NOTICE: This post references card features that have changed, expired, or are not currently available

Bank account bonuses are some of the lowest hanging fruit on the periphery of the games we play. In my household, we have banked $4,680 in new bank and brokerage bonuses in 2020 with another $1,525 expected on the way. That’ll be a grand total of $6,205 in 2020 bank account bonuses between me and my wife. While six grand won’t pave our patio in platinum or speed up our retirement measurably, bank account bonuses are like the epitome of pajama points — only in cold, hard, cash…except contactless (how 2020). This post is a progress update that will summarize which bonuses we’ve earned, which we’re still awaiting, and where we go from here in 2020.

Quick Totals: Bank account bonuses earned in 2020

Here is a list of bonuses we’ve earned this year with links to the pertinent sections below outlining the deals we pursued. In parenthesis, I’ve listed whether Player 1, Player 2, or both have done the bonus in 2020 (in some cases, one of us has done the bonus previously or plans to do it in 2020 and/or there was a large deposit requirement that we didn’t want to double, hence why we haven’t overlapped on all of them).

Earned

- $600: Citizens Bank checking & savings (P2)

- $200: SoFi Investing (P1)

- $1400: HSBC Premier (P1 + P2)

- $400: Wells Fargo (P2)

- $250: M&T Bank (P2)

- $180.40: Webull (P1. The stock I got (and kept) is worth $272.40 today.)

- $450: Merrill Edge (P1 + P2)

- $100: Bank of America Checking (P1)

- $300: Santander (P1)

- $600: NorthOne (P1 + P2)

- $200: First Tech Federal Credit Union (P1 + P2) (Note: I updated this after receiving this bonus before year’s end)

Total: $4,680.40 (note that the Webull brokerage bonus came in the form of free stock, which I kept and has increased in value by more than $90 as of the time of writing, but I didn’t include that here as I’m sure many would have cashed it out right away).

Still expected:

- $225: Merrill Edge (one of the bonuses hasn’t posted as expected, still following up)

- $400: Santander (P2)

- $400: PNC Bank Checking account (P1)

- $500: Bank of America business checking account (P1)

Total: $1,525

Straight up failed

- BBVA: I had expected a $250 bonus and never received anything. I didn’t pursue this since I hadn’t met the requirements to the letter of the terms.

Key tips / notes on bank account bonuses

Bank account bonuses can be surprisingly lucrative. Some can be frustratingly complex, but the juice can definitely be worth the squeeze in many cases.

One thing that most checking account bonuses have in common is that they usually require some amount of direct deposit (the amount varies considerably; within this post you’ll see some bonuses that only required $500 in direct deposits and others that required ten times that amount). While terms typically indicate that a direct deposit must be funds from an employer, pension, social security, etc, seasoned bank account bonus chasers know that in reality other things often work. Doctor of Credit maintains a fantastic resource page with data points about what works and doesn’t with various banks. I highly recommend checking there (and their general bank account reference pages) if you are more interested in bank account bonuses than your company’s HR rep is.

I’m noting in this post when I’ve triggered a bonus with an ACH transfer. In all cases, that means a push from the external account into the target account rather than a pull the other way around. I intentionally haven’t noted which bank I used to push the money in most cases. There are two reasons for this: first, Doctor of Credit maintains an excellent resource that doesn’t take much effort to search. Second, my single data point for each account type is of highly limited value since things may have changed. What worked for me may have stopped working. It’s like the old adage about giving a person a fish versus teaching them to fish. I’ve shown you to the fishin’ spot, but you’ll have to cast your own line.

Keep in mind for your tax planning purposes that bank bonuses are taxable and you’ll typically get a 1099.

If you take away one tip, let it be this: take screenshots. If you ever need to follow up on a bonus, they can be helpful. All of the screen shots in this post are my own except for one that Stephen had already uploaded. I keep records of any offer for which I apply.

Finally, keep in mind that some banks will deem it risky if you have opened up many bank accounts in close proximity. Try to space things out rather than trying to open ten accounts at the same time.

Details on bank account bonuses earned

I wrote last year about how bank account bonuses can be well worth a little time and effort. They can be particularly worthwhile for those of us playing the game in multi-player mode. Here are the bonuses earned in my household so far this year:

Citizens Bank: $600 checking & savings account bonuses

Citizens Bank (a smaller regional bank in the Northeast-ish area) had an online offer earlier this year (that is back on again right now) to get a new checking account bonus of $300 for opening a checking account with a direct deposit of $500 or more within 60 days. They simultaneously offer a $200 bonus for opening a savings account with a deposit of $15K — that money has to remain in the account for 3 months. If you do both of the above, you can get an additional $100. We earned the full $600 with this approximate timeline:

- 4/15: Account open & funding ($100 checking, $15K savings)

- 5/15: Direct Deposit of $500 (done via ACH from another account)

- Savings money had to remain on deposit until 7/31

- 8/1: Withdrew $15K from savings to send elsewhere for a new account bonus

- 8/20: $600 bonus posted

The Citizens Bank One Deposit checking and One Deposit savings accounts each require one deposit per statement period to remain fee-free, so we had set up automatic transfers from one account to the other every two weeks just to keep both fee-free. Writing this post reminds me that we intend to close these, so I’m adding that to my personal end-of-year checklist.

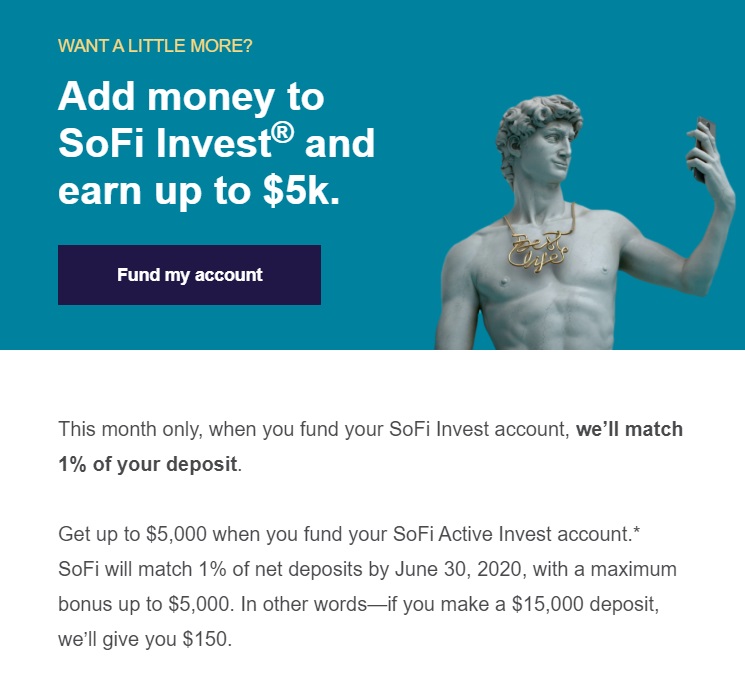

SoFi Investing: $200 deposit bonus

We had written about this bonus here. The short story is that SoFi Investing offered a targeted bonus of 1% of you net deposits by 6/30 for some users (up to $500K in deposits). The bonus was to be deposited into your SoFi Investing account within 5 days from the end of the promotion and it posted on time.

This money had to remain on deposit with SoFi Investing for 3 months or SoFi may have clawed back the bonus amount (note that as is the case with most brokerage bonuses of which I am aware, there was no requirement to invest the money but rather just to deposit it). In our case, we had savings that we had already intended to move from savings to investments, so we moved $20K into SoFi Investing for a $200 bonus.

Is it worth tying up so much money for just a couple hundred bucks? Not if you have better things to do with the money. In our case, even if we weren’t planning on investing any of it, a 1% return for tying up the money for 3 months is like 4% APY annualized, so that looked a lot better than what the money was earning in a more traditional account.

HSBC Premier Checking account bonus: $700 x 2 player mode = $1,400

HSBC changes their checking account bonus promotion every couple of months and sometimes offers different promotions at the same time. When my wife and I each signed up for our accounts early this year, the bonus for an HSBC Premier Checking account was 3% of your monthly direct deposits up to $120 per month for the first 6 months up to a max total of $700.

They currently offer two other forms of a similar deal:

- The current online (at the time of writing this post) offers 3% of monthly direct deposits back up to $100 per month for the first six calendar months (for a max total of $600). See this post at Doctor of Credit for more.

- The referral offer gives a $600 bonus after opening an account and meeting the Premier requirements within 90 days (either depositing $75K or having a monthly $5K direct deposit). The difference here is that this bonus has been posting for most readers within a month or two of completing the first direct deposit rather than requiring six months of deposits. See this post for a more detailed explanation and the comments for data points from readers: [Bonuses posting] HSBC: $600 bank account bonus available with easier requirements.

For this account, as an experiment, my wife and I decided that one of us would use traditional direct deposits while the other has used other methods known to trigger the requirements. We each earned the full $700 bonus, making this the best bonus we did this year.

Around the time of earning the last part of the new account bonus, HSBC sent us each an offer to earn $15 per month for making 3 bill payments and $15 per month for making 10 debit card transactions — that’s $30 in earnings per month for up to 6 more months ($180 each). I’ve found the Cash app particularly helpful for meeting the debit card requirements.

Wells Fargo: $400 Everyday Checking account bonus

I had signed up for this account last year and mentioned it in the original low-hanging fruit post. At the time, the account required direct deposits of at least $3,000 per month for 3 consecutive months to trigger the $400 checking account bonus.

While I did set up my official direct deposit to trigger this bonus, I had also moved money from an external checking account via ACH push in the third and final month. My $400 bonus posted after that ACH push and before my direct deposit for the month, signaling that I probably could have triggered this bonus without the hassle of changing direct deposit. At any rate, this bonus posted early in 2020.

M&T Bank: $250 Checking account bonus

While I had opened this account and earned its bonus in 2019, my wife didn’t get around to opening an account with them until 2020. Once again, a push from an external a triggered the bonus the day after it credited to M&T. This is a regional bank that will only be available to those in the northeast and the offer amount may vary by region (you can read more about this offer at Doctor of Credit). Since the account bonus here only requires a single direct deposit of $500 or more, it’s pretty easy to pick this one up. Note that to keep the account fee-free, you can either keep $2500 in it or set up monthly direct deposits of $500 or more. The account earns such little interest that it’s kind of a waste to keep $2500 in it, though it certainly is a simple way to keep it fee-free. This bank has a fee if you close your account within 180 days, so I set a reminder to evaluate whether to keep it or cancel it. It turned out to be useful, so we kept it.

Webull: 20 shares for depositing $10K ($180.40)

We wrote about a targeted bonus offer from Webull in January (and republished that post with a similar offer in February). My January offer was to get 20 free shares of stock worth $9-$1,000 per share for depositing $10K in my Webull brokerage account (note that the money did not need to be invested but rather just deposited). I had the savings on hand to do this, so I made the deposit expecting the bare minimum and that’s exactly what I got. I received 20 shares of Vonage, which was trading at $9.02 per share at the time for a total value of $180.40. An effective deposit bonus of 1.8% that only required leaving the money for a couple of weeks seemed more than fair (subsequent Webull deposit bonuses have required leaving the money for a month or more). I withdrew the $10K a few weeks later and have kept the stocks.

Keeping those shares makes the deal at least a hair better: As of the closing bell yesterday, my 20 shares of Vonage were at a total value of $272.40. That makes this bonus at least a bit more fun.

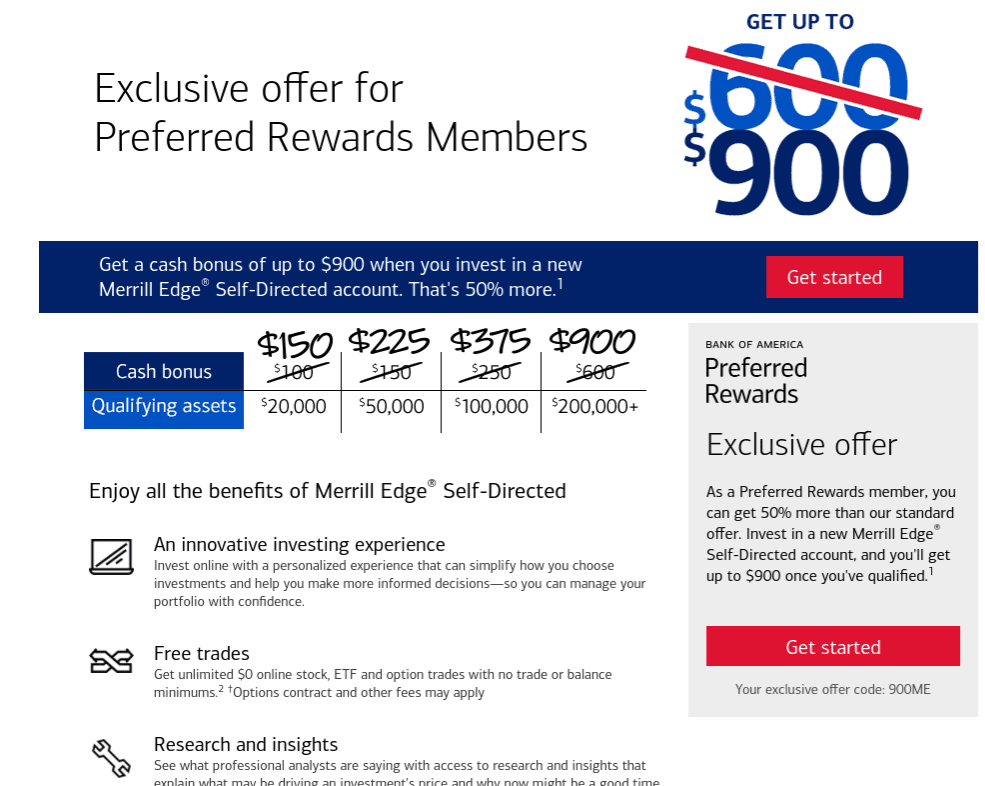

Merrill Edge: $450 posted (expecting $225 more)

In my post about Retirement planning mistakes fixed by credit cards, I wrote about how I was unhappy with how my wife and I had invested our Roth IRA funds at another brokerage and was looking to get into lower-cost index fund ETFs (and to invest some additional funds we had saved up and needed to put into long-term investments). The same day I published that post, I also posted a bonus offer for opening a new Merrill Edge account and depositing new funds within 45 days and keeping them on deposit for 90 days (that offer has since expired, though there is a new offer for bigger bonuses that requires leaving the funds on deposit longer).

My wife and I each moved over our Roth IRAs and the additional funds we intended to invest (for the purpose of triggering a higher bonus, we also moved some of our emergency savings fund that had been sitting in that Citizens Bank account above — we’ll eventually move the emergency fund money back out after earning the Merrill Edge bonuses).

We each earned the $225 bonuses for our Roth IRA accounts but haven’t yet received the $225 for a simple investing / cash management account (we’ve followed up a couple of times and reps have been slow in getting back to us. I’d be tempted to leave if not for the great bonus on credit card earnings). We’ll continue to harrass them and I expect we’ll eventually earn this $225 as advertised. Merrill Edge also covered the account closure fee for closing the IRAs at our previous brokerage ($125 each) upon request.

Bank of America Checking: $100 bonus

The impetus behind the Merrill Edge accounts was in part to fix our retirement planning, but we got to that goal because of the Premium Rewards card with the allure of Platinum Honors in the Bank of America Preferred Rewards program. Additionally, the increased bonuses on the Merrill Edge accounts under the offer we used required joining the Preferred Rewards program.

One of the requirements of the Preferred Rewards program is having a Bank of America checking account. Bank of America sometimes offers $300 or $400 bonuses for opening a checking account, but those offers are usually targeted (some readers may find one of these bonus offers right now). Unfortunately, neither of us were targeted for such an offer. I therefore Googled looking for bonus information and found this offer to get a $100 bonus with a new checking account and two direct deposits of $250 or more in the first couple of months (H/T: BestWalletHacks). I’d have preferred a higher bonus, but I’ll take a hundred bucks to do something I already had to do.

Unfortunately, my wife had trouble with this. Her online application for a checking account went pending for the better part of a week and she ended up opening the account over the phone with no bonus. That was a bummer.

However, I successfully received my $100 bonus.

Santander Bank: $300 bonus

Santander Bank briefly offered a great deal earlier this year where you had to open an account and maintain an average daily balance of $2,000 for 90 days to earn a $300 bonus. That’s it — no direct deposit requirement, no debit card purchases required — just keep the average daily balance for 90 days. Keeping the account fee-free does require a single financial transaction every month (deposit, withdrawal, transfer, payment, etc). That is easy enough to automate, so this one was very simple. I received the $300 bonus almost immediately after 90 days had passed. My wife later opened an account with a $400 bonus that required $4K in direct deposits within 90 days. That deal has since expired and we are waiting on the bonus.

NorthOne ($300 in Swagbucks x 2)

Swagbucks very briefly offered a 30,000 Swagbucks bonus (worth $300 in PayPal cash or gift cards) for signing up for a NorthOne business checking account. This account only required a single deposit of $50 to open and the only further requirement was keeping it open for 32 days. My wife and I each opened this account and we both kept it for more than 32 days because NorthOne ran a subsequent Small Business Saturday promotion where a single debit card purchase (we each loaded the Cash App with $1) earned an additional $25 bonus from North one (I’m not including the $50 we earned from that bonus since it wasn’t part of the checking account bonus itself). This account has a crummy $10 monthly fee with no way to waive it, so it definitely wasn’t worth keeping. In our case, we kept it longer than we should have: no monthly fee was charged after the first month and we each earned that additional $25 bonus. The second month recently closed with a $10 fee for each of us, so we’ll close it by the end of the month. We’ll still each come out $315 ahead overall.

Bonuses expected but not yet awarded

Merrill Edge: $225 for new cash management account

As detailed above, my wife and I each opened a Roth IRA account with Merrill Edge and moved over our IRAs from another brokerage. We also opened a taxable account and put a large chunk of savings into it in order to trigger a $225 bonus. The IRA bonuses posted as expected without intervention, but this one hasn’t. We’re continuing to follow up and I’m confident that this will get resolved since we opened all three accounts following the same process (and we had confirmed in advance that IRA and taxable accounts are treated separately for the purposes of bonuses and confirmed the expected bonus amounts before account opening).

Santander Premier Plus Checking: $400

Player 2 opened a Santander account under a different promotion: this one required $4K in total direct deposits in the first 90 days. We’ve followed data points about what works and expect to receive the $400 bonus.

PNC Virtual Wallet with Performance Select: $400

This $400 bonus is only available in select states, but I was able to apply under the $400 bonus offer (which requires $5K in direct deposits within the first 90 days). I met the deposit requirement early on and hope that the bonus may appear by the end of this month.

First Tech Federal Credit Union: $200

My wife and I each opened this account via a referral as it only required funding the account with $250 and maintaining a $250 average daily balance for 30 days. Stephen wrote about the offer here. Unfortunately, many readers have reached out saying that they did not automatically receive bonuses and had to reach out to First Tech with the name and email address of the person who referred them. Neither my wife nor I have received new member bonuses (and neither has the person who referred us). I have followed up with First Tech and am waiting the results of their investigation.

Bank of America business checking account: $500

This is a targeted offer that may not actually be targeted. In my case, the targeted offer showed up in my online account. As I was just passing the date for being able to withdraw $20K that had been tied up in the SoFi Investing bonus, I got targeted for this offer that required a deposit of $20K. I moved the money directly from SoFi Investing, where it had triggered a $200 deposit bonus as noted above, to Bank of America, where it should trigger a $500 bonus after the 5 small bill pay transactions I initiated online. As the required 75 days to keep the money on deposit has passed, I am hoping to see the bonus soon and move this money along to other checking account bonuses.

No bonus, but still worth it

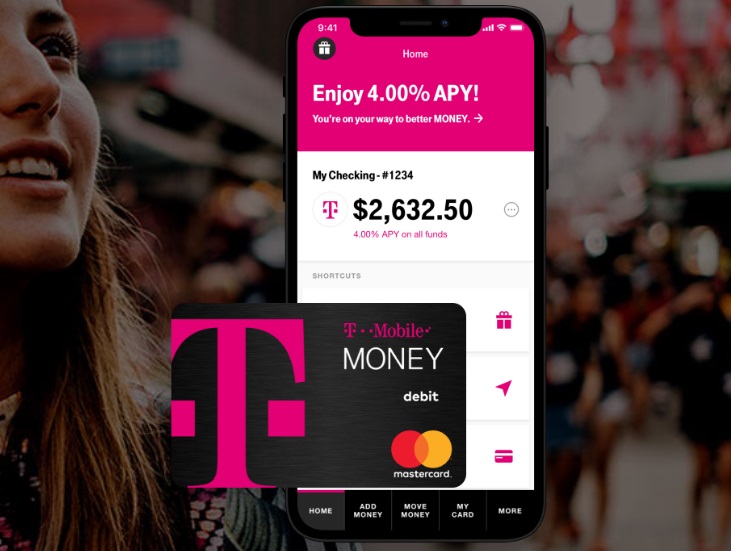

T-Mobile money: 4% APY on up to $3K and 1% on the rest

A while back, T-Mobile started offering a “T-Mobile Money” checking account in conjunction with “BankMobile”. The basic premise is that if you’re a T-Mobile customer and you deposit $200 per month in the account, you can get 4% APY on up to $3K in the account and 1% thereafter. At that rate, you only stand to earn $120 of interest per year if you deposit $3K and meet the monthly requirements. That is perhaps a small win individually, but you can certainly do worse than a 4% return with nearly no risk (and 1% on everything above $3K!). Furthermore, you can scale it at least a little bit if you have multiple lines on your T-Mobile plan since each individual on your plan is eligible for the 4% APY on the first $3K provided they meet the monthly deposit requirement.

The fact that the account offers 1% on balances above $3K isn’t terrible in the current environment — so it’s not altogether awful if you put $3K in there and deposit $200 a month and just leave it as an emergency fund. That said, customer service and posting time of deposits by all accounts seem pretty poor. I wouldn’t go in on this deal with high expectations for an amazing banking experience. There isn’t a new account bonus to be triggered here, but four percent is four percent.

In my experience, transfers and large mobile check deposits are epically slow. It took about a full week for a ~$2K mobile check deposit to clear (compare that to a bank like Wells Fargo where my mobile check deposits usually clear the next business day). Since this account doesn’t include a bonus for opening it, I’m not including it in bonus calculations.

Swing and a miss

BBVA: $0 (expected $250, got nada)

We opened a checking/savings combo with BBVA in 2019 that had relatively low requirements (had to fund the savings account with a few hundred bucks and have one direct deposit of $500 or more by the end of December – similar to this expired promo). I tried a couple of potential direct deposit methods that apparently didn’t work because I never got the bonus. Since I had stretched the definition of a direct deposit, I didn’t raise any complaint. Sometimes you’re the windshield, sometimes you’re the bug.

Bottom line

Keep in mind that some of the bonuses above required very small deposits ($500 for the M&T bonus, two deposits of $250 for the Bank of America checking bonus). Others required large deposits. In some cases, we had long-term savings built up over the course of years that weren’t earning much interest in the bank in the current environment, but in many cases we were moving around the same pile or two of money (and in the case of accounts that require a direct deposit, the money isn’t typically staying there for a long time).

There is no doubt that keeping up with the various new account requirements above takes some time and focus. That “free” money isn’t free — it requires organization and attention to detail.

Is it worth the time to trigger bonuses like these? In my case, the answer is clearly yes. I won’t dispute that these things take time and that I have put quite a few hours into earning these bonuses. On the flip side, I’ve put far fewer than $4,500 worth of hours into these efforts and feel pretty fortunate to be able to generate a not-insignificant amount of money with what is essentially an eye for detail and a few clicks of the mouse. We would ordinarily gladly put this extra money to use paying the expenses associated with travel like meals, gas, rental cars, etc. Given that we have no 2020 travel plans, we’ll be glad to instead invest that money in our future.

On the flip side, just like the credit card bonus game isn’t for everyone, neither is the bank account bonus game. I know that I’m lucky to have only missed out on one bonus this year and had to follow up on one more — reports indicate that it can sometimes be difficult to get bonus payouts. Some folks won’t want the hassle of keeping track of so many new accounts. As I have said before, my argument in favor of these relatively easy bonuses is that if I’m going to spend the time considering whether to earn 12x Hilton points or 6x Marriott points at the grocery store, I shouldn’t ignore the chance to pick low-hanging fruit that I could use to buy large sums of those same points.

Indeed, considering the fact that the cash earned from these bonuses could be used to buy hundreds of thousands of points, we’ll be glad to pack it away for a rainy day daydream. Here’s looking forward to combining those daydreams with the above cash and turning it into real-life travel in a future that we hope is inching nearer each day.

How do you keep track of all of these offers, requirements, deposits, withdrawal dates, etc. Is there a spreadsheet or an app or a systematic sticky-note system I could learn?

[…] and I’ve written several posts on my progress with them over the past couple of years (See: 2020 bank account bonus tally: $4680 earned, $1525 more on the way and Earning $6,000+ in bank and brokerage bonuses: the time spent makes […]

[…] account bonuses last year, which should be more than $6,500 once pending bonuses are received. (See 2020 bank account bonus tally: $4480 earned, $1725 more on the way for more details on that.) Chime wasn’t one of the accounts he opened, but it could be a good […]

[…] If you are interested in bank account bonuses, I recommend checking out Doctor of Credit’s Best Bank Account Bonuses page and by reading Frequent Miler’s 2020 bank account bonus tally: $4480 earned, $1725 more on the way. […]

@Nick Reyes Reyes, thanks for the update.

I followed your steps and opened a few accounts which brought some easy money.

My question to you: when you recommend closing the accounts? Immediately after the bonus was posted, or setup some recurring transfer to keep it alive for a longer time. Maybe one year.

My issue is that my local bank does not do transfers to other banks. So I have to put my funds with a bank that does this.

You don’t have to be stuck with one bank

Nick, just curious, have you calculated your total cash-on-cash return (% ROI based on the total amount of cash you had to leave tied up in these accounts)? I’ve done a handful of bank bonuses and wish I enjoyed the process more. I find it takes up too much space in my brain, so I end up feeling like the hourly rate I “earn” from the bonuses isn’t that great. But with interest rates on CDs and high-yield savings accounts so low right now, the opportunity cost of chasing bank bonuses is certainly lower than ever, too.

I hadn’t calculated it, but I sort of did it in shorthand above. The bulk of the bonuses involved moving some part of the same ~$25K around and resulted in about $5500 of the money. But truthfully, even if I tied up money separately for each and every one of these bonuses, I just can’t see how it wouldn’t be worth it.

If I eliminate the Merrill Edge bonuses, I’ve got about $5500 in bonuses. The lowest ratio bonus out of the non-Merrill bonuses that I received was $200 for leaving $20K with SoFi Investing for 3 months. That’s like 4% annualized and I think that’s the worst of the bunch. Many of the accounts didn’t require the money to spend more than a day or two in the target accounts and at the end of the year I’m essentially up over 20%.

Let’s say that you value your free time at $50/hr (Side note: I’d argue that’s probably far too generous an estimate for most people – not only because the average US salary isn’t that high but also because even if you have a day job where you earn more than that, most people don’t have an easy alternative opportunity to earn $50/hr in their pajamas in their free time; Still, let’s be generous with the estimate). If I earned $5500 in bank account bonuses, that’s the equivalent of 110 hours of work (almost 3 weeks at 40 hours per week). I promise you that I didn’t spend anywhere near 110 hours on all of this. Unfortunately, I didn’t even think to clock it, but I am very confident that it was worth the time and effort.

On the flip side, your point that it “takes up too much space” in your brain is a worthy concern. My wife is the type who will continually cycle a to-do list in her mind and get stressed about the things that need to get done (which is why I handle all of the moving parts for the bank account bonuses). If that’s you, it certainly may not be worth the brain space and that’s fair. Hopefully you have a P2 willing to step in and rake in some extra dough for you! 🙂

Final point: it’s worth noting that the bulk of the money here came from just a couple of bonuses. Had we only done the HSBC and Citizens Bank bonus, that would have been $2,000 in bonuses (or $2600 had we both done Citizens). That would have required a lot less shuffling for a still not-insignificant chunk of change. I’d argue that even if you don’t want to juggle as many as I did this year, you could still do really well just cherry-picking the best of them. In part, it worked out that we weren’t going anywhere or doing anything else in 2020, which made it easy to dedicate brain time to bank account bonuses. In a busier year of travel, it may well have been too much to do all of them — but some of them would still be worthwhile.

Great analysis–thanks. I’ll probably try a few bank bonuses in 2021, along with my current side hustle: cashing out URs with Pay Yourself Back. Thanks to a willing P2 and good MS options in my area, I earned about $5k in statement credits that way this year.

Nick,

Great article! How soon is too soon to cancel a checking account once you receive the bonus especially if you have no further use for it? Are there any banks known for clawing back bonuses more so than others?

Thanks,

Joe

Some have early termination fees. It really varies. For instance, the HSBC account doesn’t list any early termination fee. Neither do the Citizens Bank accounts. However, a common requirement is that you need to keep the account open for 180 days (if you close sooner, the penalty can range from something like $25 to the full bonus amount depending on the bank). Doctor of Credit always lists whether there is an early termination fee. I just set a reminder on my phone to close about 185 days after opening in those cases where it needs to stay open. Admittedly, sometimes I get lazy and don’t close them. That’s actually worked out well now and then as I’ve occasionally found a use for such an account, though I do probably need to be better about closing them.

great article. How much cash does a person need to start with to try to replicate what you did?

Well, if we’re talking “cash”, I assume we’re setting aside the Roth IRA bonuses as that was retirement money sitting in a retirement account, just with a different brokerage (not really “cash” per se). So I’ll leave the Merrill Edge bonuses aside.

The accounts we did that required a large amount to stay on deposit for an extended period were:

Citizens Bank (had to leave $15K for 3 months)

SoFi Investing (had to leave $20K for 3 months)

Bank of America Biz account (had to leave $20K for 75 days)

Webull (had to deposit $10K, though I moved it out the same month)

All three of those could be done in a single calendar year with the same $20K shuffled from one to the next (assuming they are offering the right bonuses at the right times).

The other bonuses required “direct deposits” of $250 to $5K, almost all of which I met with ACH transfers. Some months, I pushed $5K from Bank A to Bank B to trigger a bonus at Bank B and then pushed that same money onward from there to Bank C for a second bonus requirement in the same month.

So I guess to replicate everything apart from the Merrill Edge bonuses, you would need $25K that you don’t need to access immediately. I realize that’s no small potatoes, but if you assume I’ll eventually get the full $6205 noted in the post and we subtract the Merrill Edge bonuses, you’re looking at a return of over $5500 on that $25K by shuffling the money around. Surely you could have earned a lot more by investing in the market in March, but this was basically no risk profit.

If you are also an investor and don’t mind moving your portfolio to Merrill Edge (note: that is the low-cost self-directed arm of Merrill, so ETF/stock trades have $0 commission – it’s not the world’s greatest platform, but good enough to move your money for a bonus), you could match or exceed what I did.

[…] A great option is to earn a bank account bonus at the same time. See this Doctor of credit post for current bank account bonuses and see this post for examples in action. […]

[…] written several times this year about the value of checking account bonuses — including information on thousands of dollars we’ve earned this year in my household thanks to bank account bonuses. While we don’t cover every new checking […]

[…] transfers from an external checking account have been triggering the direct deposit requirements (I’ve written about it here). You typically need a total of $5,000 in direct deposits over the course of the calendar month […]

Hi Nick,

Nice article. I recently tried few accounts. Citi $200 very easy with $5k deposit for 3m and no fee for over 62. I also tried Chase $600 for chk/savings combo. The $200 for saving is easy with $15k deposit for 3m. But i am not sure if my ACH will trigger the checking and Combo. Finding the right alternative for DD is a pain.

Is there a way to set up Direct Deposits to perform yourself rather than going to your HR every so often to change your DD? I like the concept, but I don’t want to upset my secretaries every few months either lol.

Depending on who your company uses for payroll. I think ADP will let you go onto their site and change it yourself.

In my case, we are a small company and I just ask our Payroll admin to change it, which just requires her to plug a new acct into her excel sheet. She knows what I’m up too and is happy to help. I also make sure pass along any really easy bonuses that she might be interested in like the recent sofi one.

Thank you Matt! Great info!

I linked to this resource a couple of times within the post. You’ll find it helpful: https://www.doctorofcredit.com/knowledge-base/list-methods-banks-count-direct-deposits/

Thank you! I recently found your podcasts and love and now I am hooked!

[…] written a couple of times in the past about picking low-hanging fruit (see this recent post: Money moves: $3K in bonuses so far this year (low-hanging fruit, 2020 edition)). Bank bonuses can be easy money, and it doesn’t get a lot easier than this new SoFi bonus: […]