NOTICE: This post references card features that have changed, expired, or are not currently available

This year, for better or worse, I’ve left Hyatt behind in order to focus on achieving high level Marriott status (see: Marriott Platinum Premier: Into the home stretch). And, next year I’ll be staying often at Marriott hotels in order to take advantage of temporary sweet spots that are available due to the Marriott / SPG merger. In a few cases, I booked award stays in advance because the post-merger award prices were much higher. For example, I’ve booked awards under old prices at the Westin Grand Cayman, Marriott’s Newport Coast Villas, and Domes of Elounda. All three properties are much more expensive in the combined program. I also hope to take advantage of the fact that top-tier SPG properties, including off-the-charts properties, will cost no more than 60,000 points per night (or 48K per night thanks to 5th night free) until both category 8 and peak-season pricing are introduced in early 2019.

My plan, as described in the post “Biding my Marriott time before returning to Hyatt,” has been to return to Hyatt starting January 2020. I would then make use of the World of Hyatt credit card in order to help achieve top tier Globalist elite status. That card offers 5 elite nights per year automatically, plus 2 additional elite nights for each $5K of spend. Globalist status requires 60 elite nights initially, and then 55 elite nights per year to re-qualify.

Why bother at all? In my opinion, more so than any other hotel chain, Hyatt has top tier perks that are worth striving for:

- 4 suite upgrade awards that can be used at the time of reservation. Each upgrade award can be used to upgrade an entire stay. This is huge when booking family vacations where the extra space in a suite can be really important.

- Free parking on award stays

- Waived resort fees on paid and award nights (this is huge)

- Club lounge access or full breakfast for up to 2 guests plus 2 children

- Guest of Honor bookings lets you share in-hotel perks with others when you book award stays for them.

- Upgrade at check-in, up to standard suite

- 4pm late checkout

And then… 5/24 happened

The World of Hyatt card used to be exempt from Chase’s 5/24 rule. The latest reports, though, suggest that, as of November 13th or so, the 5/24 rule is being applied to the Hyatt card (and maybe a few other cards as well: BA, Iberia, IHG) .

| Chase's 5/24 Rule: With most Chase credit cards, Chase will not approve your application if you have opened 5 or more cards with any bank in the past 24 months. To determine your 5/24 status, see: 3 Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely. |

Currently, I’m way over 5/24, and I don’t yet have the World of Hyatt card. So, is all Hyatt hope lost for me?

The dates line up perfectly

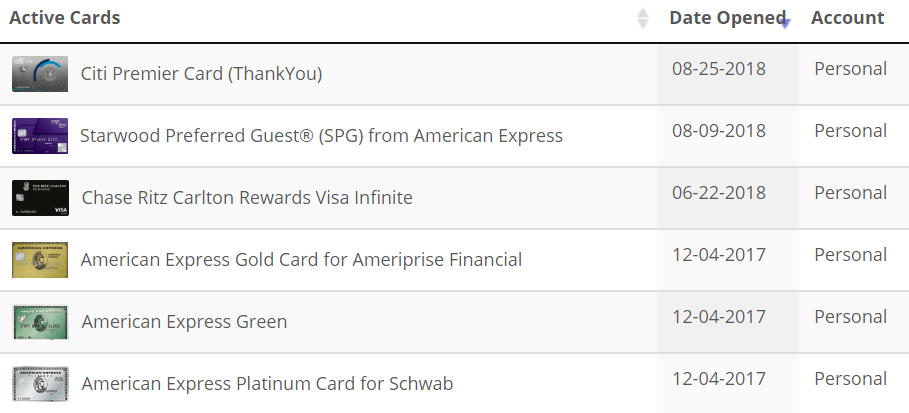

Here are the cards that I’ve signed up for most recently, including the application date:

As you can see above, I signed up for three Amex cards on December 4th 2017. I need to wait for those three cards to reach 24 months old before I have a chance of being under 5/24. In general, it’s necessary to wait for the month after the 24 month anniversary. So, in this case, given that the cards were opened on December 4 2017, I need to wait until January 1, 2020 to apply for new Chase cards.

That’s a happy coincidence given that I previously wrote that my best bet was to start pursuing Hyatt status in January 2020:

For many reasons (as described above), I won’t get started this year. And, because I’ve already planned a number of Marriott/SPG stays for next year, it wouldn’t make much sense to do it then either. My best bet is to start January 2020.

Can I do it?

If I want to get a World of Hyatt card in January 2020, I can only sign up for one more card between now and then. That is, I can get only one more card that shows up on my credit report. Most business cards do not appear as accounts on personal credit reports (Capital One is a big exception to this rule — their business cards do show up).

So, I can sign up for as many business cards as I want (but not from Capital One) and just one personal card between now and January 2020. If I sign up for more than one, then I’ll still have 5 or more new accounts on my credit report that are 24 months old or less.

Among the cards that are currently available, there’s only one consumer card I’m eager to get: The Bank of America Premium Rewards Card:

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: This card has best-in-class earnings for those with $100K+ invested with BOA. With that level of investment, you would earn 3.5X travel & dining and 2.62X everywhere else. $95 Annual Fee Earning rate: ✦ 2X travel and dining ✦ 1.5X everywhere else Base: 1.5% Travel: 2% Flights: 2% Hotels: 2% Dine: 2% Card Info: Visa Signature issued by BOA. This card has no foreign currency conversion fees. Noteworthy perks: $100 annual airline incidentals fee reimbursement ✦ $100 Airport Security Statement Credit towards TSA Pre✓ ® or Global Entry Application fee, every four years ✦ Up to 75% bonus for Preferred Rewards banking customers |

I discussed the Premium Rewards card in the post “Super Combos Cash Back Credit Cards.” If you can get Platinum Honors Preferred Rewards status with Bank of America, this is a truly incredible cash back card. I could get this card and still be under 5/24 by January 2020.

Of course, I don’t want to miss out on other great card offers that appear over the next 13 months. For those, though, my wife and/or son could apply.

What about authorized user cards?

I am an authorized user on a number of accounts not shown above. As a result, even when I dip under 5/24 based on my own accounts, my Chase applications will still be rejected. The workaround is to call and explain that I’m just an authorized user and not responsible for that credit.

Should I do it?

There is definitely a cost to staying under 5/24. I’ll risk missing out personally on great card offers (even though my wife and son could still take advantage of them).

A bigger risk is the unknown. It’s possible… likely even… that a card issuer will introduce a new card that I’ll really want. In many such cases, I could simply have my wife sign up and add me as an authorized user in order to make use of the new card. But, in some cases, the most attractive perks (whatever they are) may be reserved only for the primary cardholder.

My plan

I’m going to try to get under 5/24 by January 2020. I can safely sign up for one more consumer card (or Capital One business card) between now and then. That one card will probably be the Bank of America Premier Rewards card. That said, I’m going to wait a while before applying. It won’t surprise me at all if something more exciting appears in the interim.

If I manage to drop under 5/24 by January 2020, then I’ll sign up for the Chase World of Hyatt card and begin my quest for Globalist status. It’s not entirely rational: most perks can be had by asking a friend with Globalist status to book my award stays as Guest of Honor reservations. But, I find it fun having a goal like this to strive towards.

Note: I’ll probably apply for a second Chase card (probably a business card) at the same time to take full advantage of being momentarily under 5/24.

[…] (sort of) a wash as that now comes with five qualifying nights each year. That doesn’t help people like Greg though who don’t have the card at the moment as they’re likely locked out for now […]

Why haven’t you got around to applying for the World of Hyatt card when you heard rumors of it being subject to 5/24?

I didn’t think it was likely to happen so soon and I didn’t want to get the card yet since I’d like the signup bonus spend to count towards elite status too (which I don’t want or need this year)

ahhh. Figured it would have been a well thought through decision. Gotcha. I was fortunate to be able to apply for it before this change and after 24 months since previously having had the old Hyatt card.

Just made Globalist with the help of some hefty credit card spend. Had been a 25-30 night Hyatt guy. And just noticed schedule for Christmas 2019 has opened at some desirable Hyatt properties; just in time to use my TSUs !!!

I think even if you apply for Chase Business card, they will still count your are over 5/24.

Yes, 5/24 applies to Chase Business cards. That is, I wouldn’t get approved if I applied for any now since I’m currently over 5/24. However, once I’m under 5/24, I could get a Chase business card and it won’t add to my 5/24 count once it is approved.

Given all the changes Chase has been making and also considering how fast things change in this space its kinda moot trying to be under 5/24. There is a long time between now and Jan 2020 and who knows what would happen so it doesn’t make much sense to plan that far. IMO Chase 5/24 was already overrated and now they have made my decision much easier to build a portfolio with other rewards program.

Next card statement will give me the additional 4 nights to make Globalist with only 13 award nights and no paid nights. The reason I went for it is a European vacation that includes Park Hyatt in Paris and Milan. Then in between you have the new Small Luxury Hotels of the World and they all over France and Italy and I fully expect to spend 6 weeks in their properties so I am thinking Globalist will come in handy. The other hotels status are chump change next to Hyatt if luxury stays are your goal. That is mine and why I spent on the card.

My sister achieved Explorist status and received the lounge access awards, but the hotels we looked at available at we’re planning to stay in the next year only offer continental breakfast. Not even worth it and that’s only explorist status. We don’t care about the other “benefits” of globalist to even bother. I can get continental breakfast by being a Hilton member and just getting one of their credit cards.

I agree: Explorist status isn’t worth chasing at all. With top tier status (which I’ve had in the past), I’ve enjoyed some pretty amazing full breakfasts at awesome hotels

True that. Just booked a night at the PHV using the Globalist free night certificate — b’fasts there hold you until dinner.

And the guaranteed suite upgrade thing is a huge deal. Just made a four-day reservation yesterday (elsewhere) at a low entry-room rate, with 22% coming back from Citi Prestige 4th night — and was promptly able to use a TSU for an enormous suite. (All guaranteed on-line and in writing. I don’t think that this is commented on enough, but the difference between happening to get a suite or an airline upgrade and being able to know far in advance that you have it should be priced in somehow to the value of the emolument.) This is also at a place where you can eat well at the club (i.e., the food is good, and it is well-managed and well-maintained).

I think you have the right attitude with this. Globalist doesn’t necessarily make that much sense as an incremental status. But if you have it and get a kick out of the outer-edge things you can do with it, it is one of the more rewarding tools in the tool-kit.

This smacks of “waiting around a year for a boy/girl you like to like you back”, only to see them end up with someone else after a year of waiting, and seeing the boy/girl who liked you all along (Citi…) find someone else too.

LOL. Maybe it is that.

Do you have the existing Hyatt card? I just upgraded mine last summer– yeah, I only got 2k points for the upgrade it, but I have been finding ‘creative ways to spend’, on the card largely thanks to your’s and docs blogs. Between my stays and spend, I made Explorist this year, and while Explorist in itself is nothing exciting, getting another free night for obtaining it was, which translated to $425 value for a stay over New Years, so between the points earned on spend and obtaining status to get another free night just for obtaining Explorist was a nice win. So, yeah, I did not get 60K points, and you might not either if you just upgrade (assuming you have the old hyatt card), but with the way you earn UR points on your chase business cards is this really an issue (you can always transfer UR to Hyatt as you well know)??

I am on the fence about spending to obtain globalist. I do not currently have any other hotel elite statuses (but am gold Hilton, Marriott, plat wyndham) and my goal is ALWAYS free stays over elite perks, since I do not travel for biz. In spite of their more limited footprint, Hyatt is my fave hotel chain by a long shot and I am glad to see them grow with Two Roads acquisition and Small Luxury Hotels partnership. Maybe more down the road? It might just make me want to spend and stay to Globalist. If only I had even more time to travel! 🙂

I don’t have an existing Hyatt card. If I did then I certainly would upgrade rather than try to get under 5/24.

When I was at 4/24 a couple of years back, I was an AU on two other cards. Multiple calls to Chase were of no avail. One of them was while sitting in front of my Chase Personal Banker. Good luck Greg!

I’m with DSK and Ian on this. The rules of this game change too fast. And lately, they’re changing in the wrong direction. I was in a similar boat– I have Marriott Platinum status at least until 2020 and was considering bailing out to chase Globalist. However, the limited Hyatt footprint proved to be a deal killer: There just aren’t Hyatt’s near all of our company’s offices across the country, whereas Hiltons and Marriotts are often literally within walking distance.

I pick up at least 20-30 nights a year from business travel. Getting to Globalist without that would be a MAJOR commitment and expense on my own dime. But beyond my own personal circumstances, I fail to see how the Globalist juice is worth the squeeze.

One of the best pieces of insight on this blog is that free agency is the way to go unless you’re confident about hitting the top tier. A free agent can buy nearly all of the Globalist benefits on any given stay with Chase UR or Hyatt points. They may not come cheaply, but they can be had (with the exception of the 4:00 PM checkout).

Finally, I must be one of the few people on the planet who has been pleasantly surprised by Starriott post-merger. I’ve been scoring some great room/suite upgrades at Marriott properties since August. Maybe it’s dumb luck. Or maybe it’s because the Amex Platinum card no longer buys 50-night status and the herd is thinning.

Ditto. Thought it was just me. Getting much better upgrades, including suite upgrades, post August 2018 with Marriott.

I agree with you: free agency is the smart way to go. But I do some things because they’re fun, not because they’re smart. I like using ms techniques to earn Delta Diamond status each year, and I’m looking forward to doing the same for Hyatt Globalist. And, ironically, by ms-ing for status, I end up more as a free agent than I would if I earned status primarily through stays. I don’t need those stays to maintain status, so I don’t feel bad staying at a competing chain or airbnb or whatever.

Wow, that’s bad luck!

No, no, no, no. Do not put other cards on hold, particularly for a whole year, just to get under 5/24. For all we know by this time next year many other banks will have adopted a 5/24-esque rule and you will have wasted precious time to sign up for their cards just for…. a Hyatt card? With all due respect, no.

If there’s anything I’ve learned in this hobby, it’s to jump on things you can now, there is no planning for that far in the future. The landscape changes too quickly.

If something comes up that I feel like it would be a big opportunity wasted, then I’ll re-evaluate. In the meantime, I don’t currently feel like I’m missing out on anything by having my wife and son sign up for consumer cards instead of me.

Greg–IMHO your blog has the best ANALYSIS of anyone else out there. You can tear into and analyze a loyalty program better than anyone else can and it was a pleasure speaking with you at FTU. So please help me understand this Hyatt infatuation.

I literally just crossed the threshold for lifetime Marriott Platinum Premier elite and receive Diamond status in Hilton through the credit card (now it is easy–earlier it required $40K of spend annually). I was Hyatt Diamond for two years and have been Explorist for two years (thanks to you and Nick). I have stayed in plenty of Hyatt suites around the world and also have the new WOH credit card. But, as others have mentioned, the Hyatt footprint is so small, and I found myself during my Hyatt Diamond years planning my trips around where I could find a Hyatt with an executive lounge (which is probably among the most important desires for me travelling internationally). If you look at the Hyatt footprint and delete all of the hotels without lounges, you now have a really, really small footprint. On the other hand, there are Marriotts/Starwoods and Hiltons literally everywhere, and it is easy to find one with an executive lounge in the USA or abroad. My upgrade success has been very good with both, and surprisingly especially with Marriott post-integration. Also, a pretty significant subset of those Hyatt hotels with suites don’t work well with families (particularly my family of five). Furthermore, when I am looking just for a side-if-the-road hotel for a road trip (in at 8 pm and out at 8 am), the Hyatt footprint is pitiful compared with Marriott and Hilton. I haven’t really found that I have been treated generally any better or worse at Hyatts than at Marriots or Hiltons–it really depends on the hotel. I don’t dislike Hyatts at all and will continue to stay at them when they meet my needs.

It is a MAJOR commitment to get to Globalist. Is it really worth it to go out of your way for that many nights per year compared with Marriott and Hilton hotels that will probably treat you fairly well and might also be in a better location for you? Your upgrade rates (including to suites) should be pretty good at Marriott at the Platinum Premier elite level and also decent at the Hilton Diamond level. It is a lot easier to find 35 Marriott nights per year (which gets you lounge access with a credit card) compared to 55/60 Hyatt nights. Genuinely curious given this your usual level of analysis.

Great points. If I was in your shoes I wouldn’t go for Hyatt either. Here are some things that attract me:

– Ability to manufacture top tier status. This is the key thing. I don’t want to be tied to a particular hotel chain. So, if I can spend my way to top tier status, then I won’t feel like I have to stay at Hyatt hotels when they’re not ideal for my travel plans. Yes, I can also spend my way to Marriott Platinum and I might do that when my status runs out, but I haven’t decided yet.

– Ability to get great value from Ultimate Rewards points. I have oodles of them, but I still want to get good value. With Hyatt, most top properties are 25K per night compared to (soon) 70K – 100k with Marriott or 95K with Hilton. Yes, 5 night awards make those numbers 20% cheaper, but only if each stay is exactly 5 nights.

– Ability to confirm suite upgrades at time of booking. When traveling with more than 2, this can make a huge difference in how many rooms we have to reserve. For example, at the Hyatt Grand Cypress near Orlando, a suite is basically two complete rooms with connecting doors. We can fit twice as many people into one booked room that way.

— Side note: Marriott is actually pretty strong in this regard: many hotels will let you book with points and pay a set fee per night to upgrade at the time of booking. I’ve taken advantage of this several times. You don’t need elite status to be able to do that though.

I’m cooling down my report a bit and the approach I am taking is to hit P2 harder and add/subtract myself as an AU to double hit minimum spends. Plus some biz cards of course.

United Passes are not longer a Hyatt Globalist Perk as of Dec. 31 2018.

I had scheduled this last night and remembered the United Pass thing last night as I was drifting off to sleep :). Anyway, I removed it from the list. Thanks!

Andaz Papagayo Costa Rica should be 15,000 points for a free night, not 25,000.

Correct! Thanks. Fixed.

A year flies by when you have business cards fun. Just a reminder being an AU on some cards will show up as new acct on your report, I know that you know that, and that calling Chase can override it as long as you are under 5/24 w/o AUs, just a friendly reminder.

Cheers,

PedroNY

Yep, thanks for pointing that out. I’ve added a section about that to make it clear.