NOTICE: This post references card features that have changed, expired, or are not currently available

With the coming changes to Marriott Bonvoy in 2022, is now the time to say au revoir, adios, Bonvoyage, and time for us to move on to an all-new strategy of booking hotels through a credit card portal for 10x Ultimate Rewards points? Slow down — the writing is on the wall, but there is still plenty of time for a last dance or two and if our expectations are right I’ll be hanging on to the credit cards for years to come. On this week’s Frequent Miler on the air (which you can watch or listen to below), Greg and I discuss why.

Read on for more this week about the completely revamped (and dare I say aadvantageous?) American Airlines loyalty program, the bumpy rollout of Hyatt peak and off-peak pricing, the new coming credit card that I can’t wait get in my hands (though the marketing suggests I should be plunking it on the table a lot), and more.

Frequent Miler on the Air

- 00:52 Giant Mailbag Double Header

- 4:50 What crazy thing…did Hyatt do this week?

- 10:35 Mileage running the numbers: Is it worth spending to status with American Airlines?

- 23:18 Main Event: Is it time to say Bonvoyage to Marriott Bonvoy?

- 43:56 Are the Marriott credit cards still worth it?

- 49:41 Post Roast: Nick’s questionable picks

- 56:00 Question of the Week: How important is trust when chasing deals?

Subscribe to our podcast

We publish Frequent Miler on the Air each week in both video form (above) and as an audio podcast. People love listening to the podcast while driving, working-out, etc. Please check it out and subscribe (if we get enough people to subscribe, we might be able to earn some income from this someday. So far, the podcast is just a labor of love).

Our podcast is available on all popular podcast platforms, including:

Apple |

Spotify |

You can also listen from your browser:

This week at Frequent Miler

Marriott to drop award chart, add free night “top off”, extend free nights / status

Never have I gone from so excited to so crushed in the space of a single sentence. When I read about how Marriott was extending elite status, free night awards, suite night awards, and more, I thought that sounded great. When I learned of the coming ability to top off a free night certificate with up to 15K points to book a property that costs a bit more than the certificate’s cap, I was stoked! That was awesome! And then the next line: award charts are going away in March. What?!? That hurts….and not just the feelings of the team of people who spent months of their lives developing an award chart that combined SPG and Marriott and added 9 levels of pricing for standard rooms only to see it tossed in the trash this soon. Truthfully, this will probably be OK news for those who just want consistent value whether at the Residence Inn or Ritz-Carlton, but it is bad news for those of us who want to live out swanky St. Regis dreams on a SpringHill Suites budget. So what say you — is it time to say goodbye?

Marriott grants wishes and dashes hopes [On My Mind]

Ever the optimist, Greg had a more balanced reaction to the Marriott news. While I was clearly mostly disappointed, Greg’s tendency to look on the bright side found the potential wins in the Marriott announcement while recognizing the future losses. He makes some great points and really it was after reading his analysis that I came to the conclusions I shared on Frequent Miler on the Air — we’re about to have one more solid year with Marriott and the free night certificates are probably going to become more valuable over time even as my interest in Marriott plummets.

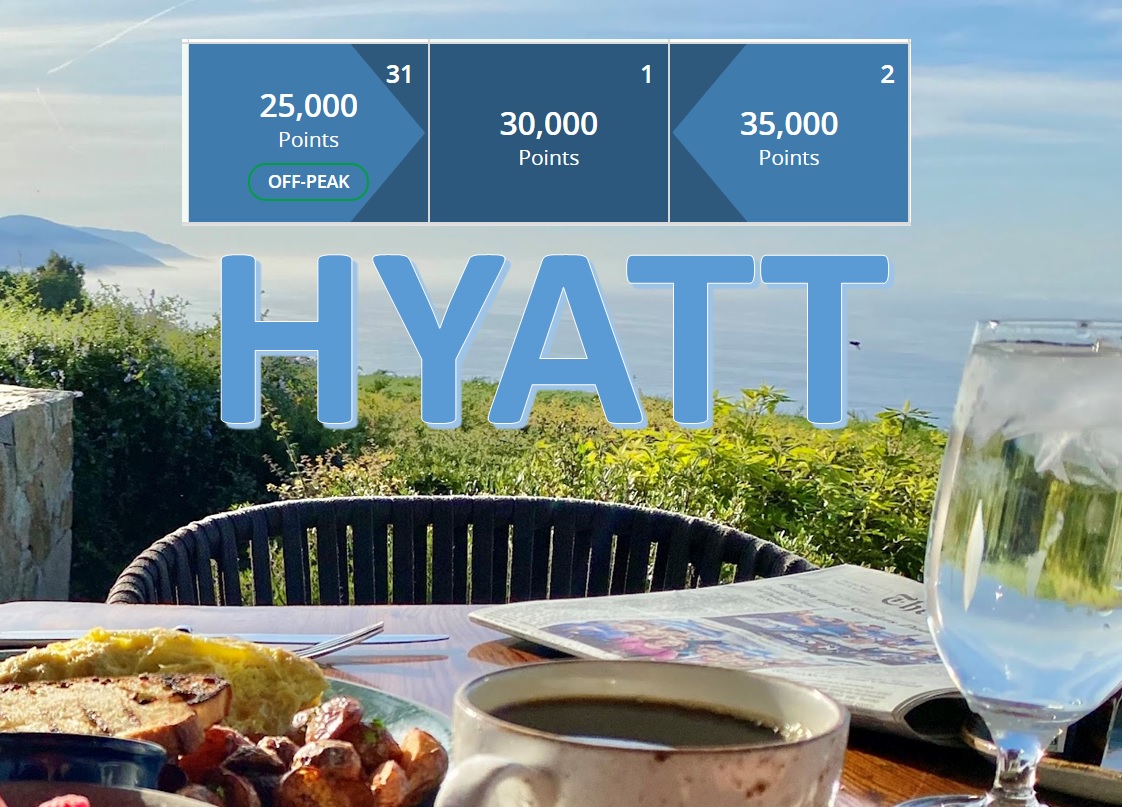

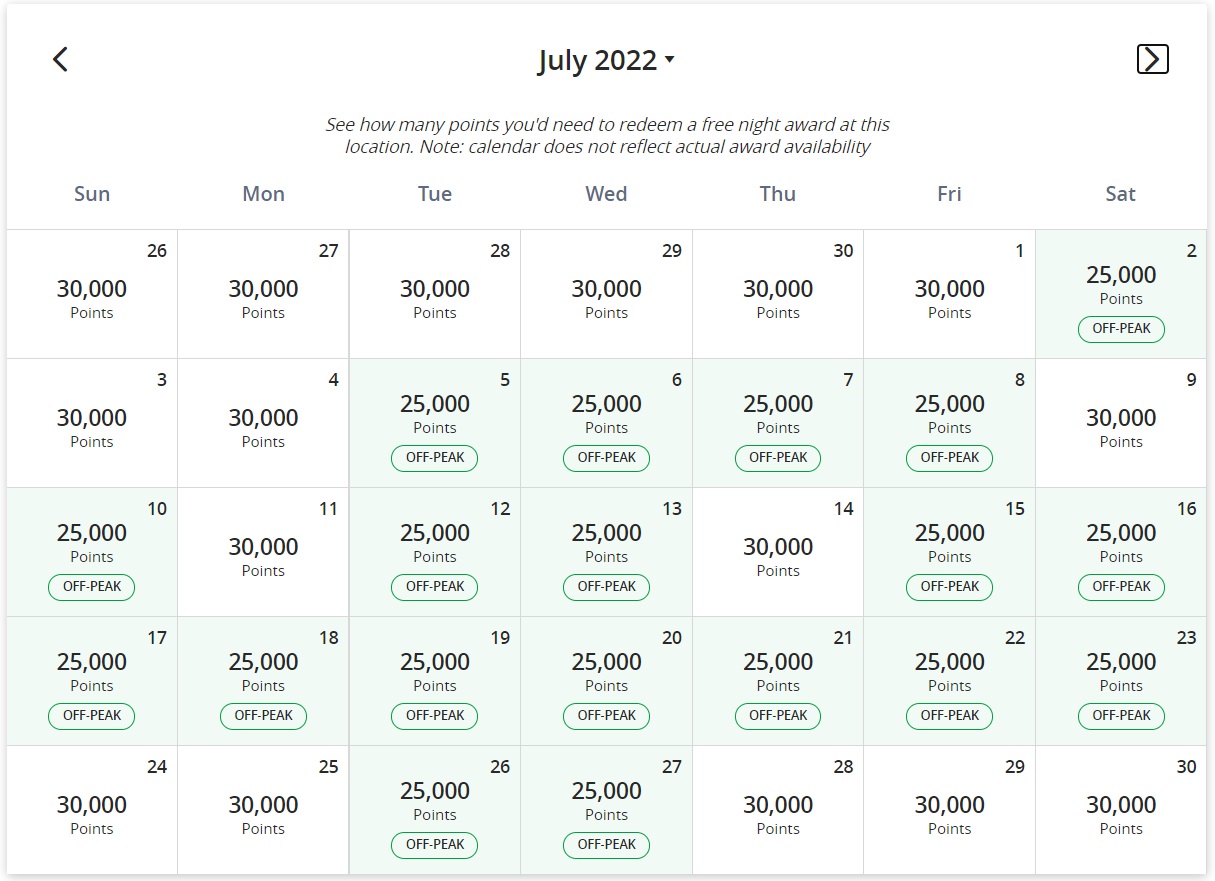

Hyatt Peak/Off-Peak Analysis

While overshadowed by Marriott’s intention to ditch award charts altogether, Hyatt’s new peak and off-peak pricing has certainly caused some grief amongst those whose favorite properties are now peak-priced more often than not. In some cases, hotels are peak-priced almost year round — there certainly is not an even split between peak and off-peak in the most popular spots. However, how bad is it? Since our point values are based on objective analysis, it was easy for Greg to go back and repeat the analysis to get an unemotional analysis — and the news isn’t that bad after all. I completely agree with Greg’s conclusion that the real pain point will be when category changes come around, but for now things aren’t all that bad with Hyatt’s pricing model.

Hyatt Points Calendar Is Now Live & The Experience Is Mixed

For more on the upsides and downsides of the new Points Calendar debuted with Hyatt’s peak and off-peak pricing this week, see this post from Stephen. What isn’t in Stephen’s post (and we’re waiting to hear back on what I hope is a solution from Hyatt) is this: if you look up an award stay and don’t look at the calendar, Hyatt is only displaying the price of the cheapest night of your stay until you get to the final checkout screen. The problem with that is that you can only get to the final checkout screen if you have enough points in your account to cover the stay. That makes it impossible to know how many points you need unless you look at the calendar to see how many nights are peak / standard / off-peak and do the math yourself. Strange and annoying but true.

American Airlines revamps program: Earn elite status through credit card and flight spend

American Airlines announced huge changes to its elite status program in 2022. While those who earn status from flight activity alone will be disappointed in the new program, I am personally very intrigued. With shopping portal and SimplyMiles activity as well as credit card spend counting toward status, I could see making a play for at least Platinum Pro — not only for its benefits on American Airlines but on Alaska and JetBlue, too. I truly think that rewarding customers for loyalty that extends beyond flights to their credit cards, shopping portal, and more just makes sense and is long overdue. Unfortunately, it is probably going to mean more elite members, so upgrades may be hard to come by.

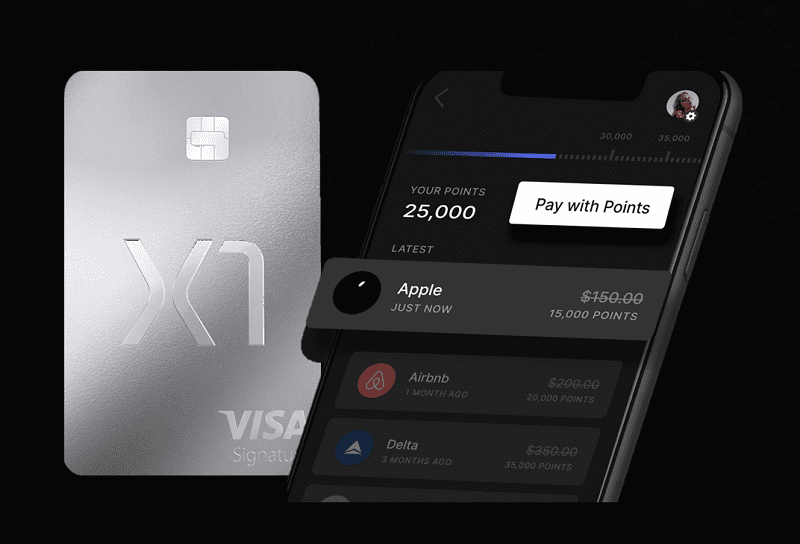

X1 Card Review: Up to 4x Everywhere. It’s here. It’s real

The X1 card joins the previously-announced but not-here-yet Curve card as the cards I am most excited about but can not yet get. The X1 card won’t work for everyone, but I’ll personally be plenty happy to get 3% back that can be used toward flights with the major US airlines, hotels via Hotels.com (which became significantly more interesting after Marriott’s announcement), Airbnb / Vrbo, and a handful of brands where I spend money anyway. It isn’t quite cash back, but at a base level the 45K points I’d earn by spending $15K in a calendar year would yield $450 toward those including things and I know I am going to spend that much or more on the included redemptions during the course of any year. I am excited to add this card to my arsenal.

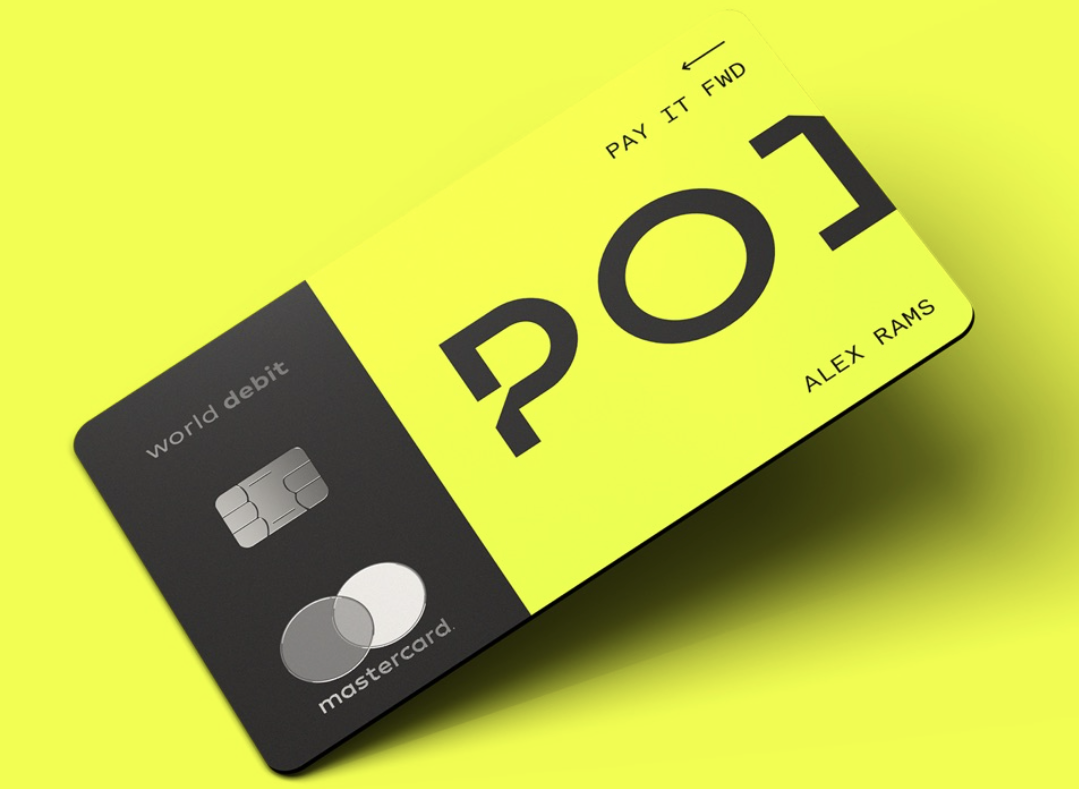

Rideshare & missed event protection: How the Point card is heating up

Am I the only one excited by $500 in protection for stuff I leave behind by mistake in an Uber and $500 per ticket in protection for missed events? With 10% back on subscriptions, 6% back on food delivery, and 2% back everywhere else on a debit card for the rest of the year, I’m stoked. The Point card is rivaling the best credit cards in my wallet in terms of benefits and return on spend and that is surprising to see on a debit card. I look forward to getting the new Visa debit card assuming these new benefits only kick in once we get the card.

Contemplating the best card for a single credit card wallet

Greg roasted me on this post this week and he made some solid points (as did readers). While I can’t think of the last time I ran into a merchant that doesn’t take American Express, I know that must be a thing still in many places and as such my pick of the Gold card was probably off (unless you’re going to supplement with something like the Point Debit Card or Cash App card since those can offer great returns in the right situations). For those with enough assets, the Bank of America Unlimited Cash Rewards could easily top the list for a no-fee solution or the Premium Rewards may be the better choice for some premium benefits. What I found most interesting though is that on Frequent Miler on the Air, both Greg and I landed on Citi cards (and different ones!) for a newbie (who doesn’t qualify for Bank of America Platinum Honors) and wants just one card with no fee. Who would have thought that?

Choice’s Ascend Collection Gems (Great Value with Citi Points!)

I have to admit that I’m still not very interested in Citi-to-Choice Privileges. Don’t get me wrong, I’m happy to have the choice now and then, but even with Greg’s post about Ascend Collection “gems” I am just not yet “in”. I reserve the right for my opinion to change entirely on the day when I actually need a suite in a place where Ascend is offering one for a standard room price, but at this point I’m still not all-in on Citi-to-Choice points. I could see myself being much more excited if and when I get around to planning another European adventure — but until then the options in North America just don’t excite me.

That’s it for this week at Frequent Miler. Keep an eye out for this week’s last chance deals.

[…] After years of devaluation, Marriott gave us something different another devaluation. […]

[…] from Frequent Miler says Bonvoyage to Marriott Bonvoy after the latter removed its award chart. I do not disagree. […]

@Nick Reyes I fundamentally disagree that loyalty points are “a better way of determining loyalty.” A loyalty program is designed to incentivize business AT THE MARGIN. This is how these programs have been massive profit engines for 35+ years. However in the past 5-7 years airlines have been making so many changes that they may face the systemic risk of killing or severely harming the golden goose. Lets also remember a loyalty program has 2 components, the perks/benefits and the earn and burn. The earn and burn part of miles are already based on dollar spend, so you’re rewarding high spenders there. One would then assume that elite status would be how you get marginal business from a guest, but no that is revenue based too. If a program decides to give status to high spenders, be that as it may, but allow it as an option. I agree combining EQM, EQD, EQS is too complicated, so give status based on ONE OF THEM. You spend lots of money get status, you give the airline lots of marginal spend that they wouldn’t have otherwise gotten by flying long distances then you get status, or if you take inconvenient routings that benefit the airline by keeping their systemwide load factors up as well as allowing them to charge more for direct routings then you get status. Finally, in regards to AA why do people only earn the bonus loyalty points for flying??? Why if I’m a gold member don’t when I use my AA card for one mile per dollar spent don’t I also earn 1.4 loyalty points(1+40% bonus)? Airlines and hotels cough cough delta marriott will have a comeuppance and will regret going down this path while businesses that incentivize marginal business like Alaska and Hyatt will benefit. Covid has delayed this comeuppance a bit but it is coming make no mistake about it.

I put this in the old jetBlue article but I’ll put it here again. So it appears that the way the $15k spend jetBlue offer works is that you get ‘Mosaic Qualifying Points’ at certain spend thresholds. This contrasts with regular “given” i.e. not “earned” status from the $50k spend in one year mosiac you get as a standard benefit. Normally on jetBlue you get 3x Mosaic Qualifying Points aka Base Points on all fares except basic b!tch economy which is 1x, so basic aside pre covid it was $5k spend on B6 flights(5k*3). However because of covid you can get mosiac with half so $2500 B6 spend which is 7500 Mosaic Qualifying Points(MQP). The $15k CC spend offer gives you 1,000 MQP at $5k spend, 3500 more MQP’s at $10k spend, and another 3500 MQP’s at $15k spend. Therefore you’d have 8,000 MQP’s exceeding the 7500 required by flying. So you’re technically getting Mosaic in a way similar to flying for the 15k bonus points, at least from B6’s end. I should note that in the email or on B6’s website it does not directly state that the MQP earning is cumulative, however if it wasn’t cumulative then they wouldn’t list 3500 MQP’s at both $10k and $15k if you only got them once. Finally, I could not find the language of “you get 15k bonus points no matter how you qualify” in my emails from jetBlue or Barclays. It’s small print point #2 at this link https://www.jetblue.com/trueblue/mosaic/trueblue-changes

From what I see, the Hyatt calendar doesn’t actually display if point nights are available on a particular night; only what the point cost would be assuming availability. Seems like an enhancement opportunity?

Hi guys, does anyone know if the certificates from booking the Marriott air and hotel travel package be eligible for the 15k top off as well?… it will be much more difficult to redeem those with the new dynamic pricing, if we’re not allow to top those off…

We specifically asked about the travel packages and Marriott told us that they would have more to share about that as we get closer to March. My advice would be to use it while there is still an award chart. Book something while you can.

Greg said the Citi Custom Cash can get like the Double Cash for bigger payback. Citi tells me the Custom Cash points cannot be added to my Premier TY points account.

Am I missing something?????

You should be able to pool the points online by yourself. You don’t really add them to your premier, you just pool the points.

The options Citi gives is basically cash back, not combining points with my Premier like I do with the Double Cash.

I pay my mortgage and car payments through Plastiq to earn those points. Since I do nothing to earn those I call those pajama points. Albeit my Plastiq fees are about $900 per year, I make sure those points are buying a $2500 plane ticket. I just need the Custom Cash to work like that.

When you go to the ThankYou Rewards portal and select your Double Cash card, doesn’t it show you the option to combine that account with your Premier account?

Greg, I do that every month. Pretty easy. However, Citi confuses customers because they have 2 TY point systems. The Double Cash lets you combine points with the Premier card. However, the Citi Custom Cash does not give you that option. With the Custom Cash, it only gives me the option to get Statement Credit, Direct Deposit, Shop at Amazon, Gift Cards, and Other. Other does do anything either. Therefore Custom Cash is very different from Double Cash. I like the outsized rewards, not cash back.

One way to get a preview of points on app and without having to go back and forth with the calendar is to check out the pay my way. And that way you don’t get surprised by points and can leverage your certificates if you have to be combining them in the reservation.

I haven’t seen Pay My Way show up in search results in ages. Is there a trick to getting it to appear?

I usually just start with a regular search and select the standard rate to get the pay my way option to show up. Unfortunately there are some properties where the system doesn’t allow it to pop up. For example I have been trying to book hotel stays in Vienna and Zurich. All the properties in Vienna, except the SLH property (no standard rate only “WoH rate”), showed pay my way in standard rate but in Zurich only the Park Hyatt allowed for it. It could be kinks being ironed out by Hyatt.

Weirder yet, some properties will allow pay my way with member rate as well and other will only allow odd ones. For example the Hyatt Centric in Waikiki allows for pay my way for the points and cash rate for their suites (checked May 16-19).

Edit: No availability for standard rooms those nights so only suites available so explains the odd pay your way.

Thanks. So now I just pulled up a random property and saw Pay My Way right away under both Member Rate and Standard Rate. I guess I’ve just been unlucky that all of the times recently when I’ve wanted to use that feature it hasn’t shown up!

As time passes and loyalty programs evolve it has become clear that they have evolved to a time that they no longer offer anything in return for loyalty. This is true of hotels and airlines.

I find it better to just shop price alone and go where the best value leads you.

for airlines I buy premium seats anyway so they offer me little. I have been Delta diamond for decades and find the program. Becoming less and less and less attractive. Seems they want to charge me 20% more for for being able to collect a reward worth less than 5%. I have been a Hilton diamond honors member for years and see the same.

these days booking.com offer deals from independent hotels or lesser known brands that are more attractive as they are often 30% cheaper for the same quality room and they too give you free breakfast.

it is easy to search google to find the lowest business class fares and many are 30% lower than the majors for lay flat seats.