Several readers reached out this week after receiving emails from Plastiq regarding their auto loan payments. Visa business cards can no longer be used to make auto loan payments. As a reminder, personal / consumer Visa cards were already prohibited from making auto loan payments, this change now expands that restriction to Visa business cards.

As I understand it, Visa simply isn’t allowing their cards to be used for any sort of debt payments (i.e. loans).

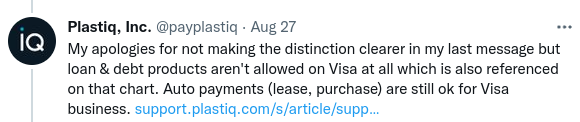

Note that there has been some confusion here. When Doctor of Credit recently reported this, Plastiq responded on Twitter to say that their post was incorrect. That was surprising to me because we had already received multiple data points from readers indicating that Plastiq had cancelled their recurring payments made using business Visa cards and Plastiq emailed them to explain that Visa cards could no longer be used for these types of payments. When I responded to Plastiq on Twitter, their eventual response indicated a small nuance in wording that makes all the difference and is a cause for confusion. In fact, just today a commenter on Twitter was making the argument that this page on the Plastiq website indicates that Visa business cards can still be used for auto payments and they are correct that it says that business Visa cards can be used for auto payments.

But my further conversation with the Plastiq Twitter team the other day revealed a small and important distinction: “auto payments” (purchase, lease) can still be made with Visa business cards, but loan & debt payments can not — which means that auto loan payments can not be made with Visa business cards (note that Visa personal/consumer cards have long been barred from any type of debt payment).

This is consistent with reports we’ve received from readers. Here is one of several emails we received about this:

Plastiq is telling me that they are no longer accepting Visa business cards for any kind of debt payment, including car loans. I had two car loans set up with payments on a Visa Chase business card – they sent me an email yesterday saying that those payments will be canceled, and then followed through on that this afternoon. I chatted with an agent who confirmed that Visa business cards are no longer allowed for car loans or any kind of debt payment. Previously, *personal* Visa cards were not allowed for car loan payments, but *business* Visa cards were OK.

Clearly the reader above had been using a Visa business card to make payments. Plastiq proactively cancelled their existing payments and confirmed to them that Visa business cards can no longer be used for any kind of debt payment.

Keep in mind that Mastercard and Discover cards should still be good to go for auto loan payments (in fact, I recently made several auto loan payments on Mastercards without issue). If you were counting on using a Visa business card, unfortunately it seems that you’ll probably be out of luck.

See our Plastiq Complete Guide for more detail about which types of payments you can make with Plastiq.

.

Another data point. I paid my lease payment through a a business visa this morning just to test the theory. Hours later, I received an email from Plastiq asking for the invoice. This was the first time this had ever happened. I supplied the invoice and within 30 minutes the upcoming payment was approved via email notification. So maybe there is a difference between lease and car payment- but that seems obscure.

I’m glad you’re finally writing about this, but I’m still confused. I’ve been paying my car lease through my personal Hyatt card since I got it. Are leases different from loans? Once I convert the car to a loan will I no longer be able use my personal Hyatt card? Also, this doesn’t affect rent payments, does it?

Just wanted to mention that the part about personal Visa cards long not being accepted is not accurate. I’ve been making auto loan payments on my Hyatt personal card all year but just after this change it no longer accepts the card as payment and gives the message about Visa cards not being eligible for debt payments.

Payments have sometimes slid through for a long time that aren’t supposed to by the rules. Varies by recipient.

Had the same question/ situation! You’re no longer able to pay with Hyatt card? I’m going to try to set it up again and see if it will go through.

I never understood why credit card companies even care what people charge as long as they get a transaction percentage. It’s crazy.

Because there are two ways credit card companies make money: a percentage of the charge and fees/interest. If you’re buying monetary instruments with the credit card, they’re unlikely to make money on the second half of that equation.

Maybe but say a transaction fee is 3% so you go buy a $500 item at Walmart and they make 3% and Walmart has to agree to the fee so they pay Walmart $485 net. If Plastiq or whoever agrees to pay a bill of $500 and you pay the 3% or whatever fee so say $515 ($500+3%) to Plastiq and the card company pays Plastiq the $500 so they can pay your car loan or whatever why should the card company car. I know it’s more complicated than that and I’m sure there is a downside for the card company but let’s say they only make .00001% on the transaction I still don’t see why it’s not profitable for them.

It’s a Hassle u have to pay people to look into things then call centers $$ !!! What a lot do is Max out then go Broke then CC’s Lose all Bad Bus..

I think the reason they care is more so tied to risk management. Being profitable relies on managing risk. I think the bank (or “Visa” in this case) thinks that if you’re looking to take a loan (use “credit”) to pay off a loan owed to someone else, it sounds like you are robbing Peter to pay Paul — and they don’t want to be Peter. So they are left either having to be in the business of figuring out who is a robber and who is a credit card rewards enthusiast that might help them earn a miniscule part of the swipe fee OR just denying the type of activity that leads to risky business. It’s like putting a lock on your house or car; in fact, in that case, you know that most people are honest and probably won’t open your door to steal, but yet you (probably) still mitigate risk by locking things up. Visa isn’t locking it up specifically to keep you (random honest person) out but rather because the risk of one good house robbin’ is great enough so as to care a lot more about the downside than the upside.

I’m not saying I’m not as disappointed as you are, just that I “get it”.

I got it Too a long time ago,retired at 51 as in a Long time ago.I’m never disappointed in anyone because I know CC’s like u do.

By the way I can do a $2,5m stock trade if need be to save my backside..

V Bernie

That would only apply to genuine cash-like instruments (gift cards) and not to loan payments for real property where you can’t recycle the funds to pay off the credit card.

But even there it doesn’t make sense. If the banks prioritized ongoing interest charges I’d never get a second card from any bank since they have the data to determine that I don’t maintain a balance.

My take is that banks interpret using debt to pay off debt as a red flag for somebody headed for default or bankruptcy. Most of us gamers that are using Plastiq to help meet welcome bonus requirements have the funds and are not a high risk for default, but banks can’t tell the difference.

Landlord..U watch their Total credit report (3) over time and see what their Doing.Before u renew u LOOK at that. Had one no job paying on line of credit from CC signed Him up for another year.U need to take a Chance but u need to know what ur Dealing with.

A game just like CC..

Lot’s of Good people out there most moved on to buy houses which I helped them Do ..

V Bernie

I have struggled at times on what to do when one stumbles across an infinite money glitch. Do you go all in and abuse it to make as much as you can, knowing it will get closed off?

Or do you operate with the idea of business as usual, and the glitch is just the cherry on top? Hoping it’s under the radar enough that it lasts for as long as possible?