The Citi ThankYou program gets less attention than its transferable points program brethren. Does Citi have a sleeper cell of cards that can provide great rewards for a very low cost? Greg tries to wake Nick up to see all that Citi has to offer.

The Citi ThankYou program gets less attention than its transferable points program brethren. Does Citi have a sleeper cell of cards that can provide great rewards for a very low cost? Greg tries to wake Nick up to see all that Citi has to offer.

Elsewhere this week on the blog, we share tips for booking free MSC cruises, where you can find the long-awaited Hyatt award availability calendar (hint: it’s not Hyatt.com), the impact of new credit cards on your credit score and a lot more. Watch, listen, or read on for more from this week at Frequent Miler.

Podcast

We publish Frequent Miler on the Air each week in both video form (above) and as an audio podcast. People love listening to the podcast while driving, working-out, etc. Please check it out and subscribe. Our podcast is available on all popular podcast platforms, including Apple Podcasts, Spotify, and many more.

Alternatively, you can listen to the podcast online here.

This week on the Frequent Miler blog…

Two more “free” MSC cruises booked & lessons learned

My wife and I each had a free MSC cruise offer thanks to Atlantic City status matching, so we recently booked two more “free” MSC cruises. In the process, we picked up some tips regarding availability and the flexibility of blackout date fees. If you’ve done the Ocean Prime match or intend to do so for the free 10-night MSC cruise anywhere in the world, it would behoove you to read this post before you call to book.

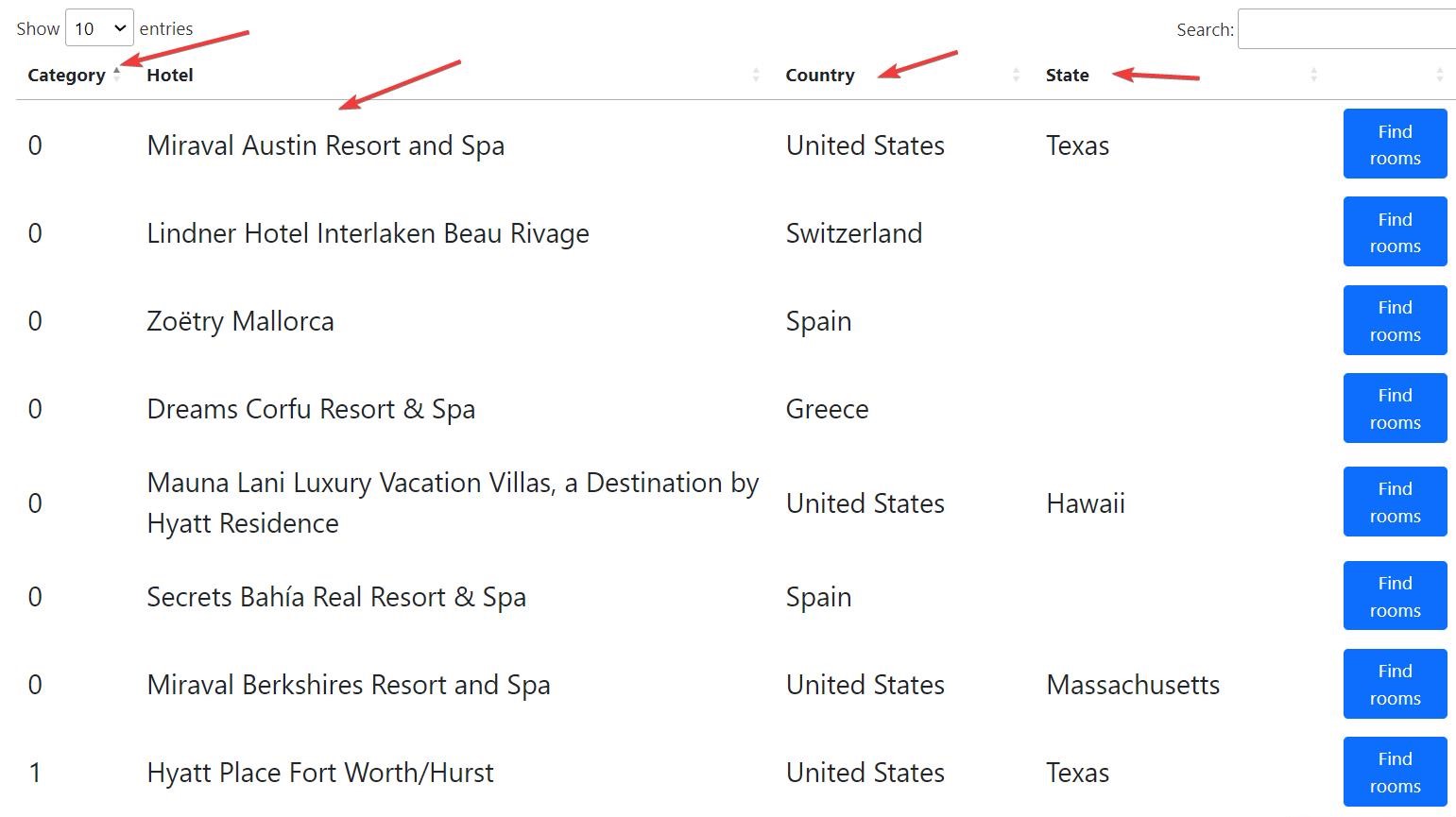

Finally, a Hyatt Award Availability Calendar: A look at Rooms.aero, Seats.aero’s new hotel search tool

Rooms.aero may arguably be an even more useful tool than the already wonderfully-nerdy Seats.aero. That’s because Rooms.aero brings us the long-awaited Hyatt availability calendar where we can easily see available nights at the most desirable Hyatt properties and plan accordingly. This is going to save me so much time. For instance, if I wanted to return to the Grand Hotel Victoria on Lake Como, I wouldn’t need to incessantly hunt for availability during each of the months when I would consider a trip but rather with a few clicks I could see that there are some available nights this September and October and there are none at all available yet for next year. It is also sweet that you can search for Hyatt suites — this might be my new favorite award search tool even though it only supports a few programs so far.

How new credit cards can impact your credit score

Whenever someone new asks me about the games we play, one of their first questions is about the impact of opening and closing credit cards on one’s credit score. Oftentimes, newcomers have been indoctrinated to think that opening or closing cards will hurt their credit scores. Common misconceptions like those are often the result of short news reports that leave out the nuance and detail that make all the difference. In this post, I explain the complex ways that credit cards can affect your score and how you can reduce negative impact and accentuate positive impact. This is a post I wrote to send to friends when they inevitably ask, “But doesn’t that ruin your credit?”.

Greg predicts Delta’s SkyMiles changes

Delta is rumored to be announcing major changes to the SkyMiles program in just a few days. In this post, Greg predicts what he thinks those changes might look like and I have to say that I agree a little bit but disagree to a large extent as well. I think Greg is right that Delta is likely to move to a single elite status metric and I’ll even give him the fact that internally Delta is looking at it from an MQD perspective (in terms of how many “dollars” a member should generate for Delta in order to get Diamond status), but I think that calling them qualifying dollars and showing high spend amounts focuses on what members are losing (money spent), so I instead expect that they will keep something closer to Medallion Qualifying Miles and roll in earnings from the SkyMiles shopping portal and other sources in much the same way that American has. I expect the requirements to increase but for the metric to highlight the miles you earn rather than the dollars you spend.

Replacing my stolen backpack

Greg’s bad luck in Santiago has turned around at least a bit in the sense that he has replaced a lot of what he could without spending wildly beyond the insurance payout he received. While I’m sure it doesn’t really feel like he is ahead or even even given all that he lost, I’m glad to see that this has worked out better than a total loss for Greg. Funny enough, I also recently acquired the same Tumi bag that he did for his replacement….and I don’t like it more than he does (though in my case a large part of the program is that I’m coming from a larger version of the bag and don’t think I can deal with less space). I’m actually leaning toward selling mine unused and trying something else.

Sheraton Grand Salzburg: Bottom Line Review

The Sheraton Grand is an odd brand, sitting somewhere above a Sheraton, which leaves a lot of room between being just OK and being great, but this property in Salzburg looks like it made for an excellent stay for Tim. If I had Salzburg in my near-term travel plans, I’d definitely be considering the Sheraton Grand.

Deal of the Week

While we mostly highly longer form posts in our week-in-review post, but this week I wanted to highlight two great deals that may be of high interest.

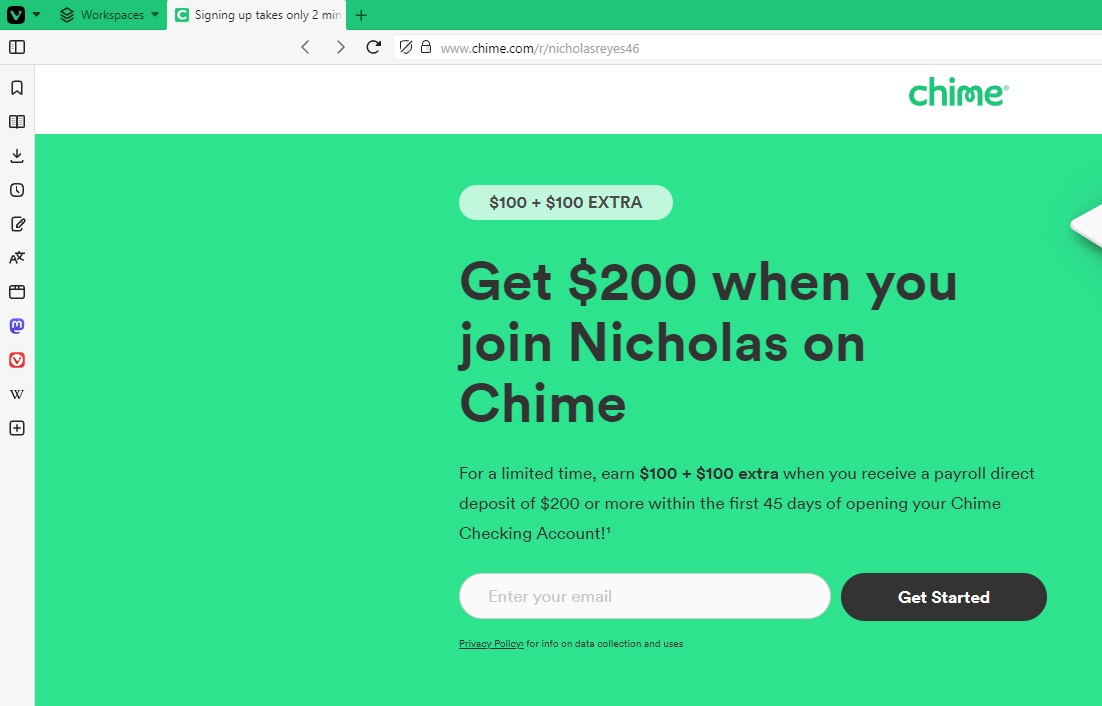

Easy $200 checking account bonus (up to $500 or maybe even $800+ in two-player mode) with Chime

I’ve fallen out of the habit of writing about new checking account bonuses, but this new bonus from Chime is such an easy one that it brought me back into the fold since a couple playing in two-player mode could easily make $500 with a few clicks of the mouse (and maybe more with a complex stack). What I found even more interesting than the easy money bonuses is the way that the new account bonus can vary based on the browser you use to open it. That type of “targeting” is something I’ve seen plenty of times with credit cards, but this is the first time I can recall seeing it with a bank account bonus. Be sure you know how to populate the $200 offer before you open your account.

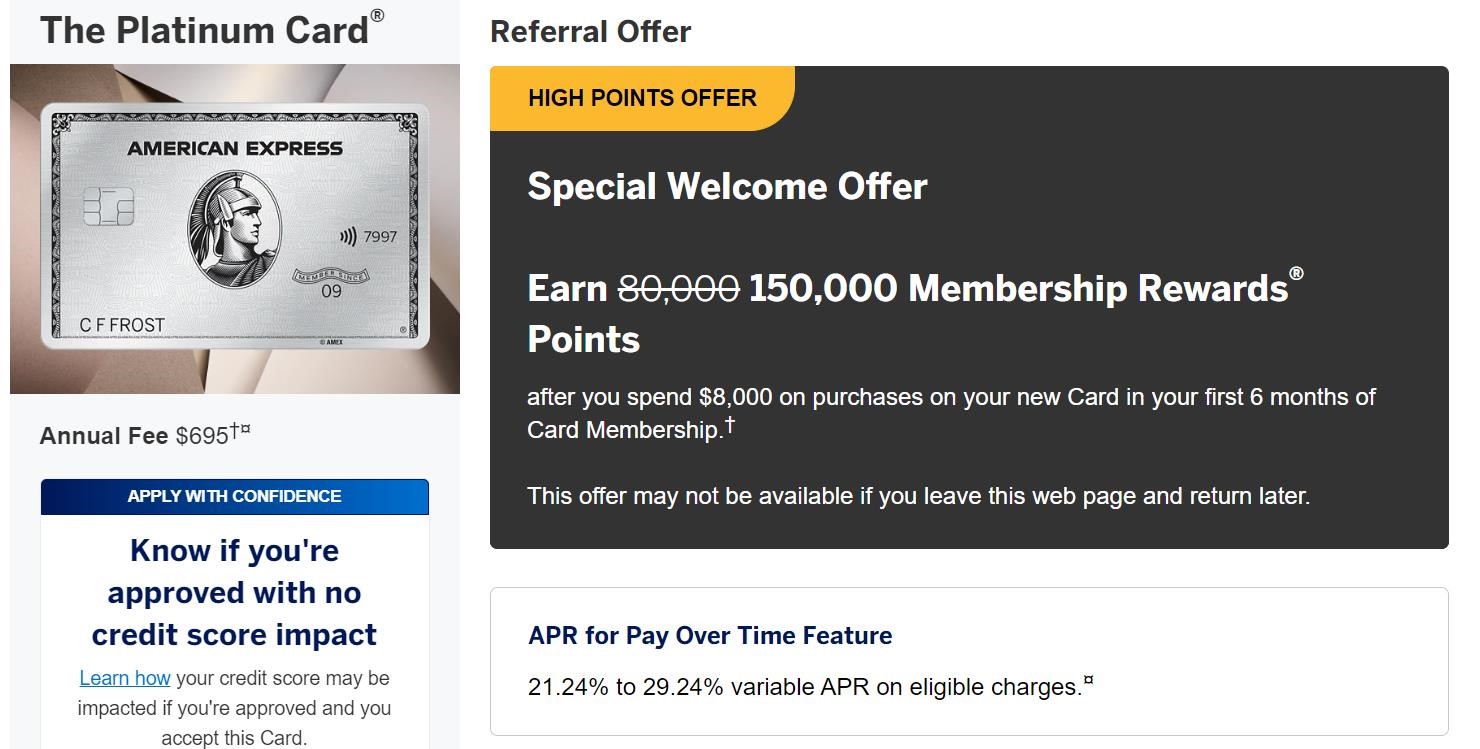

Amex Platinum Card: 150k referral offer is back again (and we need your links!)

Amex has once again released a 150K bonus on the consumer Platinum card, and once again only some cardholders have the ability to generate a 150K link. I wanted to highlight this opportunity for people who haven’t had the Platinum card before and to alert readers to the fact that we need more links to this offer — but only if you see within your Amex login that your friend will get 150K points on the consumer Platinum card. We only take link submissions in our Frequent Miler Insiders Facebook group (and then only in the proper place). See this post for more detail.

That’s it for this week at Frequent Miler. Don’t forget to set your reminders for this week’s last chance deals.

![Maximizing free night certificates, award booking for beginners, and more [Week in Review]](https://frequentmiler.com/wp-content/uploads/2024/07/Sailrock-Resort-SLH-218x150.jpg)

I have citi bank accounts, Citi custom cash and citi premier cards. I have earned TYP from all those sources. However, when I try to transfer to airlines, the system only allows me to transfer typ earned through premier and not the others. I already combined into one typ account. When i called customer service, they said it doesnt matter if you combine accounts, you can only transfer typ earned on premier to airlines. In addition, I also see there is an expiration date for the typ earned through bank accounts. Has citi changed rules to typ redemption?

The agent was correct about the bank accounts: the points earned there are not transferrable and do have expiration dates. The points from your custom cash card, though, should be transferrable since you pooled accounts with the Premier.

And the opportunity for recurring SUBs is?

Nick you say in the podcast that Citi is for those in it for the long game but I think most of us playing are in it for the long game! I started with Citi cards in 2008 just because that’s where I had opened my checking account, held on to no fee cards or converted those with AF to no AF cards for years and then in 2020 and 2022 I got SUB for Citi Premier and slowly have changed my no AF old Citi Preferred cards to Double Cash, Rewards Plus, etc.

Even this year with opening 6 new cards where we hit SUB between me and P2 we have managed to build up 60k Citi TYP with little effort between new applications. We have been using these to supplement redemptions where we also use points from other programs (Virgin, FlyingBlue, etc). This is in addition to also collecting Chase UR and Amex MR. We’re not big spenders, we don’t do business cards and we don’t manufacture spend. There are often 5x promos on the no fee cards on useful categories like dining, transit, grocery etc. Useful since we don’t have a Custom Cash yet but planning to PC my AA card to this soon. So I think it’s also a good program to keep in the background even if you’re well into the game. Start with a good Premier bonus (or maybe even this rumored new premium card…) and over time you can collect them all even if you don’t want to waste a new application on a small bonus.

You write that we can either watch listen or read this episode but I see no link to the blog where I can actually read it and cannot find the print/written version anywhere. Please send a link. I prefer that much more than watching or listening and that way I can cut and paste the information that I want into my notes. Thank you

When Nick wrote “ Watch, listen, or read on for more,” he meant read on for more topics not that you can read the podcast. The only way to read the podcast is on YouTube with its “Show Transcript” option (it can be tricky to find though)

I want a Citi card so bad. Im trapped by Chase 5/24. Greg and Nick please help. I keep picking up Chase cards because I’ll no longer have access to them after 5/24.

LOL

That’s not a bad problem to have as long as Chase keeps approving your apps

Get more players! Then you can spread out the cards between you.

Thanks for another great episode!

I am about to drop my Citi Premier, BUT I have — and will keep — my Citi Prestige (still one of my favorite cards). I think I still get full transferability for the “no annual fee” cards by keeping it, right?

Assuming I do, my plan is to get Citi Custom Cash (20,000 TY better than a sharp stick in the eye + 5X on grocery spend), then downgrade my Premier to a Rewards+.

That said, when I check the Rewards+ card, I don’t see anything about the points transfer rebate. Do I get info on that after linking the cards?

Good plan. Yes the Prestige will keep your points transferrable. The Rewards+ card doesn’t advertise that you can get the rebate when transferring points. Look instead for the rebate when redeeming points. It’s the same thing.

Great episode, as usual! As someone who must often spends on Citi cards, you missed some of the biggest reasons why their cards stay at the front of my wallet.

1. Retention offers. Year after year, Citi has given me excellent offers. For my Citi Premier, the last 4 years they have given me “spend $95, get $95” offers, essentially making the suite of cards free. On my other no annual fee cards, I usually can get annual offers of “spend $3k, get 10k bonus TYP” or “an extra 2x points per $1 for the next $17.5k spend over the next 6 months.” I have taken the latter offer on 3 cards so far this year (Double Cash and Custom Cash x2). So for basically no annual fee, I get tons of good bonus categories plus 3x or 4x on non bonus spend.

2. Extended warranty protection. While lacking in travel protection, they still have the longest extended warranty protection of an extra 2 years on several cards (regardless of the original warranty length). I keep the no annual fee AT&T Access card for this reason (and for retention offers). This is not available on the Double Cash or Custom Cash cards.

3. Less significant, but also note that the 3x at grocery stores on the Premier works outside the US. Most other cards with grocery multipliers either specify that it is US only (Amex Gold), or have foreign transaction fees.

Also, when talking about the FHR bookings, we have found it cheaper than booking directly several times recently because of “stay x days, get 1 free” deals. This past week, we stayed at the Park Hyatt Melbourne, which had a stay 3, get 1 free offer. This brought the nightly rate down to $170 when averaging out the discount, making it much cheaper than booking directly (or using 20k points/night).

Great points!

For the Citi suite of cards, in what order do your recommend getting all these cards? I have a Citi Premier, the CitiBusiness AAdvantage Platinum Select World Elite (arriving in the mail today), and an old Citi Diamond Preferred. Should I product change the Diamond Preferred to a Custom Cash card? A Double Cash Card? A Rewards Plus card? And then in a year, PC the AA card to a … ? Thank you for your guidance!

Firstly, IIRC you can’t PC(product change) biz to personal or vice versa. If over 5/24, you have options. You can see when you last premier bonus was, if 48 months ago then PC the double cash and get a new premier. Get a AA personal $95 plat select, offers are frequently waived af and 50-70k AA miles for 3-4k spend in 3 months. Wait one year then PC to custom cash. Additionally, apply for rewards plus, get 25k after 2k spend. You can then if you want PC your diamond preffered to another custom cash for another 5x category. If wanting to stay under 5/24 then PC-ing the DP to a custom or double cash if your only real option.

I’d product change the Diamond to Double Cash so that you have strong earning power right away. Sign up for the AA Platinum card for a future product change. Sign up for a Rewards plus card and one Custom Cash at your leisure to get those welcome bonuses. After a year, product change the AA Platinum card to a second Custom Cash.

Thanks for the weekly podcast, which is always enjoyable and informative! When discussing potential Citi product changes, you mentioned downgrading a Citi AA card to the custom cash – this is possible? I had thought the banks wouldn’t normally allow a cobranded card to be product changed to a “normal” card

ShitiBank let’s you PC between any personal first party and or cobrand card.

Most banks don’t allow it but Citi does.