If you’re into manufacturing spend (techniques for increasing credit card spend and getting the money back) via buying and liquidating gift cards, Simon Mall wants to help. I’m not kidding. In Ann Arbor, Denise Murray, Director of Marketing and Business Development at Briarwood Mall (a Simon Mall), reached out to me to discuss changes that will make manufactured spending simpler, with fewer visits and less wait time.

| Note: If you’re not into buying and liquidating gift cards in large volume, there’s not much reason for you to read the rest. The key takeaway is that Simon Mall wants to court our community. That’s strikingly different from most other organizations that seem to think that there is something wrong or illegal with manufactured spending. In the long run, this may lead to new opportunities that you will be quite interested in. When that happens, we’ll let you know. |

The first change towards simpler and better manufactured spending is that they have recently increased the daily limit on consumer gift card purchases from $10,000 to $25,000. I think this will be particularly interesting to those who have to drive a long distance to reach a Simon Mall (FYI, you can find area Simon Malls here) because it can mean far fewer visits to reach the same result.

Denise introduced me to Matt Morarity, Vice President at Simon Property Group, to learn about this new corporate wide policy. Through these conversations I learned the following:

- The new corporate-wide limit for gift card purchases is $25,000 per person per day. Note that this limit includes fees, so you would probably want to buy at most $24,500 worth of $500 gift cards if you want to keep things simple.

- Gift cards may be loaded up to $500 each, with a $3.95 fee per card.

- Visa, Mastercard, and Amex gift cards are available. Keep in mind that Amex gift cards don’t have PINs and therefore can’t be used as debit cards. So, don’t buy Amex cards if you plan to liquidate cards through a technique that requires debit payments. There are also sometimes issues with Amex cards not having their full value available due to $1 holds when a purchase is authorized. So, just stay away from Amex gift cards.

- According to Matt, federal regulations require that they collect additional information for purchases over $10,000:

- SSN

- Date of Birth

- ID Verification

- Specific processes may vary from one mall to another.

- At many malls you can buy the gift cards at the Guest Services counter. At others you may need to go to the Mall Office to make the purchases.

- Most of the malls welcome people calling ahead. This way they can be sure to have the gift cards ready to go when you arrive.

- As an example, the recommended process at the Ann Arbor Briarwood location is as follows:

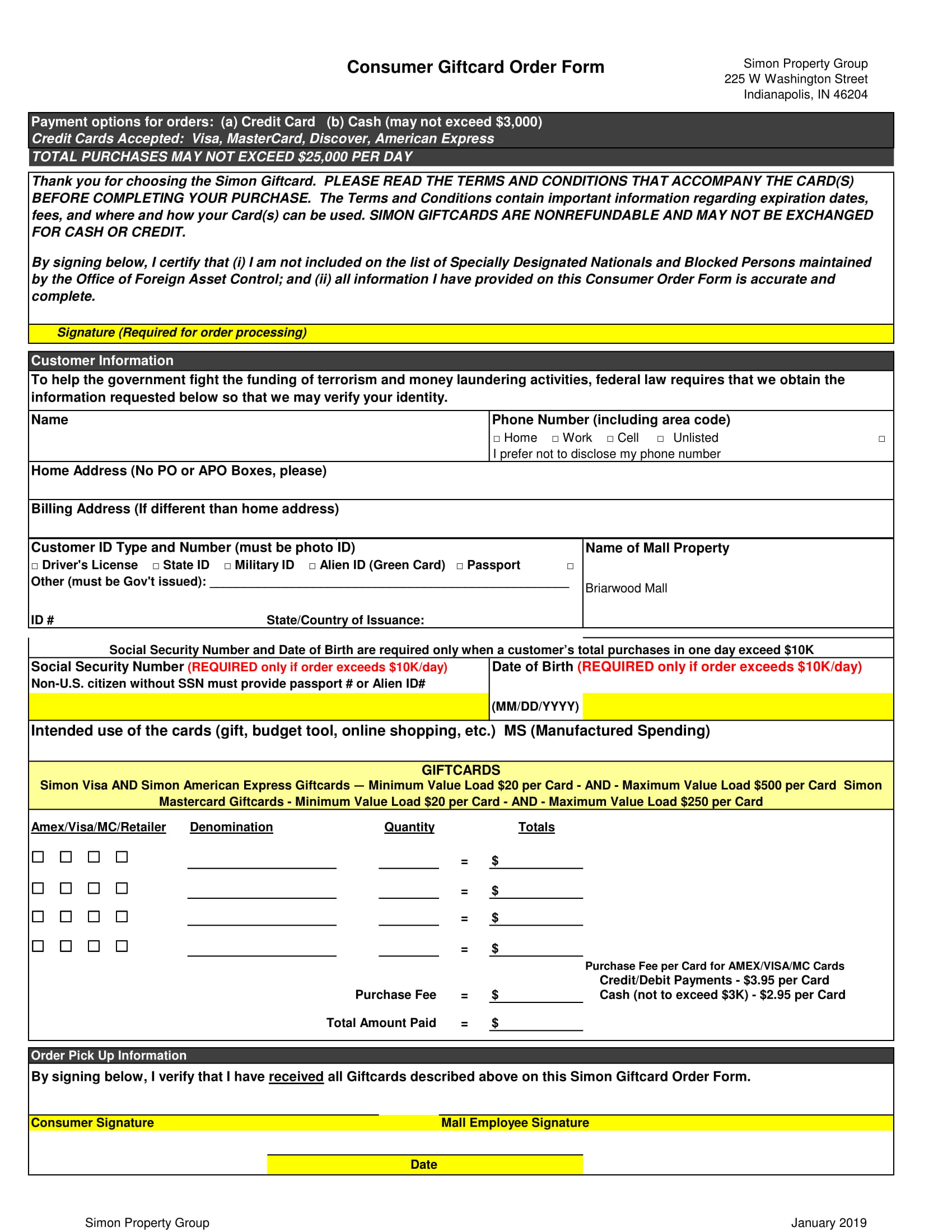

- Initially, you must fill out a gift card order form (see form image below) which Briarwood will keep on file for you.

- You must make 10 purchases before they’ll allow purchases over $10,000

- You will not be required to provide your SSN or date of birth until you are cleared to make purchases over $10,000

- When you do fill out your SSN and date of birth, those forms will be kept secure in a locked cabinet. An encrypted version of the form will be available at the guest services counter to make future purchases easier.

- Each time you go to the mall to purchase gift cards it is necessary to sign and date the encrypted form.

- Denise has asked that people call ahead to make large purchases. This way the gift cards can be ready for you when you arrive.

I expect that we’ll see more ms-friendly changes at Simon Malls in the near future. In Ann Arbor, I run a meetup group (found here). For our next meetup, Denise Murray, Director of Marketing and Business Development, will host us in the mall’s office meeting room in order to discuss the Simon gift card program and how it could benefit manufactured spenders. We’ve been told to expect Matt Morarity, Vice President at Simon Property Group, or one of his associates to join us. I’m hoping that we’ll learn then what’s coming next. And, of course, I’ll share that info with you as long as it’s “on the record” so to speak (so to type?). Stay tuned.

Simon Mall Consumer Gift Card Purchase Form

Is this now available to consumer accounts as well or corporate business accounts only? Also, did they start selling in person after covid?

[…] up in the coming weeks. Keep in mind that if you’re approved to make larger purchases (i.e. up to $25K in a single transaction) and you’re looking to purchase at a different mall than usual, you should likely reach out […]

[…] any customer can buy up to $10K in cards per day at a Simon Mall, those who have built up a history can purchase up to $25K per day. These $1K cards are exponentially easier for me to liquidate, so I’ve made a few trips to a […]

[…] are several retailers that will cash out visa gift cards (Simon Malls is one of the major […]

[…] are several retailers that will cash out visa gift cards (Simon Malls is one of the major […]

[…] are several retailers that will cash out visa gift cards (Simon Malls is one of the major […]

[…] are several retailers that will cash out visa gift cards (Simon Malls is one of the major […]

[…] No. Simon doesn’t sell gift cards loadable to $1,000 to consumers due to government regulations. $500 per card is the limit. But you can buy up to $25,000 worth per day. For full details see: Simon Mall gift card limit now $25K (previously $10K). […]

Any update from the meetup with the corporate people?

I have a post scheduled for this evening. Nothing earth shattering unfortunately.

Also, FYI not all Simon Malls have increased the limit. For example, I went to a Simon Mall today in San Diego and they only allowed $10,000.

I made my first $10k+ purchases at two simon malls in my area today. Calling ahead helped greatly and was appreciated by the staff too. In and out of both malls in less than 5 mins each. I was told the $25k spend limit is largely meant for “regular” gc buyers only.

At one of the malls the supervisor told me of 2 promos for March. A complimentary $100 vgc for “large” purchases during the month – can be done multiple times, and a similar vgc (with gift value varying) for bringing new friends to the mall to buy gc’s. for the latter she suggested a $50 card for $5k+ purchase and $100 gift for $10k+. May not seem like a lot, but these gifts will significantly offset 3.95 fees. I’m supposed to receive an email on these promos in the next days.

Coz Im such a regular and friendly customer she advance the $100 large purchase gift for my $25k purchase today!

As I get more details I’ll gladly pass them to you.

Thanks for the tip about the March promos. My local Simon contact isn’t aware of these promos, so it may be specific to the mall you visited

Hello Ken. Is there a way to contact you outside of here?

[…] Frequent Miler reports that they have recently increased the daily limit on consumer gift card purchases from $10,000 to $25,000. Here’s the details: […]

[…] Frequent Miler reports that they have recently increased the daily limit on consumer gift card purchases from $10,000 to $25,000. That’s good news for those who do large volumes. Here’s the details: […]

[…] vary by region, by county, by store, and even from one cashier to another. On the other hand, the recent Simon Malls announcement indicates that we may see a more consistent corporate policy enacted at their locations in the […]

What does a Simon purchase code as? I’m trying to figure out the best card to put this on.

I’m not aware of any cards that bonus Simon Mall spend. Look to cards with the best non-bonused spend: https://frequentmiler.com/best-everywhere-else-rewards-cards/

Greg, I have the same question as others have already posted – how do you liquidate these cards and get your money back minus the purchase fee?

I have noticed that a lot of the veteran MSers have gone to private group discussions to prolong their “gig”. We can only read of the ones that recently died or about to die. IOW, unless you can get in on these private groups, the chances of reading new MS methods would be close to nil.

Where does one find a private group? I have something I do I’d love to share in return for how others do stuff!

IME, the admin of these private groups send you an invite if they find your posts in forums like FT interesting. From there, you can accept the invite and you have to agree to their TOS determined by the group’s admin. You can also make your own group via slack app or any of the free apps where you’re the admin and start inviting people whom you think will be a productive contributor to your group.

Most people use the cards as debit cards to buy money orders. The ability to do so varies tremendously by region and stores within a region. https://frequentmiler.com/manufactured-spending-complete-guide/#MoneyOrders