NOTICE: This post references card features that have changed, expired, or are not currently available

Evening posts

This week I’m trying something new. I usually publish a new post early every morning, but this week I’m trying out evening posts instead. It seems as if evening posts generate more social network discussions, especially on Twitter. I plan to continue this experiment through Friday and then I’ll decide whether to go back to morning posts or keep to an evening schedule. What do you think or prefer? Comment below or send me a Tweet @FrequentMiler.

#milemadness

In yesterday’s post, “The next mad challenge,” I described a new contest that I’ll be judging in which people will use manufactured spend techniques in hopefully efficient, ethical, and creative ways. The reaction to the announcement has been interesting. Many readers are excited. Many others are enraged. The latter group believes that this contest will shine a spotlight on techniques that should be kept quiet. And, they believe that once that happens, the opportunities that currently exist will dry up. Our intent is not to do that. We don’t plan to give out instruction manuals. Think of this more like the show Top Chef. The competition itself is interesting even when the contestant’s recipes are not given in detail. As I said in yesterday’s post, I will use my judgment to decide what things to post explicitly, what should be veiled, and what shouldn’t be mentioned at all (see “Blogging the line“).

Questions? Check out the evolving #milemadness FAQ, here.

Serve vs Bluebird

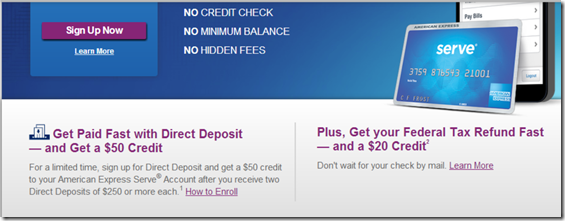

I’m thinking of switching from Bluebird to Serve. American Express is currently running two nice promotions for Serve cardholders: 1) Sign up for direct deposit and make two deposits of $250 or more and get a $50 credit; and 2) Send your federal tax refund to your Serve account and get a $20 credit.

By itself, $70 of free money is appealing, but maybe not enough to make me want to switch from Bluebird. However, these are just two examples of many other ways in which Serve seems to edge out Bluebird these days. For example, Serve cards are eligible for Amex Sync promotions, but Bluebird cards are not. And, Serve can be reloaded at CVS and 7-11, but Bluebird cannot. Serve doesn’t offer paper checks that you can write yourself, but otherwise has almost identical features and limits as Bluebird. Serve does charge a $1 fee on any month in which you didn’t load at least $500 to the account, but that is unlikely to be a problem for me.

Unfortunately, each person is only allowed to have one: either Bluebird or Serve. Has anyone tried converting to Serve? What was the process like?

[…] Feb 25 2014: On my mind […]

So does this mean your serve account has an account number and routing number like a regular bank account or would you bill pay in a different way? I’m trying to figure out how I might pay rent with it.

No, to pay rent you log in and go to the bill pay function. Add your landlord’s name and address and pay bill. Your landlord will receive a paper check in the mail

Serve would be problematic for accounts we manage for others, I might convert myself but no good for the others unless can have AUs.

I’m not sure why you would say that. All of my experience so far is with a card in my sister’s name

I was thinking CVS would verify the name on the Serve card, missed your earlier comment, I would like to hear some NYC experiences. It is hard to even find places on than that post office that will take a debit card for a money order. Might as well test it myself for one of the cards I manage, can always cancel and go back to BB if I no-go.

I’d say there seems to be enough interest in Serve to warrant a dedicated in-depth post. 🙂

Wait — is the swipe at CVS/7-11 only debit, or can you swipe credit cards directly to load? If the latter, does it code as a drug store purchase to the credit card?

And, if I’m reading correctly, serve has the advantage that it’s $6k or $7k per month, yes?

I tried not to be too explicit 🙂 Yes, drugstore purchase. Yes $7K if you do $1K credit and $1K debit online

Anyone confirm that the $200/day (max $1k) posts as a purchase or cash advance? I assume the cashier swipes to Serve at CVS post as a sales transaction, correc? Thanks in advance.t

Purchase with Citi and Amex at least

You should consider that asking your current (morning) audience if they want a change won’t necessarily give you a broad view.

For example, at an afternoon PTO meeting at my daughter’s school, as part of an effort to widen attendance parents were asked, Would a morning meeting work better for you? I pointed out that asking the people that were THERE didn’t make much sense – of course the afternoon worked for them, they were there! The people we wanted to ask were the people that WEREN’T there.

If you’re looking to broaden readership and interest beyond your current pool, asking current readers (who read in the morning) if they want to change things up is mostly going to give you a narrow and typical response: I read things in the morning and I don’t want to change it. To get a broader response, you need to reach out to the greater community, beyond your current pool of readers.

Personally, I don’t care one way or the other.

That’s all true, but my goal wasn’t really to broaden my audience but to see if evening posts generated more social media conversations (Twitter, Facebook, etc.). It doesn’t seem to have had that effect.

I like the evening posts because I don’t always remember to check/read my email in the morning when I get your updates. I could be on a packed bus/subway/standing room only and I’ll forget to read your post by the time I get to work. Or if I do read it, I’ll most likely just skim and try to remember to bookmark it to read later. I think the switch up may be good. Perhaps a morning and evening post. I know I have more time when I get home from work so I can actually sit down and read everything instead of sneaking it in on my way to work or at lunch.

Thanks for the input. You’re the first to prefer evening posts!

The online debit and credit monthly load limits are separate from each other (and separate from the “cash” monthly limit – CVS/7-11 and VR). So the total monthly limit from these sources is $7k.

That’s great. Thanks!

I see a lot of blog posts from when Serve was first introduced. Given that Serve had changed dramatically from when it first came out, I can’t find a clear comparison anywhere of Serve vs BB. Do you know of any good current blog posts for this? If not, perhaps that would be a good one to post?

I wrote a high level comparison here: https://frequentmiler.com/2013/12/24/serve-or-bluebird/

But there’s not much meat to it. I’ll consider doing an in depth follow up.

According to Slickdeals, you can get the $50 Serve credit by DDing from Amazon Payments: http://slickdeals.net/f/6581730-50-with-2-250-direct-deposits-american-express-serve-new-customers-or-ymmv-thru-3-31-14

So, if I’m understanding this correctly, it sounds like if you are willing to go to CVS (or 7-11) ten times a month to load $500 each time with a CC for free, Serve will save you $80 over loading BB with $5000 worth of VRs. That’s an interesting trade-off.

The trade off is “free” loads vs having to absorb cost/time to make 5 visits vs convenience of 1 trip to buy $5K VRs but at cost of $7.90 x 5. So is it worth your time to make 4 additional trips to save $40?

I visit often enough that Serve might make sense. It also has the advantage of not having to float the cost of VRs that sit on my desk for a week or more (although I’m almost always using free float courtesy of the CC companies).

But anytime we see “free”, it doesn’t last long. Can see Serve put a load fee sooner than later.

You said nearly the same thing as myself at the same time, except I think it’s not 4 more trips but 9, b/c the CC load limit is $500, not $1000. I don’t know why you say it’s “free,” in quotes. Isn’t it actually free?

For me, it would probably not be “so many more” trips because I’m too embarrassed to purchase $5000 in one day.

My concern is that on Serve, it would be easier for Amex to see what I’m doing. With BB, there’s at least a middle step where I’m going through VRs.

Never mind the first part of my response… I see it’s meant to be two separate $500 transactions, so both could be the same day. But the rest of what I said stands.

And the bill pay function is the same?? Sorry for so many questions..I just don’t understand why I have been going nuts trying to find VRs when this option was available???

Yes bill pay function is the same. Amex just added the swipe reload at CVS capability late last year so until then Bluebird was a bit better

The Wiki on FT seems to say it’s $1000/daily and $500 a swipe meaning two separate transactions?

Correct