NOTICE: This post references card features that have changed, expired, or are not currently available

I was a bit shell shocked yesterday (in a good way) by the news that Citi is now offering 1 to 1 transfers from ThankYou Rewards to American Airlines. This is something that we’ve long wanted and expected, but year after year it didn’t happen. Until now. For a limited time.

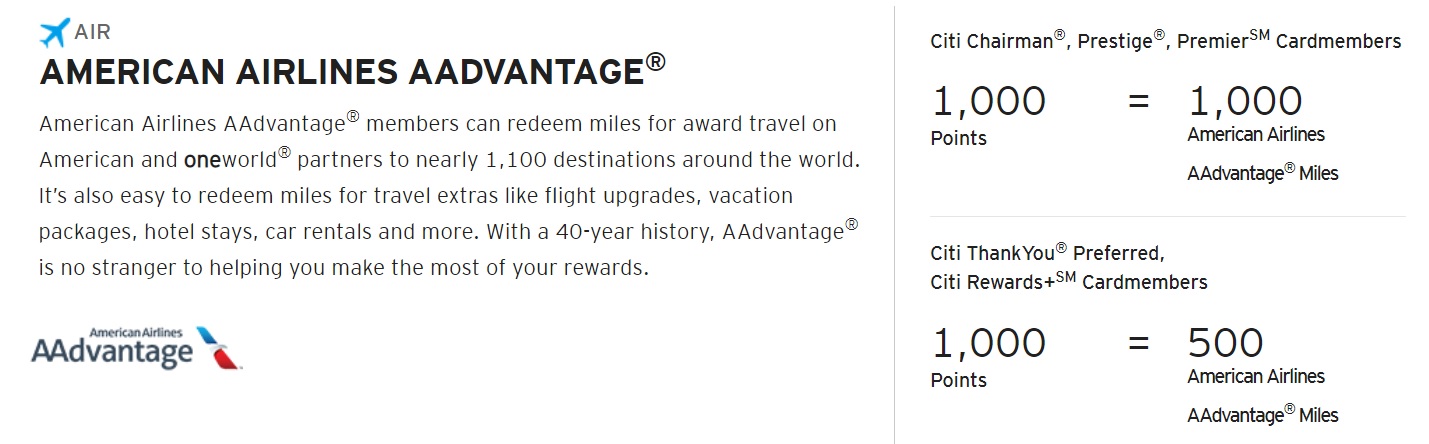

Through Nov 13th 2021, Citi is offering 1 to 1 transfers for those with Chairman, Premier or Prestige cards, or 2 to 1 transfers for those with Preferred or Rewards+ cards.

This amazing news surfaced many thoughts, ideas, and questions in my mind. In no particular order, here goes…

- What the heck is the Citi Chairman card? A Google search tells me it’s one of those invite only cards for wealthy customers, like the Amex Centurion card. And, surprisingly, it seems that the Citi Chairman card is an Amex card issued by Citi. Or at least it was one at some point in the past. I doubt it’s still an Amex but I don’t know for sure.

- Citi finally has a great transfer partner that isn’t only for niche uses! Yay! For a limited time. Boo.

- Is this transfer option really temporary? Maybe they’re just testing it out and will make it permanent?

- Both Barclays and Citi offer AA cards. Is this some kind of custody arrangement where Citi gets to offer point transfers for 4 months, then Barclays gets to do so for the next 4 months, and so on? Unlikely. Since they killed the Arrival Premier 6 months after its introduction in 2018, Barclays doesn’t offer a card with transferrable points. Are they going to try again? I doubt it.

- AA miles are great! They allow all awards to be cancelled for free with both taxes and miles refunded. Miles are easily kept alive with account activity once every 18 months. They have some great partner award rates such as US to Europe in business class for 57.5K each way; US to Asia in business class for 60K each way to Japan or Korea, 70K to India, or 80K to most of the rest of Asia; and US to Africa in business class for 75K one-way. And AA often offers great award prices on their own flights via their Web Special awards. Additionally, AA miles give you access to some of the world’s best first class products such as: Cathay Pacific, Etihad, and Japan Airlines.

- AA miles are bad! If you use miles to book AA flights, then you’re stuck flying AA (I’ve had many awful experiences with AA flight delays and cancellations). If you use miles to book British Airways, you’ll pay outrageous cash surcharges. OK, I had to get that out of the way. Those things are bad, but I think that these days AA miles are much more good than bad.

- Why did AA relent and let Citi offer point transfers? My understanding is that Citi has been trying for years to get AA as a transfer partner. Is AA about to devalue their miles? If so, will AA wait until November 14th to do so?

- The Citi Premier 80K offer is better than I thought! It’s no longer easy to earn AA miles by signing up for AA cards over and over. Now, we can earn AA miles by signing up for Citi ThankYou cards as well. But we have to complete minimum spend requirements and actually get a hold of those points by November 13th.

- For a brief time (unless the deal is extended), Citi cards offer the best way to earn AA miles through spend. Earn 3x in a number of categories (including gas stations and grocery stores) with the Premier card. Earn 2x everywhere with the Double Cash card. Earn 5x on your top spending category each billing cycle with the Custom Cash card. Earn a minimum of 10 points per transaction with your Rewards+ card.

- This temporary transfer is a great way to earn the Rewards+ 10% rebate (up to 10K rebated each calendar year). If you have a Rewards+ card and a Premier card (for example), and if you combine the ThankYou accounts for each, then if you transfer 100,000 points into AA miles, you’ll get 10,000 ThankYou points back.

- AA miles are a good choice for emptying out your ThankYou Rewards account. Most of Citi’s transfer partners are poor choices for transfers if you don’t have any specific plans for how to use the miles. This is because the best Citi transfer partners have very specific best uses and/or have hard expiration dates for their miles. AA miles, though, are easy to keep alive and have enough good uses (in my opinion) to be a reasonable option for anyone hoping to ditch their ThankYou points. See: Citi Transfer Partners for details about each and every transfer partner. Of course, the reason people may want to ditch their points is that they are thinking of cancelling their Premier or Prestige card. For other options, see this post: Cancelling your Prestige or Premier card? Here’s how to keep ThankYou points alive.

- How many points should I transfer? I’ll flesh out this question next…

How many points should I transfer?

I have around 650,000 ThankYou points. Normally, I like to keep my points as transferable points for ultimate flexibility. Point transfers are a one-way street. You can convert transferable points to airline miles, but then you can’t have a do-over if you change your mind.

But this November 13th deadline adds a twist. Now, if the transfer option really ends at that time, ThankYou points will lose some flexibility on November 14th. AA will then no longer be an option. What should I do? How many of my points should I transfer to AA?

Minimum 100K

I have the Rewards+ card pooled with my other ThankYou cards. I haven’t redeemed ThankYou points at all this year, to-date. So, if I get to November and that’s still the case, I will transfer at least 100,000 ThankYou points to AA. This way, I’ll earn 10% of my ThankYou points back thanks to my Rewards+ card. That seems like a no-brainer to me.

Keep at least 200K intact

If I ever want to take advantage of Turkish Miles & Smiles business class sweetspots or the ultimate 7.5K sweetspot to Hawaii, I’ll need to have some ThankYou points around. Since Capital One shut me down, transfers from Citi are my only reasonable option.

The only other airline miles that are unique to Citi that I currently care about are EVA Air miles. EVA often releases far more award space to their own members than to partners. Other good transfer options don’t really matter to me because I’m flush with other transferable points including Chase Ultimate Rewards and Amex Membership Rewards.

Honestly, I’m not too likely to take advantage of transfers to Turkish or EVA anytime soon (or even anytime not-so-soon). Thanks to the pandemic, I cancelled a bunch of awards and that left me with oodles of miles in several programs including United and Avianca. Both are Star Alliance members and so both can often be used to book the same flights that would otherwise be bookable with Turkish or EVA miles. Yes, I would pay more miles than with Turkish, but it might be worth it rather than dealing with the many difficulties in booking awards through Turkish. And with EVA, I just don’t think it’s likely that I’ll need their expanded award space based on how infrequently I tend to fly to Asia.

All of that said, you never know. My circumstances may change or Citi may introduce new transfer partners, or existing partners may add new sweetspot awards. For all of those reasons, I’d like to keep some ThankYou points around. I’d be comfortable with keeping as few as 200K points.

What about the other 350K?

OK, so of my 650K points, I’ll definitely transfer at least 100K and I’ll keep at least 200K. What about the remaining 350K? Should I transfer them to AA too? If I had a near term need for AA miles, then I’d do that in a heartbeat. But I don’t. And it might not be necessary. Citi might make AA transfers permanent. Or maybe they’ll make AA transfers a recurring temporary feature. Either way, I don’t think that November 13th is necessarily the last day ever to transfer Citi points to AA. And if I do transfer, how mad will I be with myself if Citi then adds a new even more valuable transfer partner?

Transfer points or keep them? Either way, it’s a risk. Remember the old saying “Nobody ever got fired for buying IBM”? Let me suggest a new, opposite version: “Nobody ever got ahead by betting on AA… or Citibank.” And there’s the dilemma. Keeping my points is akin to betting on Citi. Transferring my points is a bet on AA. Neither feels like a good bet, but both programs have shown signs of life lately that may suggest even better things to come…

What should I do? What will you do? Please comment below…

AA miles of the toughest for me to get other than SUB. So just signed up for the Premier 80 K. I am getting good value in premium cabins to South America. Using BA Avios for economy cabin

[…] to perhaps the best travel program out there, if you’re an American Airlines customer. Read about how our friends at FrequentMiler.com see this and what it might mean for the future of the Citi and AA programs. […]

Fortunately, I have an immediate need for AA miles. I need to get an adult kid from London back to the states. And I am going to suck up and pay the BA surcharges so she can fly nonstop to DEN (as she has a boatload of luggage). Then I will look further at transferring more mile speculatively.

Unable to get the Premier. Sigh.

I’d transfer about 350k total TY to AA. That gives you enough AA points for a round trip biz class adventure for 2 people pretty much anywhere. Stills leaves a good stash of TY points left over.

In the past city was NOT so sensitive to inquires or open accounts, therefore I always submitted their app after Barclays and others. This seems to have changed.

Citi Premier app was planned earlier before this limited time transfer offer, but submitted today. Denied for 2 players in family, 780-800 score and almost zero utilization.

1: Reason given is too many recent inquiries on Experian. The inquiries on Experian before this app are only 5, all chase card: 9/3/19, 1/20/21, 2/8/21, 2/11/21, 7/17/21 (IHG premier app 2 days ago). Total open accounts = 10 with 1/24 new account status.

2: Reason given is too many open accounts, last inquiry was too recent. The inquiries on Experian before this app are only 3, all chase card: 8/14/19, 2/9/21, 7/19/21 (IHG premier app today) Total open accounts = 10 with 0/24 new account status.

Both players have ~25 closed accounts between 2011 to 2019.

I hate that chase letters always mention Equifax as the bureau on which they make their decision, but they still pull Experian also every time.

My thought is given this has NEVER happened in the past, I’d be more willing to bet it’s more likely NEVER to continue in the future past the November deadline. Therefore, if I had a stash of TYPs (which I sadly do not) then I’d definitely transfer a boatload of them to AA. All other TYP transfer partners are either highly niche or are available through other transferable currencies. I’d say the risk of not cashing in on this opportunity are too great not to take AAdvantage.

The Chairman card was what predated the Prestige card, years ago. It was MUCH harder to get. I believe most ALL of us were moved to the Prestige card, but if I remember SOME people who had the AMEX version of the card were allowed to keep it since there was no way to replace the Amex. I miss the Chairman card, when it was a rare card, and not a common one. Think JPMorgan Reserve (old Palladium)

I don’t have much to say, except all the other frequent miler regular Larrys have already responded so I am feeling a bit left out. I guess my one thought is that I might wait to see what exactly it meant when AA stated a few months ago that they are doing away with award charts before transferring large quantities of points without a specific use. I figure there is no reason to rush. Getting the extra 10 percent is capped out at 10,000 and there really is nothing to do except see what happens with the program in the near future prior to November.

I’ll transfer all my TYP to AA, but I’ll probably wait till just a little bit before November 13, just in case Citi (or AA!) surprises us with a transfer bonus to AA.

Reasoning: in the last couple of years, compared to Delta and UA, AA miles have just consistently been giving me great value (lower award prices) and great flexibility (good availability and ez cancellations/ changes), esp. on domestic awards and on international awards to Latin America, which I use frequently. For example, AA quite frequently offers last minute upgrades to first class on long haul routes to/ from Hawaii for 15k miles +fees, or $700+. I jump on it every time with miles. Just recently I upgraded my entire family that way. UA sometimes has similar offers, but they’ve been much more hit or miss, and Delta charges like 90k miles for the same kind of upgrades.

Yes I know that AA is going to lose the award chart soon, but they’ve already kinda gone to dynamic pricing, and the upcoming devaluation would have to be truly catastrophic (which I don’t expect) to really change my calculus.

The only other really meaningful transfer partner IMHO would be Turkish, but they’ve proven to be pretty difficult for me to use.

Data point. My husband just denied for Premier yesterday. I don’t blame Citi, they have given him a boatload of points, and not much spending on cards. Called Citi, was told he has too many accounts and just opened another card (the CSP). Credit rating robust, only two cards opened since pandemic, but looks like Citi tired of handing over free points. Ironically, he actually would use this card because of the good bonus categories, but Citi has no reason to expect that from him.

As a citi premier member I’d be able to avoid the annual fee for an otherwise fairly worthless card. I drive electric and have other cards for groceries. I don’t use the premier card at all. Is citi trying to jettison us? Are they surrendering to Amex and chase the premium card market? I may take this opportunity to be done with citi. Wait and see for now.

As Nick and I discussed on a recent FM On the Air podcast, I do think that Citi has conceded the ultra-premium market and is focused mainly on competing in the no-fee space (or low fee in the case of the Premier).

I constantly hold back my AA miles because they have been the hardest airline miles to replace of usable carriers. And if you live near one of their hubs you are likely using them at least annually, AA is usually so much easier to find convenient flights (bad experiences with the actual flights/crew/delays aside).

Like so many I have been waiting for this opportunity for years. Hoping the removal of the Prestige just prior maybe means an epic relaunch with AA as a transfer partner. I have never considered a Prestige or Premier until now, but I have been holding onto Rewards+/DC/Preferred rewards for this very moment.

That would be interesting regarding the Prestige. I think they’ve conceded the ultra-premium market, but if I’m wrong I think they’ll have to include AA lounge access again (didn’t they have that long ago?) to make the Prestige worth a look.

Yes, Prestige did have Admirals Lounge access a while ago

And 1.6 cents for each TYP on regularly priced AA flights — an expenditure that counted as a cash ticket purchase. And trip insurance. And a $200 (or was it $250) airline credit that you could use for flights. And the fourth night free on any-old hotel reservation you made, even if it were by far the most expensive night. You could get TYPs quickly from getting both the Premier and Prestige cards, and by opening a Citi checking account — which could be funded by a credit card well into the five figures. Not to mention that the Citi account got the Prestige annual fee reduced by $100 (and on both Prestige cards, if you had a joint account with P2).

That summer — that card, the first Prestige, and all the junk surrounding it — were the apotheosis of a-lot-of-something for darned-close-to-nothing, especially if you flew AA.

(Also, three rounds of golf.)

I’m planning to ditch/downgrade my Prestige card this summer (still keeping the Premier to preserve the ability to transfer), so if I must spend my Prestige balance, this AA transfer will work nicely. Has anyone figured out whether the new Custom Cash is an available TYP downgrade from Prestige? It seems like it could be a better fit than the Double Cash or Rewards+.

I’m not sure whether it is or not. If you do downgrade to another Thank You card, you won’t need to spend down your Prestige balance first. But if you convert to a non TY card, like Double Cash, you will want to use up your balance first.

As this site has stated in the past, “Your best bet is usually to wait until you find a great flight award before transferring (Citi ThankYou) points. One exception: Citi often offers 25% or 30% transfer bonuses to certain programs.” A transfer to AA as suggested in this post isn’t taking advantage of either of these cases.

I consider the difference between ThankYou points and AA miles to be greater than Frequent Miler’s calculations, but even using their Reasonable Redemption values, a speculative transfer of 650k points would result in a loss of value around $1,000. Not a smart move IMO.

From an RRV point of view, it isn’t a smart move, but there are other important factors:

The cynic in me says that while there never may be another chance there is also a very real possibility that the whole reason we are seeing this “opportunity” is because effective some point in the near future we are never going to WANT to transfer to american again.

Correct, you don’t know what will happen. The ability to transfer may stay indefinitely. In fact, Citi may start offering 25-30% transfer bonuses to AA like they do with their other transfer partners. If exceeding the TYP RRV with AA is “very easy,” then perhaps Frequent Miler should revisit the AA RRV. Note, however, that your conditional statement of “almost every case” in the Qatar example shows that it isn’t a given, and hence the wise advice to wait for a specific sweet spot redemption or transfer bonus.

Transferrable currencies have greater average value than any of their individual transfer partners due to their ability to capitalize on outsized deals across the various airlines at any given point in time. Locking into AA miles loses that flexibility. Everybody will have their own valuations of points and miles. If you make a speculative transfer (i.e., without a specific travel goal, or without a transfer bonus) you are essentially saying that you value AA miles greater than TYPs, which I can respect (if not agree); however, I think FOMO has taken hold of a lot of folks since this limited-time transfer was announced, which may lead to a less than rational decision.