NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

Through March 14, 2022 the PointCard Debit Card is offering 10x points on Verizon, AT&T, and T-Mobile. Since points are worth $0.01 each, that’s like getting 10% back, which is a solid deal.

The Deal

- The PointCard debit card is offering 10x points on Verizon, AT&T, and T-Mobile through March 14, 2022

If you’re new to the Point Debit Card

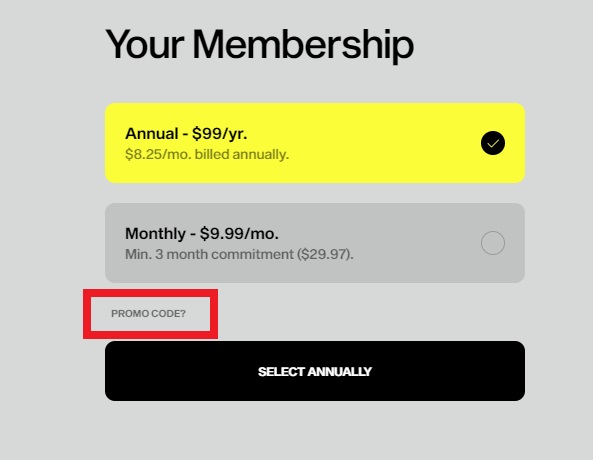

If you’re new to the Point Debit Card, note that the annual fee is now $99. That gets billed on your first deposit or you can choose to be billed $9.99 per month instead.

Note that we no longer list our referral information since referrals are now capped and new users will not receive the bonus once the person making the referral has exceeded the cap.

Quick Thoughts

Ten percent back on the phone bill could certainly be nice. I recently reduced my T-Mobile bill by 20% thanks to the terrific Insider Hookup promotion they have going on. Getting 10% back on that for the next couple of months is icing on the cake for me.

Keep in mind that the PointCard includes cell phone insurance up to $600 per incident for a stolen or damaged phone (including cracked screen) with a $50 deductible and max of $1,000 in claims per 12 months. Coverage begins the first of the month following the month in which you pay your bill on the card. From the terms, it sounds like claims are handled by the same provider used by Chase and many other card issuers (Card Benefit Services). I should also note that those terms indicate a max of $500 per claim, but in several other places Point notes a max of $600 per claim.

At any rate, ten percent back is nice. There is a maximum of 5,000 points earned during the period, so you won’t be able to use this to get 10% back on a very expensive phone, but it could nonetheless come in handy for many people.

Right now t-mobile bill is on my biz platinum card which offers both cell phone insurance and a $10 monthly statement credit. Was planning on doing a $500 charge with Point to prepay a few months and then also do a manual $10 Biz platinum credit monthly for the next 6 or 7 months – but assume if I do this I won’t have cell phone insurance from either T-mobile or Point. (Seems worthwhile as I never used to pay for cell phone insurance, the insurance benefit is nice but is never anything I would have paid for directly))

Yeah, cell phone insurance probably isn’t going to apply if you prepay several months.

As a related technique (but only semi-applicable here): Last year, Amex had a $15 monthly cell phone credit on the Amex Bonvoy Business card. That card doesn’t offer cell phone insurance. What I did was wait until my monthly autopay went through (on an Amex Biz Platinum card), then when my amount due was $0, I paid an additional $15 with the Bonvoy Biz card. That put my balance at -$15. Then, when my next bill generated a week or two later, the bill was for $15 less than the “full” amount.

Let me put numbers to that. Let’s say my monthly bill was $100. I let the $100 autopay go through on my Biz Plat. Then, I paid $15 more on my Marriott Biz card and had a -$15 T-Mo balance. Then, when my next T-Mobile bill generated, the bill was for $85 since I had a “balance forward” of $15. The autopay then charged my Biz Plat $85 and I repeated the process.

I did that because then I figured that the amount at the top of my bill ($85) was charged in full to my Biz Plat, which I figured might be good enough for meeting the terms of “paying the entire bill” on my eligible card. It turned out that worked as I had to make an insurance claim and it was approved without issue.

That won’t really work here because you’d be prepaying enough that your bill will be $0, so I don’t think there’s any way to still have cell phone insurance. Have to decide how much the insurance is worth — would you pay $50 for insurance for the next couple of months? That’s basically what it comes down to.

That’s pretty clever. Wouldn’t have thought it would work since you weren’t paying the “full” bull – but obviously it did.

And your final two sentences are exactly how I analyzed it for myself. Given that I never paid for cell phone insurance before I’m going to take the $50 over the insurance for the next few months.