NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

It’s being reported that Capital One is targeting some people for increased offers on the both the Venture Rewards and the VentureOne cards via the C1 pre-approval tool. The offers are 100,000 miles after $10K in purchases for the Venture Rewards Card and 40,000 miles after $1K in purchases for the VentureOne card. While these offers are higher than the current public offers, they also come with a higher spending requirement as well.

The pre-approval tool is effectively a Card Match that is specific to Capital One. It’s used to micro-target segments of folks for specific cards, the idea being that it allows you to see what you’d be approved for before putting in an actual application. You enter your information in the tool, after which it does a soft pull and then lets you know whether or not you’re pre-approved for any C1 products. Using the tool has no effect on your credit score. Nick found that it wasn’t actually terribly accurate in predicting what you will and won’t be approved for, however.

You can find the pre-approval tool here. No one on the FM team was able to make either offer appear for ourselves or our player 2’s.

The Deal

- Earn 100,000 bonus miles after spending $10,000 on purchases within the first 3 months of account opening when approved for a new Capital One Venture Rewards credit card through the Capital One pre-approval tool

- Earn 40,000 bonus miles after spending $1,000 on purchases within the first 3 months of account opening when approved for a new Capital One VentureOne credit card through the Capital One pre-approval tool

Direct Link to Capital One Pre-Approval Tool (does not affect credit score)

Key Card Details

These are the current best publicly-available offers

| Card Offer and Details |

|---|

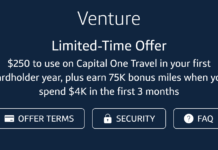

ⓘ $1205 1st Yr Value Estimate$250 travel credit valued at $220 Click to learn about first year value estimates 75K Miles + $250 Capital One Travel credit 75k miles after $4k spend within first 3 months + $250 to use on Capital One Travel in your first cardholder year$95 Annual Fee Alternate Offer: Alternate offer for 75k miles + $300 travel credit available for some via referral pre-approval Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 75k miles after $4k spend within first 3 months + a one-time $250 Capital One Travel credit to use in your first cardholder year FM Mini Review: This card earns 2 miles per dollar, which are worth exactly 1 cent each toward travel. This makes the return on spend similar to a 2% cash back card (though in this case you must redeem your miles to offset travel in order to get 1 cent per mile). One big advantage over cash back: Capital One allows transfering their miles to airline miles & hotel points. Click here for our complete card review Earning rate: 2X miles everywhere ✦ 5X miles on hotels, vacations rentals and rental cars booked via Capital One Travel ✦ 5X miles on Capital One Entertainment Card Info: Mastercard issued by CapOne. This card has no foreign currency conversion fees. Noteworthy perks: Receive up to $120 application fee credit for Global Entry or TSA PreCheck® ✦ Redeem miles for travel at value of 1 cent per mile ✦ Convert miles to airline miles & hotel points ✦ No foreign transaction fees |

| Card Offer and Details |

|---|

ⓘ $284 1st Yr Value EstimateClick to learn about first year value estimates 20K miles Earn 20,000 bonus miles once you spend $500 on purchases within the first 3 months from account openingNo Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 40K miles and $100 travel credit after $1,000 spend within 3 months (Expired 12/12/25) FM Mini Review: Decent welcome offer for a card with no annual fee, but other cards offer better rewards for ongoing spend. Earning rate: 1.25X miles everywhere ✦ 5X miles on hotels and rental cars booked via Capital One Travel ✦ 5X miles on Capital One Entertainment Card Info: Mastercard issued by CapOne. This card has no foreign currency conversion fees. Noteworthy perks: Redeem miles for travel at value of 1 cent per mile ✦ Convert miles to airline miles & hotel points |

Quick Thoughts

Let me first mention that we were unable to find either of these offers through the pre-approval tool ourselves. That’s not terribly surprising as we’re all Capital One customers already (except for Greg) and C1 is notoriously hesitant about multiple cards. I have one personal card (the Venture X) and one business card (the Spark Cash Plus) and I was told by the pre-approval tool that I couldn’t get another Capital One card…at all.

That said, these are being reported by quite a few other folks, so it seems that they do exist, regardless of how narrow the targeting is.

I’m not sure that I’d take this Venture Rewards offer over the current public offer. It’s a decent $95 card to hold onto because of the 2x earnings everywhere (although I prefer the Venture X as a keeper), but I’m not crazy about having to spend an additional $6K to get 25,000 C1 miles, especially for those folks with limited ability to create credit card spend.

While the increased portion of the offer is effectively ~6x when adding in the normal 2x earnings on the card, I think that I’d still prefer to put that $6k towards another sign-up bonus (like the 150K Amex Platinum or the 170K Business Platinum). On the other hand, if you’re a person with no spending constraints, go for the bigger offer if you’re targeted, it’s a good offer for a $95 annual fee card.

The VentureOne offer is a no-brainer. It’s simply doubling the public offer by effectively giving 40x miles on $1k spend instead of $500. As a keeper, the card isn’t terribly compelling when compared to the Venture X or Venture Rewards, but if you’re interested in the card already, it’s absolutely worth checking the pre-approval tool to see if you’re targeted.

If anyone is successful at getting these offers, let us know. I’d love to add a screenshot to the post.

(h/t: reddit user coyg92)

I did get a pre approval for it. And it was —

Earn 100,000 bonus miles once you spend $10,000 on purchases within the first 6 months from account opening

How do I send you the screenshot?

This sucks. I was “pre approved” for secured cards where I have to send money to Cap1 in order to get a credit card. I have had the Venture X since last December when the card first came out.

I got the 40K offer on the VentureOne, but the standard 75K on the Venture Rewards. I have had the Venture X for nearly a year, no other CapOne in my past. I probably open 4-6 cards/year, about half are biz cards.

My wife got wholly rejected. No CapOne history for her, only 1 card opened every 5-8 years, AU on most of mine. Maybe I should have used combined household income to bump hers up, but I doubt that made the difference.

Will this count as a hit to credit report?

The pre-approval tool will not. Applying for a credit card will. 🙂