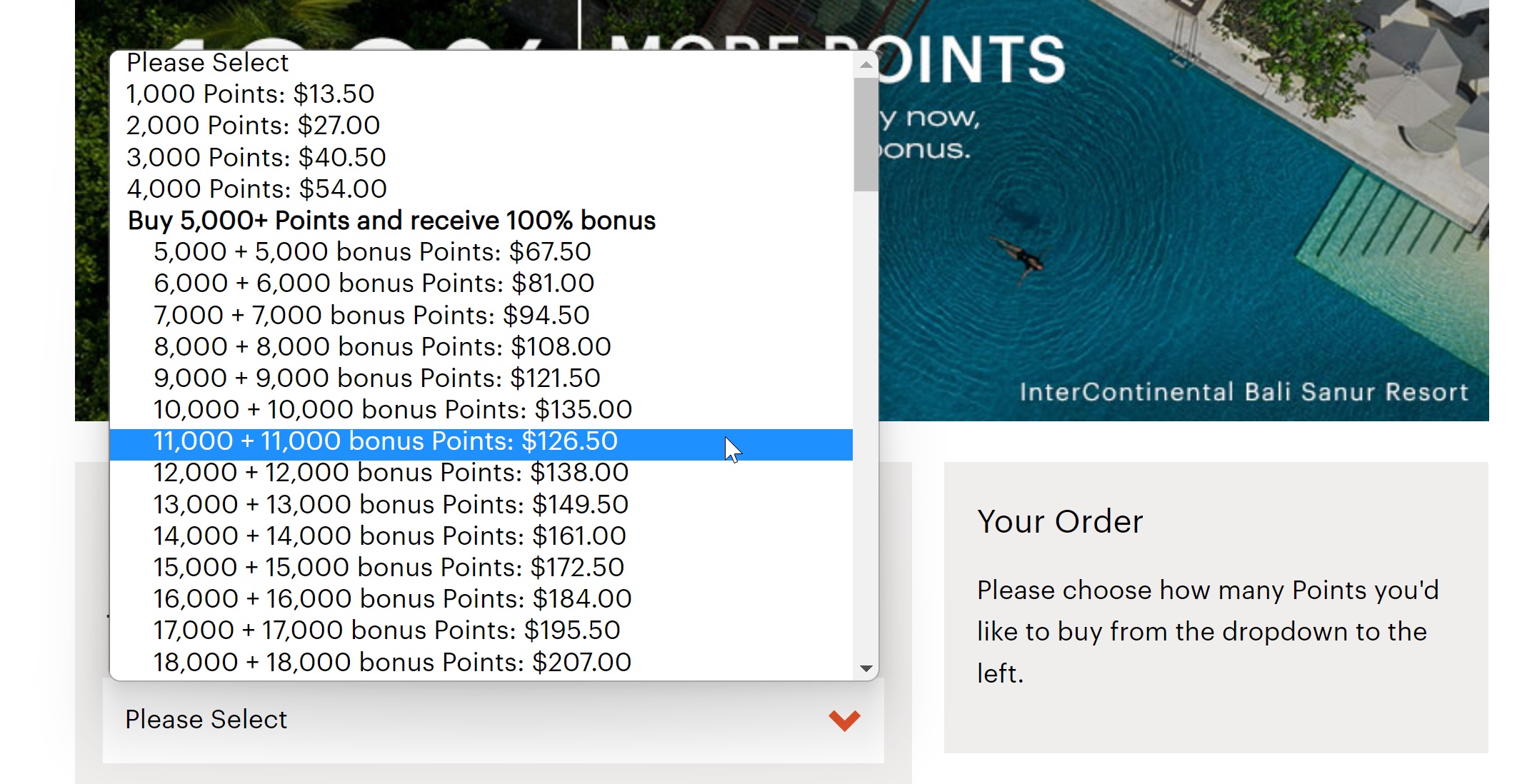

Sometimes cash is king because of its flexibility. Not only can cash be used to pay for great cash rates, but other times it can buy you points which can buy you hotels that would otherwise cost more than you want to spend :-). The moral of the story is that I am buying IHG points: today I am declaring that I will be “cashing out” 12,000 Membership Rewards points for $132 in order to buy 22,000 IHG points for $126.50 (which will leave me with an “extra” $5.50 — don’t worry, that’ll get used up elsewhere :-).

You might be saying, “Wait a second, I thought IHG points were on sale for half a cent per point (0.5c per point)?”

While that is indeed true, the minimum purchase in order to get the rate of 0.5c per point is 52,000 total points (26K purchased + 26K bonus points for $260). In real life, I bought plenty of points to get the 0.5c rate. However, since we are accounting for this trip as a standalone thing, I am accounting for the points purchase as though I purchased only the amount needed for my trip. That means I’m accounting for points at a cost of 0.575c per point.

That’s kind of funny accounting — in essence, my 3Cards3Continents trip will be accounted for as though it cost me $16.50 more than it really did since I invested enough in IHG points for future trips as to pay a lesser cost per point. But the point of the 3 Cards 3 Continents trip here is to show what could be done solely within the parameters we set — and I’m getting pretty excited because “what could be done” is looking pretty awesome.

If you are a regular podcast listener, you know that I recently said that I would probably be staying at IHG properties on 3 different continents. As it turns out, that won’t be the case. I originally intended to stay at another IHG property in part because it would have meant getting a better price per point. However, I spent a lot of time poring over lodging options this weekend and I ended up finding a deal that made more sense for my trip (both for the specific needs at that destination as well as the domino effect it had on other pieces of the puzzle) that changed things up. At this point, I have almost all of my flights and accommodations booked and I am very much looking forward to the trip. Next up: obsessing over the best activities in my destinations — and how to save a few bucks on those adventures.

Great post. I’m also finding great value w/ IHG, especially with the 4th night free. Question: I bought a significant number of points last night. Eek. And they’re still not showing in my IHG account. How long does the transfer usually take?

Hmm, something doesn’t sound right there. When I purchased, the points were immediately available in my IHG account.

That’s terrifying given how much I spent. Will call this morning!

FYI — They are telling me it takes 72 hours. 🙁

Recently bought IHG points for my account and my significant other’s account. My points posted immediately (active account with recent stays and future stays booked & Platinum status). SO’s points posted after 48 hours (not active & no status). So there appears to be a delay if there is limited engagement/activity.

I recently checked out cheap accommodation in Bali and found well-rated homestays there for between $6 and $7 a night. So that extra $5.50 could get you a night’s accommodation in paradise. . .

Bali certainly is a (potentially) very inexpensive destination depending on where you stay!

Back in the day (way back, to be fair) my wife and I stayed in a bungalow on Gili Air for $5 a night, for two people, including three meals a day.

I’m so glad I never upgraded original ihg card. 10% savings on redemptions!!! I seldom (if ever) put charges on it. I also have the new ihg Bness card. Any chance Chase shuts my Rewards Club card down bc of lack of use? Or related question…what is the history on banks allowing cardholders to continue using cards after their discontinuation? Such as Ritz, Amtrak, AT&T? Amtrak isn’t doing credit cards any more at all presently, as you know!

I would definitely put a charge on your card every six months. Could be something simple like a pack of gum. I now make sure to put a payment of just a couple of dollars toward an insurance bill once every six months to make sure I keep cards active and don’t get one closed for inactivity (because that did happen with my United card at some point!).

In terms of allowing cardholders to continue having their cards after discontinuation, that varies a ton by bank. Chase often lets old cardholders continue to have the old card for many, many years (like the old United (which I think was really Continental from back in the day) Presidential card, the Ritz card, the Ink Plus, etc. Lots of old Chase cards have been kept around for cardholders for many years — though in all of those cases, Chase still has other cards within that portfolio of cards. I can think of one case — the Fairmont card — where Chase no longer issued a card within that brand after they discontinued it and in that case they eventually converted cardholders to a CSP.

Amex has situations on both sides of the coin — some old cards have stuck around for a long time for cardholders that had them, others have converted to something new.

US Bank Radisson cardholders just got converted to Altitude Connect cards when they discontinued that card.

Citi has kept a number of old no-longer-available cards around for years.

I don’t know Bank of America’s deal on that. The only discontinued BOA card I remember before the Amtrak cards was the Virgin Atlantic White card. I don’t know what happened to people who had that.

Synchrony is dumping the Rakuten Visa and it sounds like cardholders are getting the option to get a different card.

It really varies.

Nice summary of what various issuers do with legacy cards. I have the Chase Ink and my wife and I both have the IHG Rewards Club. Definitely don’t want Chase to close or convert those.

I’m finding very consistent savings on IHG hotels by buying points when they’re on sale. Just booked 3 nights in a Mr & Mrs Smith hotel in Reykjavik for $800 worth of points. Cash price was $1135.

Can’t you get the fourth night free at Mr. and Mrs. Smith with the IHG Premier?

Presumably, but I don’t need four nights and I don’t have that card.

Portals don’t count? Leaving $2.53 on the table 😉