NOTICE: This post references card features that have changed, expired, or are not currently available

In an effort to keep loyal customers loyal through the COVID crisis, most travel loyalty programs are extending current elite status levels an extra year. Additionally, many have made changes this year to make it easier to earn status if you don’t already have it. And some programs are offering promotions that make it easier to earn elite status through credit card spend. Combined with a number of temporary credit card bonus enhancements, there are a number of opportunities this-year-only to earn elite status that will last throughout 2021 or, with some opportunities, for the rest of your life.

Is it crazy to consider earning elite status now?

It certainly seems crazy to think about elite status right now. Most of us aren’t traveling and have no near term plans to do so. But there are reasons to consider it…

- Any status earned this year will last through all of next year and often into January or February of the year after that (depending upon the program).

- Hotel elite status can be especially valuable for those planning domestic travel. Some are predicting record high levels of domestic travel this year. Instead of looking to travel internationally, people are itching to get away from home and are looking to domestic options. If this pans out, many hotels will be oversold. In those cases, people with high level elite status are much more likely to be accommodated rather than bumped to a crappy motel on the outskirts of town.

- Airline elite status can be especially valuable during irregular operations. A friend of mine was in Morocco when the COVID [bleep] hit the proverbial fan. He credits his Delta Platinum elite status with his ability to get through to a person on the phone and to get rerouted home the day before most options were terminated. This is just one of many examples where having high level elite status can save your butt when things go wrong.

Limiting to credit card spend opportunities

In order to focus this post, I’ve only included opportunities where it is possible to earn elite status entirely from credit card spend. If an opportunity requires a mix of credit card spend and travel I haven’t included it here.

If I missed any opportunities that meet the above criteria, please let me know!

Warning: Don’t Do This

Many of the opportunities listed here require ridiculously high amounts of credit card spend. I don’t recommend doing this, especially under the current viral and financial crisis. Even if you have the resources to cover this kind of spend, banks are likely red flag any sudden big spend increases. This will likely mean that they’ll shut down your accounts and potentially take back your rewards as well.

Some of the opportunities don’t require too much spend. The Air Canada opportunity is a good example. That one doesn’t require any spend if you already have transferable points. Also, in most cases, you can use the opportunities here to fill in the gap based on status you already have or expect to get by the end of the year. For example, if you’re close to earning the Southwest Companion Pass already, then you might want to increase spend at grocery stores while the Southwest cards are offering 3X rewards in May and June. If you spend $1500 per month for those two months, you’ll earn 9,000 points towards a Companion Pass.

Airline Status Opportunities

Air Canada Status with Point Transfer

Air Canada Aeroplan is offering Altitude Prestige 25K status to members with no current status who register for the promo and earn 50,000 miles from “everyday Travel at Home activities” like earning on your Aeroplan credit card or transferring from partners between April 20 and May 31, 2020. See our post about this promo here.

This overlaps with a promotion to buy miles at a discount which runs May 7 – May 15. Purchased miles only count half towards the elite status promotion so you would need to buy 100,000 miles to get Altitude Prestige 25K status.

While this isn’t directly a credit card spend opportunity (except for those with Aeroplan credit cards), many of us have cards that earn Amex Membership Rewards points (which transfer 1 to 1) or Capital One “Miles” (which transfer 1,000 to 750). Alternatively, you can earn rewards with a cash back card and take advantage of the mileage sale.

Why this is interesting

Air Canada is planning to unveil a brand new loyalty program this year. Of course, I won’t be surprised if it is delayed until 2021. Either way, with the current promotion, you would have status when the changes happen.

Its a safe bet that the new program will include plenty of bonus promotions to get people engaged. And there’s a good chance that some of those opportunities will be offered exclusively to elite members.

Amex Membership Rewards points transfer one to one to Air Canada (and Capital One “Miles” transfer 1000 to 750). If you have extra Amex or Capital One points lying around, it may be worth transferring in 50,000 points just in case something good comes out of having elite status with Air Canada in 2021. Keep in mind, though, the new program could also mean that miles will be significantly devalued. There’s a real risk to pursuing this.

What I’ll do

I have enough Amex points to be willing to throw 50,000 of them towards Air Canada even with the risk of devaluation. I wouldn’t do this, though, if I didn’t have hundreds of thousands of points. Before I transfer, I’m going to wait a bit to see whether Amex offers a transfer bonus to Air Canada before the promotion ends on May 31st.

Membership Rewards points are known to transfer to Air Canada instantly, so in theory I can wait until May 31st to initiate the transfer. You never know, though, when a computer system may go down. I’ve set a reminder to myself to do the transfer no later than May 28th, just to be certain.

UPDATE 5/25/2020: I decided that a transfer bonus before the end of the month wasn’t likely, so I went ahead and did the 50K point transfer. If you do it, don’t forget to register for the promotion (here).

American Airlines Lifetime Status

Between May 1st and December 31st, 2020, every dollar spent on an American Airlines credit card counts toward million miler status. American offers different perks with each million miles earned:

- One million miles

- AAdvantage® Gold status for the life of the program

- 35,000 bonus miles

- Two million miles

- AAdvantage® Platinum status for the life of the program

- Four one-way systemwide upgrades

- Each additional million

- Four additional one-way systemwide upgrades

Why this is interesting

The ability to earn lifetime status through spend alone is certainly special. If it was easy to manufacture spend a ridiculously high levels this year, I’d even be interested. Unfortunately, that’s not the case.

What I’ll do

Nothing. I’m not touching this one. If I was close to earning million miler status, though, I’d definitely consider it.

Delta Elite MQM Rollover

All Medallion Qualifying Miles (MQMs) earned this year will roll over to next year. This means that we have two years, instead of one, to earn enough MQMs for elite status. Both Delta Platinum and Delta Reserve credit cards offer MQMs with high spend, so the rollover means that it’s possible to earn a higher level of status than usual with fewer Delta cards.

- Delta Platinum cards earn 10K MQMs with each $25K of calendar year spend (capped at $50K spend)

- Delta Reserve cards earn 15K MQMs with each $30K of calendar year spend (capped at $120K spend)

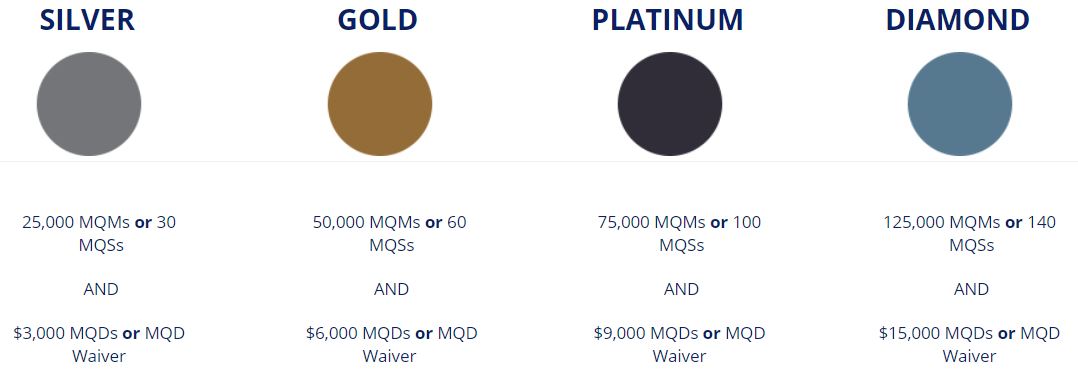

The chart above shows the number of MQMs required to earn each status tier. In addition to MQMs, you need to earn either MQDs or a MQD Waiver. You can earn a MQD Waiver (up to Platinum status) with $25,000 spend on Delta Platinum + Delta Reserve cards. Delta requires $250,000 spend, though, for a Diamond MQD waiver.

There is no word yet on whether MQDs or MQD Waivers will roll over into next year.

In addition to MQM rollovers, Amex is offering offering 4X Delta miles per dollar at US Supermarkets May through July 2020. This means that spend during this time can be more rewarding than usual.

Why this is interesting

Delta Platinum cardholders with just that one Delta card previously couldn’t earn elite status through spend alone since they were capped at earning 20K MQMs per year with spend. Now, by earning 20K MQMs in 2020 and 20K in 2021, Silver status would be assured and the cardholder would be close to Gold status without flying.

Similarly, Delta Reserve cardholders with just that one Delta card previously couldn’t earn Platinum elite status (requiring 75K MQMs) through spend alone since they were capped at earning 60K MQMs per year with spend. Now, by earning MQMs in both 2020 and 2021, it’s possible to reach Platinum status and more with a single card.

What I’ll do

My wife and I already have Diamond status from Delta credit card spend last year (see “Manufacturing Delta elite status in 2020 and beyond” for details about how it’s usually done) and so we already have Diamond status secured through all of 2021 thanks to automatic status extensions. We will continue to spend a bit on our cards to rollover some MQMs into 2021, but unless we hear that MQD waivers rollover as well, we won’t spend big.

Southwest A-List & Companion Pass

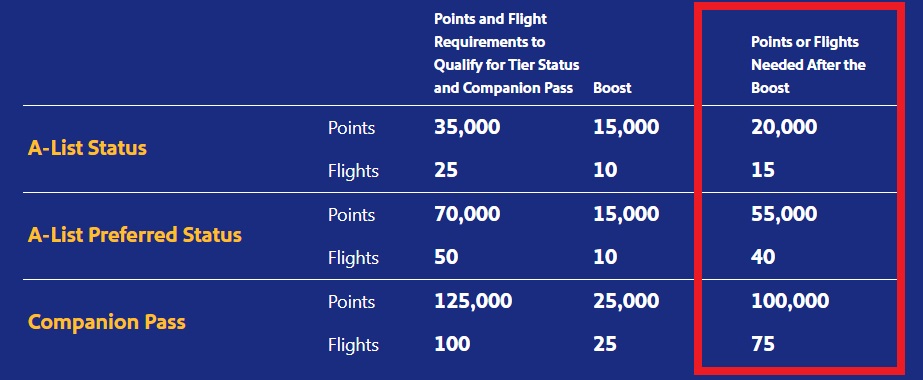

Southwest has modified requirements for earning elite status and the Companion Pass this year. Rather than reducing the requirements, Southwest is essentially juicing accounts with credit toward status and the Companion Pass. Everyone will automatically get these things added to their status and companion pass counters:

- 15,000 tier qualifying points (TQPs)

- 10 qualifying one-way flight segments toward tier status

- 25,000 Companion Pass qualifying points (CPQPs)

- 25 qualifying one-way flight segments toward Companion Pass

Additionally, Southwest is running a promotion offering cardholders double tier qualifying points towards A-List Status. Rapid Rewards Premier and Priority Cards normally earn 1500 tier qualifying points with each $10,000 spend, but will now earn double that and with no limits this year. In other words, these credit cards offer 3,000 tier qualifying points with each $10K spend this year.

Here’s a summary of each status type and the new requirements:

- A-List:

- Offers priority boarding, priority check-in, 25% earning bonus, same-day standby, and a dedicated A-list phone number

- This year, requires 20,000 tier qualifying points (or 15 one-way flights)

- 20,000 tier qualifying points can be earned with $70,000 in credit card spend.

- A-List Preferred:

- Offers all A-List benefits plus 100% earning bonus and free in-flight wifi

- This year, requires 40,000 tier qualifying points (or 40 one-way flights)

- 40,000 tier qualifying points can be earned with $140,000 in credit card spend.

- Companion Pass

- Offers a free companion on all paid and award flights for the rest of the year in which it is earned plus all of the next year.

- This year, requires 100,000 qualifying points (or 75 one-way flights)

- Southwest credit cards earn 1 point per dollar for most spend. Every point earned through credit card spend counts towards the Companion Pass. So, a Companion Pass can be earned with $100,000 in credit card spend (or less for spend that earns bonus points).

All of this overlaps with a Chase promotion that runs from May through June. In addition to many other Chase cards, Southwest Rapid Rewards Plus, Premier, and Priority cards earn 3X points at grocery stores on up to $1500 in spend. If you max out that spend in May and June, you’ll earn 9,000 points towards a Companion Pass.

What I’ll do

Nothing. I don’t have any Southwest cards. Additionally, I don’t see huge value in A-List status. The Companion Pass can be incredibly valuable, but 100,000 points (down from 125,000) is still a huge requirement unless those points are earned from a credit card signup bonus. I’m still over 5/24 so can’t successfully sign up for a Chase card today.

Hotel Status Opportunities

Hilton Lifetime Status

May through July 2020, Hilton Surpass and Aspire Consumer Card Members earn 12X Hilton Honors Bonus Points at U.S. supermarkets. Bonus Points earned through eligible purchases on all Hilton American Express Cards that post to the Card Member’s Hilton Honors account between May 1 through December 31, 2020 will be considered Base Points and will count towards Elite tier qualification and Lifetime Diamond Status.

Hilton offers lifetime Diamond elite status (their current top-tier) to members who earn 2 million base points (and have 10 years of Diamond status). This year, bonus points earned from May 1 onward count too. So, with the 12X grocery bonus it’s theoretically possible to start from zero and get to Diamond status with $167,000 in spend. That said, the 12X grocery bonus only runs for 3 months, so you would have to average a whopping $56,000 spend per month at the grocery store.

To help a bit with the pain of spending so much money, Hilton has increased the value of free nights earned with their credit cards:

- New weekend free night awards issued from May 1 to December 31 2020 will be valid for 24 months from the date of issuance (previously 12 months).

- Unexpired and new Free Weekend Night rewards issued through December 31, 2020 can now be used any night of the week.

As a reminder, the Hilton Surpass earns a free night with $15K spend and the Hilton Aspire earns a free night with $60K spend. If you have both cards, it would make sense to spread the grocery spend across both (since both earn 12X during the promotion) in order to earn 2 free nights along with lifetime diamond status and over 2 million redeemable points.

What I’ll do

Nothing. I don’t currently have a Hilton card, but I wouldn’t go big even if I did. Since the Aspire card offers Diamond status to all members, I don’t see huge value in spending my way to lifetime status. That said, I would be interested in earning 12X while spending my way to a free night with either the Surpass or Aspire card. If I had either card, I’d spend at grocery stores up to the free night and then (probably) stop there.

Hyatt Bonus Elite Nights

World of Hyatt is offering an interesting promotion for Chase World of Hyatt Credit Card holders and also for Hyatt credit card holders (the old card that is no longer available): from April 15th to June 30th, 2020, you can earn 3 elite qualifying nights for every $5K spent on the newer World of Hyatt Credit Card. Those with the old Hyatt credit card that does not ordinarily earn elite night credits will get 2 elite nights for every $5K spent. Additionally, those who become new World of Hyatt card holders between those dates will get 10 elite night credits this year.

I previously analyzed this deal in depth here: Hyatt’s 3 elite nights per $5K spend. Deal or no deal?

Short answer: this deal does make sense for many, but it depends on how much you can spend during the promotion period and how many elite nights you are likely to earn the rest of the year.

The deal is sweetened a bit with the Chase grocery promotion that runs from May through June. Hyatt cards earn 3X rewards at grocery stores for these two months. Luckily this overlaps well with the elite night promo.

What I’ll do

I thought I’d go big with this deal because I’m angling towards manufacturing Hyatt Globalist status this year. The problem is that the grocery stores I frequent do not sell gift cards and I’m not eager to make many additional store trips right now. I’m also not eager to sit on a ton of gift cards with no easy way to liquidate them right now. So, while I’m planning to spend pretty big to get the bonus free nights, I doubt much of that spend will be at grocery stores.

Conclusion

There are a number of opportunities this-year-only to earn elite status that will last throughout 2021 or, in some cases, for the rest of your life. Many of these only make sense to pursue if you’re already well along towards earning status.

For me, the most interesting promotion is with Air Canada. Air Canada has made it possible to earn low-tier elite status simply by transferring points from Amex Membership Rewards. If you have enough Amex points sitting around, it may be worth taking a chance on this to see how it plays out. I’m planning to do so.

I will also take advantage of the Hyatt promotions (mostly because I’m already well along towards earning Globalist status this year), and the Delta MQM rollovers. I’ll give the rest of the deals a pass.

I expect that we’ll soon see additional opportunities crop up. When they do, I’ll update this post!

What about Marriott?

The caps on Marriott grocery 6X spend are too low to make a material difference in the ability to earn elite status through spend in my opinion.

thoughts on UA status wia pqp on their cc?

I haven’t looked much into it to be honest. IIR, it’s not possible to earn status from spend alone.

I have the Delta Gold card and have hit the 50k spend for 2020. I’d like to pursue top-tier Delta status exclusively with cc spend and want to sign up for more cards. Is the $250k Diamond waiver cumulative amongst all AmEx Delta cards or do I need to spend $250k on one card? If I earn this status now, will Delta extend it past 2/28/2021 due to COVID? Or is the status extension only for folks who earned it in 2019? Can I roll over all of my 2020 MQM’s or only those that exceed whatever status tier I reach?

I hope you mean that you have the Delta Platinum card since that’s the one that gives you a total of 20K MQMs with $50K spend. The waiver is cumulative. If you earn status now, you’ll have status through the end of January 2022. That hasn’t changed for COVID, it’s how it always works (you have status for the rest of current year, all of next, and through Jan of the year following that).

My understanding is that all MQMs will roll over to 2021.

Nice review, Greg. A Globalist choosing to spend for status right now makes less sense, as you will still be a Globalist next year. But I’m a lowly Explorist and primarily an AA flyer (lifetime Gold, Platinum this year). The combo of spending to get Globalist and then, possibly being offered AA Executive Platinum, is alluring. That’s my short term pathway.

The American Airline status match is far from guaranteed. I got hyatt Globalist through a combonof MS and stays last year and I got a big fat zero from American.

Did you contact your Hyatt Concierge to ask for it? I know a number of people who asked and were then given AA Exec status.

Yes, I actually asked twice via email. I was turned down twice. I was specific even and asked about executive platinum status because I had heard some of my friends had gotten it.

Ouch

Great Article Greg – Thanks

Are you certain that transferred miles will count towards the Air Canada promotion? I’m looking at their offer now, and it doesn’t mention transferred points anywhere.

I transferred 55k and already got the Silver status (I booked a busienss class to Europe for 55k on Swiss in July)

Marriott Marty obviously confirmed below. Also, in our post we quoted and noted this:

All other activity: Unless otherwise stipulated, all Aeroplan Miles credited to the Eligible Participant’s Aeroplan account based on activity during the Offer Period shall qualify for the Offer. [Frequent Miler note: this should include points transferred from partners like Membership Rewards, Capital One miles, or hotel partners)

Here’s a link to our post about the promo:

https://frequentmiler.com/get-aeroplan-status-1st-tier-w-points-transfer-from-credit-cards/

Thanks!

Great post, Greg. This is the kind of post that makes Frequent Miler my favorite points blog. Nobody else is covering this, although I’ve wondered about it myself over the past few weeks.

Not so interested in any of the brands except for Delta. I think you may be missing a point here that with 4X grocery spend on Delta cards, you’re a guaranteed 4% cash towards Delta purchases and likely higher if you play your cards right. With a good liquidation method you can effectively buy miles with VGCs or MCGCs ($5.95 fee/(505.95 X 4))for less than 0.3 cents/mile without a cap for as much as you dare. This is a significantly better offer than the Air Canada deal, although it takes some work to liquidate and track. The MQMs/elite status are just gravy on top of that. This may be true for other currencies out there, too, but I haven’t run the numbers.

Thanks again guys. Keep up the good work and good posts.

Also, MQMs count towards lifetime status. So, even though it’s of limited value and modestly capped, you do get a bit of a bump in that direction, too.