NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

It’s time to check in again with our informed newbie Ben. Previously, we helped him form a credit card plan. Next, he successfully signed up for three cards at once. Intentionally, all three were business cards that do not report to personal credit bureaus. This way, Ben can sign up for many more cards without exceeding Chase’s 5/24 limits. And our next update about Ben was in July when we reported his progress and his 3X surprise. Finally, in the post “Newbie’s Second Dance,” we reported his second round of applications. He successfully signed up for a second Ink Business Preferred card (80K offer), an Amex SPG Business card (35K offer), and the Amex Delta Platinum Business card (70K offer). Coincidentally (for those interested), the SPG and Delta offers are now available again.

Recently Ben signed up for a few new cards. In January he applied through an targeted email offer for the Chase Sapphire Preferred for 60,000 points after $4K spend and an additional 5,000 points for adding an authorized user. Unlike the current public 65K offer, Ben’s first year fee was waived.

Then, after meeting the spend on his Sapphire Preferred card, he decided that it was time to pickup the SPG personal card and the Marriott Business card. Neither card is likely to be available for new signups after this year (see: Marriott announces new credit card lineup) so Ben wanted to get in on them while he still can.

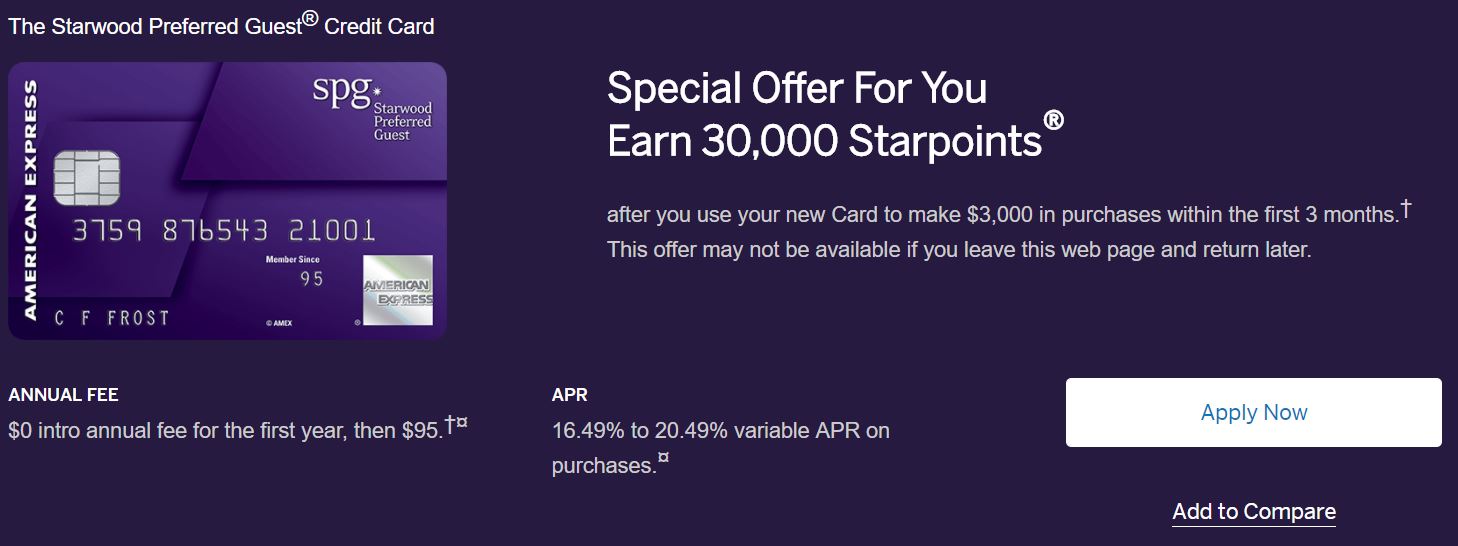

SPG Personal 30K Offer

The current public offer for the SPG personal card is 25K points after $3K spend. Ben reports, though, that he was able to find a 30K offer by doing the following:

- Ben opened an incognito window in his Chrome Browser

- He opened our Best Offers Page within that window

- Ben found the link on the Best Offers Page for the personal SPG card. Even though our page lists the public 25K offer, he found a 30K offer when he clicked through.

- Ben reports that the 30K offer did not show up when he tried the above steps with a Private Firefox window or an InPrivate Microsoft Edge window.

Ben was instantly approved when he signed up.

Marriott Business 75K Offer

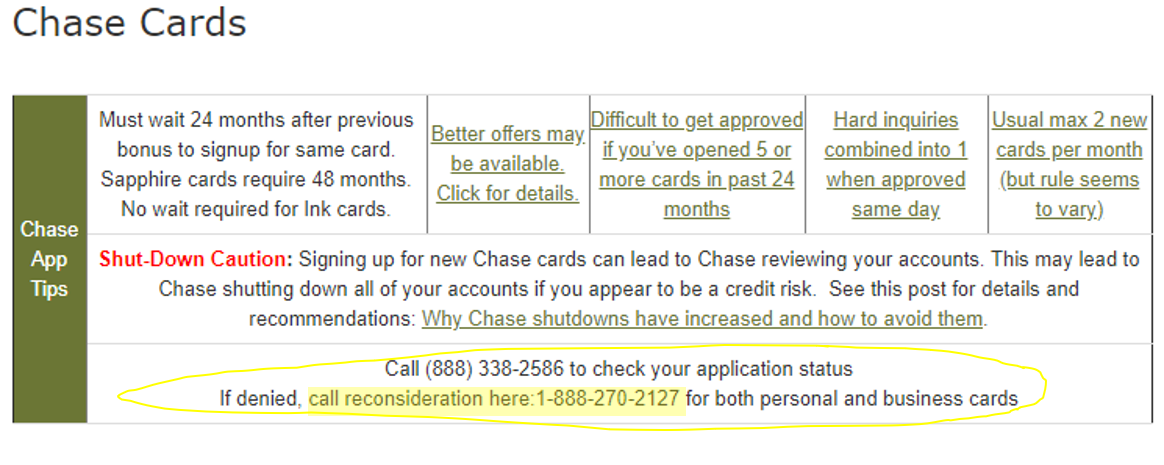

The current public offer for the Chase Marriott Rewards Premier Business card is for 75K points after $3K spend in 3 months. Ben couldn’t find a better offer than that (neither can I, FYI), so he applied for that offer. Ben’s application went pending. He reports that he called Chase’s reconsideration line (found here) and spoke to an analyst to try to get an instant decision. The analyst asked a few questions and then said that he pushed the application forward to a senior analyst. He was told that he should get a decision in 5 to 7 business days. Ben is still waiting for news on this one. If he is denied, he’ll call reconsideration again. It’s possible / likely that they’ll approve him if he moves credit from another Chase business card.

Update March 11 2018: Ben reports that his application was approved!

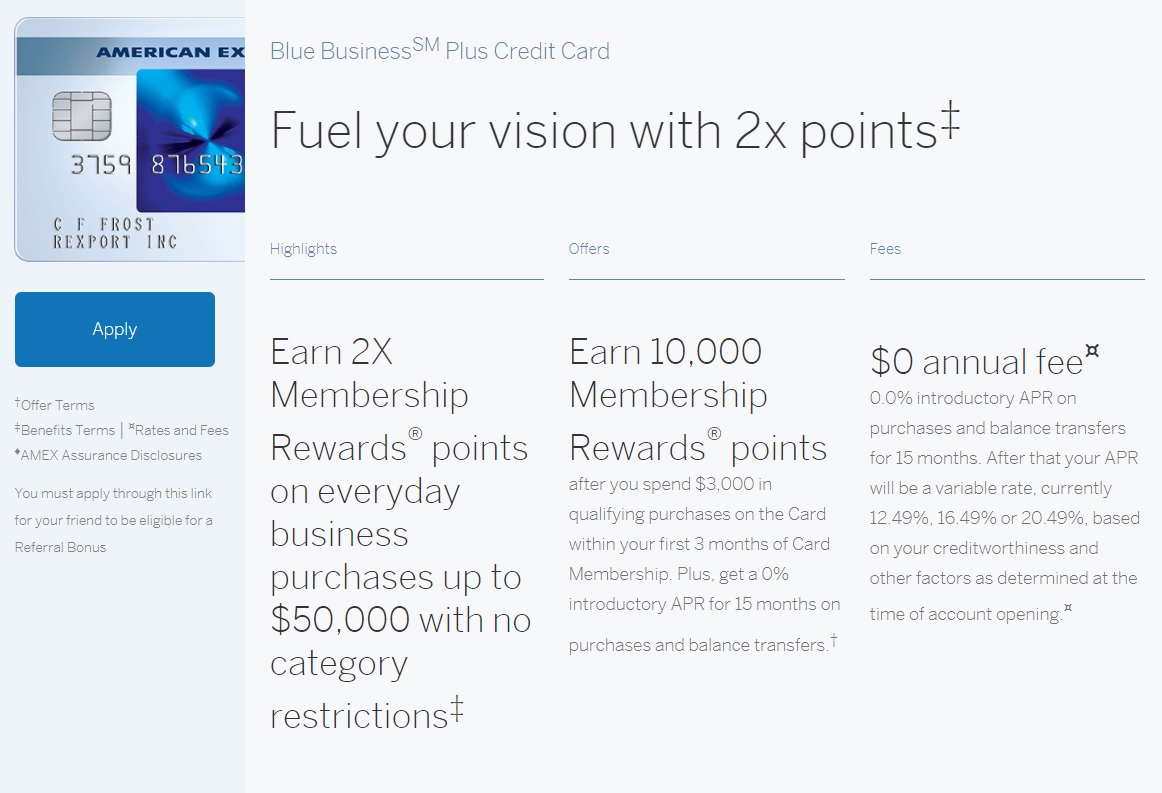

Blue Business Plus 10K Offer

Ben decided to throw one more application into the mix: the Amex Blue Business Plus Card. Thanks to its 2X everywhere Membership Rewards earnings on up to $50K spend annually, I’ve previously described this card as the “new king of everyday spend.” Ben reports that he has wanted to get this card but was waiting for a signup bonus (there hasn’t been a public signup bonus for this card since early on). Fortunately for Ben, Amex recently started offering 10K points after $3K spend when signing up through a referral link (found here).

Ben first tried his Chrome incognito trick (as described above in the SPG 30K section), but didn’t land a better offer, so he went with the 10K referral offer.

Ben’s application was instantly approved.

Staying under 5/24

| Chase's 5/24 Rule: With most Chase credit cards, Chase will not approve your application if you have opened 5 or more cards with any bank in the past 24 months. To determine your 5/24 status, see: 3 Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely. |

In the past 9 months, Ben has signed up for 10 new credit cards. Given that, you’d think he was now way over 5/24, but he’s not. Most of the cards Ben applied for were business cards from Chase and Amex. And those business cards do not count towards 5/24 (see this post for details). Out of those 10 cards, only his Sapphire Preferred card and his SPG personal card add to his 5/24 total. As a result, Ben can continue to sign up for Chase cards for a while without worrying about 5/24. As long as he sticks primarily with business cards (except from Capital One which reports business cards to the credit bureaus), he can continue to collect new card bonuses without adding to his 5/24 count.

| Chase 5/24 semantics ("Subject to" vs. "Count towards"): Most Chase cards are subject to the 5/24 rule. That means the rule is enforced in making approval decisions. In other words, you probably won't get approved if your credit report shows that you opened 5 or more cards in the past 24 months. Meanwhile, most business cards (such as those from Chase, Amex, Barclaycard, BOA, Citi, US Bank, and Wells Fargo) are not reported on your personal credit report. These cards do not count towards 5/24. Example: Chase Ink Business Preferred is subject to 5/24, so you likely won't get approved if over 5/24. If you do get approved, it won't count towards 5/24 since it won't appear as an account on your credit report. |

Adding up the points

Here’s a full tally of Ben’s point earnings so far. In most cases I assume that Ben spent (or will spend) exactly the amount needed to meet minimum spend requirements, and that this spend earns just 1 point per dollar (except where noted with an asterisk).

| Card | Offer | Total Spend | Estimated Points after Spend | |||

| Chase Ink Business Preferred | 80K after $5K spend in 3 months. $95 annual fee not waived. | $5K | 95K* | |||

| Chase Ink Cash | 30K after $3K in 3 months. No annual fee | $3K | 33K | |||

| Amex Delta Gold Business | (Expired)60K after $4K in 4 months + $50 credit after Delta purchase in 4 months. $95 annual fee waived first year. | $4K | 64K | |||

| Chase Ink Business Preferred (Ben’s second business) | 80K after $5K spend in 3 months. $95 annual fee not waived. | $5K | 95K* | |||

| Amex SPG Business | 35K: 25K after $6K spend in 3 months, Additional 10K after additional $4K spend in first 6 months. $95 annual fee waived first year. | $10K | 45K | |||

| Amex Delta Platinum Business | (Expired) 70K + 10K MQMs after $4K spend in first 3 months + $100 statement credit after Delta purchase in 1st 3 months. $195 annual fee. | $4K | 74K | |||

| Chase Sapphire Preferred | 65K: 60K after $4K spend in 3 months + 5K for adding an authorized user. $95 annual fee waived first year. | $4K | 69K | |||

| Amex SPG Personal | 30K after $3K spend in 3 months. $95 annual fee waived first year. | $3K | 33K | |||

| Amex Blue Business Plus | (Expired) 10K after $3K spend in 3 months. No annual fee. | $3K | 16K** | |||

| Chase Marriott Rewards Business | 75K after $3K spend in 3 months. $99 annual fee waived first year. | $3K | 78K |

* Ink Business Preferred 3X: As described in an earlier post, Ben has found that his Plastiq payments to his retirement home have been earning 3X when he pays with his Ink Business Preferred cards.

** Amex Blue Business Plus: The Blue Business Plus card earns 2X on all spend, up to $50K spend per year.

Point Totals:

- $44K spend

- 602,000 points

- 568,000 miles*

* Converting points to miles: Different types of points and miles have very different values. For example, Marriott points are worth far less than SPG points. Even Marriott acknowledges this by allowing members to freely convert SPG points to Marriott points at a 1 to 3 ratio (1,000 SPG points becomes 3,000 Marriott points). Similarly, they allow converting 3,000 Marriott points to 1,000 SPG points. In order to compare apples to apples, I estimated how many airline miles Ben has earned, assuming that he wants to convert all of his points to miles. Most of the points that Ben has earned are airline miles (Delta), Ultimate Rewards points, or (soon) Membership Rewards points. The latter two can be transferred 1 to 1 to a number of airline mile programs, so I counted each of these points as being equivalent to airline miles. SPG points can be converted to airline miles at a ratio of 20,000 points to 25,000 miles, so I multiplied Ben’s SPG point total by 1.25. And Marriott points can be converted down to SPG points 3 to 1 and then converted to airline miles 20,000 to 25,000, so I multiplied Ben’s expected Marriott points by 1.25/3. The latter is a conservative estimate of the number of miles he has earned since he could do even better by using his SPG and Marriott points to purchase a Marriott Travel Package.

First year expenses

Earning over 600,000 points in a short period of time is impressive, but it’s worth considering how much it cost Ben to accomplish this. In order to estimate his expenses, we’ll include the cost of meeting minimum spend and any first year annual fees.

I don’t know how much Ben really spent on meeting minimum spend requirements, but I’ll assume worst case… I’ll assume that Ben used Plastiq bill payments for all of his minimum spend and that he had no Fee Free Dollars from their refer-a-friend program. In other words, we’ll assume that he was charged 2.5% for all spend. Also, for simplicity, I’ll assume that the Plastiq fees were not themselves used to meet minimum spend. On the other hand, also for simplicity, I’ll assume that Ben got full value from his Delta card statement credits:

- Meet spend at 2.5% with Plastiq: $44K x 2.5% = $1,100

- First year fees: $385

- Less Delta card credits: ($150)

- Total expenses: $1,335

$1,335 sounds like a huge amount of spend, but it’s arguably a very small price to pay for 600,000 points. Also keep in mind that Ben probably had some Fee Free Dollars with Plastiq, and probably met some of the minimum spend requirements with natural credit card spend (no fee) rather than with Plastiq at 2.5%.

Per point cost:

- $1,335 / 602,000 = 0.22 cents per point

- $1,335 / 568,000 miles = 0.24 cents per mile

Fee Free Option:

If Ben wanted to, he could redeem Ultimate Rewards points for cash at a penny per point. So, he could actually offset all of his fees as follows:

- Redeem 133,500 points for $1,335 in cash

If Ben did this, he would still have the following points available:

- 602,000 points – 133,500 = 468,500 points

- 568,000 miles – 133,500 = 434,500 miles

In other words, Ben arguably earned over 400,000 points for free.

Credit Score?

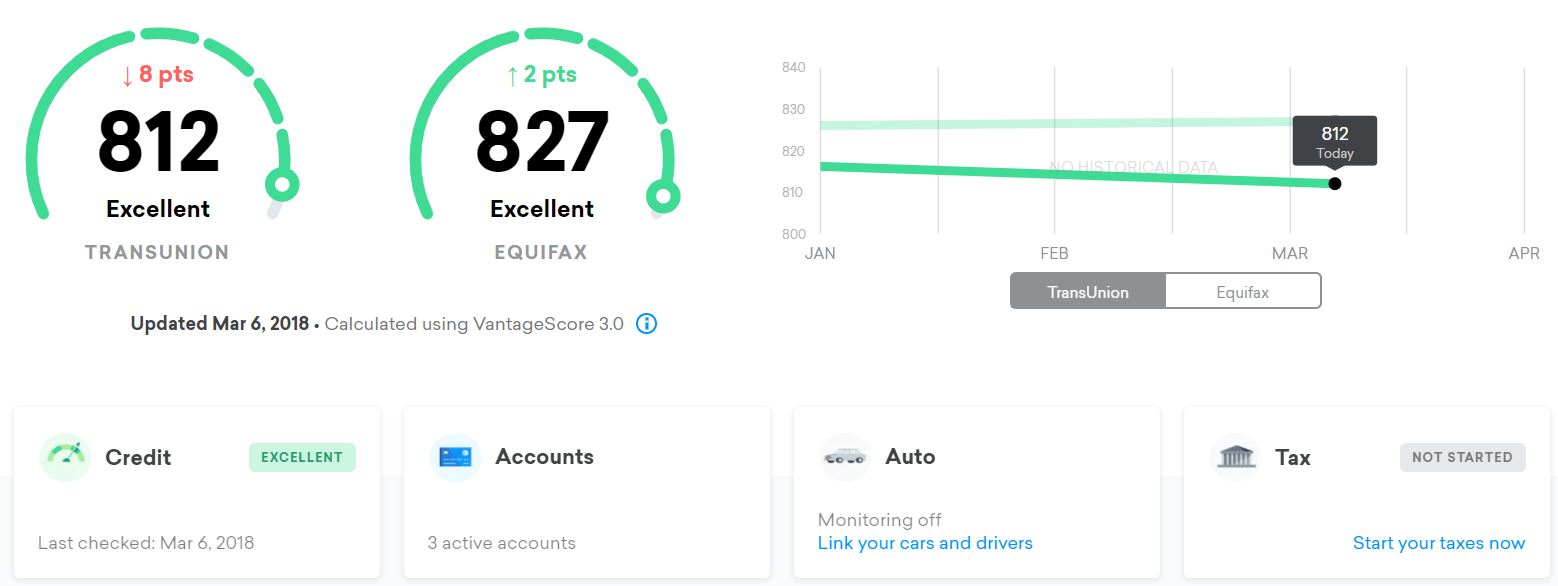

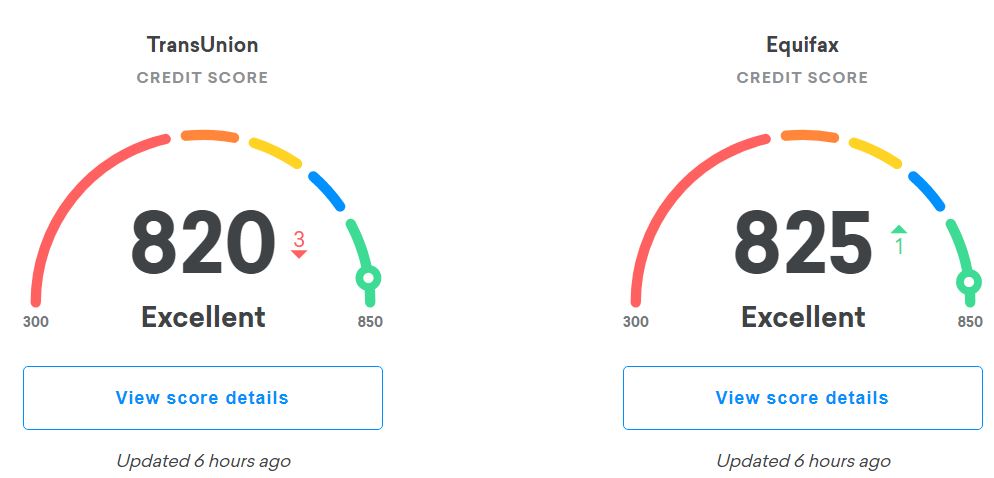

Ben’s Transunion and Equifax scores are still excellent:

Here were his comparable scores in July:

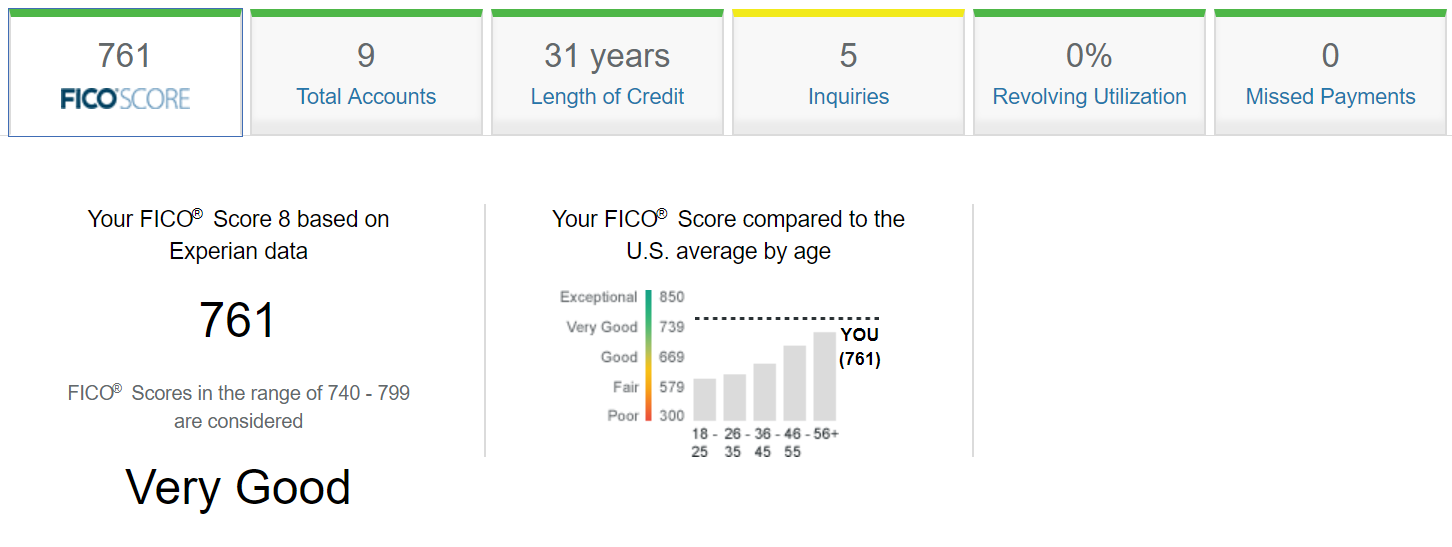

And Ben’s Experian score is still Very Good (but it has dropped 22 points since we looked at it in July):

This is a 22 point drop from July:

Ben’s Amex applications have resulted in Experian credit inquiries while his Chase applications resulted in inquiries with both Experian and TransUnion. This helps explain why his Experian score dropped the most (since all inquiries appeared on his Experian report), TransUnion just a bit, and why his Equifax score was completely unharmed (it actually increased 2 points since July).

Inquiries become less important to your credit score after about 90 days and drop off your report completely after two years. So Ben’s Experian score should recover nicely if he waits a while before applying for more cards, or applies for cards from banks that don’t use Experian for their hard credit pulls. Note that which credit bureaus the banks pull from varies by the applicant’s location. You can get a fair idea of which credit bureau may be pulled by checking the Credit Pull Database.

Summary

In the 9 months since Ben started signing up for credit cards, he has earned (or will soon earn) over 600,000 points. That’s awesome. And these are not cheap easy to get points like Hilton or Club Carlson points. Most points earned (or soon to be earned) are transferable points (Ultimate Rewards, SPG, and Membership Rewards) which I consider to be the most valuable points around.

Using my Reasonable Redemption Values (RRVs) for points & miles, we can estimate how much travel Ben can reasonably expect to get from the points he has collected so far: $9,784! And if he cherry-picks the best value rewards he can get much more.

| Applying for Business Credit Cards Yes, you have a business: In order to sign up for a business credit card, you must have a business. That said, it's common for people to have businesses without realizing it. If you sell items at a yard sale, or on eBay, for example, then you have a business. Similar examples include: consulting, writing (e.g. blog authorship, planning your first novel, etc.), handyman services, owning rental property, renting on airbnb, driving for Uber or Lyft, etc. In any of these cases, your business is considered a Sole Proprietorship unless you form a corporation of some sort. When you apply for a business credit card as a sole proprietor, you can use your own name as your business name, use your own address and phone as the business' address and phone, and your social security number as the business' Tax ID / EIN. Alternatively, you can get a proper Tax ID / EIN from the IRS for free, in about a minute, through this website. Is it OK to use business cards for personal expenses? Anecdotally, almost everyone I know uses business cards for personal expenses. That said, the terms in most business card applications state that you should use the card only for business use. Also, some consumer credit card protections do not apply to business cards. My advice: don't use the card for personal expenses if you're not comfortable doing so. |

[…] When we last checked in on our “informed newbie”, Ben had pulled in over 600,000 points through signup bonuses in a 9 month span. And, even though he had signed up for 10 cards in that time-frame, he was still under 5/24 thanks to his focus on business cards (which are not typically reported to the credit bureaus). Please see my prior post for full details: Over 600,000 points and well under 5/24. […]

Any update on the well informed newbie, Ben, on next set of card accumulation?

I haven’t heard. I’ll ask him.

Great. Would you be doing a followup article?

I will

Why is it acceptable to pay for personal expenses on a business credit card? The cards all have stipulations in the terms agreements that say that they must be used for “business expenses”. If you’re a sole prop, I don’t see a tax problem, but there’s still the issue of upholding the cardmember agreement.

Its one of those things that’s not illegal, but if you’re not comfortable with it, you shouldn’t do it

UPDATE: Ben reports that his Marriott Business card application was approved!

It looks like Ben opened up five credit cards in one year for Chase. Isn’t he concerned about a shutdown? I have read that 6 is the magic number when they start getting upset but I really have no idea. I’m only applying for three Chase cards per year but I wonder if this is perhaps too conservative. What is your opinion?

The number I’ve seen for how many is too many is >10 cards in a year, but if you have seen evidence of shutdowns at 6 cards, that would be very important to know. Can you share where you saw that number?

“Chase Ink Business Preferred is subject to 5/24, so you likely won’t get approved if over 5/24. If you do get approved, it won’t count towards 5/24 since it won’t appear as an account on your credit report.”

Chase business cards don’t count against 5/24 even though Chase will know you’ve opened them? If so that’s great! I thought I was over 5/24 but I have two Ink, that would put me under.

Yep. It was an open question for a while as to whether or not they counted their own business cards, but over time I received enough reader reports to thoroughly convince me that Chase does not count even their own business cards.

I am curious why the Southwest personal and business cards were not included Greg because you can earn a Companion pass for the remainder of this year and all of next which is a valuable asset by getting those cards. What are your thoughts on working those in and what would you replace. Also what do you suggest if a person does not have a small business?

Well, remember that this is Ben’s plan. If you see the first post in the series (the first link in the second sentence of this post), you’ll see that Ben said he wasn’t very interested in flying Southwest.

Also in that first post, you’ll find where it would have made sense to apply if he were interested. It generally makes the most sense earning the Companion Pass as early as possible in a calendar year. On the other hand, you have to balance that out with the fact that other more valuable Chase cards can be harder to get and you may want them closer to the beginning of your application strategy.

I totally agree that the Companion Pass is a great value. In fact, I’ve often said it’s the best value in domestic travel in my opinion. However, not everyone lives near an airport that’s well served by Southwest, not everyone enjoys the open seating policy, and not everyone travels in pairs. Further, if you travel for work regularly enough to qualify for elite status, you may prefer flying on the airline with which you’ve earned those benefits. In a nutshell, Southwest isn’t for everyone. Personally, I rarely ever fly domestically on anyone other than Southwest thanks in part to the Companion Pass, but the relative value to each person can vary.

Wish someone would have guided me when I started, as he is being guided.

I tried the incognito for personal Amex and still keep seeing 25k. Any tips? I tried in Safari as well.

Maybe just keep trying. I’m not sure why it works sometimes but not always

Enjoyed reading this post, I wish I wouldve seen this sooner, but way off track to even begin. Oh well, my SO can follow this flow. Also, Is it possible to receive a retention offer on Amex Chat?, I’ve closed an account last year that way and forgot to ask for a retention offer. Always been use to people calling in, I actually might try next month for my Plat.

I’ve never heard of anyone getting a retention offer via chat. I don’t think they’re authorized to do that

Ben opened an incognito window in his Chrome Browser

He opened our Best Offers Page within that window

what the heck is an “incognito window” and how do you get it?

Google Chrome has incognito mode, theres google.com > baidu > american express also. Safari has Private browsing. ect ect

The menu button on the top right of the browser should show the option to open an incognito browser window

Thanks for this great series of posts. I’m helping my mom through a similar scenario (with some different cards since she doesn’t fly Delta) so this is really useful. One card under consideration is the Barclaycard Aviator business (for AAdvantage miles). I can’t seem to find data on whether or not this reports as an account (and thus counts toward 5/24). Any idea?

Most reports suggest that Barclaycard business cards are not reported to the bureaus so that should be fine

Thanks!

I assume that Ben will close at least one of the Delta cards and at least one of the SPG cards before the annual fee hits. Does anyone have any advice for closing AmEx cards with the language about closing a card within 12 months within the terms? I’ve read that people recommend letting the annual fee hit and then close the card within 30 days of the fee posting.

Last time I closed an AmEx card, I did it without ever speaking to a human on the phone. I assume that if you want to close a card and get the annual fee credited that you’ll have to talk to a customer service rep to get that done. Just wondering if anybody had any experience with closing a card through the automated system and automatically getting the fee credited?

I don’t think it matters how you close the account. Amex will refund the annual fee if you’ve already paid it and you cancel within the 30 day period

How was Ben able to apply and get approved for and earn the bonus offer on the second Ink Business Preferred? Would not Chase only allow you to receive the 80,000 bonus points one time only?

Great Job Ben !!!! WilliamC I have 2 INK chase cards and got the points for each .I always call and ASK if before I do something .

INKer for Life !!!!!

CHEERs

If Ben now have Ink Business Preferred and Ink Business Cash and after a year decide AF is not worth it, to which “No Fee” card he will Product Change if he already has Ink Business Cash?

He can product change to another Ink Cash if he wants to. Or he can move his points to another card and cancel the Ink Business Preferred

Most Chase cards have a 24 month rule: you can’t get the bonus again if you’ve received the bonus for the same card in the past 24 months. Chase Ink cards, though, do not have this rule. So, it works to get a second card

Any record of approved second IBP card applications before the first IBP card hits its first anniversary?

I am a little confused when you recommend for people to open a business card. Do you have to own your own business to do this ? Do you need some sort of Tax ID for the business ?

In Ben’s case, he has a rental business. He didn’t do anything special to set it up as a business. He just used his SSN as his Tax ID and his own name as his business name to sign up for business cards and specified business type Sole Proprietor (later he got an EIN online for free — it only takes a minute in order to apply for the second Ink Business Preferred card). For others without rental businesses, there is usually something that can be considered a business even if you don’t have income from it yet: Maybe you’re an artist or writer and you hope to sell your work someday. Maybe you sell things on eBay. Maybe you have plans to do consulting for pay. Anything like this can be considered a sole proprietor business

So it’s not necessary that the business card can only be used for business purpose? Can you use business card for personal expenses?

Technically the banks say that you’re not supposed to use business cards for personal expenses, but many of us do so anyway. It’s up to you as to whether you feel OK about it or not.

I am new to miles & points. Can you explain is there any issue with using for personal expenses? Anything different in filing tax (NO business income)?

There are only two issues that I can think of:

1) The card issuer can technically close your account if they believe that you are not adhering to the terms. I’ve never seen this happen, but it’s possible.

2) Some business cards have fewer protections (extended warranties, travel insurance, etc.) than personal cards, but most have similar protections.

There is no tax impact

Thank You!

So to get 2 Ink Business, you need a EIN for the second card? You cannot just use your SSN?

You don’t necessarily need an EIN for the second business, but I think that the approval process will likely be easier that way.

I had 2 questions. 1) I thought the Marriott Business card was NOT subject to 5/24 while the personal premier was? and 2) I currently have 2 Ink Plus and an Ink Business Preferred. I was going to close one of the ink pluses thinking its credit line might hurt instant approval of a marriott business card but was wondering if it is better to proactively close it BEFORE I apply for the Marriott Business card or is it better to wait until after the application to offer to close it in convo with a credit anayst?

1) That’s correct: the Marriott Business card is not subject to 5/24 while the personal card is

2) Honestly I don’t know the answer. It might help to get auto-approved if you cancel first, but then you lose some bargaining power if you need to call recon. If anyone out there somehow knows which option is better I’d love to hear it!

I read I think on DOC that chase still has it in there system as extended credit for a while even after closing the account so the suggestion was to lower the credit limit before closing

There are pros and cons for each. Closing or lowering limits increase auto approvals but limit your recon leverage. I had 3 inks and closed 2 of them and left 1 open at 5k limit to increase my auto approval odds for Marriott Business. Unfortunately, Marriott Biz went pending and I got the denial letter for too many recent accounts and credit extended.

Called recon and after extensive grilling and 3 times being placed on hold, was offered to shift 5k from Chase Ink to open. Problem was that I only have 5k limit on the Ink so it would have been closed lol. Told her no but if I changed my mind can I call back to get it. She said yes.

So I promptly SM Chase asking for a credit line increase. They responded with some questions to answer. I answered them and they increased my limit to 7,500. Since I applied for Chase the same month I think that caused the system to not do another hardpull which is typical for CLI.

I then called recon again for Marriott biz and successfully shifted 5k from the Ink to open the Marriott and keep the Ink.

Success! But if I had to do it all over again, I would keep multiple Inks open but enough CL for leverage but low enough to increase auto approval odds. And if your over 5/24, like myself, you can’t get those Ink cards ever again =(