NOTICE: This post references card features that have changed, expired, or are not currently available

If you have been sleeping on the Amex +4 referral promotion, it is time to wake up. The chance to earn at least 5x everywhere (and 8 or 9x in popular bonus categories or as much as 19x) Membership Rewards points per dollar spent is a terrific opportunity that you shouldn’t miss. How can you trigger it? What are the best ways to take advantage of the increased return on spend? How am I planning to earn 600K from a single card? We discuss all of that and more on this week’s Frequent Miler on the Air.

Also read on for more from this week at Frequent Miler, including how you can save thousands on a European cruise, the best uses of your ThankYou points, and more.

Frequent Miler on the Air

- 00:39 Giant Mailbag

- 7:51 What crazy thing did Greg the Frequent Miler do this week?

- 13:27 Mattress running the numbers: Is it worth indirectly buying Membership Rewards points for 0.9c per point?

- 19:12 Main Event: Is the Amex +4 referral deal the deal of the year?

- 43:17 Question of the Week: Is the Rewards+ a good downgrade option from Citi Premier?

Subscribe to our podcast

We publish Frequent Miler on the Air each week in both video form (above) and as an audio podcast. People love listening to the podcast while driving, working-out, etc. Please check it out and subscribe (if we get enough people to subscribe, we might be able to earn some income from this someday. So far, the podcast is just a labor of love).

Our podcast is available on all popular podcast platforms, including:

Apple |

Spotify |

You can also listen from your browser:

This week at Frequent Miler

Maximizing value from Amex multi-referrals

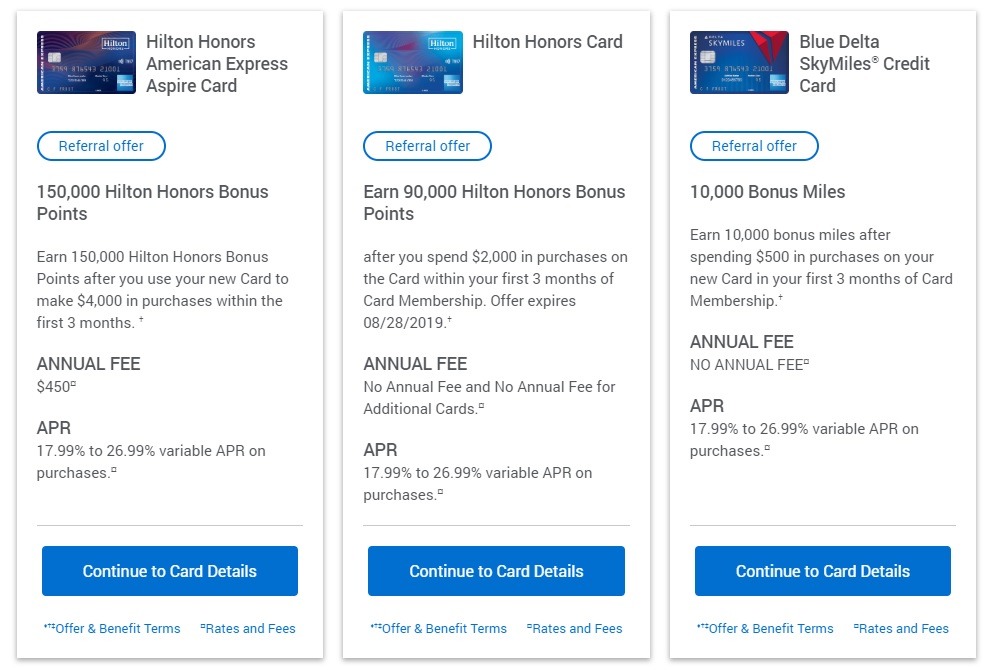

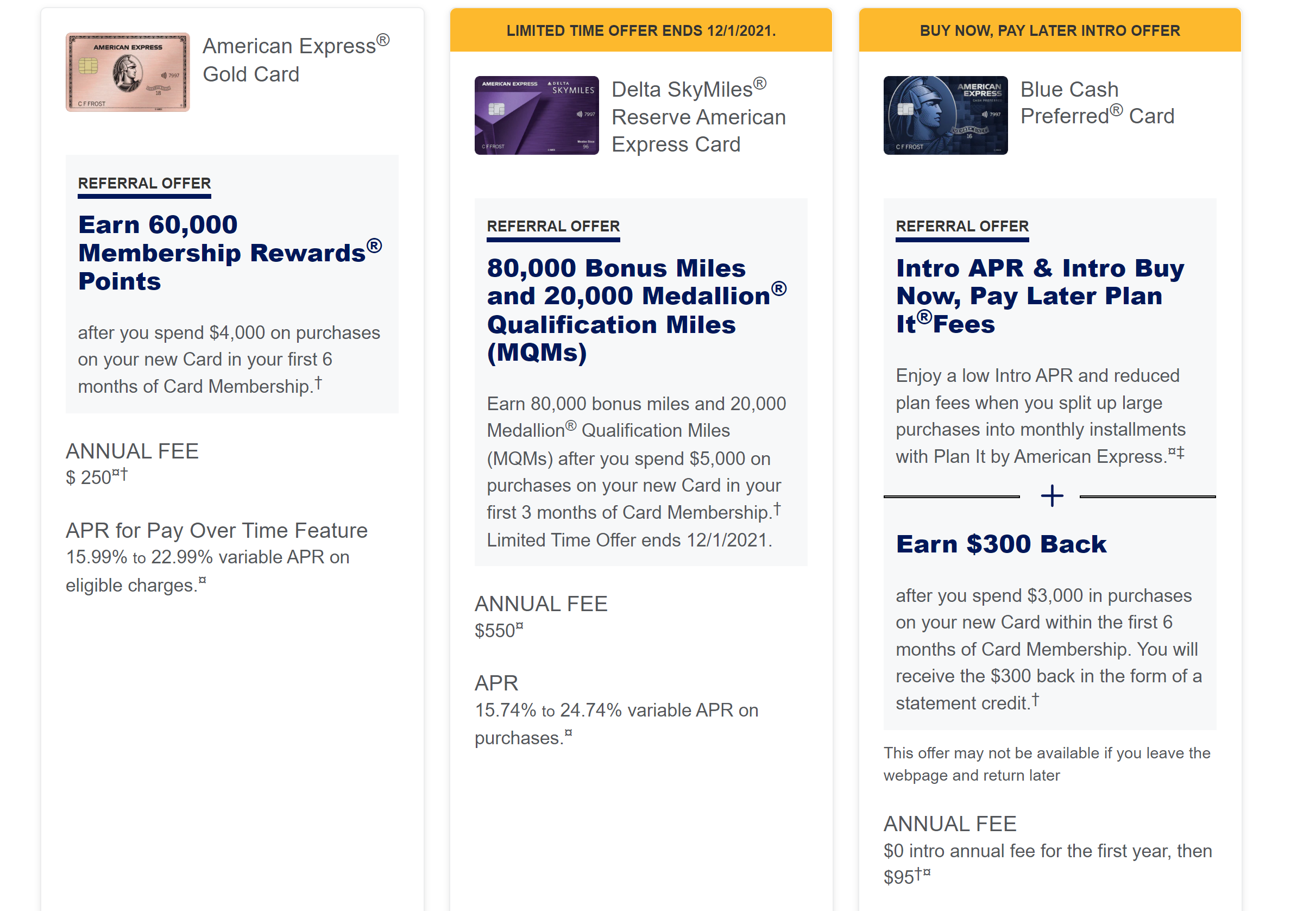

The real beauty of the +4 referral offer is that you can refer to almost any Amex card to pick up the bonus. So if you want 8x restaurants and US Supermarkets (4x on up to $25K per year, then 1x, plus 4x from the referral offer), you can refer a spouse to a fee-free card like the Everyday or Blue Business Plus or even a co-branded card like the Delta Platinum and get your +4x on the Gold card. We’ve updated this post with details of the current referral deal. You can 10 days left to trigger the deal and then 3 months of +4 goodness. Get after it now!

It was the best of times, it was the worst of timing

I finally put my money where my mouth is and opened the Amex Platinum card under what is indisputably the best new credit card offer we have ever seen. But I’m not going to leave it at 125K + 15x — I plan to pump it up to 19x and max out the spending cap on a single purchase. Unfortunately, my timing probably cost me $400 in credits, but when I bank 600K points I won’t lose much sleep over that last set of airline and FHR credits. Cross your fingers for me that this all works out.

Status cruising: Saving $2K+ on a cruise to Europe, Alaska, etc with a match

I started this post with absolutely no interest in a cruise and ended up booking a 10-night European cruise for four passengers for $1157 net with a $200 onboard credit (it only would have been $680 without the kids!). That’s a huge discount over the sticker price. Whether you want to cruise the fjords of Norway, around Iceland, through the Greek Isles, to Alaska or Hawaii, or just stick around the Caribbean, there are some great deals to be had with this match.

10 Years of Frequent Miler

Can you believe that Greg forgot about the 10 year anniversary of the day that he decided to start what would quickly become a full-time career in the blogosphere? What struck me about this post was the incredible comments that people left. Reading page after page about how much people have enjoyed Frequent Miler and appreciate our approach certainly made me very proud to be a part of what Greg has built. Thanks to those of you who took a minute out of your day to say something kind; it meant a lot. We certainly look forward to the opportunity to keep building something better and to continue helping people travel more and more comfortably for a long time to come.

How to use your Citi ThankYou point fortune

Unfortunately, temporary transfers to AA have ended, but Citi has added Choice Privileges at 1:2 and Wyndham Rewards at 1:1, significantly bolstering their transfer program. Citi now has a couple of my favorite award sweet spots in Turkish and Wyndham and they have a really compelling suite of fee-free cards to complement the Premier. If they would only add back some travel protections and bring the ThankYou system out of the stone age (make it easy to pool / transfer points without weird expiration, Citi!), they might be able to compete once again for the chance to play third fiddle behind Amex and Capital One. Yeah, I just insinuated that Capital One has passed Chase Ultimate Rewards for the #2 transfer program in my mind. That’s another topic for another day.

That’s it for this week at Frequent Miler. Keep your eye on this week’s last chance deals so you don’t miss any opportunities to stack in the lead-up to Black Friday and Cyber Monday.

![Cutting our collections, comparing free night certificates, and expediting new cards [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/07/Nick-Platinum-cancel-218x150.jpg)

![Re-Bilt already, Fixing Marriott, the best Hyatts for Free Night Certificates and more [Week in Review]](https://frequentmiler.com/wp-content/uploads/2026/01/wp-1768653765552601913603261308925-218x150.jpg)

Hey Nick.. how are you doing on your search for a car you can purchase with Amex? I’ve inquired at a couple of dealers considered part of the Amex Shop Small program and they will only accept a down payment on an Amex. One only allowed $3000 and the other $5000. When I asked if I could charge the whole car on it they mentioned the Amex merchant fee as being the reason they couldn’t do it. I researched and discovered the Amex merchant fee can run 2.5%-3.5% so I offered to pay for the merchant fee. A manager then told me it actually has more to do with banking laws that they can’t do it. He said it had to do with having to name a lienholder. I guess Amex as lienholder of your car doesn’t fly…. ? I was thinking to try to see if they could at least do a higher down.

I refered someone that wasn’t eligible for the bonus but they got approved. Does that mean my referal isn’t eligible for the 4+. I still haven’t received an email stating I get the 4+ even though the person got their card.

I’d expect your referral to be eligible. Have you put any money on the card since then? I’m wondering if you can see your +4 bonus points? See this post for how to find them: https://frequentmiler.com/finding-and-figuring-your-bonus-membership-rewards-points/

It looks like I didn’t get the bonus. Not sure why, I guess I need to call Amex

Based on your experience, how long does it take for the +4 to post after a charge?

A couple of days. You have to click on your Membership Rewards balance (where it says “Explore Rewards” under the points total on desktop), then click the number of points again and you’ll see a more detailed (but very confusing) list. If you see something like “MGM 4” with a string of letters and stuff, that should be your +4. It’s very similar to how the grocery bonuses have posted this year:

https://frequentmiler.com/yes-your-new-platinum-card-is-earning-10x-where-appropriate/

Thanks Nick. I just saw the bonus points post. It looks like it takes 3 days after the charges are posted. By the way, I just want to say that out of all of the travel points and miles bloggers I follow, you guys come out on top when it comes to useful information and tips. Really enjoy all of your posts.

On the Resy Plat, does the 15x for $25k in combined purchases refer to the first $25k in Restaurants and Small Business, or does it refer to the first $25k spend regardless of category, with 15x applying only to the portion that is Restaurant and Small Business? I interpret it as the former, but I couldn’t assure P2 I am 100% confident. My finger’s getting itchy and wants to pull the trigger, but I want to be sure I’m reading the terms correctly.

The former – it refers to the first $25K in restaurant and small business purchases. Your other purchases do not count against that cap.

The +4 referral offer (if you refer someone after opening the card) adds +4 on the first $25K in purchases regardless of category.

Woohoo, Resy triple-dip, here I come!

I woke up this morning and discovered that the “Refer A Friend Limited Time Offer” section on a couple of my cards has been changed to a “Let’s Shop Small® on November 27” section. This seems to have happened overnight.

Has anyone else noticed this? Is there another way to access the referral link for this +4 offer?

I still have the referral links on all of the cards in my household. We have heard two or three reports this week from people who say that they suddenly no longer see a referral link specifically from their Platinum card, but between my wife and I we have four Platinum cards and help manage finances for another family member who has one and we still see all of our referral links.

Have you tried logging in on desktop and scrolling to the bottom and clicking “Refer a Friend”? That takes me to a page where I can scroll through all of my links.

Nick, thanks for the reply. The link that went missing for me was on an Amex EveryDay card which is the only one I carry that was targeted for the +4 promo.

Inexplicably, I logged back in and the links were back on both the account page and the “Refer a Friend” page. I went ahead and copy and pasted them to someplace safe just in case it starts acting up again.

The +4 promo isn’t targeted. It should be available on all of your cards that earn membership rewards points except for the cards from Morgan Stanley and Schwab.

Bizarre. I have referral offers on 3 of my 4 cards: Blue Cash Everyday, Hilton, Amex EveryDay. Notably absent is my Amex Platinum. This seems to be the case both when looking for the link on the account page for each card as well as the “Refer a Friend” page. My Amex Plat is not a co-branded version, it’s the regular personal card.

Do I understand this correctly? Assume for this example that I can’t buy a car with the Resy Plat. Apply for Resy Plat, when approved refer P2 for Business Green, spend $25k on Resy Plat and $3k.on Biz Green.

I end up with 125k Resy Plat signup bonus + 125k (25k spend x 5) + 25k Biz Green signup bonus + 3k spend. So $28k spend + $695 Plat AF = 278 MR?

Yes, that would totally work (though you would likely end up with a lot more points because you are likely to do at least some of that Platinum card spend at restaurants and small businesses for 19x, which really adds up quite quickly).

Thanks for the reply, Nick. Most, if not all, of the $25k + $3k spend probably will be paying taxes (I’ve got other min spend to hit on other cards too). So add $560 in fees (2% of $28,000).

Fair enough. Still hard to beat 19x at small businesses and restaurants with this thing and it adds up quickly. Just this week, I’ve spent just over $400 on one meal at a restaurant, a used cell phone that I bought (at Swappa.com) to trade in at T-Mobile for a deal on a different phone, and getting my car detailed (since I wanted to take pictures in prep of selling it when I find my new car) and I’ve earned about 7600 points on that small amount of spend. To be clear, I still intend to put the car entirely on the card, I just figured it wouldn’t hurt to test some things out and see how they code.

Tried to refer P2, but they got the pop up saying they wouldn’t be eligible for the welcome bonus. They’ve never had the card before, only have 1 Amex (gold), way under 5/24. The only thing I can think of is that they have annual fee due on Gold card and trying to open up fee free card to keep MR alive. Cancelled the application, but do you think this is related to the specific card they were opening or something else? Didn’t know if I should try again in a few days for a different card.

That’s a bummer. Nobody really understands why some people end up seeing the pop up in that type of situation. Anecdotally, I have heard of people that are getting the pop up on the consumer side having more success on the business side. In other words, maybe referring them for the Blue Business Plus would work.

The other thing worth noting is that even if they don’t qualify for the welcome bonus, if they get approved you’ll still get the +4 referral bonus, so it might be worth applying even if they won’t get a welcome bonus (I’m assuming P2 is a spouse or partner where it doesn’t much matter which person has the points). For instance, if they were looking to open the everyday card, you wouldn’t have to spend very much at+4 to earn more points than the welcome bonus on that card anyway.

It seems like every week there is a new deal we can’t refuse. I’m not complaining! But for those of us who don’t MS as much as you do, or who have limited MS opportunities in their area, it can be tough to choose which deals to pursue, and which to pass on. Deals like this +4 offer or the Venture X are intriguing, but there is a big opportunity cost. Between my P2 & I, we currently are working on Paypal deals between 2 Marriott Amex cards & 3 Freedoms (up to $17k spend), the extra Freedom Flex deal, Hilton free night spends ($8k x2), finishing up 15k spend on WoH before the end of the year, a targeted Citi spend offer, plus finishing up spend on a retention offer and a couple SUBs. Oh, and trying not to waste the good spend categories on cards we already have (5x or 5% on grocery, gas, home utilities, etc)!

Each person has to decide which offers make sense in his or her situation, but given all the killer deals, I would be curious to hear which you guys thought were keepers for those of us who are looking to have somewhat more minor league spend in the next few months, like “only” around $20k or so.

After you refer someone and they get approved for a card, how will I know when I can start using my card to get the referral bonus? Does Amex send an email?

Thanks,

Martha

Yes, they do send an email. My wife received an email almost immediately after I was approved for the business screen rewards through her link. Other people have said it has taken a day or two to receive the email, but lately we’ve been getting them pretty shortly after approval.

The screenshot at the top of this post is an example of that email.

If my two Amex cards all have this +4 referral offer, can I get this bonus twice?

Yes you can get +4 on both cards if you refer one person from each card.

I’m sure this will likely be a topic in December/January, but I still say that Brex was the deal of the year. 110k bonus, no hard pull, no AF, longterm keeper card (4x on dining, 8x on rideshare), plus the additional 100k bonus for linking to PayPal. Yea, there were some bumps along the road, but to get over 200k points on a great keeper card with no downside (in terms of credit pulls, AF, etc.) is an incredible deal.

Timing has worked well for us. P2 is in the middle of SUB for BBP card 50k MR after $15k spend in 12 mo. Referred P1 to get the +4. Getting 6x everywhere now while completing the $15k. Now considering how to get another referral to get +4 on P1 SUB. Gotta love the points avalanche from AMEX. Chase, where you ar for the last 2 years?

How you gonna say do +4 instead of LifeLock? You can use your +4 to get LifeLock for 95 points per $ or 105 if it goes to 100%. Not including Norton promo.

Data point: downgraded Citi prestige to custom cash. Rep said card number wouldn’t change (I didn’t even ask). Card is exactly the same with expiration date and security code. Super annoying since the prestige is a metal card. Guess I gotta hold onto it for a couple years before I can toss it. Denied for Citi premier 🙁

Recommend upgrade/downgrade cycle between premier and prestige until you get approved for another premier. Can double dip the $250 prestige credit(calendar year) to pay $90 fee every 2 years. -$5 from prestige $95 from premier.

I can see the appeal of the LifeLock deal for some. It definitely is a win, it just feels like a small win in a time when Amex is showering us with easy points. With a minimum of 5x everywhere right now (6x as long as I have capacity on the Blue Business Plus), I just don’t feel like I need to buy more points at nearly a cent per point. And with welcome bonuses, employee card bonuses, and other authorized user bonuses, points are coming in even higher multiples. I just filled up on gas with our Wyndham business card at 8x and then realized that was probably silly since I have a fee-free Gold AU card on my wife’s Platinum card that’s working on the 20K points for $2K spend and also has the +4 from a referral on her account, so that card is really like an effective 14x everywhere until I hit the $2K. When I get done with that, the 5 employee cards on my Business Green each have 20K bonus after $4K spend and will end up with the +4 also I hope, so that’ll be like an effective 10x on the next $20K in spend over those 5 cards. Now my wife’s Business Platinum is also targeted for up to 5 employee cards at 20K for $4K spend, so that could be another $20K of capacity at 10x. I’m just not interested in paying for points while Amex is throwing them at me like this.

That said, the Lifelock deal certainly seems easy and doesn’t require much spend, so I guess it has its place for some.

Yeah, spending 40k+ would definitely be difficult for me…14k between CSP and Hyatt is difficult enough. Gotta up my MS game

But at 8x or 9x or 10x, it’s ~$5K-$6K spend to earn the same ~50Kish points as the max you’ll earn through the Lifelock offer. I don’t know as though I’ll hit all $40K of that spend capacity either, but I’ll hit enough of it not to find the Lifelock deal very compelling right now. Like I said, I get it though.

PayPal showing 20% cash back for me. Seems like a portal but I don’t think they have one?

That would be net -10% with rakuten excluding other cc earnings/spend. -19% with Schwab 1.1*90=99% if you want straight cash?

I’d love to hear your thoughts on whether this is a great idea or asking for trouble:

I have to spend $15k for 150k MR on Amex bus platinum. I have the referral bonus on this card (+4x), and I have the offer to get 20k bonus MR points for each AU that spends $4k (up to 100k bonus points). Should I open 5 AU cards and charge $5k (@1.5x base + 4x ref bonus) in taxes on each, or is this just asking for Amex to shut me down? By my estimate I’ll make almost 400k MR points, but it will cost me almost $500 (2% fee on taxes), I’ll have to float $25k until the IRS pays me back, and might I be asking for trouble from Amex. I guess my biggest question is whether or not I’m being too risky with Amex.

I’m sorry that I have already mentioned this on Nick’s post earlier this week, but now I’m asking more about the risks of doing it (as opposed to understanding all the potential points I could get).

I’m not really sure why you think this is a risk. Amex has always been fine with people paying taxes on their Amex card. It is one of the few types of bills that you could pay with an Amex via Plastiq even when Amex stopped working for most stuff via Plastiq (they have since expanded a bit with a few more categories, but taxes was one of the few that always hung around), so obviously it was Amex that decided that’s OK with with them. I’m sure that many business owners pay a lot more than $25K in taxes. I don’t see any issue there on the Amex side at all.

The only sizable risk I see is floating the money. The IRS usually has a reasonable window for processing returns, but every now and then you hear about someone waiting for months and months. The risk of that is probably low, but there is a non-zero risk of having to float the money for a long time. If you are in position to do that, then I think your plan sounds fine (and while obviously that wouldn’t be preferable, a 400K point return on letting that $25K sit with the IRS even for a year wouldn’t be a bad rate of return).

Thanks Nick. My only reason for thinking it was a risk is because I’m kind of “gaming” the system. Obviously I’m doing everything within their rules, but I’m squeezing every last drop out of stacking these offers. Since Amex can be shut down happy, I could envision a scenario where they shut me down because I’m abusing the system in their opinion, etc. I appreciate your insight.

As someone still waiting on my 2020 refund, I would say be prepared to float it. 🙁

That’s concerning. I was prepared to float about $13k in the spring, but I got the money back before credit card statement even posted.

I don’t see an issue there as taxes are legit spend, but I guess it is always hard to count the RAT squad out.

Does your green Amex really offer a 20k bonus for each additional cardholder? I received a similar offer on personal platinum. Although it says I can add multiple cardholders Amex told me I’d only get 20k once. Thanks

Yes, this only shows up on business cards. The offer specifically says 20K per employee card up to five cards with $4K required spend on each (versus $2K on the personal Platinum). Some people have been able to add more than 5 with the bonus over the phone. Again, that’s only on business cards. On the personal side, the offer is always for one, but sometimes you’ll get the offer again a few months down the road and apparently if the POID is different it will work again.