NOTICE: This post references card features that have changed, expired, or are not currently available

Over the past several years, business credit cards have been the best option for acquiring points, miles and cash back through welcome bonuses. Business card offers consistently top our Best of the Best Offers list. Plus, most business cards do not add to your 5/24 Count and so they make it easy to keep getting more and more cards.

| Chase's 5/24 Rule: With most Chase credit cards, Chase will not approve your application if you have opened 5 or more cards with any bank in the past 24 months. To determine your 5/24 status, see: 3 Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely. |

Pandemic influence

During the pandemic, things have changed. Business card offers still top our lists, but card issuers have made it harder and harder to get approved for business cards. During the recession, businesses are less likely to be able to pay their bills, and card issuers don’t want to be stuck footing those bills.

Meanwhile, we’ve seen the appearance of some of the best offers ever for consumer cards. Are individuals really less likely to default on their credit card bills than small business owners? Card issuers seem to think so.

Here are a few examples:

- Chase has made their Freedom and Freedom Unlimited offers exciting. They’ve continued the 20K welcome offer but tacked on 5X grocery earnings for the first year on up to $12K spend. If you spend the full $12K at grocery stores in the first year (and don’t otherwise use your new Freedom card at all), you’ll end the year with 80,000 points. That’s awesome for a fee-free card. See these posts for more details:

- Air France’s credit card now has a 50K welcome offer. True, it’s not particularly notable for an airline card to offer 50K miles, but this card has only offered up to 25K miles until now. It has changed this snoozer of a card to one to consider if you’ve already hit up all of the more valuable offers (or if you need a good way to keep your Air France miles alive).

- The Amex Hilton Aspire card continues to offer 150,000 points after $4K spend. What has changed is that Amex has made the card more valuable this year: free night certificates last longer and are good any day of the week; the $250 resort credit can be earned through dining and delivery purchases; and they’ve offered a great grocery spend bonus (12X) through the end of July (plus, I think it’s likely that we’ll see other spend bonuses appear in August). For details, see: Is it time to get an Amex Hilton Card?

- Amex has offered up to 125K for their Platinum card (targeted). And, overall, Platinum cards have become more valuable than ever this year thanks to a slew of new credits. See: Is it time to get an Amex Platinum Card?

Best Credit Card Offer Page: Changed

Despite some personal cards having best-ever offers, business cards have continued to top our overall “best of the best” list which is sorted by estimated first year value. As a reminder, we estimate first year value for each card by estimating the welcome bonus value and subtracting out both the first year annual fee and the opportunity cost of spend to meet minimum spend requirements (see this page for details).

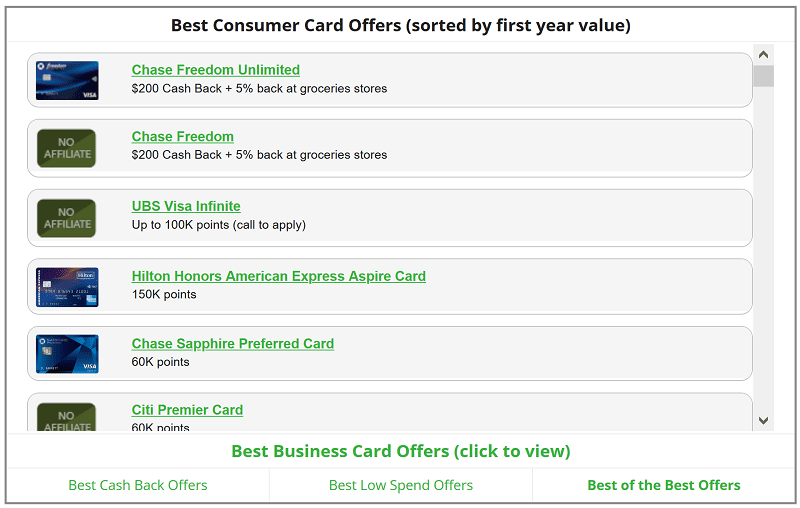

At the top of our Best Credit Card Offers page we used to have the “Best of the Best” list. But I looked at this recently and noted that the list wasn’t very useful. With business cards taking most of the top spots, the list wasn’t showing what most people currently need: a list of the best offers that they can actually get. That’s why, for now at least, I changed the top list to show just the best of the best consumer card offers:

As you can see above, at the time of this writing the Freedom cards top the list now that business cards have been eliminated from view. If you’d like to see a list of the best business card offers, there’s a link at the bottom (second to bottom row). And if you want to see the original collection of all offers mixed together, you can click on the “Best of the Best Offers” link in the bottom right.

As always, further down on our Best Card Offers page, you can see all offers separately by card issuer. For example, if you want to view Citi cards, you can click to “jump” to the Citi section, and there you’ll see Citi cards separated by “Thank You Points,” “Airline Cards,” “Hotel Cards,” and “Cash Back Cards.”

Reader Input

What do you think about the Best Card Offers page change? Is the top display now more relevant to you or less? Also, have you applied for any business cards during the pandemic? If so, let us know which cards you applied for and whether or not you were approved. Thanks!

![Hyatt goes next level with Mr & Mrs Smith [Integration “early 2024”!] a heart shaped sign over a house overlooking a body of water](https://frequentmiler.com/wp-content/uploads/2023/05/Mr-and-Mrs-Smith-and-Hyatt-218x150.jpg)

[…] updating links on our Best Credit Card Offers page today, I stumbled on a number of awesome targeted offers. They didn’t show up every time I […]

Great change. I have a business, but some folks don’t. Even with a business, however, I often want to compare options within each category, so this is very helpful. Thanks!

Was listening to the latest podcast where Greg and Nick asked for feedback on card applications. A thought came into my mind.

Is it crazy to suggest something like the FM labs section where ppl can put in whether they were approved or denied?

It would be searchable so others looking to apply for the same card could get aggregate data quickly.

Maybe it’s already been done and I didn’t notice in which case, ignore…

That’s a good idea.

DP: Applied Jul 2020 for the Chase Ink Business Unlimited; denied, called reconsideration, still denied, not enough accounts checking/savings, too many cards was the explanation. I do have 4 other chase biz cards so it was hard to refute.

Thanks

[…] On my mind: Pandemic Best Credit Card Offers […]

Just got 5x offer via Chase/IHG card. Register and earn 5x on groceries and gas. Now until the end of September.

Greg, may I suggest that you guys are overvaluing the 5% Grocery benefit of the Chase Freedom and Freedom Unlimited cards? I’m not sure exactly how much you’re valuing it, but whatever it is seems like way too much to me if it’s your #1 and #2 consumer cards. I think there are two potential holes here:

1) To get the full 60K URs for Groceries, one would have to spend $12,000 there. Some people spend that much on groceries, but some don’t. I know I don’t (I’m a single person household). And I’m not manufacturing spending at the grocery store to get to $12K.

2) Many people have other cards which give them excellent grocery bonuses. I use the Citi Thankyou Premier card which offers a 3x bonus. Some folks have the Amex gold card which offers a 4x bonus. The value of the CF and CFU are only on the difference in value between someone’s best grocery credit card and those cards.

For someone like me, who spends maybe $5,000 a year at the grocery store and already has a Citi Thankyou Premier card, the CF and CFU fall well short of the first year value of something like the CSP.

I think if you are valuing the potential 60K URs from the CF and CFU grocery bonus at anywhere close to full value, that’s way too much. Half value would be the absolute cap IMO–still far too much for someone like me, but it would be balanced out by people who would spend the full $12K on groceries and maybe only have a 2% cash back card as their best alternative at grocery stores.

I agree with this. I think the 5X is overvalued. You have to take into consideration opportunity loss. If you put those $12K on another card, say the Amex Gold which also comes with 30K-50K MRs, the added value from the CF/CFU could be potentially pretty minor.

Of course, if you’re MSing, it could be a situation where it’s not either/or (i.e. you could be putting $12K in grocery spend on the CF/CFU regardless of what you put on other cards). However, most readers probably don’t MS.

Thanks Brian, these are good points. In our calculation of first year value, we assume (for all offers) that the alternative spend earns 3% cash back. So, while we are overvaluing the benefit compared to spend on the Citi Premier, we are undervaluing compared to spend on many other cards.

What we didn’t consider is people like you who spend less than $12K on groceries per year. You’re right that we didn’t consider this in our valuations. We do need to make assumptions in order to estimate value, though, and so we’re always wrong one way or another. I still think that assuming $12K grocery spend over a year ($1K per month) is a good assumption for most readers, but I certainly could be wrong!

I always like when biz cards are separated.

P2 started a business in October 2019, got CIP end of Dec ‘19 and CIU end of Mar ‘20 but was denied CIC end of Jun ‘20 for “business too new”. So guess we’ll just PC the CIP to CIC in Jan ‘21 after the AF hits

Does she have a business checking accout with chase?

The change is good.

During the pandemic my sister and I both applied for the Bank of America Business cash $500 offer and were both approved. I have also applied for the Citi Business American Airlines card and was approved.

May I ask with what you have gotten approved for the Citi Business AA card?

I am contemplating applying for that one as well. I have several Business cards and a “B” Experian Business rating and my personal FICO is around 760. With Citi I have had the a Premier card for a little over a year, and at around the same time I had applied for the Citi Business AA card and was denied due to length of credit history (2 years vs. 3 years now). That’s why I am a little hesitant to try again as it was my first denial ever and recon shut me down pretty quickly after calling them, and told me no chance of getting approved.

Sole proprietor. My brother was denied a few years ago for the same reason as you – only had a Citi relationship for about 1 year or so. He was recently approved for the AA Business card as well.

Hchris

Lots of cards out there canceled that card a week ago .NEVER spent any money but Citi spent 30 mins tying to get me to renew ????I have the no fee card and just got the 10k points ..T

Thanks FM .

Try NEXT year

#stayincave