2020 is the year of the rat, but sadly American Express is trying to also make it the year of the RAT.

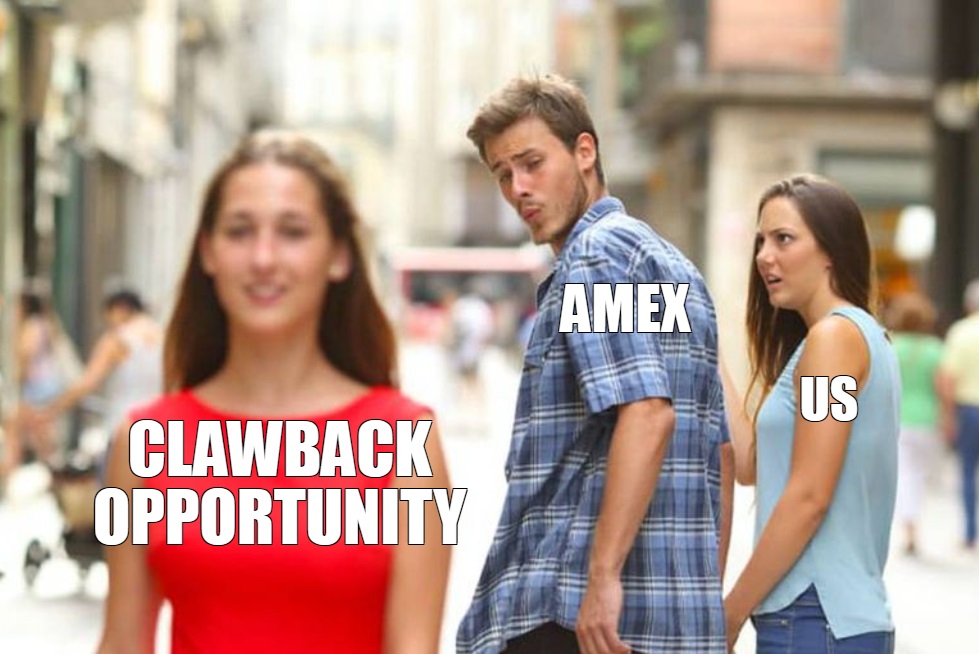

Amex’s Rewards Abuse Team (RAT) is starting to send out notifications to cardholders that received a statement credit for airline incidentals and subsequently had that payment refunded by the airline.

The email states the following:

We’ve charged your account referenced above for $xxx and we would like to explain why.

You already received a credit from the merchant.

We discovered that, while we issued you a credit under our Airline Fee Credit program, you also received a credit from the merchant for the same charge(s). to correct this error, we have charged your account for the amount identified above to offset the credit(s).

You will see this adjustment on an upcoming statement. There’s nothing further you need to do.

Thank you for your Card Membership.

American Express Customer Care

I suspect that contrary to American Express Customer Care’s wishes, many people won’t be feeling too thankful for their card membership with this development. While there was definitely the potential for gaming with the airline incidental credits, there’s a good chance that a significant number of cardholders will have statement credits clawed back who had no idea they were doing anything untoward in Amex’s eyes and weren’t even looking to have some ineligible airline charges offset by the credits in the first place. These are the $100, $200 and $250 airline incidental credits that come on select Amex cards like the Amex Gold, Platinum and Hilton Aspire cards.

One of the must frustrating features of these Amex clawbacks is that they’ll no doubt refuse to reset the airline incidental credit allowance to allow customers to use it towards “legitimate” charges, meaning customers could be out hundreds of dollars.

It’s not clear yet how far back Amex will be clawing back airline incidental credits that were subsequently refunded by the airline. Even if you’ve closed your credit card, there’s a good chance they’ll claw back ineligible credits and send a bill for that amount like they did with the Dell statement credit benefit on Business Platinum cards. What they’re willing to do for $1 with Dell they’ll no doubt be willing to do with airline incidental credits.

h/t Doctor of Credit and US Credit Card Guide

I called Amex about a 2020 incidental credit for a charge that was already refunded by the carrier. They told me there is no way to reverse the incidental credit received and not to worry about it and that I can keep the credit.

Bottom line – if someone games the system they should be called out on it. IMO Amex customer service >>>> chase. Have had some issues where I have called or messaged and it got resolved right away. I even had a disputed charge that involved my daughter ( long story ) that was not found in my favor. I called , explained my situation and they ate the difference and refunded me the money after a 5 minute phone call. They have always gone above and beyond for me. I have the reserve as well and when I have called them they aren’t as responsive and courteous as AMEX.

Is this only for closed accounts or for new accounts as well?

will likely get a bill in the mail even on closed accts

My question is why does Amex make the airline credit so restrictive in the first place? Someone with a premium card is likely to choose the airline they fly the most, and most people will already have some sort of status with the airline, in which case they will likely have no need to pay any sort of fees. Amex is a shady business, and I have scaled back most of my spending with them because of it. Almost all of my spending is now within the Chase ecosystem.

Their goal is to NOT award these travel credits OR make it as difficult as as possible. Look at other banks and how they do this ..

Correct my first AMEX card 12 years ago I Deep-Sixed it to hard to use..

CHEERs

Ok I am going to be next dp, which was booked last year end

I used amex to pay for e+ of a reward ticket, but I had to involuntarily change to another route which there is no e+ to purchase as non ua metal

The refund showed up today

Let’s wait and see

It would absolutely behoove them to ensure that the available credit is correctly restored when one is revoked. A large number (maybe not the majority — no real way to know) of people who will get caught up in this probably had a genuine cancellation and, while they’re not entitled to the credit for the canceled incidental they should get it when they re-book the flight / incidental later on.

What’s being reversed might be something like award booking fees that a Diamond/Plat cancels the trip on legitimately. Or it might be flights cancelled within 24 hours, which could be legitimate but might also be abused.

Stephen, your article says ” customers could be out hundreds of dollars.”

The only ones out that kind of money are intentional shop lifters.

If you go shop lift a tube of toothpaste at Walmart you will get the cops called on you, so stupid petiole better be careful out there.

Amex is doing the right thing here. They ought to go a step further and shut down repeat offenders.

It is sad that in today’s world very few people have any ethics or morality.

SI

As in NONE Today HaHa ..

S I, can you see if you can get out of Amex’s as* possibly?

They financial review me every so often because I use their rewards to the Max. And then restore all my cards. I like companies that fire bad customers.

Don’t see why this is a problem. American express is just getting rid of the thieves and shop lifters.

Travel bloggers will be telling people not to steal toothpaste at Walmart next.

Cards with air credits are all premium cards. Amex is doing something against being premium customers, especially it’s unlike signup bonus abuse.

It is abuse. If they get rid of non premium customers on the premium cards, that makes their business more valuable. Kudos to amex for doing this.

A truly premium customer wouldn’t care about a few dollars being clawed back when they got a legitimate refund from the airline already.

They can definitely lose premium customers who care about time and hassle, even if they don’t care about a few bucks. It’s much easier to use these credits on Chase, US Bank, CNB and Citi. They also don’t even make you select an airline in January. Did Amex get that crazy idea from studying cell phone contracts?

“premium” cards with dining credits that you would use for delivery and fast food restaurants, and travel credits for economy class… that sounds funny

Well, AmEx should deploy those credits on FHR, makes more sense.

amex will likely see cancellation / downgrade of many high-fee cards going forward

I doubt this will have any impact on that

I plan on canceling 4 different high ANNUAL FEE cards in my own wallet plus not apply for another 2 I had planned to and will be downgrading another one… so yeah I’m sure this will have an impact…I do plan to help every service member get SCRA benefits to get these for free and take AMEX for all they can…

I’m doing that too got the United no fee(Thanks Steve) ,BMO no fee ,Green $150 . Bonus points + like 7 lounge passes total . Then dump all but United .

CHEERs

lol, what’s ur logic that this will not have any impact?

That seems to be the idea. They don’t want to do business with a bunch of moochers. Can’t blame them.

My assumption is that this will only affect the situations where the refund was back to the card, as this is clearly an oops by Amex. If the refund was to a credit kept with the airline, not so much.

Maybe don’t game the system, people play with fire like everyone getting their AA accounts shut down (thank go more award seats for us who get miles in a legitimate way). So lets see her you pay a fee get reimbursed with the fee credit and then cancel it so you double dip, that is wrong and I’m glad AMEX is doing something about it.

I can understand that when people have deliberately double dipped, but this clawback could draw in a bunch of cardholders who hadn’t actually done anything wrong intentionally, but where Amex gave them statement credits when the cardholder hadn’t intended to use their credits that way.

I’m guessing 99% of the clawbacks are for folks who tried to have the system. I’m all for trying to game the system, but don’t get upset when you get called out.

I wouldn’t be so sure that 99% of the clawbacks are for folks who tried to game the system. In fact, I would bet that far less than half of Amex’s customer base reads blogs and knows much about the nuts and bolts of how these credits work. I would further surmise that a relatively high percentage of Amex Platinum / Business Platinum customers (compared to the average person buying a plane ticket) are people who book flexible tickets — whether with miles or refundable fares — because they value that flexibility. Those same people by and large are presumably busy enough that they likely don’t keep meticulous track of which charges triggered which credits.

Imagine the small business owner who changes plans often. Does he or she track or even know which flight booking triggered which credit? Or imagine someone who booked an award ticket and didn’t even realize that the taxes triggered the credit and then later paid a checked bag fee and assumed that’s what triggered their airline credit. Is Amex going back to figure out the next subsequent charge that should have triggered the credit? I’m not sure at this point.

I think the average reasonable person would assume that Amex knows when you’ve been charged and when you’ve been refunded and likely assumes that Amex takes back their credit if you later canceled. I’d bet that most of their customers just keep an eye on the meter from time to time that shows how much credit they have left — and if it has a little more or less than they anticipated, they probably don’t pay it much mind.

I can understand that some won’t feel any sympathy for those who knew they were being double-credited and booked tickets they had no intention to use in order to take advantage of a chance to “game the system” as you say. That’s a fair viewpoint to have.

On the other hand, keep in mind that none of those customers asked Amex to credit those charges — Amex credited those charges automatically and didn’t build a system that automatically debited those charges when refunded. It isn’t unreasonable that people bought flexible tickets and later cancelled — 75% of the reason I book Southwest for domestic flights is precisely because they are so flexible. I book and cancel tickets all the time (regardless of which credit card I use). If Amex automatically refunded me for fees on tickets I later cancelled, I think it seems unreasonable for them to expect me to go back through and figure out which of my cancelled tickets they had refunded fees on previously and ask them to charge me again for those fees. I’m not even sure it would have been possible for me to get someone on the phone who would know how to do that. Think that through: I flew 100K+ miles last year. In any given month, I’m sure I booked and cancelled several flexible itineraries. I’m not immediately sure which of those Amex refunded fees on — but if I called them later to say, “hey, you guys refunded this but then the airline refunded me because I canceled”, do you think an agent would have known what to do? I’d bet $20 that an agent would say, “We don’t have any way to do that. I guess just consider it your lucky day!”.

It seems poor form to me for Amex to penalize customers for its own technological shortcomings. I don’t think it should be on the customers to keep track of their qualifying charges and when Amex should take their credits back, especially because I don’t think a phone agent could do it if they wanted to.

To be clear, I *do* hope that most blog readers here are keeping spreadsheet records and know which charges triggered which credits. I also understand that you win some and lose some and for many of us, we’ll accept the sting here and move on. But I still think Amex is being unreasonable and unfair to the many folks who weren’t making any effort to game anything.

Nick/Greg—should we all be waiting for the other shoe to drop? Claw backs on regular (non refundable) airfare that are still triggering The credits: DL (split payment) and SW (<$100), etc. I’m worried that is coming next!

Yes I’m worried that the shoes will drop. I’m going out to buy an umbrella strong enough to withstand a shoe-shower

What do you call gaming the system? I had a $100 Dell credit so of course I used it. I also got the 10%, which I don’t care much about, what was I supposed to do, call Amex to withdraw me from the offer?

Maybe don’t punish your customers for your screw-ups.

Lmao remember when Gary Leff was telling people to do this

Of course, must have been a slow day for Gary’s usual boobs on a plane trash news for Gary

How would you handle a similar situation for a 2020 credit received on a refunded airline charge? I assume it is only a matter of time before they claw back 2020 cases too. I’d rather it happen this year so I can lobby AMEX to restore the credit and hopefully still use it in 2020. Doesn’t help me to have it clawed back in 2021 and not have a window to use the credit. Would you go as far as bringing the situation to their attention now?

I certainly wouldn’t draw attention to your account yet. We’re only two months into the year, so they might still claw back any applicable credits this year rather than next. If they do, contacting them at that point would be fair enough.