NOTICE: This post references card features that have changed, expired, or are not currently available

Update 11/14/20: Since this post was written, additional great offers have surfaced. Please click here to see every option.

Update 12/23/19: Some people are once again being targeted for this offer via the Card Match Tool at CreditCards.com. (H/T: One Mile at a Time)

Update 11/4/19: A new round of people are reporting these offers via the Card Match Tool at CreditCards.com.

Update 5/27/19: People are once again reporting these offers via the Card Match Tool.

Update 4/29/19: A fresh round of people are reporting being targeted. If you’re eligible, it’s probably worth a second to check the Card Match Tool at CreditCards.com to see if you’re targeted. (H/T: Miles to Memories)

Update 4/4/19: A fresh round of people are reporting being targeted.

Update 2/25/19: Some people are once again seeing a targeted offer for a welcome bonus of 100,000 Membership Rewards points after making $5,000 in purchases on the Platinum Card from American Express.

Recent reports indicate that a new round of people have been targeted (H/T: Doctor of Credit). That’s a good reminder to check periodically for good targeted offers like this one, which is significantly better than the standard offer on this card.

Note that these offers usually include lifetime language — so the welcome offer will likely not be available to you if you have or have had these cards before (it’s always a good idea to check the terms before you apply if you’ve had the card before).

While the personal Platinum card carries a $550 annual fee, it comes with a number of great benefits:

- 5X points for prepaid hotel bookings at Amextravel.com

- 5X points for flights booked directly with airlines or with American Express Travel®

- $200 Uber credit annually ($15/month, $35 in Dec). Credit can be used for Uber or Uber Eats (meal delivery).

- Up to $200 a year in statement credits for airline incidental fees

- $100 Global Entry fee reimbursement.

- Airport lounge benefits.

- Rental car elite status.

- Marriott Gold status

- Hilton Gold status

- Free Boingo wifi

- Access to Fine Hotels & Resorts (and the ability to earn 5x on some of those bookings now)

- Cruise Privileges

- Transfer points to participating frequent flyer programs

Remember that there are many different versions of the Platinum card — See: Which is the best Amex Platinum card? for comparison of the various versions, though note that the current targeted offer is only available on the standard Platinum card.

This offer matches the best we’ve ever seen on the consumer version of this card. Based on our Reasonable Redemption Values of 1.82 cents for Membership Rewards, 100K points are worth about $1,820 — though you could certainly get more value than that out of them.

For just a few ideas on how to get a lot more value out of transfer partners, see these posts about Iberia Avios, British Airways Avios, Cathay Pacific Asia Miles, and Avianca LifeMiles (all Membership Rewards transfer partners):

- Searching for business class sweet-spots in Iberia’s OneWorld award chart

- From 11K RT on American: A sweet spot for North American flight redemptions

- Hacking Avios

- Toward hacking Asia Miles: the unified oneworld award chart

- Avianca LifeMiles’ awesome mixed-cabin award pricing. First Class for less.

You can also read about some of the Strengths Membership Rewards has over Ultimate Rewards. That’s not to say that Ultimate Rewards doesn’t have its strengths also — but that post will give you some ideas as to why 100K points is a very valuable offer.

Reports this year of new rounds of this offer have happened on:

- January 12, 2019

- February 23, 2019

- April 4, 2019

- April 29, 2019

- May 27, 2019

The link to the Card Match Tool and more information about it can be found here:

–> Card Match Tool at CreditCards.com <–

[…] on the Platinum card and it easily beats even the targeted 100K offer that people sometimes find via the Card Match Tool. See the post: Amazing Platinum card offer: 75K + up to $300 + 10x bonus categories for a limited […]

[…] targeted offers on the business version for 150K that require a lot more spend and we have recently reported some being targeted for a 100K offer on the personal Platinum, but this offer is the best return on spend I recall seeing). If you’re eligible and […]

Got the Amex Platinum 100,000 point offer through card match. Application was submitted and approved

If we had the platinum card before, can we be re-targeted?

Cardmatch listed 8 offers that included 4 cards (CSP I have CSR, CFreedom, Quicksilver, and Alaska) I can’t get and the rest not even worth talking about.

I just ran the card match and got offers for CSP, even though I am way over 5/24. Does card match bypass the 5/24 rule?

Sadly, no

CardMatch Tool doesn’t seem to work if credit freezes are in place. Despite several searches I’ve found no info about which bureau needs to be unfrozen for it to work. This is pretty essential information which should be included with any references to the tool.

I have only been getting a white page after entering all of my information. I’ve tried over the last two days. Anyone else having issues?

Have you tried a different browser / device / clearing cookies?

What do you have to unfreeze for these? TransUnion? Cardmatch almost never recognizes any of my family members.

My wife has the offer. What does the $550 in benefits to fine hotels mean?

Not sure how many of these benefits we would actually use? Can I buy airline gift card to trigger the airline credit?

My challenge is no amex pre-qualified credit card offers. Wonder how to get Amex on the pre-qualified list.

Same

I have the exact same problem. I never have any Amex offers. I’ve wondered if I opted out on their website maybe? I’ve searched a lot and not found a solution.

Likewise.

I’ve never seen one for those in my household, either.

Some people just get them. I’m not sure someone has figured out a science of getting targeted for these Card Match offers.

I’m also in the same boat. But get this – I mixed up my apartment and home address city on accident. So I had my correct street but the incorrect city and zip – and I got about 5-6 other credit cards, including two amex preferred ones (no plat).

When I tried again with the correct address (both my apartment and home) – back to no Amex.

How do you know if you’re targeted?

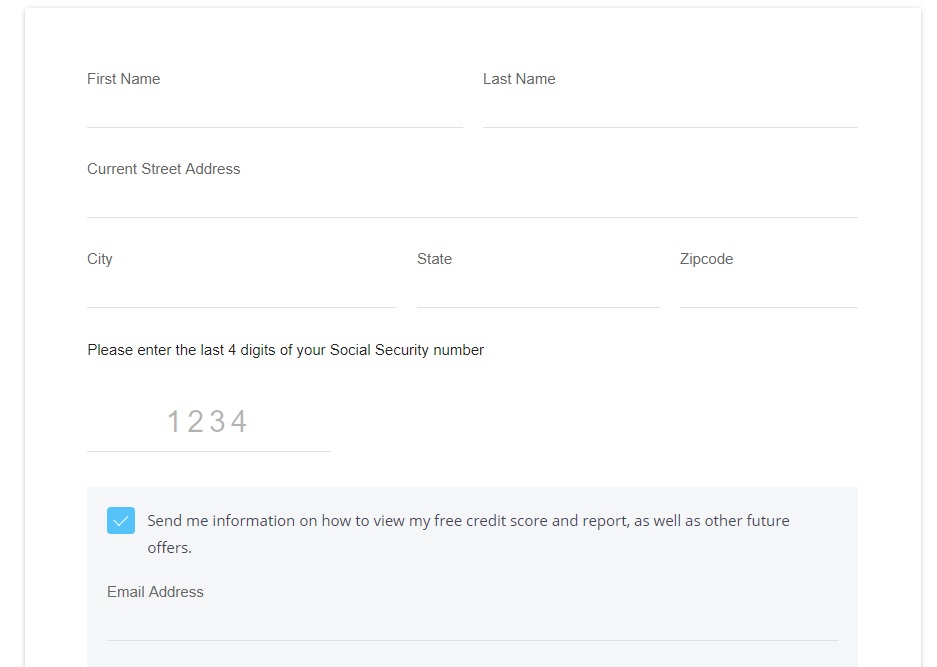

Google cardmatch, and you should see the screenshot above. Then you enter the necessary information and you can see your pre-qualified offers. It is a soft pull.