Credit card intro bonuses are clearly the fastest way to a points and miles fortune, but how does the plan differ for someone who spends $1,000 per month versus someone who spends $4,000 per month? On this week’s Frequent Miler on the Air, we discuss everything from how to be selective if your spending is minimal to the big spend bonuses we would pursue if our capacity to spend were unlimited. Watch or listen below (though note that due to Internet issues, this week’s upload is taking longer than normal, so the show may not show up on podcast platforms and Youtube immediately. Check back again soon if you don’t yet see it).

Read on for more from this week at the blog including why you probably don’t want to book travel through your credit card travel portal but also why I did do exactly that and how I scored a free business class seat for my son doing so. All that and more below in this Frequent Miler Week in Review.

2:30 What crazy thing did Hyatt do this week?

6:59 Mattress running the numbers: 20% transfer bonus to Air Canada Aeroplan. Worth it?

14:00 Main Event: Credit card strategies for low spenders, medium spenders, and big spenders

16:03 Low spenders ($1K per month)

31:02 Medium spenders ($1K-$2K per month)

50:00 Medium high spenders ($2K-$4K per month or more)

54:45 Do big spend bonuses matter at $4K-$8K spend per month?

1:02:04 If you had unlimited spend, which big spend bonuses would you want?

1:09:58 Question of the Week: Do miles from the American Airline shopping portal stack with miles from the credit card?

Subscribe to our podcast

We publish Frequent Miler on the Air each week in both video form (above) and as an audio podcast. People love listening to the podcast while driving, working-out, etc. Please check it out and subscribe. Our podcast is available on all popular podcast platforms, including Apple Podcasts, Spotify, and many more.

Alternatively, you can listen to the podcast online here.

This week at Frequent Miler

Low spend credit card strategy: A lot of vacation with low expenses

Fly to Bali and spend 20 nights there with just $1,000 spend each month with the right credit card plan — even low spenders can get a lot of value out of maximizing which cards they choose and how they handle spending requirements. A little bit of strategy goes a long way, but there certainly are multiple ways to achieve similar ends.

Why your credit card travel portal might be a poor way to book travel

Maybe you have a credit card that offers 1.5c per point toward paid travel, but keep in mind that’s probably toward paid travel based on the bank’s online travel agency’s prices. Those prices may not be the best you can find, which means you’re not necessarily getting 1.5c per point in value. I find flights to usually be a good value if you want to use your credit card’s travel portal (beware of the hassles if you need to cancel though — getting your airline credit stuck with the travel portal could be a big pain). In many cases, you’ll do better by either transferring to hotel partners or cashing out your points to pay for travel directly with the travel provider.

Success: Takeaways from booking a “free” child business class seat

Speaking of booking travel through your credit card travel portal…..I recently booked a British Airways flight through Amex Membership Rewards. I did this because I wanted to use my Business Platinum card’s 35% rebate when paying with points (which yields a net value of just over 1.5c per point). I also wanted to take advantage of the fact that British Airways would allow me to book a trip with my son ticketed as a lap infant even though he turns 2 during the trip — they’ll give him a free seat with us in business class for the legs of the trip after he turns 2 years old. The unexpected surprise in all this was far better flight pricing through Amex Travel than what I saw elsewhere.

Booking Directly With Airlines? Don’t Forget To Click Through From A Shopping Portal.

I said above that booking flights through credit card portals can be a good deal, but Stephen Pepper provides a counterpoint: you can sometimes earn a small amount of cash back through a shopping portal. I’ve done this now and then, though the amounts are usually quite small (maybe even a fixed amount of a couple of dollars per flight). Still, if you’re booking paid airfare, it’s worth looking to consider your options.

Palacio de Santa Paula Granada, Autograph Collection: Bottom Line Review

As Tim notes in this post, Frequent Miler has gone almost fully European this month with Greg, Tim, and Carrie all in Europe right now and Stephen actually being European. I didn’t get the memo, but fear not — I’ll be flying to Europe next month to do my part in scouting out the Frequent Miler Europe headquarters. Unfortunately, I won’t be going to Granada or else I’d have to check out this Marriott property that Tim said was one of the most satisfying uses of a 35K free night certificate that he’s had in a while.

Are Greg and Nick reasonable or are they reward value heretics?

Tim tosses his hat in the ring for a “post roast” by questioning the ways in which Greg and I have handled some recent redemptions. He’s not wrong, I certainly admitted to my recent cash-out-to-buy-I-bonds being a suboptimal redemption from a cash-value-of-the-points perspective. On the other hand, I took points that would sit unused for a long time and made them into cash that’s going to grow by about 8.5% in the next year. Since I know I’ll earn those points back before I’ll need to use them, getting cash that will grow made more sense to me for now (and it also removes the temptation to “waste” those points on a redemption just because “I have enough points”. It’s not the strategy I would pursue if I only earned a couple hundred thousand points per year and I routinely used most of the points I’d earned, but considering the great offers of the past couple of years, we thankfully have some cushion. So yes, I’m a heretic….but a heretic with a little more money than I had before and without any impact to my ability to travel when I want to thanks to having plenty of points left :-).

Turkish Miles & Smiles Complete Guide (online bookings once again possible)

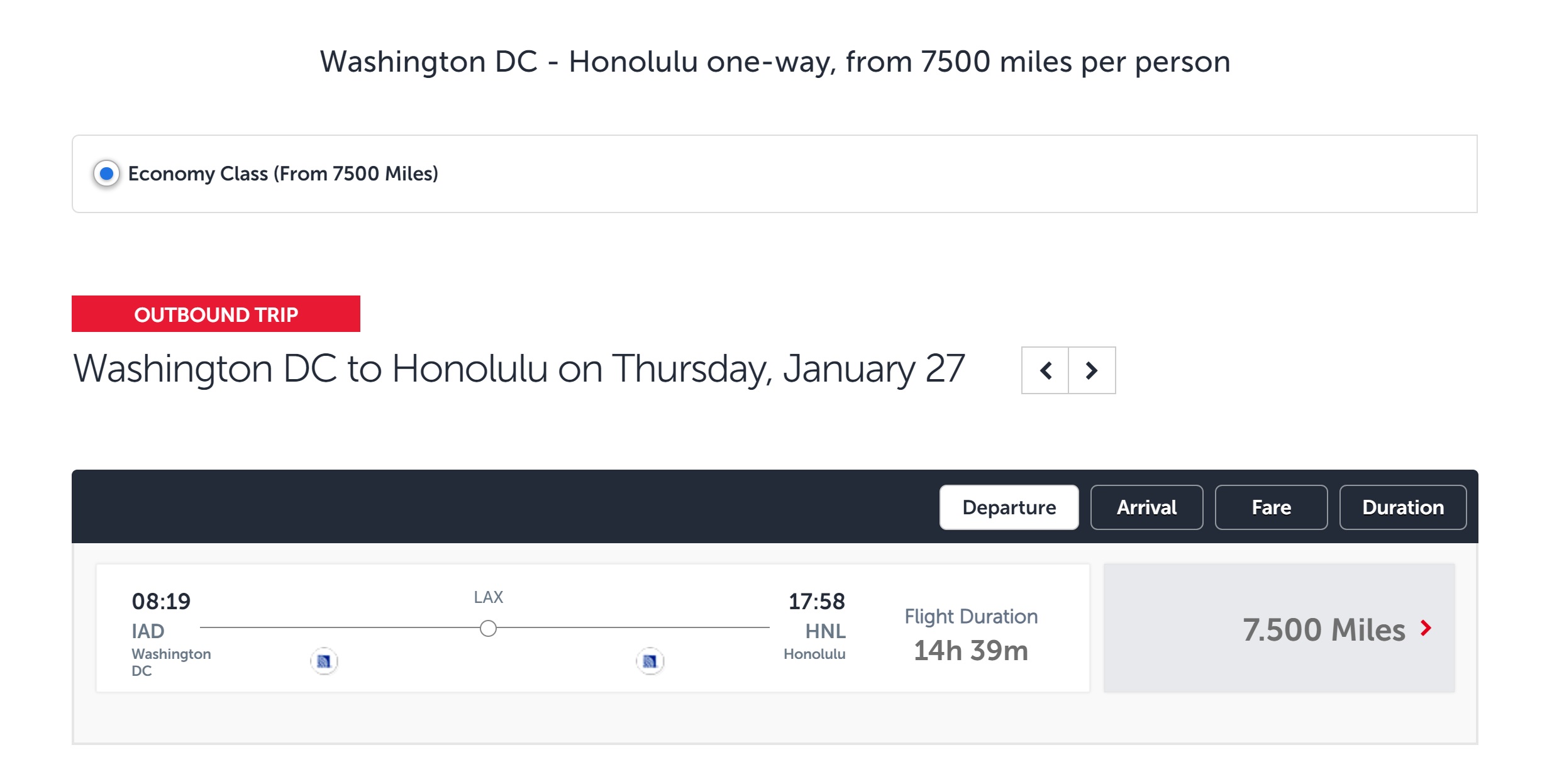

You can once again book Turkish Miles & Smiles awards online. This is great news for anyone with Capital One miles, Citi ThankYou points, or Bilt Rewards points as it means that you can once again easily book flights to Hawaii, Alaska, or the rest of the US for 7,500 miles each way in economy class (relatively) easily. But there’s a lot to know about Turkish Miles & Smiles before you dive in. This post covers everything you need to look at before you leap.

IHG One Rewards Complete Guide

Now that IHG has revamped its program, it was time to give our IHG guide a complete overall to match the new IHG One Rewards program. Keep in mind that new benefits like free breakfast for Diamond members are scheduled to debut “sometime in June”, but we still don’t yet have a specific date for implementation.

That’s it for this week at Frequent Miler. Keep an eye on this week’s month-ending last chance deals to make sure you don’t miss anything ending in May.

![Sharpening your coupon-clipping scissors, great value hotels, shopping portal myths, and more [Week in Review]](https://frequentmiler.com/wp-content/uploads/2024/04/Quarterly-hotel-credit-218x150.jpg)

![Qatar’s hierarchy of award access, 3% bonus offers that won’t last, tools you may be forgetting and more [Week in Review]](https://frequentmiler.com/wp-content/uploads/2024/04/hierarchy-218x150.jpg)

Thank you guys so much! This was a very enlightening video for me. I’ve been trying to find just the right cards for each and every category of spending when, realistically, I would probably be better served by simply pursuing sign-up bonuses. Very eye-opening.

Now that I have reasonable balances in 3 different types of transferable points, I’ll want to keep my $95 AF cards to preserve the ability to transfer. So the question becomes: What transferable points should be given priority going forward?

I know you guys touched on this a few times, but I think it might be interesting to expand on it since I’m guessing most readers’ spending tends to be in the low to middle category.

Who should focus on Amex? Who should focus on Chase? What about Citibank? And now Capital One?

I am in the low to middle monthly spend, and there was another point that you two didn’t mention. People in my boat also have to consider how much credit the banks will give you. I can’t spend much on cards, because I don’t make much. So I have maxed out how much credit Chase will give me. The last card I got, which is my 5th Chase card, I had to downgrade my credit amount on other cards to get enough to open a new card. Because of this, now all my cards are at the least amount of credit they allow on each card. So I will have to close a card to open a new card.

Another thing that matters to people in my situation is that we don’t have to time and money to travel much. We are always working our low income jobs and are unable to take off because we need the income to pay our bills. I have plenty of Chase, Amex, Wells Fargo, IHG, Southwest, Choice, etc. I just don’t have the money/time to spend the points.

Even if you travel to a new destination and hotel and flight are covered, there are a lot more expenses that you have to afford, unless you just want to see the inside of a hotel room.

Thank you for the video guys.

Just wanted to point out that around 26:17 Greg mentions that only Mastercards and Discover cards work to pay rent on Plastiq, but actually Amex cards work also.

Podcasts haven’t posted yet…

As Nick says in the post, internet problems are making for long upload times. I have about 6 hours before a flight, hoping to have the podcast by then!

Seriously dood, ya gotta getta betta Internet provider

Flip them !!!!