American Express has been offering good authorized user bonuses this year. My wife had a few offers in her account over the last several months that would periodically show up under her Amex Offers. Unfortunately, they had mostly dried up and have no longer been showing up under her Amex Offers for the past month. However, she noticed that a couple of the offers are now showing up under the prequalification tool.

In recent months, my wife has seen additional cardholder bonuses on a few of her cards, including:

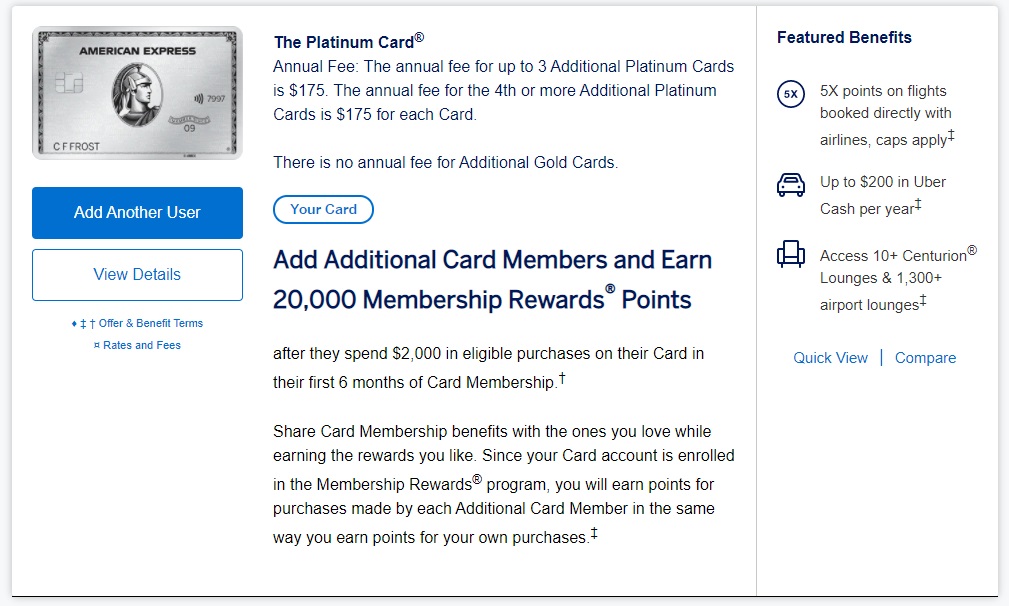

- Platinum Card: Get 20,000 points when you add an additional cardholders and they spend $2,000 in the first 6 months

- Gold Card: Get 10,000 points when you add an additional cardholders and they spend $1,000 in the first 6 months

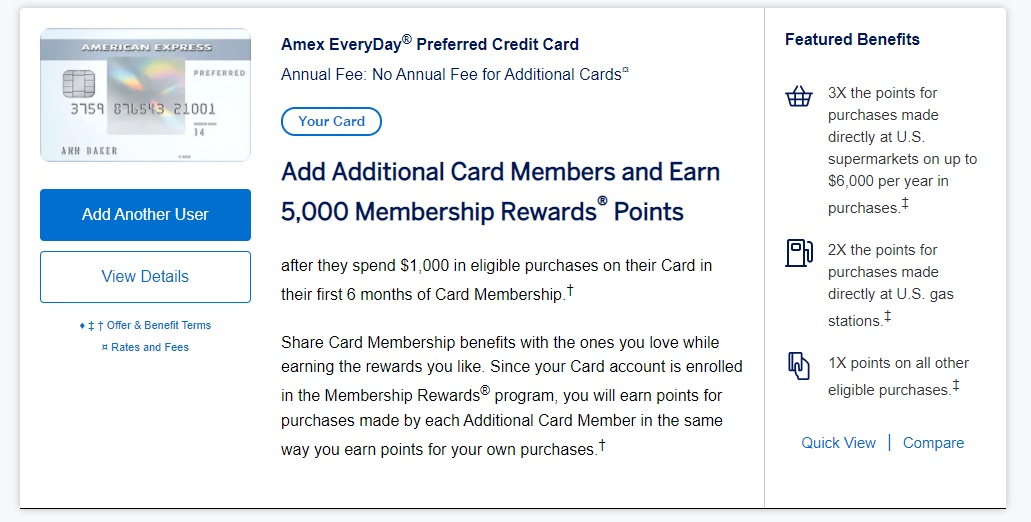

- Everyday Preferred: Get 5,000 points when you add an additional cardholders and they spend $1,000 in the first 6 months

In each case, she has seen those offers appear under her Amex Offers or sometimes at the top of the page for each card in her account. However, in recent weeks, she has only seen the Everyday Preferred card additional cardholders offer (sometimes under “useful links” to the right of the Amex Offers section on desktop).

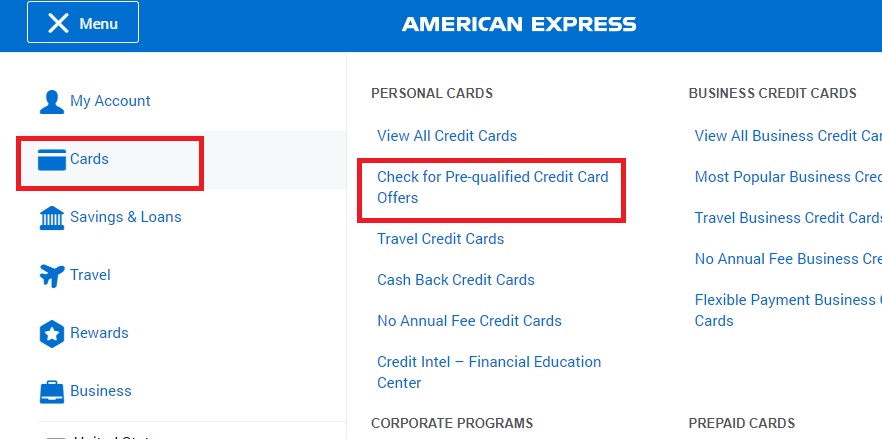

She hasn’t seen the Platinum or Gold additional cardholders offers in recent weeks. Then she checked her “Pre-Qualified Credit Card Offers” by clicking the menu, cards, and then the pre-qualified section as shown below:

On that page, the first couple of offers she saw were for adding authorized users to her Everyday Preferred and Platinum cards:

The Gold card offer was no longer showing.

She had previously completed the Platinum card offer earlier this year. The offer terms suggest that the offer is only valid for the first additional cardholder added. That said, the offer disappeared after taking advantage of it and then it came back again, so it may be possible to complete again (I don’t know yet but will know eventually). Remember that while most Platinum cards charge $175 for up to three additional Platinum cardholders, you can add free additional Gold cardholders. That isn’t an Amex Gold card (no supermarket or restaurant bonus). The card comes with the Platinum card’s earning structure and without Platinum card benefits like Centurion Lounge access or Delta Sky Club access. The good news is that it is free to add and triggers the 20K bonus (again, she previously completed the offer).

Keep in mind that there have also been great offers for additional cardholders on the Business Platinum card this year. I was just glad to know where to find these easy additional cardholder offers that had seemingly disappeared from the Amex Offers section.

For me the “check for prequalified credit card offers” menu tab has completely disappeared. Is that true for others too?

Any reason to avoid AUs to stay on RAT’s good side? I keep my and my wife’s accounts separate (no AUs back and forth) to avoid RAT attention, but that’s my own “superstition.” I feel like if I’m an AU on my wife’s Gold card (or whatever product), and I then open my own Gold card, that might look problematic to RAT.

Am I being too careful?

Ben,

Nobody knows for sure despite what you may read here, because what’s been fine for years can change in an instant.

My dad’s charge was declined and the plat card was cancelled by Amex after being a loyal “member” since 1965… after he tried to buy a $100,000 piece of jewelry.

Good riddance to Amex . The guy never took advantage of any of the “coupon book” credits available , any Amex offer, never used an airport lounge, and certainly didn’t buy gift cards or do anything untoward.

Besides, there’s nothing exclusive about the plat since Amex started giving it to anyone breathing who has a decent credit score.

My dad’s credit approval goes back to the days when card companies used neighbor interviews , among other things (probably including race) , to determine creditworthiness. Algorithms and credit scores didn’t exist. I’ve seen some of the old local credit bureau reports and they were handwritten on index cards.

Sorry for the rant, but the recent spate of continued Amex offers for a 2nd , 3rd or 4th iteration of a given card makes me wonder both where this ends and how Amex is making so much money.

I laugh at RAT and at Chase 5/24. I’ve had my own run-in with Chase and loyalty means zero not only to airlines, but also to card companies.

and BTW, the jeweler just handed him the $100k piece of jewelry and asked him to send a check. So, there’s still some trust in the World.

New to AMEX and AU

My wife added me as an AU to her Gold card this year. I later got a Gold card of my own, without issue.

Becoming an AU put me right at 5/24 but the Chase reconsideration line approved my application, given this AU status.

Since I’m an AU on her account, my wife can transfer her points to my airline and hotel partner accounts.

Nick, do you know what chase sees as the open date for purposes of 5/24 when aa AU is added to an Amex personal card? P2 hates calling so I need to try to keep open the possibility of auto approvals on chase cards for her.

Not positive, but I believe it’s the date you’re added — so adding P2 would add to 5/24 count. As you clearly know, Chase can usually be persuaded to ignore AU accounts on recon, but if P2 isn’t going to want to call then best not to add P2.

I’m probably making this more complicated than it is, but since Chase toughened up with 5/24, including non-business AU cards, P2 and I have ceased with the AU cards (except for business), and even feel too guilty to ask P3, P4 and P5 to be AUs, because, who knows, some day they may want to get more heavily into the game.

Why? Well Nick and Greg are right, that one can call in to recon with Chase and get an AU card discounted from the 5/24 count. Lots of evidence for that, including this thread. However… As Nick mentions, this starts to put a burden on P2s who might not enjoy calling, and even on P1s who have a hard time answering a straight up question with an easy-to-detect lie.

To wit: A few years ago, when the CSR first came out, I was at 5/24. I tried the in-branch route, but was still rejected. I called recon and pointed out that one of my cards was a Citi Premier on which I was the AU. The rep said he could see that, but then asked me whether I was actually using the card. Well, I was — it had some good categories and, more to the point of this thread, since the Amex incentive to add AUs necessitates that they are spending, this is going to create a situation in the near to medium term in which it can and will look to Chase as though you are actually using the card.

Maybe I just got a strange Chase rep on that recon call, maybe if I had flat-out lied and said I didn’t use the card, that would have been the thing to do; but since then the allure of the Chase universe has weaned me from the AU thing.

Can we add someone who already has the card as an authorized user? For example my wife and I recently both got the amex platinum personal card. Can we now put eachother as authorized users on the other person’s card?? Or will the Amex cancel team come calling?

Yes, that’s totally fine.