Update 8/21/21: We are once again seeing these big welcome offers sent out via email. Greg’s son, who has already been targeted to add an additional Business Platinum card twice, got targeted yet again for this offer that includes no lifetime language (the subject line of the email says, “Limited-Time Offer for [Name]: You could earn 150,000 points”). Note that he’s been getting the pop-up when trying to apply for other cards but has been able to get approved for Business Platinum offers like this one. My wife didn’t receive an email, but did have an offer to expand her membership with another Business Platinum card found under her Blue Business Plus card.

You can check for yourself to see if you get targeted for the 150K offer at this link.

Note also that my wife and I have each received mailer offers for 80K points after $10K in purchases on the Business Gold card for new LLCs we formed this year, which isn’t as good as the targeted offer seen below or the 90K offer that some have seen but is still better than the current public offer. It’s definitely worth keeping your eye out for these targeted offers as Amex seems to be making a pretty aggressive push.

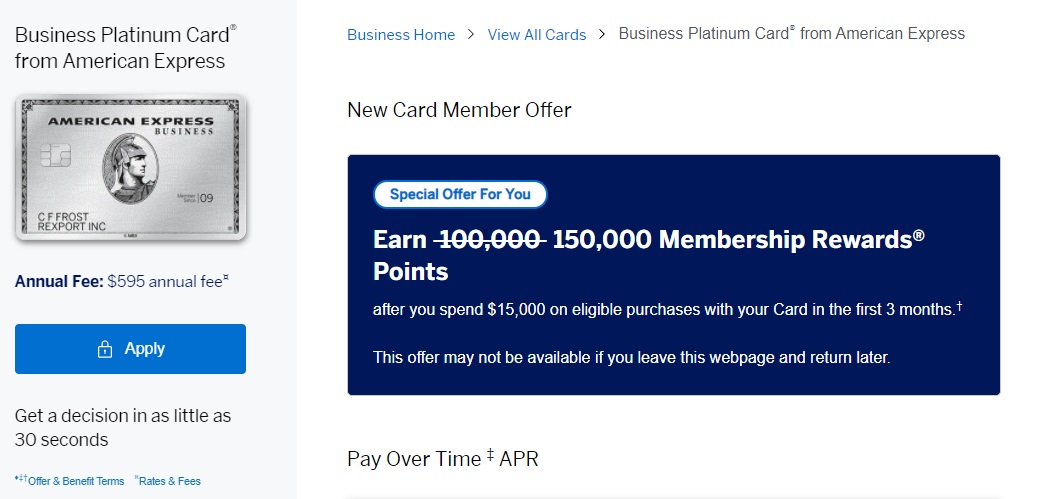

Update 4/15/21: We’re now seeing an offer for 150K points for some people! That’s the best offer I’ve ever seen on the Business Platinum card and matches the offer I got when I first opened the card years ago. The spending requirement is still $15K, but if this card is on your radar it’s worth reading the original post below and seeing if you’re targeted. H/T: Miles to Memories

Note: We originally reported that this happens when clicking through a referral link, but then I later found this offer via the generic card page at Amex as well as through affiliate links, so it is possible that you will find these increased targeted offers when clicking through any link.

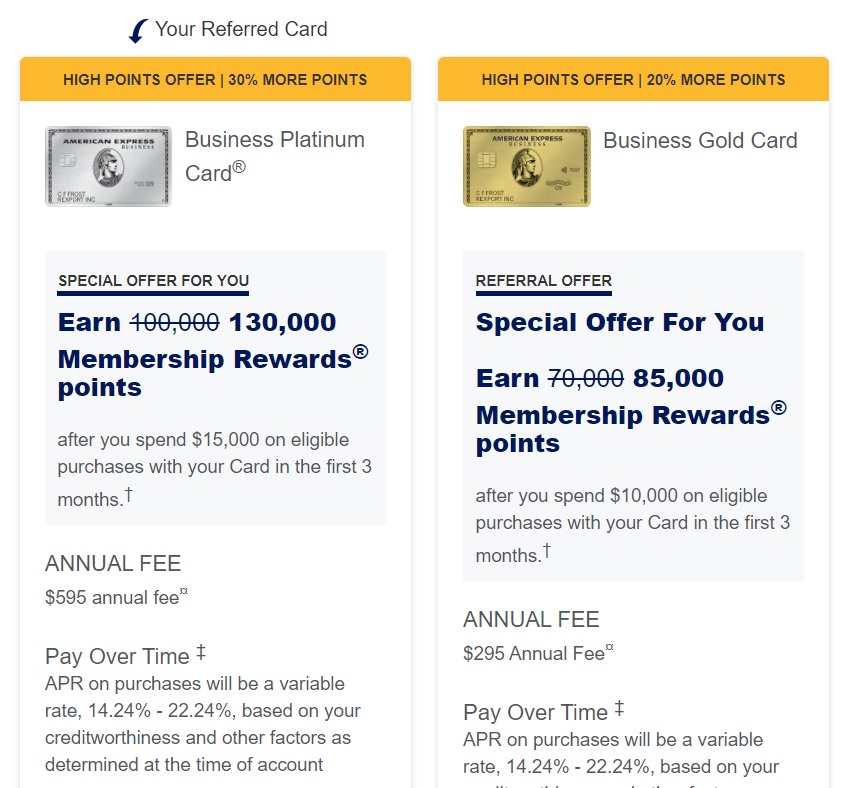

Spencer Howard of Straight to the Points, ahem, points out in his Instagram story that there are newly improved targeted offers that some are seeing for the Business Platinum card (130K Now up to 150K points after $15K in eligible purchases in the first 3 months) and the Business Gold card (85K points after $10K in eligible purchases in the first 3 months) when clicking through a referral link (we currently feature referral links for each of these cards on our Best Offers page at the time of writing) .. These are terrific offers, particularly on the Business Platinum card as that is nearly an all-time high offer.

Years ago, I opened a Business Platinum card under a targeted 150K offer that required $20K in spend, but 130,000 Membership Rewards points is the largest offer I’ve seen on that card that didn’t require a mailer or friendly phone agent. And in this case, if you are using a referral link from Player 2 in your household, you may be netting more total points for the home team with their referral bonus included depending on the card from which they refer you.

Years ago, I opened a Business Platinum card under a targeted 150K offer that required $20K in spend, but 130,000 Membership Rewards points is the largest offer I’ve seen on that card that didn’t require a mailer or friendly phone agent. And in this case, if you are using a referral link from Player 2 in your household, you may be netting more total points for the home team with their referral bonus included depending on the card from which they refer you.

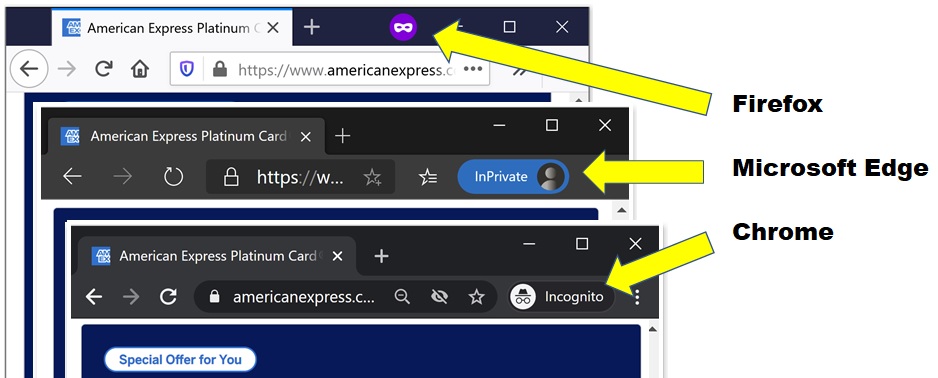

That said, not everyone is seeing these offers when they click through referral links. As I’m working on our site, I am often checking things in multiple browsers to be sure that displays look right and links work for readers who use a variety of machines and browser types. It might be worth trying out a new browser if you haven’t in a while.

I clicked through the referral link we have listed on our Best Offers page for the Business Platinum card on my computer and was lucky to see the offers shown above right away.

The increased offer on the Business Gold card isn’t quite as compelling to me since we recently saw a targeted 90K offer on that card – and more importantly, the public offer on that card that expired yesterday was potentially better yet because of the statement credits that were included. The annual fee on the Business Platinum card isn’t cheap, but between the card’s regular benefits and the increased offer here, it will certainly make sense for some. For more on these cards see our Business Platinum card page and our Business Gold card page.

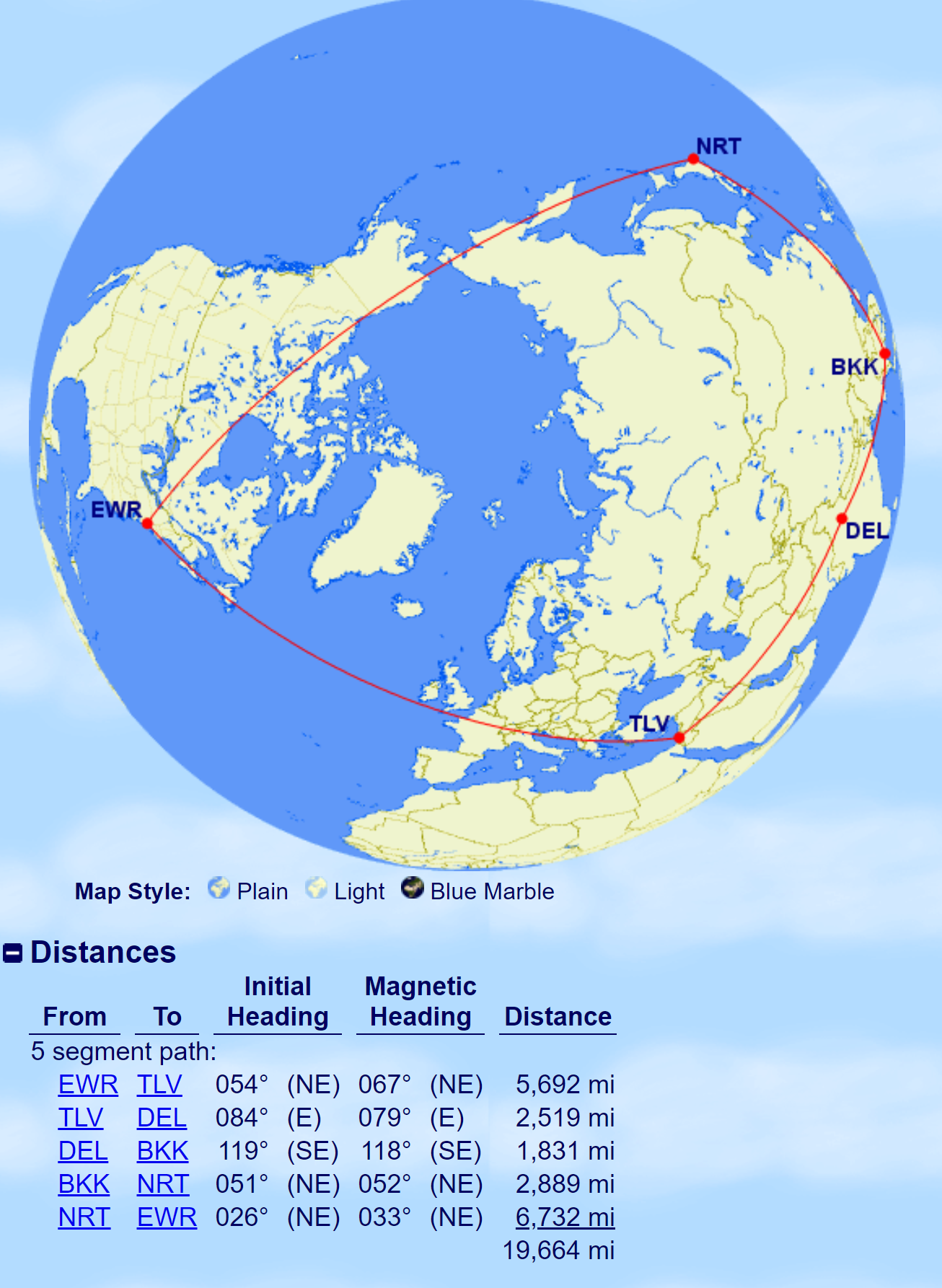

That said, either offer is notable. Spencer of course points to the Virgin Atlantic sweetspot for ANA first class that recently got even sweeter now that Virgin Atlantic is allowing one-way redemptions on ANA. Of course that is but one of the many strengths of Membership Rewards points. Those who have found inspiration in Greg’s recent series on booking a round-the-world business class trip on Star Alliance airlines via ANA will be thrilled to find that it is possible to fly a route like either of the two examples below (maps courtesy of GCMap.com) entirely in business class with stops in each included city for just 115K Membership Rewards points.

For more on ANA round the world awards, see:

For more on ANA round the world awards, see:

- Tips for booking ANA’s Round the World award

- My Round the World business class adventure (exploring hacks, and testing limits)

There are plenty of great Membership Rewards sweet spots from which to choose.

Keep in mind of course that both cards are typically subject to the Amex lifetime rule, so you likely aren’t eligible for the bonus if you have had the card before.

I logged on to my business account and saw a targeted offer for the Bus Plat for 150,000 after $15K in 3 months, but I already have one I applied for and received and have already got my 100,000 points.just a few months ago. I did assign that card to a different logon (the one with my personal cards) for easy access as I log onto that one frequently.

So, I thought I had read somewhere on your site that someone had applied for a received a new card even while they still had the exact same card in use. Now I cannot find that post – was it real or am I not remembering correctly?

Any suggestions? I do have a second business but may not keep it for much longer.

Yes you are remembering correctly: https://frequentmiler.com/bypass-amexs-lifetime-rule-when-you-expand-your-membership/

It’s also worth noting that my offer is titled “You recently redeemed points.” For someone else looking to get this offer to pop up, I wonder if redeeming some points could trigger it?

I’ll try this and see what happens. Thanks for the tip.

I have the offer on the BBP even though I signed up for the Bus Platinum a few months ago. It says the offer expires at the end of December. What are the chances it disappears before then? Or am I likely to be okay if I wait?

I had the offer on my BBP too and decided to wait but then it disappeared today. Hopefully it will come back before Dec 🙁

How long ago did the offer show up for you?

My offer is still there, but I wonder if you could get it to appear again if you tried the link in this article?

I did try the link, unfortunately no longer targeted :(. hopefully I’ll be targeted again by the end of the year

… and lo and behold, I’m now targeted for the 0% APR 150k business platinum offer!

I got the 150K offer email. But when I click through and login I get “This offer no longer available.” I already have a Business Platinum,

Same, but the 150k Plat offer for my bbp under Amex offers when I log in works.

I wanted the 6k spend offer so about 2 weeks ago I found the business gold 6K spend 80 K offer from a doctor of credit link. I had to search for about 45 minutes – an hour and used every link I could find and finally got the offer. I found it on my iphone. Tried to airdrop it to my MacBook and there it changed to the 10K spend offer.

i got the pop up with 150k offer but it has the once lifetime words. 🙁 I already have a biz Plt card.

So it looks like at least a couple others here have been successful in getting their second Amex Platinum biz (congrats!) I got an offer for second one as well…. certainly makes sense to apply for it- but if I do, do I **have** to keep my 1st Biz Plat open until the annual fee hits in order to avoid risking points getting clawed back? And they will definitely refund the AF when I call to cancel then? I just have no interest in paying that hefty fee again for a card I no longer need.

I think the following may be relevant to your question ….

A couple of weeks ago, I called in for the second or third time regarding my longtime Amex Platinum card. Regular, not business. I was something like a week and a half from having to pay the Annual Fee. Having just gotten the Amex Business Platinum myself, I was not in the mood for another big fee, most of the new benefits are meaningless to me, and so on. However, in the end, I bit on a $400 retention offer for the Amex Plat with $3,000 spend in 3 months. Color me weak.

Anyhow, I did listen pretty intently while the CSR was reading what I was committing to in exchange for the $400. It included keeping the card open for at least another 12 months, else the $400 would be clawed back. Not exactly sure how you claw back cash, but I assume they would reverse the credit and leave me owing them money. After he read it, I said, “Whoa… I have already told you that I’m on the verge of canceling given that the new benefits are not worth much to me, and next year I would be looking at a $695 fee. If I take this $400 offer for the current year, am I in effect committing myself to another year at $695 a year from now? Because I am already darned close this year to the 30 days post-posting of the upcoming Annual Fee.”

To my amazement, the guy totally understood my question, and acknowledged that the window between the end-of-the-12-months-for-keeping-the-card-lest-the-$400-retention-be-retroactively-revoked and the due date on the AF for the subsequent year would be very, very thin. This should have made me punt on the retention offer, but once I realized that the CSR and I were speaking the same language, I got him to tell me precisely, from Amex’s perspective, when I would be released in August 2022 from my 12 months of good behavior, when the (July) 2022 AF fee would post again and — to finally get to your issue — when I could still get a refund on that new AF posting without triggering a claw back. In my case, it is about a 9-day window, which I have now marked on my Google calendar. Here’s hoping I am not in a coma that week-plus.

————————————————————————————————————

As for the more general issue, since I, like you, seem eligible for yet another Business Platinum: I just hit the $15k spend, over half of which involved paying fees (property taxes, estimated taxes). My rough-and-ready estimate is that with the AF, I am paying (including opportunity costs) something like $900-$1,000 for 170,000 MR points, $200-$400 in United Travel Bank cash, and all the Dell wireless keyboards I can eat, plus a Clear membership I will likely never activate. If it were all point-and-click, I suppose I should do it again; but there is that concern that you have raised, plus tax payments aside, I’m not into MS and $15K over-and-over can be a tough nut to make. Will probably revisit in December, assuming the offer is still around.

Thanks so much for this and all the detail. This is great to know (and aggravating at the same time); you really understand what I’m talking about. I’m pretty much in the same boat in terms as you. I guess I will call Amex around the 11 month mark before the annual fee is due to parse out exactly when I can wiggle out.

I’m not familiar with United Travel bank cash, although I did just look it up- is this basically as good as cash when buying United flights? Is this safe to buy in $100 increments with the travel credit?

Haven’t tried to spend the Travel Bank funds yet, but I was able to salt away $400 this past month across the two cards. Started at $50 to make sure I knew what I was doing. Went fine and I moved to $100. Hoping this is still working first week in January — has made a difference in how I think about these Platinum cards.

deleted.

P2 redeemed about 100k point a bit ago and now has an offer for the 90,000 gold business in offers. “You recently redeemed points.” She already has gold and platinum business. Clearly they are looking to pump up their business portfolio. Crazy.

Thanks, got my 2nd biz platinum 😀

I just got my 150K points from the last round (2nd card) and now Amex sent me an email offering the same again. I’m looking at buying a piece of commercial real estate soon. Any thoughts on whether deciding to forego the offer or not might be prudent. It’s the eternal greed vs. fear conundrum.

That is sad.

P2 got the card on FEB for 85k.

I got it on MAR for 110k + 15k referal

And now it is even better…

I got a popup of 100k when I logged into my account but I’ve had this card before and closed it. I’m also getting 150k offer to show if I click on referral link on frequentmiler site in incognito. If I go through the link on frequentmiler page, will I be eligible for the welcome offer as I won’t qualify due to the lifetime rule and what are the chances the popup doesn’t show up because I’ve had that happen too.

Referral from P2 showed 100k for Biz Plat. However, an anonymous browser showed 150k (no referral) so I took the bait. Let’s hope Amex and/or their partners won’t devalue too soon 🙂

Just approved last week for a 110K offer…is it worth calling AMEX to see if the offer can be adjusted? not sure of their history here.

No, not on this I’m afraid. This is a targeted offer. There’s not going to be any way for you to prove to a phone agent that you’re targeted for it and issuers almost never match targeted offers. I always say that you hit 0% of the balls at which you do not swing (in other words, you’re better off asking than not asking), but in this case I put the chance of success at very nearly zero.

The 1-way on ANA with VA is a nice change —- but the ANA Round the World – during the COVID19 era seems an exercise in futility and/or frustration with travel rules changing as often as the view on a merry go round.