There is a new link available for a targeted bundle offer on the American Express Business Platinum card and a Business Checking account that gives the opportunity to earn up to 200,000 total points. This isn’t as good as an offer we saw late last year, but it’s certainly not a bad offer either. Not everyone will be eligible (and you need to apply separately for the Business Platinum and Business Checking, so keep in mind that you may or may not be approved for both). Still, this can be a nice windfall of points if you’re eligible and you can meet the spending requirement (though it comes at the right time of year if you have to make upcoming tax payments).

This is a no-lifetime-language offer (NLL), meaning that you can be targeted even if you already have one (or more) Business Platinum cards. Stephen and my wife were both targeted for this offer, even though neither has been via the last several NLL links that have come out.

The Deal

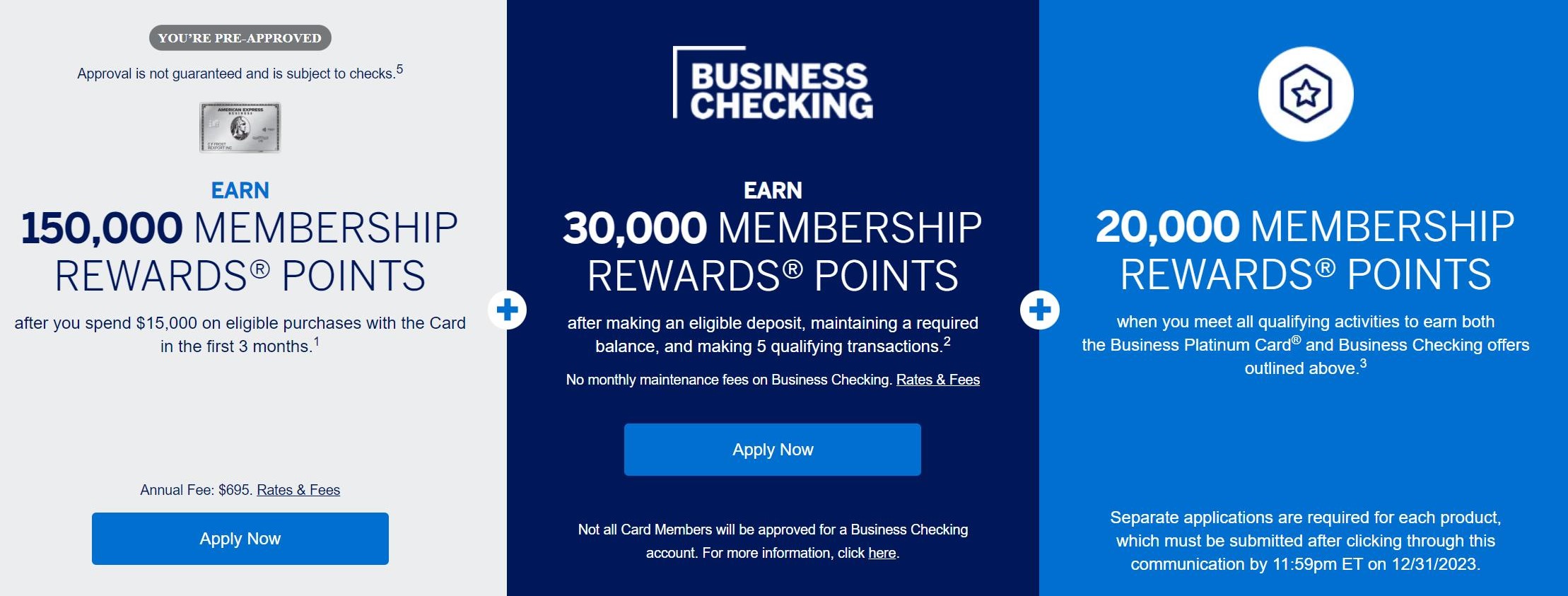

- American Express is offering some people a targeted offer to get up to 200,000 Membership Rewards points:

- Open a Business Platinum card and earn 150,000 points after $15K spend in the first 3 months

- Open a Business Checking account and earn 30,000 points after qualifying activity

- Earn 20,000 points when you meet all qualifying activity for both

- Direct link to this deal (note that it is targeted)

You must log into your Amex account first, then click the “apply now” link on the pre-approval landing page.

If, after clicking “apply now,” you see the message below or see a screen with no offer listed, it means you’re not targeted. If you get a pop-up telling you that you are not eligible for the welcome offer, you aren’t.

Key Terms

- Separate applications are required for each product, which must be

submitted by 12/31/23. - (Checking Account only) You are not eligible to earn a Welcome Bonus for any accounts opened for a business that currently has or has had an American Express® Business Checking account.

Quick Thoughts

There are two separate components to this deal. You’ll need to open a Business Platinum card and meet the $15,000 spending requirement within the first three months to earn 150,000 points. I do not see lifetime language in the terms (though always be sure to double check since these offers are targeted). Greg’s wife was targeted for this offer via e-mail, but the link worked for my wife and Stephen also.

For the Business Checking component, you’ll need to apply and be approved, deposit $5,000 within 20 days of opening, maintain an average daily balance of $5K for 60 days thereafter, and complete 10 transactions within the first 60 days of having the account open. Note the timelines: You have 20 days from account opening to deposit and then you must maintain $5K for 60 days after first deposit — so the 60-day clock for that begins when you make your first deposit. You also have to make 5 transactions within 60 days of account opening — the clock for that component begins on the day you open your account, not on the day you deposit (ask me how I know). The 5 transactions can even be ACH deposits or withdrawals, so it is very easy to hit ten. Just don’t miss the clock on that.

Note that, if you already have a Amex Business Checking account, you are not eligible for the bonus on a new checking account (although you still can get approved for the bonus offer on the Business Platinum card).

If you complete both components, you’ll get an additional 20,000 points.

Overall, this is a very good deal if you’re eligible, though it’s not the best deal we’ve seen (we previously saw the same deal offer 60,000 points for the Business Checking account component). Still, given the fact that those with an Amex Business Checking account can redeem Membership Rewards points for $0.01 per point, the total points here are worth a floor level of $2,000 — or potentially much more if transferred to partners to take advantage of the many Amex Membership Rewards sweet spots.

Business checking Amex is asking for Articles of Incorporation for sole proprietorship

HARD PASS, nothing special as I was targeted for this offer but rather wait as the article stated previous targeted offers were way better…

Isn’t there a straight 200k offer out there?

I’ve had the toughest time getting the final 20k MR “bundle bonus” for completing both the Biz Plat 150k and Biz Checking Account 60k offer from the end of last year. Finally filed a ticket with Amex this week, as it’s way past 12 weeks since I finished the requirements for both accounts.

My red letter point posting dates: card SUB 03/08/23; checking SUB 03/12/2023 and finally bundle bonus 04/05/2023. Yes, you’re way late obviously. Approved for bundle 12/21/2022 card one approval & checking another independently same day.

Thanks for the data point. Hopefully my complaint ticket gets things moving forward. There’s a bunch of us on Doctor of Credit who haven’t received the 20k, but it’s good to see that it is paying out for some.

I’m in the same boat — my advice to anyone pursuing this is “be prepared to ahve to make repeated calls to find out where your bonus MRs are.”

Completed the CC and Checking account tasks in mid-February, but still no 20k bonus MRs. I have called AMEX at least 5 times, getting the general run-around each time. Each of the last 2 Reps said the MR team was taking care of it. My last call was 8 days ago and still nothing. I had planned to keep the Biz checking account open, but there is now no doubt in my mind that I will close it once the bonus MRs hit.

The frustration that I have experienced is not worth 20k MRs.

I almost bit on this last year but then I was glad I waited. Ultimately got 170k for biz plat and 60k for the checking account, so 30k more than this.

I have the offer but already have 3 business platinum cards for my business. Should I try for #4?

y not? i have 6

One question for either of you. How do you justify the $695 and/or spend the $400 Dell credit. Have 2 and thought I could go for 3 but the Dell component keeps me from it. In my mind, three components – Dell @ $400, phone credit $120 & airline $200. Phone no problem and airline if you apply towards United Travel Bank. Use sometimes for AA lounge on one of our personal cards. But Dell, really curious do you really get meaningful use? The gift card route (Greg’s post recently) is so hit or miss, really don’t consider anymore. Received the 230K offer late last year, so this offer would be no bonus, just card and another business checking account which I really like.

I ended up cancelling one and two days ago applied again when I got a popup (no, not <i>that</i> popup) with a 200K offer – 150 for biz platinum, 30 for bank account, 20 for doing both. I was approved and got the card today. Since I already have the bank account I’ll leave that one alone.

As to justifying the annual fee, I use the credits you mention then cancel the card after paying the annual fee once or twice. I value MR points at around 1.5 cents each so with the spend needed to get the SUB I get around 170K points, which is worth around $2,500 to me. Add in the aforementioned credits and I find it worthwhile.

Did you receive the 150k?

I have a targeted offer to apply for the card and checking plus receive extra points for completing both offers, similar to what’s described here. However I just want the card and the 150k. It’s not clear whether I can submit my 1 card application and not apply for checking at all. The way it’s worded makes me think I still have to apply for both, and then whether I complete the other activities determines how much I get. Thanks.

Nick, I believe I’ve read where people have responded to targeted offers for biz checking accounts and opened multiple amex biz checking accounts by creating a new online account for each business platinum card associated to each new biz checking account. I’m not sure if they used the same or a different business each time.

It’s one banking bonus per business, but not churnable per terms.

There’s the small problem that even though I’m a business, and I pay the taxes I owe from it I’m not a registered business.

I’ll need to consider whether it’s worth the trouble and expense of registering in order to get the business checking account.

There’s also the question of whether I can pay my credit card with a debit card and get the 1/2 pt per dollar from it.

Why can’t you sign up as a sole proprietorship under your SSN?

That part is OK, but in ‘what do I need to open a business checking account’ it adds: “• Your Articles of Organization or a Certificate of Formation”

That’s my barrier.

When you say registered do mean IRS as in EIN? And/or with the state as in corporation or LLC? You can get your EIN online almost painless from IRS. Corps/LLC can be done in my state say for $300. Sole proprietorship is about $25 to register your business in my city/county. As you have probably read, the account does come with a debit card. I have not used it, so no DP on 1/2 pt per dollar bit.

“maintain an average daily balance of $5K for 60 days thereafter”

I can see that I’m 3/3 on my biz checking account tracker but for some reason the points haven’t posted. Weird stuff

Our experience (P1 & P2) takes about 2-3 weeks.

got email upgrade offer of 25k today for ED -> ED Pref. $2k spend in 6 months. Did this before…2020-2021 (Downgrade). Know there has been a 40,000 point offer…but 25k is enough for me to bite. (offer was at 15k recently – rejected that, good thing I waited) Since PLASTIQ doesn’t take Amex any more…the 6 months is nice for organic spend. Amex is handing out points like candy it seems.

Any DPs on how long it took to get your extra 20k points? I completed the 150k + 60k + 20k offer recently and have not received the extra 20k

Same here for P2. 150K posted in say 2-3 days and 60K took about 2-3 weeks (myself & P2).

What about the extra 20k bonus?

So far no 20K for P2 only. I was already a Biz Platinum cardholder, but did not have checking so no bonus 20K for me but of course 60K checking bonus. P2 did the 230K deal.

I have the same question – completed the 150k +60k +20k and received the 150+60, but not the 20. P1 completed 3/3 offers by Feb 18. P2 completed 3/3 offers by March 10. No 20k points for either so far.

Same boat, still waiting on the 20k bundle bonus after getting the card and checking bonuses in Feb.