NOTICE: This post references card features that have changed, expired, or are not currently available

Are your points and miles free? Does it cost you something when you redeem them? Is your travel free if you use your points? Does it make a difference how you’ve earned them? Spoiler alert: Greg didn’t agree with everything in my post about this topic the other day and I think we walked away agreeing to disagree, so if you ever ponder the purchasing power and value of your points, you’ll want to check out this week’s Frequent Miler on the Air.

Are your points and miles free? Does it cost you something when you redeem them? Is your travel free if you use your points? Does it make a difference how you’ve earned them? Spoiler alert: Greg didn’t agree with everything in my post about this topic the other day and I think we walked away agreeing to disagree, so if you ever ponder the purchasing power and value of your points, you’ll want to check out this week’s Frequent Miler on the Air.

On the blog this week, read about how to score 2 Southwest Companion Passes and 267,000 points or more with just 3 credit cards if you’re playing in two-player mode, which could be a great way to drastically reduce costs for a family of four or two couples who want to join forces. We also try to answer the tough questions like how to pronounce Qatar, whether you should speculatively transfer to Aeroplan with a 30% bonus, and a lot more. Watch, listen, or read on for more.

00:43 Giant Mailbag

04:59 What crazy thing….did Barclays do this week?

10:44 Mattress Running the Numbers: Why Greg isn’t transferring to Aeroplan

16:27 Awards we booked this week

26:20 Main Event: Award travel is free! No, it’s not! Does it matter?

27:39 Opportunity Cost

31:16 Redeeming points: is it free?

42:50 When people say “my travel is free”, are they talking about the earning or redemption side?

52:55 Is acquisition cost relevant to your redemptions?

1:08:44 Does free matter? What is the Joy of Free worth?

1:20:05 Question of the Week: How can one meet minimum spending requirements on business cards?

Subscribe to our podcast

We publish Frequent Miler on the Air each week in both video form (above) and as an audio podcast. People love listening to the podcast while driving, working-out, etc. Please check it out and subscribe. Our podcast is available on all popular podcast platforms, including Apple Podcasts, Spotify, and many more.

Alternatively, you can listen to the podcast online here.

This week on the Frequent Miler blog…

The joy and myth of free travel

There is a common habit that exists in describing award travel as “free” — and let’s be honest, it’s fun to walk into a swanky hotel or airline cabin and feel like you got it for nothing. But is it free? I think if we’re being honest we can agree that it isn’t. But how much are we paying? Since we could alternatively earn cash back, does it cost us something to earn miles? If we could redeem our points for cash or an experience, should we think of it as though the experience “cost” us the equivalent amount of cash that we could have gotten with the miles? This post attempts to answer some of those questions — and we expand on many of them on this week’s podcast. Whether or not you agree with my perspective, I hope you are at least thinking of the opportunity costs of playing our game.

Chase’s 30% transfer bonus to Aeroplan is awesome, but I’m not buying [On my mind]

On a recent episode of Frequent Miler on the Air, Greg and I talked about why it might make sense to speculatively transfer to Aeroplan with the current Chase transfer bonus. Then, on this week’s show, he might have convinced me not to do it with the argument he put into this post. Like Greg, I’ve been earning Amex Membership Rewards points at a much faster flip and so, while I’d likely miss out on a transfer bonus, I have access to a decent supply of points that could become Aeroplan miles, but a far more limited supply of points that could become Hyatt points. I’m still considering it though: if for example I transferred 150K Ultimate Rewards points to Aeroplan, I’d pick up 45K bonus miles — and I’m pretty sure that I could replace that 150K Ultimate Rewards points before I’ll need another transfer to Hyatt. If I become more sure of that statement, I might make a speculative transfer to Aeroplan — we’ll see.

2 Southwest Companion Passes and a boatload of points with just 3 cards

It is common knowledge that one person can get a Southwest Companion Pass with two new credit card welcome bonuses, but did you know that two individuals playing the game together could get two Companion Passes with just three total credit cards? Thanks to Southwest multi-referrals and currently-increased offers, you could end up with well over $3,000 worth of points and two Companion Passes with just $11K spend.

How to pronounce Qatar

Do you know how to pronounce Qatar correctly? Does Greg? You watch the video and judge for yourself whether you, Maisie, or Greg sounds the most like the locals. This much I know: I’m probably never going to pronounce it well, but if I get back to Qatar and get out of the first class lounge, I hopefully be able to say where I am thanks to this post.

United MileagePlus Changes: Increased Status Qualification Requirements, Fewer PlusPoints, Removed Award Redeposit Fees & More

United is making changes to earning elite status next year — the short story is that earning status will be harder, but I’m not one to chase status so that part of the news didn’t make much difference for me. Much more interesting to me is the fact that United has finally gotten with 2022 and removed award redeposit fees. That makes United miles more valuable to me than they previously had been, so I’ll call this a net win for me.

Air France/KLM Flying Blue: Free stopovers on award tickets coming soon

Well this is potentially exciting news: Air France may soon start allowing stopovers on a one-way award ticket and it sounds like a stopover will be free. If this comes to pass, it will certainly increase the value of Flying Blue awards – and given how easy it is to earn Flying Blue miles (since you can transfer from any major transferable currency to Flying Blue), I could see this becoming very popular despite Air France’s moderate surcharges.

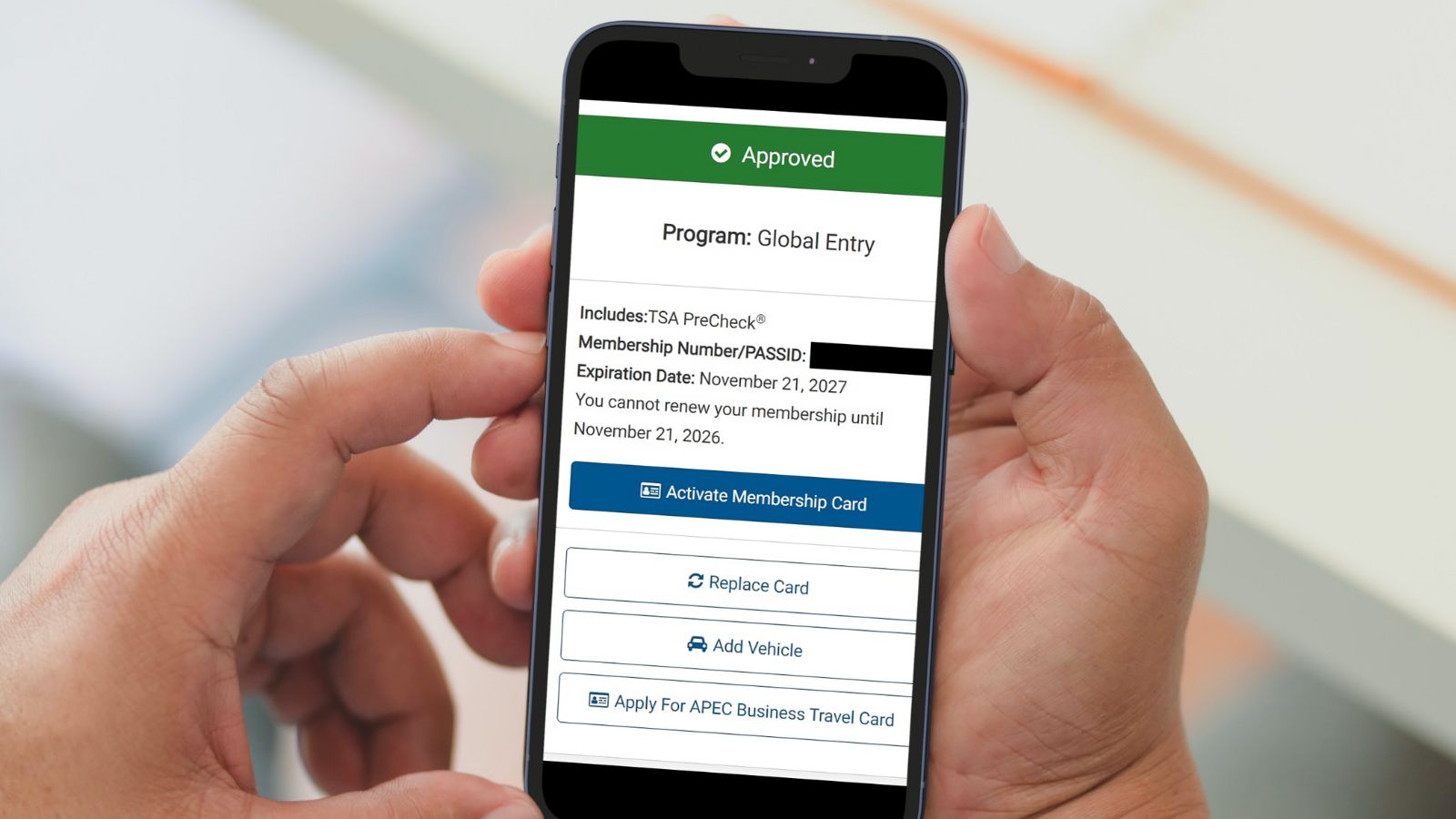

My Global Entry renewal experience (success on arrival)

Greg writes here about his experience renewing global entry on arrival back into the US. Unlike Greg, I do not have Global Entry. Part of the reason for that has been that appointments are difficult to get and I generally don’t want to commit to a 6hr-8hr round trip to the nearest airport that does interviews. However, many readers have told me how painless it can be to handle the interview portion on arrival. Greg found that to be totally accurate, though some readers in the comments have not been so lucky. Personally, I’ll just stick with Mobile Passport: it’s free, easy, and there’s none of this periodic interview business to deal with.

Don’t forget to check for this week’s update to last chance deals to make sure you check deals off your list before they expire.

![Cutting our collections, comparing free night certificates, and expediting new cards [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/07/Nick-Platinum-cancel-218x150.jpg)

![Re-Bilt already, Fixing Marriott, the best Hyatts for Free Night Certificates and more [Week in Review]](https://frequentmiler.com/wp-content/uploads/2026/01/wp-1768653765552601913603261308925-218x150.jpg)

I love the nitty gritty discussions on this podcast, even when they are a little painful to listen to. 😉

I agree that nobody should be hawking this hobby as free. But I also don’t buy into the analysis paralysis over opportunity cost. Even Nick, when accounting for opportunity costs, must think this hobby is worth more than he’s missing out. If not, the answer would just be to use 2% cash back cards and nothing else.

I also thought it was interesting that Nick said he didn’t consider the amount of hours worked, etc, when paying cash for something. I feel the opposite! When I was a fellow moonlighting at the hospital, I’d get paid $1000 for an overnight 12-hour shift (maybe $600 after deductions). And when it came time to spend that $600, I would think about all the awake hours I spent operating and taking care of patients – that $600 suddenly becomes much more valuable. I also think about this in the reverse – if I want extra money for a trip, what kind of extra work is worthwhile?

Overall I think opportunity costs are a personal perception. And we all think the points and miles game is worth it, or else we wouldn’t be here. Great podcast as usual guys!

Interesting discussion on the podcast! The one thing that was missing is how you actually value the redemption. In Nick’s example, he clearly values the restaurants he frequented at face value, as he chose to pay cash for them. However, travelers have options when redeeming for flights and hotels.

Flights: I’ve redeemed on business class, but never paid cash for them. I can’t justify the cash outlay. I value business class flights at economy prices with a nominal upgrade fee. There aren’t many alternatives for flights, and economy is fairly similar between airlines, so you’re stuck using the economy valuation for your redemption as a minimum.

Hotels are more interesting. If we accept the base standard as a clean place to sleep, with enough room for your group and their stuff, then valuing a high-end redemption at face value becomes more challenging. If you make a 1 night redemption of 50k points, and those points could be cashed out for $500, that’s a false choice. If you didn’t have points, you might’ve paid $150 for a hotel (you can add a nominal rate for the added luxury). This means that your redemption value isn’t MSRP/50k, nor is it $500/50k, but it’s actually $150/50k, which is much lower. If you’re willing to couchsurf, your redemption value becomes even lower.

House money effect

Paradox of Choice

Enjoyed the episode 🙂

I love these philosophical discussions. My take is rather than think about whether the travel is free or not I prefer to think about whether the redemption saved me money or not. A trip to the Maldives that I would never pay cash for didn’t save me money ( in fact that travel is very costly in incidentals ) A trip to Grandma’s that we would pay to take yearly does save me money if I book on points. Cashing out UR at 1.5cpp to pay down a mortgage also saves me money.

Prince of Travel site has an interesting article on economic theories as the relate to points and miles. ” what can economic theory teach us about points and miles ” He talks about comparative advantage , loss aversion, endowment effect etc.

Jake Broe also has an excellent YouTube video called ” The true cost of points and miles ” worth checking out.

P2 and I refer to it as a method to heavily discounted travel. Especially when one combines MS and miles/points purchases to top off accounts (e.g. get enough points for a Hilton 5 night award).

HaHa must be a $$ maker for FM we went over this a few days ago $$$..

Long Live Travel Blogs.

ALOHA

Sorry Greg, I’m on team Nick with this one.

I absolutely hate when other travel blogs/podcasts/etc refer to travel with points as “free”. There’s always an opportunity cost with earning the points, along with an opportunity cost in using the points for travel instead of cashing them out

Example case:

It’s pretty clear to me that I paid money for those tickets, so it wasn’t free. I just ended up getting quadruple the value that I would have gotten by cashing out.

Now imagine I had done the exact same thing with the Spark Travel Elite card, so I earned the same miles directly instead of converting cashback. I would argue that this is almost identical, since I could have alternatively used those miles to erase travel at 1 cent/point. So in the same way, using those miles to purchase the tickets would be paying 1 cent/point.

Is the experience diminished because I know I actually paid money for those tickets instead of thinking of them as “free”? Personally, my answer is no. I’m using them to take a trip where:

So what if it’s not “free”? Points/miles enabled me to book a trip that I otherwise never would have experienced. That’s enough to keep me in the game.

Great podcast and I don’t disagree with most of what was said about the main topic regarding “free” travel, but I think there were two points where Greg and Nick had some disconnect with what the other was saying.

The first was the discussion of whether it matters how the points were earned when evaluating redemption values. I think Greg was right here. Nick’s counter argument that you shouldn’t redeem for less than you acquired the points for, is true and makes sense, but what it’s missing is that it doesn’t necessarily mean that both legs of that transaction were a bad idea/mistake. As an example, if you bought Hyatt points at 1cpp and redeemed them for 0.5cpp, that would be a mistake, but it wouldn’t necessarily be a mistake that you bought them for 1cpp, it would be a mistake that you redeemed them for 0.5cpp. The opposite could also be true if you bought Hyatt points for 10cpp and redeemed them for 7cpp.

Earning/redeeming points and miles is effectively two separate legs of a transaction. I think where it makes sense to think of them together is when evaluating the true cost of your final redemption. For example, if you were given the choice between $300 and 30,000 points and those points were redeemable for either 1.5cpp in cash or a free night. The cost of the free night would be $450. Since even if you wanted cash back, it would be better to take the points on the “earning” side and then redeem for 1.5cpp in cash.

The second point is related to the above and was about the discussion of whether these redemptions “cost” real money. I think Nick is right here and Greg’s counter argument about the free certificate only exchangeable for a cruise is interesting, but what I think the argument is missing is that adding the option to redeem for cash makes that certificate more valuable. The key is that the optionality has value. A free certificate only exchangeable for a cruise (let’s call this certificate A) will always be equal or lesser value than a free certificate exchange for either a cruise or $X (let’s call this certificate B) and the difference in value will depend on how likely you are to exercise that option for $X. If you don’t value the cruise / would never spend real money on the cruise, certificate A might have close to $0 in value, but certificate B will never be worth less than $X. Therefore, if you wouldn’t normally pay for a cruise, exchanging certificate A could be considered “free” while exchanging certificate B would be considered as exchanging $X.

I might be putting words in Greg’s mouth / misunderstanding, but my interpretation was that his counter argument to nick essentially boiled down to “How could certificate A be free, but adding the option to exchange for cash make it not free”, but I don’t think this is actually a contradiction because that option to exchange for cash has value.

To Judy’s point, Sly says that you are either in the game or you are not. And, if you want to be in the game, you have to be in it 100 percent. If you are not in it 100 percent, you are not really in it.

Piggybacking on Telnar, a person can get to a position at which one is so flush with points across all programs that the marginal utility of new points is zero. And, the only thing left is cash back and that return is meager in comparison.

It is an interesting and thought provoking episode. Greg’s point is once you acquired those miles and points, you spend them like standalone currency. Nick’s point is you factor in the acquisition cost before pulling the trigger on the redemption. I think everyone will try to acquire points at a cost lower than the estimated value of the miles and points and aim to redeem at a value higher than the estimated value of the miles and points.

The marginal disutility of expending anything (even US$) declines the more one has of it.

Greg’s AA situation is just a specific example of this general principle. In essence, he chose to buy enough AA miles (at 0.4 cents each) that they no longer felt even a little scarce — making them essentially “free” for any remotely reasonable redemption.

If one values “the joy of free” for its own sake, there’s nothing wrong with accumulating excess points for that specific purpose as long as one understands that they are in essence prepaying for the feeling that travel is “free.”

Accumulating excess points to make them feel free isn’t for those with tight budgets, but anyone who isn’t bothered by spending extra in other areas of life to avoid hassle might consider doing some of it in our hobby by over-accumulating points compared to the most financially efficient option. This could be done by collecting points instead of cash back past the level where they will probably be used in the next year or two, or by not cashing out transferrable points resulting in a similarly large balance.

We all know that points don’t pay interest and can be devalued, but those factors are arguably the cost of “the joy of free” to those who make this choice.

Love the podcast typically but this wasn’t my favorite episode. Wasn’t sure if these are actually differing opinions for you guys, but my take is as follows:

Is acquiring points free?

Absolutely not. You always have the option to spend money on a 2% cash back card, so any points you are earning from a card not earning cash back is at a 2 cent cost. Most of the time in this hobby, it doesn’t matter because the trade-off is great: spend towards a sign-up bonus and you often earn 10 cents per dollar spent or more, but you are absolutely still “spending” by not putting that spend on a 2% cash back card. In reality, this doesn’t matter when for example you’ve signed up for a Chase Sapphire Reserve and are getting 20 points per dollar on your minimum spend requirement (80k points / $4k spend now), so you’re buying Ultimate Rewards for 0.1cpp. This is obviously a great trade however you use the points, because you have a way to acquire points for 0.1cpp and trade them in for 1.5cpp via PYB or potentially more via partners/travel, but there was an opportunity cost to acquisition.

Earning points may FEEL free because you can earn points without really changing anything about your day to day lifestyle and spending habits, but there is always an opportunity cost to acquire those points.

Is redeeming points free?

This depends on which currency we’re talking about: most of the conversation on the podcast focused on flexible currencies with a cash-out option, so for any that do (Ultimate Rewards, Membership Rewards, C1, etc), there is an opportunity cost to NOT cashing out points, of course, because you could have had that cash. Any time you redeem these points, you are trading a travel experience for whatever the cash-out option is.

On the other hand, if you’re earning a specific airline or hotel program’s points that don’t have a cash out option, then the points are only “worth” what you can redeem them for. But they’re still not free, because you traded away cash back to acquire the points!

The bottom line is there is an opportunity cost to acquisition and an opportunity cost to redemption in the hobby. For the most part, it doesn’t matter, because the hobby has identified a great engine for earning these currencies that leaves a lot of value to the consumer above and beyond the cash out equivalents.

When people talk about “free” travel, I always take this to mean they did not pay cash directly for their travel experience, so they don’t feel the pain of cash leaving their wallets for the experience. There is certainly a “joy of free” as Nick describes in his article, but the “free” here should really stand for “free from directly spending cash”, not “free”. It’s more likely appropriate to say “the joy of significantly discounted” travel.

Good podcast today. Thought provoking. So Nick, how do you reconcile that a “great” international award to Europe is 50k on delta one each way – so 100,000 miles RT. At 1.5cpp, that $1,500 opportunity cost (cash not in pocket) for a RT ticket. If cash prices for economy are $500 RT – now you are paying an extra $1,000 to sit up front. While it’s undeniably better – would you pay that in cash if you saw that same business class flight for sale at $1,500? If not – why would you pay points for it and not cash? Just curious. It’s the reason I have trouble booking international business class travel with points. It’s still WAY more than I would ever dream of paying for a flight.

Signed,

Sitting on way too many miles because I overthink this stuff, Blair

Yes u Do Blair if it Looks Good ” Book it Dano ” Just like I do..V Bernie

The whole subject of ‘free’ as it pertains to loyalty plans is just a bunch of hot air. If you put in the effort, stay current on the ‘news’, read all the fine print, pay attention and chose judiciously, you get great benefits from loyalty plans. If not, you lose. A simple concept.

Guys, I love the podcast and listen every week, but this one was rough.

First, the whole section about whether it matters how much you paid for the points, where Nick subscribes to the sunk cost fallacy and spends a bunch of time trying to defend it was so infuriating for me that I had to stop the podcast and come back half an hour later.

And then the question of the week where Nick encourages people to do something that could very easily be considered fraud because “who is ever gonna ask you to justify it” (paraphased). OOF! You may wanna have a lawyer listen to that and help determine whether its something you should be taking down